Market Overview:

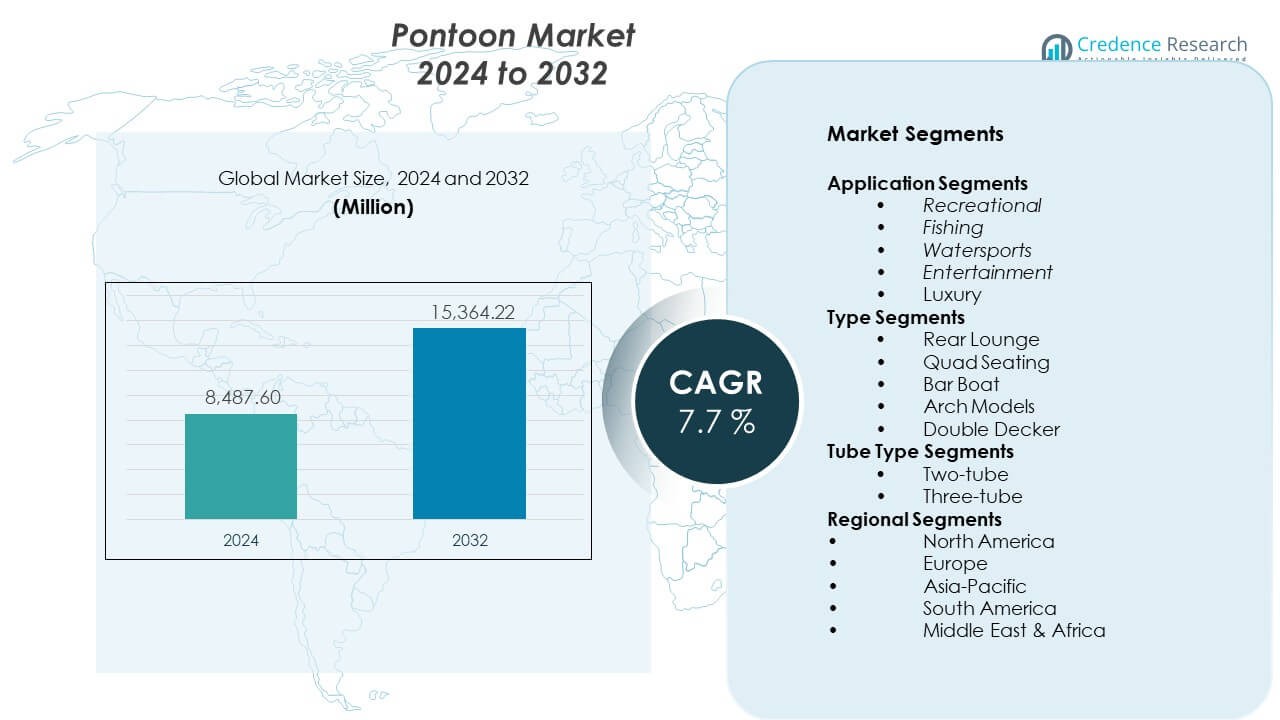

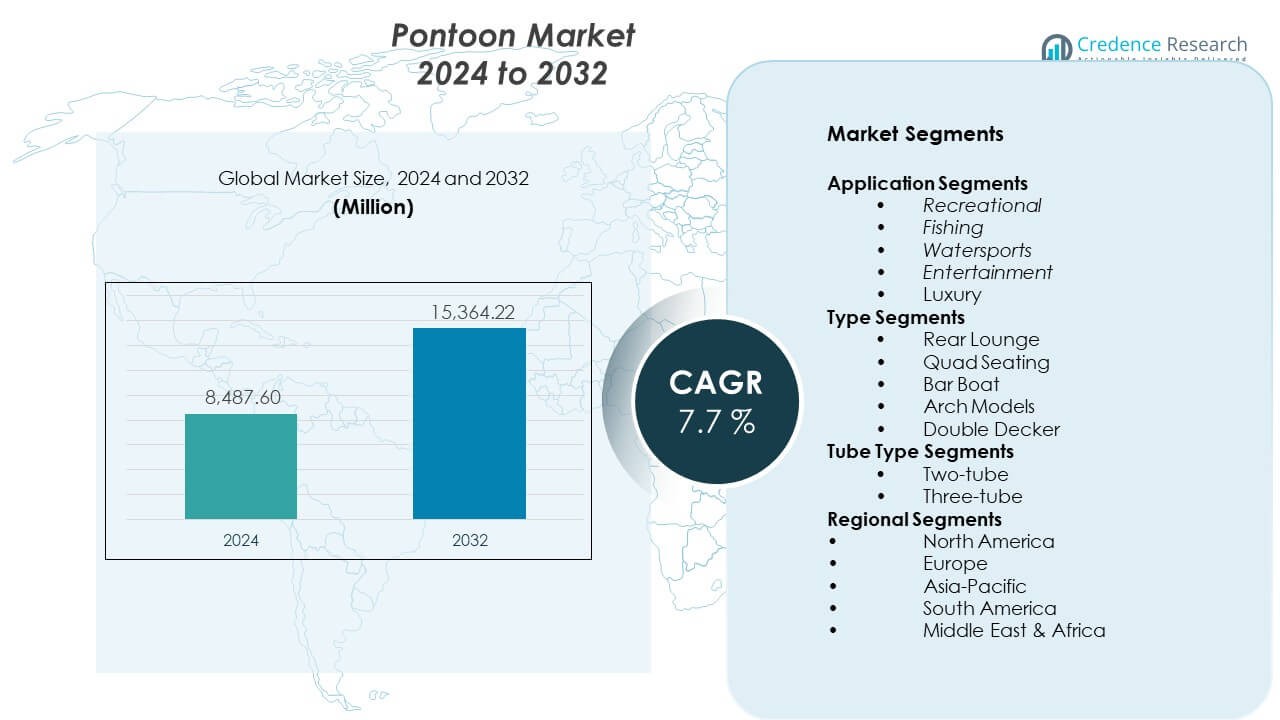

The Pontoon Market is projected to grow from USD 8,487.6 million in 2024 to USD 15,364.22 million by 2032. The market is expected to record a CAGR of 7.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pontoon Market Size 2024 |

USD 8,487.6 Million |

| Pontoon Market, CAGR |

7.7% |

| Pontoon Market Size 2032 |

USD 15,364.22 Million |

Recreation demand drives strong momentum across the Pontoon Market. Rising disposable income supports spending on leisure boats and water activities. Tourism operators invest in pontoons for resorts, marinas, and rental fleets. Modular designs allow quick installation and flexible use. Improved materials extend service life in harsh water conditions. Commercial users value low maintenance needs. Urban waterfront development increases demand for floating docks. Safety-focused designs improve buyer confidence. These combined drivers support steady market expansion.

North America leads the Pontoon Market due to strong boating culture and lake tourism. The United States shows high adoption across recreational and commercial uses. Europe follows, driven by marina upgrades and coastal tourism projects. Countries like Germany and France show steady demand growth. Asia Pacific emerges as a fast-growing region. China and Australia invest in waterfront infrastructure and leisure boating. Expanding tourism in Southeast Asia further supports regional demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market stood at USD 8,487.6 million in 2024 and is projected to reach USD 15,364.22 million by 2032, reflecting a CAGR of 7.7% driven by leisure boating and floating infrastructure demand.

- North America leads with about 42% share due to strong boating culture, lake density, and rental fleets, while Europe holds nearly 27% supported by marina upgrades and coastal tourism.

- Asia-Pacific accounts for around 21% share and remains the fastest-growing region, supported by tourism investment, waterfront development, and rising leisure spending in China and Australia.

- By application, recreational pontoons account for roughly 55% share, driven by family leisure use and rental activity, while fishing and watersports together contribute about 25% due to stability and deck space benefits.

- By tube type, two-tube models hold close to 60% share due to cost and ease of use, while three-tube designs represent about 40% driven by demand for higher load capacity and performance.

Market Drivers:

Rising Demand For Leisure Boating And Waterfront Recreation Activities

Growing interest in leisure boating supports steady demand across the Pontoon Market. Consumers prefer stable platforms for family and group recreation. Pontoon boats suit lakes, rivers, and calm coastal waters. Tourism operators expand fleets to serve rental demand. Resorts adopt pontoons for water transport and guided tours. Product versatility supports fishing, cruising, and event use. Improved comfort features raise buyer appeal. These factors sustain consistent market demand.

- For instance, Bennington Marine designs many of its pontoon models to support passenger capacities of up to 14 people, with reinforced deck structures tested for high static load stability, supporting family and rental use.

Expansion Of Commercial Waterfront And Marina Infrastructure Projects

Public and private investment drives demand for floating platforms and docks. Waterfront redevelopment supports tourism and urban leisure projects. The Pontoon Market benefits from flexible installation features. Modular pontoons suit marinas, restaurants, and event spaces. Operators value fast deployment and scalable layouts. Commercial users seek durable structures with low upkeep. Municipal projects favor floating solutions for access areas. Infrastructure growth strengthens long-term market demand.

- For instance, EZ Dock, a subsidiary of Brunswick Corporation, supplies modular floating dock systems with UV-stabilized polyethylene sections rated for multi-ton static loads, enabling rapid installation for commercial marinas and waterfront venues.

Advancements In Materials And Structural Design Technologies

Material innovation improves durability and load capacity. Aluminum and composite pontoons resist corrosion and wear. The Pontoon Market gains from longer service life expectations. Improved buoyancy designs enhance safety and stability. Manufacturers refine welding and sealing techniques. Weight optimization improves fuel efficiency for motorized units. Buyers value reduced maintenance cycles. Technology progress supports premium product adoption.

Growth In Inland Water Tourism And Recreational Fishing Activities

Lake-based tourism expands across developed and emerging regions. Recreational fishing communities favor stable pontoon platforms. The Pontoon Market serves guided tours and angling services. Local operators invest in customized deck layouts. Easy access features support older and family users. Tourism policies promote inland water experiences. Seasonal rental demand boosts fleet expansion. This driver supports recurring sales volumes.

Market Trends:

Shift Toward Customizable And Modular Pontoon Configurations

Buyers seek personalized layouts for varied uses. Modular sections allow flexible deck arrangements. The Pontoon Market adapts to lifestyle-driven preferences. Manufacturers offer seating, storage, and canopy options. Custom finishes improve visual appeal. Dealers promote build-to-order models. Modular designs simplify transport and installation. Customization strengthens brand differentiation.

- For instance, Avalon & Tahoe Manufacturing offers configurable seating modules and floorplans across its pontoon lineup, with CNC-cut decking systems that allow layout changes without structural modification, supporting faster customization cycles.

Integration Of Comfort-Oriented And User-Friendly Features

Comfort gains importance in recreational purchases. Soft seating and shade systems gain popularity. The Pontoon Market reflects higher comfort expectations. Easy-access ladders improve safety perception. Noise reduction designs enhance onboard experience. Controls favor simple and intuitive layouts. Family-friendly features influence purchase decisions. Comfort trends support premium pricing.

- For instance, Yamaha Motor Co., Ltd. integrates outboard engines with vibration-dampening mounts and optimized exhaust routing, achieving measurable reductions in perceived onboard vibration during low-RPM cruising on compatible pontoon platforms.

Rising Preference For Low Maintenance Floating Structures

Operators favor solutions with reduced upkeep needs. Corrosion-resistant materials support this trend. The Pontoon Market aligns with lifecycle cost focus. Coated surfaces reduce cleaning frequency. Sealed flotation systems limit water damage. Buyers compare long-term ownership costs. Maintenance efficiency improves adoption rates. This trend shapes product development priorities.

Adoption Of Electric And Hybrid Propulsion Compatibility

Sustainability interest influences boating choices. Electric-ready pontoons gain attention in regulated waters. The Pontoon Market responds to quieter propulsion needs. Hybrid compatibility supports fuel flexibility. Charging infrastructure growth aids adoption. Eco-friendly branding attracts new buyers. Regulations encourage cleaner boating solutions. This trend supports innovation pipelines.

Market Challenges Analysis:

High Initial Investment And Ownership Cost Sensitivity

Purchase costs remain a barrier for many buyers. Premium materials raise manufacturing expenses. The Pontoon Market faces price sensitivity among first-time users. Custom features increase final pricing. Financing access varies across regions. Commercial buyers assess payback periods carefully. Maintenance and storage add ownership costs. Cost concerns slow adoption in emerging markets.

Regulatory Compliance And Environmental Usage Restrictions

Waterbody regulations affect pontoon deployment. Local permits delay project timelines. The Pontoon Market must meet safety and environmental standards. Emission rules impact motorized pontoons. Noise limits restrict operating zones. Compliance increases design complexity. Operators face varying regional rules. Regulatory hurdles challenge uniform market expansion.

Market Opportunities:

Expansion In Emerging Tourism And Waterfront Development Regions

Developing regions invest in water-based tourism assets. Floating infrastructure suits limited shoreline space. The Pontoon Market can support fast project execution. Tourism growth raises rental fleet demand. Local governments favor modular floating solutions. Resorts seek distinctive water attractions. Regional suppliers gain partnership opportunities. This opportunity supports geographic expansion.

Product Innovation For Events And Multi-Use Commercial Applications

Event platforms create new revenue streams. Floating stages and dining decks gain interest. The Pontoon Market supports adaptable commercial designs. Operators seek quick reconfiguration options. Safety-certified platforms attract organizers. Urban waterfront events drive visibility. Custom branding features add value. Innovation opens diversified application segments.

Market Segmentation Analysis:

Application Segments

Recreational use holds a dominant share due to wide consumer appeal and family use. Fishing pontoons attract buyers who value deck space and stability. Watersports models support towing and active leisure on calm waters. Entertainment pontoons serve events, rentals, and social gatherings. Luxury variants focus on premium finishes and advanced comfort features. The Pontoon Market benefits from this wide application mix. It allows manufacturers to target varied buyer needs. This diversity supports steady demand across user groups.

- For instance, the SUN TRACKER pontoon line includes fishing-specific models like the BASS BUGGY and FISHIN’ BARGE series, which feature stable, elevated casting decks and lockable rod storage systems that accommodate rods up to 7′ 6″ (2.29 m) in length, supporting organized angling activity.

Type Segments

Rear lounge designs attract leisure users who prefer relaxed seating layouts. Quad seating models suit social boating and group travel. Bar boats gain traction in tourism and rental fleets. Arch models support watersports equipment and shade systems. Double decker pontoons appeal to entertainment and sightseeing operators. Each type addresses specific usage patterns. Buyers choose layouts based on comfort and activity needs. Product variety strengthens market positioning.

- For instance, Manitou Pontoon Boats, part of BRP Inc., engineers its performance pontoons with triple-tube configurations and integrated arches rated to support tow loads for watersports equipment, aligning layout design with functional demand.

Tube Type Segments

Two-tube pontoons serve entry-level and moderate-use buyers. These models suit calm water conditions and light loads. Three-tube designs support higher weight and improved stability. Commercial users prefer three-tube structures for safety margins. Performance-focused buyers favor enhanced buoyancy. Tube choice affects speed, handling, and capacity. Manufacturers align designs with application demands. Tube segmentation guides pricing and feature strategies.

Segmentation:

Application Segments

- Recreational

- Fishing

- Watersports

- Entertainment

- Luxury

Type Segments

- Rear Lounge

- Quad Seating

- Bar Boat

- Arch Models

- Double Decker

Tube Type Segments

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads With Strong Recreational And Commercial Adoption

North America holds the largest share of the Pontoon Market, accounting for about 42% of global demand. The United States drives regional dominance through strong recreational boating culture. Lake tourism and inland water activities support high unit sales. Commercial marinas and rental operators expand fleets steadily. Product customization attracts repeat buyers. Canada contributes through leisure boating and tourism growth. Mexico supports demand through resort-based applications.

Europe Maintains Stable Demand Through Marina And Tourism Projects

Europe represents nearly 27% of the Pontoon Market share. Countries such as Germany, France, and the U.K. support demand through marina upgrades. Coastal and inland tourism drives steady adoption. Southern Europe favors entertainment and sightseeing pontoons. Regulatory compliance shapes product design choices. Commercial waterfront redevelopment sustains long-term demand. The region shows balanced growth across applications.

Asia-Pacific And Rest Of World Show Emerging Growth Potential

Asia-Pacific accounts for around 21% of the Pontoon Market share. China and Australia lead due to tourism investment and waterfront development. Japan supports demand through leisure boating and marina modernization. India shows early-stage adoption tied to tourism projects. South America holds nearly 6% share, led by Brazil. Middle East and Africa represent about 4% share, driven by luxury tourism and resort infrastructure. These regions offer strong future expansion opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Polaris Inc.

- Brunswick Corporation (Lowe Boats)

- BRP Inc. (Manitou Pontoon Boats)

- Mastercraft Boat Holdings, Inc.

- Yamaha Motor Co., Ltd.

- Avalon & Tahoe Mfg., Inc.

- Forest River

- Silver Wave Pontoons

- Smoker Craft, Inc.

- White River Marine Group

- Bennington

- Godfrey

- Tracker Marine

- G3 Boats

- Crest Marine LLC

- Forza X1, Inc.

- JC Triton Marine

- Berkshire Pontoons

Competitive Analysis:

The Pontoon Market features strong competition among global and regional boat manufacturers. Leading players focus on product breadth, brand loyalty, and dealer networks. It benefits from continuous model refresh cycles and design upgrades. Established brands leverage scale to manage costs and supply chains. Mid-sized players compete through customization and niche positioning. Innovation centers on comfort, layout flexibility, and propulsion compatibility. Strategic pricing supports penetration across recreational and commercial users. After-sales service and warranty terms influence buyer choice. Competitive intensity remains high across North America and Europe.

Recent Developments:

- In November 2025, Godfrey Pontoons announced a complete redesign of its Monaco and Sanpan series for the 2026 model year. The redesigned Sanpan features a modernized rail frame, an updated helm with a 12-inch multifunction display, digital switching, and an innovative push-button entry door system with magnetic hold-open technology. The Monaco series received modernized rails for a sleek updated look, an enhanced helm with a 5-inch multifunction display, wireless phone charger, and new glass windscreen. Both 2026 models include a new center tube, centrally positioned fuel tank, NytCruz Auto Navigation, and Anchor Lights features. Additionally, Godfrey introduced the Click & Cruise modular accessory mounting system designed for 2026 Sanpan, Monaco, Sweetwater, and Xperience models, featuring integrated solutions like Fender Hangers, Flagpole Kits, Rod Holder Kits, and Sports Racks.

- In September 2025, Brunswick Boat Group announced a strategic consolidation of its fiberglass boat manufacturing operations, including the closure of its Reynosa, Mexico facility and the Flagler Beach, Florida production facility. Production would transition to high-performing U.S.-based manufacturing centers in Vonore, Tennessee and Merritt Island, Florida. Brunswick invested $5 million in capital improvements across Tennessee and Florida facilities, resulting in the creation of more than 200 U.S. manufacturing jobs over the next several years, with the transition expected to complete by Summer 2026.

- In July 2025, Forest River Marine announced a vibrant collaboration with Margaritaville, introducing the Chill Series—a line of pontoon boats designed to bring the easygoing spirit of Margaritaville to the water. Each model in the series features custom Margaritaville-inspired design elements, premium sound systems, and comfort-first layouts made for maximum relaxation. The Chill Series is available to order through Forest River Marine’s authorized dealers including Berkshire, South Bay, and Trifecta brands, with a starting MSRP of $45,169.

- In January 2025, Yamaha announced new product offerings including an expansion of its HARMO line available in single and twin configurations, fully integrated with Helm Master EX. The company also released new cowling designs and color options within its mid-range product line, along with new Steering Assist Tiller Handle F150 and F200 outboards.

Report Coverage:

The research report offers an in-depth analysis based on application segments, type segments, and tube type segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Recreational boating demand will remain the primary growth pillar

- Tourism-linked pontoon rentals will expand across lake destinations

- Modular and customizable designs will gain wider adoption

- Comfort and safety features will support premium positioning

- Electric propulsion compatibility will shape future models

- Commercial waterfront projects will create steady volume demand

- Emerging regions will attract new manufacturing investments

- Dealer network expansion will improve market reach

- Material innovation will enhance durability expectations

- Brand differentiation will rely on design and service quality