Market Overview:

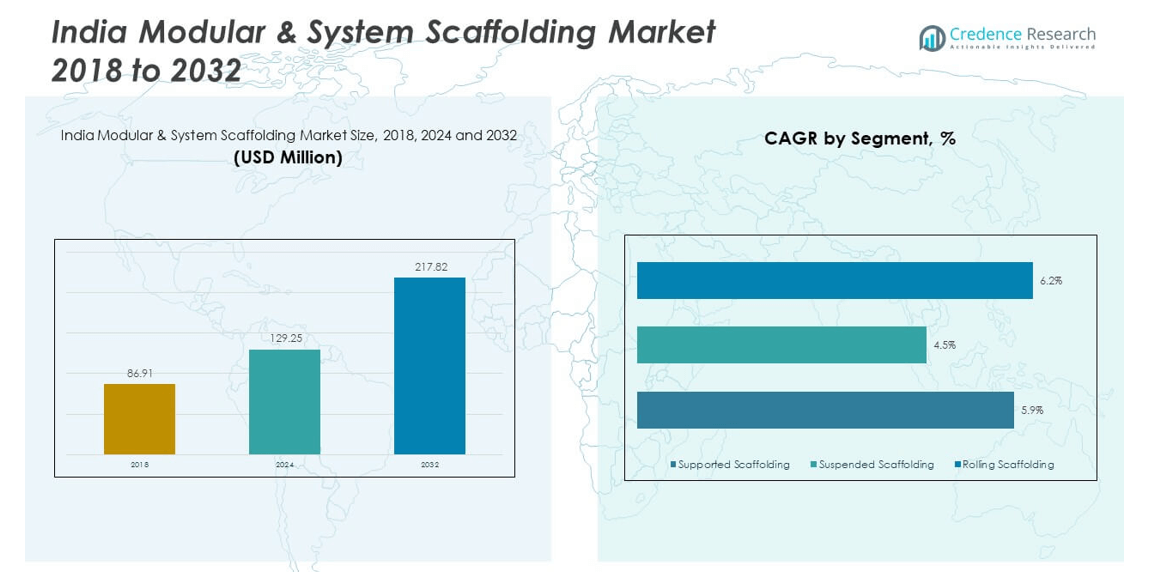

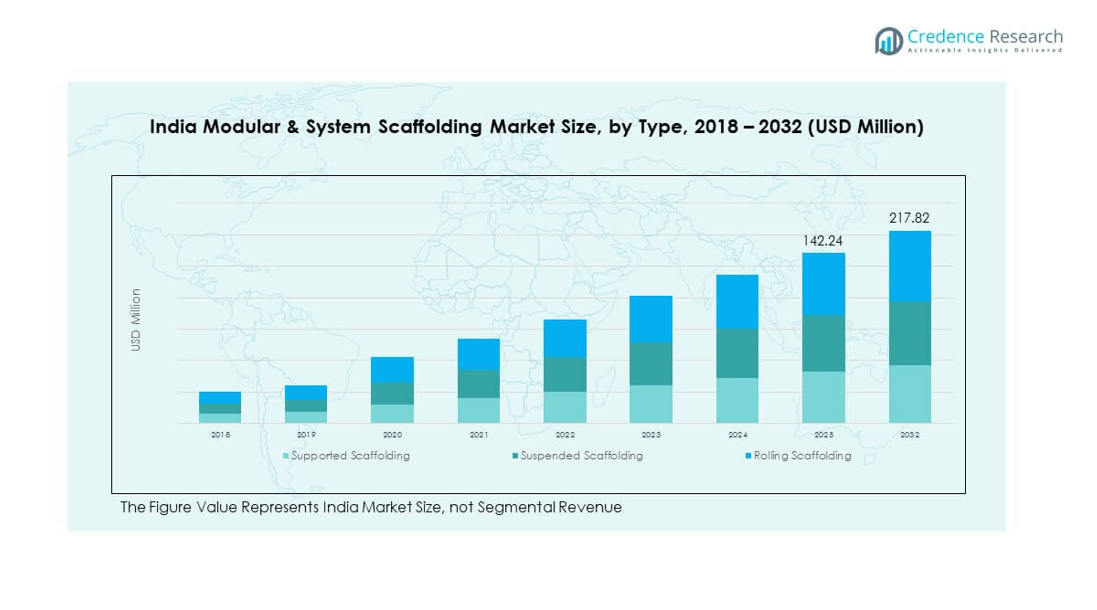

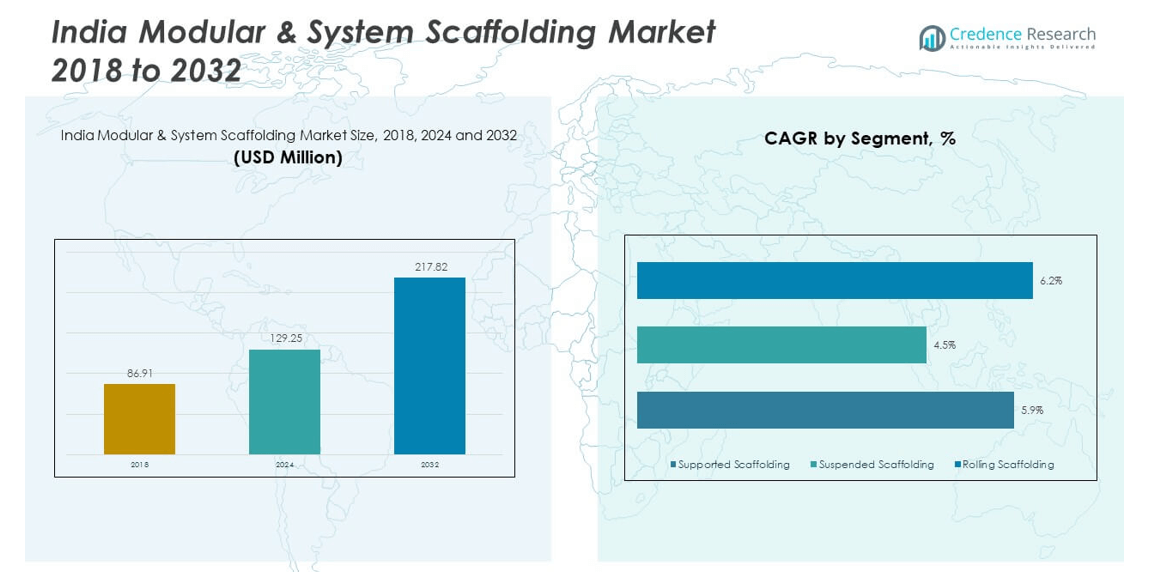

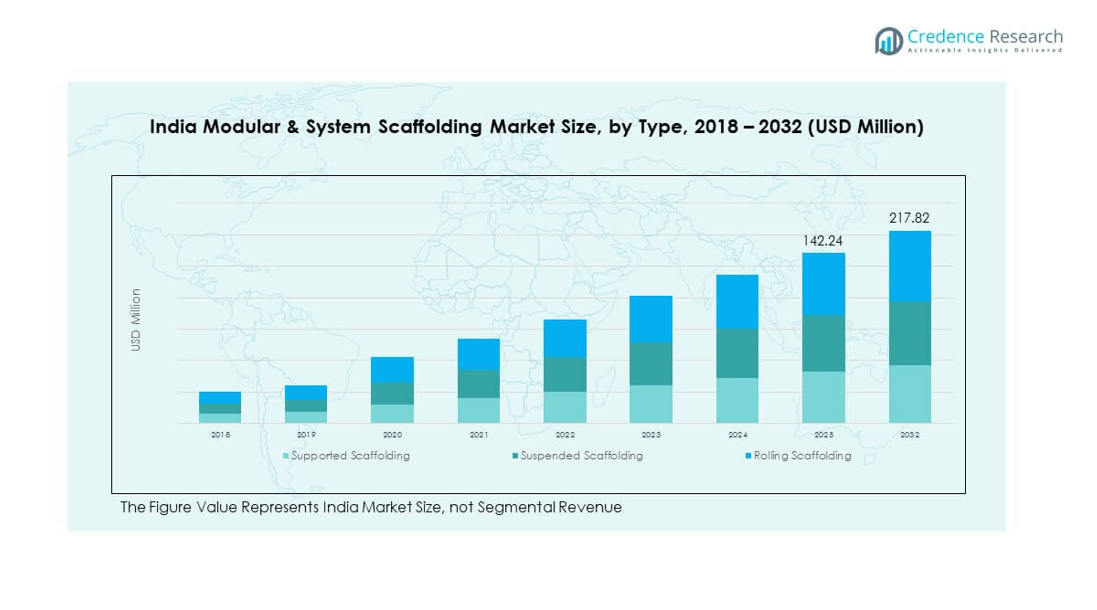

The India Modular & System Scaffolding Market size was valued at USD 86.91 million in 2018 to USD 129.25 million in 2024 and is anticipated to reach USD 217.82 million by 2032, at a CAGR of 6.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Modular & System Scaffolding Market Size 2024 |

USD 129.25 million |

| India Modular & System Scaffolding Market, CAGR |

6.67% |

| India Modular & System Scaffolding Market Size 2032 |

USD 217.82 million |

The India Modular & System Scaffolding Market is experiencing robust growth due to the surge in infrastructure development, urban expansion, and industrial construction projects. Increased government investments in smart cities and metro rail networks have propelled the demand for safer and more efficient scaffolding systems. Contractors and builders are increasingly shifting toward modular scaffolding solutions for their ease of assembly, durability, and compliance with safety standards. Additionally, the growing adoption of advanced construction techniques and increased emphasis on worker safety are reinforcing market demand across urban construction hubs.

Regionally, western and southern India dominate the modular and system scaffolding market due to high construction activity in states like Maharashtra, Gujarat, Karnataka, and Tamil Nadu. These regions host numerous commercial and industrial projects, fueling sustained demand. Meanwhile, northern and eastern regions are emerging markets, driven by infrastructure upgrades, residential developments, and growing foreign investments in Tier II and Tier III cities. Expansion of transportation corridors and industrial parks in these areas is also contributing to increased adoption of modular scaffolding solutions.

Market Insights:

- India Modular & System Scaffolding Market is projected to grow from USD 129.25 million in 2024 to USD 217.82 million by 2032, registering a CAGR of 6.67%. This expansion reflects increasing infrastructure investments and the shift toward safer, standardized scaffolding practices across urban and industrial sectors.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Government-funded infrastructure projects, including smart cities and metro rail networks, are driving strong demand for modular scaffolding systems due to their efficiency, safety, and faster setup capabilities.

- Real estate growth in metro cities like Mumbai, Bengaluru, and Hyderabad is pushing builders to adopt flexible and high-strength scaffolding systems that comply with modern safety and regulatory standards.

- Manufacturing clusters, logistics hubs, and industrial parks in non-urban zones are boosting demand for high-load modular scaffolds used in facility maintenance and expansion under the Make in India and PLI initiatives.

- Worker safety norms and compliance awareness are catalyzing the shift from traditional bamboo and tube scaffolds to engineered modular systems, especially in large-scale and high-rise construction sites.

- Adoption in smaller projects is hindered by high capital investment and logistical barriers, particularly in rural and Tier III towns where transport and storage add significant costs.

- Regionally, Western India leads with 34.2% market share, followed by Southern India at 27.6% and Northern India at 22.8%, while Eastern and Northeastern zones hold 15.4% and are seen as emerging growth areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government-Led Infrastructure Growth Catalyzes Demand Across Urban and Semi-Urban Projects

The Government of India continues to prioritize large-scale infrastructure initiatives, including smart cities, metro corridors, and highway expansions. These projects require highly durable and modular scaffolding systems to ensure safe and efficient construction. The India Modular & System Scaffolding Market benefits directly from increased tender activity and public-private partnerships in urban renewal projects. Demand intensifies where timelines are tight and worker safety is paramount. Modular systems, with their faster assembly and disassembly, meet these expectations efficiently. Contractors are replacing traditional bamboo and tube scaffolding with modern modular systems across most government-funded developments. This structural shift is fueling consistent market expansion.

Private Sector Real Estate Expansion Spurs the Need for Safe and Flexible Scaffolding Systems

Rapid urbanization and rising incomes have created robust demand for residential and commercial buildings. Builders are scaling high-rise projects in cities like Mumbai, Bengaluru, and Hyderabad, requiring adaptable scaffolding structures. The India Modular & System Scaffolding Market supports these needs by offering configurable platforms that enhance worker access and safety on vertical builds. Developers are embracing modular systems to meet stringent regulatory norms and improve operational efficiency. The private sector is also investing in green building certifications, which favor modern scaffolding solutions with minimal site disturbance. This transition from traditional methods to engineered systems continues to drive demand.

Industrial Corridor and Logistics Infrastructure Drive Adoption in Non-Urban Zones

The development of industrial parks, logistics hubs, and manufacturing clusters across non-metropolitan regions is expanding the market footprint. The India Modular & System Scaffolding Market finds significant opportunity in sectors like steel, cement, and automotive where industrial infrastructure requires regular maintenance and construction. These zones demand high-load scaffolding solutions for plant structures and warehouse units. Modular scaffolding improves turnaround time during shutdown maintenance or facility expansions. As the government promotes Make in India and Production Linked Incentives (PLI), the need for industrial infrastructure accelerates. This dynamic pushes scaffolding suppliers to scale operations across emerging corridors.

- For instance, Cuplock scaffold systems are recognized for their high-capacity performance and fast assembly well-suited for maintenance and industrial turnaround projects like those at JSW Steel’s Vijayanagar facility.

Strict Safety Norms and Rising Awareness Drive the Shift from Traditional to Modular Scaffolding

India’s construction industry has seen a growing focus on worker safety and regulatory compliance. Government agencies and private institutions have begun enforcing stricter norms for site safety, leading to broader acceptance of modular scaffolding. The India Modular & System Scaffolding Market responds to these regulations with engineered systems offering enhanced stability and load-bearing capacity. Builders and contractors increasingly prioritize solutions that reduce fall risks and support quality certifications like ISO and OHSAS. Training programs by construction boards have created awareness of system scaffolding benefits. This transformation is replacing unsafe, labor-intensive practices with structured, secure alternatives.

- For example, ULMA Construction offers structured training programs and on-site supervision to support safe deployment of its MK System and associated solutions in markets including India.

Market Trends:

Integration of Scaffolding with Digital Project Management Tools Enhances Efficiency

Construction firms are integrating modular scaffolding setups with digital tools to improve on-site planning and logistics. The India Modular & System Scaffolding Market is witnessing the trend of using Building Information Modeling (BIM) to design scaffolding structures that align with overall project schematics. These integrations reduce errors, optimize resource allocation, and minimize rework. QR code tracking for scaffold components, cloud-based monitoring, and mobile checklists are becoming standard. Companies use this data-driven approach to plan scaffolding cycles and avoid bottlenecks. Such digitization supports smoother coordination between contractors and project managers on complex construction sites.

- For instance, Technocraft Industries India Ltd. leverages Building Information Modeling (BIM) in scaffolding and formwork design to improve accuracy, reduce design rework, and generate material schedules automatically.

Rental Model Emerges as a Cost-Efficient Alternative Across Project Scales

Construction companies increasingly opt for scaffolding rental services rather than investing in permanent ownership. The India Modular & System Scaffolding Market is seeing growth in rental and leasing models, particularly among small to mid-sized contractors. These businesses aim to reduce upfront capital expenditure while accessing high-quality, certified equipment. Scaffolding rental firms are offering delivery, erection, and dismantling services bundled into packages. The rise in short-term industrial shutdowns and maintenance projects supports rental scalability. Market players are expanding their inventory and logistics support to address this shift toward flexible, on-demand scaffolding access.

Customized Scaffold Designs Gain Ground in Specialized Construction Applications

Architectural diversity and structural complexity across Indian cities have driven the trend of custom-designed scaffolding systems. The India Modular & System Scaffolding Market is adapting by developing modular frameworks tailored for bridges, tunnels, stadiums, and heritage restoration projects. Companies now offer 3D model-based planning, adaptable connections, and variable load systems to match specific site conditions. Custom scaffolding improves safety and fits non-standard geometries better than generic solutions. This trend is particularly visible in large infrastructure ventures and complex urban redevelopment schemes, where precision is essential to avoid structural conflicts or safety lapses.

- For instance, WINSTEEL Engineering Works India offers movable scaffolding systems (MSS) including both underslung and overhead variants tailored for cast-in-place bridge decks spanning approximately 20–70 m.

Eco-Friendly Scaffolding Materials Attract Builders Committed to Sustainability Goals

Sustainability is becoming central to procurement decisions in the Indian construction sector. The India Modular & System Scaffolding Market is responding with recyclable materials and corrosion-resistant coatings. Aluminum and galvanized steel scaffolds are replacing wooden poles and rust-prone tubular systems. These eco-friendly solutions reduce material waste and extend lifecycle performance. Developers pursuing IGBC or LEED certification prefer these systems for their durability and environmental benefits. The move toward green construction has also driven innovations in modular design that enable easy reuse and reconfiguration. This trend aligns with India’s larger green building movement.

Market Challenges Analysis:

Fragmented Contractor Ecosystem Limits Standardization and Quality Compliance

India’s construction sector is heavily fragmented, with a large number of unorganized and small-scale contractors operating across regions. The India Modular & System Scaffolding Market faces hurdles in penetrating this segment due to cost concerns, limited awareness, and low willingness to upgrade. Many contractors still rely on traditional bamboo or tube-and-coupler scaffolds to save on upfront investment. This behavior limits the pace at which modern systems gain traction, especially in low-budget projects. Further, inconsistent adherence to safety norms makes it difficult for manufacturers to enforce standard practices or offer training across dispersed geographies. Educating and converting these users remains a challenge.

High Initial Investment and Logistical Complexity Discourage Adoption in Smaller Projects

The capital expenditure involved in procuring modular scaffolding systems can be substantial, particularly for small-scale developers. Although rentals offer a partial solution, logistics and transport costs often deter adoption in rural or remote projects. The India Modular & System Scaffolding Market contends with high handling and storage costs associated with bulky equipment. Transportation infrastructure limitations in tier-III towns and construction belts add to this complexity. Project timelines sometimes compress scaffold erection and dismantling windows, demanding more manpower and planning. These limitations affect deployment scalability and restrict penetration into lower-margin or short-duration projects.

Market Opportunities:

Tier-II and Tier-III City Expansion Unlocks Demand for Mid-Sized Construction Projects

India’s construction activity is rapidly shifting beyond metros into smaller cities driven by real estate affordability, industrial decentralization, and government-led smart city initiatives. The India Modular & System Scaffolding Market finds significant opportunity in these regions, where demand for commercial complexes, institutional buildings, and small infrastructure is rising. Developers in these cities are now adopting modular solutions to enhance project efficiency and comply with evolving safety norms. This geographic expansion allows suppliers to establish local rental hubs and improve market access.

Public-Private Partnerships and Foreign Investments Create Long-Term Growth Potential

The increasing participation of private players in infrastructure development under public-private models is generating new business for scaffolding vendors. Foreign direct investments in roads, ports, renewable energy, and industrial zones continue to rise. The India Modular & System Scaffolding Market benefits from global companies demanding high safety standards and structured construction systems. This influx of institutional projects offers long-term contracts and repeat business for suppliers providing certified, engineered scaffolding. It also encourages technology transfer and capacity building within the local ecosystem.

Market Segmentation Analysis:

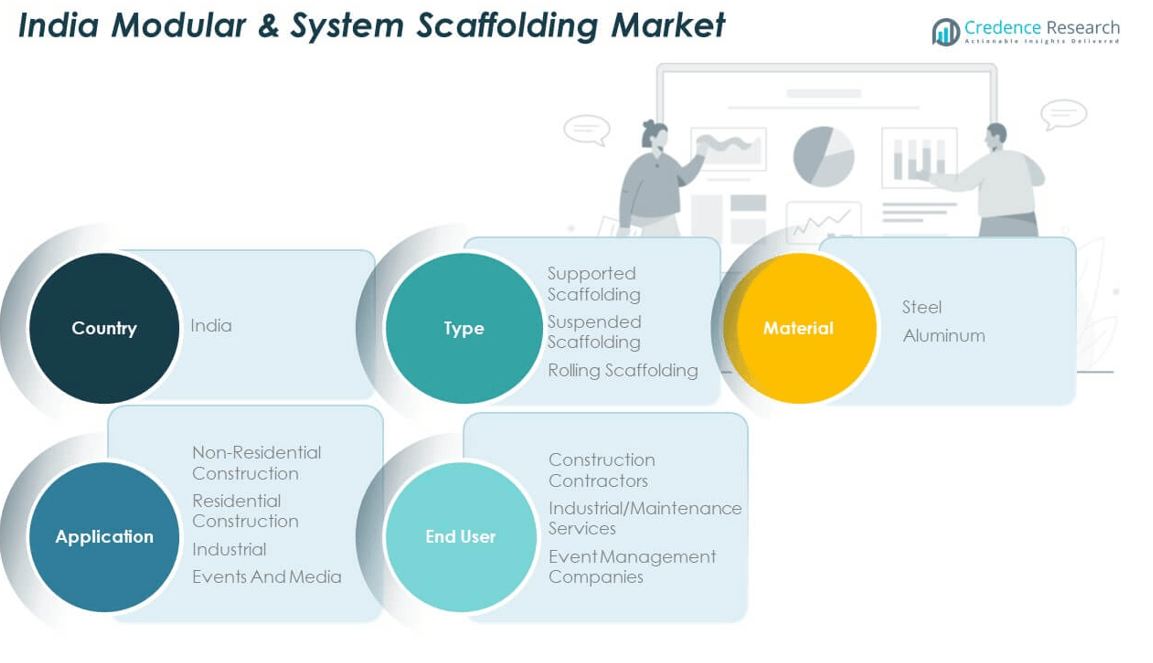

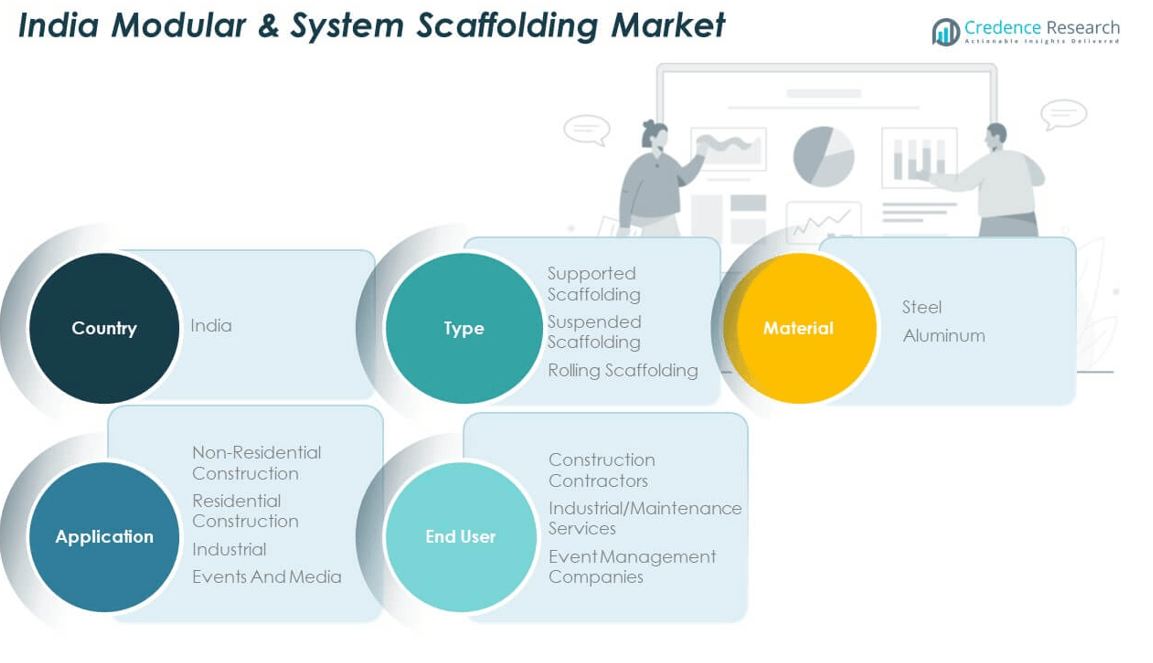

The India Modular & System Scaffolding Market is segmented by type, material, application, and end user.

By type, supported scaffolding dominates the market due to its stability and wide use in high-rise and infrastructure projects. Suspended scaffolding finds niche application in exterior maintenance and repair works, particularly for tall structures. Rolling scaffolding is gaining adoption in indoor construction and industrial applications where mobility is essential.

- For example, Technocraft India manufactures modular scaffolding systems such as Techlok (Ringlok) and Cuplock, compliant with major global standards, and exports them for infrastructure, industrial, and bridge projects.

By material, steel scaffolding leads the market owing to its superior strength and durability, while aluminum scaffolding is preferred for lightweight, portable applications in maintenance and event setups.

- For example, Alufase manufactures modular aluminum scaffold towers like the Span 400 and Span 500, engineered for rapid, tool-free setup and mobility—well suited to event staging and exhibition environments.

By application, non-residential construction holds the largest share due to extensive commercial, institutional, and industrial projects across urban centers. Residential construction follows, supported by growing urban housing demands. Industrial applications are steadily rising, driven by plant maintenance and infrastructure expansions. Events and media represent a smaller yet stable segment where temporary and quick-setup scaffolding is required.

By end user, construction contractors form the largest customer group in the India Modular & System Scaffolding Market, with widespread deployment across public and private projects. Industrial and maintenance services contribute significantly to recurring demand, particularly in factories, warehouses, and utilities. Event management companies make up an emerging user base, utilizing modular scaffolds for stages, lighting rigs, and temporary structures. It continues to evolve with changing user needs and growing preferences for safer, modular, and reusable scaffolding systems across sectors.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

Regional Analysis:

Western India commands the largest share of the India Modular & System Scaffolding Market, accounting for 34.2% of the overall market in 2024. This dominance stems from high infrastructure investment and commercial construction activity in Maharashtra and Gujarat. Metro rail expansions, high-rise developments, and smart city projects in cities like Mumbai, Pune, and Ahmedabad have accelerated the adoption of modular scaffolding. The region’s mature construction industry prefers modular systems for their compliance with safety regulations and efficiency on complex builds. Industrial projects, including ports and SEZs, further boost demand. Strong logistics infrastructure supports scaffolding suppliers with seamless distribution networks.

Southern India holds the second-largest share of the market at 27.6%, driven by rapid urbanization and real estate growth in Karnataka, Tamil Nadu, and Telangana. Bengaluru and Chennai are major hubs for IT parks, commercial complexes, and mixed-use developments. These projects require modern scaffolding solutions to meet vertical construction demands and tight timelines. The region is witnessing strong adoption of rental scaffolding models among mid-sized contractors. Government-backed housing and infrastructure projects also contribute to steady demand. The presence of local manufacturers and service providers strengthens regional supply chains.

Northern India captures 22.8% of the India Modular & System Scaffolding Market, with the National Capital Region (NCR), Punjab, and Uttar Pradesh leading growth. Delhi NCR is a major driver with multiple infrastructure and redevelopment projects fueling market expansion. The adoption of system scaffolding in flyover construction, metro stations, and commercial towers continues to grow. Government focus on industrial corridors and transportation connectivity supports the demand for high-load modular scaffolds. Eastern and Northeastern India together hold a smaller market share of 15.4%, but present emerging opportunities. Infrastructure development in states like West Bengal and Assam is improving scaffold penetration in underdeveloped zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BSL Scaffolding Ltd

- Renny Kwikstage Scaffolding

- PERI India

- Layher Scaffolding Systems Pvt Ltd

- ULMA Formworks India Pvt Ltd

- Finomax Scaffolding Pvt Ltd

- PASCHAL Formwork (India) Pvt Ltd

- Gleanore India Pvt Ltd

- Wheels Scaffolding Ltd (WSL)

- Winntus Formwork System Pvt Ltd

Competitive Analysis:

The India Modular & System Scaffolding Market features a moderately consolidated competitive landscape, led by both multinational players and established domestic firms. Key companies include PERI India, Layher Scaffolding, Harsco Infrastructure, and Indian Scaffolding Solutions. These firms compete on the basis of product durability, system flexibility, rental services, and safety certifications. Local manufacturers focus on cost-effectiveness and project-specific customization to gain market share. Strategic partnerships with construction firms and rental service expansion remain core growth strategies. It continues to attract new entrants offering modular kits and scaffolding accessories tailored for small to mid-scale projects. Players are enhancing logistics and technical support to improve customer retention in regional markets.

Recent Developments:

- In June 2025, Finomax Scaffolding Pvt Ltd announced the transformational impact of its aluminium formwork solutions on India’s construction industry. According to their CEO, the new modular systems deliver superior efficiency, quality, and sustainability across project types, representing a significant innovation for the sector in 2025.

Market Concentration & Characteristics:

The India Modular & System Scaffolding Market demonstrates medium market concentration with a mix of organized and unorganized players. Large firms dominate metro city projects while regional contractors and rental operators serve tier-II and tier-III cities. It exhibits characteristics such as high demand variability, price sensitivity, and a growing preference for system-based scaffolds over conventional methods. The market favors players who offer rapid assembly, compliance with safety norms, and scalable rental services. Seasonality influences demand, with peaks aligned to infrastructure and real estate project cycles. Innovation in lightweight materials and digital tracking features is becoming a competitive differentiator. Entry barriers remain moderate due to low initial investment for rental-based operations. Strong after-sales service and technical training also influence long-term client retention.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased urban infrastructure development will drive sustained demand for modular scaffolding across metro and tier-I cities.

- Expansion of smart city and affordable housing projects will create new opportunities for system scaffolding adoption.

- Growing rental and leasing models will attract small and mid-sized contractors to shift from traditional scaffolds.

- Integration of digital planning tools like BIM will enhance precision and reduce setup time on large-scale projects.

- Rising emphasis on construction safety will accelerate regulatory push toward certified scaffolding systems.

- Industrial corridor development and logistics parks will boost usage in non-residential and maintenance applications.

- Customized scaffold solutions will gain traction in complex architectural and heritage restoration projects.

- Adoption of eco-friendly and corrosion-resistant materials will align with sustainability goals in construction.

- Strategic partnerships between scaffolding providers and EPC contractors will strengthen market reach.

- Improved logistics and warehousing networks will support faster equipment deployment in remote regions.