Market Overview

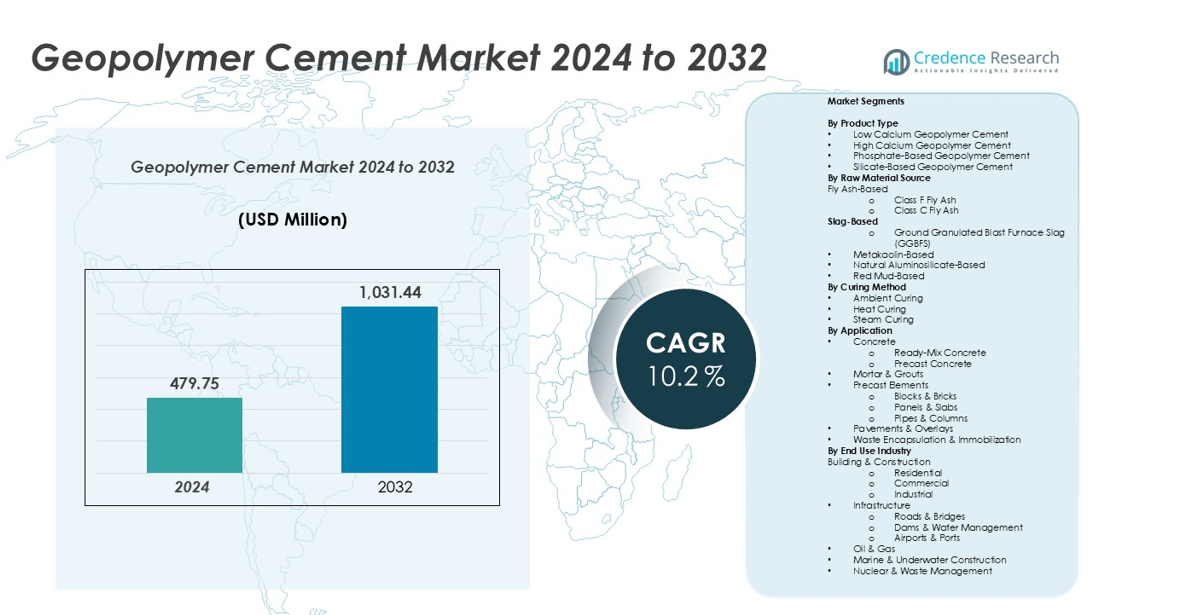

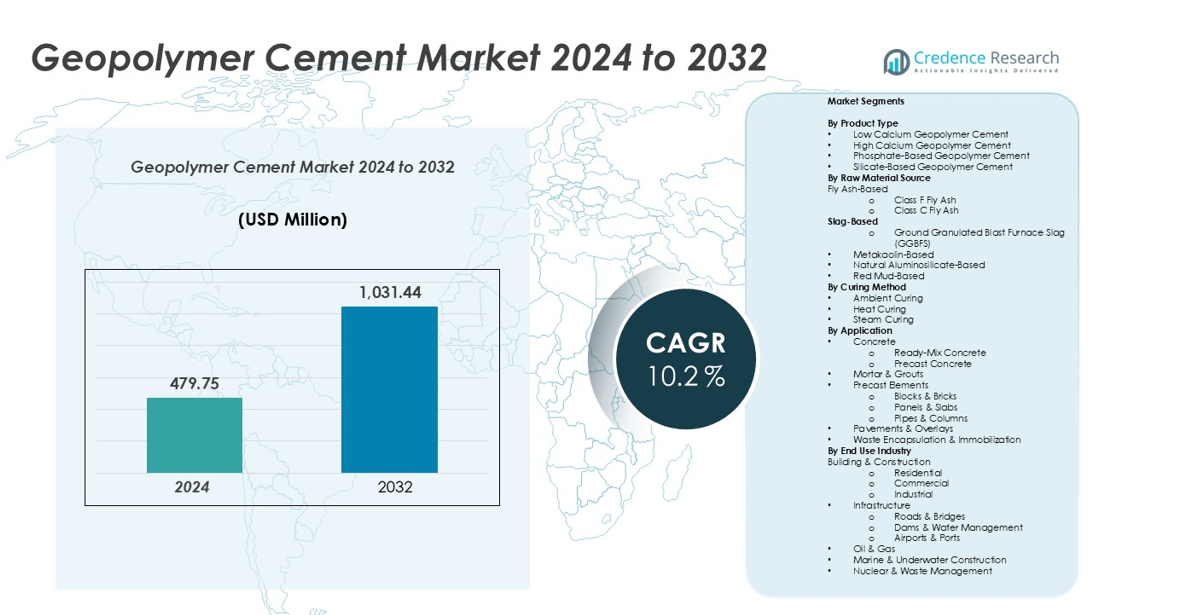

The geopolymer cement market size was valued at USD 479.75 million in 2024 and is anticipated to reach USD 1,031.44 million by 2032, growing at a CAGR of 10.2% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geopolymer Cement Market Size 2024 |

USD 479.75 million |

| Geopolymer Cement Market CAGR |

10.2% |

| Geopolymer Cement Market Size 2032 |

USD 1,031.44 million |

The geopolymer cement market is driven by leading players such as BASF SE, CEMEX S.A.B. de C.V., Wagners, Schlumberger Ltd, Imerys Group, and Zeobond Pty Ltd, which focus on sustainable innovation and advanced material technologies. These companies emphasize developing low-carbon cement formulations, expanding global production capacities, and forming strategic partnerships to strengthen market presence. Asia-Pacific dominates the global market with over 35% share in 2024, supported by rapid urbanization, infrastructure growth, and abundant raw material availability. Europe follows with around 30% share, driven by strict environmental regulations and green construction initiatives, while North America accounts for approximately 25%, benefiting from technological advancements and sustainability-focused infrastructure projects.

Market Insights

- The global geopolymer cement market was valued at USD 479.75 million in 2024 and is projected to reach USD 1,031.44 million by 2032, growing at a CAGR of 10.2% during the forecast period.

- Increasing demand for sustainable and low-carbon construction materials is driving market growth, supported by government initiatives promoting eco-friendly building practices and the utilization of industrial by-products like fly ash and slag.

- Key market trends include advancements in curing technologies, customized formulations for infrastructure and industrial use, and growing adoption of ambient-curing systems for energy efficiency.

- The market is moderately competitive, with leading players such as BASF SE, CEMEX S.A.B. de C.V., Wagners, and Schlumberger Ltd focusing on R&D, strategic alliances, and product diversification.

- Asia-Pacific leads with over 35% share, followed by Europe at 30% and North America at 25%; low calcium geopolymer cement remains the dominant product segment globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The geopolymer cement market is segmented into low calcium, high calcium, phosphate-based, and silicate-based geopolymer cements. Among these, low calcium geopolymer cement dominates the market, accounting for the largest share in 2024. Its superior mechanical strength, chemical resistance, and lower carbon footprint compared to traditional Portland cement drive its widespread use in infrastructure and construction projects. The growing demand for sustainable materials and stricter environmental regulations are further accelerating the adoption of low calcium formulations, particularly in residential and commercial building applications.

- For instance, Wagners Holding Company Limited (Australia) produces Earth Friendly Concrete (EFC), a low-carbon geopolymer cement used in infrastructure projects. For example, over 30,000 cubic meters of EFC were used in the construction of the heavy-duty aircraft pavements at Brisbane West Wellcamp Airport.

By Raw Material Source:

Based on raw material source, the market is categorized into fly ash-based, slag-based, metakaolin-based, natural aluminosilicate-based, red mud-based, and hybrid & blended systems. Fly ash-based geopolymer cement, particularly Class F fly ash, holds the dominant market share due to its abundance, cost-effectiveness, and ability to deliver high compressive strength and durability. Increasing availability of industrial by-products and the emphasis on reducing landfill waste are key growth drivers. The shift toward utilizing waste materials like slag and red mud for cement production also supports sustainability goals within the construction sector.

- For instance, research confirms that concrete incorporating low-calcium Class F fly ash can achieve compressive strength values of up to 90 MPa under specific mix designs and long-term curing conditions.

By Curing Method:

In terms of curing method, the market includes ambient curing, heat curing, steam curing, and others. Heat curing leads the segment, driven by its ability to accelerate strength development and improve long-term performance, particularly in precast and large-scale infrastructure applications. This method enables efficient curing under controlled conditions, reducing time and variability in production. However, ambient curing is gaining traction as an energy-efficient alternative suitable for on-site applications. The ongoing innovations in curing technology are expected to expand the applicability of geopolymer cement across diverse climatic and operational environments.

Key Growth Drivers

Rising Demand for Sustainable and Low-Carbon Construction Materials

The growing emphasis on sustainable infrastructure and carbon reduction is a major driver for the geopolymer cement market. Conventional Portland cement production contributes significantly to global CO₂ emissions, prompting a shift toward eco-friendly alternatives. Geopolymer cement, made from industrial by-products such as fly ash and slag, offers up to an 80% reduction in carbon footprint. Governments and environmental agencies are implementing green building standards and carbon-neutral construction policies, further boosting demand. The material’s superior durability, chemical resistance, and reduced lifecycle cost make it a preferred choice in residential, commercial, and infrastructure projects, strengthening its position in the global sustainable construction landscape.

- For instance, Wagners in Australia developed its Earth Friendly Concrete (EFC®) geopolymer binder, which replaces 100% of Portland cement. EFC® has been used for precast tunnel segments and has been featured in large pours for infrastructure projects, including a 736 m³ continuous pour for a tunnel shaft base on the London Power Tunnels project.

Expanding Infrastructure Development and Industrialization

Rapid urbanization and infrastructure expansion, particularly in emerging economies, are fueling the demand for geopolymer cement. The material’s high compressive strength and excellent performance in harsh environments make it ideal for large-scale applications such as bridges, roads, dams, and industrial flooring. With governments investing heavily in sustainable infrastructure and smart cities, the need for durable and long-lasting construction materials is rising. Additionally, the industrial sector is increasingly adopting geopolymer cement for oil and gas, mining, and marine applications due to its superior resistance to corrosion and thermal stress. These factors collectively position geopolymer cement as a crucial material in modern infrastructure development.

- For instance, Wagners demonstrated its proprietary geopolymer concrete achieved a lab compressive strength of 55.6 MPa in a “40 MPa” design mix after 7 days.

Utilization of Industrial By-Products and Waste Materials

The effective use of industrial by-products like fly ash, slag, and red mud in geopolymer cement production is another key growth driver. This approach supports the circular economy by minimizing waste disposal and reducing dependency on natural resources. Power plants and metal industries are finding new value in their waste streams, while manufacturers benefit from lower raw material costs. The increasing availability of fly ash and slag, coupled with advancements in blending technologies, enhances product consistency and performance. This waste valorization not only aligns with global sustainability initiatives but also contributes to significant cost savings and environmental compliance in cement manufacturing.

Key Trends & Opportunities

Growing Adoption of Advanced Curing and Production Technologies

Technological advancements in curing and production methods are creating new opportunities in the geopolymer cement market. Modern heat-curing and steam-curing systems improve early strength development, enabling faster project completion and higher productivity. Furthermore, innovations such as ambient curing and chemical activators are expanding the application scope in on-site and precast construction. Automation and digital manufacturing are also enhancing product uniformity and scalability. As construction companies prioritize efficiency and sustainability, these technological developments are driving greater adoption across diverse end-use industries, opening pathways for cost optimization and performance improvement.

- For instance, based on various academic studies, certain high-early-strength geopolymer mortar formulations under specific heat-cure protocols can achieve a compressive strength of around 20 MPa after just 4 hours and over 90 MPa at 28 days. These values are demonstrative of laboratory results and are not representative of a single, universally standardized geopolymer material.

Rising Investment in Research and Development for Product Customization

R&D investments are increasingly focused on developing customized geopolymer formulations to meet specific performance requirements across industries. Manufacturers are exploring hybrid systems and nano-additives to improve workability, thermal stability, and setting time. The emergence of phosphate- and silicate-based binders offers new possibilities for specialized applications, including marine and nuclear construction. Additionally, collaborations between universities, research institutions, and industrial players are accelerating innovation and commercialization. These advancements present lucrative opportunities for market players to diversify their product portfolios and cater to evolving customer needs in sustainable construction materials.

- For instance, Zeobond Pty Ltd (Australia) has developed E-Crete, a geopolymer concrete that uses low-calcium fly ash and slag. As with many geopolymer products, special formulations and curing conditions allow it to achieve high early compressive strength.

Key Challenges

Limited Awareness and Standardization Issues

Despite its environmental and performance advantages, the adoption of geopolymer cement remains limited due to low awareness among builders, engineers, and policymakers. The absence of standardized testing procedures, codes, and certifications also restricts large-scale implementation. Construction professionals often hesitate to switch from conventional Portland cement due to unfamiliarity with geopolymer properties and application techniques. Developing globally recognized standards and providing technical education will be essential to overcome this challenge and foster wider acceptance in mainstream construction practices.

High Initial Costs and Limited Supply Chain Infrastructure

The high initial production and setup costs associated with geopolymer cement manufacturing present a significant challenge. Specialized raw materials, activators, and curing systems increase operational expenses compared to traditional cement. Moreover, the limited availability of processing facilities and inadequate supply chain networks, particularly in developing regions, constrain market penetration. To address these issues, manufacturers are focusing on scaling up production, optimizing material sourcing, and improving distribution logistics. Economies of scale and government incentives for green materials can help reduce costs and promote broader market growth.

Regional Analysis

North America

North America holds a substantial share of the geopolymer cement market, accounting for over 25% of the global revenue in 2024. The region’s growth is driven by the rising adoption of sustainable building materials, stringent environmental regulations, and advancements in green construction technologies. The United States leads the market, supported by large-scale infrastructure modernization and industrial applications in oil and gas, marine, and transportation sectors. Additionally, increasing research investments and collaborations between academic institutions and manufacturers are accelerating product innovation, further strengthening North America’s position in the global geopolymer cement industry.

Europe

Europe represents a significant market for geopolymer cement, capturing around 30% of the global share in 2024. The region’s strong focus on carbon neutrality, supported by the European Green Deal and eco-friendly construction initiatives, drives market expansion. Countries such as Germany, France, and the United Kingdom are leading adopters due to advanced construction standards and widespread use of industrial by-products like fly ash and slag. Moreover, continuous government funding for low-carbon material innovation and circular economy practices is fostering product development and encouraging the integration of geopolymer cement in sustainable infrastructure projects.

Asia-Pacific

Asia-Pacific dominates the geopolymer cement market, holding the largest share of over 35% in 2024, and is projected to register the fastest growth through 2032. Rapid industrialization, urbanization, and infrastructure investments across China, India, Japan, and Southeast Asia drive strong demand. The abundance of raw materials such as fly ash and slag, combined with supportive government policies promoting green construction, further boosts regional production. Expanding manufacturing capabilities and the increasing preference for cost-effective, eco-friendly alternatives to Portland cement are expected to reinforce Asia-Pacific’s leadership in the global geopolymer cement market.

Latin America

Latin America accounts for approximately 6–7% of the global geopolymer cement market in 2024, with steady growth expected through 2032. Countries like Brazil, Mexico, and Chile are driving demand through infrastructure modernization and growing adoption of sustainable construction practices. The region’s expanding mining and industrial sectors also contribute to the availability of by-products such as slag and red mud, which support local production. However, limited awareness and technological constraints remain challenges. Ongoing government initiatives for eco-friendly materials and foreign investments in green infrastructure projects are expected to accelerate regional market growth.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 5% of the global geopolymer cement market in 2024 and is witnessing gradual adoption. Infrastructure expansion in the Gulf Cooperation Council (GCC) countries and large-scale investments in sustainable urban development projects are key growth drivers. The high durability and heat resistance of geopolymer cement make it suitable for extreme climatic conditions common in the region. South Africa is emerging as a notable market due to its focus on waste utilization and green building initiatives. Increased investment in construction and environmental sustainability will support future market expansion.

Market Segmentations:

By Product Type

- Low Calcium Geopolymer Cement

- High Calcium Geopolymer Cement

- Phosphate-Based Geopolymer Cement

- Silicate-Based Geopolymer Cement

By Raw Material Source

- Fly Ash-Based

- Class F Fly Ash

- Class C Fly Ash

- Slag-Based

- Ground Granulated Blast Furnace Slag (GGBFS)

- Metakaolin-Based

- Natural Aluminosilicate-Based

- Red Mud-Based

- Hybrid & Blended Systems

By Curing Method

- Ambient Curing

- Heat Curing

- Steam Curing

- Other

By Application

- Concrete

- Ready-Mix Concrete

- Precast Concrete

- Mortar & Grouts

- Precast Elements

- Blocks & Bricks

- Panels & Slabs

- Pipes & Columns

- Pavements & Overlays

- Repair & Rehabilitation

- Waste Encapsulation & Immobilization

By End Use Industry

- Building & Construction

- Residential

- Commercial

- Industrial

- Infrastructure

- Roads & Bridges

- Dams & Water Management

- Airports & Ports

- Oil & Gas

- Mining

- Marine & Underwater Construction

- Nuclear & Waste Management

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The geopolymer cement market is characterized by a moderately consolidated competitive landscape, with several global and regional players focusing on innovation, sustainability, and strategic expansion. Leading companies such as BASF SE, CEMEX S.A.B. de C.V., Wagners, Schlumberger Ltd, and Imerys Group are actively investing in research and development to create low-carbon, high-performance cement alternatives. These players emphasize partnerships, product diversification, and advancements in curing and formulation technologies to strengthen their market presence. Emerging companies like Zeobond Pty Ltd, Banah UK Ltd, and Geopolymer Solutions LLC are also contributing to technological evolution through specialized eco-friendly products and localized production strategies. The competition is further fueled by growing regulatory support for green materials and increasing infrastructure investments worldwide. Overall, the market is witnessing a dynamic shift toward sustainability-driven innovation, with players differentiating themselves through product quality, supply chain efficiency, and customized construction solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Banah UK Ltd

- BASF

- Corning Inc.

- Imerys Group

- Milliken & Company Inc.

- Murray & Roberts Cementation Co. Ltd

- Nu-Core

- PCI Augsburg GMBH

- Rocla

- Schlumberger Ltd

- Uretek

- Universal Enterprise

- Wagners

- Zeobond Pty Ltd

Recent Developments

- In 2024, BASF have certified all its production sites globally under the ISCC PLUS and REDCert² standards. The steps forward taken by BASF in this regard will clearly signal that the company is committed to sustainable manufacture, whose products are a hallmark of world-class environmental standards, no matter what the region.

- In July 2024, cement company CEMEX formed a joint venture partnership with ALBA to process biochar-an inert, carbon-neutral fuel from biomass-at the Rudersdorf cement factory. The initiative essentially reinforces CEMEX in advancing sustainable practices and reducing carbon footprints in the cement-making process.

- In April 2024, SLB revealed that it had entered into a definitive agreement to acquire ChampionX Corporation with a stock transaction. Notably, the deal is set to improve SLB’s capabilities in low-carbon cementing technologies such as geopolymer-based solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Raw Material Source, Curing Method, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The geopolymer cement market is expected to witness strong growth due to rising demand for sustainable construction materials.

- Adoption of low-carbon and eco-friendly cement alternatives will continue to increase across residential, commercial, and infrastructure projects.

- Technological advancements in curing methods and formulation processes will enhance product performance and durability.

- Governments worldwide will support green construction initiatives, encouraging the use of geopolymer cement in large-scale projects.

- Industrial by-products like fly ash, slag, and red mud will see higher utilization in geopolymer cement production.

- Customized formulations for specialized applications, including marine, nuclear, and oilfield projects, will expand market opportunities.

- Asia-Pacific is projected to remain the fastest-growing region due to urbanization and infrastructure expansion.

- Strategic partnerships and collaborations among manufacturers will drive innovation and market penetration.

- Increasing awareness of environmental benefits will boost adoption among construction professionals.

- Investment in research and development will lead to new products with enhanced workability, strength, and sustainability.