Market Overview:

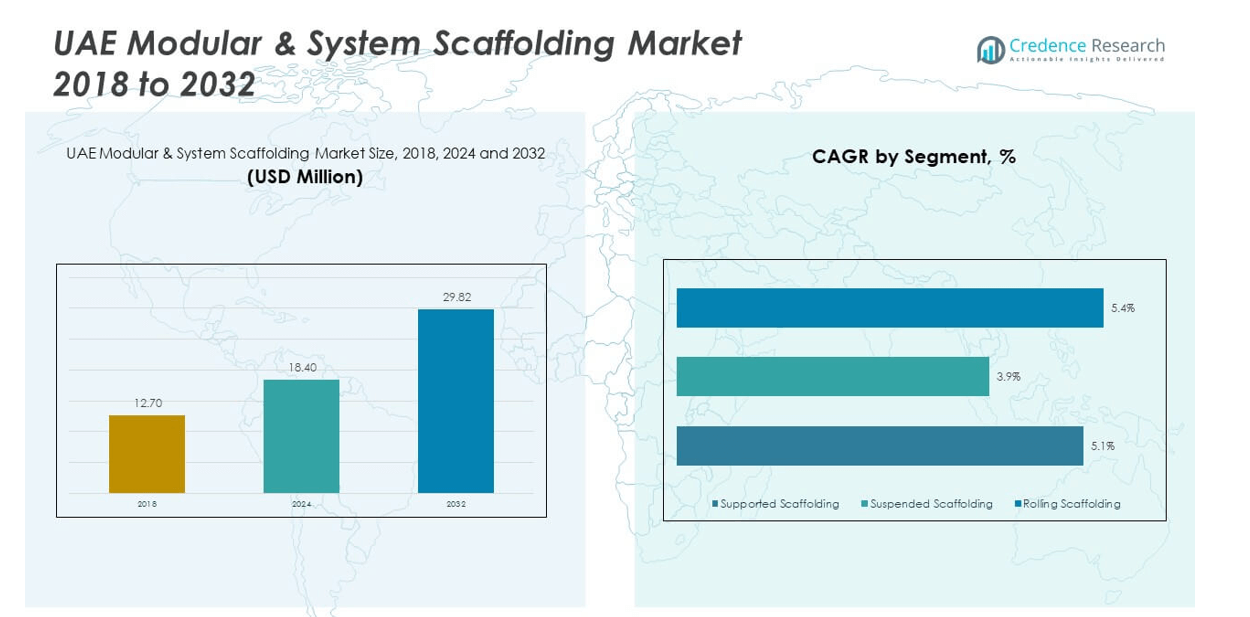

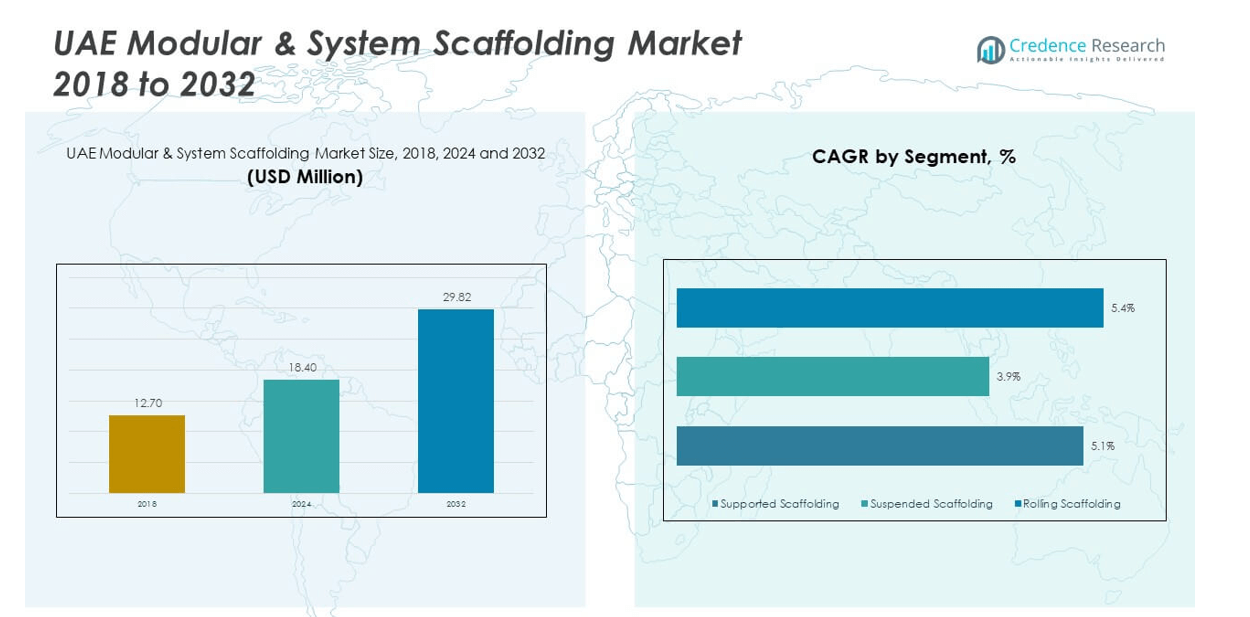

The UAE Modular & System Scaffolding Market size was valued at USD 12.70 million in 2018 to USD 18.40 million in 2024 and is anticipated to reach USD 29.82 million by 2032, at a CAGR of 6.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Modular & System Scaffolding Market Size 2024 |

USD 18.40 million |

| UAE Modular & System Scaffolding Market, CAGR |

6.27% |

| UAE Modular & System Scaffolding Market Size 2032 |

USD 29.82 million |

The market growth is primarily driven by ongoing infrastructure development, large-scale construction projects, and the UAE government’s strategic initiatives to diversify the economy beyond oil. Urbanization and investments in commercial and residential buildings are fueling demand for safe and efficient scaffolding solutions. Additionally, stringent safety regulations and the push for productivity in construction activities have encouraged the adoption of modular and system scaffolding due to their enhanced flexibility, time-efficiency, and reduced labor requirements.

Regionally, the market is most active in key urban centers like Dubai and Abu Dhabi, where major construction and infrastructure development activities are concentrated. These regions continue to lead due to robust investments in tourism, commercial real estate, and transportation projects. Emerging areas such as Sharjah and Ras Al Khaimah are gradually gaining traction as government-backed development plans and industrial expansions boost demand. The market’s regional dynamics are shaped by population growth, urban planning efforts, and the strategic role of the UAE as a hub for Gulf-wide infrastructure projects.

Market Insights:

- The UAE Modular & System Scaffolding Market was valued at USD 18.40 million in 2024 and is projected to reach USD 29.82 million by 2032, growing at a CAGR of 6.27%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Increasing infrastructure development and commercial construction projects are significantly boosting demand for modular scaffolding systems.

- Regulatory mandates enforcing safety and structural integrity are encouraging wider adoption of standardized system scaffolding.

- High raw material costs and import dependency are creating pricing volatility and procurement challenges for local players.

- Dubai remains the leading regional market, driven by high-rise developments, smart city initiatives, and sustained tourism infrastructure growth.

- Emerging regions like Sharjah and Ras Al Khaimah are witnessing gradual demand growth due to industrial diversification and housing projects.

- The market is shifting toward digital-ready scaffolding systems and rental-based models to improve flexibility and reduce operational costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Robust Investment in Infrastructure and Mega Projects Accelerating Demand for Scaffolding Solutions

The UAE government continues to invest in large-scale infrastructure initiatives under its national development agenda, spurring construction activity across transportation, energy, and real estate sectors. Projects like Etihad Rail and the expansion of Dubai Metro demand high-volume, efficient scaffolding systems. These undertakings require modular scaffolding due to its adaptability and safety standards. It is preferred for fast-paced environments, enabling contractors to meet project timelines. The UAE Modular & System Scaffolding Market benefits from growing public-private partnerships and foreign direct investments. The UAE’s ambition to become a global hub for logistics and tourism increases the demand for quality scaffolding systems. High-rise buildings, smart city developments, and hospitality projects are boosting systemized scaffolding demand. This infrastructure momentum positions modular scaffolding as a critical enabler of modern construction workflows.

Strict Safety Regulations and Quality Standards Encouraging System Adoption

The UAE enforces rigorous health and safety regulations in the construction sector, compelling developers to adopt certified and secure scaffolding solutions. Regulatory bodies such as the Ministry of Human Resources and Emiratisation have intensified on-site safety inspections. These efforts drive adoption of system scaffolding, which minimizes risks through improved structural stability and engineered design. Contractors seek to avoid penalties and delays by ensuring compliance with safety norms. It promotes consistent demand for modular solutions with reliable load capacity and ease of installation. The UAE Modular & System Scaffolding Market is responding to this with certified products and training initiatives. Global and local suppliers are aligning product offerings to adhere to UAE safety benchmarks. This trend encourages industry-wide upgrades in scaffolding practices.

- For example, Layher products are manufactured under a DIN EN ISO 9001-certified quality management system, ensuring consistent safety and production standards across all regional operations including Turkey and the Middle East.

Increasing Labor Efficiency and Project Timelines Favoring Modular Solutions

The industry’s focus on cost and labor optimization has triggered a shift from traditional tube-and-coupler scaffolds to modular scaffolding systems. Modular scaffolds require less time and manpower for assembly and dismantling, directly reducing labor costs. They also minimize operational downtime, allowing faster project completion. Developers prioritize modular systems to meet tight deadlines, especially in fast-paced urban environments. It offers repeatable configurations and greater reuse, improving project cost control. The UAE Modular & System Scaffolding Market is experiencing rising interest from contractors who prioritize operational efficiency. The economic advantage of lower labor reliance supports demand in both public and private projects. Market participants continue to invest in automation-ready and easy-to-erect scaffolding innovations.

Technological Integration Enhancing Scaffolding System Capabilities

The integration of digital technologies like Building Information Modeling (BIM) and smart sensors is redefining scaffolding planning and monitoring. Digital modeling allows precise scaffolding layouts, reducing errors and enhancing safety. Sensor-equipped systems help track structural integrity and detect load imbalances in real time. These innovations increase operational reliability and reduce project liabilities. The UAE Modular & System Scaffolding Market is evolving with a strong emphasis on digital transformation. Contractors prefer solutions that integrate with digital project management systems. Demand is shifting toward providers offering data-enabled scaffolding components. The ability to track productivity and site safety through technology is becoming a key differentiator. These innovations are critical to meeting the region’s construction digitization goals.

- For example, Doka’s DokaXact Load & Pressure sensor technology enables real-time monitoring of formwork tie loads and fresh concrete pressure for enhanced safety and schedule accuracy on major infrastructure projects. The company also uses proprietary AI to automate material counting in its yards, tracking over 1.5 million items with 98% accuracy.

Market Trends:

Shift Toward Green Building Practices Influencing Material Choices

Sustainability has emerged as a central pillar in the UAE’s construction strategy, impacting scaffolding system preferences. Developers are seeking recyclable and reusable scaffolding materials to align with LEED and Estidama guidelines. Aluminum-based modular systems are gaining traction due to their lighter weight and recyclability. It supports sustainability mandates without compromising strength and durability. The UAE Modular & System Scaffolding Market is observing a growing inclination toward eco-friendly scaffold designs. Government initiatives to reduce construction-related carbon emissions support this trend. Manufacturers are introducing green-certified scaffolding solutions tailored for environmentally conscious projects. This shift is expected to redefine procurement practices among major contractors.

Rising Prevalence of Rental-Based Scaffolding Business Models

The increasing cost pressure on construction firms has accelerated the preference for scaffolding rentals over ownership. Rental services offer flexibility, maintenance support, and inventory scalability without capital expenditure. Many contractors are opting for short-term rental agreements that align with project timelines. It enables firms to maintain financial agility during project execution. The UAE Modular & System Scaffolding Market is witnessing expansion in scaffolding rental networks. Rental providers are diversifying their inventory with modular and quick-assembly systems. Competitive rental pricing and value-added services are becoming core differentiators. This trend enhances accessibility to advanced systems, even for small to mid-sized contractors.

- For example, Ace Aluminium Scaffolding (Abu Dhabi/Dubai) operates a substantial rental fleet of aluminium mobile scaffold towers including single-width, double-width, folding, podium, stairway, and bridge-type models and provides erection and dismantling services. Their towers are built to the BS EN 1004 standard, support up to 270 kg per platform, and can reach working heights up to 17 m.

Growing Use of Lightweight and Ergonomic Scaffold Designs

Contractors are demanding scaffold systems that enhance ease of mobility, minimize manual strain, and simplify on-site handling. Lightweight scaffold components are increasingly preferred in residential and interior fit-out projects. Ergonomic designs reduce assembly complexity and improve worker safety. It allows for seamless deployment in confined or irregular workspaces. The UAE Modular & System Scaffolding Market is responding with product innovations that focus on weight reduction and modularity. Manufacturers are introducing compact solutions tailored for mid-rise and interior refurbishments. These systems support agile construction workflows and reduce installation overhead. The trend reflects a shift toward labor-friendly and productivity-oriented scaffolding tools.

- For instance, Al Mateen Scaffolding Industries LLC (Sharjah) manufactures aluminum mobile scaffold towers including single-width and foldable types certified to EN 131 and EN 1004 standards. These lightweight systems are engineered for rapid handling and adaptability, making them well-suited for interior fit-outs and mid-rise refurbishment applications.

Expansion of Integrated Scaffolding and Access Solutions

Contractors are opting for scaffolding systems that offer combined access, work platforms, and mobility features. Integrated systems improve on-site logistics and reduce equipment fragmentation. Demand is rising for multifunctional solutions that accommodate material hoisting, suspended workstations, and guardrail integration. It addresses the growing need for holistic access control and site management. The UAE Modular & System Scaffolding Market is adapting to offer bundled services combining scaffolding with elevators, stair towers, and safety nets. Suppliers who offer complete site access solutions gain competitive leverage. The market is shifting from isolated scaffolding products to ecosystem-based offerings that support comprehensive site efficiency.

Market Challenges Analysis:

Cost Volatility in Raw Materials and Supply Chain Disruptions Limiting Market Stability

Fluctuating prices of steel and aluminum have led to unpredictable input costs for scaffolding manufacturers. This volatility complicates budgeting for both suppliers and end-users, particularly in long-term infrastructure projects. Contractors face challenges in cost estimation and risk management during procurement planning. The UAE Modular & System Scaffolding Market is affected by global supply chain disruptions, which delay deliveries and raise logistics expenses. Regional conflicts and maritime freight instability further impact the availability of imported components. Price-sensitive segments such as small construction firms hesitate to adopt premium modular systems due to affordability concerns. The market requires stable material sourcing and regional stockpiles to mitigate price shocks. Overdependence on foreign suppliers increases exposure to economic and geopolitical risk.

Fragmentation of Standards and Limited Skilled Workforce Hampering Adoption

Despite regulatory efforts, inconsistencies in scaffolding installation standards across projects persist, affecting system compatibility and safety practices. The market lacks a uniform code for modular scaffolding implementation, leading to varying performance outcomes. It limits the potential benefits of system interoperability and reuse. The UAE Modular & System Scaffolding Market also faces a skilled labor gap in modular system handling. Workers trained in conventional scaffolding methods may struggle with newer, precision-based modular systems. Employers must invest in ongoing training to ensure compliance and productivity. These challenges slow down market penetration, especially among mid-size contractors. Addressing these gaps is critical for the safe and efficient deployment of modular solutions.

Market Opportunities:

Integration with Smart Cities and Urban Redevelopment Plans Creating New Growth Avenues

The UAE’s Smart City roadmap and focus on digital infrastructure provide a promising avenue for scaffolding system providers. Scaffolding is crucial in retrofitting aging buildings and supporting modular vertical expansions in urban centers. The UAE Modular & System Scaffolding Market can benefit from aligning with urban regeneration and digitization programs. Suppliers that cater to mixed-use developments and intelligent building requirements will capture demand from integrated township projects.

Opportunity to Expand Through Local Manufacturing and Rental Expansion

Establishing local manufacturing facilities for scaffolding components can reduce import dependency and improve supply reliability. This enhances responsiveness to project timelines and quality expectations. Scaffolding rental networks also present an opportunity to penetrate the SME segment, enabling broader access to advanced systems. The UAE Modular & System Scaffolding Market has room to grow by combining localized production with strategic rental partnerships.

Market Segmentation Analysis:

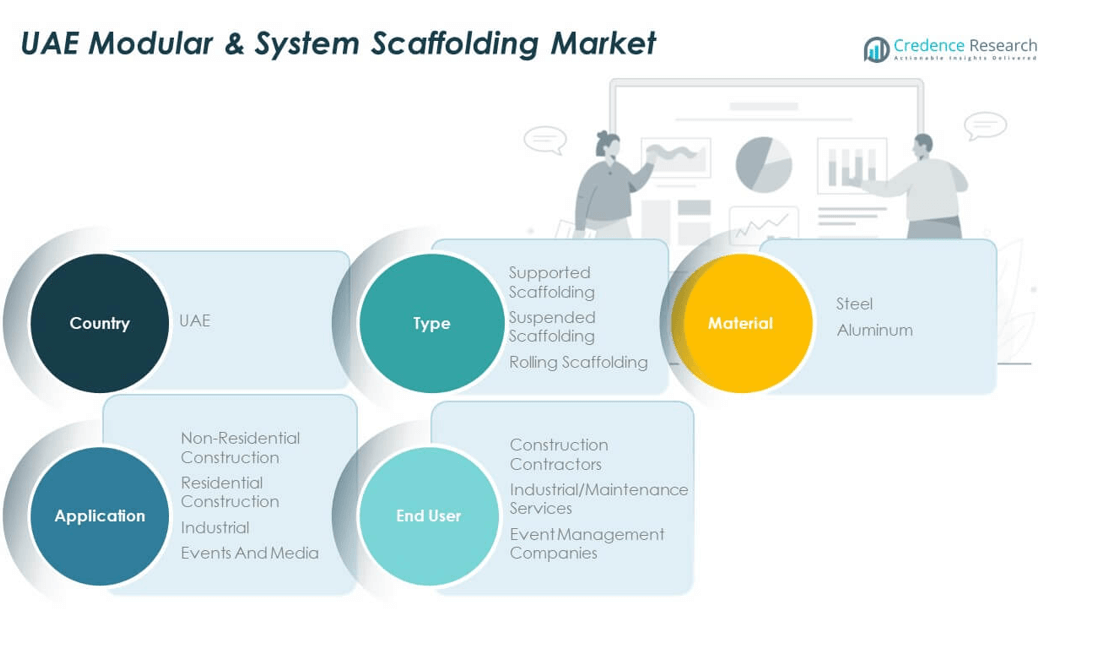

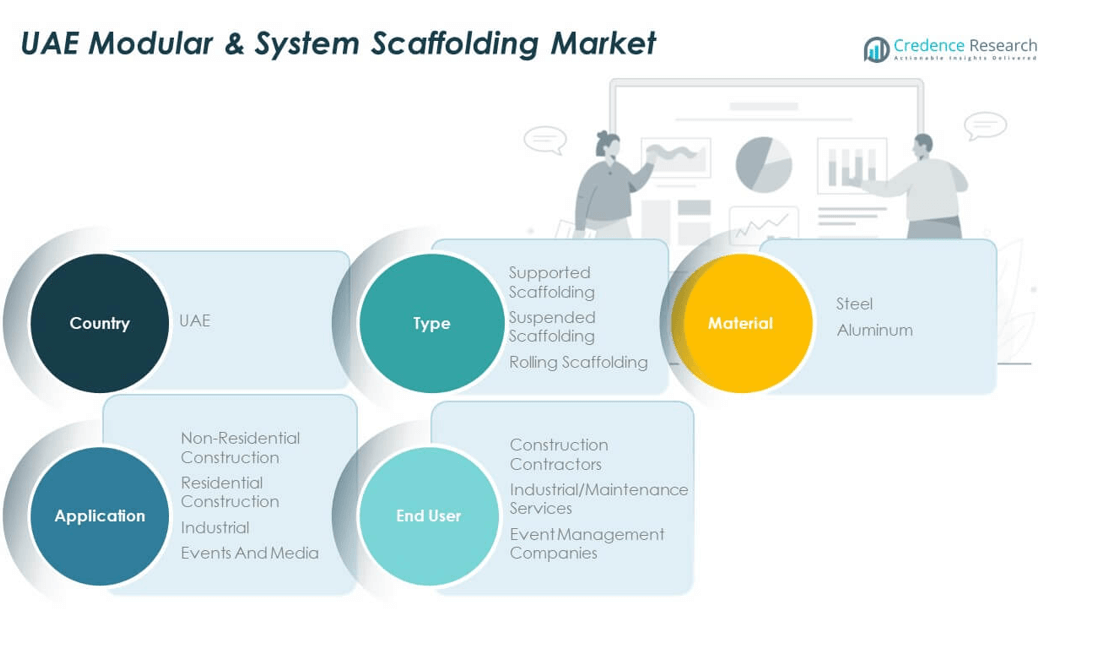

The UAE Modular & System Scaffolding Market is segmented

By type into supported scaffolding, suspended scaffolding, and rolling scaffolding. Supported scaffolding leads the segment due to its widespread use in large-scale construction and infrastructure projects. Suspended scaffolding is gaining traction in high-rise maintenance and façade work, while rolling scaffolding serves compact indoor projects requiring mobility and ease of access.

By material, the market is divided into steel and aluminum. Steel scaffolding dominates due to its strength and load-bearing capacity, preferred for high-rise and industrial use. Aluminum scaffolding is growing in demand due to its lightweight nature, corrosion resistance, and ease of assembly, supporting trends in quick deployment and ergonomic handling.

- For instance, Harsco Infrastructure (now part of Brand Infrastructure Services) provided scaffolding and formwork solutions in the UAE—including Abu Dhabi—and specializes in heavy-duty steel Cuplock and supported scaffolding capable of handling industrial load demands.

By Application-wise, the UAE Modular & System Scaffolding Market is driven primarily by non-residential construction, followed by industrial and residential sectors. Events and media contribute marginally but show potential due to rising demand for temporary structures.

- For example, EGA’s contractor safety protocol (“The Green Book”) mandates rigorous scaffolding and access standards during maintenance shutdowns, emphasizing reliable equipment, risk assessment, and compliance with international safety norms.

By end users, construction contractors represent the largest share, with industrial/maintenance services and event management companies forming emerging user bases. Each segment reflects specific usage patterns aligned with project needs, regulatory norms, and material performance.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

Regional Analysis:

Dubai holds the largest share of the UAE Modular & System Scaffolding Market, accounting for 48% of the total market in 2024. Its dominance stems from ongoing mega infrastructure developments, high-rise commercial towers, hospitality projects, and continuous urban expansion. Expo 2020’s legacy projects and Dubai’s Smart City vision have fueled sustained construction demand. Contractors in the region are adopting modular scaffolding for high productivity and regulatory compliance. Dubai’s leadership in tourism, logistics, and real estate continues to create favorable conditions for market growth. It remains the epicenter of innovation and large-scale scaffolding system deployments.

Abu Dhabi ranks second with a 32% share in the UAE Modular & System Scaffolding Market. Government investments in oil and gas infrastructure, residential expansion, and industrial development sustain scaffolding demand across the emirate. The city’s commitment to Vision 2030 and sustainable urban planning drives public sector-led construction. Modular systems are gaining traction across government-backed housing projects and strategic transport networks. Abu Dhabi’s emphasis on long-term infrastructure reliability encourages the use of advanced scaffolding technologies. It plays a vital role in supporting offshore construction and oil facility maintenance, where safety and efficiency are critical.

Sharjah and the Northern Emirates collectively hold a 20% share, representing an emerging growth frontier in the UAE Modular & System Scaffolding Market. These regions are benefiting from government incentives aimed at decentralizing industrial activity and promoting regional development. Mid-scale residential and mixed-use developments in Sharjah are steadily increasing demand for cost-effective modular scaffolds. Ras Al Khaimah and Fujairah are witnessing gradual industrial growth, contributing to modest but rising scaffolding adoption. It presents a favorable environment for rental services and local scaffolding suppliers to expand their footprint. The overall regional balance highlights a strong core in Dubai and Abu Dhabi, with emerging momentum in the Northern Emirates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Capital Scaffolding CO. LLC

- Fitwell Scaffolding LLC

- Forever Scaffolding and Contracting

- Al Bawadi Metals

- Finomax Scaffolding

- Spar Steel (Sparsteel)

- Al Jonoub Scaffolding

- Dubai Scaffolding Company

- Al Bader Scaffolding

- Al Rajhi Scaffolding

Competitive Analysis:

Key international scaffold providers such as Layher, Safway (BrandSafway), PERI, ULMA Group, ADTO Group and Waco Kwikform vie for market share through broad product lines, innovation and service strength. Layher garners attention for its advanced modular designs and engineering performance, while Safway leverages its global service network and strong rental offerings. PERI and ULMA maintain presence with robust R&D, certification credentials and project-level support, securing contracts in high‑specification infrastructure. ADTO Group and Waco Kwikform attract customers via regional responsiveness and turnkey scaffolding access systems. Competition centers on quality, compliance and product range. It influences pricing dynamics, pushing providers to differentiate through safety certification, digital integration and customer support. The UAE Modular & System Scaffolding Market faces pressure from these global players and local specialists, which intensify innovation cycles and elevate service expectations.

Recent Developments:

- In April 2025, Doka unveiled its innovative Multi‑Purpose Beam System (MPBS) at bauma, introducing a modular scaffolding breakthrough tailored for diverse UAE construction sites. The MPBS enables longer structural spans, fewer components, and seamless integration with existing Ringlock systems to enhance onsite efficiency.

- In February 2023, Doka completed the full acquisition of scaffolding specialist AT‑PAC, integrating its product lines and global customer base. This strategic move cemented Doka’s position in the industrial scaffolding space and expanded its modular scaffolding capabilities across the Gulf region, strengthening its footprint in the UAE Modular & System Scaffolding Market.

Market Concentration & Characteristics:

The UAE Modular & System Scaffolding Market remains moderately concentrated, featuring several major manufacturers and rental firms alongside local suppliers. Global names such as Layher, PERI, ADTO and ULMA dominate significant market share through established distribution and technical capability. Local players focus on project-specific customization and rapid delivery, addressing SMEs and mid‑tier construction firms. Market traits include strong emphasis on certified safety, modular design versatility and technology integration. Suppliers differentiate via digital tools and value‑added services like training. Competitive actions include strategic partnerships and selective consolidation. It drives evolution toward more integrated offerings. Market structure supports innovation but pressure from global leaders keeps price sensitivity tight and customer requirements high.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience steady growth driven by large-scale infrastructure and commercial real estate projects.

- Adoption of modular scaffolding systems will rise due to increasing demand for speed, safety, and labor efficiency.

- Smart city developments and urban renewal plans will continue to generate sustained scaffolding demand.

- Government regulations enforcing site safety and structural compliance will shape procurement patterns.

- Digital integration, including BIM compatibility and sensor-based monitoring, will gain more traction.

- Rental-based business models will expand, particularly among small and medium construction firms.

- Sustainable and lightweight scaffolding materials will see increased preference in green projects.

- Market players will invest in local manufacturing and regional partnerships to improve supply chain agility.

- Training programs and workforce development initiatives will be crucial to support modular system deployment.

- Competitive dynamics will intensify, pushing companies to innovate through service, design, and technology.