Market Overview:

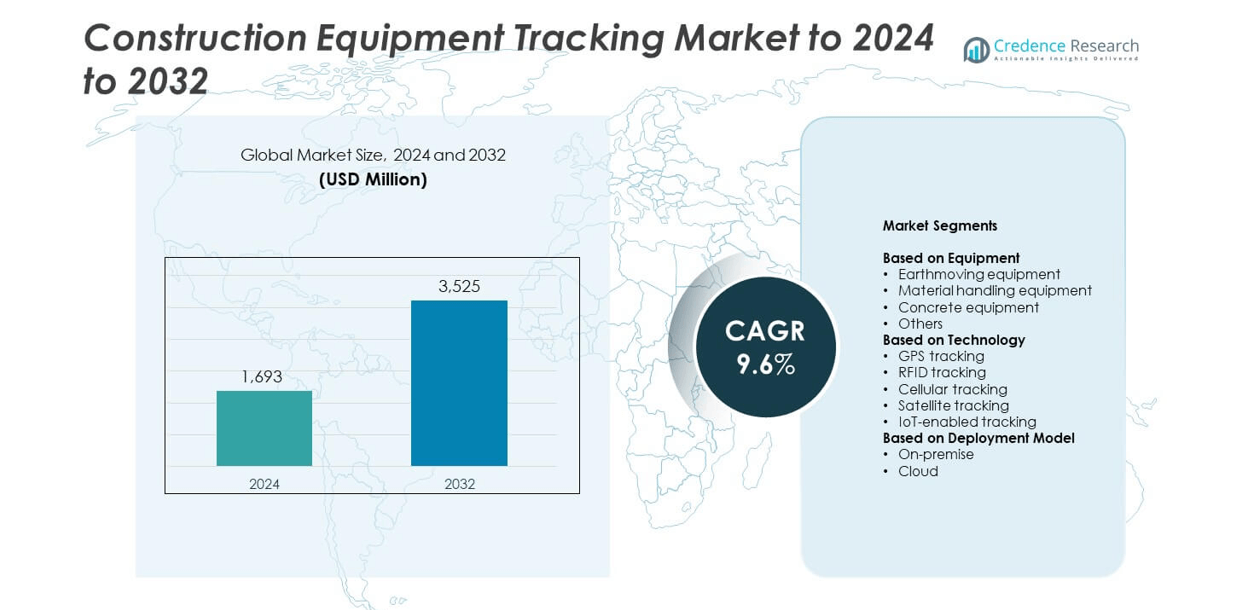

Construction Equipment Tracking Market size was valued at USD 1,693 million in 2024 and is anticipated to reach USD 3,525 million by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Tracking Market Size 2024 |

USD 1,693 million |

| Construction Equipment Tracking Market, CAGR |

9.6% |

| Construction Equipment Tracking Market Size 2032 |

USD 3,525 million |

The construction equipment tracking market is led by key players such as Trimble Inc., Komatsu Ltd., Verizon Connect, Robert Bosch GmbH, Hitachi Construction Machinery Co., Ltd., Honeywell International Inc., Hexagon, Doosan Infracore Co., Ltd., John Deere, Caterpillar Inc., and Topcon Positioning Systems, Inc. These companies focus on telematics, IoT integration, and real-time data analytics to enhance fleet visibility and operational efficiency. North America dominated the market with a 37.4% share in 2024, supported by early adoption of digital fleet management and stringent safety regulations. Europe followed with a 31.6% share, driven by infrastructure modernization and sustainability initiatives. Asia Pacific accounted for 23.8%, emerging as the fastest-growing region due to expanding construction activities and rapid digitalization.

Market Insights

- The construction equipment tracking market was valued at USD 1,693 million in 2024 and is projected to reach USD 3,525 million by 2032, growing at a CAGR of 9.6%.

- Market growth is driven by rising demand for real-time equipment monitoring, predictive maintenance, and fleet optimization in large-scale infrastructure projects.

- The adoption of IoT and cloud-based tracking systems is accelerating, improving operational efficiency and reducing downtime across construction fleets.

- The market is competitive, with major players focusing on AI-driven telematics, product innovation, and data security to expand their global presence.

- North America led the market with a 37.4% share in 2024, followed by Europe with 31.6% and Asia Pacific with 23.8%, while the earthmoving equipment segment accounted for 46.3% of total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment

The earthmoving equipment segment dominated the construction equipment tracking market with a 46.3% share in 2024. This leadership is driven by the extensive use of excavators, loaders, and bulldozers across large-scale infrastructure and mining projects. Tracking systems enhance asset utilization, reduce idle time, and support predictive maintenance for high-value machinery. Increasing demand for fleet efficiency and theft prevention has prompted contractors to integrate advanced GPS and IoT tracking solutions. The rising focus on remote monitoring and real-time diagnostics continues to strengthen adoption in earthmoving applications.

- For instance, United Rentals has the industry’s largest number of telematics-enabled equipment in its fleet, with over 375,000 units as of May 2024.

By Technology

The GPS tracking segment held the largest share of 41.8% in 2024. Its dominance stems from precise location monitoring and compatibility with diverse construction machinery. GPS-based systems provide real-time data on equipment movement, fuel consumption, and performance, improving fleet visibility and productivity. The technology’s integration with telematics and cloud-based analytics enhances operational efficiency and safety compliance. Growing deployment in large-scale projects and infrastructure modernization programs further drives the preference for GPS-enabled tracking over traditional manual methods.

- For instance, Caterpillar has more than 1.5 million connected and reporting assets linked through Product Link and VisionLink.

By Deployment Model

The cloud segment accounted for a 58.6% share in 2024, emerging as the leading deployment model in the construction equipment tracking market. Cloud-based solutions offer scalable data storage, centralized fleet management, and remote access from any device. Construction firms favor cloud systems for their lower setup costs, automatic updates, and real-time analytics capabilities. The model supports integration with IoT platforms and AI-driven maintenance alerts, helping reduce downtime. Growing digitalization in construction management and the shift toward connected job sites continue to propel the demand for cloud-based tracking platforms.

Key Growth Drivers

Rising Demand for Fleet Management Efficiency

Construction firms are increasingly investing in equipment tracking to enhance fleet utilization and minimize downtime. Advanced tracking systems provide real-time data on asset location, usage, and maintenance needs, optimizing operations and reducing fuel consumption. The growing emphasis on cost control, safety compliance, and productivity across large-scale construction projects continues to drive adoption. Integration of telematics and IoT analytics further supports predictive maintenance and improved decision-making, making fleet efficiency a primary growth accelerator for the market.

- For instance, Volvo CE’s ActiveCare in Asia surpassed 1,000 machines under 24/7 monitored service, aimed at reducing unplanned downtime.

Expansion of Infrastructure and Smart City Projects

Rapid urbanization and government investments in infrastructure development have expanded the use of heavy construction machinery. Equipment tracking solutions help manage diverse fleets across highways, airports, and smart city construction sites. The need for transparency, remote monitoring, and automated reporting strengthens the demand for tracking platforms. Global initiatives promoting digital transformation in construction are also fueling system integration, ensuring operational control and regulatory compliance across project phases.

- For instance, Sunbelt Rentals initially connected 30,000–40,000 assets and accelerated retrofits to support large project operations.

Integration of IoT and Cloud-Based Technologies

IoT and cloud-enabled tracking platforms are revolutionizing construction equipment monitoring. These technologies facilitate real-time analytics, preventive maintenance, and centralized data access. Cloud deployment allows scalability and remote management, making it ideal for contractors handling multi-site operations. IoT sensors improve accuracy in location and performance tracking while enabling automated alerts. The convergence of IoT, AI, and telematics has enhanced data-driven decision-making, boosting efficiency and driving long-term adoption across construction fleets.

Key Trends & Opportunities

Adoption of Predictive Maintenance and Data Analytics

Predictive maintenance through AI and telematics analytics is gaining traction in construction fleet management. Equipment tracking systems analyze machine health indicators, fuel consumption, and performance patterns to predict potential breakdowns. This proactive approach reduces repair costs and extends equipment life cycles. The growing availability of data-driven platforms supports enhanced project planning, resource allocation, and overall productivity, presenting a key opportunity for technology providers and contractors alike.

- For instance, an Infosys mining telematics deployment ingests about 300 MB per asset per day to enable failure prediction and shift-wise reporting.

Rising Use of Satellite and Hybrid Tracking Solutions

Hybrid tracking systems combining GPS, cellular, and satellite connectivity are emerging as vital solutions for remote construction sites. These technologies ensure uninterrupted tracking even in low-network areas, enhancing operational control and asset safety. The expanding use of advanced communication networks and miniaturized sensors is driving innovation in tracking hardware. This trend supports large-scale infrastructure and mining projects in geographically challenging regions, opening new avenues for technology adoption.

- For instance, Hitachi Construction Machinery’s Global e-Service monitors ~300,000 machines across 140 countries, supporting global remote tracking.

Growing Focus on Sustainability and Equipment Utilization

Sustainability goals are prompting construction companies to track energy consumption and idle hours through connected systems. Equipment tracking helps optimize usage, reduce emissions, and align operations with green construction standards. The growing push for carbon neutrality in infrastructure projects and smart cities increases demand for eco-efficient solutions. Companies leveraging tracking data for sustainability metrics are expected to gain a competitive advantage in upcoming infrastructure developments.

Key Challenges

High Implementation and Integration Costs

The initial investment in equipment tracking systems, including sensors, connectivity, and software integration, remains high for many contractors. Small and medium-sized enterprises often struggle to justify the cost due to limited budgets and short project durations. Additionally, integrating new systems with existing machinery and ERP platforms can require technical expertise and time. These financial and operational barriers may slow adoption rates, particularly in cost-sensitive markets.

Data Security and Connectivity Limitations

Data privacy concerns and unreliable connectivity across remote job sites pose major challenges. Tracking platforms rely on continuous data transmission, which can be disrupted in areas with weak network infrastructure. Unauthorized access to cloud-stored fleet data may also lead to security risks. Ensuring robust encryption, secure cloud frameworks, and compliance with data protection standards is critical to maintaining user trust and preventing operational disruptions.

Regional Analysis

North America

The North America region held an estimated 37.4% share of the construction equipment tracking market in 2024. Early adoption of advanced tracking technologies among contractors and large infrastructure investments in the United States drive market demand. Strong fleet management practices and strict equipment-safety regulations further support regional growth. The presence of major telematics and tracking-solution providers enhances market maturity. Ongoing upgrades in digital construction operations across the U.S. and Canada reinforce North America’s leading position in global market expansion.

Europe

Europe accounted for approximately 31.6% share of the construction equipment tracking market in 2024. Infrastructure modernization across Germany, France, and the UK, along with strict EU compliance on equipment monitoring, fuels regional demand. Increased focus on sustainability, automation, and connected job-site operations accelerates technology adoption. The dominance of established construction equipment rental fleets further strengthens implementation of tracking systems. These factors together position Europe as a strong contributor to global market growth.

Asia Pacific

The Asia Pacific region captured around 23.8% share of the construction equipment tracking market in 2024. Rapid urbanization, rising infrastructure spending, and growing awareness of asset theft prevention in China, India, and Southeast Asia drive adoption. Affordable IoT and cloud-based solutions encourage uptake among small and medium contractors. Expanding construction activities in smart cities and transportation networks further boost market growth. The region is projected to show the fastest growth toward 2032.

Latin America

Latin America accounted for an estimated 4.5% share of the construction equipment tracking market in 2024. Increasing public and private investments in road, airport, and commercial infrastructure in Brazil and Mexico promote adoption. However, limited digital infrastructure and cost sensitivity restrain rapid deployment. Growing awareness about equipment productivity and maintenance efficiency is gradually improving technology penetration. These factors are expected to support steady regional growth in the coming years.

Middle East & Africa (MEA)

The Middle East & Africa region represented about 2.7% share of the construction equipment tracking market in 2024. Large-scale projects in Saudi Arabia, the UAE, and South Africa are driving uptake of real-time monitoring systems. However, low internet coverage in remote areas and high initial costs continue to challenge adoption. As broadband networks and construction digitalization improve, the region is expected to witness gradual but stable growth, particularly in infrastructure and industrial construction sectors.

Market Segmentations:

By Equipment

- Earthmoving equipment

- Material handling equipment

- Concrete equipment

- Others

By Technology

- GPS tracking

- RFID tracking

- Cellular tracking

- Satellite tracking

- IoT-enabled tracking

By Deployment Model

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction equipment tracking market is characterized by strong competition among leading players such as Trimble Inc., Komatsu Ltd., Verizon Connect, Robert Bosch GmbH, Hitachi Construction Machinery Co., Ltd., Honeywell International Inc., Hexagon, Doosan Infracore Co., Ltd., John Deere, Caterpillar Inc., and Topcon Positioning Systems, Inc. Companies in this sector are focusing on integrating telematics, IoT, and AI-based analytics to enhance equipment visibility, efficiency, and preventive maintenance capabilities. Strategic initiatives such as technology partnerships, product upgrades, and cloud-based tracking solutions are central to strengthening market presence. Vendors are increasingly emphasizing cybersecurity, data integration, and user-friendly interfaces to improve adoption among contractors and fleet operators. The competitive environment also reflects growing investment in predictive diagnostics, cross-platform interoperability, and software-driven innovations. With rapid construction digitalization and the rise of smart infrastructure projects worldwide, companies are expanding their geographic footprint and targeting end users seeking cost-effective, real-time monitoring systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble Inc.

- Komatsu Ltd.

- Verizon Connect

- Robert Bosch GmbH

- Hitachi Construction Machinery Co., Ltd.

- Honeywell International Inc.

- Hexagon

- Doosan Infracore Co., Ltd.

- John Deere

- Caterpillar Inc.

- Topcon Positioning Systems, Inc.

Recent Developments

- In 2024, Hexagon’s Geosystems division launched new reality capture solutions, enhancing data collection for construction sites.

- In 2023, Caterpillar unveiled the new VisionLink at the CONEXPO trade show. VisionLink is a cloud-based, customer-facing platform designed as an integrated full-fleet management solution to track assets, maximize machine uptime, and optimize utilization.

- In 2023, Komatsu completed the acquisition of iVolve, a specialist in brand-agnostic fleet management systems, for small- to mid-tier miners, contractors, and quarries.

Report Coverage

The research report offers an in-depth analysis based on Equipment, Technology, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption of digital fleet management solutions.

- Integration of IoT and AI analytics will enhance predictive maintenance and performance monitoring.

- Cloud-based deployment models will dominate due to scalability and remote access advantages.

- Demand for real-time tracking will rise across large-scale construction and mining operations.

- Hybrid tracking systems using GPS, RFID, and satellite networks will gain wider acceptance.

- Governments will promote digital transformation in infrastructure and construction management.

- Equipment manufacturers will collaborate with telematics providers to offer built-in tracking systems.

- Sustainability goals will drive the use of tracking data for emission and fuel optimization.

- Emerging economies will see rapid adoption due to urbanization and infrastructure investments.

- Continuous advancements in data security and connectivity will improve user trust and market penetration.