Market Overview

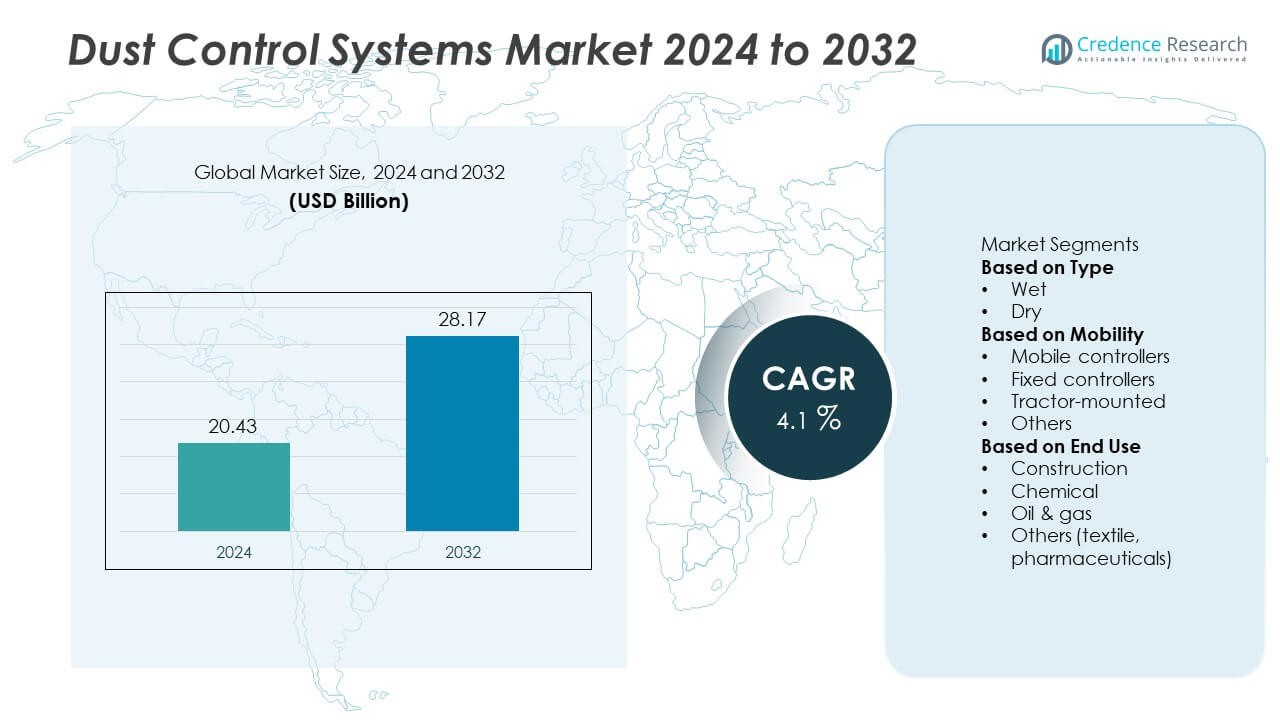

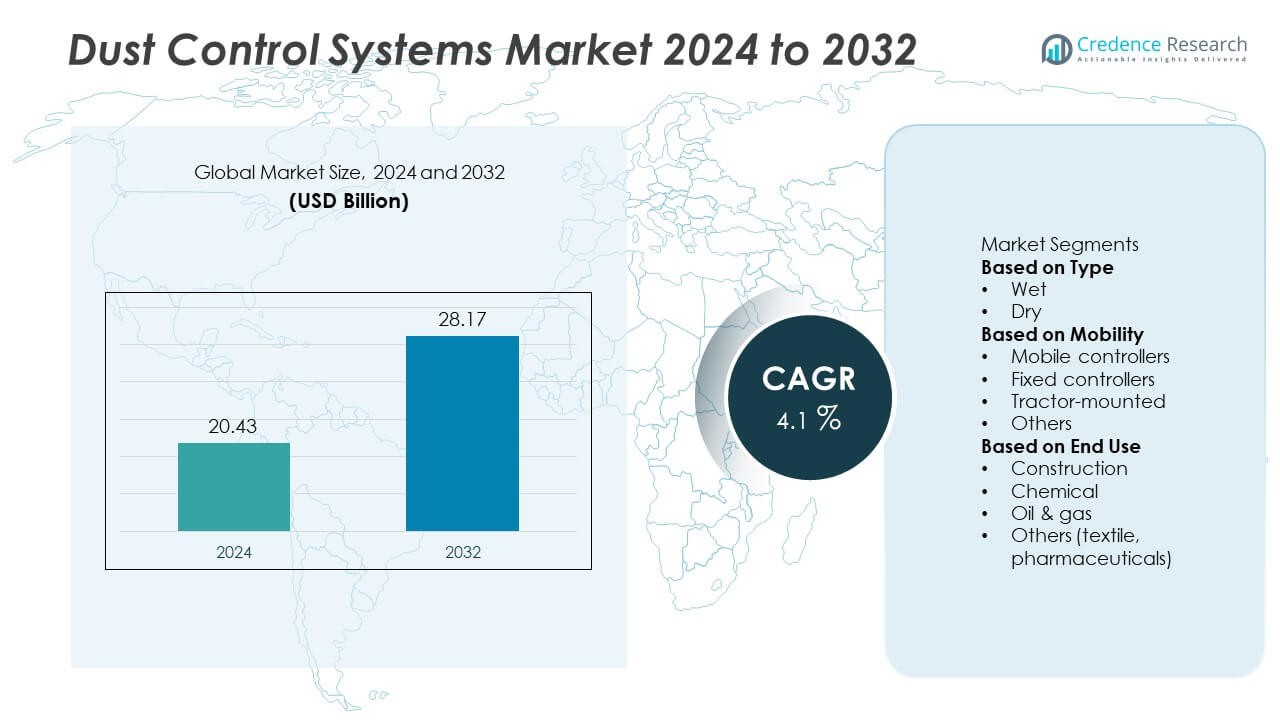

The global dust control systems market was valued at USD 20.43 billion in 2024. It is projected to reach USD 28.17 billion by 2032, registering a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dust Control Systems Market Size 2024 |

USD 20.43 Billion |

| Dust Control Systems Market, CAGR |

4.1% |

| Dust Control Systems Market Size 2032 |

USD 28.17 Billion |

The dust control systems market is led by key players including Donaldson, Nederman Holding, Dust Control Technologies, CW Machine Worx, Duztech, Spraying Devices, Illinois Tool Works, Sly Filters, Dust Control Systems, and Colliery Dust Control. These companies dominate through advanced product portfolios, global service networks, and continuous innovation in smart and water-efficient suppression technologies. Asia-Pacific emerged as the leading region, holding a 34% market share in 2024, driven by large-scale construction, mining, and industrial activities. North America followed with a 31% share, supported by stringent air quality regulations and strong technology adoption. Continuous investments in automation, sustainability, and compliance-focused solutions strengthen market competitiveness globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global dust control systems market was valued at USD 20.43 billion in 2024 and is projected to reach USD 28.17 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

- Market growth is driven by strict air quality regulations, increasing construction and mining projects, and the need for safer workplaces.

- Key trends include the adoption of IoT-enabled smart monitoring systems, water-efficient suppression technologies, and sustainable dust control solutions.

- The competitive landscape is led by Donaldson, Nederman Holding, Dust Control Technologies, CW Machine Worx, and Duztech, focusing on automation and eco-friendly innovation.

- Regionally, Asia-Pacific held 34%, North America 31%, and Europe 27% market shares in 2024, while the wet systems segment dominated with 62% share due to its high dust capture efficiency across industries.

Market Segmentation Analysis:

By Type

The wet dust control systems segment dominated the market with a 62% share in 2024. This dominance is attributed to its higher efficiency in capturing fine particulate matter across mining, construction, and cement operations. Wet systems, such as misting and spray-based solutions, are preferred for handling large dust volumes and maintaining air quality compliance. The growing enforcement of emission control standards and demand for effective airborne dust suppression in bulk material handling facilities continue to drive adoption of wet systems over dry variants.

- For instance, BossTek developed the DustBoss DB-100 system, which has a 60 HP fan motor and a throw distance of 100 meters. It has 30 brass nozzles and uses between 67 and 147.6 liters of water per minute.

By Mobility

The mobile controllers segment held the largest share of 46% in 2024, driven by their flexibility and ease of deployment across construction sites, quarries, and mining operations. These units offer efficient dust suppression for temporary or remote locations where fixed installations are impractical. Growing use of self-propelled and trailer-mounted systems enhances on-site operational efficiency. Manufacturers are integrating IoT-enabled monitoring and automated control systems to improve spray precision and water usage optimization, supporting the segment’s strong growth outlook in high-dust industrial environments.

- For instance, Duztech AB introduced the D60 Mobile Dust Suppression Unit featuring an 18.5-kilowatt fan motor, a 50- to 60-meter throw capacity, and automatic 360-degree rotation. The system delivers a water flow rate of up to 60 liters per minute and includes a remote control option for easy operation.

By End Use

The construction sector accounted for a 38% share in 2024, emerging as the leading end-use segment. Rising urban infrastructure projects, road expansion, and cement plant activities are key contributors to demand. Dust suppression systems are widely deployed to comply with worker safety and environmental regulations at construction sites. Increased government investment in smart city and transport infrastructure projects, coupled with stricter air quality norms, continues to boost system installations. The need to reduce particulate emissions during demolition and material handling further supports segment dominance.

Key Growth Drivers

Stringent Environmental Regulations

Rising enforcement of air quality and emission control regulations is a key growth driver for the dust control systems market. Governments across North America, Europe, and Asia-Pacific are mandating dust suppression in mining, construction, and manufacturing sectors to limit particulate emissions. Compliance with standards such as OSHA and EU Industrial Emissions Directive has accelerated adoption. Industries are investing in high-efficiency filtration and suppression technologies to avoid penalties, strengthen environmental performance, and ensure worker safety.

- For instance, Donaldson Company introduced the iCue™ Connected Filtration Service, which monitors differential pressure, airflow, and particulate levels in real time across industrial dust collectors. The platform transmits over 10,000 sensor readings per hour to cloud-based dashboards, allowing maintenance teams to prevent emission breaches under OSHA and EU IED standards.

Expanding Mining and Construction Activities

Rapid infrastructure growth and increasing mineral extraction projects are boosting the demand for dust control systems. Expanding mining operations in countries such as China, Australia, and India generate significant airborne dust, driving installation of wet and dry suppression units. The construction industry also relies on these systems for road building, cement mixing, and demolition. Rising urbanization and government-funded projects are further supporting deployment of mobile and fixed dust suppression solutions to maintain compliance and operational efficiency.

- For instance, Dust Control Technologies engineered the DB-60 Fusion system with a 25-HP fan and integrated 45 kVA generator, producing a 60-meter atomized mist throw.

Increasing Focus on Worker Health and Safety

Growing awareness of occupational health hazards linked to airborne particulates is strengthening market demand. Dust inhalation is a leading cause of respiratory diseases such as silicosis, prompting stricter workplace safety protocols. Industries are prioritizing air quality management through advanced suppression and filtration systems. Continuous monitoring, coupled with automation in spray control, enhances protection for workers in mines, quarries, and production plants, aligning with global health and safety initiatives.

Key Trends & Opportunities

Adoption of IoT and Smart Monitoring Systems

Integration of IoT-enabled sensors and automated controls is transforming the performance of dust control systems. Smart controllers allow real-time data tracking on air quality, water consumption, and equipment performance. Manufacturers are introducing remote diagnostics and predictive maintenance features that reduce downtime and improve operational efficiency. This shift toward connected and data-driven dust suppression creates opportunities for system upgrades and service-based business models in industrial facilities.

- For instance, Nederman Holding launched the Insight Analytics platform that collects performance data from connected filtration systems. Through its cloud-based platform, Insight detects anomalies in fan speed, pressure drops, and filter load to enable predictive maintenance.

Shift Toward Sustainable and Water-Efficient Solutions

Rising environmental awareness is driving demand for water-efficient and eco-friendly dust suppression technologies. Companies are developing systems that recycle and reuse water, minimizing waste and operating costs. The introduction of biodegradable chemical suppressants also supports sustainability goals. Industries adopting closed-loop systems and automated spray controls benefit from reduced environmental footprints and improved compliance with green manufacturing standards, creating long-term growth potential.

- For instance, Spraying Systems Co. introduced the AutoJet® Dust Control System, which uses PulsaJet® nozzles and Precision Spray Control (PSC) to adjust flow rates automatically based on line speed.

Key Challenges

High Installation and Maintenance Costs

The significant capital investment required for advanced dust control systems remains a key restraint. Wet and dry suppression technologies, especially those with automated and IoT-enabled components, involve high setup and maintenance expenses. Small and medium enterprises often delay adoption due to budget constraints. Frequent nozzle replacements, water management issues, and regular cleaning further add to operational costs, affecting affordability in cost-sensitive regions.

Limited Awareness in Developing Regions

Lack of awareness about occupational hazards and air quality regulations in emerging economies hinders market expansion. Many small-scale construction and mining operations continue to rely on basic dust suppression methods or manual practices. Weak regulatory enforcement and limited access to technical expertise slow adoption of advanced systems. Efforts to improve training, policy enforcement, and public health awareness are essential to overcome this challenge and expand market penetration.

Regional Analysis

North America

North America held a 31% share in 2024, supported by strict regulatory frameworks and advanced industrial practices. The U.S. leads the market due to OSHA and EPA mandates for workplace air quality and emission control. Strong adoption across construction, mining, and manufacturing sectors drives steady growth. Technological innovations, such as IoT-enabled and automated dust suppression systems, are widely integrated to enhance compliance and efficiency. High infrastructure investment and demand for sustainable industrial operations further strengthen market performance across the region.

Europe

Europe accounted for a 27% share in 2024, driven by the EU Industrial Emissions Directive and emphasis on environmental sustainability. Germany, the U.K., and France are major contributors owing to strong manufacturing bases and strict workplace safety norms. Companies are adopting advanced wet suppression and filtration systems to comply with particulate emission limits. Growing focus on eco-friendly dust control technologies, including water-efficient and chemical-free systems, aligns with the region’s decarbonization goals. Infrastructure renovation and industrial modernization continue to sustain market expansion.

Asia-Pacific

Asia-Pacific dominated the global market with a 34% share in 2024, supported by rapid industrialization and expanding mining and construction activities. China, India, and Australia are key markets due to extensive mining operations and infrastructure growth. Government initiatives promoting air quality improvement and worker safety drive large-scale installations. Local manufacturers are introducing cost-effective mobile and fixed dust control systems to meet growing demand. Rising adoption of automation and water-saving technologies across industries further enhances regional market development.

Middle East & Africa

The Middle East & Africa captured a 5% share in 2024, led by increased industrial and oil & gas activities. The Gulf Cooperation Council countries are investing in large-scale infrastructure and mining projects that require efficient dust suppression. Rising awareness of environmental and occupational safety standards supports adoption of mobile and fixed systems. Countries such as Saudi Arabia and the UAE are integrating smart monitoring technologies in industrial zones. Ongoing construction under initiatives like Vision 2030 strengthens future market prospects.

Latin America

Latin America represented a 3% share in 2024, with steady growth across Brazil, Mexico, and Chile. Expanding mining and cement production activities are major demand drivers. Governments are reinforcing air quality regulations and promoting the adoption of environmentally safe dust suppression solutions. Local industries are increasingly using wet dust control systems for cost efficiency and regulatory compliance. Rising investments in construction and energy infrastructure projects are expected to create new opportunities for mobile and tractor-mounted systems in the coming years.

Market Segmentations:

By Type

By Mobility

- Mobile controllers

- Fixed controllers

- Tractor-mounted

- Others

By End Use

- Construction

- Chemical

- Oil & gas

- Others (textile, pharmaceuticals)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dust control systems market features key players such as Donaldson, Dust Control Technologies, CW Machine Worx, Nederman Holding, Duztech, Spraying Devices, Illinois Tool Works, Sly Filters, Dust Control Systems, and Colliery Dust Control. These companies focus on expanding product portfolios, improving system efficiency, and integrating smart technologies to strengthen market presence. Leading manufacturers invest in R&D to develop water-efficient, automated, and eco-friendly suppression systems that meet global environmental standards. Strategic partnerships and acquisitions are common to enhance distribution networks and service capabilities. Firms are also emphasizing digital monitoring, remote operation, and predictive maintenance to increase operational uptime and reduce costs. As industrial emission standards tighten, competition intensifies around innovation and compliance-driven solutions. North America and Europe remain technology hubs, while Asia-Pacific offers high growth potential due to expanding mining and construction sectors, prompting global players to establish localized manufacturing and service facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Donaldson

- Dust Control Technologies

- CW Machine Worx

- Nederman Holding

- Duztech

- Spraying Devices

- Illinois Tool Works

- Sly Filters

- Dust Control Systems

- Colliery Dust Control

Recent Developments

- In August 2024, Sly LLC highlighted its legacy in industrial filtration innovation, noting its pulse-jet baghouse dust collectors operate in environments up to 500 °F and employ a “no tools required” design for bag changes—underscoring its ongoing product development in dust collector technology.

- In 2024, Donaldson Company, Inc. launched the Downflo® Evolution Pre-assembled Small (DFPRE) dust collector, which integrates iCue™ Connected Filtration Technology for real-time performance analytics and aims to reduce filter replacements and unplanned downtime.

- In 2024, Nederman Holding AB reported that its Monitoring & Control Technology division achieved a sales record for a single quarter, while its Extraction & Filtration Technology unit secured large orders and its Duct & Filter Technology unit strengthened its U.S. production and logistics competitiveness.

- In 2024, Dust Control Technologies, Inc. emphasized its focus on fugitive dust and bulk material handling solutions for mining and material-processing industries, reinforcing its service footprint across USA, Canada, Mexico, Peru, Chile, Turkey, South Africa and Europe.

Report Coverage

The research report offers an in-depth analysis based on Type, Mobility, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing enforcement of industrial emission and air quality standards.

- Adoption of automated and IoT-integrated dust suppression systems will continue to rise.

- Demand from mining and construction sectors will remain a major growth contributor.

- Manufacturers will invest more in developing water-efficient and eco-friendly suppression technologies.

- Integration of AI-based monitoring will enhance system performance and maintenance efficiency.

- Regional players in Asia-Pacific will strengthen their presence through cost-effective solutions.

- Stricter worker safety regulations will drive installations across industrial facilities.

- Collaboration between technology providers and equipment manufacturers will accelerate innovation.

- Mobile and tractor-mounted systems will gain wider adoption in temporary and remote operations.

- Sustainability-focused industries will prioritize dust control systems to meet environmental compliance goals.