Market Overview

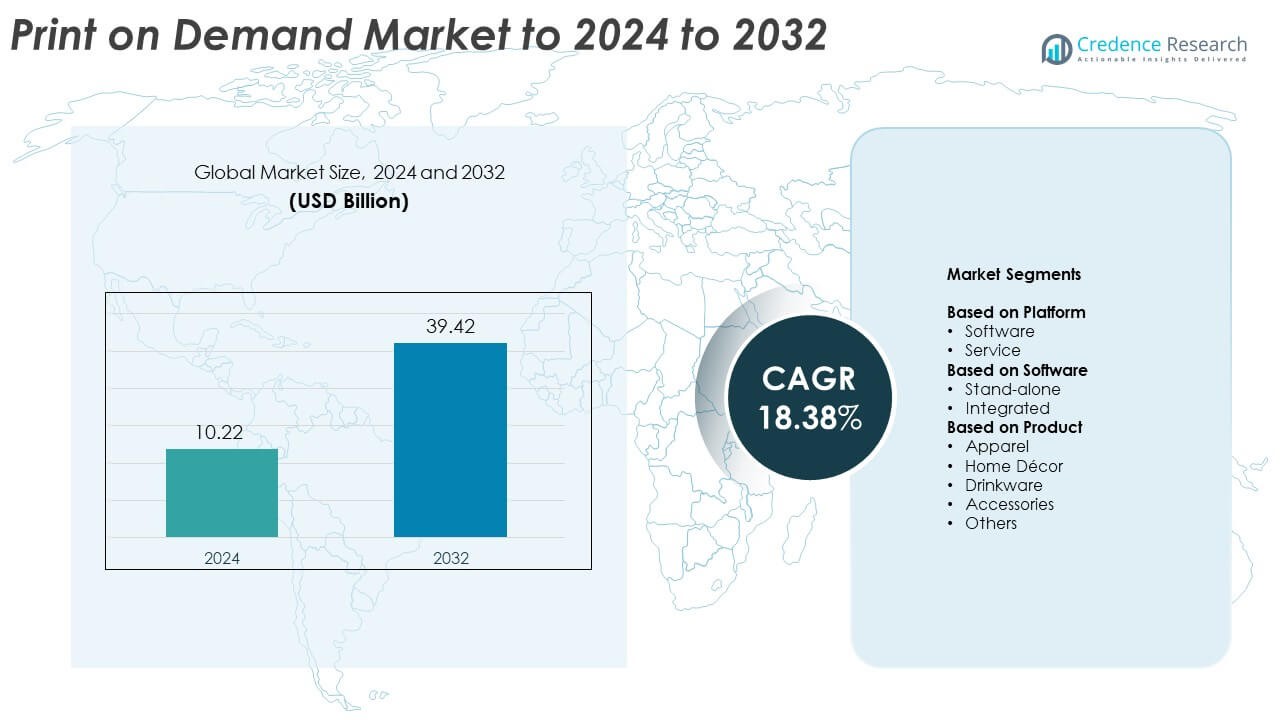

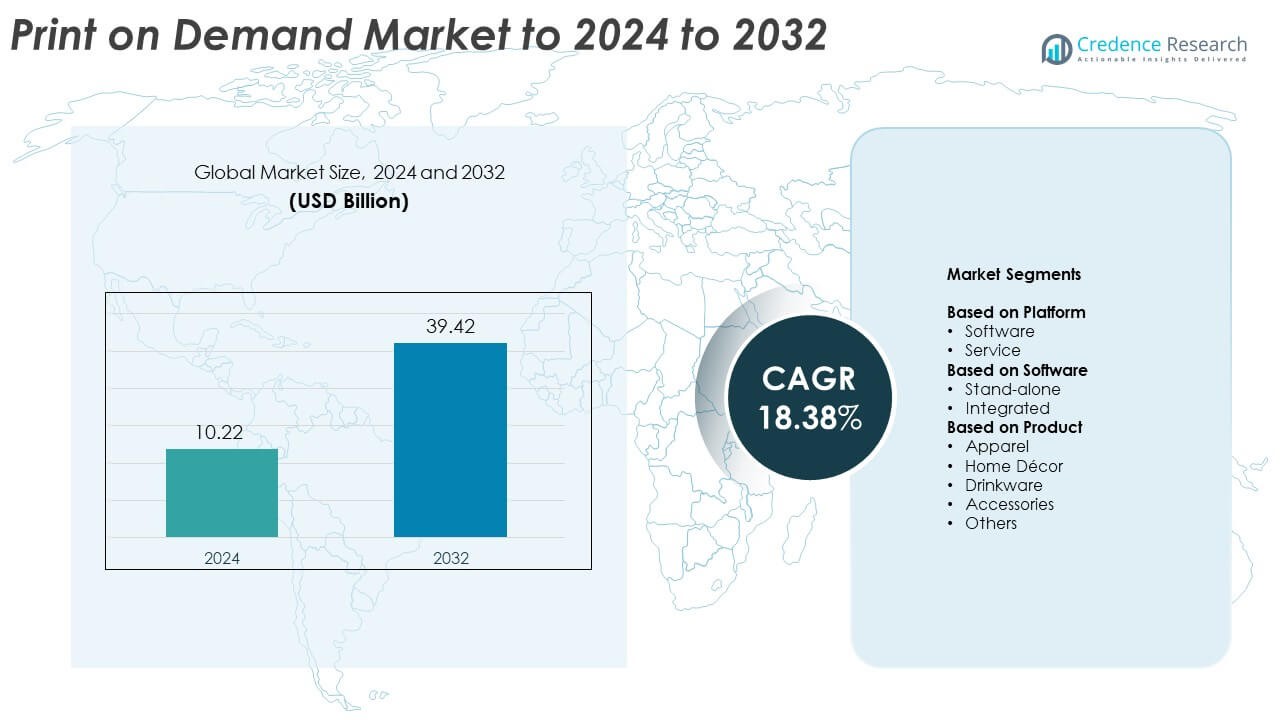

Print On Demand Market size was valued USD 10.22 Billion in 2024 and is anticipated to reach USD 39.42 Billion by 2032, at a CAGR of 18.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Print On Demand Market Size 2024 |

USD 10.22 Billion |

| Print On Demand Market, CAGR |

18.38% |

| Print On Demand Market Size 2032 |

USD 39.42 Billion |

The print on demand market features major players such as Gooten, Printify, Apliiq, Creator Studio, JetPrint Fulfillment, CustomCat, VistaPrint, Amplifier, Printed Mint, Printful, and Gelato, all competing through wider product ranges, stronger automation, and faster global fulfilment. These companies support creators, small brands, and enterprises by offering integrated design tools, scalable production, and multi-location printing. North America leads the market with about 36.2% share due to advanced e-commerce adoption and strong platform presence, while Asia Pacific follows with nearly 29.3% share driven by rapid digital retail growth and expanding manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The print on demand market reached USD 10.22 Billion in 2024 and is projected to hit USD 39.42 Billion by 2032, growing at a CAGR of 18.38% during the forecast period.

- Strong demand for custom apparel, fast product launches, and low-inventory models drives steady adoption among creators, small brands, and online retailers across global platforms.

- Key trends include expansion of sustainable product lines, rapid use of AI-based design automation, and rising demand for premium customization across apparel, drinkware, and home décor, with apparel holding about 54% share in 2024.

- Competition intensifies as leading providers expand fulfilment hubs, improve printing technology, and integrate tightly with major e-commerce systems to support faster delivery and broader product catalogs.

- North America leads with around 36.2% share, followed by Asia Pacific at nearly 29.3% as digital retail rises, while Europe accounts for about 18% and LAMEA contributes close to 16–17%, reflecting growing adoption across emerging markets.

Market Segmentation Analysis:

By Platform

Software held the dominant position in 2024 with about 61% share of the print on demand market. Strong growth came from rising adoption of automated design tools, improved API integrations, and better workflow management for global sellers. Software platforms supported fast store setup, real-time order syncing, and reduced manual work for merchants on Shopify, Etsy, and WooCommerce. Service platforms grew at a steady pace as more creators outsourced printing and logistics, but software stayed ahead due to higher scalability, lower operating cost, and strong demand from small and mid-sized online businesses.

- For instance, Printful has delivered over 120 million items since its founding in 2013, operating from 12 facilities worldwide, according to data on the official Printful website.

By Software

Integrated software led the segment in 2024 with nearly 68% share. Merchants chose integrated solutions because these systems combine design tools, product catalogs, order routing, and fulfillment dashboards in one place. This setup helped reduce errors, improve production speed, and enable smooth cross-platform management for omnichannel sellers. Stand-alone tools remained relevant for niche creators needing customized design modules, but demand stayed lower due to limited automation. Integrated platforms grew faster as brands sought unified systems that support high order volumes and minimize turnaround time.

- For instance, As of late 2024 and early 2025, Kittl reported serving over 5 million registered users worldwide.

By Product

Apparel dominated the product segment in 2024 with about 54% share of the print on demand market. Growth was driven by strong demand for custom T-shirts, hoodies, sportswear, and merchandise promoted on social platforms by influencers and small brands. Apparel offered high margins, fast printing cycles, and wide personalization options, which attracted new sellers. Home décor and drinkware expanded as gifting and interior personalization trends increased, but apparel stayed ahead due to larger repeat-purchase rates, a broader buyer base, and the rising shift toward low-inventory fashion models.

Key Growth Drivers

Rising Adoption of Custom Apparel and Merchandise

Demand for custom apparel and merchandise continues to surge as online sellers, influencers, and small brands use print on demand to launch products without holding inventory. This model reduces financial risk and supports faster experimentation with new designs. Buyers prefer personalized clothing, accessories, and lifestyle goods, which drives continuous order volume. Strong integration with e-commerce platforms also supports rapid scaling, helping creators turn trends into sellable products within hours. These benefits make custom merchandise a major growth engine for the print on demand market.

- For instance, Spring reported hosting 450,000 verified creators selling custom products on its platform.

Expansion of E-commerce and Creator Economy

The fast growth of global e-commerce and the rise of creator-led brands have strengthened the market. Sellers want flexible production models that avoid bulk manufacturing and reduce waste. Print on demand supports this shift by offering low upfront cost, automated order handling, and global delivery networks. Social commerce platforms help creators market niche designs to targeted audiences, boosting conversion rates. This ecosystem encourages more individuals and microbrands to adopt print on demand, turning digital influence into stable revenue streams and driving strong market expansion.

- For instance, Printify is reported to serve over 12 million people who have signed up to build businesses, with more than 60 million total orders completed through its network of print providers, as stated on the official Printify website and company information pages.

Advancements in Printing Technology and Automation

New printing technologies such as direct-to-garment, UV printing, and advanced sublimation enable higher-quality output, faster turnaround, and improved color accuracy. Automation in order routing, design processing, and multi-location fulfillment also supports higher scalability. These improvements help sellers manage peak demand, reduce defects, and offer broader customization options. Lower production time strengthens customer satisfaction, while automated workflows reduce operational strain for small businesses. These technology gains play a central role in expanding production capacity and supporting long-term market growth.

Key Trends & Opportunities

Growth of Sustainable and Eco-Friendly Product Lines

Sustainability is becoming a core trend as consumers seek eco-friendly apparel, recycled materials, and low-waste production models. Print on demand aligns well with this shift because products are made only after an order is placed. Companies are offering organic fabrics, water-based inks, and reduced-waste packaging to appeal to conscious buyers. This trend creates opportunities for brands targeting green consumers and supports premium pricing strategies. Sellers who adopt sustainable inputs gain stronger loyalty and differentiate themselves in a crowded online marketplace.

- For instance, T-Pop states that over 30,000 online sellers use its eco-focused print-on-demand platform.

Rapid Rise of AI-Driven Design and Personalization Tools

AI-assisted design tools help creators produce unique artwork, automate mockups, and customize products at scale, making it easier for beginners to enter the market. These tools reduce creative time and help sellers respond quickly to seasonal trends or viral themes. Personalization features, such as name-based designs or location-based prints, also boost customer engagement. AI-driven automation expands product variety and strengthens a seller’s ability to test multiple concepts, creating major opportunities for growth in both small and enterprise-level POD operations.

- For instance, As of late 2024 and throughout 2025, Canva has reported a community of over 240 million monthly active users,

Expansion into Home Décor and Lifestyle Categories

Beyond apparel, home décor and lifestyle goods such as wall art, cushions, and drinkware are gaining traction. These categories attract both gifting customers and interior design buyers seeking unique and personalized items. Better printing formats for wood, canvas, ceramics, and metal enable stronger quality and product diversity. This expansion helps sellers reduce dependency on apparel and tap into higher-margin categories. Rising interest in personalized home spaces creates steady demand and opens new growth avenues for suppliers and creators.

Key Challenges

Intense Competition and Price Pressure Across Platforms

The market faces heavy competition as thousands of new sellers enter each year, leading to price-driven battles across apparel and accessories. Many stores offer similar designs, reducing differentiation and pushing creators to lower margins. High marketplace fees also affect profitability for small sellers. This environment forces brands to rely on strong marketing, niche targeting, and higher-quality materials to stand out. While demand is strong, competition remains a major barrier for new entrants trying to scale in the print on demand space.

Quality Control and Fulfillment Delays During Peak Demand

Maintaining consistent print quality across different fulfillment centers is challenging, especially during seasonal peaks. Variations in materials, color output, and production speed can affect customer satisfaction. Delays in shipping during high-volume periods often lead to complaints and order cancellations. Sellers rely heavily on third-party production partners, giving them limited control over operational issues. These risks make quality control and reliable delivery some of the biggest obstacles for scaling brands in the print on demand market.

Regional Analysis

North America

North America accounted for approximately 36.2% of the global print on demand market in 2024. The region benefits from advanced e-commerce infrastructure, a strong creator economy, and multiple leading POD companies headquartered in the U.S. Buyers’ preference for personalized apparel, home décor, and accessories drives demand. High internet penetration and efficient logistics networks enable fast fulfilment and return processing. The U.S. dominates within the region, supported by platforms such as Shopify and Etsy; Canada and Mexico are emerging markets as digital retail adoption climbs.

Asia Pacific

The Asia Pacific region captured around 29.3% of the global print on demand market in 2024. Rapid growth stems from rising online retail penetration, increasing disposable income, and strong demand for custom products in China, India, Japan, and Southeast Asia. The region leads in manufacturing scale and has a growing number of digital print hubs. Expansion of mobile commerce and social-commerce platforms further fuels adoption. Asia Pacific is poised to register the fastest regional growth over the forecast period, making it a key focus for POD service providers and sellers.

Europe

Europe’s share of the global print on demand market stood near 18% in 2024 (based on available estimates). The market is expanding thanks to high e-commerce adoption, increased demand for sustainable and personalized goods, and strong presence of SMEs leveraging POD. Germany, the United Kingdom, and France are notable markets with growing preference for custom apparel, lifestyle products and home décor. Regulatory emphasis on sustainability and localised fulfilment centre build-out support the value chain. Europe offers steady growth with opportunities for cross-border fulfilment within the EU.

Latin America & Middle East & Africa (LAMEA)

Combined, the LAMEA region accounted for the remaining approximate 16-17% share in 2024. Growth in Latin America is driven by rising smartphone usage, growth of regional e-commerce platforms and local fulfilment partnerships. In Middle East & Africa, early stage digital retail, expanding logistics networks and increasing creator-led merchandise stores are enabling growth. However, challenges such as weaker infrastructure, customs delays and lower per-capita disposable income slow adoption. Nonetheless, LAMEA offers long-term opportunity for POD expansion through localisation and low-inventory models.

Market Segmentations:

By Platform

By Software

By Product

- Apparel

- Home Décor

- Drinkware

- Accessories

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The print on demand market is shaped by key players such as Gooten, Printify, Inc., Apliiq, Creator Studio, JetPrint Fulfillment, CustomCat, VistaPrint, Amplifier, Printed Mint, Printful, Inc., and Gelato. The competitive landscape reflects rapid expansion as providers strengthen global fulfilment networks, improve automation, and enhance product customization options. Many companies focus on integrating with major e-commerce platforms to simplify store setup and order routing for sellers. Advanced printing methods, diversified product catalogues, and faster delivery models help providers differentiate in a crowded space. Firms also invest in sustainable materials and on-demand manufacturing techniques to meet rising consumer expectations. Growing demand from creators, small businesses, and enterprise clients encourages platforms to scale production capacity and add region-specific fulfilment centres to reduce delivery time and shipping costs.

Key Player Analysis

- Gooten

- Printify, Inc.

- Apliiq

- Creator Studio

- JetPrint Fulfillment

- CustomCat

- VistaPrint

- Amplifier

- Printed Mint

- Printful, Inc.

- Gelato

Recent Developments

- In 2025, Gooten was acquired by Taylor Corporation in October 2025, combining Gooten’s innovative OrderMesh platform and global production partners with Taylor’s manufacturing footprint.

- In 2024, Gelato, launched GelatoConnect, an AI-powered operating system to optimize procurement, workflow, and logistics for print producers.

- In 2024, Creator Studio, H&M Group’s print-on-demand merchandise service, launched its first clothing printing hub in the UK.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Platform, Software, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as more creators and small brands adopt low-inventory business models.

- Apparel will remain the strongest category while home décor and lifestyle goods gain faster traction.

- AI-based design and automation tools will expand product variety and reduce creation time.

- Fulfilment networks will scale globally to support faster shipping and regional production.

- Eco-friendly materials and sustainable printing methods will become major decision factors for buyers.

- Integration with e-commerce platforms will deepen, improving automation and order accuracy.

- Personalization features will become more advanced across apparel, accessories, and décor.

- Competition will intensify, pushing brands toward niche markets and premium quality.

- Multi-location print hubs will help reduce delays during peak seasons.

- Enterprise-level adoption will rise as companies use POD for marketing and limited-run merchandise.