Market Overview

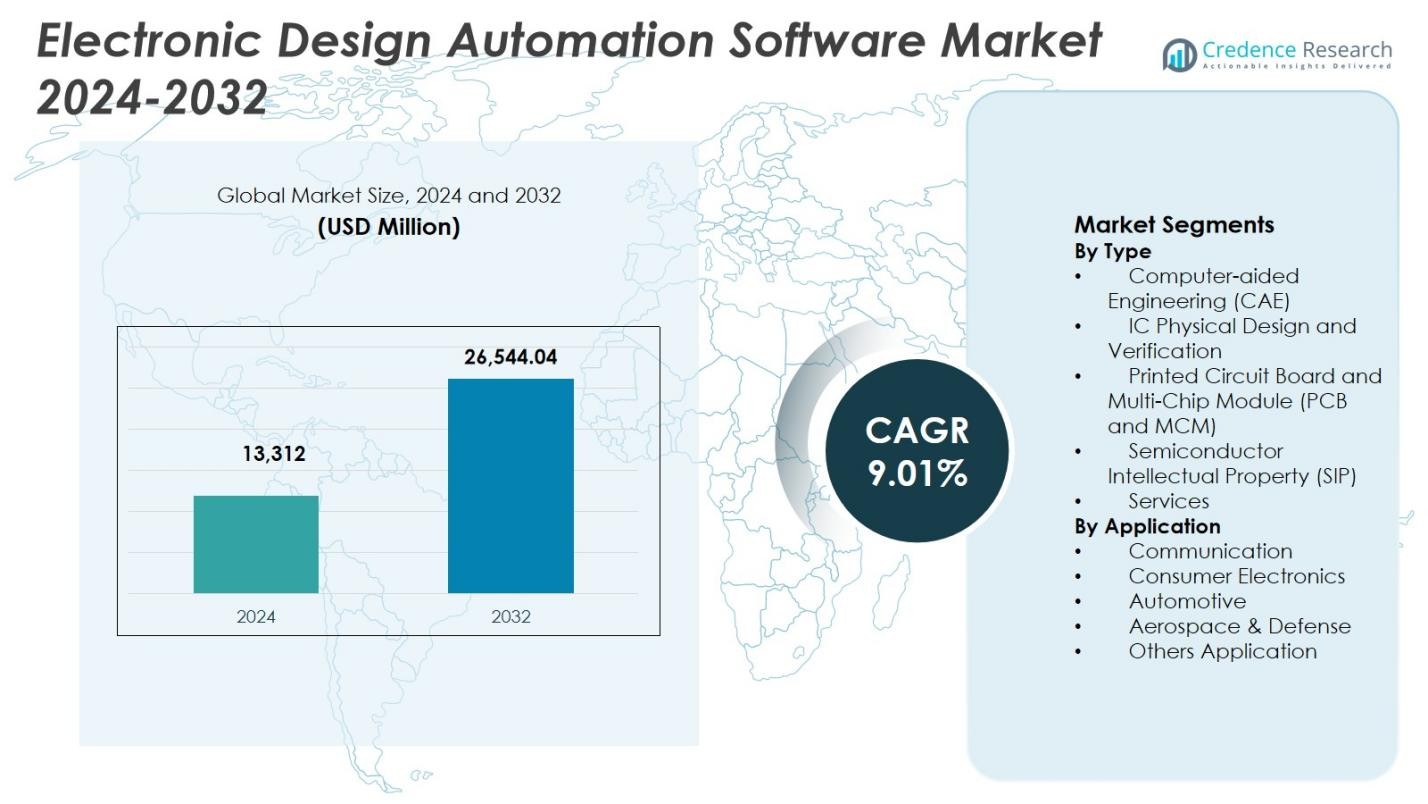

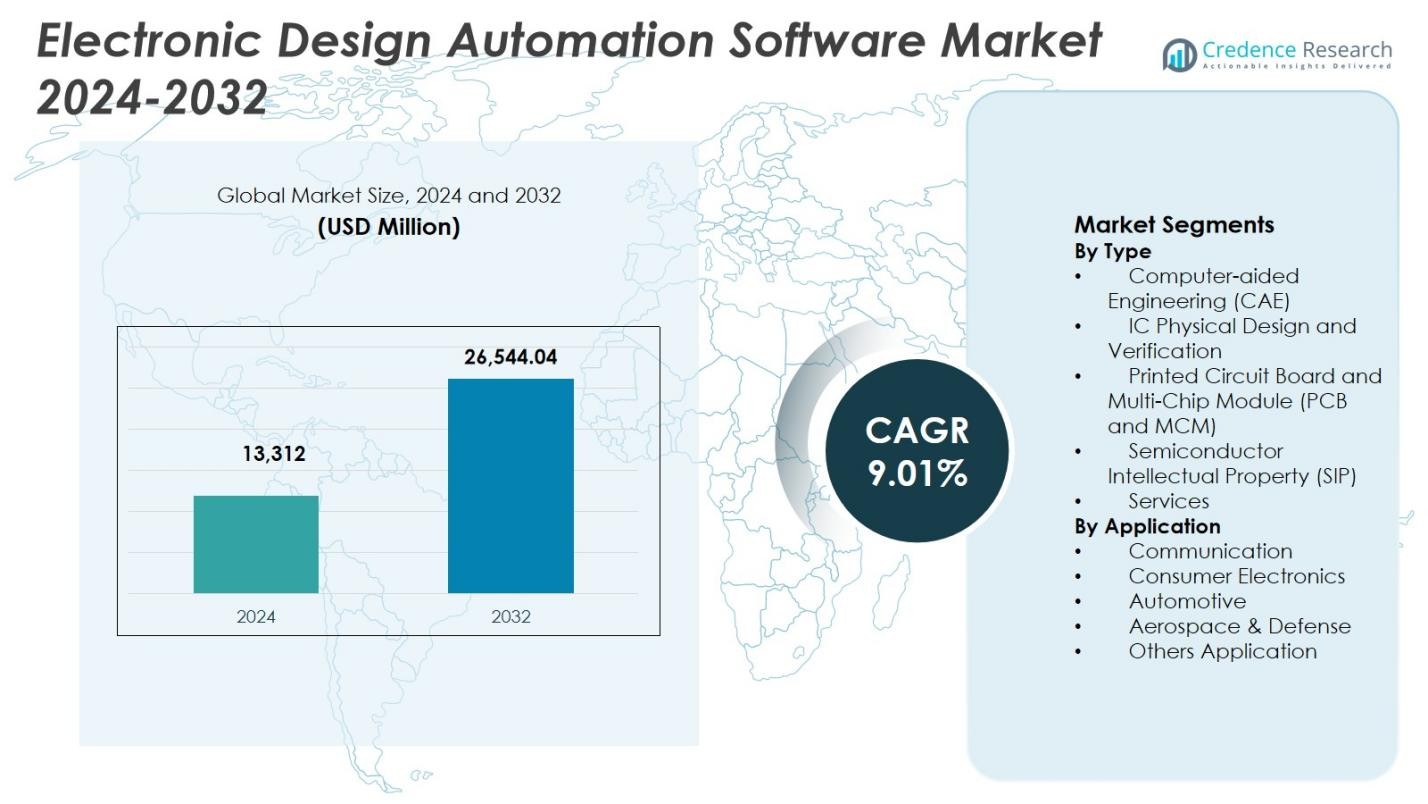

The Electronic Design Automation Software Market size was valued at USD 13,312 million in 2024 and is anticipated to reach USD 26,544.04 million by 2032, growing at a CAGR of 9.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Design Automation Software Market Size 2024 |

USD 13,312 Million |

| Electronic Design Automation Software Market, CAGR |

9.01% |

| Electronic Design Automation Software Market Size 2032 |

USD 26,544.04 Million |

Electronic Design Automation Software Market is characterized by the strong presence of established technology providers such as Cadence Design Systems Inc., Synopsys Inc., Siemens, ANSYS Inc., Keysight Technologies Inc., SAP, Oracle Corp, Xilinx Inc., BluJay Solutions, and Werner Enterprises. These companies focus on advanced design, verification, simulation, and system-level integration solutions to support increasingly complex semiconductor architectures. Continuous investments in AI-enabled automation, cloud-based design platforms, and advanced packaging capabilities strengthen their market positions. Regionally, North America leads the Electronic Design Automation Software Market with a 39.8% market share, supported by a robust semiconductor ecosystem, high R&D spending, and strong demand from AI, data centers, automotive electronics, and aerospace applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electronic Design Automation Software Market was valued at USD 13,312 million in 2024 and is projected to grow at a CAGR of 9.01% through the forecast period, supported by rising semiconductor complexity and expanding electronics applications.

- Growing demand for advanced semiconductor nodes, AI accelerators, high-performance computing, and automotive electronics drives sustained adoption of Electronic Design Automation Software Market solutions across design and verification workflows.

- Increasing adoption of AI-enabled automation, cloud-based EDA platforms, and chiplet-based architectures represents a key trend, with IC Physical Design and Verification holding a 34.6% segment share due to advanced node requirements.

- High software costs, complex licensing models, and shortages of skilled design engineers restrain broader adoption, particularly among small and mid-sized firms, despite ongoing innovation by leading EDA vendors.

- North America leads with a 39.8% regional share, followed by Asia-Pacific at 29.4% and Europe at 24.6%, while strong demand from consumer electronics accounts for a 38.2% application segment share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

Based on type, the Electronic Design Automation Software Market is led by IC Physical Design and Verification, which accounted for 34.6% market share in 2024. This dominance is driven by rising complexity of advanced semiconductor nodes, growing adoption of 5nm and 3nm process technologies, and increasing demand for design rule checking, timing analysis, and functional verification. The rapid expansion of AI accelerators, high-performance computing chips, and system-on-chip (SoC) designs further accelerates adoption. Continuous investments by foundries and fabless companies to reduce design errors and shorten time-to-market strengthen demand for physical design and verification solutions.

- For instance, Cadence’s Innovus Implementation System supported imec in taping out a 5nm test chip using EUV lithography and self-aligned quadruple patterning, optimizing power, performance, and area through advanced place-and-route technology.

By Application:

Based on application, Consumer Electronics dominated the Electronic Design Automation Software Market with a 38.2% market share in 2024. Growth is driven by high-volume production of smartphones, wearables, smart home devices, and connected consumer products requiring compact, power-efficient, and high-performance integrated circuits. Frequent product refresh cycles and increasing integration of AI, 5G, and advanced display technologies intensify design complexity, boosting reliance on EDA tools. The strong presence of fabless semiconductor companies and OEMs focusing on rapid innovation and cost optimization further supports sustained demand in the consumer electronics application segment.

- For instance, Synopsys provides EDA tools like DSO.ai for optimizing smartphone processors, enabling autonomous exploration of power-performance-area trade-offs in complex SoCs.

Key Growth Drivers

Increasing Complexity of Advanced Semiconductor Designs

The Electronic Design Automation Software Market is strongly driven by the growing complexity of semiconductor designs. Advanced process nodes, multi-core architectures, and heterogeneous integration significantly increase design and verification requirements. Modern chips used in AI accelerators, high-performance computing, and data centers contain billions of transistors, requiring precise simulation and validation. EDA tools enable accurate timing analysis, power optimization, and functional verification, helping manufacturers manage design complexity. Continuous innovation in semiconductor manufacturing and rising demand for high-performance, energy-efficient chips sustain strong reliance on advanced EDA software platforms.

- For instance, Siemens Innovator3D IC supports heterogeneous 3D IC integration through rapid floorplan prototyping and analysis. It facilitates System Technology Co-optimization for chiplet-based designs on ASE’s VIPack platform, handling FOCoS and TSV technologies for ultra-high density packaging.

Rapid Adoption of AI, 5G, and Automotive Electronics

Expanding adoption of AI, 5G, and automotive electronics is a major growth driver for the Electronic Design Automation Software Market. AI workloads require customized processor architectures, increasing demand for advanced design and verification tools. The deployment of 5G infrastructure drives complex RF and mixed-signal designs, while automotive electronics growth is supported by electric vehicles, ADAS, and autonomous driving technologies. These applications require safety-critical and high-reliability designs, reinforcing the need for robust EDA solutions across multiple industry verticals.

- For instance, Keysight’s PathWave Advanced Design System (ADS) supports 5G by enabling 3D electromagnetic-circuit co-simulation on multi-technology modules and verifying performance against 5G modulation standards.

Need for Faster Time-to-Market

The pressure to shorten product development cycles significantly drives the Electronic Design Automation Software Market. Semiconductor and electronics manufacturers face intense competition and frequent product refreshes, making rapid innovation essential. EDA tools streamline design workflows through automation, design reuse, and early error detection. Cloud-based EDA platforms enhance collaboration and scalability, enabling faster design iterations. These capabilities help reduce development costs, improve first-pass success rates, and accelerate commercialization of advanced electronic products.

Key Trends and Opportunities

Adoption of AI-Enabled EDA Platforms

AI-enabled design automation represents a major trend in the Electronic Design Automation Software Market. Machine learning algorithms improve placement, routing, verification, and power optimization by learning from large design datasets. These tools reduce manual intervention, improve accuracy, and enhance productivity. AI-driven insights allow early detection of design flaws and performance bottlenecks. This trend creates opportunities for vendors to differentiate offerings with intelligent automation that supports increasingly complex and large-scale semiconductor designs.

- For instance, Siemens Solido provides 2-1000x faster simulation speeds for variation-aware design and verification. The tool supports characterization and IP validation using machine learning on large datasets.

Expansion of Advanced Packaging and Chiplet Designs

Advanced packaging and chiplet architectures create strong growth opportunities in the Electronic Design Automation Software Market. Chiplet-based designs require system-level co-design across silicon, package, and board domains. EDA tools support thermal analysis, signal integrity, and interconnect optimization for heterogeneous integration. As manufacturers adopt chiplets to improve performance and reduce costs, demand increases for EDA solutions that manage cross-domain complexity. Vendors offering integrated, end-to-end design capabilities are well positioned to benefit from this trend.

- For instance, Intel uses its Foveros and EMIB advanced packaging technologies to integrate heterogeneous chiplets, driving demand for EDA tools that support 3D IC thermal analysis, signal integrity, and die-to-die connectivity validation.

Key Challenges

High Cost of Software and Licensing Models

High acquisition and licensing costs remain a key challenge in the Electronic Design Automation Software Market. Advanced EDA tools involve substantial upfront investment, recurring subscription fees, and maintenance expenses. These costs limit adoption among small and mid-sized semiconductor firms and startups. Complex licensing structures also add operational burden. Cost sensitivity in emerging markets further restricts adoption, prompting demand for more flexible pricing models and scalable, cloud-based EDA solutions.

Shortage of Skilled Design and Verification Talent

The shortage of skilled professionals poses a significant challenge for the Electronic Design Automation Software Market. Advanced EDA platforms require expertise in semiconductor physics, system architecture, and complex software workflows. Limited availability of trained engineers increases development timelines and costs. As chip complexity continues to grow, the skills gap widens, placing pressure on organizations to invest in training and automation. Addressing talent shortages remains essential for sustaining long-term market expansion.

Regional Analysis

North America

North America held a 39.8% market share in 2024 in the Electronic Design Automation Software Market, driven by its strong semiconductor ecosystem and early adoption of advanced design technologies. The region benefits from the presence of leading fabless chip companies, integrated device manufacturers, and hyperscale data center operators. High investment in AI, high-performance computing, and cloud infrastructure sustains demand for advanced EDA tools. Continuous innovation in automotive electronics, aerospace systems, and defense technologies further supports growth. Strong R&D spending and close collaboration between EDA vendors and semiconductor manufacturers reinforce North America’s market leadership.

Europe

Europe accounted for a 24.6% market share in 2024 in the Electronic Design Automation Software Market, supported by strong demand from automotive, industrial automation, and aerospace sectors. The region’s focus on electric vehicles, ADAS, and functional safety standards increases reliance on robust design and verification tools. Government-backed semiconductor initiatives and investments in advanced manufacturing strengthen local chip development capabilities. Growing adoption of Industry 4.0, IoT, and smart manufacturing technologies further drives EDA software usage. Europe’s emphasis on quality, reliability, and regulatory compliance sustains steady demand across multiple end-use industries.

Asia-Pacific

Asia-Pacific captured a 29.4% market share in 2024 in the Electronic Design Automation Software Market, driven by its dominant role in semiconductor manufacturing and electronics production. Countries such as China, Taiwan, South Korea, and Japan host major foundries, OSAT providers, and consumer electronics manufacturers. High-volume production of smartphones, consumer devices, and networking equipment fuels demand for EDA tools. Government initiatives supporting domestic semiconductor development and rising investments in AI chips and automotive electronics further strengthen regional growth. Asia-Pacific remains the fastest-growing region due to expanding manufacturing capacity.

Latin America

Latin America represented a 3.6% market share in 2024 in the Electronic Design Automation Software Market, supported by gradual growth in electronics manufacturing and automotive assembly. Increasing adoption of digital technologies, IoT-enabled devices, and industrial automation drives demand for basic and mid-level EDA solutions. Regional semiconductor design activities remain limited, but rising interest in localized electronics production and smart infrastructure projects creates new opportunities. Expansion of automotive electronics and consumer device manufacturing in select countries supports steady growth, although high software costs continue to limit broader adoption.

Middle East & Africa

The Middle East & Africa accounted for a 2.6% market share in 2024 in the Electronic Design Automation Software Market. Growth is supported by increasing investments in smart cities, telecommunications infrastructure, and defense electronics. Governments in the region focus on digital transformation, aerospace development, and advanced manufacturing, creating demand for specialized electronic design tools. Semiconductor design activity remains at a developing stage, but rising adoption of AI, 5G networks, and data centers contributes to gradual market expansion. Limited local expertise and high costs restrain rapid adoption, keeping growth moderate.

Market Segmentations:

By Type

- Computer-aided Engineering (CAE)

- IC Physical Design and Verification

- Printed Circuit Board and Multi-Chip Module (PCB and MCM)

- Semiconductor Intellectual Property (SIP)

- Services

By Application

- Communication

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Others Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Electronic Design Automation Software Market is shaped by key players such as Cadence Design Systems Inc., Synopsys Inc., Siemens, ANSYS Inc., Keysight Technologies Inc., SAP, Oracle Corp, Xilinx Inc., BluJay Solutions, and Werner Enterprises. The market structure reflects high entry barriers due to complex technology requirements, long development cycles, and strong customer lock-in. Leading vendors focus on expanding end-to-end design platforms covering simulation, verification, physical design, and system-level analysis to address growing chip complexity. Strategic priorities include integration of AI-driven automation, cloud-enabled deployment models, and support for advanced packaging and chiplet architectures. Companies also invest heavily in R&D, partnerships with foundries and OEMs, and ecosystem development to strengthen tool interoperability. Continuous enhancement of scalability, accuracy, and productivity remains central as customers demand faster design cycles, higher first-pass success rates, and compliance with evolving performance and reliability standards.

Key Player Analysis

Recent Developments

- In December 2025, NVIDIA and Synopsys announced an expanded strategic partnership aimed at revolutionizing design and engineering workflows across industries, underpinned by a $2 billion NVIDIA investment in Synopsys common stock.

- In October 2025, Qiyunfang, a subsidiary of SiCarrier, officially launched two domestically developed Electronic Design Automation (EDA) software products at the SEMiBAY 2025 event, marking a major step toward China’s technological independence in EDA tools.

- In July 2025, Synopsys completed its acquisition of Ansys in a $35 billion deal, combining EDA and advanced simulation capabilities to strengthen its position in chip design and systems engineering software.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electronic Design Automation Software Market will benefit from rising adoption of advanced semiconductor nodes and complex chip architectures.

- Increasing demand for AI, high-performance computing, and data center processors will strengthen long-term reliance on EDA platforms.

- Growing use of chiplet-based designs and advanced packaging will expand the scope of system-level design and verification tools.

- AI-driven automation will play a larger role in improving design efficiency, accuracy, and productivity across EDA workflows.

- Cloud-based EDA deployment will gain momentum due to scalability, collaboration, and cost optimization advantages.

- Automotive electronics growth, driven by electric vehicles and autonomous systems, will increase demand for safety-compliant EDA solutions.

- Expanding 5G and future wireless technologies will support continued demand for RF and mixed-signal design tools.

- Emerging semiconductor ecosystems in Asia-Pacific will contribute significantly to market expansion.

- Vendors will focus on integrated, end-to-end platforms to support faster time-to-market and design reuse.

- Ongoing skills development and automation will remain critical to address growing design complexity and talent shortages.

Market Segmentation Analysis:

Market Segmentation Analysis: