Market Overview:

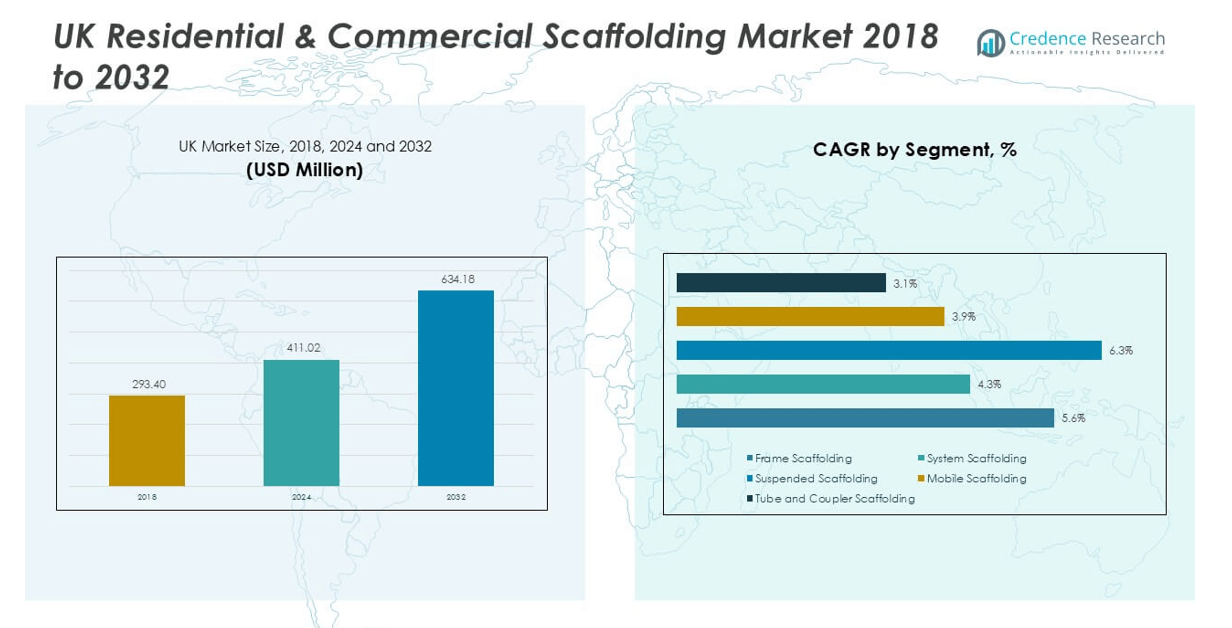

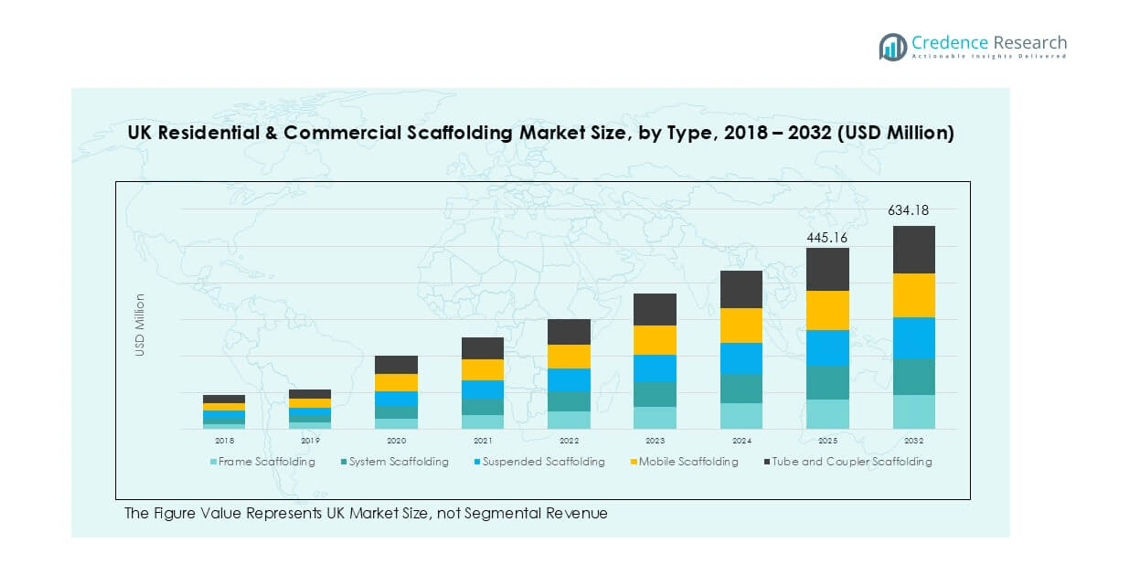

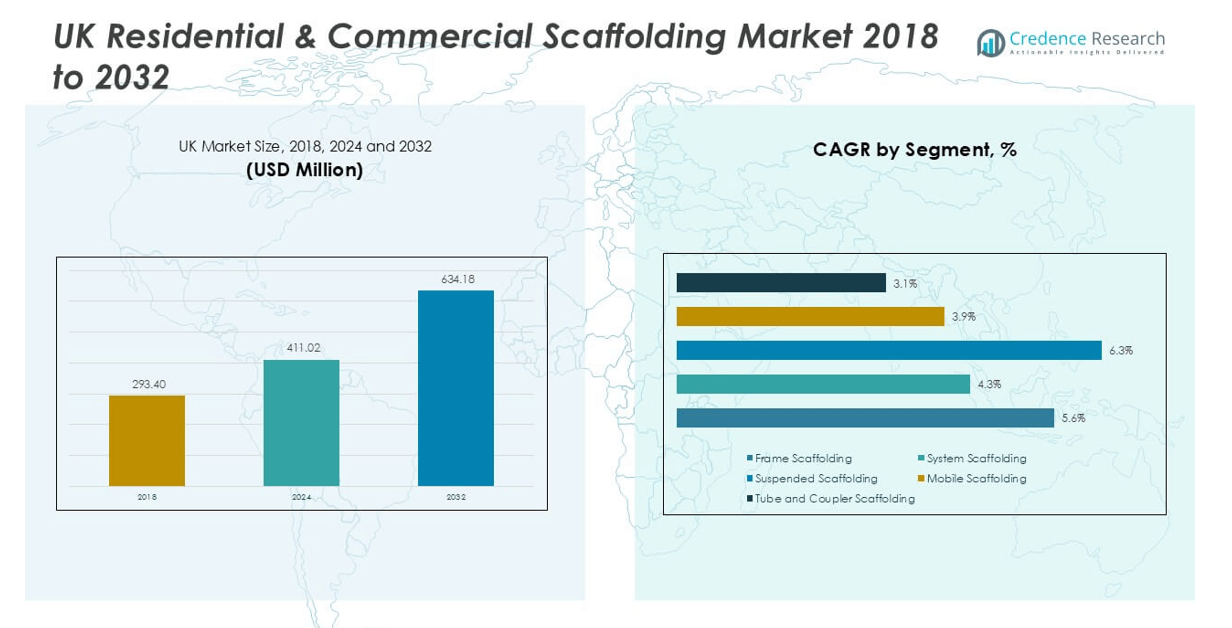

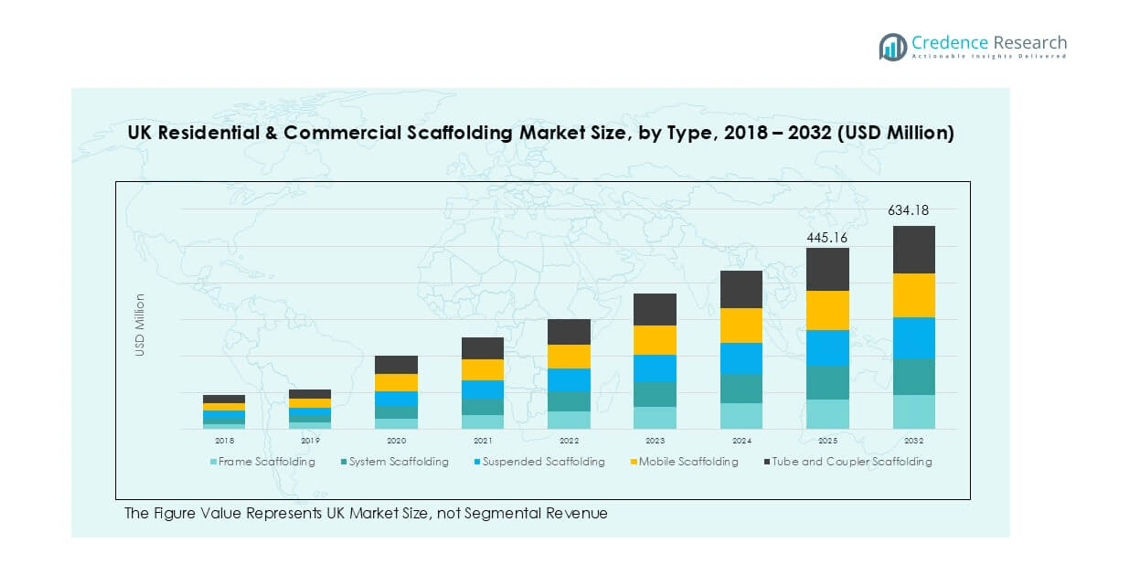

The UK Residential & Commercial Scaffolding market was valued at USD 293.40 million in 2018 and reached USD 411.02 million in 2024. It is projected to grow further, attaining a value of USD 634.08 million by 2032, expanding at a CAGR of 6.3% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Residential & Commercial Scaffolding Market Size 2024 |

USD 411.02 million |

| UK Residential & Commercial Scaffolding Market, CAGR |

6.3% |

| UK Residential & Commercial Scaffolding Market Size 2032 |

USD 634.08 million |

The UK Residential & Commercial Scaffolding market is led by key players such as Palmers Scaffolding, PHD Modular Access, Enigma Industrial, and Premier Scaffolding Solutions Ltd, all of which maintain a strong foothold through comprehensive service offerings, advanced scaffolding systems, and adherence to safety standards. These companies dominate large-scale infrastructure and commercial projects, particularly in urban centers. London remains the most prominent regional market, accounting for approximately 35% of the total market share in 2024, driven by dense construction activity and ongoing redevelopment projects. Manchester and Birmingham follow, supported by urban expansion and public infrastructure investments.

Market Insights

- The UK Residential & Commercial Scaffolding market was valued at USD 411.02 million in 2024 and is projected to reach USD 634.08 million by 2032, expanding at a CAGR of 6.3% during the forecast period.

- Growth is primarily driven by rising residential and commercial construction activities, infrastructure investments, and increasing demand for refurbishment and maintenance across aging buildings.

- A key trend is the growing adoption of modular scaffolding systems and digital technologies such as BIM for enhanced safety, faster setup, and operational efficiency.

- Major players like Palmers Scaffolding, PHD Modular Access, and Enigma Industrial dominate the market through strong project capabilities and nationwide presence; however, rising raw material costs and skilled labor shortages continue to restrain smaller contractors.

- Regionally, London leads with a 35% market share, followed by Manchester (20%) and Birmingham (18%), while frame scaffolding and steel scaffolding remain the most dominant segments by type and material, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the UK Residential & Commercial Scaffolding market, frame scaffolding holds the dominant position, accounting for the largest market share in 2024. Its widespread use is driven by its ease of installation, cost-effectiveness, and suitability for low to mid-rise buildings, particularly in residential construction. System scaffolding is also gaining traction due to its modular design and enhanced safety features, making it favorable for commercial projects. Suspended scaffolding and mobile scaffolding serve niche applications, especially for high-rise structures and maintenance tasks, respectively. Tube and coupler scaffolding, while versatile, sees declining use due to longer setup times and higher labor costs.

- For instance, PHD Modular Access utilized over 5,000 linear meters of system scaffolding for the Battersea Power Station redevelopment, ensuring efficient installation with reduced man-hours on site.

By Material

Steel scaffolding leads the market by material segment, commanding a significant share in 2024, primarily due to its superior strength, durability, and high load-bearing capacity. It is widely preferred in commercial construction projects where structural safety is critical. Aluminum scaffolding is gaining adoption for residential and small-scale commercial applications, offering benefits such as lightweight structure, corrosion resistance, and ease of transport. Bamboo and wood scaffolding, though more environmentally friendly, holds a minimal market share in the UK due to regulatory restrictions and limited durability, making it less viable in modern construction practices.

- For instance, Palmers Scaffolding deployed over 2,200 tons of galvanised steel scaffolding during the refurbishment of Sellafield nuclear site, meeting the structural demands of complex industrial architecture.

By Application

The new construction segment dominates the UK scaffolding market by application, driven by ongoing urban development and a steady pipeline of residential and commercial building projects. Government initiatives to increase housing supply and infrastructure investments continue to fuel this demand. The renovation and maintenance segment also holds a significant share, especially in the commercial sector, as aging infrastructure and building upgrades require consistent scaffolding solutions. The “others” category, which includes temporary event structures and industrial applications, represents a smaller portion of the market but is expected to grow steadily with increased demand for short-term and specialized scaffolding setups.

Market Overview

Rising Infrastructure and Housing Development

The UK government’s continued investment in public infrastructure and housing has significantly contributed to the demand for scaffolding. With increased residential construction to meet housing shortages and large-scale commercial developments in urban centers, scaffolding remains essential for safe and efficient construction practices. This growth is particularly evident in metropolitan areas like London and Manchester, where high-rise and mixed-use developments are prevalent. As urbanization intensifies, scaffolding usage will remain a vital component supporting structural access, height safety, and project timelines in both residential and commercial segments.

- For instance, Enigma Industrial Services supported the £150 million Victoria Square regeneration in Woking, supplying 1,800 tonnes of scaffolding to facilitate high-rise mixed-use construction and façade installation.

Stringent Safety Regulations and Compliance Standards

Stringent safety regulations from the Health and Safety Executive (HSE) and related construction authorities are compelling contractors to adopt certified scaffolding systems. Compliance with workplace safety protocols—particularly in high-risk environments such as high-rise buildings—has increased reliance on professionally designed scaffolding solutions. This is accelerating the shift from traditional systems to engineered solutions such as system scaffolding, which offers improved stability and worker protection. As regulatory oversight tightens, demand for high-quality scaffolding solutions that align with safety codes will continue to drive market expansion.

- For instance, Premier Scaffolding Solutions Ltd received NASC certification for achieving zero scaffold-related incidents across 42 high-rise projects completed between 2022 and 2024, underscoring adherence to evolving safety codes.

Growth in Maintenance and Refurbishment Activities

The UK’s aging building stock, especially in the commercial sector, is fueling the need for renovation, restoration, and façade maintenance—activities that heavily rely on scaffolding. Increasing sustainability efforts, retrofitting needs, and energy-efficiency upgrades in both private and public sectors have led to a surge in maintenance works. Additionally, government support for building modernization and energy refurbishment programs contributes to sustained demand for scaffolding in renovation projects. These long-term refurbishment trends are expected to maintain consistent scaffolding requirements across both residential and commercial settings.

Key Trends & Opportunities

Increasing Adoption of Modular and Mobile Scaffolding Systems

A key trend in the UK scaffolding market is the shift toward modular, pre-engineered scaffolding systems such as ringlock and cuplock scaffolding. These systems offer quicker assembly, enhanced load-bearing capacity, and improved safety features, which are critical in complex construction environments. Furthermore, mobile scaffolding is gaining popularity for short-term maintenance jobs, especially in residential areas, due to its flexibility and reduced setup time. Manufacturers are leveraging this trend to innovate with lightweight materials and compact designs, presenting a notable opportunity for market players to differentiate their offerings.

- For instance, Layher UK developed the Allround Lightweight system, reducing component weight by up to 35% while maintaining load-bearing standards—deployed extensively in both housing and commercial retrofitting projects.

Integration of Digital Technologies and Smart Scaffolding

Digital transformation is gradually entering the scaffolding industry through the integration of smart technologies. Digital scaffolding design software, Building Information Modeling (BIM), and real-time project tracking tools are enabling contractors to plan safer, more efficient scaffold installations. Additionally, sensor-enabled scaffolding structures that monitor stress loads and vibrations are emerging as part of broader site safety initiatives. This digital shift not only enhances productivity but also helps reduce labor costs and errors. As the construction sector continues to embrace digitalization, scaffolding services integrating smart features will see growing demand.

Key Challenges

Shortage of Skilled Labor and Training Gaps

One of the primary challenges facing the UK scaffolding industry is the shortage of skilled labor. The scaffolding trade requires certified training and experience, yet the industry faces high turnover rates and limited influx of young workers. Brexit-related restrictions on EU labor have further tightened the workforce availability. This shortage has resulted in project delays and rising labor costs. To address this issue, the industry must invest in apprenticeships, training programs, and upskilling initiatives to build a more robust and sustainable workforce pipeline.

High Operational and Material Costs

Rising prices of raw materials such as steel and aluminum are increasing the cost of scaffolding components, directly impacting project budgets and contractor profitability. In addition, transport, storage, and regulatory compliance expenses further elevate the overall operational cost. For small- to medium-sized contractors, these financial pressures can lead to reduced margins and competitiveness. The fluctuating costs make long-term pricing strategies difficult, prompting companies to seek more efficient supply chain models and cost-saving innovations in scaffolding design and logistics.

Regional Analysis

London

London dominates the UK residential and commercial scaffolding market, accounting for approximately 35% of the total market share in 2024. As the nation’s economic and construction hub, the city experiences continuous demand for high-rise residential complexes, commercial office spaces, and infrastructure developments. Ongoing projects such as mixed-use towers, transport upgrades, and urban redevelopment drive the extensive use of scaffolding solutions. The high density of buildings and stringent safety regulations further increase the demand for advanced scaffolding systems. London’s market growth is also supported by strong investment inflows and sustained urban regeneration initiatives across Central and Greater London areas.

- For instance, PHD Modular Access supplied scaffolding for over 200 projects in London alone in 2024, including high-profile contracts at the Nine Elms and Canada Water Masterplan zones, each involving multi-level scaffold structures.

Manchester

Manchester holds a significant 20% market share in the UK scaffolding market, fueled by its transformation into a northern commercial powerhouse. The city has seen a surge in residential towers, commercial developments, and urban expansion projects such as the Northern Gateway and Manchester City Centre regeneration. Both residential and commercial scaffolding applications are in high demand due to continuous construction activity and maintenance works across industrial zones and newly urbanized districts. Local government support for infrastructure modernization and housing initiatives contributes to stable market growth. Manchester’s role as a regional construction hub is expected to strengthen further in the forecast period.

- For instance, Palmers Scaffolding erected over 90,000m² of access scaffold across the Northern Gateway project, supporting façade replacement, internal access, and M&E system installations for residential towers.

Birmingham

Birmingham contributes roughly 18% to the UK scaffolding market, driven by robust construction in both residential and commercial sectors. As one of the UK’s fastest-growing cities, Birmingham has ongoing infrastructure and transport developments such as HS2 and the regeneration of city center districts. Demand for scaffolding is also rising from refurbishment and maintenance activities in both private and public buildings. Commercial properties, student housing, and mid-rise residential complexes require advanced scaffolding solutions that comply with safety norms. The region’s strategic location and increasing investment in housing and public works continue to support its consistent scaffolding demand.

Scotland

Scotland accounts for an estimated 12% of the UK scaffolding market, with demand spread across key cities including Glasgow, Edinburgh, and Aberdeen. The region’s market is driven by a mix of new residential housing schemes, commercial office expansions, and public infrastructure upgrades. The Scottish Government’s focus on sustainability and energy-efficient building retrofits has boosted the need for scaffolding in renovation projects. Additionally, offshore construction and industrial maintenance—especially in oil and gas hubs—contribute to commercial scaffolding use. Although smaller in share compared to major English cities, Scotland’s steady construction pipeline ensures moderate but consistent market growth.

Market Segmentations:

By Type

- Frame Scaffolding

- System Scaffolding

- Suspended Scaffolding

- Mobile Scaffolding

- Tube and Coupler Scaffolding

By Material

- Steel Scaffolding

- Aluminum Scaffolding

- Bamboo and Wood Scaffolding

By Application

- New Construction

- Renovation and Maintenance

- Others

By End User

- Residential Construction

- Commercial Construction

By Geography

- London

- Manchester

- Birmingham

- Scotland

Competitive Landscape

The competitive landscape of the UK Residential & Commercial Scaffolding market is characterized by a mix of well-established players and regional service providers competing on the basis of safety compliance, service quality, project capability, and pricing. Leading companies such as Palmers Scaffolding, PHD Modular Access, and Enigma Industrial maintain a strong presence through diversified service portfolios, national coverage, and participation in large-scale infrastructure and commercial projects. Smaller firms like London Bridge Scaffolders and Elite Tower Access cater primarily to local or specialized projects, offering flexible and cost-effective solutions. Innovation in modular systems, digital scaffolding design, and adherence to evolving health and safety regulations have become key competitive differentiators. Strategic partnerships, investments in workforce training, and expansion into refurbishment and maintenance services are common growth strategies. As construction demand rises, competition intensifies, pushing companies to enhance efficiency, invest in advanced equipment, and strengthen their operational footprint across major UK cities and regions.

- For instance, Enigma Industrial Services completed more than 600 scaffolding contracts across the UK in 2023, supported by a fleet of over 250 vehicles and 12 regional depots, enabling rapid deployment and national coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Palmers Scaffolding

- PHD Modular Access

- Premier Scaffolding Solutions Ltd

- Capital Access Systems

- London Bridge Scaffolders

- Elite Tower Access

- Skyline Scaffold Services

- Thames Professional Access

- Metropolitan Access Solutions

- Enigma Industrial

Recent Developments

- In July 2025, ULMA Construction highlighted their “Smart Construction Technology” for ambitious residential projects, specifically mentioning the Symphony Village project in Rome. This technology likely involves innovative formwork systems and other solutions to enhance efficiency and quality in large-scale residential developments. The Symphony Village project, located near Rome, is a large-scale residential complex comprising 470 living units across multiple buildings.

- In June 2025, Altrad completed a €1.25 billion bond issue to support growth and optimize capital structure, signifying robust financial health and the ability to invest in industrial and construction scaffolding services.

- In March 2025, Mohed Altrad detailed strategic expansions in energy services, adding to the Group’s already diverse scaffolding portfolio. This includes continued acquisitions and a decentralized structure to encourage subsidiary autonomy and operational innovation.

- In January 2024, Renta Group acquired Scaffolding Group, a Polish scaffolding company catering to industrial customers in Southern Poland. The acquisition allows the company to enter the Polish industrial scaffolding market and continue to scale the operations geographically and further expand the customer base of the company.

- In August 2022, United Scaffolding Inc., a provider of scaffold rental and sales rebranded to ScaffSource. Under the new brand, the organization offers customers a network for the rental and sales of scaffolding and shoring materials, as well as project design /management services.

Market Concentration & Characteristics

The UK Residential & Commercial Scaffolding Market displays a moderately consolidated structure, with a few key players holding substantial market share alongside a broad base of regional and local providers. Major companies such as Palmers Scaffolding, PHD Modular Access, and Enigma Industrial dominate complex and large-scale projects due to their technical capabilities, safety compliance, and nationwide service networks. It features a clear divide between high-capacity firms operating across commercial infrastructure and smaller contractors catering to localized residential demand. The market emphasizes regulatory compliance, particularly with health and safety standards, which drives demand for engineered scaffolding systems. Steel remains the material of choice due to its strength and durability, especially in commercial projects. Frame scaffolding leads in usage across both residential and commercial construction due to its cost-efficiency and ease of assembly. The sector benefits from continuous urban redevelopment, maintenance needs, and public infrastructure programs, which create consistent project opportunities and sustain competition across different contractor tiers.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK scaffolding market is expected to witness steady growth driven by rising residential and commercial construction activities.

- Demand for advanced and modular scaffolding systems will increase due to safety regulations and efficiency requirements.

- Urban redevelopment and regeneration projects will continue to create consistent scaffolding demand in major cities.

- Renovation and maintenance work across aging building stock will boost long-term scaffolding usage.

- London will remain the leading regional market, followed by Manchester, Birmingham, and parts of Scotland.

- Adoption of lightweight aluminum scaffolding is likely to rise for residential and short-duration projects.

- Integration of digital tools like BIM and project management software will enhance operational precision.

- The market will face ongoing challenges from skilled labor shortages and rising material costs.

- Investment in worker training and safety compliance will remain a strategic priority for key players.

- Increased emphasis on sustainability may lead to growth in reusable and environmentally friendly scaffolding solutions.