Market overview

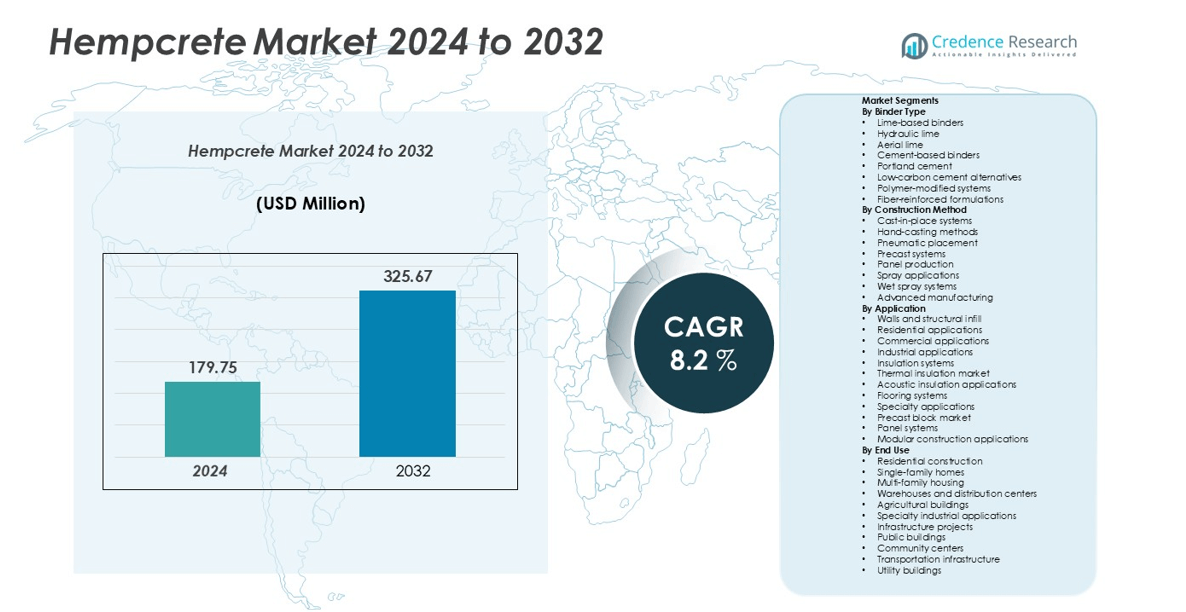

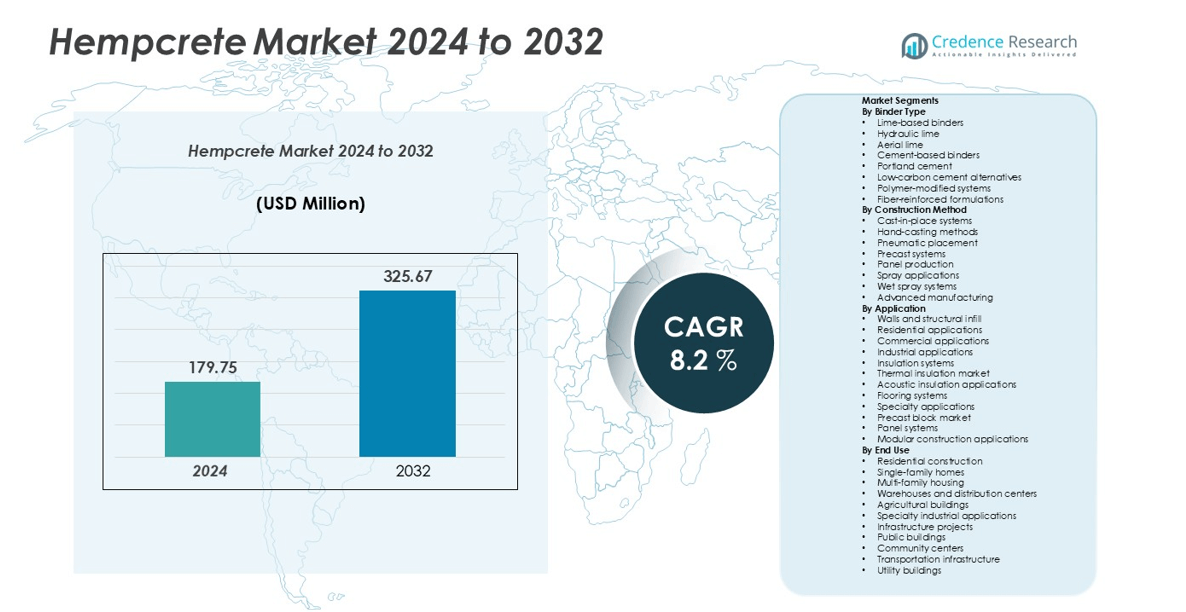

Hempcrete market size was valued at USD 179.75 million in 2024 and is anticipated to reach USD 325.67 million by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hempcrete Market Size 2024 |

USD 179.75 million |

| Hempcrete Market, CAGR |

8.2% |

| Hempcrete Market Size 2032 |

USD 325.67 million |

The global hempcrete market is led by key players such as Hempitecture Inc., IsoHemp, Cavac Biomatériaux, American Hemp LLC, and HempStone, which collectively account for over 45% of the total market share. These companies focus on sustainable material innovation, modular construction solutions, and regional production expansion to meet rising demand. Europe remains the leading region with approximately 30% market share, driven by strong environmental regulations and widespread adoption of green construction. North America follows with around 35% share, supported by favorable hemp cultivation policies and increasing demand for low-carbon housing. Emerging markets in Asia-Pacific, holding about 22%, are poised for rapid growth due to expanding industrial hemp production and sustainable infrastructure initiatives.

Market Insights

- The global hempcrete market was valued at USD 179.75 million in 2024 and is projected to reach USD 325.67 million by 2032, growing at a CAGR of 8.2% during the forecast period.

- Market growth is driven by rising demand for sustainable and low-carbon construction materials, increasing adoption of green building certifications, and supportive government policies promoting eco-friendly infrastructure.

- Key trends include the rise of prefabricated and modular hempcrete systems, technological advancements such as 3D printing and hybrid binders, and the integration of hempcrete in residential and commercial building designs.

- The market is moderately consolidated with major players like Hempitecture Inc., IsoHemp, Cavac Biomatériaux, and American Hemp LLC, focusing on innovation, scalability, and regional expansion amid high production costs and limited structural strength.

- North America holds 35% of the market, followed by Europe at 30% and Asia-Pacific at 22%, with lime-based binders and walls and structural infill applications dominating overall segmental demand

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Binder Type:

The hempcrete market by binder type is dominated by lime-based binders, accounting for the largest market share in 2024. Lime-based formulations, including hydraulic and aerial lime, are preferred due to their superior breathability, moisture regulation, and compatibility with hemp shiv. The growing demand for sustainable and low-carbon construction materials further boosts the adoption of modified lime formulations. While cement-based binders such as blended and low-carbon cements are gaining traction for enhanced strength, alternative binders like geopolymers and mycelium-based systems are emerging as eco-friendly innovations driving future market expansion.

- For instance, Hempire’s proprietary Fifth Element hempcrete binder has been utilized in over 100 projects globally, including projects in Ukraine and California, demonstrating its widespread application and effectiveness in sustainable construction.

By Construction Method:

Among construction methods, cast-in-place systems hold the dominant share, supported by their flexibility, cost-effectiveness, and suitability for on-site customization. These methods, including hand-casting and formwork systems, enable seamless integration of hempcrete into residential and commercial structures. Precast systems and spray applications are expanding rapidly, driven by rising industrial adoption and demand for faster construction processes. Advanced manufacturing techniques such as 3D printing and automated production systems are expected to revolutionize the sector by improving precision, reducing labor costs, and enhancing sustainability in large-scale hempcrete construction projects.

- For instance, The Lower Sioux Indian Community has opened a new industrial hemp facility that enables large-scale, vertically integrated hempcrete production and demonstrates manufacturing feasibility.

By Application:

The walls and structural infill segment leads the hempcrete market, capturing the largest share due to its extensive use in residential and commercial buildings. Hempcrete’s excellent insulation, breathability, and fire resistance make it ideal for wall systems that enhance indoor air quality and energy efficiency. Insulation systems, particularly thermal and acoustic applications, are also witnessing strong growth amid increasing demand for sustainable building envelopes. Emerging applications such as 3D printing and composite materials present new opportunities for innovation, supporting eco-friendly construction practices and expanding hempcrete’s role in modern architecture.

Key Growth Drivers

Rising Demand for Sustainable and Low-Carbon Construction Materials

The growing emphasis on sustainability in the construction industry is a major driver for the hempcrete market. As global efforts to reduce carbon emissions intensify, hempcrete has emerged as a preferred eco-friendly alternative to traditional concrete. Its natural composition, incorporating hemp hurds, lime, and water, results in a carbon-negative material that absorbs more CO₂ than it emits during production. Governments and developers are increasingly promoting green building certifications such as LEED and BREEAM, encouraging the use of biobased materials. Additionally, heightened awareness among consumers regarding the environmental and health impacts of conventional materials fuels adoption. The shift toward circular economy practices and renewable resources further enhances hempcrete’s market potential, particularly in regions enforcing strict carbon-reduction mandates.

- For instance, the production of one ton of hemp hurd is expected to sequester between 0.219 and 0.763 metric tons of CO₂, depending on the parameters of a given scenario.

Growing Applications in Residential and Commercial Construction

The expanding use of hempcrete in residential and commercial projects significantly contributes to market growth. Hempcrete’s excellent thermal and acoustic insulation properties, combined with its breathability and fire resistance, make it an attractive option for walls, floors, and roofing systems. The material’s lightweight structure allows easier handling, reduced load-bearing requirements, and enhanced building longevity. In the residential sector, increasing demand for energy-efficient homes and sustainable retrofitting solutions drives adoption. Commercial developers are also embracing hempcrete to meet green building standards and appeal to environmentally conscious tenants. Additionally, the trend toward biophilic design—integrating natural materials and aesthetics into urban structures—supports hempcrete’s growing use in both new construction and renovation projects across North America and Europe.

- For instance, the PA Hemp Home renovation in New Castle, Pennsylvania, utilized HempLime insulation, marking a pioneering effort in integrating hempcrete into affordable housing.

Technological Advancements and Product Innovation

Technological progress in material processing and binder formulation is accelerating hempcrete market expansion. Innovations such as modified lime blends, geopolymer binders, and hybrid composites enhance structural strength, curing speed, and overall performance. Advanced manufacturing techniques—including 3D printing, robotic spraying, and modular prefabrication—are optimizing production efficiency and scalability. These advancements not only reduce construction time but also lower labor and transportation costs, making hempcrete a more viable commercial option. Furthermore, research initiatives exploring the integration of natural fibers and nanomaterials aim to improve tensile strength and water resistance. Collaboration between startups, research institutes, and established construction firms continues to generate innovative, standardized hempcrete products that meet regulatory codes. Such developments are expected to expand market accessibility and drive global adoption over the forecast period.

Key Trends and Opportunities

Expansion of Prefabricated and Modular Hempcrete Construction

The growing popularity of prefabricated and modular construction presents a key opportunity for the hempcrete market. Precast hempcrete panels and blocks allow faster assembly, cost efficiency, and enhanced quality control compared to traditional casting methods. Manufacturers are increasingly investing in automated production systems and digital fabrication technologies to meet rising demand for ready-to-install, sustainable building components. This approach aligns with the global shift toward industrialized construction, where speed, precision, and sustainability are prioritized. Moreover, modular hempcrete systems are gaining traction in affordable housing, temporary structures, and disaster-resilient buildings due to their lightweight, durable, and carbon-neutral properties. As the construction industry embraces off-site manufacturing, prefabricated hempcrete components are expected to play a pivotal role in reducing environmental impact and construction timelines.

- For instance, Dun Agro Hemp Group, a company in the Netherlands, manufactures prefabricated hemp-lime panels up to 6 by 3 meters for use in walls, roofs, and floors. These panels undergo a natural air-drying process lasting approximately two to three months before delivery to construction sites.

Government Incentives and Supportive Regulatory Frameworks

Supportive government policies and incentives for sustainable construction create favorable conditions for hempcrete market growth. Many countries are implementing green building mandates, tax benefits, and funding programs to encourage eco-friendly materials in infrastructure projects. In Europe, the adoption of hempcrete aligns with the EU Green Deal and national climate strategies targeting net-zero emissions by 2050. Similarly, North American regions are expanding industrial hemp cultivation and standardizing building codes for hemp-based materials. These regulations provide a robust foundation for market expansion and investor confidence. Additionally, public-private partnerships are emerging to support R&D activities, supply chain development, and large-scale pilot projects using hempcrete. The regulatory momentum surrounding decarbonization and sustainable urbanization continues to create long-term opportunities for manufacturers and builders operating in this market.

- For instance, The U.S. Environmental Protection Agency (EPA) awarded a $6,186,200 grant to the Hemp Building Institute in July 2024 to promote research and development of hemp-based construction materials, including hempcrete. This funding was part of a larger federal initiative to reduce embodied greenhouse gas emissions in construction materials and supports the adoption of sustainable building practices.

Key Challenges

Limited Structural Strength and Building Code Constraints

Despite its environmental benefits, hempcrete faces limitations due to its low structural strength compared to traditional concrete. It functions effectively as an insulating and infill material but requires additional load-bearing frameworks, which can increase project complexity and cost. Moreover, building codes and construction standards for hemp-based materials remain underdeveloped in many regions, restricting large-scale adoption. The lack of standardized testing methods and certification processes hinders approval for commercial and high-rise projects. Addressing these challenges will require collaboration between industry stakeholders, regulatory authorities, and research institutions to establish clear performance benchmarks and ensure safety compliance, thereby enhancing the credibility and scalability of hempcrete in mainstream construction.

High Production Costs and Supply Chain Limitations

The hempcrete market also struggles with relatively high production costs, driven by limited industrial hemp availability, specialized processing requirements, and low economies of scale. The dependence on region-specific cultivation and the need for quality-controlled lime binders further elevate costs. Additionally, the absence of a well-established global supply chain results in inconsistent material availability and price fluctuations. Manufacturers face logistical challenges related to hemp sourcing, processing infrastructure, and transportation. Overcoming these barriers demands strategic investments in regional hemp cultivation, processing facilities, and supply chain integration. As the industry matures, improved efficiency, scale, and technological innovation are expected to gradually reduce costs and strengthen market competitiveness.

Regional Analysis

North America

North America dominates the global hempcrete market, accounting for around 35% of the total market share in 2024. The region’s growth is driven by strong regulatory support for industrial hemp cultivation, coupled with rising adoption of sustainable building practices in the U.S. and Canada. Increasing green building certifications such as LEED and growing awareness of carbon-neutral materials further boost demand. The residential construction sector leads market adoption, supported by government incentives for energy-efficient homes. Expanding R&D in hemp-based materials and advancements in modular construction technologies continue to strengthen North America’s leadership position in the hempcrete industry.

Europe

Europe holds the second-largest market share of approximately 30%, driven by stringent environmental regulations and extensive adoption of green construction materials. Countries such as France, the U.K., and Germany are pioneers in using hempcrete for residential and commercial projects. The European Union’s climate neutrality goals and carbon reduction mandates have encouraged widespread acceptance of hemp-based products. Increasing retrofitting activities in heritage buildings and government funding for low-carbon infrastructure projects also contribute to market growth. Continuous innovation in prefabricated hempcrete panels and standardized construction codes are reinforcing Europe’s position as a key hub for sustainable building materials.

Asia-Pacific

The Asia-Pacific region accounts for nearly 22% of the global hempcrete market share and is projected to witness the fastest growth during the forecast period. Rapid urbanization, rising construction activity, and growing awareness of sustainable housing are key drivers across countries like China, India, Japan, and Australia. Government initiatives promoting green infrastructure and carbon reduction strategies are boosting adoption. Expanding industrial hemp cultivation and local manufacturing capacity are improving material availability and cost efficiency. Additionally, increased investments in research and the growing popularity of eco-friendly building solutions in emerging economies are expected to propel Asia-Pacific’s market expansion.

Latin America

Latin America represents about 8% of the global hempcrete market share, supported by gradual progress in sustainable construction practices. Countries such as Brazil, Mexico, and Chile are witnessing growing interest in eco-friendly building solutions, particularly in residential and small-scale commercial projects. Rising awareness of hemp’s environmental benefits and supportive agricultural reforms promoting industrial hemp cultivation are fostering market growth. However, limited industrial infrastructure and regulatory uncertainties continue to challenge large-scale adoption. Nonetheless, ongoing investments in affordable green housing projects and regional manufacturing partnerships are expected to drive future expansion of hempcrete applications across the region.

Middle East & Africa

The Middle East & Africa region holds a market share of around 5%, with growth primarily concentrated in eco-conscious urban projects and sustainable tourism infrastructure. Increasing demand for energy-efficient and thermally stable materials in high-temperature environments supports hempcrete adoption in countries like the UAE, South Africa, and Morocco. Government initiatives promoting green building certifications and low-carbon construction practices are also encouraging market entry. However, limited awareness, high import dependency, and lack of standardized regulations restrain faster growth. Despite these challenges, the region offers strong potential for future development through sustainable city projects and renewable material investments.

Market Segmentations:

By Binder Type

- Lime-based binders

- Hydraulic lime

- Aerial lime

- Modified lime formulations

- Cement-based binders

- Portland cement

- Blended cement systems

- Low-carbon cement alternatives

- Alternative binders

- Alkali-activated binders

- Cenosphere binders

- Geopolymer binders

- Mycelium-based binders

- Hybrid formulations

- Lime-cement blends

- Polymer-modified systems

- Fiber-reinforced formulations

By Construction Method

- Cast-in-place systems

- Hand-casting methods

- Pneumatic placement

- Formwork systems

- Precast systems

- Block manufacturing

- Panel production

- Modular components

- Spray applications

- Wet spray systems

- Dry mix applications

- Robotic spray systems

- Advanced manufacturing

- 3D printing technology

- Automated production systems

- Digital fabrication methods

By Application

- Walls and structural infill

- Residential applications

- Commercial applications

- Industrial applications

- Insulation systems

- Thermal insulation market

- Acoustic insulation applications

- Retrofit insulation solutions

- Roofing and flooring

- Roofing applications

- Flooring systems

- Specialty applications

- Precast blocks and panels

- Precast block market

- Panel systems

- Modular construction applications

- Cast-in-place applications

- On-site casting

- Spray applications

- Custom formulations

- Emerging applications

- 3D printing applications

- Composite materials

- Specialty construction uses

By End Use

- Residential construction

- Single-family homes

- Multi-family housing

- Affordable housing projects

- Retrofit and renovation

- Commercial construction

- Office buildings

- Retail spaces

- Educational facilities

- Healthcare facilities

- Industrial construction

- Manufacturing facilities

- Warehouses and distribution centers

- Agricultural buildings

- Specialty industrial applications

- Infrastructure projects

- Public buildings

- Community centers

- Transportation infrastructure

- Utility buildings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hempcrete market is moderately consolidated, with several key players focusing on product innovation, regional expansion, and strategic partnerships to strengthen their market presence. Leading companies such as Hempitecture Inc., IsoHemp, Cavac Biomatériaux, American Hemp LLC, and HempStone dominate the industry by offering high-performance hempcrete blocks, panels, and insulation materials tailored for sustainable construction. Emerging firms like Sativa Building Systems, Rare Earth Global, and Hemp Technology Ltd. are investing in advanced manufacturing techniques, including modular prefabrication and automated production systems, to enhance efficiency and scalability. Collaborations with research institutions and government initiatives promoting industrial hemp cultivation further support technological development and material standardization. Additionally, organizations such as the Hemp Building Institute and rePlant Hemp Advisors play an essential role in promoting industry awareness and policy support. The competitive focus remains on improving strength, thermal performance, and carbon reduction to capture the growing demand for eco-friendly building solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hempitecture Inc.

- Cavac Biomatériaux

- HempStone

- American Hemp LLC

- Rare Earth Global

- Hemp Technology Ltd.

- IsoHemp

- Sativa Building Systems

- Hemp and Block

- Lower Sioux Indian Community

- Hemp Building Institute

- rePlant Hemp Advisors

Recent Developments

- In November 2024, a grant of USD 8.4M was awarded to Hempitecture Inc. by DOE to construct a large-scale hemp fiber processing plant in Tennessee; this establishes its leadership position in North America and gives its supply chain substantial enhancement of carbon-negative insulating material capacity and strengthens its supply chain.

- In May 2022, Carrying out a joint capital stake, Cavac Biomaterials, a subsidiary of the Vendee cooperative group Cavac, joined Vendee Profibres. This alliance constitutes all the prerequisites to create a portfolio of bio-sourced insulation products entirely Vendee-based, responsible and customized to the requirements of the construction sector

Report Coverage

The research report offers an in-depth analysis based on Binder Type, Construction Method, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hempcrete market is expected to witness steady growth driven by increasing demand for sustainable construction materials.

- Advancements in binder formulations and prefabrication methods will enhance material strength and production efficiency.

- Expanding green building regulations worldwide will encourage wider adoption of hemp-based construction solutions.

- Growing investments in modular and 3D-printed hempcrete systems will improve scalability and affordability.

- Rising awareness of carbon-neutral and energy-efficient housing will continue to boost market penetration.

- Regional expansion of industrial hemp cultivation will strengthen supply chains and reduce manufacturing costs.

- Collaboration between research institutes and industry players will accelerate innovation in hybrid and fiber-reinforced hempcrete products.

- Governments promoting net-zero emission goals will create favorable policies for biobased construction materials.

- Increasing commercial and residential retrofitting projects will generate new opportunities for hempcrete applications.

- The development of standardized building codes will support mainstream adoption in large-scale construction projects.