Market Overview:

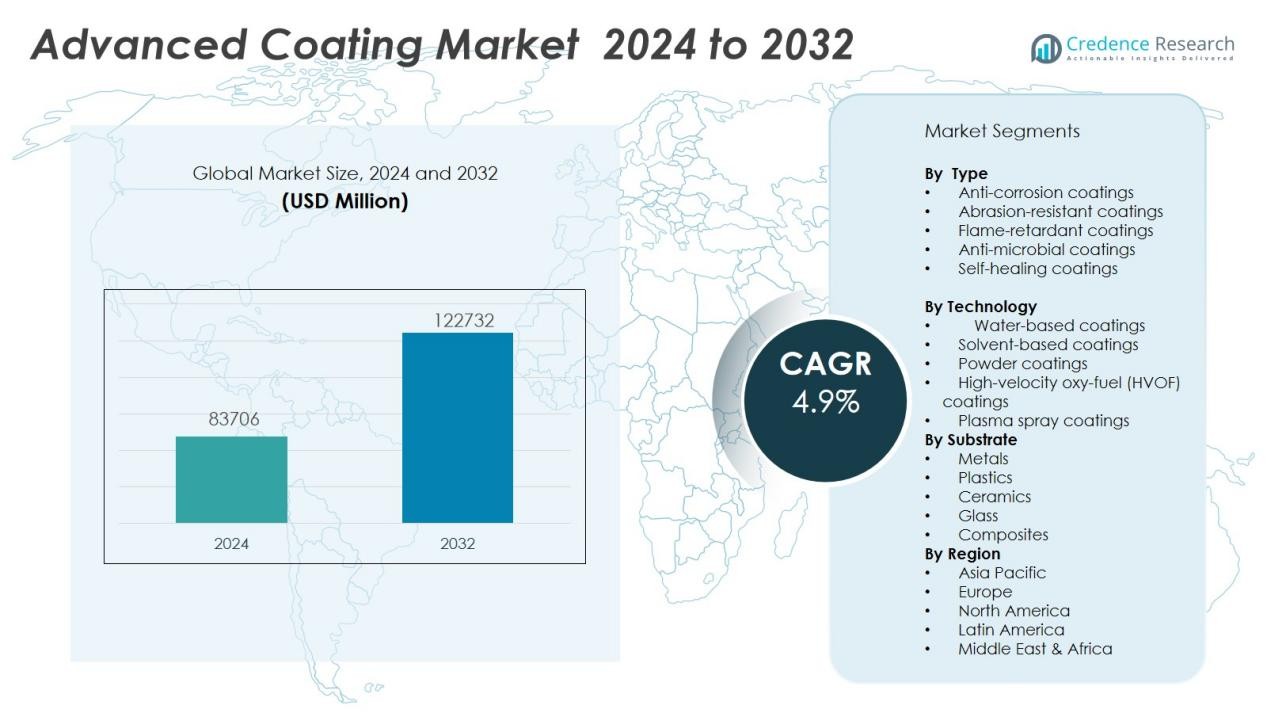

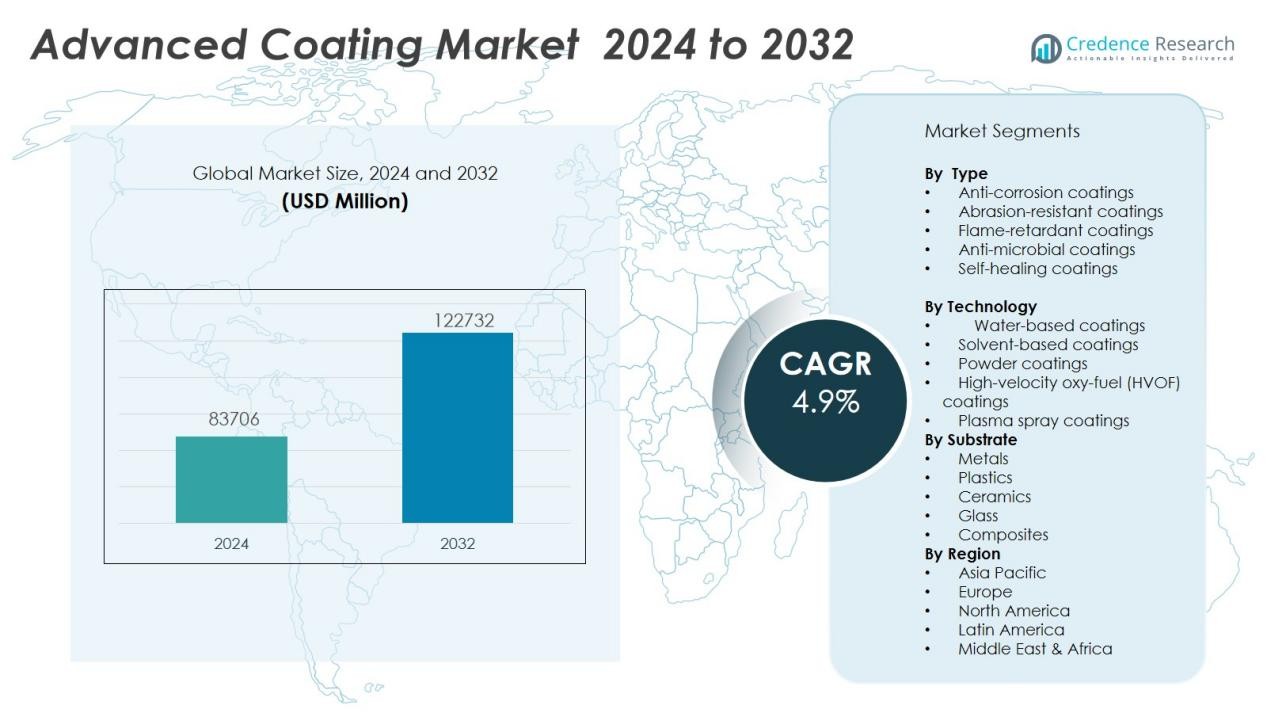

The advanced coating market size was valued at USD 83706 million in 2024 and is anticipated to reach USD 122732 million by 2032, at a CAGR of 4.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Coating Market Size 2024 |

USD 83706 Million |

| Advanced Coating Market, CAGR |

4.9 % |

| Advanced Coating Market Size 2032 |

USD 122732 Million |

Market drivers for advanced coatings include increased focus on sustainability, stringent regulatory standards, and the ongoing shift toward lightweight, corrosion-resistant materials. Growing awareness regarding the environmental impact of traditional coatings has driven the adoption of water-based, powder, and bio-based advanced coatings. Rapid industrialization, the need for energy efficiency, and technological advancements such as nanotechnology and smart coatings also contribute to market momentum, supporting manufacturers in meeting performance and regulatory demands.

Regionally, North America and Europe hold significant shares due to advanced manufacturing sectors, high investment in R&D, and strict environmental regulations. The Asia-Pacific region is witnessing the fastest growth, fueled by expanding industrial bases, rising construction activities, and increasing automotive production in countries such as China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The advanced coating market reached USD 83,706 million in 2024 and is projected to reach USD 122,732 million by 2032, with a CAGR of 4.9% from 2024 to 2032.

- Demand is driven by sustainability, stricter regulations, and a shift toward lightweight, corrosion-resistant, and high-performance materials across key industries.

- Adoption of water-based, powder, and bio-based coatings is accelerating due to environmental concerns and compliance with low-VOC standards.

- Technological advancements, such as nanocoatings and smart coatings, are enabling new functionalities like self-cleaning, anti-microbial, and scratch resistance.

- Asia-Pacific is the fastest-growing region, accounting for 26% of the global market, driven by rapid industrialization, urbanization, and manufacturing growth in China, India, Japan, and South Korea.

- North America and Europe together represent 60% of global revenue, benefiting from robust R&D, strong manufacturing, and stringent environmental regulations.

- The market faces challenges from regulatory complexity, volatile raw material prices, and supply chain disruptions, but opportunities remain strong in eco-friendly and functional coatings for emerging sectors and regions.

Market Drivers:

Rising Demand for High-Performance and Durable Solutions across Industries:

The advanced coating market benefits from increased demand in sectors such as automotive, aerospace, construction, and electronics. These industries require coatings that deliver superior durability, corrosion resistance, and enhanced mechanical properties. Advanced coatings extend product life cycles and reduce maintenance costs, supporting operational efficiency and safety. Manufacturers prioritize innovation to meet strict industry standards and performance expectations.

- For instance, PPG developed its ENVIRO-PRIME EPIC 200X electrocoat technology that demonstrates exceptional sustainability benefits at Toyota Motor Manufacturing Canada North Plant in Cambridge, Ontario, enabling a total reduction of 3,500 metric tons of CO₂ emissions per year.

Stringent Environmental Regulations and Shift toward Sustainable Products:

Strict regulatory frameworks drive the adoption of eco-friendly and low-VOC (volatile organic compound) coatings. Companies focus on developing water-based, powder, and bio-based formulations to comply with environmental standards and reduce emissions. This shift aligns with growing global awareness of sustainability, prompting research into non-toxic alternatives. The advanced coating market capitalizes on these trends by offering sustainable solutions that do not compromise performance.

- For instance, Sherwin-Williams achieved a major breakthrough with their water-based acrylic alkyd technology using recycled PET bottles and soybean oil, eliminating over 800,000 pounds of VOCs in 2010 alone.

Rapid Advancements in Coating Technologies and Nanomaterials:

Innovations in nanotechnology and material science fuel the development of advanced coatings with unique functionalities. Nanocoatings deliver self-cleaning, anti-microbial, anti-fouling, and scratch-resistant properties, expanding the scope of application across sectors. Continuous R&D efforts enable manufacturers to create coatings with enhanced protective features, improved adhesion, and greater surface versatility. The advanced coating market leverages these technological breakthroughs to address evolving customer requirements.

Growing Investments in Infrastructure and Industrial Expansion in Emerging Regions:

Emerging economies in Asia-Pacific and Latin America present new opportunities for the advanced coating market. Infrastructure projects, rapid urbanization, and industrial growth drive demand for high-performance coatings in construction, transportation, and energy sectors. Companies invest in local production facilities and distribution networks to serve rising regional demand. It enables manufacturers to tap into high-growth markets and strengthen their global presence.

Market Trends:

Increasing Adoption of Smart and Functional Coatings Driven by Technological Advancements:

The advanced coating market demonstrates a clear shift toward smart and functional coatings, propelled by significant advances in material science and digital technology integration. Manufacturers introduce coatings that respond to environmental stimuli, such as temperature, humidity, or light, providing applications in automotive, aerospace, and electronics sectors. Demand for anti-microbial, self-healing, anti-fouling, and anti-corrosion coatings continues to rise, supported by growing end-user expectations for performance and product longevity. Research in nanomaterials and hybrid composites enables the development of coatings with multifunctional properties, such as thermal regulation and electrical conductivity. The trend aligns with the need for next-generation protective solutions that combine durability with additional value-added features. The advanced coating market leverages these developments to expand its portfolio and strengthen its competitive positioning.

- For instance, Sherwin-Williams has developed Paint Shield microbicidal paint that achieves 99.9% bacteria kill rate against Staph, E. coli, and MRSA within 2 hours of exposure on painted surfaces.

Sustainability, Circular Economy, and Regulatory Compliance Shape Product Innovation:

Sustainability and circular economy principles play a pivotal role in shaping product innovation within the advanced coating market. Companies focus on creating formulations that minimize environmental impact by reducing volatile organic compounds (VOCs), hazardous chemicals, and energy consumption during application. Bio-based and waterborne coatings are gaining traction, with end users seeking products that comply with stricter global regulations and green building standards. It reflects a broader industry trend toward transparency, recyclability, and lifecycle assessment, driving collaboration between raw material suppliers, manufacturers, and end users. Adoption of eco-labels and certifications is accelerating as customers demand verification of sustainable practices. The emphasis on environmental responsibility supports brand reputation and facilitates market access in regions with rigorous regulatory landscapes.

- For instance, Arkema has developed a biobased, zero-VOC coalescent technology for waterborne paints with 96% biobased carbon content as measured by ASTM D6866, meeting zero-VOC requirements under ASTM D6886.

Market Challenges Analysis:

Evolving Regulatory Environment and Environmental Compliance Drive Up Costs:

The advanced coating market faces increasing pressure from evolving regulatory frameworks and strict environmental mandates. Companies must invest in research and reformulation to eliminate hazardous chemicals and reduce volatile organic compounds, adding to operational costs. Navigating a patchwork of international standards requires significant resources and slows product approvals. This complexity challenges both global players and regional manufacturers seeking broader market access. Delays in certification or non-compliance can limit opportunities and damage reputation. It often creates a barrier for new entrants and small businesses with limited compliance budgets.

Volatility in Raw Material Prices and Supply Chain Disruptions Challenge Profitability:

Frequent fluctuations in raw material prices and ongoing supply chain disruptions pose significant risks for advanced coating manufacturers. High dependence on specialty chemicals and advanced resins leaves companies vulnerable to cost spikes and shortages. Tightening global supply networks can lead to inconsistent quality and delayed delivery schedules, straining customer relationships. Managing costs while maintaining product performance requires advanced procurement strategies and strong supplier partnerships. The advanced coating market must address these hurdles to protect margins and sustain growth in a highly competitive landscape.

Market Opportunities:

Rising Demand for Sustainable and Smart Coating Solutions Fuels Innovation:

The advanced coating market holds significant opportunities in the development of eco-friendly, smart, and functional coatings. Manufacturers can leverage demand for water-based, bio-based, and low-VOC products to meet both regulatory requirements and consumer preferences. Expanding applications in automotive, aerospace, electronics, and healthcare create new avenues for growth, especially for coatings that deliver self-cleaning, anti-microbial, or energy-saving properties. Partnerships with research institutions and technology firms support the rapid commercialization of next-generation coatings. Investments in R&D help companies address sustainability goals and differentiate their offerings in a crowded market. It positions manufacturers to capture share in emerging segments driven by environmental and performance standards.

Expansion into High-Growth Regions and New Industrial Applications Drives Market Potential:

Untapped markets in Asia-Pacific, Latin America, and the Middle East present attractive opportunities for advanced coating providers. Growing infrastructure projects, rising automotive production, and expanding electronics manufacturing stimulate regional demand for high-performance coatings. Companies that establish local manufacturing and distribution networks can strengthen their competitive advantage and enhance responsiveness to local needs. The advanced coating market benefits from targeting new industrial sectors, such as renewable energy, medical devices, and advanced packaging, where specialized coatings improve efficiency and product lifespan. It allows manufacturers to diversify revenue streams and build long-term customer relationships across a broader industrial landscape.

Market Segmentation Analysis:

By Type:

The advanced coating market offers a broad range of types, including anti-corrosion coatings, abrasion-resistant coatings, flame-retardant coatings, anti-microbial coatings, and self-healing coatings. Demand for anti-corrosion and abrasion-resistant coatings remains strong in automotive, aerospace, and industrial sectors due to the need for long-lasting protection and durability. Flame-retardant and anti-microbial coatings gain traction in construction, electronics, and healthcare, driven by stringent safety and hygiene requirements. Self-healing coatings, though still emerging, attract attention for their ability to extend product life and reduce maintenance.

By Technology:

Key technologies in the advanced coating market include water-based, solvent-based, powder coating, and high-velocity oxy-fuel (HVOF) coating. Water-based and powder coatings gain momentum due to environmental regulations and the push for low-VOC solutions. Solvent-based coatings maintain a presence in demanding applications where superior performance is required. HVOF and other advanced deposition methods support the production of high-performance coatings for aerospace, energy, and heavy industry.

- For instance, AkzoNobel Aerospace Coatings’ PTFE-filled polyurethane 23T3 (a solvent-borne anti-chafe coating) dries-to-touch in 5.25 hours, maintains VOC levels below 420 g/L, and remains resistant to hydraulic fluids on aircraft control surfaces.

By Substrate:

The advanced coating market applies solutions to various substrates such as metals, plastics, ceramics, glass, and composites. Metal substrates dominate, supported by applications in transportation, manufacturing, and infrastructure. Coatings for plastics and composites increase in importance in automotive, electronics, and medical devices, reflecting the move toward lightweight, high-performance materials. It drives ongoing innovation to meet diverse application and performance needs across the industry.

- For instance, Japan Airlines achieved a significant breakthrough with riblet-shaped coating technology on their Boeing 787-9 aircraft, reducing drag by 0.24 percent during cruising altitude.

Segmentations:

By Type:

- Anti-corrosion coatings

- Abrasion-resistant coatings

- Flame-retardant coatings

- Anti-microbial coatings

- Self-healing coatings

By Technology:

- Water-based coatings

- Solvent-based coatings

- Powder coatings

- High-velocity oxy-fuel (HVOF) coatings

- Plasma spray coatings

By Substrate:

- Metals

- Plastics

- Ceramics

- Glass

- Composites

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe :

North America holds 32% of global revenue in the advanced coating market, while Europe accounts for 28%. Both regions maintain their leadership through strong investment in R&D, early adoption of innovative coating technologies, and adherence to strict environmental regulations. Major players in these markets focus on developing high-performance coatings for automotive, aerospace, and industrial applications. Presence of established manufacturing infrastructure and well-developed distribution networks accelerates product deployment and customer reach. Demand for sustainable and smart coatings continues to rise as regulatory bodies enforce lower VOC emissions and promote circular economy practices. It strengthens the competitive advantage of regional manufacturers and drives consistent growth.

Asia-Pacific :

Asia-Pacific contributes 26% to the global advanced coating market and shows the highest CAGR among all regions. Strong growth in construction, automotive, electronics, and consumer goods sectors fuels demand for innovative coating solutions. China, India, Japan, and South Korea serve as major hubs for both consumption and production, supported by large-scale manufacturing investments and rising urbanization. Regional governments promote foreign investment and technology transfer, enabling local companies to enhance capabilities. Access to cost-effective raw materials and skilled labor makes the region attractive for international players seeking new opportunities. It positions Asia-Pacific as a pivotal market for future expansion and innovation in advanced coatings.

Rest of the World :

Latin America, the Middle East, and Africa collectively account for 14% of global advanced coating market revenue. Steady infrastructure development and modernization projects in these regions create demand for durable and protective coatings in oil and gas, transportation, and energy industries. Adoption of advanced technologies remains moderate but shows upward momentum, especially in urban centers and industrial corridors. International companies form partnerships with local firms to expand product availability and adapt offerings to regional requirements. It supports gradual growth and paves the way for broader acceptance of advanced coating solutions in emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Axalta Coating Systems

- BASF SE

- AkzoNobel N.V.

- Asian Paints

- Beckers Group

- Hempel A/S

- Nippon Paint Holdings Co., Ltd.

- Dulux Powder & Industrial Coating

- Evonik Industries

- Jotun Powder Coatings

- Kansai Paint Co., Ltd.

- PPG Industries

Competitive Analysis:

The advanced coating market features a competitive landscape dominated by leading global players and a mix of regional and specialty companies. Major firms such as Axalta Coating Systems, BASF SE, AkzoNobel N.V., Asian Paints, Beckers Group, Hempel A/S, Nippon Paint Holdings Co., Ltd., and Dulux Powder & Industrial Coating drive industry innovation and set quality benchmarks. These companies invest heavily in research and development to expand their product portfolios, focusing on sustainable, high-performance coatings tailored for diverse applications. Strategic mergers, acquisitions, and partnerships remain common as firms seek to broaden their geographic reach and strengthen market presence. The advanced coating market demands agility, ongoing investment in technology, and a proactive approach to regulatory changes, enabling leading companies to maintain a competitive edge and respond effectively to dynamic customer requirements.

Recent Developments:

- In April 2025, Axalta Coating Systems launched its next-generation Fast Cure Low Energy System products, enhancing refinish quality and energy efficiency for automotive bodyshops.

- In April 2025, BASF SE launched three new natural-based personal care ingredients—Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA—at the in-cosmetics Global 2025 event, focusing on sustainability.

- In February 2025, AkzoNobel launched a new generation of waterborne basecoat for vehicle repair, designed to boost productivity and sustainability in automotive refinishing.

Market Concentration & Characteristics:

The advanced coating market exhibits a moderately consolidated structure, with leading global players holding significant market shares and regional companies competing through niche product offerings and innovation. Intense competition drives continuous research and development, with firms investing in advanced technologies, sustainable solutions, and high-performance formulations to address evolving industry needs. Strategic alliances, mergers, and acquisitions characterize the competitive landscape as companies seek to expand their product portfolios and geographic reach. The advanced coating market demonstrates a high level of technological sophistication, rapid adoption of new materials, and a strong focus on regulatory compliance and environmental responsibility. It requires manufacturers to remain agile and invest in ongoing capability enhancement to maintain competitiveness and capture new growth opportunities.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Substrate and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers will prioritize development of smart coatings with multifunctional attributes such as self-healing, anti-microbial, thermal regulation, and conductivity.

- Rising demand for sustainable formulations will push producers to scale water-based, bio-based, and low-VOC advanced coatings.

- Partnerships with research institutions and material science firms will accelerate commercialization of next-generation coatings.

- Companies will invest in digital technologies and automation to enhance process efficiency and application consistency.

- Expansion into industrial sectors like renewable energy, medical devices, and advanced packaging will create new growth avenues.

- Growth in emerging markets will spur industry investment in local plants, logistics infrastructure, and customer service networks.

- Manufacturers will integrate lifecycle assessment and eco-certifications to reinforce brand credibility and market differentiation.

- Raw material sourcing strategies will focus on diversification and supplier collaboration to mitigate volatility and ensure quality.

- Regulatory alignment across global regions will encourage development of universal coating platforms that comply with various standards.

- Companies that embrace sustainability, technological innovation, and strong distribution networks will strengthen global competitiveness and enjoy long-term market leadership.