Market Overview

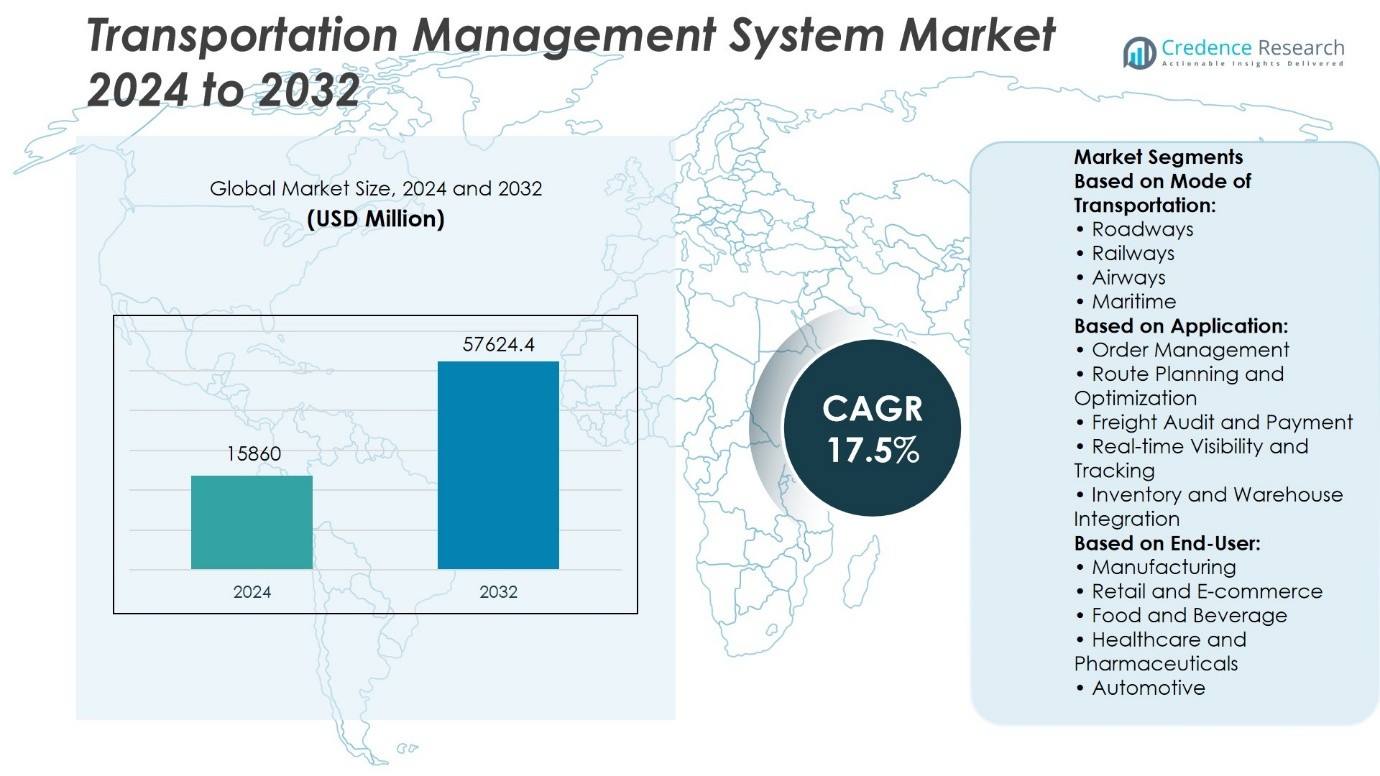

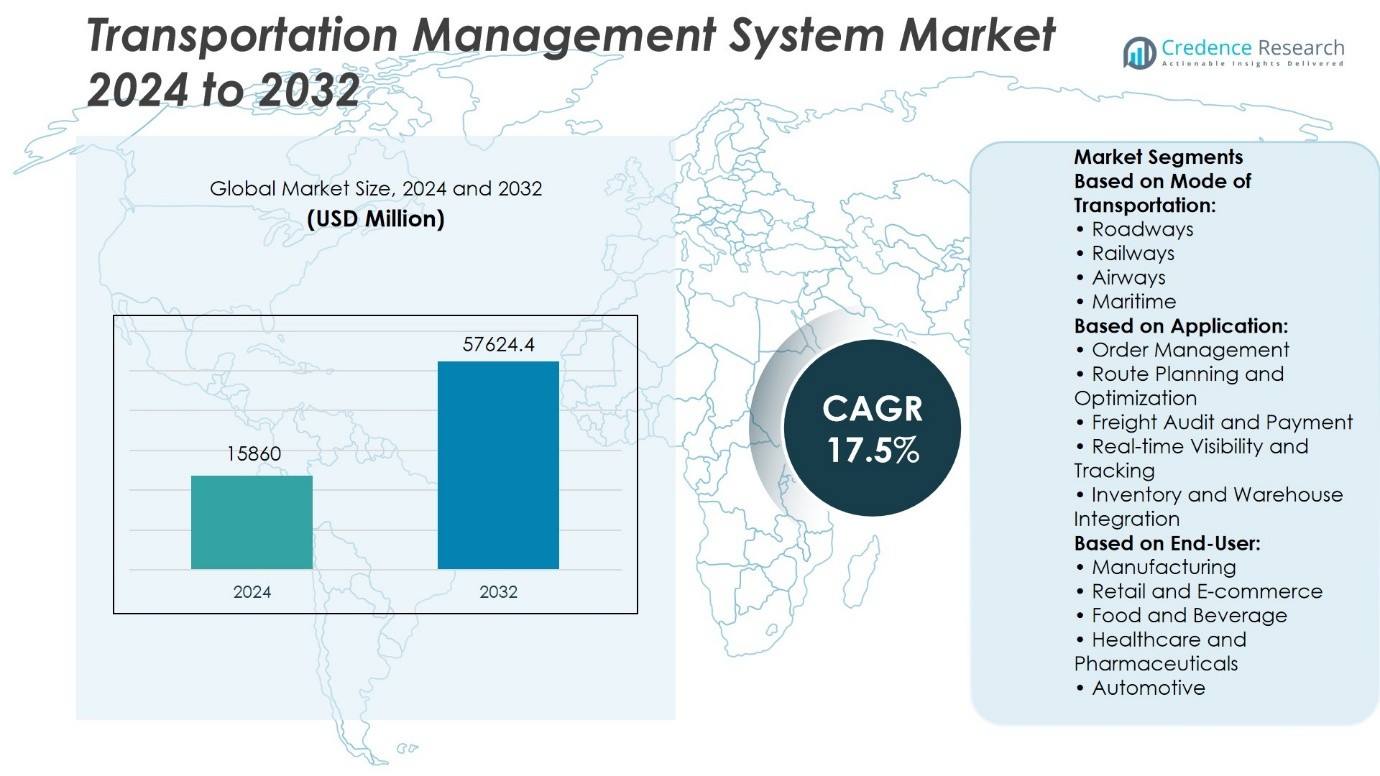

Transportation Management System Market size was valued at USD 15860 million in 2024 and is anticipated to reach USD 57624.4 million by 2032, at a CAGR of 17.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transportation Management System Market Size 2024 |

USD 15860 Million |

| Transportation Management System Market, CAGR |

17.5% |

| Transportation Management System Market Size 2032 |

USD 57624.4 Million |

The Transportation Management System Market grows on the strength of rising demand for supply chain visibility, last-mile delivery efficiency, and cost optimization. It advances as enterprises adopt cloud-based platforms, AI-driven analytics, and real-time tracking to improve decision-making and reduce delays. E-commerce expansion accelerates adoption, while regulatory compliance and sustainability initiatives push companies to optimize routes and reduce emissions. Vendors focus on automation, predictive insights, and integration with enterprise systems to deliver end-to-end logistics control. The market reflects a clear shift toward digital transformation, where innovation and efficiency define competitiveness across industries and global supply chains.

The Transportation Management System Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America leading due to advanced digital infrastructure and high e-commerce activity. Europe emphasizes sustainability and cross-border trade, while Asia-Pacific grows rapidly through expanding retail and logistics networks. Latin America and the Middle East & Africa adopt solutions gradually with infrastructure investments. Key players include IBM Corporation, Infor Inc., Manhattan Associates, MercuryGate International, and BluJay Solutions Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Transportation Management System Market size was valued at USD 15860 million in 2024 and is projected to reach USD 57624.4 million by 2032, at a CAGR of 17.5%.

- Rising demand for supply chain visibility, last-mile delivery efficiency, and cost optimization drives strong adoption.

- Cloud-based platforms, AI-driven analytics, and real-time tracking define major market trends with focus on digital transformation.

- The competitive landscape features global players offering automation, predictive insights, and seamless enterprise integration.

- High implementation costs and integration complexity act as restraints for SMEs in cost-sensitive markets.

- North America leads adoption with advanced infrastructure, Europe emphasizes sustainability, and Asia-Pacific grows rapidly with e-commerce expansion, while Latin America and the Middle East & Africa show gradual adoption.

- Innovation in predictive analytics, compliance features, and sustainability-focused solutions continues to shape long-term growth opportunities.

Market Drivers

Rising Demand for Supply Chain Visibility and Optimization

The Transportation Management System Market expands strongly due to the rising need for end-to-end supply chain visibility. Companies prioritize real-time tracking to monitor freight status, reduce delays, and improve customer service. It helps organizations optimize load planning and route selection, which reduces empty miles and fuel costs. The growing complexity of global supply chains increases the importance of centralized control over shipments. Cloud-based platforms enhance accessibility, enabling firms to manage transportation operations across regions efficiently. The market gains momentum as enterprises integrates advanced analytics to forecast disruptions and maintain delivery reliability.

- For instance, in 2024, 2.71 billion people, or 33% of the global population, shop online, reflecting a 2.7% increase from 2023. This increased volume demands efficient order fulfillment processes, enabling businesses to process and ship orders promptly.

Growth in E-Commerce and Last-Mile Delivery Needs

The rapid expansion of e-commerce drives significant adoption of transportation management systems. Online retailers rely on efficient logistics to handle high parcel volumes, quick delivery expectations, and return shipments. It provides automation that streamlines carrier selection, freight billing, and order tracking. Companies benefit from improved last-mile delivery operations, where time and cost efficiency remain critical. The rise in same-day and next-day delivery services accelerates the need for advanced solutions. The Transportation Management System Market strengthens as both large and small retailers adopt digital platforms to meet customer expectations.

- For instance, Amazon reported handling over 5.9 billion U.S. packages in 2023 through its integrated TMS and delivery service partner program, cutting average delivery time to less than 1.9 days.

Rising Adoption of Cloud-Based and AI-Powered Solutions

The shift toward cloud deployment plays a critical role in increasing system adoption across industries. Organizations prefer cloud solutions for scalability, flexibility, and cost-effectiveness compared to on-premise systems. It integrates with AI and machine learning to deliver predictive insights that enhance route optimization and demand planning. Automation of manual processes improves workforce productivity and reduces operational errors. The ability to access centralized data across multiple locations strengthens global transportation coordination. Vendors innovate continuously, introducing AI-driven platforms that align with evolving logistics needs.

Stringent Regulatory Compliance and Sustainability Pressures

Governments and industry bodies enforce strict regulations on freight movement, safety, and emissions, which stimulate system adoption. The Transportation Management System Market grows as firms seek tools that ensure compliance with cross-border and regional transportation rules. It enables automated documentation and customs clearance to reduce compliance risks. Growing focus on sustainability pushes organizations to cut carbon footprints by optimizing routes and reducing fuel usage. TMS platforms help track environmental metrics, supporting corporate sustainability goals. The regulatory landscape and sustainability commitments together strengthen the business case for advanced management solutions.

Market Trends

Increasing Integration of Artificial Intelligence and Machine Learning

The Transportation Management System Market witnesses a strong trend toward the integration of artificial intelligence and machine learning. Companies deploy predictive analytics to forecast demand, identify bottlenecks, and optimize delivery schedules. It improves real-time decision-making, reducing costs and delays. Machine learning models enhance route planning by analyzing traffic, weather, and carrier performance. Automation minimizes manual intervention, which increases accuracy in freight billing and shipment tracking. This trend reinforces efficiency while supporting smarter logistics strategies.

- For instance, DHL’s AI-powered Resilience360 platform analyzed 32 billion data points in 2023 to predict supply chain disruptions, cutting average response time to incidents from 72 hours to 6 hours.

Expansion of Cloud-Based and Software-as-a-Service Deployment Models

Enterprises adopt cloud-based and SaaS transportation platforms to achieve scalability and cost-effectiveness. The Transportation Management System Market shifts rapidly from on-premise systems to cloud solutions that offer flexibility and faster implementation. It enables companies to integrate global operations under a single platform. Remote accessibility empowers distributed teams to manage logistics without geographic constraints. Vendors introduce modular subscription-based services to attract small and mid-sized enterprises. This expansion drives higher adoption across varied industry verticals.

- For instance, Oracle reported that its Oracle Transportation Management Cloud processed over 6 billion logistics transactions globally in 2023, supporting enterprises in 150 countries.

Growing Emphasis on Last-Mile Delivery Optimization

The surge in e-commerce reinforces the importance of last-mile delivery within transportation strategies. It supports retailers in handling growing parcel volumes and ensuring timely delivery commitments. Companies use digital platforms to optimize vehicle allocation, reduce empty miles, and manage returns. The Transportation Management System Market benefits from rising investment in route optimization software tailored for last-mile challenges. It also enables dynamic delivery slot management, which improves customer satisfaction. This trend reflects the shift toward consumer-driven logistics models.

Rising Focus on Sustainability and Green Logistics

Sustainability emerges as a critical trend influencing transportation management strategies. The Transportation Management System Market evolves as organizations adopt solutions that track fuel usage and carbon emissions. It promotes route optimization to minimize fuel consumption and reduce environmental impact. Integration of electric and alternative-fuel fleets into logistics networks gains momentum. Companies adopt TMS platforms to generate sustainability reports that align with regulatory and corporate targets. This trend highlights the growing alignment of logistics with environmental responsibility.

Market Challenges Analysis

High Implementation Costs and Integration Complexity

The Transportation Management System Market faces challenges due to the high upfront investment required for deployment. Many small and medium-sized enterprises hesitate to adopt advanced systems because of licensing fees, customization expenses, and training costs. It becomes more complex when businesses attempt to integrate TMS platforms with existing enterprise resource planning and warehouse management systems. Legacy infrastructure often lacks compatibility, which delays implementation timelines. Integration issues also increase the risk of operational disruptions during the transition phase. These financial and technical barriers limit adoption, particularly in cost-sensitive markets.

Data Security Concerns and Limited Skilled Workforce

Cybersecurity threats pose significant risks for enterprises adopting cloud-based transportation solutions. The Transportation Management System Market encounters obstacles as organizations seek to secure sensitive shipping data and customer information. It requires strong data encryption and compliance with global privacy regulations, which demand additional investments. Shortage of skilled professionals further restricts effective deployment and management of advanced systems. Companies struggle to hire staff with expertise in artificial intelligence, analytics, and digital supply chain platforms. The lack of qualified resources delays innovation and weakens the ability to fully leverage TMS capabilities.

Market Opportunities

Expansion of Digitalization and Advanced Technology Adoption

The Transportation Management System Market creates opportunities through rapid digitalization across global supply chains. Companies adopt automation, artificial intelligence, and Internet of Things integration to improve real-time visibility and operational efficiency. It enables firms to predict demand, enhance route optimization, and reduce fuel consumption. The shift toward predictive analytics supports more accurate forecasting, which strengthens logistics planning. Growing interest in blockchain for transparent documentation also opens new pathways for innovation. Vendors that deliver secure, AI-driven, and data-centric solutions can capture strong demand in this evolving landscape.

Rising Demand from Emerging Economies and E-Commerce Growth

Expanding trade networks and the surge in e-commerce in developing economies create untapped growth potential. The Transportation Management System Market gains momentum in regions where rising consumer demand and infrastructure development fuel logistics modernization. It supports enterprises in managing high parcel volumes and meeting strict delivery timelines. Governments in Asia-Pacific, Latin America, and the Middle East invest heavily in transportation infrastructure, which increases the relevance of TMS solutions. Cross-border trade agreements further encourage companies to adopt digital platforms for compliance and cost efficiency. The expansion of global e-commerce and emerging market logistics strengthens opportunities for system providers.

Market Segmentation Analysis:

By Mode of Transportation

The Transportation Management System Market demonstrates strong adoption across roadways, railways, airways, and maritime transport. Roadways hold a dominant role, driven by the growth of e-commerce deliveries, regional freight networks, and the need for real-time tracking solutions. It supports fleet optimization, driver management, and route efficiency in both urban and intercity logistics. Railways leverage TMS for bulk freight management, load optimization, and cross-border cargo compliance. Air and maritime transport integrate TMS platforms to handle complex international shipping requirements and customs processes. This segment reflects the increasing demand for multi-modal solutions that unify all modes of logistics under a single platform.

- For instance, SAP SE announced that more than 5,000 companies used its cloud-based logistics solutions in 2023, handling 2.4 billion freight orders annually through SAP Business Network for Logistics.

By Application

Core components include software, services, and hardware integrations. Software dominates due to its role in providing route optimization, freight management, and analytics. Services such as system integration, training, and support strengthen long-term adoption. Applications span order management, freight audit, carrier selection, and real-time visibility and tracking. It enhances shipment accuracy, improves customer satisfaction, and supports sustainability initiatives through optimized transport planning. The growing emphasis on predictive analytics and automation reinforces the value of these applications, making TMS central to modern logistics transformation.

- For instance, Blue Yonder reported that its Luminate Logistics platform processed over 20 billion forecasts and optimized 1.6 billion transportation decisions for clients in 2023, directly improving route planning accuracy.

By End-User

The Transportation Management System Market caters to both large enterprises and SMEs, with larger organizations driving widespread adoption to streamline global supply chain operations. It supports SMEs through modular solutions that reduce complexity and cost barriers. Key industries adopting TMS include manufacturing, retail, e-commerce, healthcare, and automotive. Manufacturing firms use it to optimize raw material movement and finished goods distribution. Retail and e-commerce companies rely heavily on TMS to handle high order volumes, last-mile delivery, and reverse logistics. Industry-wide adoption demonstrates its relevance across both B2B and B2C ecosystems.

Segments:

Based on Mode of Transportation:

- Roadways

- Railways

- Airways

- Maritime

Based on Application:

- Order Management

- Route Planning and Optimization

- Freight Audit and Payment

- Real-time Visibility and Tracking

- Inventory and Warehouse Integration

Based on End-User:

- Manufacturing

- Retail and E-commerce

- Food and Beverage

- Healthcare and Pharmaceuticals

- Automotive

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 38% share of the Transportation Management System Market, driven by strong digital infrastructure and mature logistics networks. The region benefits from early adoption of advanced technologies, including AI-driven route optimization and cloud-based TMS platforms. It supports large-scale e-commerce, retail, and manufacturing industries that require efficient multi-modal transportation. Companies in the United States invest heavily in automation and last-mile delivery solutions, supported by strong demand for same-day and next-day services. Canada also plays a growing role, with investments in cross-border freight solutions and sustainability initiatives. The regional presence of global leaders strengthens innovation, making North America a leading hub for TMS adoption.

Europe

Europe holds a 27% share of the Transportation Management System Market, supported by strong regulatory frameworks and an emphasis on green logistics. The European Union enforces sustainability targets, which encourage enterprises to adopt TMS for route optimization and carbon footprint reduction. It enables efficient coordination of road, rail, and maritime transport across countries with complex cross-border trade requirements. Germany, the UK, and France dominate adoption, driven by advanced manufacturing and retail sectors. Eastern Europe also contributes, with growing demand from logistics firms modernizing their transportation systems. Investments in digital freight corridors and cross-European trade enhance regional opportunities for TMS providers.

Asia-Pacific

Asia-Pacific represents a 22% share of the Transportation Management System Market, making it one of the fastest-growing regions. The rise of e-commerce giants in China, India, and Southeast Asia drives significant demand for advanced logistics platforms. It supports businesses handling high parcel volumes, rapid urbanization, and growing consumer expectations for fast deliveries. Governments in countries like India and China invest in smart logistics infrastructure, creating opportunities for TMS integration. Japan and South Korea contribute with adoption in automotive and electronics supply chains, where precision and efficiency remain critical. The rapid expansion of SMEs in Asia-Pacific further boosts cloud-based TMS deployment, accelerating overall growth.

Latin America

Latin America captures a 7% share of the Transportation Management System Market, supported by growing modernization of logistics infrastructure. Brazil and Mexico lead adoption, driven by increasing e-commerce penetration and rising international trade activities. It enables companies to manage fragmented transportation networks across diverse geographies. The region experiences strong demand for route optimization and real-time tracking solutions to address urban congestion. Local logistics providers adopt modular cloud-based solutions to overcome financial constraints and improve efficiency. Expanding cross-border trade within the region and with North America strengthens the role of TMS platforms in supply chain operations.

Middle East & Africa

The Middle East & Africa hold a 6% share of the Transportation Management System Market, reflecting early-stage but promising adoption. The Gulf states, particularly the UAE and Saudi Arabia, invest heavily in digital transformation and logistics hubs that integrate TMS solutions. It supports large-scale infrastructure projects, retail expansion, and global trade flows through strategic ports. Africa shows growing interest, led by South Africa, where transportation modernization initiatives improve supply chain efficiency. Regional logistics firms adopt TMS platforms to reduce operational costs and improve transparency. With ongoing government initiatives to diversify economies and enhance digital adoption, the region provides long-term opportunities for TMS providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MercuryGate International, Inc.

- GoComet

- IBM Corporation

- Cargobase

- Manhattan Associates

- Cerasis, Inc.

- JDA Software Group, Inc.

- BluJay Solutions Ltd.

- Infor Inc.

- 3GTMS

Competitive Analysis

The Transportation Management System Market features include BluJay Solutions Ltd., Cargobase, Cerasis, Inc., GoComet, 3GTMS, Infor Inc., IBM Corporation, JDA Software Group, Inc., Manhattan Associates, and MercuryGate International, Inc. The Transportation Management System Market reflects intense competition, driven by the need to deliver advanced, scalable, and efficient logistics solutions. Vendors focus on integrating cloud platforms, predictive analytics, and real-time visibility to address the rising complexities of global supply chains. It evolves as companies emphasize automation to reduce costs, streamline carrier selection, and optimize last-mile delivery. Differentiation comes through AI-driven insights, sustainability-focused features, and seamless integration with enterprise resource planning and warehouse management systems. Firms also expand their reach through regional investments, partnerships, and tailored solutions for small and medium enterprises. The competitive environment highlights continuous innovation, with technology advancements shaping the long-term value of transportation management platforms.

Recent Developments

- In May 2025, Siemens Digital Industries Software announced that Thanakorn Vegetable Oil Products Co., Ltd. (TVOP), a leading Thai edible oil producer, adopted Siemens’ Digital Logistics solutions to modernize its supply chain.

- In February 2024, Oracle enhanced its Supply Chain and Manufacturing (SCM) Fusion Cloud to improve enterprise logistics management. The updates to Oracle Transportation Management and Oracle Global Trade Management include expanded business intelligence, improved logistics network modeling.

- In February 2024, C.H. Robinson introduced a new technology that enhances freight shipping efficiency by eliminating the need for separate pickup and delivery appointments. This AI-driven solution determines optimal appointment times by analyzing transit-time data.

- In 2023, Hitachi Rail, a division of Hitachi, Ltd., announced the expansion of its digital transport app named 360Pass. Based on this development, Hitachi Rail signed a new contract with Genoa’s (U.S.) city transit authority to connect Genoa’s whole public transport infrastructure, including 600,000 citizens with the 360-pass digital transport app.

Market Concentration & Characteristics

The Transportation Management System Market shows a moderately concentrated structure, with a mix of established global providers and emerging niche players competing for market share. Large enterprises dominate through broad portfolios that integrate advanced analytics, automation, and cloud platforms, while smaller vendors focus on offering specialized and cost-effective solutions for regional and mid-sized businesses. It reflects characteristics of high technological intensity, where AI, IoT, and real-time visibility solutions drive differentiation. Strong competition encourages continuous innovation in freight optimization, last-mile delivery, and sustainability-driven features. Market characteristics also include high switching costs for large enterprises, growing demand for modular cloud-based solutions, and significant investments in cybersecurity to protect sensitive logistics data. The balance between global expansion and localized customization defines competitive positioning, shaping the industry’s long-term growth dynamics.

Report Coverage

The research report offers an in-depth analysis based on Mode of Transportation, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Transportation Management System Market will expand with stronger adoption of cloud-based platforms for scalable logistics operations.

- It will integrate advanced artificial intelligence and machine learning to improve predictive planning and route optimization.

- Real-time visibility and tracking solutions will gain importance as enterprises prioritize transparency across global supply chains.

- Sustainability goals will drive wider use of TMS for fuel optimization and carbon emission reduction.

- Last-mile delivery optimization will remain a critical growth area supported by the rise of e-commerce.

- Cross-border trade and regulatory compliance will increase reliance on automated documentation and customs management features.

- Small and medium enterprises will adopt modular and cost-effective TMS solutions to modernize logistics.

- Cybersecurity features will become a priority to safeguard sensitive freight and customer data in digital platforms.

- Partnerships and acquisitions will strengthen vendor portfolios and expand global reach.

- Emerging economies will offer high growth potential through infrastructure development and rapid e-commerce expansion.