Market Overviews

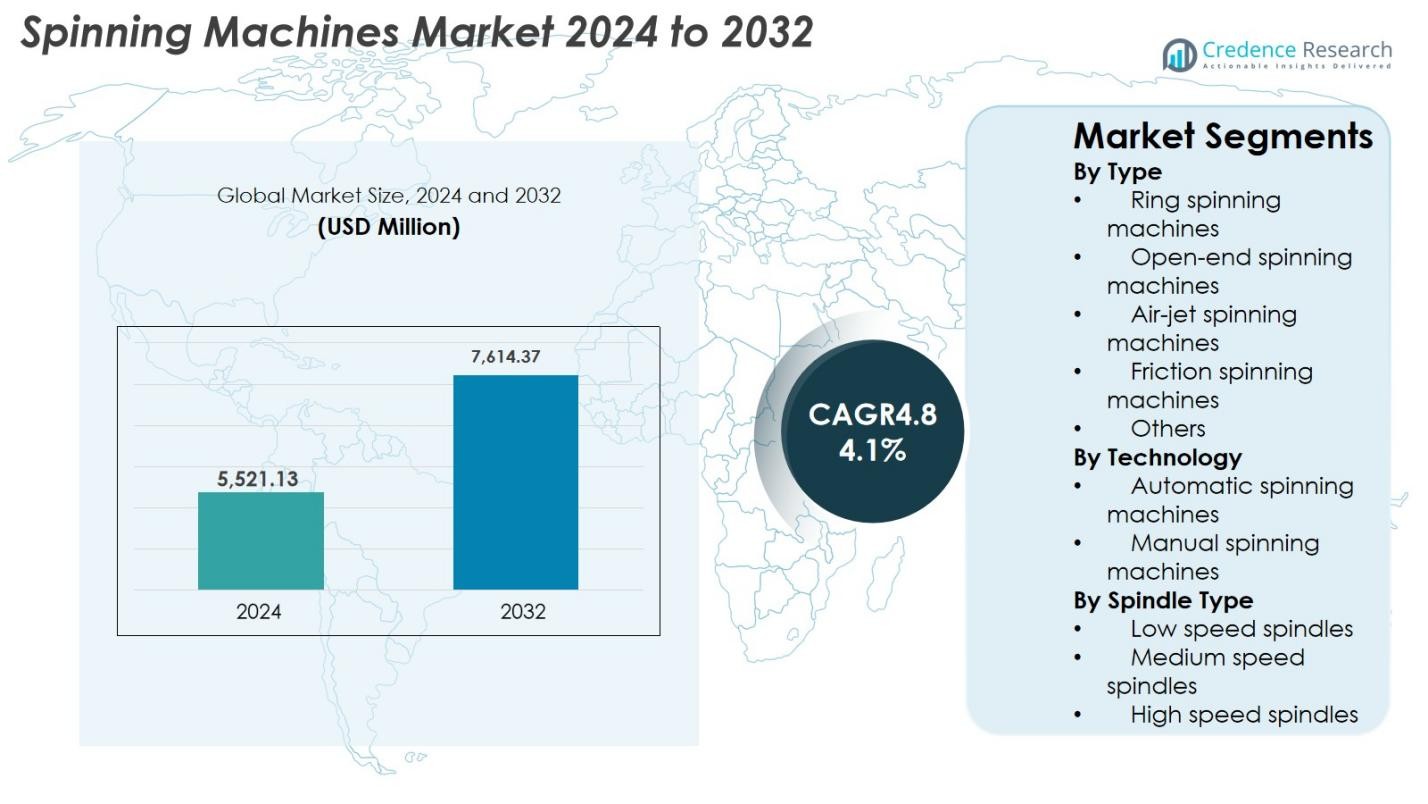

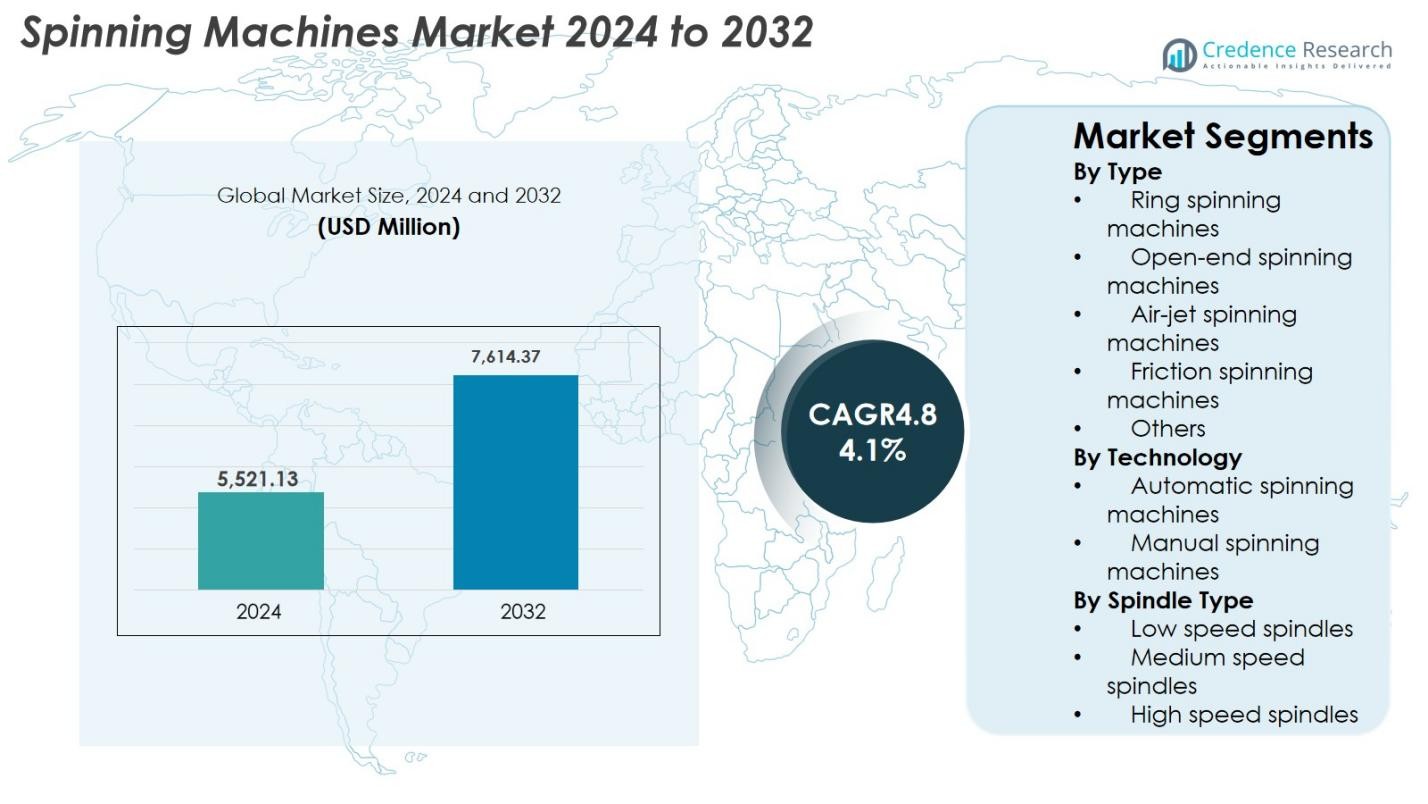

Spinning Machines Market size was valued at USD 5,521.13 Million in 2024 and is anticipated to reach USD 7,614.37 Million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spinning Machines Market Size 2024 |

USD 5,521.13 Million |

| Spinning Machines Market, CAGR |

4.1% |

| Spinning Machines Market Size 2032 |

USD 7,614.37 Million |

Spinning Machines Market is driven by the strong presence of global manufacturers offering advanced, high-efficiency spinning technologies. Key players such as Rieter, Saurer, Muratec, Lakshmi Machine Works, Jingwei Textile Machinery, Picanol, Juki, Savio Macchine Tessili, Schlafhorst, and Marzoli Machines Textile lead the industry with comprehensive product portfolios and automation-focused solutions that enhance yarn quality and production speed. Their continuous investments in digitalization, high-speed spindles, and energy-efficient machinery strengthen market competitiveness. Regionally, Asia-Pacific dominates the global landscape with over 52.4% market share in 2024, supported by large-scale textile manufacturing clusters in China, India, Bangladesh, and Vietnam, making it the primary hub for spinning machinery demand and expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spinning Machines Market was valued at USD 5,521.13 million in 2024 and is projected to reach USD 7,614.37 million by 2032, growing at a CAGR of 4.1%.

- Rising textile and apparel demand, along with modernization of spinning mills, drives adoption of advanced ring spinning machines, which held the largest segment share of 46.8% in 2024.

- Automation, AI-enabled monitoring, and energy-efficient high-speed spindles are key trends, reshaping productivity and improving yarn consistency across global mills.

- Leading companies such as Rieter, Saurer, Muratec, Lakshmi Machine Works, Savio, and Jingwei focus on innovation, speed optimization, and lifecycle service models, though high capital costs remain a restraint for smaller mills.

- Asia-Pacific dominated the market with over 52.4% share in 2024, followed by Europe at 18.9% and North America at 14.6%, supported by strong textile clusters and increasing investments in automated spinning technologies.

Market Segmentation Analysis:

By Type

The Spinning Machines Market by type is dominated by ring spinning machines, which accounted for 46.8% market share in 2024 due to their superior yarn quality, flexibility across fiber types, and widespread use in cotton and blended yarn production. Open-end spinning machines follow, driven by increasing demand for high-volume, cost-efficient yarn manufacturing. Air-jet and friction spinning machines continue to gain traction as mills adopt high-speed, energy-efficient technologies. Rising textile automation, expanding apparel demand, and modernization of spinning mills in Asia-Pacific further strengthen the dominance of ring spinning systems.

- For instance, open-end spinning machines are widely used in mills that prioritise volume and efficiency: such machines significantly reduce labour requirements and production costs compared with ring spinning.

By Technology

In the technology segment, automatic spinning machines held the dominant share of 62.4% in 2024, supported by the rapid digitalization of textile mills and the growing need for consistent yarn quality with minimal labor intervention. Automatic systems integrate robotics, real-time monitoring, and AI-based quality control, enabling higher productivity and reduced operational costs. Manual spinning machines remain relevant in small-scale mills but continue to lose share as manufacturers prioritize efficiency, precision, and reduced downtime. The push toward Industry 4.0 and rising labor costs in emerging economies further accelerate the adoption of automated spinning technologies.

- For instance, Rieter’s Autocoro and related automated platforms have been documented to reduce manual piecing and deliver continuous quality monitoring, enabling mills to run higher spindle speeds with fewer operators. Real-time sensor feedback improves yarn uniformity and reduces waste.

By Spindle Type

High-speed spindles led the spindle-type segment with a market share of 54.2% in 2024, driven by large manufacturers seeking greater output, enhanced yarn uniformity, and lower energy consumption per kilogram of yarn. Medium-speed spindles remain significant in mills balancing efficiency with machine longevity, while low-speed spindles cater to specialized or legacy operations. The dominance of high-speed spindles is fueled by rising global textile demand, increasing investments in high-capacity spinning frames, and innovations in spindle design that reduce vibration, enhance durability, and support high-quality yarn spinning across diverse fiber categories.

Key Growth Drivers

Rising Global Textile and Apparel Consumption

The steady increase in global textile and apparel consumption remains a major driver for the Spinning Machines Market, as expanding fashion retail, fast fashion cycles, and rising per-capita clothing expenditure stimulate demand for high-quality yarn production. Emerging economies such as China, India, Bangladesh, and Vietnam are significantly scaling textile manufacturing capacities, prompting mills to invest in advanced spinning machinery to boost productivity. Additionally, the growing preference for blended yarns and performance fabrics is encouraging manufacturers to upgrade to more versatile spinning technologies. This sustained consumption trend directly amplifies demand for efficient, high-output spinning systems.

- For instance, India’s textile sector expansion, supported by production-linked incentive (PLI) schemes, has led to documented mill upgrades and new installations of advanced spinning lines to meet the rising demand for cotton and synthetic-blend yarns in domestic and export markets.

Shift Toward Automation and Industry 4.0

Automation is transforming spinning operations, positioning automated spinning machines as a central growth engine for the market. Mills increasingly adopt robotics, automated doffing, digital monitoring, and AI-enabled quality control to reduce labor dependency, improve consistency, and lower operational costs. The integration of IoT sensors enables predictive maintenance, minimizing downtime and extending machinery lifespan. As labor shortages intensify in key textile hubs, automation becomes a crucial strategic priority. The push toward smart factories, coupled with government incentives for industrial modernization, further accelerates the adoption of intelligent spinning machinery across global textile clusters.

- For instance, Rieter’s automated doffing and real-time monitoring technologies, integrated into systems like the Autocoro and ring-spinning platforms, enable autonomous bobbin handling and self-adjusting controls, helping mills maintain stable yarn quality while reducing operator workload.

Rising Investments in High-Speed and Energy-Efficient Spinning Solutions

Growing emphasis on energy savings, reduced wastage, and higher throughput drives investments in high-speed and energy-efficient spinning machines. Manufacturers seek systems that optimize yarn production while lowering electricity consumption, given that energy costs constitute a major share of textile mill expenses. Technological advancements in spindle design, motor efficiency, and lightweight components enable machines to achieve higher rotation speeds without compromising quality. Additionally, sustainability goals and carbon-reduction commitments are prompting mills to replace legacy equipment with eco-efficient models. These upgrades enhance competitiveness and align with global efficiency benchmarks in modern spinning operations.

Key Trends & Opportunities

Adoption of Smart, Connected, and AI-Driven Spinning Machinery

A major trend reshaping the Spinning Machines Market is the integration of smart technologies that enhance operational transparency, predictive maintenance, and real-time decision-making. AI-driven systems analyze yarn quality, detect defects instantly, and optimize spinning parameters based on fiber characteristics, significantly improving consistency and reducing material waste. IoT-enabled platforms allow mills to monitor machine performance remotely, track energy consumption, and automate workflows across large production lines. This digital transformation unlocks opportunities for manufacturers to deliver value-added features such as remote diagnostics, cloud-based analytics, and machine-learning-driven optimization. As textile mills accelerate their shift toward smart manufacturing, the demand for digitally enabled spinning equipment is expected to rise sharply.

- For instance, Savio’s Smart Factory solutions, built around IoT sensors and remote diagnostics, allow mills to monitor winding performance, receive predictive maintenance alerts, and execute digital workflow automation to reduce downtime across production lines.

Growing Demand for Sustainable, Eco-Efficient Spinning Technologies

Sustainability is emerging as a high-priority opportunity, pushing spinning machine manufacturers to develop solutions that reduce resource consumption and environmental impact. Innovations such as low-energy motors, optimized air systems, reduced lint pollution, and recyclable machine components align with global green manufacturing goals. Additionally, the rising use of recycled fibers and bio-based materials requires sophisticated spinning systems capable of handling diverse fiber properties while maintaining yarn quality. Mills adopting sustainable solutions benefit from lower operating costs, improved compliance with environmental regulations, and enhanced brand value. This increasing focus on eco-efficiency—and the pressure on textile supply chains to reduce carbon footprints—creates strong long-term growth prospects for next-generation spinning technologies.

- For instance, Rieter has documented energy-efficient upgrades such as optimized suction systems and low-power drive motors across its modern ring-spinning platforms, enabling mills to reduce electricity consumption while maintaining consistent yarn output.

Key Challenges

High Capital Investment Requirements

One of the most significant challenges in the Spinning Machines Market is the high upfront capital required for procurement, installation, and modernization. Advanced automated spinning systems and high-speed spindles demand substantial financial commitment, making adoption difficult for small and mid-sized mills with limited budgets. Additionally, fluctuating raw material costs and tight profit margins in the textile industry discourage aggressive capital spending. Financing constraints and long payback periods further hinder large-scale modernization initiatives. As a result, many manufacturers continue operating older machinery, slowing overall market penetration of advanced spinning technologies.

Shortage of Skilled Workforce for Advanced Machinery

The increasing adoption of automated and digitally enabled spinning technologies highlights a critical shortage of skilled operators capable of managing sophisticated systems. Many textile clusters face gaps in technical expertise related to machine programming, digital monitoring, and predictive maintenance. This lack of skilled labor leads to operational inefficiencies, reduced machine performance, and higher maintenance costs. Training new workers requires time and investment, adding further constraints for mills transitioning toward advanced systems. As spinning machinery becomes more technologically complex, bridging the workforce skill gap remains a persistent challenge for industry growth.

Regional Analysis

North America

North America held 14.6% of the Spinning Machines Market share in 2024, supported by steady demand for high-quality yarn in technical textiles, home furnishings, and performance apparel. The region shows increasing adoption of advanced automated spinning systems as manufacturers focus on reshoring textile operations and improving productivity through digitalization. Investments in sustainability-driven textile production and innovations in fiber blending further enhance market growth. Although the region operates fewer spinning mills compared to Asia, its emphasis on high-value yarn, energy-efficient machinery, and precision manufacturing continues to stimulate stable adoption of modern spinning technologies.

Europe

Europe accounted for 18.9% market share in 2024, driven by strong demand for premium yarns used in fashion, automotive, and industrial applications. The region leads in modernization initiatives, with mills investing heavily in high-speed, automated, and eco-efficient spinning machines to comply with strict energy and emission regulations. Germany, Italy, and Turkey are key contributors, supported by advancements in machinery technology and growing interest in recycled fiber processing. Europe’s focus on sustainable textile production and quality-driven output continues to shape machinery upgrades, strengthening its position as a technologically progressive market within the global spinning machinery landscape.

Asia-Pacific

Asia-Pacific dominated the global market with over 52.4% share in 2024, making it the largest and fastest-growing region for spinning machinery. China, India, Bangladesh, and Vietnam continue to expand their textile and apparel production capacities, creating strong demand for high-speed, automated spinning systems. The region benefits from abundant labor, large-scale manufacturing ecosystems, and government support for textile modernization. Rising exports, increasing domestic consumption of apparel, and continuous mill expansions drive sustained investments in advanced spinning technologies. Asia-Pacific’s leadership is further reinforced by rapid adoption of energy-efficient machines to improve productivity and reduce operational costs.

Latin America

Latin America captured 7.8% of the market share in 2024, supported by growing textile production in Brazil, Mexico, and Peru. The region is witnessing increased demand for spinning machines as manufacturers shift toward localized yarn production, reducing import dependence. Investments in modernizing outdated spinning facilities and expanding capacity for denim, cotton, and blended yarns are fueling machinery adoption. Although the region faces challenges related to energy costs and infrastructure, rising export opportunities, supportive industrial policies, and the gradual shift to automated systems are enabling steady growth in the spinning machinery sector.

Middle East & Africa

The Middle East & Africa region accounted for 6.3% market share in 2024, driven by expanding textile manufacturing hubs in Turkey, Egypt, Ethiopia, and the UAE. Growing investments in industrial zones, low labor costs, and rising interest from global brands in regional sourcing are boosting demand for spinning machinery. The region continues to upgrade its textile infrastructure with high-speed spindles and automated spinning equipment to improve competitiveness. While adoption levels remain lower than other regions, increasing government support, export-oriented production strategies, and mill modernization efforts position MEA as an emerging growth market for spinning machines.

Market Segmentations:

By Type

- Ring spinning machines

- Open-end spinning machines

- Air-jet spinning machines

- Friction spinning machines

- Others

By Technology

- Automatic spinning machines

- Manual spinning machines

By Spindle Type

- Low speed spindles

- Medium speed spindles

- High speed spindles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Spinning Machines Market is characterized by strong participation from global machinery manufacturers focused on innovation, automation, and energy-efficient technologies. Leading players such as Rieter, Saurer, Muratec, Lakshmi Machine Works, Jingwei Textile Machinery, Picanol, Juki, Savio Macchine Tessili, Schlafhorst, and Marzoli Machines Textile dominate the market through extensive product portfolios and advanced spinning solutions tailored for large-scale textile operations. These companies emphasize high-speed spindles, automated monitoring systems, and digitalized spinning platforms to enhance productivity and yarn quality. Strategic initiatives—including capacity expansions, technology collaborations, after-sales service strengthening, and regional market penetration—remain central growth strategies. In emerging markets like Asia-Pacific, manufacturers compete by offering cost-effective, energy-efficient machines aligned with mill modernization programs. Established players also invest heavily in R&D to develop eco-efficient technologies capable of handling recycled fibers and new material blends. As textile manufacturers pursue higher efficiency and consistent output, competition intensifies around automation, innovation, and lifecycle service excellence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Savio Macchine Tessili

- Muratec

- Juki

- Rieter

- Schlafhorst

- Lakshmi Machine Works

- Saurer

- Picanol

- Jingwei Textile Machinery

- Marzoli Machines Textile

Recent Developments

- In October 2025, Lakshmi Machine Works Ltd. (LMW) unveiled the concept of a “Smart Spinning Mill” showcasing its latest spinning-machinery innovations at ITMA ASIA + CITME 2025.

- In May 2025, Alok Industries Ltd. (India) selected Rieter’s compact-spinning system to upgrade its yarn production operations a sign of rising demand for modern spinning technology.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Spindle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion as textile mills increasingly adopt automated and digitalized spinning technologies.

- High-speed and energy-efficient spindle systems will gain stronger demand to improve productivity and reduce operational costs.

- AI-driven quality monitoring and predictive maintenance will become standard features across new spinning installations.

- The shift toward sustainable manufacturing will accelerate investments in eco-efficient spinning machines.

- Rising use of recycled and specialty fibers will drive demand for advanced spinning systems capable of handling diverse material properties.

- Modernization programs in Asia-Pacific will continue to position the region as the global hub for spinning machinery growth.

- Manufacturers will strengthen service-led business models, including remote diagnostics and performance optimization.

- Compact, flexible, and multi-material spinning solutions will gain traction in mid-sized and emerging mills.

- Digital twins and smart factory integration will reshape operational planning and real-time performance control.

- Strategic collaborations between machinery makers and textile producers will increase to accelerate innovation and customized solutions.