Market Overview:

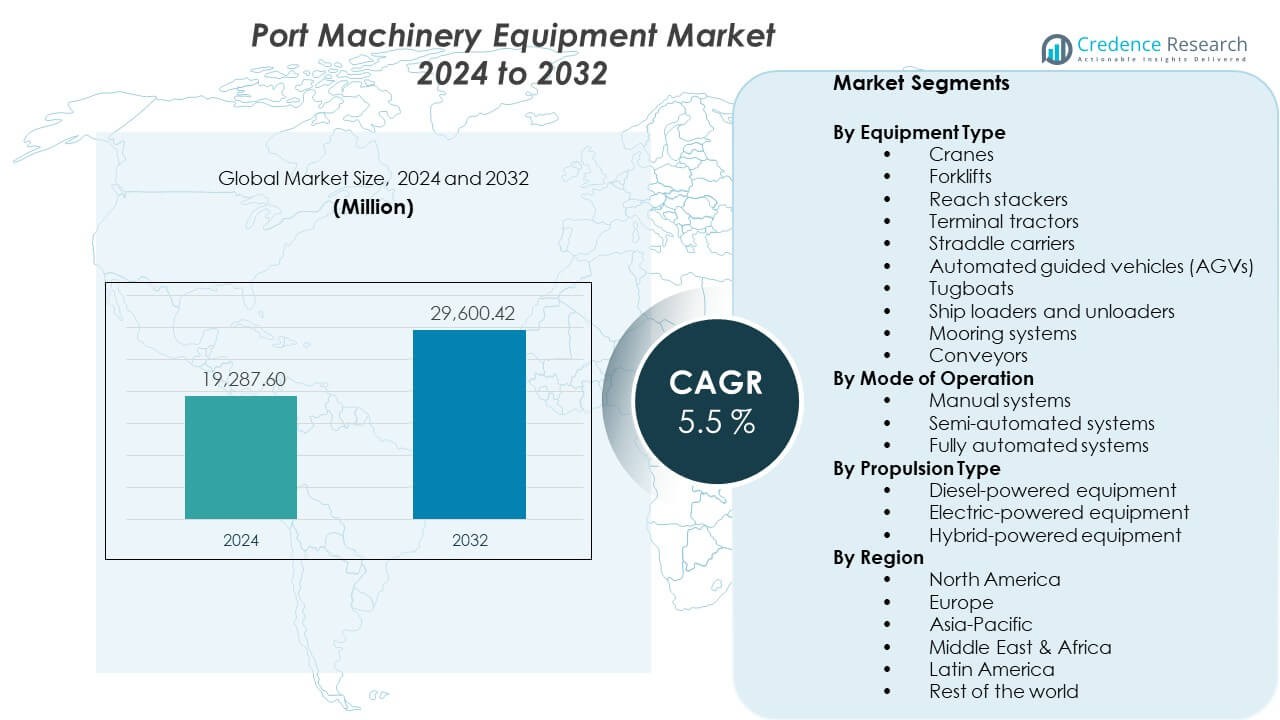

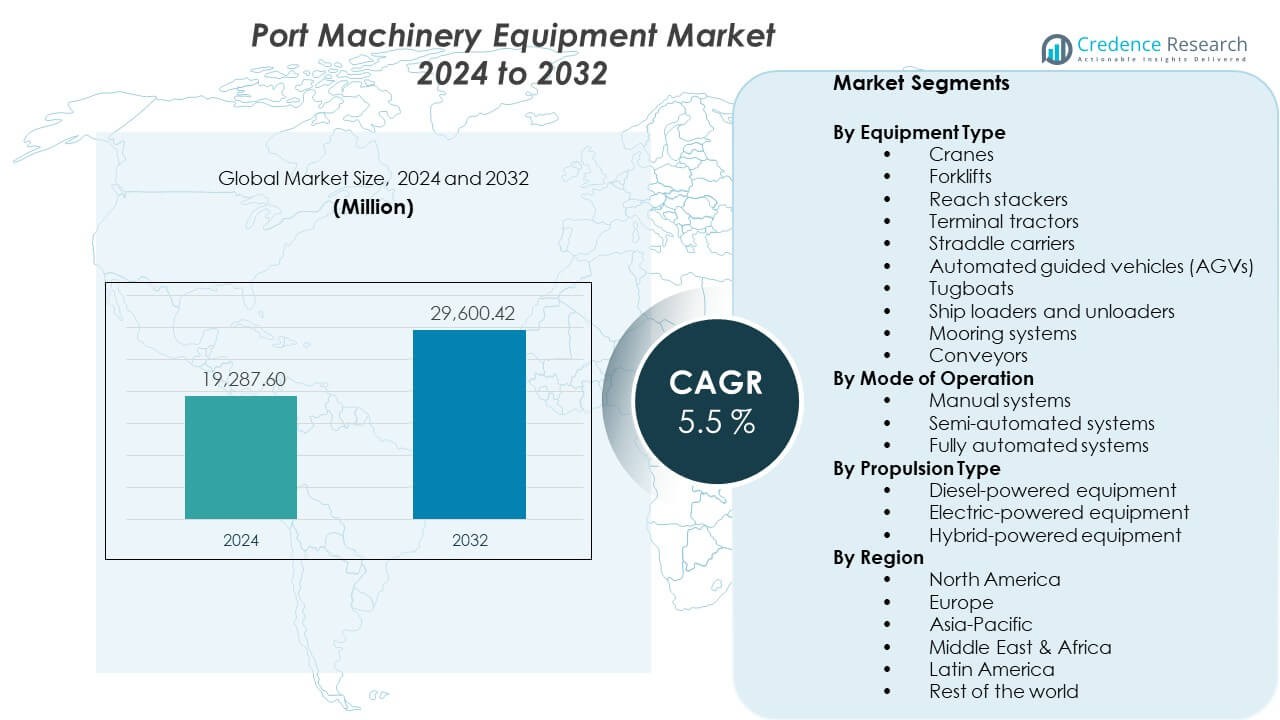

The Port Machinery Equipment Market is projected to grow from USD 19,287.6 million in 2024 to an estimated USD 29,600.42 million by 2032. The market is expected to record a CAGR of 5.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Port Machinery Equipment Market Size 2024 |

USD 19,287.6 Million |

| Port Machinery Equipment Market, CAGR |

5.5% |

| Port Machinery Equipment Market Size 2032 |

USD 29,600.42 Million |

Demand rises due to higher container traffic and bulk cargo movement across major ports. Port authorities focus on operational efficiency, safety, and lower emissions. Automated cranes and smart handling systems reduce labor dependency and delays. Electrified equipment helps ports meet environmental rules and cut fuel costs. Expansion of container terminals supports demand for advanced lifting solutions. Growth in inland ports also increases machinery needs. These combined drivers sustain strong equipment replacement and upgrade cycles.

Asia Pacific leads the market due to large-scale port infrastructure in China and Southeast Asia. China drives demand through continuous port modernization and export growth. Europe follows with upgrades focused on automation and green ports. Countries like Germany and the Netherlands invest in smart terminals. North America shows steady growth driven by capacity expansion and labor efficiency needs. Emerging regions include the Middle East and Africa, supported by new port projects and trade corridor development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

Write Market insights in 5 short pointers by using this:

- Use the Market Overview with exact values for 2024, 2032 and CAGR.

- Highlight the top three regional shares (with percentages) from the regional analysis and explain briefly why they dominate.

- Add a point for the fastest-growing region with its share and drivers.

- State in 2 points segment share distribution (with percentages)

Market Drivers:

Rising Global Trade Volumes And Port Capacity Expansion Programs

Global seaborne trade continues to rise across container and bulk cargo segments. Ports expand capacity to manage higher cargo throughput with better efficiency. The Port Machinery Equipment Market benefits from large-scale terminal expansion projects worldwide. Larger vessels demand cranes with higher lifting capacity and longer outreach. Ports invest in advanced handling equipment to reduce berth congestion. Capacity upgrades support faster vessel turnaround times. Strategic trade corridors increase cargo flow consistency. Infrastructure investment strengthens long-term port competitiveness.

- For instance, ZPMC has delivered ship-to-shore cranes with lifting capacities above 80 tons and outreach exceeding 70 meters, enabling mega-vessel handling at major Asian and Middle Eastern container ports.

Focus On Operational Efficiency And Cargo Handling Productivity Improvements

Port operators prioritize higher productivity per crane and terminal area. Advanced machinery enables faster loading and unloading cycles across vessels. The Port Machinery Equipment Market supports efficiency-driven procurement decisions. Automated handling systems reduce manual errors during operations. Improved equipment utilization helps lower operating costs. Faster cargo movement supports shipping schedule reliability. High-performing terminals attract global shipping alliances. Productivity improvements justify continuous equipment upgrades.

- For instance, Konecranes reports that its Automated Stacking Cranes achieve container handling rates exceeding 30 moves per hour, supporting higher yard density and consistent terminal throughput.

Growing Emphasis On Port Safety Standards And Equipment Reliability

Ports enforce strict safety standards across cargo handling activities. Modern machinery reduces accident risks for operators and ground staff. Remote-controlled equipment limits worker exposure to hazardous zones. The Port Machinery Equipment Market aligns with safety-focused modernization strategies. Reliable machines help minimize unexpected downtime. Condition monitoring supports planned maintenance cycles. Safer terminals improve workforce confidence. Strong safety records enhance port reputation.

Environmental Regulations Driving Equipment Modernization Initiatives

Ports face increasing pressure to reduce emissions and noise levels. Electric and hybrid machinery replaces traditional diesel-powered equipment. Energy-efficient systems support sustainability and compliance goals. The Port Machinery Equipment Market adapts to stricter environmental requirements. Cleaner equipment improves air quality near port cities. Noise reduction supports operations near residential areas. Green initiatives influence procurement policies. Sustainability targets accelerate machinery replacement plans.

Market Trends:

Rising Adoption Of Smart And Digitally Connected Port Machinery Systems

Ports integrate digital controls and sensors into handling equipment. Connected systems provide real-time performance and usage data. The Port Machinery Equipment Market reflects steady digital transformation across terminals. Data analytics supports better asset utilization decisions. Remote monitoring improves predictive maintenance accuracy. Digital tools enhance operational transparency. Smart systems support semi-automated terminals. Technology adoption improves long-term efficiency.

- For instance, ABB’s Ability™ condition monitoring platform enables real-time diagnostics across port cranes and has demonstrated up to 20% reduction in unplanned equipment downtime through predictive maintenance algorithms.

Shift Toward Electrified And Hybrid Port Handling Equipment Fleets

Ports transition toward electric-powered cranes and vehicles. Hybrid systems balance performance needs and energy efficiency. The Port Machinery Equipment Market follows clean energy adoption trends. Charging infrastructure expands within terminal yards. Electric fleets reduce fuel dependency and emissions. Lower operating noise benefits urban port locations. Energy savings improve lifecycle cost control. Fleet electrification gains wider acceptance.

- For instance, Kalmar’s fully electric terminal tractors operate with zero tailpipe emissions and support continuous multi-shift operations with fast-charging systems designed for high-throughput container terminals.

Increasing Demand For Modular And Flexible Equipment Configurations

Ports seek machinery that supports varied cargo types and volumes. Modular equipment allows faster customization for terminal needs. The Port Machinery Equipment Market benefits from adaptable system demand. Flexible designs support multi-purpose port operations. Space optimization improves yard productivity. Interchangeable components reduce downtime during maintenance. Scalable machinery fits phased expansion plans. Flexibility improves operational resilience.

Growing Preference For Automation In High-Volume Container Terminals

High-volume container terminals adopt automated handling solutions. Automation improves consistency in cargo movement processes. The Port Machinery Equipment Market aligns with terminal automation strategies. Automated cranes support continuous operations with minimal disruption. Labor constraints encourage automation investment. Precision systems reduce cargo damage risk. Automation enhances throughput predictability. Large ports lead automation adoption.

Market Challenges Analysis:

High Capital Investment Requirements And Long Equipment Payback Periods

Port machinery requires significant upfront capital investment. High costs limit adoption for small and mid-sized ports. The Port Machinery Equipment Market faces budget-related constraints in public ports. Long payback periods affect procurement planning. Financing access differs across regions. Economic uncertainty delays upgrade decisions. Cost pressure impacts port authority budgets. Capital planning remains a major challenge.

Complex Maintenance Needs And Skilled Workforce Shortages

Advanced machinery requires skilled technicians and engineers. Workforce shortages affect maintenance quality and response time. The Port Machinery Equipment Market encounters talent availability constraints. Training programs demand time and investment. Technical complexity increases service dependence. Spare part access influences equipment uptime. Maintenance delays reduce terminal productivity. Skill gaps slow technology adoption.

Market Opportunities:

Expansion Of Emerging Ports And Trade Corridors In Developing Regions

Developing regions invest heavily in new port infrastructure projects. Trade corridor expansion creates fresh equipment demand. The Port Machinery Equipment Market gains opportunities in emerging economies. New ports adopt modern machinery from the start. Government-led projects support large procurement volumes. Export growth strengthens infrastructure investment plans. Emerging ports seek efficient handling systems. Early adoption supports long-term supplier relationships.

Advancement Of Automation And Digital Solutions Across Mid-Sized Ports

Mid-sized ports explore cost-effective automation solutions. Digital upgrades improve visibility across terminal operations. The Port Machinery Equipment Market benefits from scalable technologies. Affordable automation widens adoption potential. Software-driven systems extend equipment service life. Digital tools support gradual modernization paths. Technology partnerships create new revenue streams. Innovation supports sustainable growth opportunities.

Market Segmentation Analysis:

By Equipment Type

Cranes represent the core equipment across container and bulk terminals. Forklifts and reach stackers support flexible cargo movement within yards. Terminal tractors play a key role in horizontal transport between quayside and storage zones. Straddle carriers enable high-density container stacking in large terminals. Automated guided vehicles support unmanned cargo transport in advanced ports. Tugboats ensure safe vessel maneuvering within harbor limits. Ship loaders and unloaders serve bulk commodity handling needs. Mooring systems improve vessel stability during loading operations. Conveyors support continuous bulk material flow. The Port Machinery Equipment Market relies on this diverse equipment mix to support varied port operations.

- For instance, Liebherr’s mobile harbor cranes provide lifting capacities up to 308 tons and support both container and bulk cargo handling from a single multipurpose platform.

By Mode of Operation

Manual systems remain common in small and mid-sized ports with limited automation budgets. Semi-automated systems offer a balance between cost efficiency and productivity improvement. Fully automated systems gain adoption in high-volume container terminals. Automation improves operational consistency and safety. Digital control systems support precision and reliability. Advanced ports prioritize automation to improve throughput. Labor efficiency remains a key consideration across operation modes. Technology maturity influences adoption pace.

- For instance, APM Terminals’ Maasvlakte II facility operates with fully automated quay cranes and AGVs, achieving highly consistent container handling cycles under centralized digital control systems.

By Propulsion Type

Diesel-powered equipment continues to serve heavy-duty port operations. Electric-powered equipment gains traction due to emission regulations. Electric systems reduce noise and operating costs. Hybrid-powered equipment offers flexibility across duty cycles. Hybrid solutions support gradual fleet transition. Energy efficiency shapes procurement strategies. Propulsion choice depends on port size and policy goals. Environmental compliance drives long-term equipment upgrades.

Segmentation:

By Equipment Type

- Cranes

- Forklifts

- Reach stackers

- Terminal tractors

- Straddle carriers

- Automated guided vehicles (AGVs)

- Tugboats

- Ship loaders and unloaders

- Mooring systems

- Conveyors

By Mode of Operation

- Manual systems

- Semi-automated systems

- Fully automated systems

By Propulsion Type

- Diesel-powered equipment

- Electric-powered equipment

- Hybrid-powered equipment

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the Port Machinery Equipment Market at about 45%. China leads the region due to large container ports and continuous infrastructure upgrades. Ports such as Shanghai, Ningbo, and Shenzhen drive strong demand for cranes and automated systems. Southeast Asian countries expand ports to support export-led growth. Japan and South Korea invest in smart and energy-efficient port equipment. Public and private funding supports modernization programs. High trade volumes sustain long-term equipment replacement demand.

North America And Europe

North America accounts for nearly 25% market share, supported by capacity expansion and productivity improvement projects. The United States focuses on port modernization to reduce congestion and improve turnaround times. Automation adoption grows to address labor constraints. Europe represents around 22% market share, driven by environmental compliance and digitalization goals. Countries such as Germany, the Netherlands, and Spain invest in green port equipment. Electrification trends shape procurement strategies. Strong regulatory frameworks influence equipment upgrades.

Latin America, Middle East, And Africa

Latin America, the Middle East, and Africa together hold about 8% market share. Latin American ports expand through privatization and trade recovery initiatives. Brazil and Mexico lead regional equipment demand. The Middle East benefits from logistics hub development and large port projects. Countries such as Saudi Arabia and the UAE invest in advanced terminals. Africa shows gradual growth through new port construction. Emerging trade corridors support future demand growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Liebherr Group

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Sany Heavy Industry Co., Ltd.

- Konecranes

- Kalmar (Cargotec)

- Terex Corporation

Competitive Analysis:

The Port Machinery Equipment Market features strong competition among global and regional manufacturers. Leading companies focus on product reliability, automation capability, and lifecycle service support. Large players benefit from wide portfolios that cover cranes, vehicles, and digital solutions. It favors suppliers with proven delivery capacity for large port projects. Strategic partnerships with port authorities strengthen long-term contracts. Technological capability differentiates suppliers in automated terminals. Pricing pressure remains high in emerging regions. Brand reputation and aftersales support influence buyer decisions. Competitive intensity remains moderate to high across major regions.

Recent Developments:

- In November 2025, Luka Koper, a longstanding customer of Konecranes, ordered four additional electric Rubber-Tired Gantry (RTG) cranes, following its 2024 order of four identical electric RTGs. The new order was booked in Q3 2025 with hand-over planned for Q2 2026. Each crane features Konecranes’ Truck Lift Prevention safety technology and will be powered by cable reel systems connected to the local grid with onboard battery packs for stack changing.

- In November 2025, Terex Corporation and REV Group announced a definitive merger agreement to form a leading specialty equipment manufacturer. The merger will create a diversified company manufacturing equipment for the emergency, waste, utilities, environmental, and materials processing industries with expected pro forma net sales of $7.8 billion. Terex CEO Simon Meester will serve as president and CEO of the combined company. Additionally, Terex initiated a process to exit its Aerials segment, including the Genie business, through a potential sale or spin-off.

- In October 2025, Konecranes signed a five-year full-scope service agreement with OPCSA at the Port of Las Palmas, Spain’s largest and busiest marine gateway. The agreement includes preventive and corrective maintenance as well as 24/7 on-call support for the port’s hybrid RTG fleet, with eight additional hybrid Konecranes RTGs scheduled for delivery in Q2 2026.

- In September 2025, Liebherr signed a landmark ten-year partnership agreement with Transnet Port Terminals in South Africa, marking a significant strategic collaboration in the port equipment sector. The agreement encompasses the supply of ship-to-shore (STS) cranes, rubber-tyred gantry (RTG) cranes, and rail-mounted gantry (RMG) cranes to enhance port operations across South Africa’s major terminals. Transnet has already placed substantial orders including four large STS cranes for the Port of Durban currently being assembled in South Africa and 48 RTG cranes for multiple batches destined for the Durban and Cape Town terminals. The partnership extends beyond equipment supply to include a comprehensive 20-year asset management program, ensuring lifecycle support, maintenance, repairs, and parts management. Liebherr is investing in a new Competence and Distribution Centre in Durban featuring the Liebherr Technology Campus, a training and innovation hub for professional development and customized solutions.

Report Coverage:

The research report offers an in-depth analysis based on equipment type, mode of operation, and propulsion type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Port automation adoption will expand across large container terminals

- Electrification of handling equipment will gain momentum

- Smart maintenance systems will improve equipment uptime

- Emerging ports will invest in modern handling solutions

- Hybrid propulsion will support transition strategies

- Digital integration will enhance operational visibility

- Safety-focused equipment design will gain priority

- Modular machinery will support flexible port layouts

- Service-based business models will strengthen revenues

- Sustainability goals will influence procurement decisions