Market Overview:

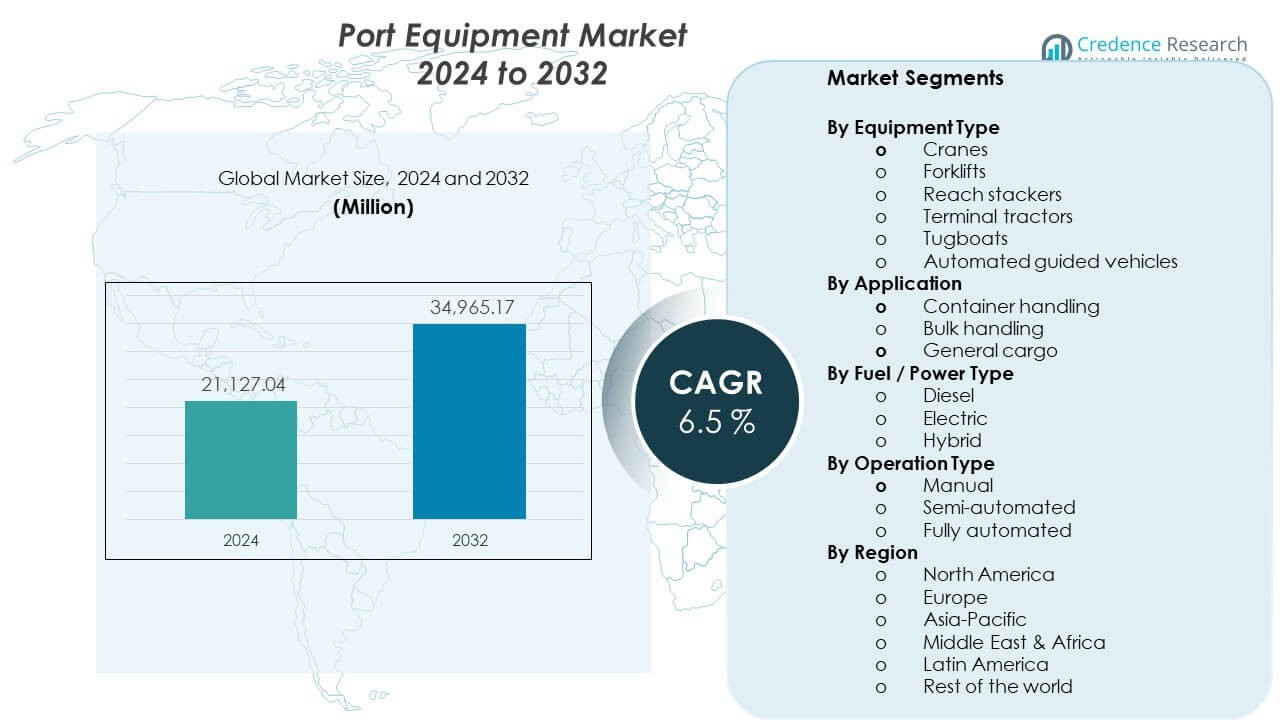

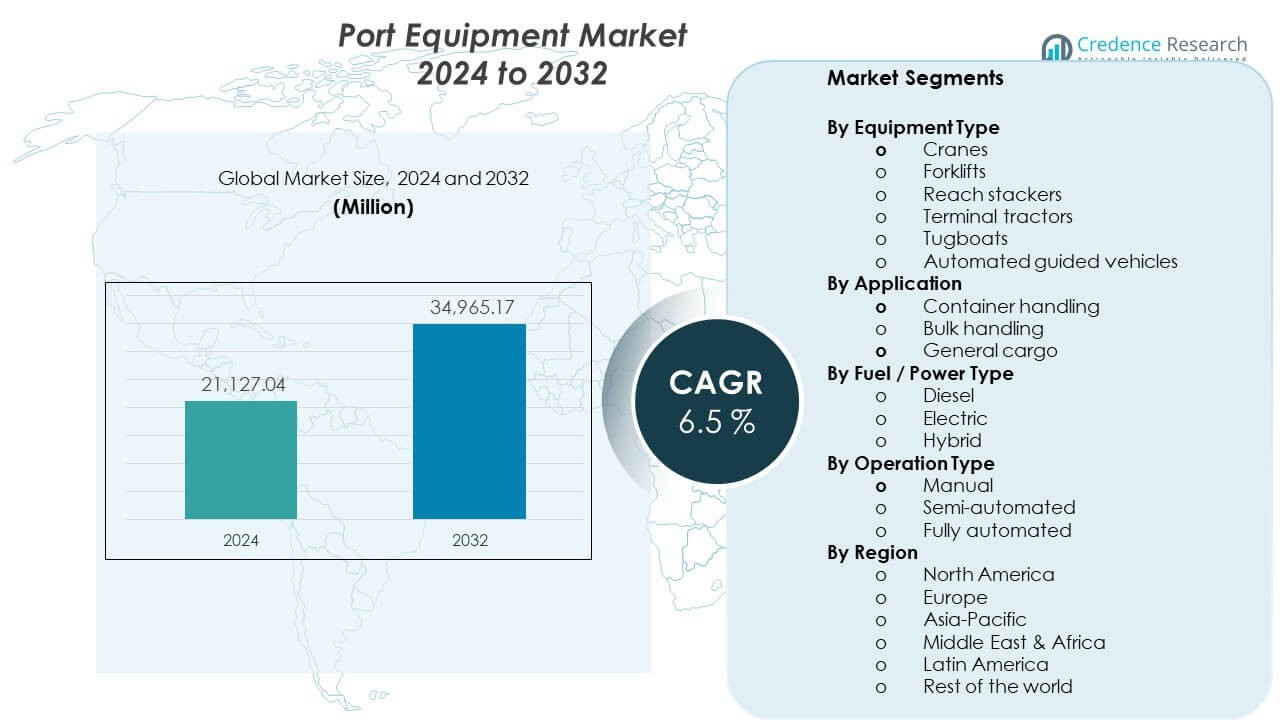

The Port Equipment Market is projected to grow from USD 21,127.04 million in 2024 to USD 34,965.17 million by 2032. The market is expected to record a CAGR of 6.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Port Equipment Market Size 2024 |

USD 21,127.04 Million |

| Port Equipment Market, CAGR |

6.5% |

| Port Equipment Market Size 2032 |

USD 34,965.17 Million |

Trade growth drives strong demand across the Port Equipment Market. Rising container traffic increases demand for cranes, stackers, and yard vehicles. Ports adopt automation to reduce labor risk and improve speed. Electric and hybrid equipment gains traction due to emission targets. Terminal operators upgrade fleets to handle larger vessels. Smart systems improve load control and asset tracking. Public and private funding supports port modernization. Maintenance efficiency also shapes buying decisions.

Asia Pacific leads the Port Equipment Market due to high trade volumes and port investment. China shows strong demand from large terminals and automation programs. Southeast Asian countries expand ports to support export growth. Europe follows with a focus on energy-efficient upgrades. Germany and the Netherlands lead advanced port operations. North America shows steady demand from terminal renewal projects. The Middle East and Africa invest in new ports to strengthen logistics links.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market stood at USD 21,127.04 million in 2024 and will reach USD 34,965.17 million by 2032, posting a 6.5% CAGR.

- Asia-Pacific leads with about 45% share due to large ports and trade volume, followed by Europe at 25% for modernization focus and North America at 18% from terminal upgrades.

- Middle East & Africa is the fastest-growing region with nearly 8% share, driven by new port hubs, logistics corridors, and public-private investment.

- By application, container handling holds nearly 60% share due to high throughput needs, while bulk handling accounts for around 25% with commodity trade support.

- By equipment type, cranes represent about 40% share for heavy lift demand, while yard equipment and vehicles together contribute nearly 45% from daily terminal operations.

Market Drivers

Expansion of Global Trade and Container Throughput Capacity

Rising seaborne trade volumes push ports to expand handling capacity. The Port Equipment Market benefits from growing containerized cargo flows worldwide. Port authorities invest in cranes and yard equipment to reduce congestion risks. Larger vessels require higher lift capacity and wider crane outreach. Terminal operators target faster ship turnaround and better berth use. Equipment upgrades support continuous port operations. National logistics plans back large port projects. These factors drive steady equipment demand across major ports. For instance, ZPMC has delivered ship-to-shore cranes with over 24-row outreach and lift capacities above 65 tonnes for ultra-large vessels.

Port Modernization Programs and Infrastructure Renewal Initiatives

Many ports operate with aging assets and limited automation levels. The Port Equipment Market gains momentum from structured modernization programs. Governments fund replacement of outdated cranes and vehicles. Private operators align assets with global port standards. Modern equipment improves safety and operational reliability. New terminals require full equipment deployment from early stages. Upgrades raise efficiency under space limits. These programs sustain long replacement cycles. For instance, Konecranes reports rubber-tired gantry cranes achieving availability above 98% during fleet renewal.

Operational Efficiency and Labor Productivity Improvement Needs

Ports face pressure to cut vessel waiting time and operating costs. The Port Equipment Market responds to strong productivity needs. Advanced equipment enables faster loading and unloading cycles. Operators reduce manual work and error risk. High labor costs support demand for efficient machinery. Better uptime supports predictable schedules. Standard systems simplify training and operations. Efficiency goals guide most procurement decisions.

Environmental Compliance and Emission Reduction Requirements

Stricter emission rules reshape port investments worldwide. The Port Equipment Market aligns with demand for cleaner machinery. Ports replace diesel units with electric or hybrid options. Regulators enforce noise and air limits. Low-emission equipment supports sustainability targets. Green port programs influence public funding choices. Suppliers adapt designs to meet rules. Environmental pressure remains a strong purchase driver.

Market Trends

Shift Toward Automated and Semi-Automated Terminal Operations

Automation adoption rises across large and mid-sized ports. The Port Equipment Market reflects this operating shift. Automated cranes improve precision and cycle stability. Remote operation improves worker safety. Software coordination improves yard traffic flow. Operators value predictable performance levels. Automation spreads beyond mega ports. This trend reshapes equipment design priorities. For instance, Kalmar’s AutoStrad™ tractors run unmanned for over 20 hours daily at automated terminals.

Growing Preference for Electrified and Hybrid Port Equipment

Electrification gains traction across global port fleets. The Port Equipment Market sees wider hybrid acceptance. Electric units reduce fuel cost exposure. Battery systems improve energy use per move. Ports invest in charging and grid upgrades. Lower maintenance supports lifecycle cost control. Energy efficiency aligns with decarbonization plans. This trend shapes fleet planning. For instance, Liebherr electric harbor cranes deliver zero local emissions with hoist speeds above 120 m/min.

Integration of Digital Monitoring and Fleet Management Systems

Digital tools support real-time equipment oversight. The Port Equipment Market adopts connected machinery platforms. Sensors track load, wear, and usage. Data improves preventive maintenance planning. Alerts reduce unexpected downtime. Fleet analytics optimize asset use. Dashboards improve management visibility. Connectivity becomes a standard feature.

Customization of Equipment for Terminal-Specific Layouts

Ports differ by layout, climate, and cargo mix. The Port Equipment Market adapts through customization. Suppliers offer modular designs for flexibility. Equipment fits space-limited terminals. Climate-specific designs improve durability. Customization supports mixed cargo handling. Operators value fit-for-purpose machinery. Collaboration between suppliers and operators strengthens.

Market Challenges Analysis

High Capital Investment and Long Payback Cycles

Port equipment requires high upfront capital. The Port Equipment Market faces buyer budget pressure. Long payback periods delay purchases. Public ports depend on funding approvals. Private operators balance returns and finance costs. Economic slowdowns affect capital plans. Currency risk raises import prices. Smaller ports face adoption limits.

Complex Maintenance Requirements and Skilled Workforce Gaps

Advanced equipment needs skilled technical support. The Port Equipment Market faces service capability gaps. Ports struggle to hire trained technicians. Maintenance delays raise operational risk. Spare part access affects uptime. Training needs time and investment. Equipment complexity increases service reliance. These issues challenge smooth operations.

Market Opportunities

Port Expansion in Emerging Trade Corridors

Emerging economies invest heavily in port capacity. The Port Equipment Market gains from greenfield terminals. New ports require full equipment supply. Trade corridors support steady demand. Public-private models fund large projects. Strategic locations attract logistics firms. Early-stage ports adopt modern standards. Expansion creates long-term opportunities.

Technology Upgrades Focused on Safety and Operational Resilience

Ports prioritize safety and resilience upgrades. The Port Equipment Market benefits from this focus. Advanced controls reduce accident risk. Redundant systems improve reliability. Weather-resistant designs support harsh climates. Safety rules guide procurement. Resilient equipment supports continuity. This opportunity drives premium demand.

Market Segmentation Analysis

- By equipment type, cranes lead due to heavy lift needs. Forklifts support flexible terminal movement. Reach stackers enable fast stacking in tight yards. Terminal tractors improve yard transport. Tugboats support vessel control. Automated guided vehicles enable precise flow. For instance, SANY reach stackers lift 45-tonne containers to five-high stacking.

- By application, container handling dominates operations. Bulk handling supports coal and grain cargo. General cargo serves mixed freight needs. Each use case drives different capacity needs.

- By fuel type, diesel remains common for reliability. Electric equipment grows under emission rules. Hybrid systems balance range and efficiency.

- By operation type, manual systems suit small ports. Semi-automated systems raise productivity. Fully automated solutions serve high-volume terminals. Automation choice depends on scale and labor strategy.

Segmentation:

By Equipment Type

- Cranes

- Forklifts

- Reach stackers

- Terminal tractors

- Tugboats

- Automated guided vehicles

By Application

- Container handling

- Bulk handling

- General cargo

By Fuel / Power Type

By Operation Type

- Manual

- Semi-automated

- Fully automated

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific and Europe Market Performance

Asia-Pacific holds the largest global share at nearly 45%. The Port Equipment Market benefits from high container volumes across Chinese ports. Japan and South Korea support demand through advanced terminal systems. Southeast Asia expands capacity to support export growth. Europe accounts for around 25% of total share. Germany, the Netherlands, and Spain lead due to strong modernization programs. Regional focus stays on automation and emission reduction.

North America and Middle East & Africa Market Position

North America represents about 18% of global demand. The Port Equipment Market sees strong activity from terminal upgrades in the United States. Canada supports steady replacement at major ports. Regional operators focus on efficiency and safety standards. Middle East and Africa hold nearly 8% share. Gulf countries invest in large-scale port projects. African ports expand capacity to improve trade connectivity.

Latin America and Rest of the World Market Outlook

Latin America contributes close to 3% of global share. The Port Equipment Market gains traction from export-led port expansion. Brazil and Chile lead equipment demand in the region. Ports invest in systems for agricultural and mineral cargo. The rest of the world accounts for about 1% share. Smaller ports focus on selective replacement. Demand remains stable with gradual modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Port Equipment Market shows strong competition among global manufacturers with broad product portfolios. Leading players focus on cranes, yard vehicles, and automated solutions to serve diverse terminals. Companies compete on equipment reliability, lifecycle cost, and service reach. Product differentiation centers on automation capability and energy efficiency. Strategic partnerships help suppliers expand regional presence. After-sales service quality influences buyer loyalty. Technology integration strengthens competitive positioning. Scale and manufacturing capacity support pricing flexibility. It remains moderately consolidated with strong global brands.

Recent Developments:

In September 2025, Liebherr Group signed a long-term partnership with Transnet Port Terminals in South Africa. The 10-year agreement includes a 20-year asset management program and major equipment orders. Transnet ordered four ship-to-shore cranes for Durban and 48 rubber-tyred gantry cranes for Durban and Cape Town. The deal also covers rail-mounted gantry and mobile harbor cranes. Liebherr plans a new technology and service center in Durban with 24/7 support in Cape Town.

In June 2025, ZPMC delivered four compact ship-to-shore cranes for Hong Kong’s Integrated Waste Management Facilities project. These cranes feature a 25.5-ton lifting capacity and energy-efficient design. In December 2025, ZPMC entered the South Korean market by delivering its first advanced portal crane to Hanwha Ocean. The crane offers a 60-ton lift capacity with smart safety and control systems.

In June 2024, Cargotec completed the partial demerger of Kalmar into an independent company. Kalmar began trading on Nasdaq Helsinki on July 1, 2024. The move positioned Kalmar as a focused provider of sustainable cargo handling equipment. The company operates in over 120 countries with about EUR 2.0 billion in annual sales and nearly 5,000 employees.

Report Coverage:

The research report offers an in-depth analysis based on equipment type, application, fuel or power type, operation type, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.