Market Overview:

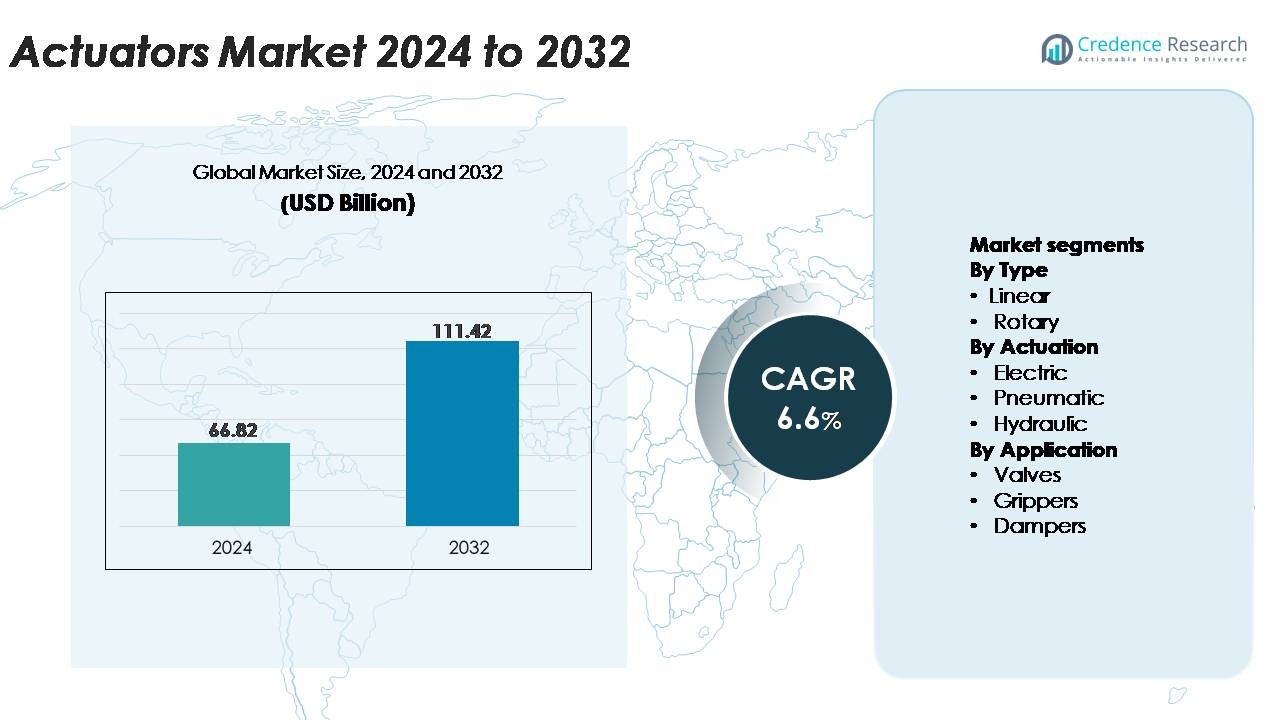

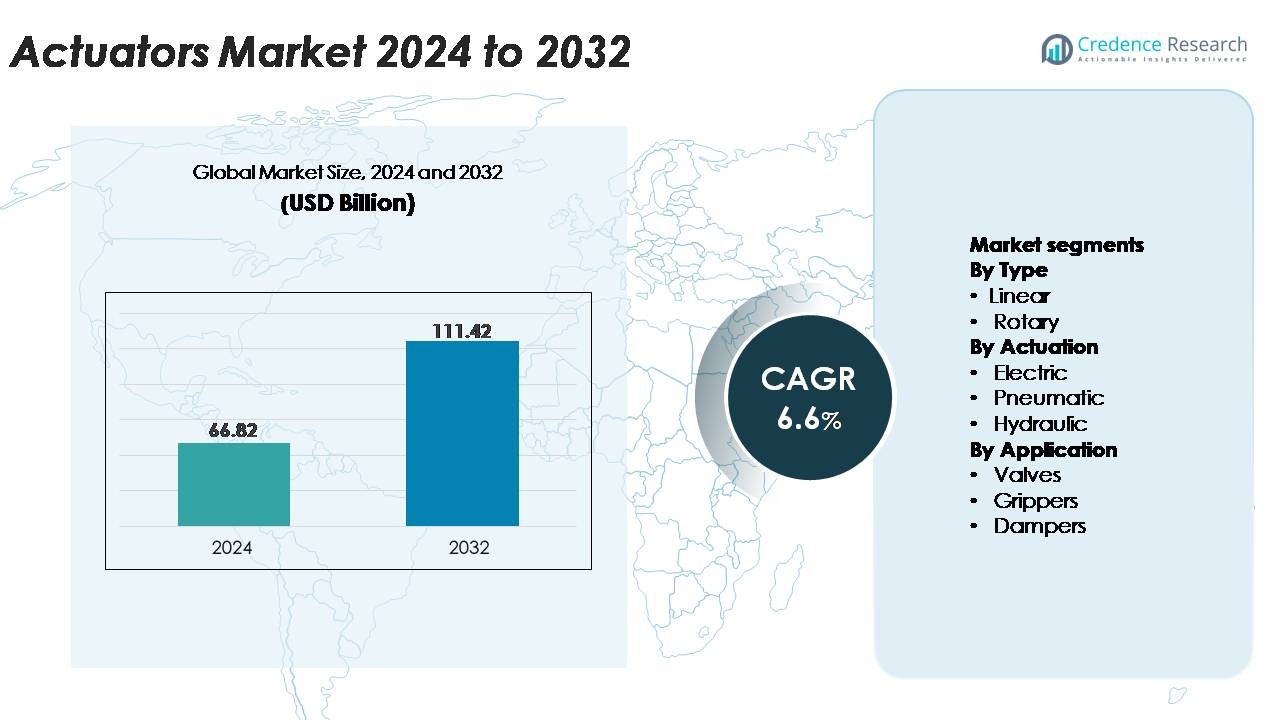

The global actuators market was valued at USD 66.82 billion in 2024 and is forecast to reach USD 111.42 billion by 2032, registering a CAGR of 6.6% over the forecast period.”

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Actuators Market Size 2024 |

USD 66.82 Billion |

| Actuators Market, CAGR |

6.6% |

| Actuators Market Size 2032 |

USD 111.42 Billion |

The actuators market is driven by major global players such as Emerson Electric Co., Siemens AG, ABB Ltd., Parker Hannifin Corporation, Honeywell International Inc., Rockwell Automation, Rotork plc, SMC Corporation, and Curtiss-Wright Corporation. These companies lead through broad product portfolios, strong R&D capabilities, and widespread integration of electric, pneumatic, and hydraulic actuators across industrial, process, and infrastructure applications. Their focus on smart, sensor-enabled designs and IIoT-ready platforms strengthens their competitive position. Asia-Pacific remains the leading region with an exact market share of 34%, supported by rapid industrialization and automation adoption, followed by North America and Europe with strong technology-driven demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global actuators market was valued at USD 66.82 billion in 2024 and is projected to reach USD 111.42 billion by 2032, registering a CAGR of 6.6%, driven by rising adoption of automated motion-control systems across industries.

- Strong market growth is supported by increasing deployment of electric actuators in smart factories, robotics, and precision equipment, with electric actuation holding the largest segment share due to higher efficiency and digital integration capabilities.

- Key trends include rapid expansion of IIoT-enabled, sensor-integrated actuators, miniaturized high-precision devices for medical and electronics applications, and wider use in renewable energy systems.

- Competitive intensity remains high as leading players Emerson, ABB, Siemens, Parker Hannifin, Honeywell, Rotork, and SMC focus on smart technologies, reliability enhancement, and global service expansion, while supply chain volatility and material cost fluctuations act as restraints.

- Regionally, Asia-Pacific leads with 34% market share, followed by North America at 32% and Europe at 28%, supported by automation maturity, industrial investments, and strong demand from process and discrete manufacturing sectors.

Market Segmentation Analysis:

By Type

Linear actuators dominate the market, accounting for the largest share due to their extensive use in industrial automation, robotics, material handling, and precision motion systems. Their high force output, compact design, and compatibility with electric, hydraulic, and pneumatic power sources strengthen adoption across manufacturing and process industries. Growing demand for precision-controlled movement in packaging lines, semiconductor equipment, and automotive assembly further reinforces their leadership. Rotary actuators continue to grow in applications requiring angular movement, but linear actuators remain the preferred choice for high-load, high-accuracy, and repeatable positioning tasks across diverse end-use sectors.

- For instance, Parker Hannifin’s ETH125 electric linear actuator delivers up to 114,000 N of thrust with positioning repeatability of ±0.03 mm, enabling deployment in high-load automotive assembly and press-fit applications.

By Actuation

Electric actuators hold the dominant market share, driven by the rapid shift toward energy-efficient, digitally controlled motion systems. Their advantages including precise positioning, low maintenance, programmability, and integration with smart sensors make them essential in robotics, medical devices, and advanced industrial automation. The rise of IIoT-enabled factories and electric mobility systems further accelerates adoption. Pneumatic actuators maintain strong presence in cost-sensitive, high-speed applications, while hydraulic actuators remain relevant for heavy-duty operations requiring very high force. However, the continued electrification of industrial processes ensures electric actuators lead the segment.

- For instance, SMC’s LEY100 electric rod actuator delivers a maximum pushing force of 12,000 N with a positioning repeatability of ±0.02 mm, enabling high-precision motion in semiconductor and laboratory equipment.

By Application

Valves represent the largest application segment, supported by widespread use across oil & gas, water treatment, chemicals, power generation, and HVAC systems. Automated valve control is critical for flow regulation, safety management, and process optimization, making actuators indispensable in complex industrial environments. The shift toward smart, remote-operated valves in refineries and processing plants strengthens demand for high-reliability electric and pneumatic actuators. Grippers are expanding rapidly with the growth of collaborative robotics, while dampers remain essential in ventilation and thermal management systems. Despite this, valve automation continues to command the dominant share.

Key Growth Drivers

Rapid Industrial Automation and Expansion of Smart Manufacturing

Industrial automation remains the primary force accelerating actuator adoption across process and discrete industries. Manufacturers increasingly deploy automated machinery, robotic systems, and PLC-controlled equipment to enhance throughput, reduce labor dependency, and improve precision in production processes. Actuators enable controlled linear and rotary motion, making them essential in assembly lines, packaging equipment, robotic grippers, CNC tools, and quality-inspection systems. The emergence of smart factories amplifies this demand as actuators integrate with sensors, machine-vision modules, and IoT platforms for real-time performance monitoring and predictive maintenance. Industries such as automotive, electronics, pharmaceuticals, and semiconductors continue to expand automation intensity, creating sustained demand for compact, high-accuracy, and digitally compatible actuation systems. This shift toward faster, flexible, and data-driven production environments ensures long-term growth across electric, pneumatic, and hydraulic actuator categories.

- For instance, Festo’s EPCO electric cylinder delivers thrust forces up to 1,300 N with stroke lengths reaching 400 mm and repeatability of ±0.02 mm, enabling high-accuracy, high-speed positioning in automated manufacturing cells.

Increasing Adoption of Energy-Efficient and Electrified Motion Systems

The industry’s ongoing transition from hydraulic and pneumatic systems toward electric actuation significantly drives market growth. Electric actuators deliver higher energy efficiency, lower operational costs, and minimal leakage risk compared to fluid-driven alternatives. Their superior precision, programmability, and compatibility with advanced control architectures position them as the preferred choice for robotics, medical devices, semiconductor tools, and automated laboratory systems. Sustainability mandates and carbon-reduction policies encourage industries to replace legacy systems with clean, energy-efficient solutions. Electric actuators also support condition monitoring through embedded sensors that track load, temperature, and cycle health, enabling predictive maintenance. As industries prioritize energy optimization and intelligent motion control, electric actuators experience accelerating adoption, reinforcing their market leadership across multiple end-use environments.

- For instance, Thomson Industries’ Electrak® HD electric actuator delivers up to 10,000 N of force with integrated J1939 CANbus controls and on-board load monitoring, replacing hydraulic cylinders in mobile and industrial equipment with zero fluid leakage.

Growth of Robotics, Mechatronics, and Autonomous Systems

The expanding use of industrial robots, collaborative robots (cobots), autonomous mobile robots (AMRs), and automated guided vehicles (AGVs) fuels substantial demand for advanced actuator technologies. Actuators enable precise movement, grip strength, steering, and positioning, making them foundational to robotic functionality. Rising investments in automation within logistics, warehousing, healthcare, defense, and electronics manufacturing create strong demand for compact, lightweight, high-torque actuators designed for dynamic, multi-axis robotic operations. Cobots in particular rely on safe, low-noise, sensor-integrated electric actuators to perform repetitive, high-accuracy tasks alongside human workers. As robots gain higher payload capacities and motion sophistication, actuator manufacturers innovate with high-resolution motors, modular actuator assemblies, and enhanced communication capabilities. This broad robotics ecosystem ensures long-term, diversified demand for both linear and rotary actuator solutions.

Key Trends & Opportunities:

Expansion of Smart, Connected, and Sensor-Integrated Actuators

A significant trend shaping the actuators industry is the shift toward smart, sensor-equipped actuation systems capable of self-diagnostics and data reporting. These next-generation actuators are embedded with load sensors, temperature sensors, torque feedback, and digital communication interfaces such as CANbus, IO-Link, and Ethernet/IP. Connected actuators enable continuous performance monitoring, allowing equipment operators to predict component failure, optimize energy use, and improve overall equipment effectiveness (OEE). This transition unlocks opportunities in predictive maintenance platforms, real-time process control, and automation of safety-critical operations. Adoption is accelerating in pharmaceuticals, food processing, semiconductor fabrication, and energy industries where precision and uptime are paramount. As Industry 4.0 initiatives expand globally, demand for intelligent actuators continues to rise, opening avenues for value-added software, remote monitoring solutions, and cloud-enabled control architectures.

· For instance, the Rotork IQ3 Pro electric actuator stores up to 3,000 time-stamped diagnostic events and offers a position resolution of 7.5° at the output. It features robust torque-sensing capabilities, enabling precise monitoring and predictive maintenance across mission-critical operations.

Growing Demand for Miniaturized and High-Precision Actuation Solutions

The market observes strong opportunities in miniaturized actuators designed for compact equipment, medical devices, laboratory automation, micro-assembly tools, and portable robotics. Precision-critical industries increasingly require actuators with high torque density, minimal backlash, low noise, and micron-level positional accuracy. Manufacturers respond by developing mini linear actuators, piezoelectric actuators, voice-coil actuators, and micro-rotary motors to address this emerging need. These technologies enable ultra-precise dosing, positioning, gripping, and optical alignment tasks. The broader trend of equipment downsizing in electronics, biotechnology, and surgical robotics further enhances demand for compact, lightweight actuator systems. As product design evolves toward smaller footprints and greater motion refinement, actuator suppliers gain new opportunities to innovate in materials, mechatronic integration, and fine-motion control systems.

- For instance Physik Instrumente’s (PI) Q-545 miniature piezo-motor linear stage is available with a travel range of 13 mm or 26 mm. The stage offers a high position resolution in the nanometer range, with unidirectional repeatability down to 0.050 µm and a maximum speed of 8 mm/s in closed-loop operation, or up to 10 mm/s in open-loop mode.

Increasing Use of Actuators in Renewable Energy and Environmental Systems

Actuators play a growing role in renewable energy applications, including wind turbine pitch control, solar panel tracking systems, and energy-efficient HVAC equipment. The accelerating global transition toward clean energy and smart environmental management broadens deployment across power plants, desalination facilities, water treatment systems, and air-quality infrastructures. Precision-controlled actuators regulate damper positions, flow valves, and grid-balancing mechanisms, enabling operational efficiency and sustainability compliance. The expansion of utility-scale solar farms and offshore wind installations drives demand for corrosion-resistant, weather-proof actuator designs. With governments increasing support for decarbonization initiatives, actuators are positioned for strong adoption in green technologies and smart environmental systems.

Key Challenges:

High Maintenance Requirements and Performance Limitations of Legacy Systems

Despite extensive adoption, traditional pneumatic and hydraulic actuators face notable challenges related to maintenance intensity, energy inefficiency, and operational complexity. Fluid leakage, pressure loss, heat generation, and frequent component replacements increase operational costs for industries relying heavily on legacy systems. These actuators also offer limited precision and slower response compared to modern electric variants, restricting their use in high-accuracy automation tasks. The transition to electric actuators requires significant upfront investment and compatibility upgrades across machinery and control architectures. Many industries remain constrained by existing infrastructure and budget limitations, slowing the shift toward advanced solutions. This imbalance between legacy system limitations and modernization needs represents a major challenge for the overall sector.

Volatility in Raw Material Prices and Supply Chain Disruptions

Actuator manufacturing depends heavily on high-grade metals, alloys, motors, seals, electronic components, and machining processes. Fluctuations in prices of steel, aluminum, copper, rare earth magnets, and semiconductor components directly affect production costs. Global supply chain disruptions including geopolitical tensions, logistics delays, and shortages in electronic parts further constrain manufacturing timelines and inventory stability. Lead times for critical components such as precision bearings, control chips, and servo motors often extend during periods of supply stress, impacting OEM delivery schedules. Manufacturers must invest in supply chain diversification, localized sourcing, and inventory optimization to mitigate these risks. Persistent raw material volatility remains a substantial operational challenge for actuator producers worldwide.

Regional Analysis:

North America

North America holds a substantial share of the actuators market, accounting for around 32%, driven by strong automation adoption across manufacturing, aerospace, automotive, and energy sectors. The region benefits from widespread deployment of electric and smart actuators in industrial machinery, oil & gas facilities, and process plants. High investments in robotics, IIoT infrastructure, and advanced motion-control systems reinforce demand. The U.S. leads with extensive use of automated assembly lines, while Canada contributes through growth in mining, utilities, and renewable energy installations. Strong presence of global automation suppliers further strengthens the region’s competitive position.

Europe

Europe captures approximately 28% of the global actuators market, supported by advanced industrial automation, strong automotive production, and widespread modernization of process industries. Germany, Italy, and France dominate demand through extensive use of high-precision actuators in packaging, material handling, and industrial robotics. The region’s sustainability agenda accelerates adoption of electric actuators, particularly in energy-efficient HVAC systems and clean manufacturing environments. Investments in renewable energy, wastewater treatment, and smart infrastructure further stimulate market growth. The presence of established automation suppliers enables rapid technological integration across both discrete and process industries.

Asia-Pacific

Asia-Pacific leads the global actuators market with about 34% share, driven by rapid industrialization, large-scale manufacturing expansion, and strong growth in robotics and automotive production. China and Japan dominate consumption through extensive use in electronics, semiconductors, and advanced machinery. India and Southeast Asia contribute significantly due to increased infrastructure development, process plant upgrades, and adoption of automated equipment in textiles, food processing, and chemicals. Government-led automation initiatives and large investments in renewable energy and smart factories further strengthen demand for electric, pneumatic, and hydraulic actuators across the region.

Latin America

Latin America accounts for around 4% of the actuators market, with growth driven by expanding oil & gas operations, mining activities, and modernization of industrial facilities in Brazil, Mexico, and Argentina. Demand for pneumatic and hydraulic actuators remains strong in heavy-duty applications, while electric actuators gain traction in manufacturing and automation upgrades. The region’s growing investments in water treatment, food processing, and energy infrastructure support additional adoption. Despite economic fluctuations and slower automation maturity compared to major regions, increasing industrial digitization and regulatory compliance requirements contribute to steady market expansion.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 2% of the global market, primarily supported by substantial demand from oil & gas, petrochemicals, power generation, and desalination industries. Actuators play a critical role in valve automation, flow control, and process optimization across large-scale energy and water infrastructure projects. GCC countries lead adoption through continuous investment in refinery expansion and utility modernization. Africa shows growing potential in mining, water management, and industrial equipment upgrades. While automation penetration remains comparatively lower, increasing industrial diversification and smart infrastructure initiatives drive incremental market growth.

Market Segmentations:

By Type

By Actuation

- Electric

- Pneumatic

- Hydraulic

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The actuators market features a highly competitive landscape characterized by established global manufacturers, specialized motion-control suppliers, and rapidly innovating automation technology providers. Leading companies such as Emerson Electric, ABB, Siemens, Parker Hannifin, Honeywell, Rockwell Automation, and Rotork maintain strong positions through extensive product portfolios spanning electric, pneumatic, and hydraulic actuators tailored for industrial, process, and infrastructure applications. These firms compete on precision, reliability, digital connectivity, and integration with advanced control systems. Continuous investments in smart, sensor-enabled actuators and IIoT platforms strengthen their technological advantage. Mid-sized players and niche specialists focus on compact actuators, valve automation systems, and application-specific solutions for robotics, medical devices, and semiconductor equipment. Strategic partnerships with system integrators, expansion into emerging economies, and upgrades to energy-efficient designs further shape the competitive environment. Overall, innovation, customization capability, and global service networks remain decisive factors in market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In June 4, 2025, Rotork announced it joined Rockwell Automation’s Technology Partner Program major step in promoting its IQ3 Pro electric actuator with EtherNet/IP connectivity in industrial automation systems.

- In February 1, 2023, Curtiss-Wright,the company announced that it had been awarded a contract to provide electromechanical actuators for the first 16 platforms of the Dynetics “Enduring Shield” ground-based launcher system for the U.S. Army.

- In July 2022, Honeywell announced that Archer Aviation selected Honeywell to supply its MicroVCS thermal-management and actuator/climate-system technology for eVTOL aircraft.

Report Coverage:

The research report offers an in-depth analysis based on Type, Actuation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness accelerated adoption of electric actuators as industries shift toward energy-efficient and low-maintenance motion-control solutions.

- Smart, sensor-integrated actuators will become standard, enabling predictive maintenance and real-time equipment performance optimization.

- Robotics, cobots, and autonomous systems will drive strong demand for compact, high-precision actuators across manufacturing and logistics.

- Miniaturized actuators will gain traction in medical devices, laboratory automation, and semiconductor equipment.

- Advanced valve automation will expand with rising modernization of oil & gas, water treatment, and chemical processing facilities.

- Industrial IoT platforms will increasingly integrate with actuators, enhancing connectivity, diagnostics, and remote operation.

- Renewable energy applications, including wind and solar systems, will create new opportunities for durable and corrosion-resistant actuator designs.

- Material innovations and improved motor technologies will enhance actuator torque density, speed, and control accuracy.

- The aftermarket for actuator servicing, retrofitting, and automation upgrades will grow steadily across global industries.

- Emerging economies will experience rapid uptake as manufacturing capacity expands and automation investment intensifies.