Market Overview:

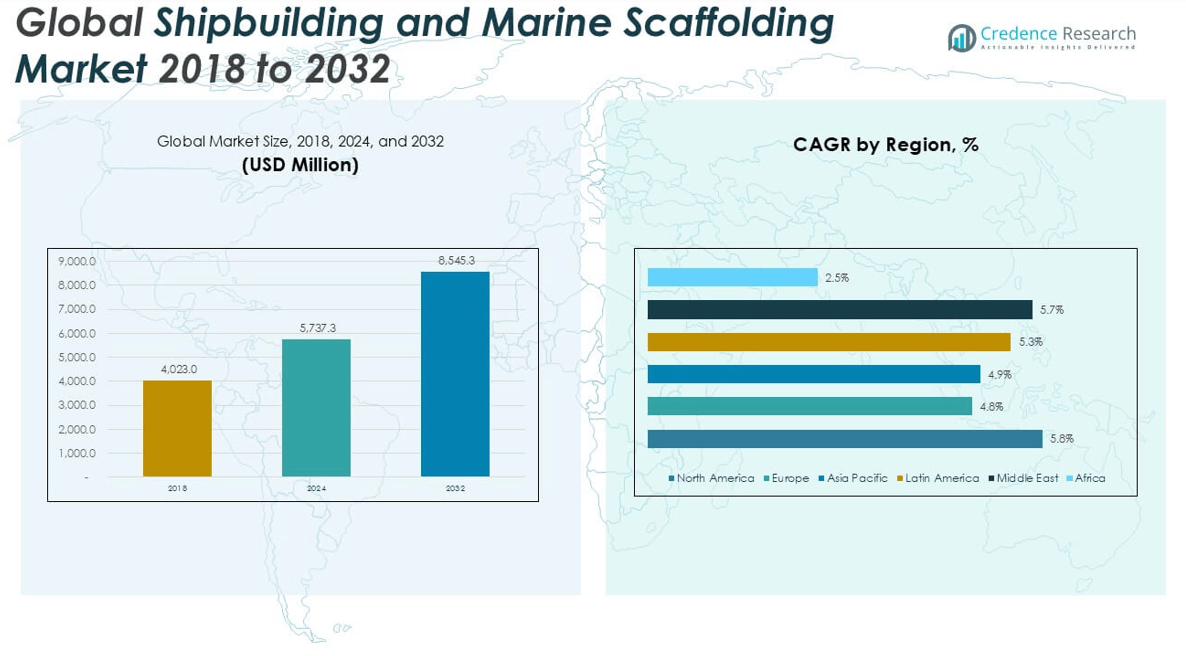

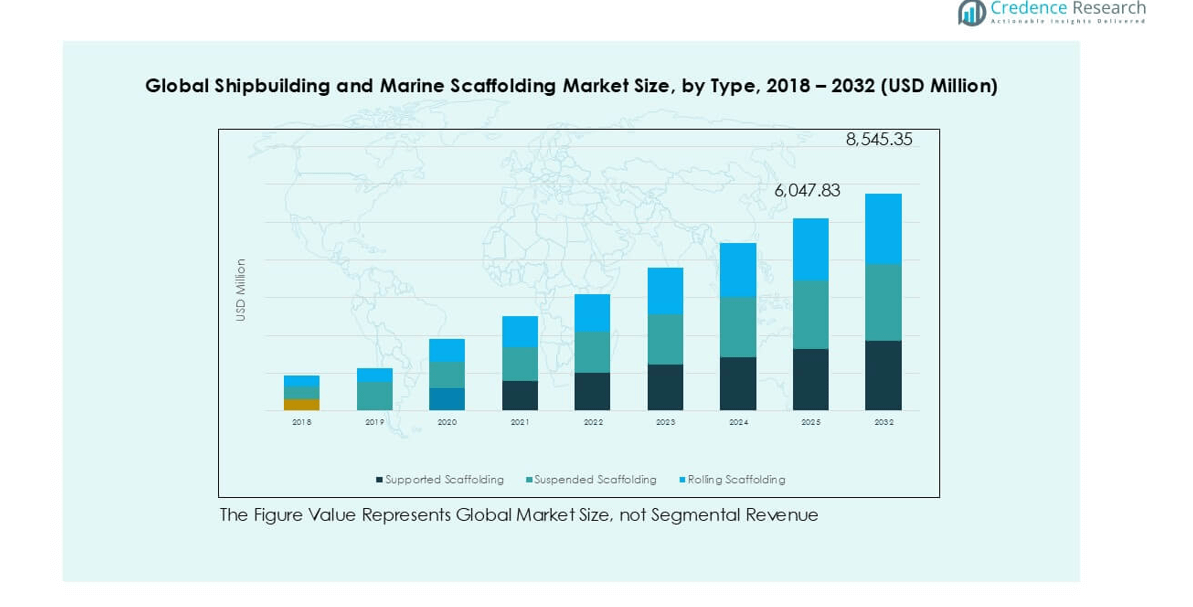

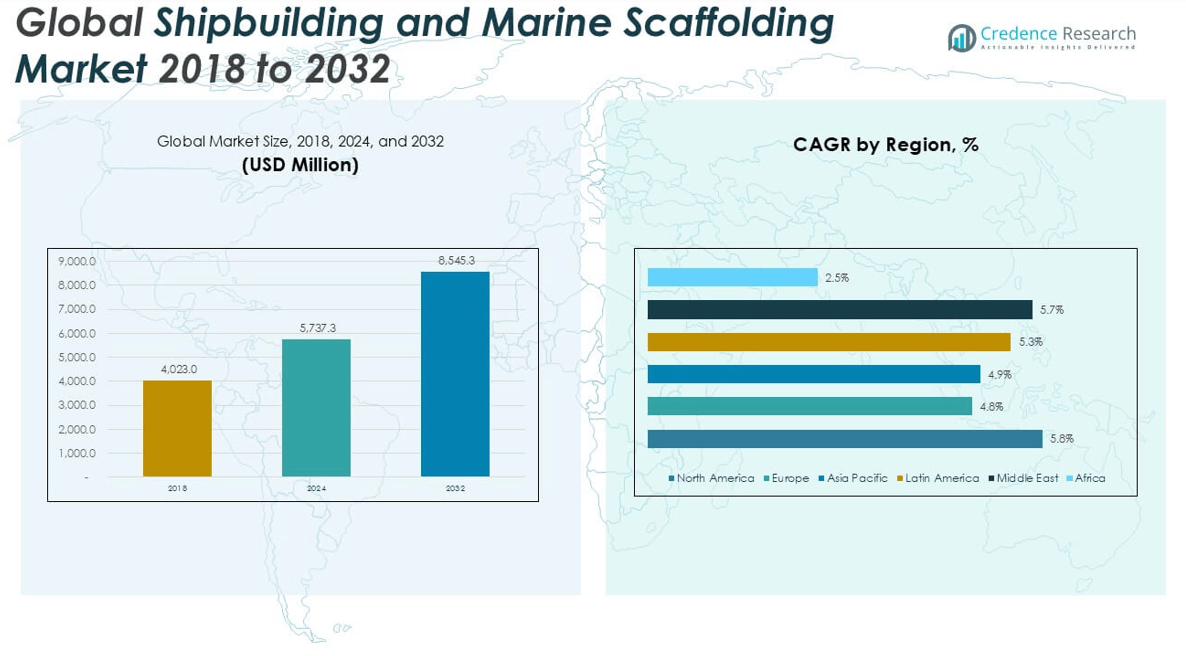

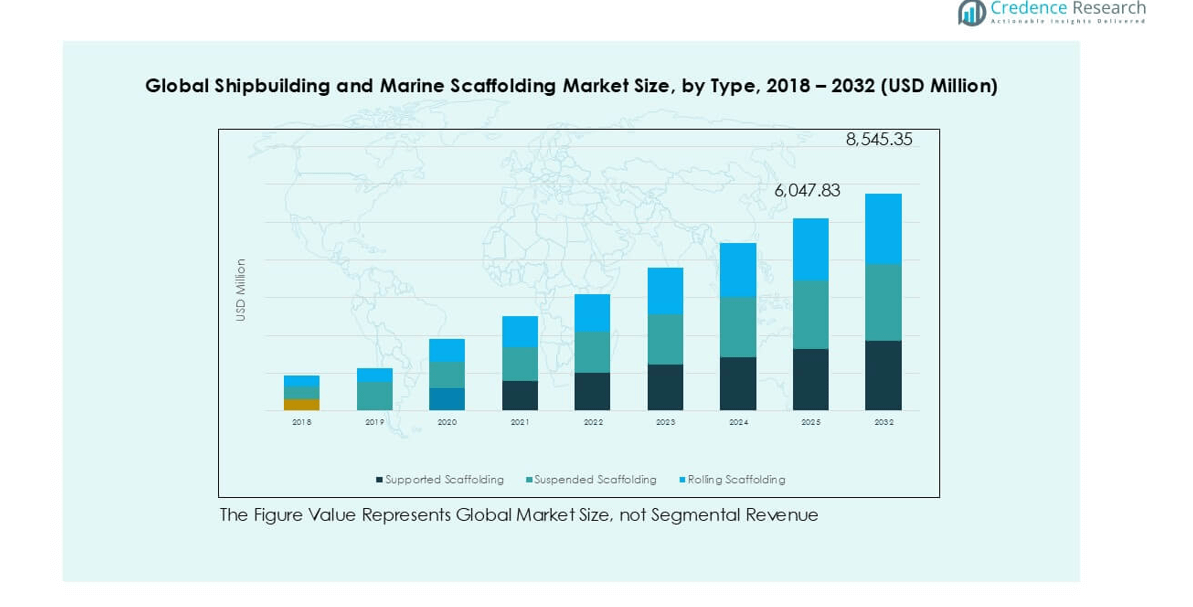

The Shipbuilding and Marine Scaffolding market size was valued at USD 4,023.0 million in 2018 and grew to USD 5,737.3 million in 2024. It is anticipated to reach USD 8,545.3 million by 2032, growing at a CAGR of 5.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shipbuilding and Marine Scaffolding Market Size 2024 |

USD 5,737.3 million |

| Shipbuilding and Marine Scaffolding Market, CAGR |

5.06% |

| Shipbuilding and Marine Scaffolding Market Size 2032 |

USD 8,545.3 million |

Top players in the Shipbuilding and Marine Scaffolding market include BrandSafway, Layher, PRISMEC, Saudi Scaffolding Factory, and Wellmade Scaffold, all of which offer comprehensive scaffolding solutions tailored for complex marine construction environments. These companies leverage advanced materials, modular systems, and strong global distribution networks to maintain competitive advantage. BrandSafway and Layher are recognized for their strong international presence and robust service portfolios, while regional leaders like Saudi Scaffolding Factory cater to growing demand in the Middle East. In terms of geography, Asia Pacific dominates the market with a 35.3% share in 2024, driven by large-scale shipbuilding activities in China, South Korea, and Japan. Europe and North America follow, supported by established naval infrastructure and stringent safety regulations. The market is shaped by players’ continuous efforts in innovation, safety compliance, and expansion into emerging shipyard hubs.

Market Insights

- The Shipbuilding and Marine Scaffolding market was valued at USD 5,737.3 million in 2024 and is expected to reach USD 8,545.3 million by 2032, growing at a CAGR of 5.06% during the forecast period.

- Market growth is primarily driven by rising global shipbuilding activities, increasing repair and maintenance operations, and stringent safety regulations in marine construction environments.

- Trends such as the adoption of modular, lightweight scaffolding systems and the integration of digital tools for project planning are reshaping operational efficiencies and safety standards.

- The competitive landscape is moderately fragmented, with key players like BrandSafway, Layher, and PRISMEC focusing on innovation, geographic expansion, and strategic partnerships to strengthen market presence.

- Regionally, Asia Pacific holds the largest share at 35.3%, followed by Europe at 26.3% and North America at 19.5%; segment-wise, Supported Scaffolding and Steel material lead in adoption due to their durability and suitability for complex shipyard structures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Shipbuilding and Marine Scaffolding market, Supported Scaffolding dominates the type segment, accounting for the largest market share in 2024. This dominance is attributed to its structural stability, ease of installation, and widespread application in large-scale shipyard projects, especially during hull construction and repair activities. Supported scaffolding is particularly preferred for its load-bearing capacity and adaptability to complex marine structures. Meanwhile, Suspended Scaffolding and Rolling Scaffolding are gaining traction due to their flexibility and mobility, respectively, with growing demand in maintenance and smaller vessel operations.

- For instance, Layher, a global scaffolding manufacturer, supplied over 120,000 square meters of supported scaffolding for the construction of a naval shipyard dock in South Korea, demonstrating the capability of their systems to safely support loads up to 2,500 kilograms per bay during intensive hull repairs.

By Material

Among material types, Steel Scaffolding holds the largest market share due to its high strength, durability, and suitability for heavy-duty applications in shipbuilding environments. Steel’s resistance to harsh marine conditions and its long lifecycle contribute to its dominant use in shipyards worldwide. Aluminum Scaffolding is witnessing steady growth, driven by its lightweight nature and ease of assembly, making it ideal for projects requiring frequent repositioning. The Others segment, which includes composites and fiberglass, remains niche but is gaining attention for specialized applications requiring corrosion resistance and reduced weight.

- For instance, ULMA Construction supplied steel scaffolding components with a yield strength of 355 MPa that were used extensively at the Damen Shipyards in the Netherlands, where steel scaffolds endured exposure to saline environments over 18 months without structural degradation.

Market Overview

Rising Global Shipbuilding Activities

The expansion of global shipbuilding activities is a primary driver fueling growth in the shipbuilding and marine scaffolding market. Emerging economies, particularly in Asia-Pacific, are witnessing increased demand for commercial vessels, naval ships, and offshore structures. Governments and private players are investing heavily in expanding shipyards and modernizing fleets, which in turn creates a sustained need for robust and adaptable scaffolding systems. The growing emphasis on maritime trade, defense capabilities, and offshore energy exploration further strengthens the market’s long-term outlook.

- For instance, Hyundai Heavy Industries in South Korea reported the use of more than 150,000 square meters of scaffolding systems during the build of an LNG carrier, with scaffold structures supporting up to 3,200 workers simultaneously during peak construction phases.

Strict Safety Regulations and Compliance Standards

The enforcement of stringent safety standards in marine construction is driving the demand for high-quality scaffolding systems. Regulatory bodies are increasingly mandating safer work environments at shipyards, requiring scaffolding that meets specific structural and safety criteria. This has prompted shipbuilders to adopt engineered scaffolding solutions that minimize risks and enhance worker safety during complex operations. Compliance with global standards such as OSHA and ISO is boosting the replacement of traditional scaffolding with modular, safer alternatives, thereby pushing market growth forward.

- For instance, Altrad Belle adopted scaffolding systems that meet ISO 9001 certification standards and OSHA guidelines, deploying over 10,000 modular scaffold units in European shipyards to reduce fall hazards and improve assembly safety through engineered guardrails and secure locking mechanisms.

Increased Demand for Maintenance and Repair Services

As global fleets continue to age, the need for ship repair and maintenance has significantly increased, driving demand for marine scaffolding solutions. Routine overhauls, dry-docking, and refurbishments require reliable scaffolding systems that provide safe and efficient access to all parts of the vessel. This trend is particularly evident in ports with high ship traffic, where rapid turnaround times are critical. The rising preference for outsourcing maintenance services has also expanded the scaffolding rental market, creating new growth avenues for service providers.

Key Trends & Opportunities

Adoption of Modular and Lightweight Scaffolding Systems

A prominent trend shaping the market is the adoption of modular and lightweight scaffolding, especially aluminum-based structures. These systems offer improved mobility, ease of assembly, and reduced labor costs, making them highly attractive for shipyards seeking efficiency. As shipbuilding processes evolve toward faster turnaround and flexibility, modular scaffolding designs are becoming essential. Manufacturers are focusing on innovation in design and materials to meet the demand for customizable scaffolding systems suited to different ship types and construction phases.

- For instance, Peri Group’s modular aluminum scaffolding system was implemented in the construction of a fast ferry in Norway, where 8,500 linear meters of scaffolding were assembled by a team of 20 workers in under 5 days, cutting typical setup time by nearly half compared to conventional systems.

Integration of Digital Tools for Project Management

The integration of digital technologies such as 3D modeling, scaffold design software, and project management tools is creating opportunities for market players. These technologies streamline scaffolding planning, improve accuracy, and reduce downtime, leading to better cost efficiency and worker safety. As shipyards increasingly adopt digitalization in construction processes, scaffolding providers that offer tech-enabled solutions are gaining a competitive edge. This trend also supports predictive maintenance and lifecycle management of scaffolding components, improving operational efficiency.

- For instance, PERI’s proprietary Scaffold Designer software was used in a recent project at the Meyer Werft shipyard in Germany, where it reduced scaffold design time by 35 hours per project and identified potential collision risks in 3D virtual models, significantly improving onsite safety and reducing rework.

Key Challenges

High Initial Investment and Operating Costs

One of the major challenges in the shipbuilding and marine scaffolding market is the high initial cost of advanced scaffolding systems and related safety equipment. Small and medium-sized shipyards often struggle to allocate sufficient capital for upgrading their scaffolding infrastructure. Additionally, the ongoing costs of maintenance, transportation, and skilled labor further impact profitability. These cost pressures can delay decision-making or lead to continued use of outdated and less efficient systems, slowing market adoption.

Shortage of Skilled Labor

The shortage of skilled labor in marine construction, particularly for erecting and dismantling complex scaffolding systems, poses a significant challenge. Working in shipyards requires specialized training and strict adherence to safety protocols, which limits the available talent pool. This labor gap can lead to project delays, increased safety risks, and higher operational costs. Companies are increasingly investing in workforce training programs, but the pace of talent development often lags behind market growth, creating persistent bottlenecks.

Exposure to Harsh Marine Environments

Scaffolding systems used in shipbuilding are continuously exposed to extreme environmental conditions, including saltwater, high humidity, and fluctuating temperatures. These factors can lead to accelerated material degradation, corrosion, and structural failures if not properly addressed. Ensuring long-term durability and compliance with safety standards in such environments demands high-quality materials and regular maintenance, which increase operational burdens for shipbuilders. This challenge underscores the need for corrosion-resistant materials and improved maintenance protocols.

Regional Analysis

North America

North America accounted for approximately 19.5% of the global shipbuilding and marine scaffolding market in 2024, with a market size of USD 1,120.09 million, up from USD 751.10 million in 2018. The market is projected to reach USD 1,765.47 million by 2032, growing at a CAGR of 5.8% during the forecast period. The region’s growth is driven by increasing naval shipbuilding contracts, modernization of shipyards, and stringent safety standards. The U.S. remains the dominant contributor due to its advanced maritime infrastructure, while Canada and Mexico are witnessing steady investments in ship repair and refurbishment facilities.

Europe

Europe held a 26.3% share of the global market in 2024, with its size growing from USD 1,077.37 million in 2018 to USD 1,511.86 million in 2024. It is expected to reach USD 2,202.99 million by 2032, registering a CAGR of 4.8%. The region’s mature shipbuilding industry, particularly in countries such as Germany, Italy, and the Netherlands, drives demand for high-performance scaffolding solutions. Emphasis on eco-friendly and safe construction practices has also encouraged shipyards to adopt advanced scaffolding systems. Additionally, the refurbishment of aging fleets across Western Europe supports sustained demand in the maintenance segment.

Asia Pacific

Asia Pacific remains the largest regional market, capturing a 35.3% share in 2024, with its market size rising from USD 1,435.02 million in 2018 to USD 2,027.32 million in 2024. It is projected to reach USD 2,981.47 million by 2032, growing at a CAGR of 4.9%. The region’s dominance is attributed to booming shipbuilding activities in China, South Korea, and Japan. Rising maritime trade, naval fleet expansion, and government-backed infrastructure investments have further reinforced regional growth. Additionally, the shift toward modular ship construction and advanced dry-docking practices has spurred adoption of reliable scaffolding systems across shipyards.

Latin America

Latin America represented approximately 8.6% of the global market in 2024, with its size increasing from USD 339.95 million in 2018 to USD 492.92 million in 2024. The market is forecasted to reach USD 750.28 million by 2032, growing at a CAGR of 5.3%. The region’s growth is driven by increased investments in port development, offshore energy projects, and expansion of ship maintenance infrastructure. Brazil and Mexico are key contributors, with growing demand for floating production systems and coastal patrol vessels. Government initiatives to develop domestic shipbuilding capabilities are also creating opportunities for scaffolding providers.

Middle East

The Middle East accounted for 6.7% of the global market share in 2024, growing from USD 259.49 million in 2018 to USD 383.58 million in 2024. It is projected to reach USD 598.17 million by 2032, at a CAGR of 5.7%. The market is supported by rising investments in naval shipbuilding, offshore oil & gas platforms, and port expansion projects, particularly in the UAE and Saudi Arabia. The region’s emphasis on maritime security and regional trade has led to the modernization of shipyards, resulting in increased demand for safe and efficient scaffolding systems in complex environments.

Africa

Africa held a modest 3.5% share of the global market in 2024, with its value increasing from USD 160.12 million in 2018 to USD 201.54 million in 2024. The market is projected to reach USD 246.96 million by 2032, registering the lowest CAGR of 2.5%. Limited shipbuilding infrastructure and slow industrial development have constrained regional growth. However, rising interest in offshore exploration and expansion of port facilities in nations such as Nigeria and South Africa present emerging opportunities. The demand for scaffolding is mainly concentrated in coastal shipyards and industrial zones focused on repair and maintenance activities.

Market Segmentations:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Shipbuilding and Marine Scaffolding market features a moderately fragmented competitive landscape, characterized by a mix of global, regional, and specialized players. Companies such as BrandSafway, Layher, and PRISMEC lead the market with extensive service portfolios, strong financial performance, and widespread geographic presence. These players focus on delivering engineered scaffolding solutions that meet strict safety and performance standards, catering to both new ship construction and maintenance operations. Regional companies like Saudi Scaffolding Factory and Nassaco play a crucial role in serving localized demand across the Middle East and Asia, often leveraging cost-effective solutions and strong distribution networks. Competitive strategies include product innovation, partnerships with shipbuilding firms, expansion into emerging markets, and investment in lightweight and modular scaffolding systems. Additionally, companies are incorporating digital technologies for better project planning and operational efficiency. The market remains competitive as players strive to balance customization, safety, and cost-effectiveness to gain a strategic advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PRISMEC

- BrandSafway

- Saudi Scaffolding Factory

- Layher

- C J Scaffold Service Inc

- Nassaco

- Wellmade Scaffold

- Qingdao Scaffolding

- Guangzhou AJ Building Material Co., Ltd

- EK Scaffolding

Recent Developments

- In March 2025, Prism Marine is actively engaged in worldwide shipyard construction supervision and refit projects, including landmark shipbuilding projects like the world’s first fully electric harbor tug and the first hybrid dual fuel methanol/diesel vessel.

- In October 2022, Lumax Group acquired IAC India to diversify its revenue by increasing its customer base.

- In August 2022, Layher Holding GmbH & Co. KG announced plans to expand its manufacturing unit in Zabergäu to cater to the demand of customers in other countries in 2023.

- In July 2022, MJ-Gerüst GmbH expanded its business in the U.K. by entering into a partnership with ST. Helens Plant limited, which is a leading company in metal construction and scaffolding.

Market Concentration & Characteristics

The Shipbuilding and Marine Scaffolding Market shows moderate market concentration, with a balanced mix of global leaders and regional players operating across key shipbuilding hubs. Leading companies such as BrandSafway, Layher, and PRISMEC hold significant market shares through diversified service offerings, advanced scaffolding technologies, and established client networks. It features strong regional dynamics, with Asia Pacific contributing the largest market share due to high shipbuilding volumes in China, South Korea, and Japan. Europe and North America follow, supported by regulatory enforcement and modern shipyard infrastructure. The market favors companies that offer customized, modular scaffolding solutions that meet project-specific safety and efficiency standards. It remains highly responsive to shifts in naval contracts, commercial shipping demand, and offshore energy investments. Product quality, worker safety, and operational efficiency define competitive advantage. Market players focus on cost-effective design, corrosion resistance, and speed of installation to meet evolving customer expectations in both new construction and refurbishment applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by increasing global demand for new ship construction and maintenance.

- Rising investments in naval defense and commercial shipbuilding will support long-term market expansion.

- Adoption of modular and lightweight scaffolding systems will improve operational efficiency and safety.

- Digitalization in shipyard operations will enhance scaffolding design, planning, and maintenance processes.

- Demand for environmentally durable and corrosion-resistant materials will increase in marine applications.

- Asia Pacific will continue to dominate the market due to strong shipbuilding activity in key countries.

- Europe and North America will witness stable growth supported by stringent safety regulations and advanced shipyard infrastructure.

- Market players will focus on strategic partnerships and regional expansions to strengthen competitiveness.

- Increased outsourcing of repair and maintenance services will boost the scaffolding rental market.

- Development of customized scaffolding solutions tailored to vessel types will become a key differentiator.