Market Overview:

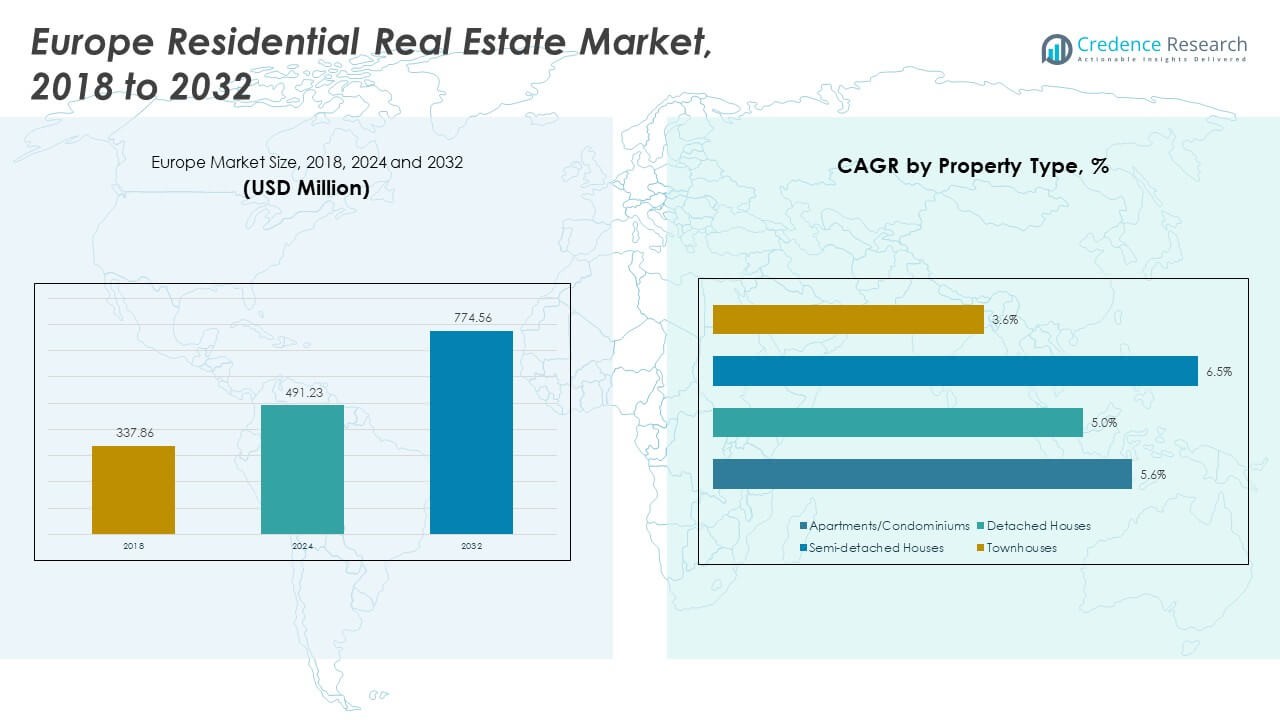

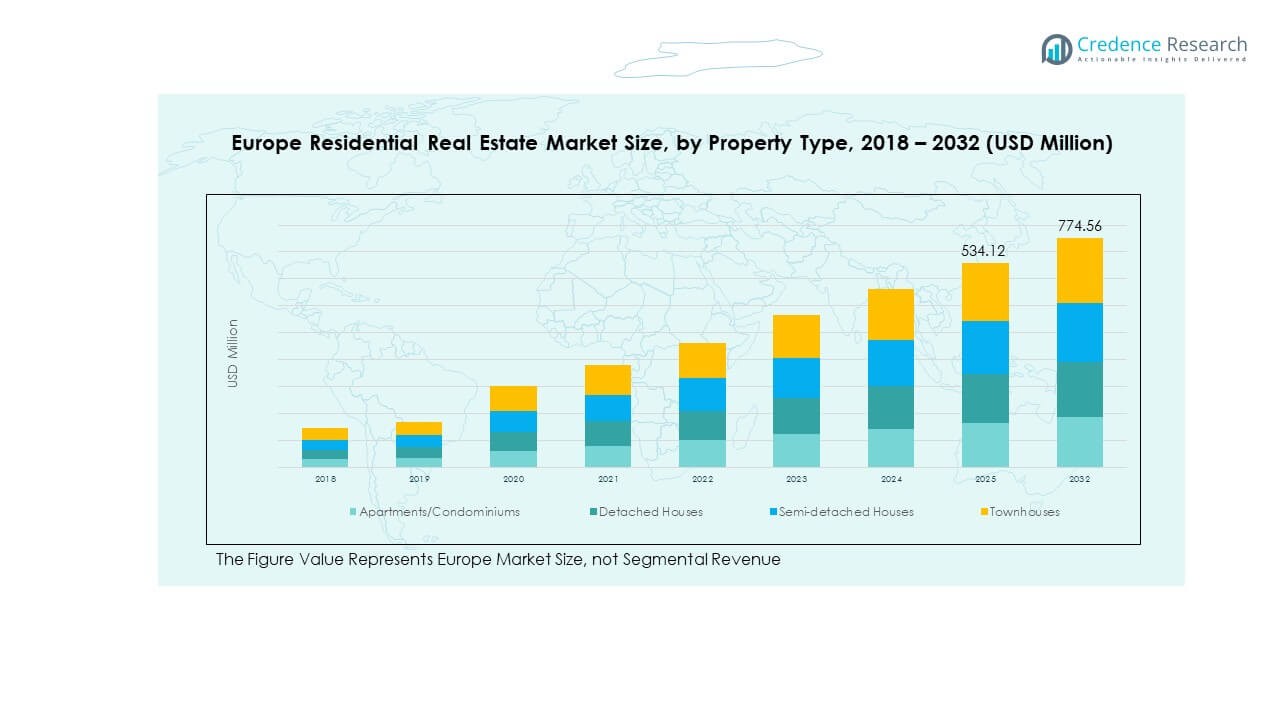

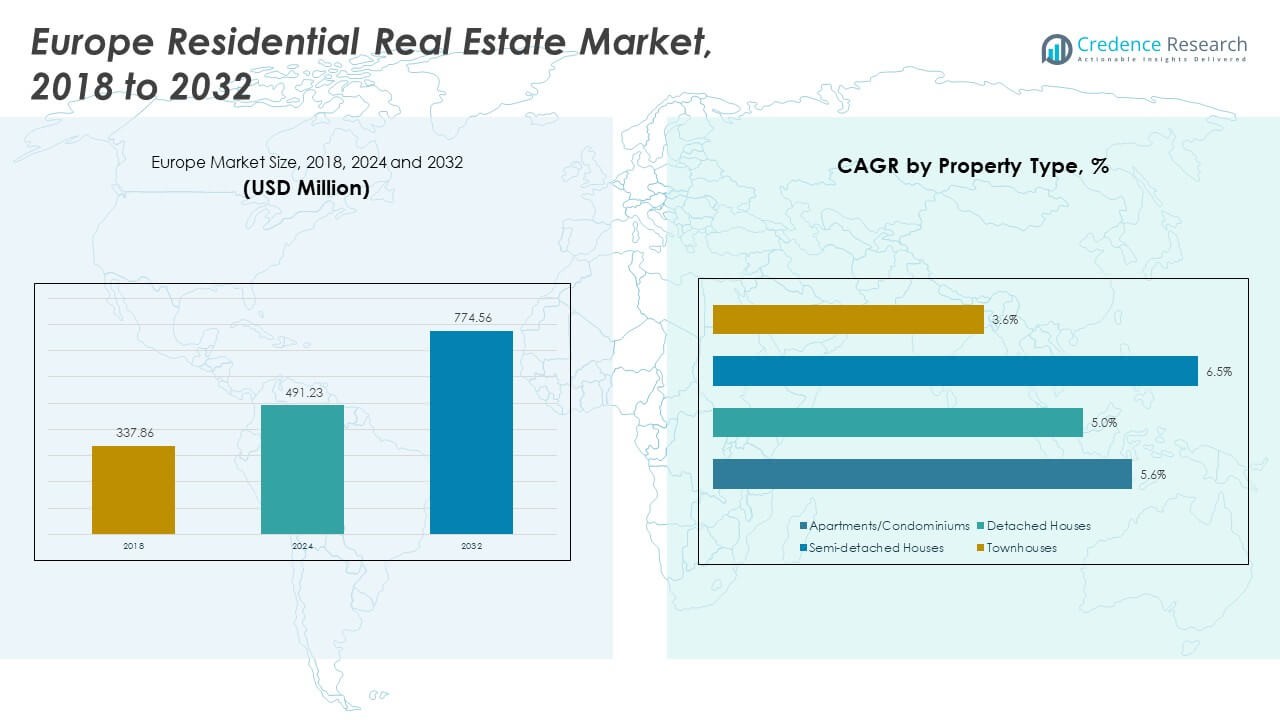

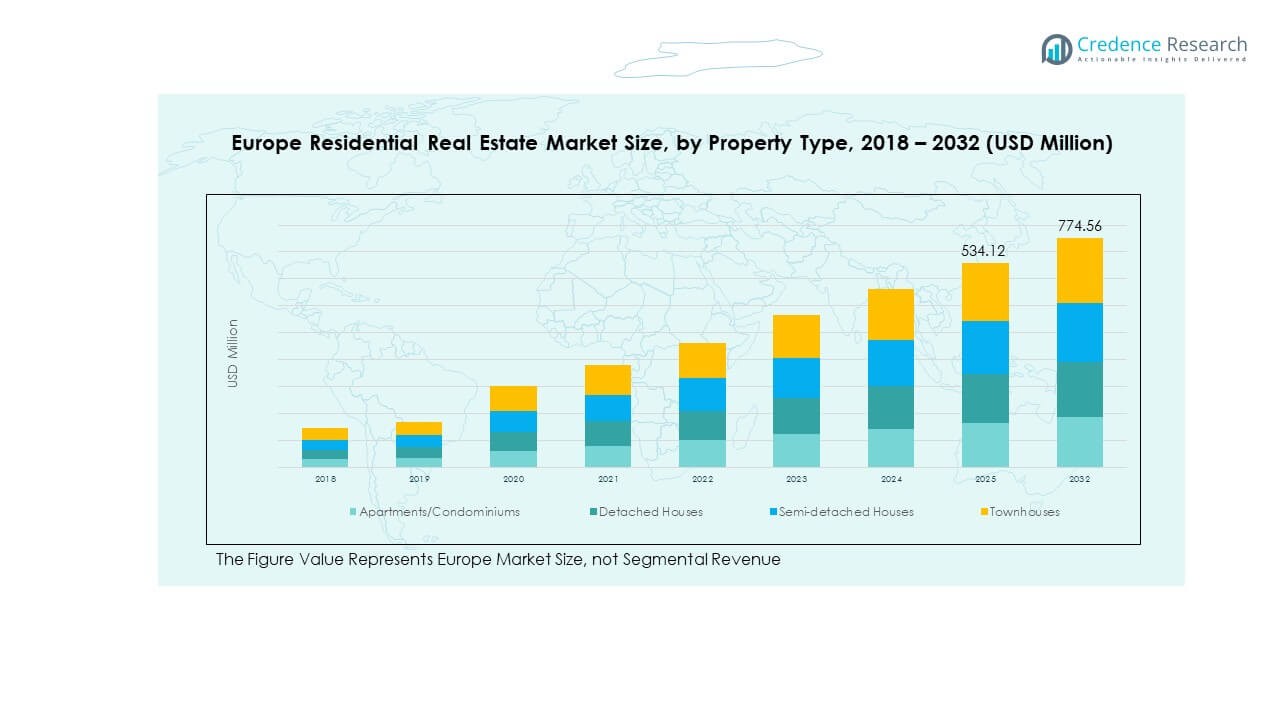

The Europe Residential Real Estate Market size was valued at USD 337.86 million in 2018 to USD 491.23 million in 2024 and is anticipated to reach USD 774.56 million by 2032, at a CAGR of 5.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Residential Real Estate Market Size 2024 |

USD 491.23 Million |

| Europe Residential Real Estate Market, CAGR |

5.45% |

| Europe Residential Real Estate Market Size 2032 |

USD 774.56 Million |

The market growth is driven by rapid urbanization, rising disposable income, and strong demand for modern housing infrastructure. Increasing investments in smart homes, sustainable housing, and energy-efficient construction practices are supporting expansion. Government initiatives promoting affordable housing and mortgage flexibility have also accelerated property sales across major European cities. Rising consumer preference for digital property platforms and improved lending conditions further stimulate market growth.

Western Europe leads the regional market, supported by well-established infrastructure and high real estate demand in countries such as Germany, the United Kingdom, and France. Southern Europe is showing steady recovery driven by tourism-related housing investments in Spain, Portugal, and Italy. Eastern Europe is emerging as a promising region due to rising foreign investments, infrastructure modernization, and growing residential construction activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Residential Real Estate Market was valued at USD 337.86 million in 2018, increased to USD 491.23 million in 2024, and is projected to reach USD 774.56 million by 2032, expanding at a CAGR of 5.45% during the forecast period.

- Western Europe holds about 45% share, driven by high-income economies and advanced infrastructure in nations such as Germany, France, and the United Kingdom. Southern Europe follows with 25%, fueled by tourism-based investments and lifestyle migration, while Eastern and Northern Europe collectively account for 30%, reflecting rapid modernization and affordability.

- Eastern Europe represents the fastest-growing region with nearly 15% share, supported by urbanization, rising middle-class population, and expanding cross-border real estate investments.

- Apartments and condominiums dominate the property segment, accounting for around 40% of total market share, owing to affordability and higher demand in urban regions.

- Detached and semi-detached houses together contribute about 45% share, while townhouses are gaining momentum with increasing interest in compact, modern residential layouts.

Market Drivers:

Rising Urbanization and Increasing Demand for Modern Housing Infrastructure

The Europe Residential Real Estate Market is expanding due to rapid urbanization and migration to cities. Growing urban populations are pushing demand for apartments, condominiums, and sustainable housing solutions. Developers are focusing on energy-efficient designs and modern amenities to attract middle-income and premium buyers. The shift toward vertical living and smart building technologies is transforming the housing landscape. Governments across the region are supporting development through favorable urban planning policies. Affordable housing programs and flexible mortgage schemes are also driving ownership rates. The market continues to benefit from population growth in major metropolitan regions.

- For instance, Vonovia SE currently owns around 540,000 residential units across Germany, Sweden and Austria, reinforcing its presence in urban regions. Growing urban populations are pushing demand for apartments, condominiums and sustainable housing solutions. Developers are focusing on energy-efficient designs and modern amenities to attract middle-income and premium buyers.

Growing Investments in Smart and Sustainable Residential Developments

Investments in green and smart housing projects are rising across Europe. Consumers are seeking homes that integrate digital features, energy management systems, and sustainable materials. Developers are responding with eco-friendly housing and low-carbon construction models. The emphasis on net-zero homes is shaping new design and building strategies. It is supported by strict energy regulations that encourage renewable integration. Buyers prefer smart homes that ensure comfort, safety, and long-term value. This focus on sustainable living is increasing construction quality standards. Investors and policymakers are prioritizing green certification as a key value driver.

- For example, CBRE Group, Inc.’s European business has access to over €5 billion of sustainability-linked financing and has executed over 100 MW of rooftop solar initiatives under Project Helios. Consumers are seeking homes that integrate digital features, energy-management systems and sustainable materials.

Government Initiatives and Policy Reforms Supporting Homeownership Growth

Governments across Europe are strengthening their focus on affordable housing supply. Reforms in land use policies and tax incentives are enabling faster project approvals. Public-private partnerships are accelerating residential development in urban and suburban regions. It benefits from supportive lending conditions and reduced interest rates. National housing schemes are promoting financial inclusion for first-time homebuyers. Regulatory efforts toward rent control and transparent real estate practices are improving investor confidence. Such reforms are fostering a balanced housing ecosystem across diverse income groups. The public sector’s active participation ensures long-term market stability and accessibility.

Rising Disposable Income and Expansion of Real Estate Financing Options

Higher household incomes and strong economic growth are fueling property purchases. Increasing employment and improved consumer credit access are driving mortgage demand. Financial institutions are offering diverse loan products and flexible repayment models. It encourages investment in primary and secondary housing markets. The low-interest-rate environment is making homeownership more attractive. Cross-border investors and developers are capitalizing on these favorable financial trends. Expansion of real estate crowdfunding and digital financing platforms is increasing accessibility. Such developments are fostering long-term stability and widening the customer base.

Market Trends:

Shift Toward Smart Home Integration and Digital Real Estate Platforms

Digitalization is transforming the residential real estate experience across Europe. Homebuyers increasingly prefer properties with integrated smart technologies. Real estate platforms are enhancing property search, financing, and transaction processes. It is driving transparency and faster decision-making. Developers are collaborating with tech firms to embed AI, IoT, and automation in homes. Smart metering, energy management, and security systems are becoming standard offerings. The demand for digital home management tools reflects Europe’s tech-driven lifestyle. This trend is strengthening the competitive edge of technologically advanced projects.

- For instance, real-estate platforms and firms are integrating AI, IoT and automation to streamline home-buying and property-management processes. Homebuyers increasingly prefer properties with integrated smart technologies. Real-estate platforms are enhancing property search, financing and transaction processes, which drives transparency and faster decision-making.

Growing Popularity of Sustainable and Eco-Friendly Housing Projects

Environmental awareness is influencing purchase decisions across the housing sector. Developers are adopting green materials and energy-efficient designs. The Europe Residential Real Estate Market is witnessing growth in eco-certified residential projects. Buyers prefer homes that minimize environmental impact and reduce energy costs. Governments are enforcing carbon neutrality targets and sustainability certifications. It is encouraging construction companies to shift toward green technologies. The use of recycled materials and renewable energy integration is gaining traction. This sustainable shift is redefining building standards and customer expectations.

- For instance, CBRE’s research found that buildings with sustainability certification in Europe earn a rental premium of compared with non-certified peers. Developers are adopting green materials and energy-efficient designs to meet this demand. The Europe Residential Real Estate Market is witnessing growth in eco-certified residential projects.

Expansion of Co-Living and Rental Housing Models Among Urban Professionals

The demand for flexible living spaces is rising among young professionals. Co-living and rental models are gaining traction in urban centers. Shared housing solutions cater to affordability and convenience in major European cities. It reflects shifting lifestyles and rising mobility among the working population. Developers are investing in furnished apartments and short-term rental formats. The trend is reshaping traditional ownership concepts into experience-driven housing. Investors are diversifying portfolios to include rental-based real estate assets. The growth of remote work is supporting flexible living solutions across cities.

Emergence of Mixed-Use Residential Developments with Integrated Amenities

Mixed-use projects combining housing, retail, and leisure spaces are gaining popularity. These developments promote community living and sustainable urban planning. The integration of healthcare, education, and green areas enhances livability. It supports balanced urban growth and lifestyle-driven communities. Investors are favoring projects offering multi-purpose utility and high tenant retention. Developers are creating compact neighborhoods with seamless access to services. The trend aligns with the increasing preference for self-contained communities. Mixed-use concepts are shaping the future of residential planning across Europe.

Market Challenges Analysis:

Rising Construction Costs and Supply Chain Disruptions Impacting Project Timelines

The Europe Residential Real Estate Market faces pressure from escalating construction costs. Shortages in raw materials, labor, and logistics inefficiencies are delaying project completions. Developers are experiencing margin compression due to inflation and regulatory costs. It challenges affordability and limits new housing supply in several countries. The dependency on imported construction materials is exposing the sector to currency risks. Prolonged permitting processes and stricter building codes are adding further delays. Developers are adopting modular construction and digital design tools to reduce inefficiencies. However, cost volatility remains a critical restraint for sustained expansion.

Regulatory Complexity and Market Saturation in Major Urban Centers

Real estate regulations vary widely across European nations, creating procedural barriers for developers. The approval process for zoning, land acquisition, and environmental clearance remains complex. High saturation in mature markets such as London, Paris, and Berlin limits growth opportunities. It restricts the ability of new entrants to compete effectively. Strict rent controls are reducing investor interest in certain cities. Regional disparities in tax policies and construction permits are adding compliance costs. Developers are shifting focus toward emerging suburban and Eastern European markets. The need for regulatory harmonization remains essential for balanced sector growth.

Market Opportunities:

Emerging Growth Potential in Eastern Europe and Secondary Cities

The Europe Residential Real Estate Market is witnessing expansion in Eastern Europe and secondary urban zones. Countries such as Poland, Hungary, and Romania offer affordable land and rising demand for modern housing. Investors are exploring suburban regions for large-scale development projects. Improved infrastructure and growing middle-class populations are supporting these markets. Governments are offering tax incentives to attract foreign real estate investments. It is opening new revenue channels for regional developers. Growing urban migration continues to boost residential construction activity in emerging cities.

Expansion of Digital Platforms and Sustainable Building Innovations

The adoption of digital tools in real estate transactions presents new business opportunities. Virtual property tours, blockchain-based contracts, and AI valuation models are improving efficiency. Developers are leveraging data analytics to predict buyer preferences and design accordingly. It supports the shift toward technology-led customer engagement. Sustainable innovations such as 3D printing, modular housing, and renewable energy integration are gaining attention. These solutions enhance affordability and long-term property value. The alignment of technology and sustainability is defining future opportunities across the sector.

Market Segmentation Analysis:

By Property Type

The Europe Residential Real Estate Market is segmented into apartments/condominiums, detached houses, semi-detached houses, and townhouses. Apartments and condominiums hold a dominant share due to increasing urban population and limited land availability in major cities. High-rise developments are preferred in metropolitan areas for their affordability and convenience. Detached houses continue to attract affluent buyers seeking privacy and larger living spaces, especially in suburban and rural zones. Semi-detached houses remain popular in middle-income communities, offering a balance of space and cost efficiency. Townhouses are gaining traction in compact urban settings due to their modern designs and shared infrastructure benefits. The trend toward sustainable and energy-efficient construction is influencing all property types, driving innovation and investment.

By End-User

The market caters to owner-occupied, rental/investment properties, and co-living or shared spaces. Owner-occupied housing leads due to strong cultural preference for homeownership and favorable mortgage terms. Rental and investment properties are expanding with rising investor participation and demand from mobile professionals. Institutional investors are targeting rental assets for stable returns and long-term value. Co-living and shared spaces are emerging as a fast-growing category, supported by urban workforce mobility and flexible lifestyle choices. It reflects evolving consumer priorities toward affordability, convenience, and community-driven living models. The segment diversification is reinforcing the resilience and adaptability of Europe’s residential property landscape.

Segmentation:

By Property Type

- Apartments/Condominiums

- Detached Houses

- Semi-detached Houses

- Townhouses

By End-User

- Owner-Occupied

- Rental/Investment Properties

- Co-living and Shared Spaces

By Region

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominating the Market with Strong Urban Demand

Western Europe holds the largest share of the Europe Residential Real Estate Market, accounting for nearly 45% of total revenue. The region benefits from robust economic stability, high disposable incomes, and mature real estate ecosystems. Countries such as Germany, France, and the United Kingdom are key contributors, supported by strong housing demand in major cities like Berlin, Paris, and London. Government-backed mortgage incentives and low interest rates continue to stimulate housing transactions. It is also witnessing a surge in sustainable housing projects and digital property platforms. Rising investment from institutional buyers and global funds strengthens regional growth. The emphasis on modern urban living and smart housing infrastructure drives market maturity in this region.

Southern Europe Experiencing Growth Through Tourism and Investment

Southern Europe captures around 25% of the market share, supported by rising tourism-driven property investments and lifestyle migration. Spain, Italy, Portugal, and Greece are seeing renewed interest from foreign buyers seeking vacation and retirement homes. Developers are capitalizing on affordable land availability and favorable tax regimes to attract overseas investors. The expansion of short-term rentals and second-home ownership is fueling market momentum. It benefits from infrastructure development and digital real estate services improving buyer access. Local governments are promoting urban regeneration and energy-efficient renovation programs. Southern Europe’s property sector is evolving into a hub for long-term residential investments with strong cross-border appeal.

Eastern and Northern Europe Emerging as High-Growth Frontiers

Eastern and Northern Europe collectively account for nearly 30% of the regional share, marking the fastest-growing zones in the continent. Poland, the Czech Republic, and Hungary are leading growth through rapid urbanization and foreign direct investment. The Baltic states and Nordic countries are adopting smart housing technologies and sustainable construction practices. It is supported by expanding middle-class populations and rising housing affordability. Cross-border developers are targeting these markets for their lower entry costs and strong rental yields. Government initiatives focusing on green housing and urban development are enhancing investor confidence. The region’s modernization and digital transformation are establishing it as a major growth engine in the European real estate landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Vonovia SE

- Segro

- CBRE Group, Inc.

- Jones Lang LaSalle

- Savills

- Knight Frank

- BNP Paribas Real Estate

- Cushman & Wakefield

- Engel & Völkers

- Sotheby’s International Realty

Competitive Analysis:

The Europe Residential Real Estate Market is moderately fragmented, featuring a mix of international developers, real estate investment firms, and regional property management companies. Key players such as Vonovia SE, CBRE Group Inc., Savills, Knight Frank, and BNP Paribas Real Estate hold significant influence through their extensive portfolios and digital transformation strategies. It is marked by growing competition in smart housing and sustainable project development. Companies are emphasizing technology adoption, strategic mergers, and asset diversification to maintain market leadership. The shift toward energy-efficient housing and co-living spaces is intensifying rivalry among developers targeting urban markets.

Recent Developments:

- Vonovia SE, on 2025 dates, the firm has pursued acquisitions and strategic growth moves in Europe’s residential real estate space, including announcements highlighting strengthening rental operations and expansion of its portfolio through targeted investments and partnerships designed to improve scale and efficiency in the German and broader European markets.

- SEGRO, Europe’s leading owner-operator of urban logistics and industrial property, recent activity has focused on expanding its footprint through development partnerships and strategic investments aimed at accelerating its last-mile and urban logistics network, with communications highlighting new joint ventures and expansions across key European markets during 2025.

Report Coverage:

The research report offers an in-depth analysis based on property type and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of sustainable housing designs across all European regions.

- Growing use of AI and IoT technologies in property management and sales.

- Expansion of co-living and rental spaces targeting young professionals.

- Rising focus on energy efficiency and carbon-neutral construction.

- Greater integration of digital real estate platforms for seamless transactions.

- Eastern Europe expected to emerge as a strong growth frontier.

- Institutional investors to expand their portfolios in residential assets.

- Urban regeneration projects to redefine city housing landscapes.

- Strong policy support to drive affordable housing initiatives.

- Continued innovation in financing models to enhance buyer accessibility.