Market Overview:

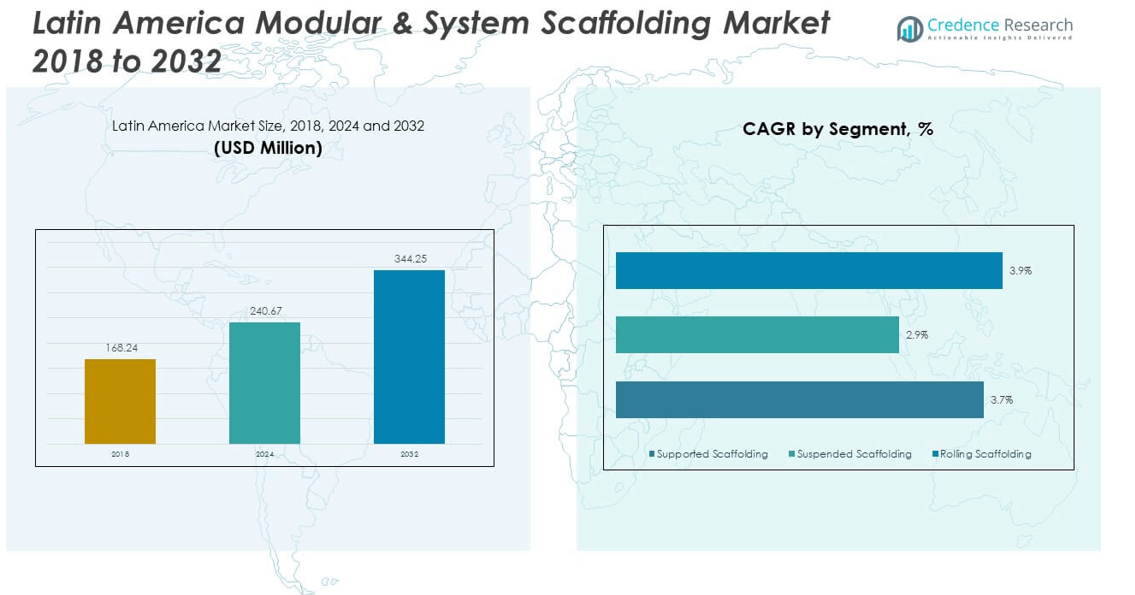

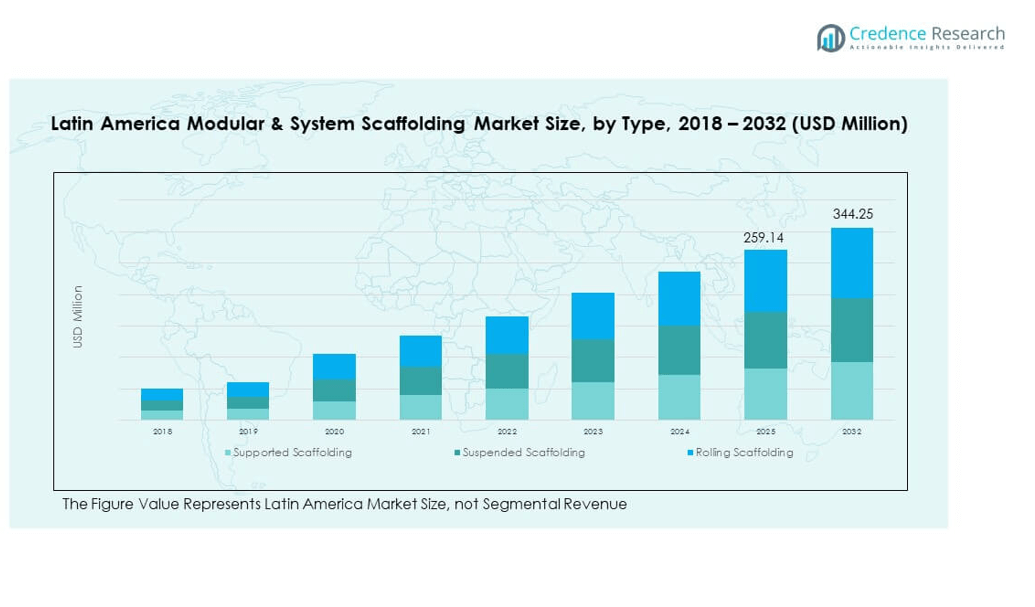

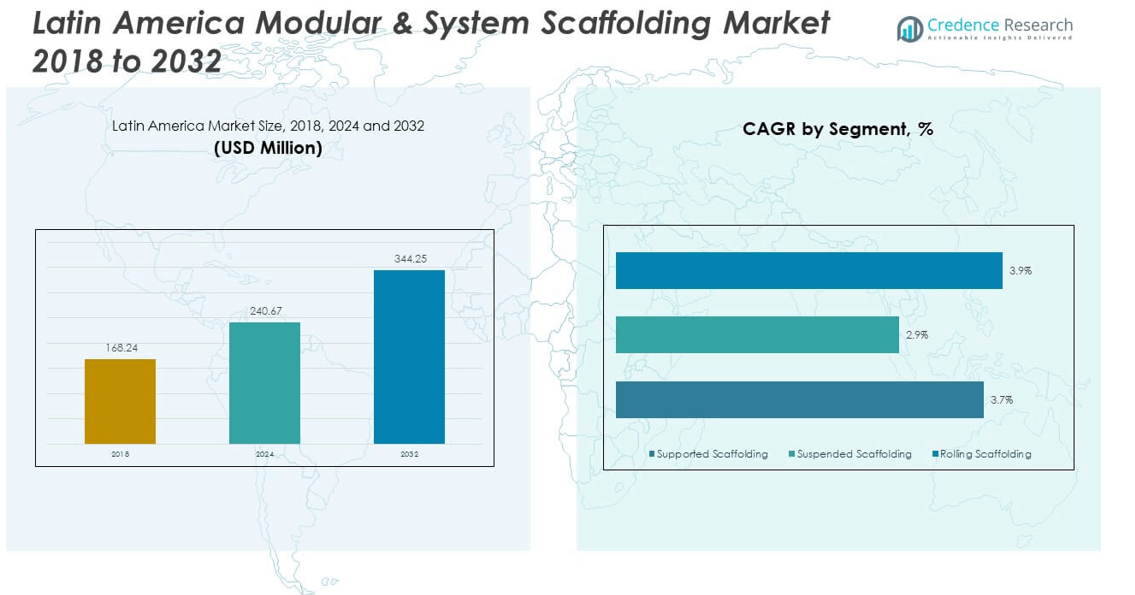

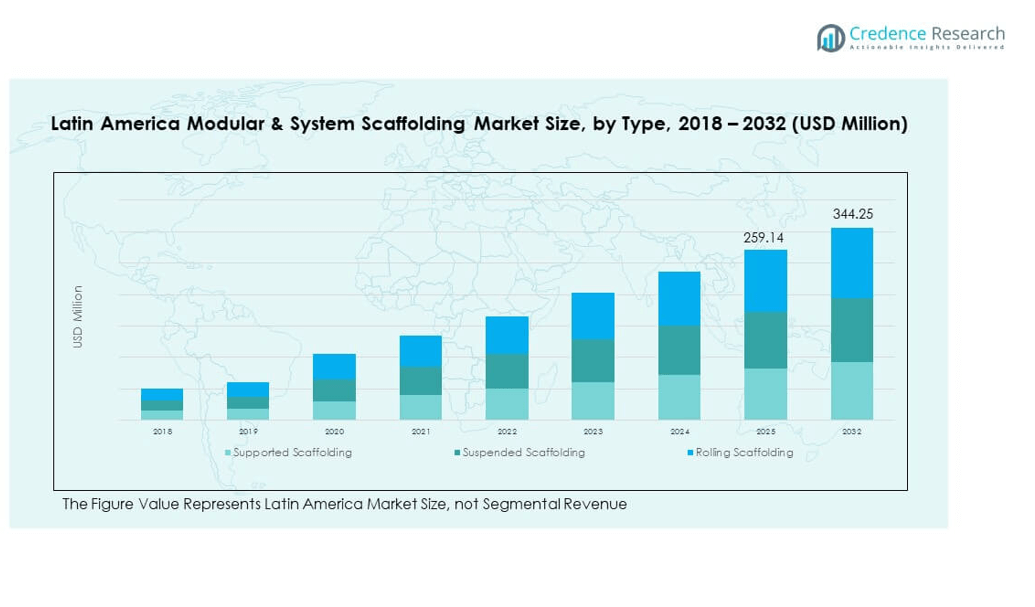

The Latin America Modular & System Scaffolding Market size was valued at USD 168.24 million in 2018 to USD 240.67 million in 2024 and is anticipated to reach USD 344.25 million by 2032, at a CAGR of 4.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Modular & System Scaffolding Market Size 2024 |

USD 240.67 million |

| Latin America Modular & System Scaffolding Market, CAGR |

4.01% |

| Latin America Modular & System Scaffolding Market Size 2032 |

USD 344.25 million |

The market is being driven by rapid urbanization, increasing infrastructure development, and growing construction activities across commercial, residential, and industrial sectors. Governments across Latin America are investing in large-scale projects such as bridges, tunnels, highways, and public housing to meet growing urban demand. Additionally, the need for safer and faster scaffolding systems has encouraged contractors to adopt modular and system scaffolding solutions, which provide improved efficiency and labor safety. Rising renovation activities and stricter safety standards are further reinforcing market demand.

Regionally, Brazil holds a leading position in the Latin American modular & system scaffolding market due to its extensive infrastructure pipeline and strong construction sector. Mexico is another prominent market, backed by industrial growth and commercial expansion. Meanwhile, countries like Colombia, Chile, and Peru are emerging as high-potential markets, fueled by urban expansion, favorable government initiatives, and foreign investments. The demand in these regions is being supported by efforts to modernize construction techniques and meet evolving safety and efficiency standards in the scaffolding industry.

Market Insights:

- The Latin America Modular & System Scaffolding Market was valued at USD 240.67 million in 2024 and is projected to reach USD 344.25 million by 2032, growing at a CAGR of 4.10%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Urban infrastructure development and increased high-rise construction are key factors driving demand for modular and system scaffolding solutions.

- Stringent safety regulations across construction sites are encouraging the shift from traditional scaffolding to engineered modular systems.

- High initial costs and fragmented regulatory standards across countries remain significant restraints to market expansion.

- Brazil holds the largest market share, driven by public infrastructure investments and industrial maintenance activities.

- Mexico follows as a strong market, supported by manufacturing growth, energy projects, and rental-based scaffolding adoption.

- Emerging economies like Colombia and Peru are witnessing growing demand due to foreign investments and urbanization-led construction activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Accelerated Urban Infrastructure Growth Across Major Latin American Cities

Rapid urbanization in key Latin American cities has intensified demand for efficient construction tools. Governments are expanding public infrastructure, prompting contractors to invest in modular scaffolding systems. These systems enhance operational safety, speed, and worker productivity. Traditional scaffolding often fails to meet modern efficiency requirements. The Latin America Modular & System Scaffolding Market benefits from rising investments in public transit networks and commercial zones. It also aligns with public-sector goals for sustainability and structural durability. Private developers increasingly seek faster, reusable solutions for high-rise and industrial buildings.

Government Focus on Safety Regulations Fuels Equipment Upgrades

Construction safety laws are becoming stricter across Brazil, Mexico, and Colombia. Regulatory bodies enforce compliance standards, prompting the replacement of outdated scaffolding. The Latin America Modular & System Scaffolding Market gains momentum through this mandatory equipment modernization. Contractors prefer engineered modular systems to meet evolving workplace safety demands. It encourages suppliers to offer customizable, secure components. These regulations drive adoption by reducing injury risks and improving inspection outcomes. Authorities link public project approvals to safety protocol compliance.

- For instance, Layher’s Allround Scaffolding system is certified to EN 12810/12811 and supports load classes up to 6 kN/m², with documented assembly and dismantling time savings of over 30% compared to conventional systems.

Industrial Project Expansions in Oil, Gas, and Utilities Stimulate Adoption

Large-scale industrial projects are surging across sectors such as oil and gas, energy, and mining. These projects require stable, heavy-duty access platforms during maintenance and installation activities. The Latin America Modular & System Scaffolding Market supports this need with tailored scaffolding configurations. It addresses load-bearing requirements and time-sensitive assembly. Project managers rely on flexible systems that reduce project downtime. Energy plants and refineries often operate in tight or hazardous environments. Scaffolding vendors cater to this segment with corrosion-resistant, modular frameworks.

- For instance, Aluma Systems provides corrosion-resistant aluminum scaffolding solutions tailored for refinery and petrochemical environments.

Rising Demand for Multi-Story Housing Projects in Urban Zones

Real estate developers are building more vertical housing to optimize land usage in dense urban cores. Residential towers and apartment complexes require reliable scaffolding for façade and structural work. The Latin America Modular & System Scaffolding Market meets this growing vertical demand through stackable systems. It facilitates high-elevation work with minimal risk. Developers prioritize rapid assembly to adhere to project deadlines. Modular platforms help complete formwork, painting, and glass installation faster. This supports urban renewal and affordable housing efforts.

Market Trends

Adoption of Digital Planning and Building Information Modeling (BIM) Solutions

Construction firms are integrating digital tools to improve project planning and execution. Building Information Modeling (BIM) enables precise scaffolding layouts and load assessments. The Latin America Modular & System Scaffolding Market responds by aligning system designs with BIM compatibility. It improves pre-construction planning and risk mitigation. Project teams can simulate structural needs and optimize material use. This trend enhances stakeholder collaboration through centralized data models. Digital workflows also support predictive maintenance of scaffolding assets.

- For instance, Autodesk BIM 360’s Model Coordination module offers integrated 4D scheduling and 5D cost management within a cloud-collaborative BIM workflow, enabling automated clash detection and issue tracking across disciplines. Studies show that BIM coordination can reduce design errors by ~30%, RFIs by ~25%, and project timelines by up to 35%.

Rental-Based Scaffolding Services Gain Momentum Across Mid-Sized Projects

Contractors increasingly prefer rental over ownership due to budget constraints and short project cycles. Scaffolding rental services offer flexible deployment options and reduce capital expenditures. The Latin America Modular & System Scaffolding Market sees higher engagement from rental firms offering engineered systems. It helps contractors avoid storage and maintenance costs. Rental providers also ensure compliance with updated standards. This trend encourages system standardization and wider access to advanced configurations. Mid-sized firms find rentals ideal for scaling operations.

- For instance, United Rentals provides scaffolding rental services in strict alignment with OSHA scaffold regulations (29 CFR 1926 Subpart L), including trained staff inspections and setup guidance during each rental cycle.

Growing Use of Lightweight Composite Materials for Modular Systems

The industry is witnessing material innovation to reduce system weight without compromising strength. Lightweight alloys and composite panels are replacing heavier steel components. The Latin America Modular & System Scaffolding Market adopts these materials to improve transport and assembly speed. It enables safer handling and lower logistical costs. Lighter systems increase worker efficiency, especially in hard-to-reach zones. Manufacturers test composite-based systems for durability under varied site conditions. The trend supports green construction objectives through material optimization.

Emphasis on Rapid Assembly and Dismantling for Time-Sensitive Projects

Construction schedules are becoming tighter due to rising urban congestion and project penalties. Contractors seek scaffolding that minimizes downtime and labor requirements. The Latin America Modular & System Scaffolding Market answers this need with quick-lock mechanisms and pre-engineered connections. It improves productivity during installation and removal. Modular kits reduce reliance on skilled labor. Rapid setup ensures minimal site disruption in busy locations. System versatility enhances on-site task sequencing and equipment coordination.

Market Challenges Analysis

Fragmented Regional Standards and Inconsistent Adoption of Quality Systems

Scaffolding safety standards vary significantly across Latin American countries. The lack of unified regulatory frameworks creates uncertainty among vendors and users. The Latin America Modular & System Scaffolding Market contends with inconsistent inspection protocols and certification processes. It makes regional expansion complex for international suppliers. Smaller contractors may ignore quality benchmarks to reduce costs. This hampers adoption of modular systems that comply with higher safety requirements. In some areas, outdated wooden or tubular structures remain in use despite known risks.

Economic Instability and Construction Budget Constraints Impact Market Growth

Fluctuations in currency, inflation, and public funding affect construction activity. Government-backed infrastructure projects often face delays or cancellations due to fiscal constraints. The Latin America Modular & System Scaffolding Market experiences slowdown when capital-intensive projects are deferred. Private developers also reduce construction timelines and scale to manage financial risk. High initial costs of modular systems discourage adoption in price-sensitive segments. Import tariffs on scaffolding components can increase overall project budgets and limit system imports.

Market Opportunities

Expansion of Public-Private Partnerships for Infrastructure Modernization

Governments across Latin America are entering joint ventures with private firms to rebuild aging transport and utility infrastructure. These collaborations generate long-term projects with defined safety mandates. The Latin America Modular & System Scaffolding Market can capitalize on such developments through compliant, scalable system offerings. It enables scaffolding providers to engage in multi-phase developments. Public-private models reduce payment risk and support structured procurement cycles. Firms that offer technical training and after-sales support gain a competitive edge in bidding.

Growing Demand for Customized Scaffolding in Renewable Energy Projects

Wind and solar energy installations require highly specific scaffolding platforms for tower and panel assembly. Project developers seek lightweight, corrosion-resistant systems that function in remote or uneven terrains. The Latin America Modular & System Scaffolding Market sees potential in tailoring products for this niche. It supports new revenue streams in sustainable construction. Companies that develop modular kits aligned with renewable project standards attract long-term contracts. Specialized scaffolding fosters brand loyalty in emerging energy sectors.

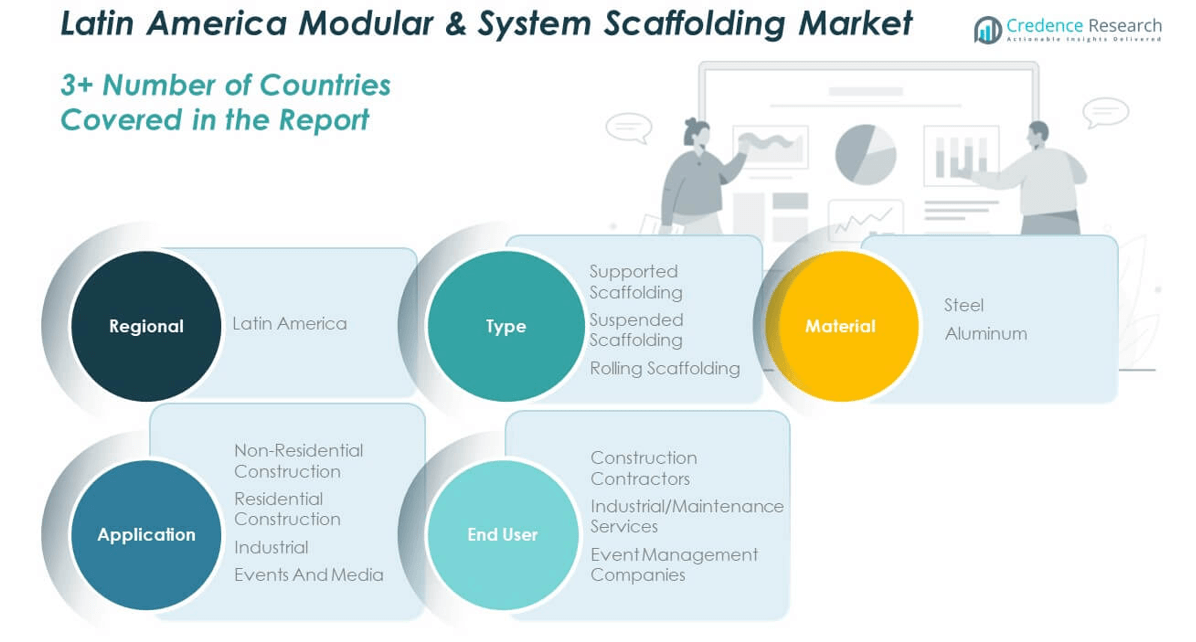

Market Segmentation Analysis:

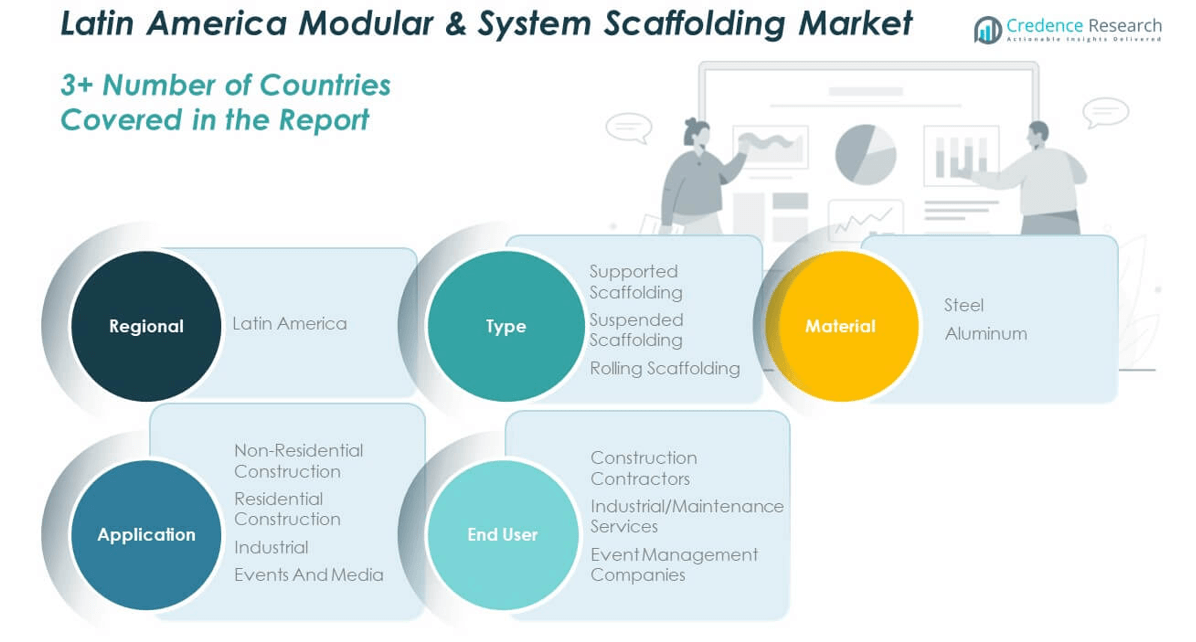

The Latin America Modular & System Scaffolding Market is segmented

By type, material, application, and end user. Supported scaffolding leads the type segment due to its widespread use in large-scale construction and infrastructure projects. Suspended scaffolding finds adoption in high-rise building maintenance and façade work, while rolling scaffolding caters to mobile requirements in interior works and lightweight industrial tasks.

- For instance, ULMA Construction offers high‑load formwork and scaffold systems such as the MK Carriage and BRIO scaffold used in tunnel, bridge, and civil engineering infrastructure globally.

By material, Steel dominates the material segment, driven by its durability, strength, and suitability for heavy-duty applications. Aluminum is gaining traction in applications that demand lightweight structures and easy mobility, particularly in small-scale and temporary setups.

- For instance, Harsco Infrastructure offers steel-based Cuplock scaffolding systems featuring integral cup-lock joints at 500 mm spacing, robust ANSI-compliant steel construction, and capacity for heavy-duty load-bearing assemblies.

By application, non-residential construction accounts for a major share due to ongoing commercial and public infrastructure development. Residential construction is expanding steadily with urban housing projects. The industrial segment uses modular scaffolding in plant maintenance and installations, while events and media rely on quick-to-assemble systems for temporary stages and structures.

By end user, construction contractors represent the largest end-user group, followed by industrial and maintenance service providers who use system scaffolds for operational flexibility. Event management companies prefer modular solutions for their adaptability and fast setup times. The Latin America Modular & System Scaffolding Market benefits from rising demand across all end-user categories, with scalability and compliance remaining critical to segment growth.

Segmentation:

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

By Application

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region

- Brazil

- Argentina

- Rest of Latin America

Regional Analysis:

Brazil commands the largest share of the Latin America Modular & System Scaffolding Market, accounting for 38.7% in 2024. Its dominance stems from the country’s extensive infrastructure pipeline and steady investments in residential and commercial construction. Government-backed programs such as housing initiatives and energy projects support strong demand for modular scaffolding systems. Brazil’s industrial sector also contributes through the refurbishment of oil refineries, ports, and manufacturing plants. Leading construction firms in Brazil favor modular systems to comply with evolving safety regulations and reduce project timelines. The country’s large workforce and construction-focused policy measures continue to support market expansion.

Mexico represents the second-largest market in the region, holding a 27.3% share in 2024. It benefits from robust growth in industrial construction, driven by the expansion of automotive plants and logistics facilities. The government’s infrastructure modernization initiatives—particularly in transport and energy—create stable opportunities for scaffolding deployment. The Latin America Modular & System Scaffolding Market sees active adoption in Mexico due to the rising prevalence of turnkey and EPC contractors who prioritize engineered solutions. Scaffolding rental firms are also expanding their networks to serve regional construction hubs. Mexico’s proximity to the U.S. supports steady imports of advanced system components.

Chile, Colombia, and Peru are emerging markets with a combined share of 22.6% in 2024. These countries are witnessing growth in public infrastructure development and private commercial real estate. The mining and energy sectors in Chile and Peru are investing in scaffolding solutions that offer durability and customization. Colombia’s urban housing sector supports the uptake of modular platforms in dense city zones. The Latin America Modular & System Scaffolding Market is expanding in these regions through the entry of regional distributors and localized manufacturing. Growth potential remains high due to increasing foreign direct investments and improved regulatory alignment with international standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Step Up Scaffold

- Catari Industria, S.A.

- BrandSafway

- The Brock Group

- Sunbelt Rentals

- Atlantic Pacific Equipment (AT-PAC)

- Sunshine Enterprise

- ADTO Industrial Group

- Altrad Group

- KHK Scaffolding & Formwork

Competitive Analysis:

The Latin America Modular & System Scaffolding Market features a competitive landscape marked by both global leaders and regional suppliers. Key players such as Layher, PERI, ULMA, and Altrad dominate the market through established distribution networks and scalable product portfolios. These companies invest in product innovation, safety certifications, and technical training to support client adoption. Regional companies compete by offering cost-effective rental services and responsive local support. It remains dynamic, with market participants forming strategic alliances to increase project wins and expand their geographic reach. Suppliers focus on modular versatility and speed of assembly to meet diverse construction needs. Competition intensifies in urban zones where demand for high-performance scaffolding is strongest.

Recent Developments:

- In January 2025, BrandSafway showcased several new solutions at the World of Concrete, notably the Flexi Deck slab formwork system—an innovative, lightweight product exclusive to Aluma Systems, part of the BrandSafway family. Flexi Deck allows for early dismantling of beams and planking and is designed for safe, efficient slab construction. Updates also include enhancements to the QuikDeck Suspended Access System and demonstrations of the SC1000 Voyager™ battery-powered hoist.

- In January 2025, PERI Group announced the launch of two new formwork solutions, SKYFLEX and LEVO, introduced at the World of Concrete 2025 in Las Vegas. These innovative systems demonstrate PERI’s commitment to advancing construction technology and providing safer, more efficient scaffolding solutions to the North American market.

- In April 2025, Layher North America relocated its operational footprint by opening a new scaffolding materials and support facility in Baltimore County. The new location enables Layher to expand its engineering, assembly, storage, and office capabilities in the region, supporting both new and existing clients in North America.

- In April 2025, Atlantic Pacific Equipment (AT-PAC) announced it had completed its integration into Umdasch Industrial Solutions. This follows its acquisition by Doka, a Umdasch Group company, in 2023. The move strengthens AT-PAC’s offering as an end-to-end scaffolding provider for industrial and construction clients across North America, now leveraging increased resources and logistics.

- In Dec 2024, Sunbelt Rentals expanded its sustainable equipment fleet by adding the Bobcat T7X all-electric compact track loaders in California, offering powerful, zero-emission operation. This expansion highlights Sunbelt’s emphasis on carbon reduction and sustainable solutions for its customers

Market Concentration & Characteristics:

The Latin America Modular & System Scaffolding Market displays moderate concentration, with a few multinational firms holding significant influence alongside a large number of small to mid-sized local vendors. It is characterized by project-based procurement cycles, strong rental demand, and growing emphasis on compliance-driven sales. Contractors value suppliers that offer fast delivery, engineering support, and modular design flexibility. Product customization and safety features remain key differentiators. The market evolves with rising adoption in commercial, industrial, and public infrastructure segments. Demand fluctuations are closely tied to government infrastructure budgets and private sector investments. Companies that offer training, on-site assistance, and post-project support are gaining a competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will benefit from ongoing urbanization and increased investment in high-rise residential and commercial developments.

- Demand for engineered scaffolding systems will rise due to stricter safety regulations across construction sectors.

- Rental-based business models will expand as contractors prioritize flexibility and cost-efficiency.

- Growth in public-private infrastructure projects will create long-term opportunities for modular system providers.

- Adoption of digital construction tools like BIM will influence product design and pre-planning services.

- Industrial sectors, including oil, gas, and utilities, will drive demand for heavy-duty and customized scaffolding solutions.

- Local manufacturers are expected to increase market share by offering region-specific, cost-effective systems.

- Emerging economies within the region will see faster adoption due to foreign investments in infrastructure.

- Sustainability goals will encourage the use of recyclable and lightweight materials in scaffolding systems.

- Expansion of training and certification programs will improve end-user awareness and increase compliance-driven purchases.