Market Overview

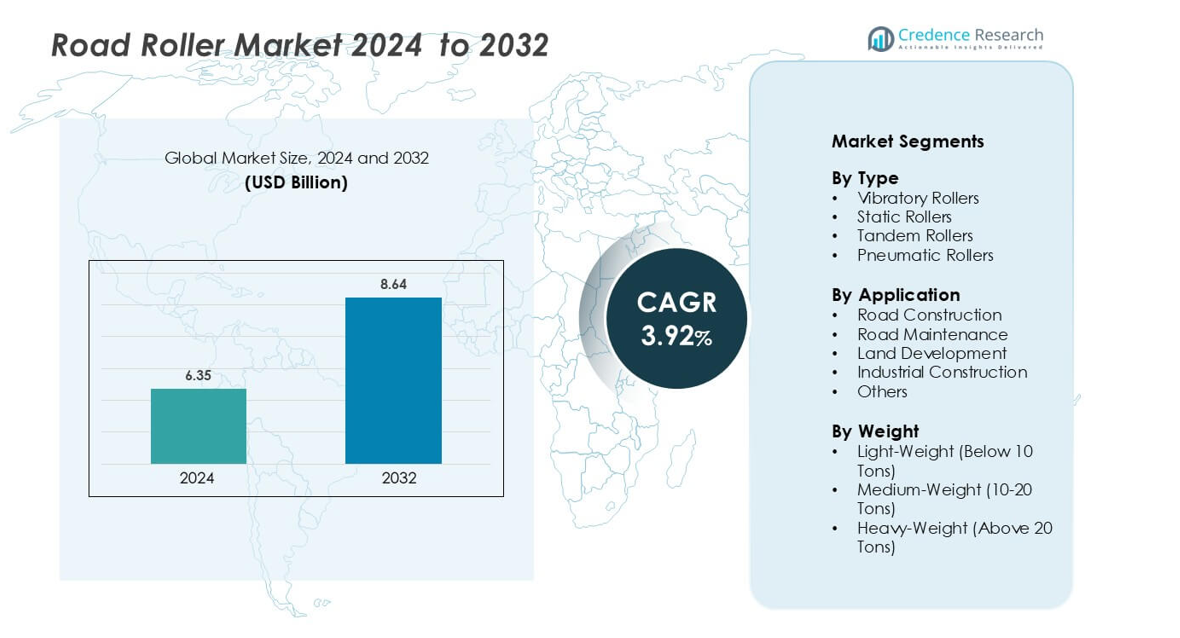

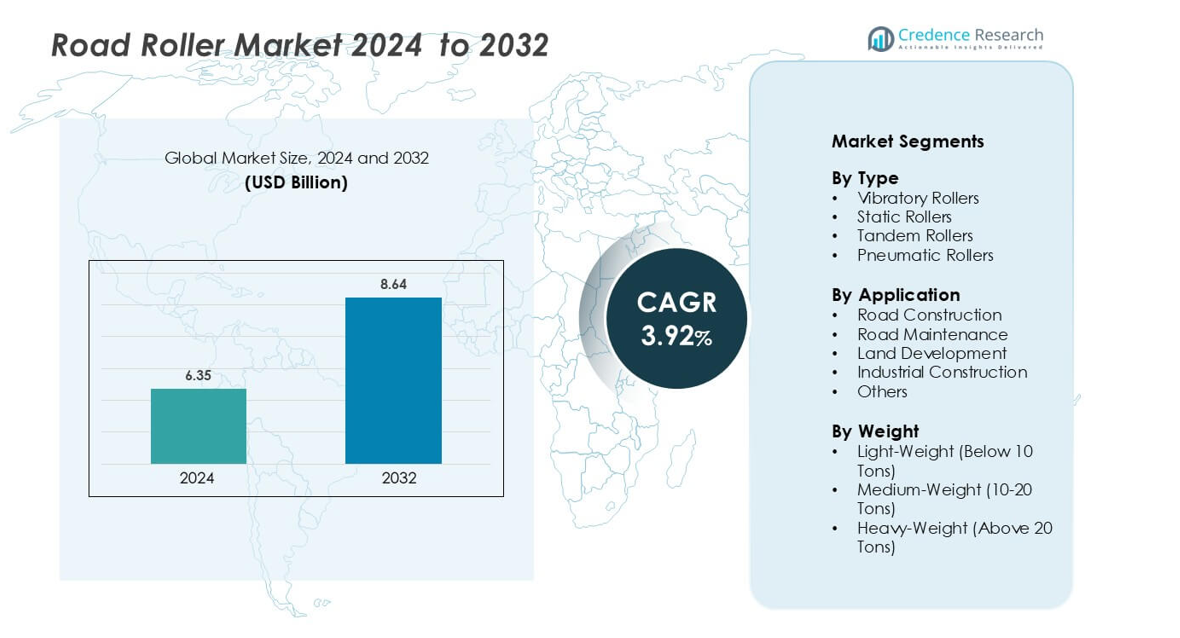

Road Roller Market size was valued USD 6.35 billion in 2024 and is anticipated to reach USD 8.64 billion by 2032, at a CAGR of 3.92 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Roller Market Size 2024 |

USD 6.35 billion |

| Road Roller Market, CAGR |

3.92% |

| Road Roller Market Size 2032 |

USD 8.64 billion |

The road roller market is characterized by strong competition among global and regional manufacturers emphasizing innovation, efficiency, and sustainability. Key players include SANY Group, Caterpillar, XCMG Construction Machinery Co. Ltd., Liugong Machinery Co. Ltd., Wirtgen Group, BOMAG GmbH, JC Bamford Excavators Ltd., Changlin Company Limited, Speedcrafts Limited, and Xiamen XGMA Machinery Co., Ltd. These companies focus on expanding product portfolios through electric and hybrid rollers, telematics-enabled systems, and advanced compaction technologies. Asia Pacific dominates the global market with a 39% share, supported by rapid industrialization, large-scale infrastructure projects, and government-led road development programs. Strategic collaborations and regional expansions continue to define the competitive landscape.

Market Insights

- The global Road Roller Market was valued at USD 6.35 billion in 2024 and is projected to grow at a CAGR of 3.92 % through 2032, driven by rising demand for efficient compaction equipment across infrastructure and construction sectors.

- Expanding road infrastructure projects and government investments in highway development are the primary growth drivers enhancing equipment adoption worldwide.

- Technological trends such as IoT integration, GPS-based monitoring, and hybrid power systems are improving machine performance, efficiency, and sustainability.

- The market is competitive, with key players including Caterpillar, SANY Group, XCMG, Liugong, and BOMAG focusing on smart rollers, emission control, and energy-efficient technologies.

- Asia Pacific leads the market with a 39% share, followed by North America at 34% and Europe at 27%, while the vibratory roller segment dominates with a 46% share due to its superior compaction performance and wide industrial application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Vibratory rollers dominate the road roller market with a 46% share due to their superior compaction efficiency and adaptability. These rollers use high-frequency vibrations to compact asphalt and granular materials effectively. Their growing use in highway, airport, and large-scale road projects drives segment growth. The inclusion of telematics and GPS-based monitoring systems enhances operational accuracy and productivity. Demand is also rising for energy-efficient and low-emission models that meet environmental standards, encouraging manufacturers to innovate in hybrid and electric roller technologies.

- For instance, Caterpillar introduced its CB2.7 GC Vibratory Compactor featuring a dual amplitude system with 62 Hz high-frequency vibration and 0.52 mm amplitude for fine asphalt compaction.

By Application

Road construction holds the largest share at 48%, supported by continuous infrastructure expansion and highway modernization programs. Governments across emerging economies are investing heavily in road connectivity and expressway networks, boosting demand for high-capacity rollers. These machines are vital in achieving smooth, durable road surfaces that meet global compaction standards. Rapid urbanization and rising public-private partnerships also accelerate market growth. Increased adoption of automated rollers with real-time compaction control further strengthens the dominance of the road construction segment.

- For instance, HAMM’s HC 250i compactor integrates Smart Compact technology and HCQ Navigator, providing GPS-based real-time compaction mapping with up to 10 cm precision, enhancing surface uniformity and quality control.

By Weight

Heavy-weight rollers (above 20 tons) lead the market with a 41% share due to their ability to deliver deep compaction for large infrastructure projects. These machines are primarily used in highways, airports, and industrial foundations where high load-bearing capacity is required. Their hydraulic and dual-drum systems provide uniform surface density and reduced passes. Manufacturers are developing smart heavy rollers integrated with load sensors and data tracking systems to improve compaction quality and project efficiency. The segment continues to expand with the rise of large-scale construction initiatives globally.

Key Growth Drivers

Expanding Road Infrastructure Development

Global infrastructure expansion remains the leading growth driver for the road roller market. Governments are increasing investments in highway upgrades, urban roads, and rural connectivity projects. The rising demand for efficient compaction equipment to ensure smooth, long-lasting pavements fuels adoption. Major economies such as India, China, and the United States are implementing national highway expansion and smart city projects that rely heavily on road rollers. The use of advanced rollers in large-scale infrastructure developments reduces project timelines and improves surface uniformity. Additionally, public-private partnerships and foreign investments in construction sectors are sustaining equipment demand across developing regions.

- For instance, Caterpillar’s CB10 Asphalt Compactor features an advanced Compaction Control System using infrared temperature sensors and accelerometers capable of monitoring up to 20 data points per second to optimize rolling patterns and surface density.

Technological Advancements and Automation

Automation and digitalization are reshaping road construction, driving demand for intelligent and connected rollers. Modern machines feature GPS-based compaction control, telematics, and real-time monitoring systems to enhance accuracy and operational efficiency. These features allow operators to optimize compaction patterns, minimize fuel use, and ensure consistent soil density. The integration of electric and hybrid technologies aligns with sustainability targets and reduces carbon emissions during operation. Manufacturers such as Caterpillar and BOMAG are introducing smart rollers equipped with data analytics and automated control systems. This technological shift increases productivity and extends machine lifespan, making automation a major market growth driver.

- For instance, BOMAG’s Asphalt Manager 2 system automatically adjusts amplitude and vibration direction based on material stiffness (measured as the EVIB value), achieving optimal and uniform compaction throughout the asphalt layer.

Rising Focus on Sustainable and Energy-Efficient Equipment

The growing emphasis on sustainability in construction is encouraging the adoption of energy-efficient road rollers. Governments and contractors are prioritizing eco-friendly machinery to meet emission standards and reduce environmental impact. Hybrid and electric-powered rollers are gaining traction due to lower fuel consumption and noise levels. Manufacturers are focusing on developing lightweight yet high-performance materials to improve energy efficiency without compromising durability. For instance, the demand for rollers compliant with EU Stage V and U.S. Tier 4 emission norms is rising. Sustainability-driven procurement policies across major economies are further stimulating demand for environmentally responsible compaction equipment.

Key Trends & Opportunities

Integration of Telematics and IoT Solutions

Telematics and Internet of Things (IoT) integration represent a major trend transforming the road roller market. These technologies enable remote diagnostics, performance tracking, and predictive maintenance, reducing downtime and operational costs. Construction firms are increasingly adopting connected rollers for better fleet management and productivity optimization. IoT-enabled data analytics assist in improving compaction accuracy and monitoring operator behavior in real time. Manufacturers are capitalizing on this trend by offering subscription-based digital monitoring platforms. The trend creates opportunities for service-based revenue models and supports the shift toward smart construction ecosystems globally.

- For instance, in August 2019, an article citing Volvo Construction Equipment (Volvo CE) reported that for customers using its ActiveCare Direct service, only 1% of monitored units ever became critical machine-down cases.

Growing Adoption of Electric and Hybrid Rollers

The transition toward cleaner energy is driving the adoption of electric and hybrid road rollers. Governments are offering tax incentives and grants for low-emission construction equipment, creating significant opportunities for manufacturers. Electric rollers provide advantages such as reduced noise, lower operational costs, and compliance with stringent environmental regulations. Several leading OEMs are investing in R&D to develop fully electric compact rollers for urban construction. The trend also supports sustainable infrastructure goals and aligns with green construction mandates in Europe and North America. This growing shift toward electrification marks a key opportunity for innovation in the market.

- For instance, Wacker Neuson’s RD28e tandem roller operates on a 48 V lithium-ion battery with a 23.4 kWh capacity, providing up to 3.5 hours of continuous operation on a single charge while producing zero tailpipe emissions.

Expansion in Emerging Economies

Rapid urbanization and industrialization across Asia Pacific, Africa, and Latin America are creating new growth avenues. Infrastructure development programs, particularly in India, Indonesia, and Brazil, are boosting demand for high-performance compaction machinery. The rise in government-backed road development schemes, along with private sector participation, supports market expansion. Manufacturers are establishing regional production facilities and service networks to cater to local demand efficiently. This expansion into emerging markets presents opportunities for cost-effective product offerings and long-term partnerships in the construction equipment sector.

Key Challenges

High Initial Investment and Maintenance Costs

The significant upfront cost of purchasing road rollers remains a key challenge, especially for small and medium-sized contractors. Advanced models equipped with automation and telematics systems further increase investment requirements. Maintenance costs related to hydraulic systems, sensors, and electronic components also add to operational expenses. High repair and replacement costs can reduce the return on investment for rental and leasing firms. Limited access to financing options in developing countries further restricts market adoption among smaller enterprises. These cost-related barriers continue to slow down widespread adoption of technologically advanced rollers.

Shortage of Skilled Operators and Training Requirements

The road roller market faces a persistent shortage of skilled machine operators capable of handling automated and connected equipment. Modern rollers with advanced control systems require specialized training for safe and efficient operation. Insufficient training programs in emerging regions lead to reduced machine efficiency and increased risk of equipment damage. Additionally, improper handling can compromise compaction quality and increase project delays. Manufacturers and construction firms must invest in operator training and digital simulation programs to address this gap. The lack of skilled personnel remains a challenge to maximizing equipment performance and achieving operational efficiency.

Regional Analysis

North America

North America holds a 34% share of the global road roller market, driven by continuous infrastructure modernization and highway rehabilitation projects. The United States leads the region with strong demand for vibratory and tandem rollers in large-scale road and airport construction. Federal investments under the Infrastructure Investment and Jobs Act (IIJA) have accelerated equipment procurement across states. Canada also contributes significantly through urban road upgrades and sustainable construction initiatives. The presence of major manufacturers such as Caterpillar and Case Construction supports technological adoption and drives steady growth across the regional construction equipment market.

Europe

Europe accounts for 27% of the market, supported by stringent environmental standards and high infrastructure quality requirements. Countries such as Germany, France, and the United Kingdom are focusing on energy-efficient and low-emission rollers to comply with EU Stage V norms. The region’s demand is further boosted by ongoing maintenance of aging road networks and expansion of smart city projects. Advanced technologies like telematics and GPS-integrated rollers are widely adopted to ensure operational precision. Manufacturers such as BOMAG and Volvo Construction Equipment play a key role in shaping Europe’s market growth and innovation.

Asia Pacific

Asia Pacific dominates the global market with a 39% share, fueled by rapid urbanization, industrialization, and major infrastructure programs. China and India lead in demand for heavy-duty road rollers due to large-scale expressway, railway, and airport development projects. Government-backed initiatives like India’s Bharatmala Pariyojana and China’s Belt and Road Initiative have created robust equipment needs. Southeast Asian countries are also investing in road connectivity and smart mobility infrastructure. Local manufacturers and affordable production costs strengthen the region’s market position, making Asia Pacific the fastest-growing region in the global road roller industry.

Latin America

Latin America holds a 7% market share, driven by growing investments in transportation and urban development projects. Brazil, Mexico, and Chile are key contributors, with demand rising in road rehabilitation and industrial construction. Regional governments are emphasizing road connectivity improvements to enhance trade efficiency. Adoption of medium-weight and compact rollers is increasing due to diverse terrain conditions. However, limited infrastructure funding and import dependency pose challenges for consistent growth. International manufacturers are expanding partnerships with local distributors to strengthen after-sales support and capture emerging opportunities in the region’s construction sector.

Middle East & Africa

The Middle East & Africa region represents a 6% share of the global market, supported by infrastructure diversification and urban expansion. GCC countries such as Saudi Arabia, the UAE, and Qatar are investing heavily in smart cities and transport corridors under national development programs. Africa’s road construction initiatives, particularly in South Africa and Kenya, are also boosting roller demand. The market favors heavy and vibratory rollers suited for large-scale infrastructure and desert terrain. Strategic collaborations between global manufacturers and local contractors are driving equipment adoption and expanding market penetration across emerging economies.

Market Segmentations:

By Type

- Vibratory Rollers

- Static Rollers

- Tandem Rollers

- Pneumatic Rollers

By Application

- Road Construction

- Road Maintenance

- Land Development

- Industrial Construction

- Others

By Weight

- Light-Weight (Below 10 Tons)

- Medium-Weight (10-20 Tons)

- Heavy-Weight (Above 20 Tons)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The road roller market is highly competitive, led by global and regional manufacturers such as Caterpillar, SANY Group, XCMG Construction Machinery Co. Ltd., Liugong Machinery Co. Ltd., Wirtgen Group, BOMAG GmbH, JC Bamford Excavators Ltd., Changlin Company Limited, Speedcrafts Limited, and Xiamen XGMA Machinery Co. Ltd. These companies focus on technological innovation, product diversification, and geographic expansion to strengthen market reach. Advancements in telematics, compaction control, and hybrid power systems enhance machine efficiency and operator safety. Manufacturers are increasingly investing in eco-friendly and intelligent rollers designed to reduce fuel consumption and carbon emissions. Strategic collaborations and aftersales network expansions are helping players capture infrastructure development opportunities across Asia-Pacific and Africa. Continuous innovation in vibration technology, drum design, and automation supports performance improvement and operational precision, giving leading firms a strong edge in the evolving road construction equipment landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- SANY Group

- XCMG Construction Machinery Co. Ltd.

- Liugong Machinery Co. Ltd.

- Wirtgen Group

- BOMAG GmbH

- JC Bamford Excavators Ltd.

- Changlin Company Limited

- Speedcrafts Limited

- Xiamen XGMA Machinery Co., Ltd.

Recent Developments

- In March 2023, Dynapac plans to commence the manufacturing of a fresh lineup of tandem rollers across its 6, 7, and 10-ton categories by the end of 2023. CC2200 VI, a tandem asphalt roller series, is tailored for optimal operational simplicity as well as driver comfort and safety. With drum widths spanning from 1,500 to 1,680mm, these rollers are available in split drum and combi variations, showcasing Dynapac’s commitment to enhanced versatility & efficiency.

- In November 2022, Ammann introduced the eARX 26-2 Light Tandem Roller designed for construction endeavors. This roller showcases a complete electric drive system capable of continuous operation for 18 hours or more before requiring a recharge.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Weight and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric and hybrid road rollers will rise as governments promote green construction.

- Integration of IoT and telematics will enhance performance tracking and predictive maintenance.

- Automation and operator-assist technologies will improve compaction accuracy and safety.

- Asia Pacific will remain the dominant region due to ongoing infrastructure expansion.

- Rental and leasing services will gain traction among small and medium contractors.

- Manufacturers will focus on low-emission and noise-reduction designs to meet environmental norms.

- Digital monitoring and fleet management solutions will drive operational efficiency.

- Urbanization and smart city projects will create consistent demand for compact rollers.

- Partnerships between global and local manufacturers will strengthen regional market penetration.

- Continuous R&D investments will lead to durable, energy-efficient, and intelligent roller models.