Market Overview

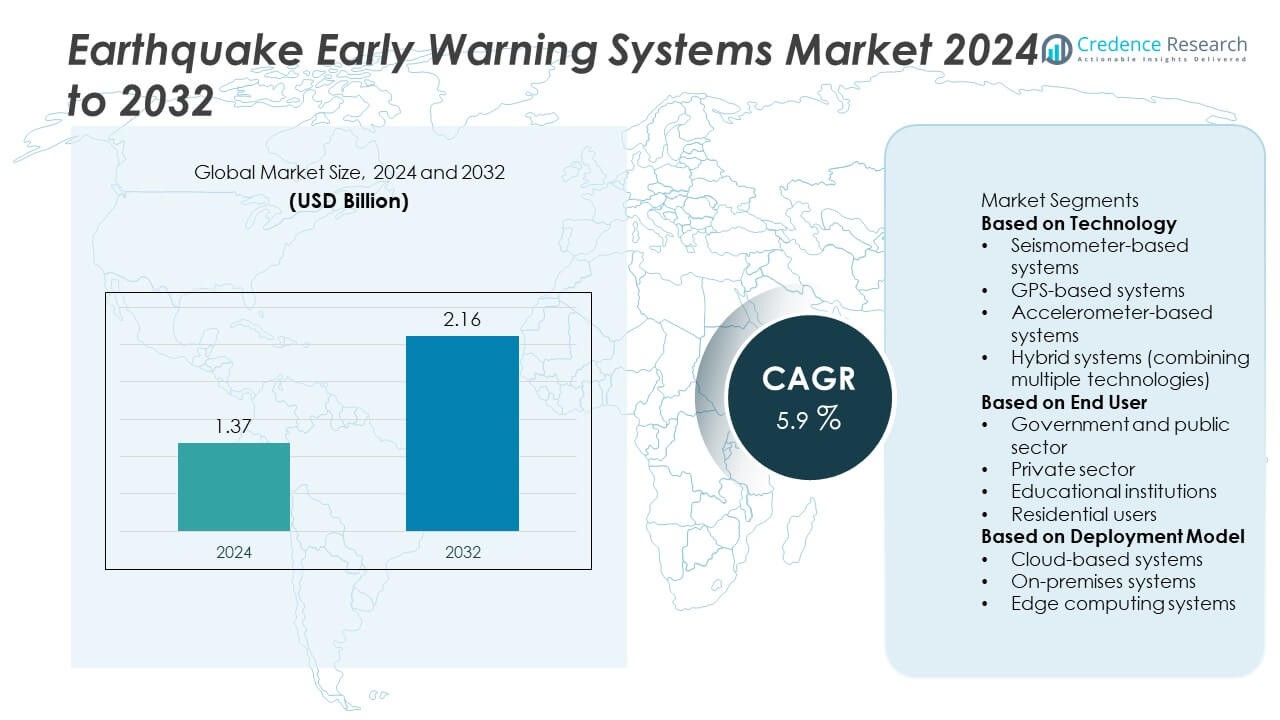

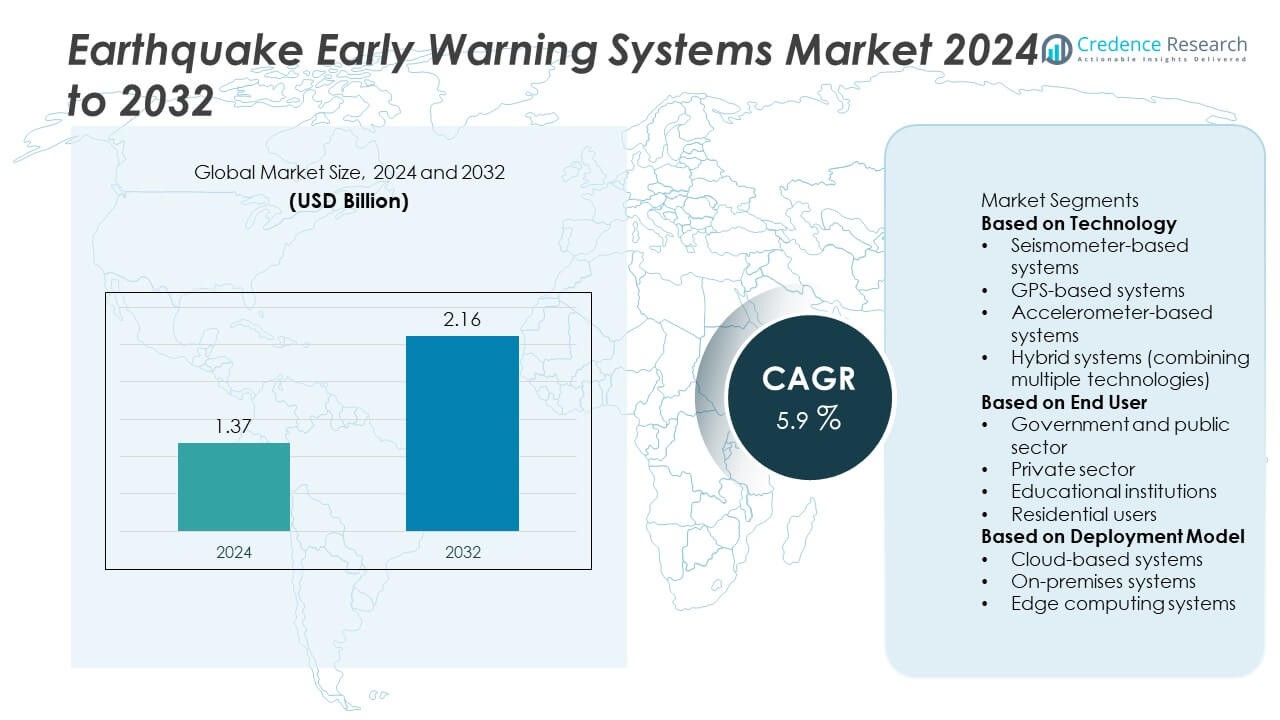

The Earthquake Early Warning Systems market was valued at USD 1.37 billion in 2024 and is projected to reach USD 2.16 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earthquake Early Warning Systems market Size 2024 |

USD 1.37 Billion |

| Earthquake Early Warning Systems market, CAGR |

5.9% |

| Earthquake Early Warning Systems market Size 2032 |

USD 2.16 Billion |

The earthquake early warning systems market is led by key players such as Kinemetrics, SeismicAI, Early Warning Labs, SeisComP3, Optimum Seismic, Seismic Warning Systems, Seismic Warning Group, Nanometrics Inc., SkyAlert, and GeoSIG Ltd. These companies dominate the market through technological innovation in multi-sensor networks, AI-driven seismic data processing, and cloud-based alert delivery. They focus on improving detection precision and reducing alert latency across public and private sectors. North America led the market with a 37% share in 2024, supported by large-scale government initiatives like ShakeAlert. Asia-Pacific followed with a 29% share, driven by Japan and China’s advanced nationwide warning infrastructure and growing investments in seismic safety modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The earthquake early warning systems market was valued at USD 1.37 billion in 2024 and is projected to reach USD 2.16 billion by 2032, growing at a CAGR of 5.9%.

- Growth is driven by rising seismic vulnerability, government safety mandates, and investments in public alert infrastructure across high-risk regions.

- Integration of AI, IoT, and multi-sensor hybrid systems is a major trend improving detection accuracy and reducing response time.

- The market is moderately competitive, with key players like Kinemetrics, SeismicAI, and Early Warning Labs focusing on cloud-based analytics and real-time data integration.

- North America held a 37% market share in 2024, followed by Asia-Pacific with 29%, while seismometer-based systems led by technology with a 43% share due to their precision in large-scale seismic monitoring.

Market Segmentation Analysis:

By Technology

The seismometer-based systems segment dominated the earthquake early warning systems market with a 43% share in 2024. This dominance is attributed to their proven reliability in detecting primary seismic waves and issuing alerts within seconds. These systems are widely used in national and regional warning networks due to their high precision and low false-alarm rate. Hybrid systems are gaining traction as they integrate GPS and accelerometer data for enhanced detection accuracy. The increasing focus on real-time, multi-sensor integration supports hybrid adoption in densely populated and high-risk seismic zones.

- For instance, the U.S. ShakeAlert network uses a network of over 2,000 seismic sensors, which include equipment from partners like Kinemetrics, to detect seismic activity. The system is designed to provide alerts within a few seconds of an earthquake’s start, with the precise warning time depending on the recipient’s distance from the epicenter.

By End User

The government and public sector segment held a 56% share of the earthquake early warning systems market in 2024. Governments lead adoption through large-scale infrastructure projects and national seismic monitoring initiatives. These systems are deployed to protect public safety, critical infrastructure, and transportation networks. Public agencies in Japan, the U.S., and Mexico have implemented extensive alert networks connected to schools, hospitals, and industries. The private sector is also expanding adoption to safeguard industrial facilities, while educational institutions integrate systems for campus safety and evacuation management.

- For instance, SeismicAI powers a nationwide Earthquake Early Warning system in a Balkan country in partnership with a local hardware manufacturer, delivering fast alerts to civilians and critical infrastructure. The company uses its AI-based platform and advanced algorithms to analyze data from sensors to provide high-precision regional alerts.

By Deployment Model

The cloud-based systems segment accounted for a 48% share of the earthquake early warning systems market in 2024. Cloud deployment enables faster data processing, centralized monitoring, and easy scalability for regional and national networks. It supports seamless integration with communication platforms and mobile alerting applications. The shift toward cloud computing enhances system reliability and accessibility for emergency agencies and public networks. Edge computing systems are emerging for remote and high-risk regions requiring low-latency alerts, while on-premises models remain preferred for secure government and defense installations.

Key Growth Drivers

Rising Seismic Vulnerability and Urban Development

Increasing urbanization in earthquake-prone regions is driving the demand for advanced early warning systems. Governments and city planners are investing in seismic monitoring infrastructure to protect critical assets, transportation networks, and populations. These systems provide crucial seconds of warning before seismic waves arrive, reducing casualties and infrastructure damage. Growing awareness of disaster resilience and risk mitigation has led to large-scale national implementations in countries like Japan, the U.S., and Chile, positioning earthquake early warning systems as essential components of urban safety planning.

- For instance, Japan’s Earthquake Early Warning (EEW) system, operated by the Japan Meteorological Agency (JMA) alongside other national and local government networks, utilizes an expansive network of seismometers across the country.

Government Initiatives and Funding Programs

Public sector investments and funding initiatives are major drivers of the earthquake early warning systems market. Governments across North America, Asia-Pacific, and Europe are launching national seismic alert networks to strengthen disaster preparedness. Programs like Japan’s JMA warning system and the U.S. ShakeAlert have inspired similar frameworks globally. Financial support for sensor installation, software upgrades, and communication infrastructure enhances deployment reach. These initiatives aim to ensure rapid public notifications and protect critical infrastructure such as railways, utilities, and hospitals.

- For instance, the U.S. Geological Survey expanded its ShakeAlert network through Early Warning Labs, which deployed more than 1,200 MEMS-based seismic sensors across California and Oregon. The network transmits real-time alerts through integrated cell broadcast and API-based systems, achieving signal transmission speeds under 2.5 seconds to emergency management agencies and public notification platforms.

Advancements in Sensor and Data Processing Technology

Technological advancements in seismic sensors, GPS monitoring, and cloud-based analytics are transforming earthquake early warning capabilities. Modern systems leverage high-speed data transmission, AI-based analytics, and edge computing for real-time ground motion assessment. Improved accuracy and lower latency in signal processing enable faster alerts to emergency services, industries, and citizens. Integration with IoT and mobile applications expands accessibility, allowing broader dissemination of warnings. These innovations enhance system efficiency and promote large-scale adoption across both government and private sectors.

Key Trends & Opportunities

Integration of AI and Machine Learning for Predictive Analysis

The integration of AI and machine learning is revolutionizing earthquake detection and early warning precision. AI algorithms analyze vast datasets from seismometers and GPS sensors to identify seismic patterns and minimize false alarms. Predictive models enhance the system’s ability to distinguish real events from noise, improving reliability. This trend offers opportunities for developing adaptive systems capable of self-learning from past tremors. The growing collaboration between research institutions and technology providers accelerates innovation in predictive analytics and real-time event forecasting.

- For instance, Nanometrics offers the Pegasus seismic data acquisition system, which processes waveform data. Nanometrics introduced an advanced AI-powered event detection engine that integrates with its systems, providing faster processing and enhanced accuracy for identifying seismic events in near real-time.

Expansion of Public Alert Networks and Mobile Connectivity

Global expansion of mobile and public alert networks presents significant opportunities for the earthquake early warning systems market. Countries are integrating warnings into mobile platforms, TV networks, and IoT-based devices to maximize population coverage. Partnerships with telecom operators and emergency agencies enable instant, region-specific alerts. The adoption of multilingual, automated notification systems enhances accessibility in diverse communities. This growing emphasis on public communication infrastructure supports faster response coordination and broader system deployment in high-risk regions.

- For instance, SkyAlert expanded its EEW mobile platform to serve more than 7 million users across Mexico and select areas of California, Oregon, and Washington. The system delivers localized seismic alerts through AWS cloud servers, broadcasting messages in both English and Spanish to ensure effective real-time communication during seismic emergencies.

Key Challenges

High Implementation and Maintenance Costs

The high cost of deploying and maintaining large-scale seismic networks remains a major challenge. Installation of advanced sensors, cloud platforms, and communication infrastructure requires substantial investment. Developing regions face financial limitations that hinder widespread implementation. Regular calibration, data management, and system upgrades further increase operational expenses. To address this, governments and private organizations are exploring cost-sharing models, while manufacturers are focusing on modular, low-maintenance solutions to improve affordability and expand coverage.

Limited Infrastructure and Technical Expertise in Developing Regions

In many developing countries, limited technical expertise and insufficient communication infrastructure restrict the deployment of early warning systems. Inconsistent data connectivity and lack of trained personnel reduce system reliability and response effectiveness. These regions often depend on international aid or partnerships to establish seismic monitoring networks. Strengthening local capacity through training programs, technology transfers, and regional collaboration is essential to overcome these barriers and ensure sustainable, long-term adoption of earthquake early warning systems.

Regional Analysis

North America

North America held a 37% share of the earthquake early warning systems market in 2024. The region’s leadership is driven by advanced seismic infrastructure, robust government programs, and strong public safety policies. The U.S. leads with extensive deployment through the ShakeAlert system, which covers high-risk areas along the West Coast. Canada also invests in expanding seismic monitoring networks to strengthen early disaster response. Continuous technological innovation, integration with mobile alert systems, and partnerships between research institutions and emergency management agencies support market growth across the region.

Europe

Europe accounted for a 28% share of the earthquake early warning systems market in 2024. Countries such as Italy, Greece, and Turkey are major adopters due to frequent seismic activity across the Mediterranean zone. The European Union supports coordinated research initiatives and infrastructure funding to improve real-time earthquake detection. Integration of IoT and AI technologies enhances system precision and cross-border data sharing. Growing urban safety regulations and government-backed monitoring programs are boosting implementation in public transportation networks, utilities, and industrial zones, driving regional market expansion.

Asia-Pacific

Asia-Pacific captured a 29% share of the earthquake early warning systems market in 2024. The region’s growth is driven by high seismic vulnerability in Japan, China, Indonesia, and the Philippines. Japan remains the global leader, with a fully operational nationwide warning network operated by the Japan Meteorological Agency. China continues to expand regional alert systems under its national emergency management initiatives. Rising investments in disaster resilience, rapid urbanization, and government-led early alert programs support steady adoption. Technological collaborations between universities and tech firms further enhance innovation in real-time seismic monitoring.

Middle East & Africa

The Middle East & Africa region held a 3% share of the earthquake early warning systems market in 2024. Seismic hotspots in Iran, Turkey, and parts of North Africa are driving limited but growing adoption. Governments are focusing on integrating early warning systems within disaster management frameworks to reduce damage from frequent tremors. Infrastructure development projects and regional cooperation with international research agencies are improving access to seismic data. However, limited technical expertise and funding constraints continue to slow large-scale implementation across developing economies in the region.

Latin America

Latin America accounted for a 3% share of the earthquake early warning systems market in 2024. The region’s growth is fueled by seismic risk in countries such as Mexico, Chile, and Peru. Mexico’s national alert system, SASMEX, remains one of the most established networks globally, covering millions of residents. Governments are expanding similar initiatives to protect critical infrastructure and urban populations. Increasing awareness of disaster preparedness, combined with regional collaborations and international aid programs, supports technological upgrades and broader deployment across high-risk areas in Latin America.

Market Segmentations:

By Technology

- Seismometer-based systems

- GPS-based systems

- Accelerometer-based systems

- Hybrid systems (combining multiple technologies)

By End User

- Government and public sector

- Private sector

- Educational institutions

- Residential users

By Deployment Model

- Cloud-based systems

- On-premises systems

- Edge computing systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the earthquake early warning systems market includes key players such as Kinemetrics, SeismicAI, Early Warning Labs, SeisComP3, Optimum Seismic, Seismic Warning Systems, Seismic Warning Group, Nanometrics Inc., SkyAlert, and GeoSIG Ltd. These companies compete through advancements in real-time seismic monitoring, AI-based analytics, and rapid alerting technologies. Leading firms focus on integrating multi-sensor networks with cloud and edge computing to enhance detection accuracy and reduce latency. Strategic partnerships with governments, research institutions, and telecom operators are expanding their deployment reach and improving disaster resilience infrastructure. Product differentiation through automated response systems, mobile integration, and predictive algorithms strengthens competitiveness. Meanwhile, regional players emphasize cost-effective and modular systems for local implementation. Continuous innovation, strong after-service support, and data reliability remain key factors driving competition in this evolving and safety-critical market segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, SeismicAI’s pilot system detected and issued a warning for a magnitude 6.0 event near Crete.

- In April 2025, Kinemetrics, Inc. announced delivery of its OASISPlus earthquake response platform tailored for smart-city infrastructure, supporting multiple M2M protocols and real-time alerting.

- In June 2024, Sanlien Technology Corp. launched a structural health monitoring and advanced earthquake early warning system. The system employed advanced technology to issue alerts seconds to tens of seconds before earthquakes occur. This early warning capability allows for vital evacuation time and facilitates proactive safety measures.

- In February 2024, Kinemetrics launched earthquake early warning alerts for its OasisPlus Earthquake Response Platform, powered by ShakeAlert. The system integrated real-time seismic data to provide timely alerts to users in the event of an earthquake.

Report Coverage

The research report offers an in-depth analysis based on Technology, End User, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing government investments in seismic safety programs.

- AI and machine learning will enhance real-time earthquake detection and prediction accuracy.

- Cloud and edge computing will improve data processing speed and alert distribution.

- Integration with public communication networks will ensure wider emergency coverage.

- Hybrid sensor systems will gain adoption for improved reliability and precision.

- Asia-Pacific will emerge as the fastest-growing region with strong government support.

- North America will maintain leadership with advanced seismic monitoring infrastructure.

- Private sector participation will increase through industrial safety initiatives.

- Partnerships between technology firms and research institutions will drive innovation.

- Development of low-cost, scalable systems will expand adoption in developing regions.