Market Overview:

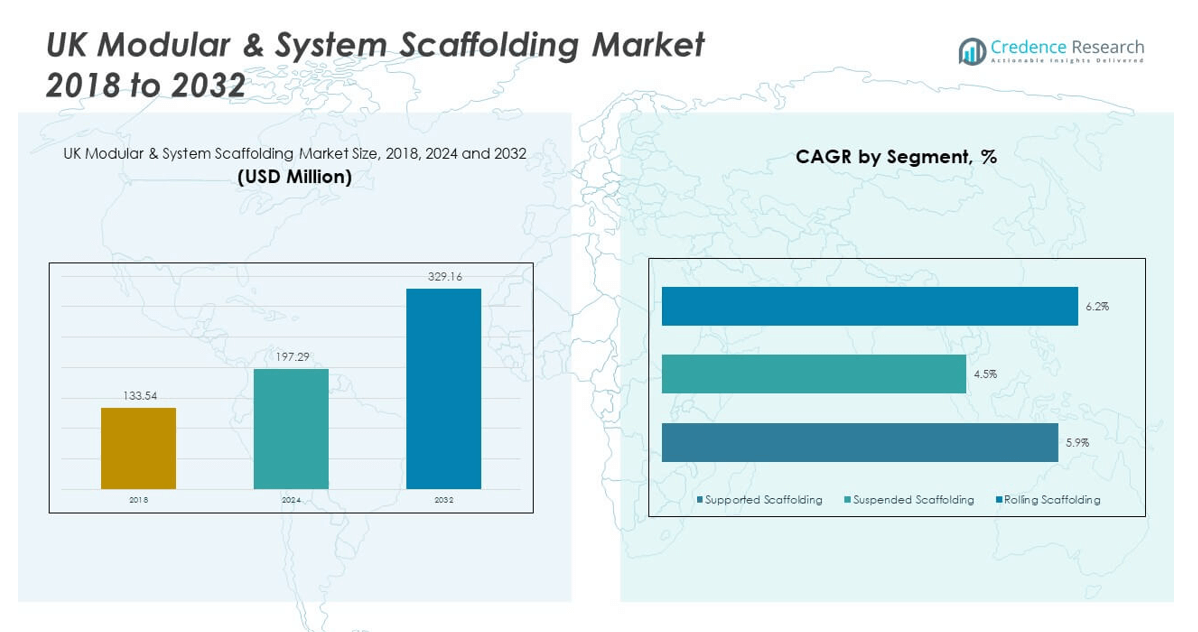

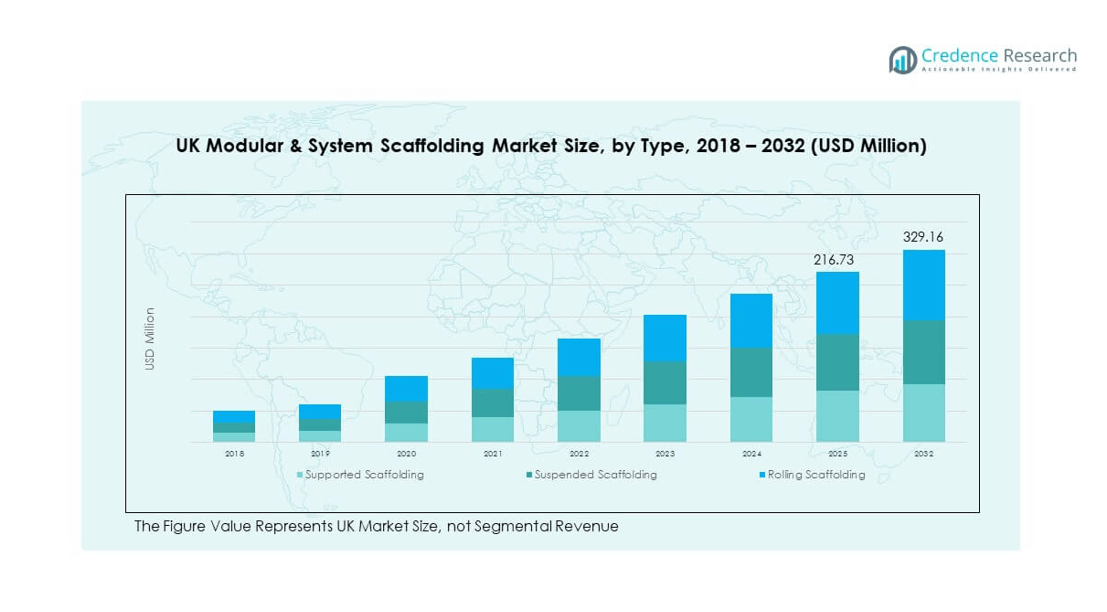

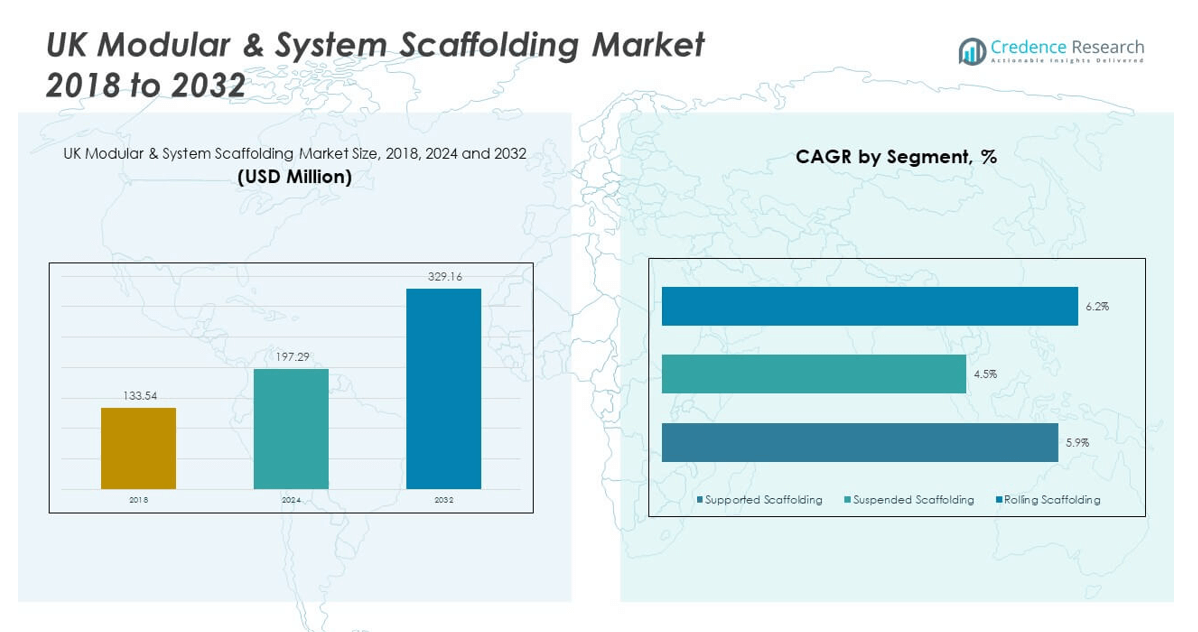

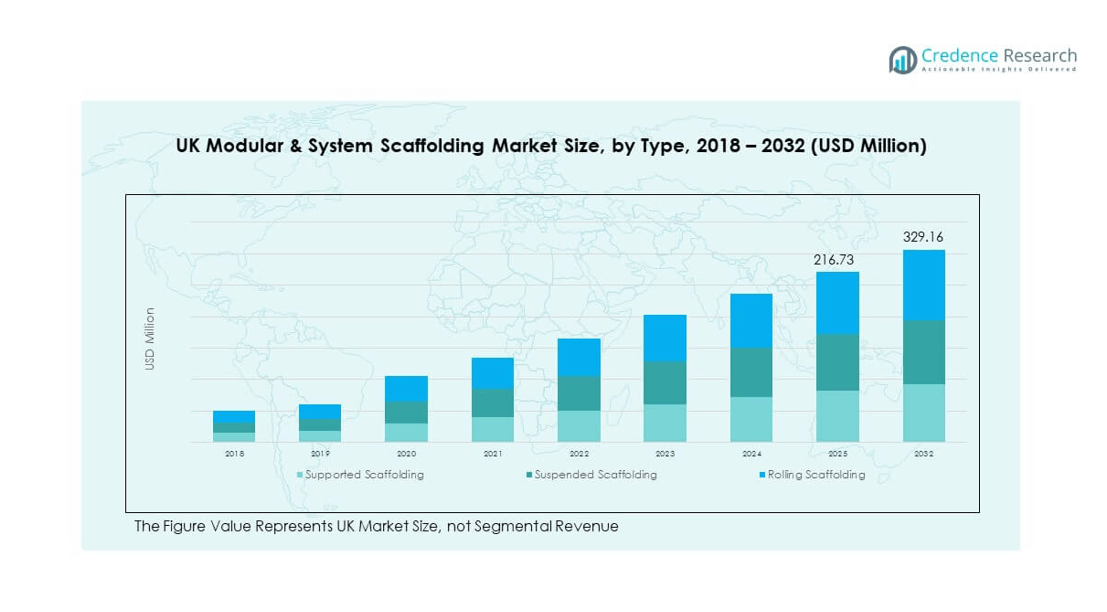

The UK Modular & System Scaffolding Market size was valued at USD 133.54 million in 2018 to USD 197.29 million in 2024 and is anticipated to reach USD 329.16 million by 2032, at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Modular & System Scaffolding Market Size 2024 |

USD 197.29 million |

| UK Modular & System Scaffolding Market, CAGR |

6.62% |

| UK Modular & System Scaffolding Market Size 2032 |

USD 329.16 million |

The market is witnessing strong growth driven by rapid urban infrastructure development, increasing investments in residential and commercial construction, and rising emphasis on worker safety and efficient project execution. Modular and system scaffolding solutions offer enhanced flexibility, faster assembly, and reusability, which are becoming crucial for contractors seeking cost-effective and time-saving solutions. Additionally, regulatory compliance and stricter safety norms are pushing construction firms to adopt advanced scaffolding systems over traditional methods. The refurbishment of aging infrastructure and expansion of industrial facilities also contribute to the growing demand.

Regionally, England dominates the UK Modular & System Scaffolding Market due to its high concentration of construction activities in urban hubs such as London, Manchester, and Birmingham. These cities lead in infrastructure upgrades, public transport development, and commercial real estate expansion. Scotland and Wales are emerging markets, supported by regional construction programs, industrial project investments, and government-led infrastructure renewal initiatives. The presence of major contractors and increasing regulatory oversight across all UK nations is fostering widespread adoption of standardized scaffolding solutions.

Market Insights:

- The UK Modular & System Scaffolding Market size was valued at USD 133.54 million in 2018 to USD 197.29 million in 2024 and is anticipated to reach USD 329.16 million by 2032, at a CAGR of 6.62% during the forecast period.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Rapid urban redevelopment, public infrastructure upgrades, and commercial construction projects are driving market expansion.

- Demand for safer, modular, and reusable scaffolding systems is rising due to stricter construction safety regulations.

- High upfront costs and limited access to advanced systems remain major barriers for small contractors and SMEs.

- England dominates the regional landscape with over 63% market share, led by projects in London, Manchester, and Birmingham.

- Scotland and Wales are emerging as secondary growth zones, supported by industrial developments and government-backed housing schemes.

- Shortage of skilled labor for system scaffolding assembly continues to challenge efficient deployment across complex construction sites.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Infrastructure Modernization and Public Sector Development Projects

The UK Modular & System Scaffolding Market benefits significantly from the country’s robust infrastructure development plans. Government-backed regeneration initiatives and large-scale transportation upgrades have increased scaffolding demand across public works. Projects like railway electrification, bridge maintenance, and hospital upgrades require scalable and safe access solutions. Modular scaffolding provides an efficient answer, reducing time spent on site setup. Contractors prefer systems that offer quick assembly and flexibility across project types. With urban population growth, public infrastructure expansion remains a key priority. This sustains long-term demand in the scaffolding industry.

Increased Construction Activities in Residential and Commercial Real Estate Sectors

The resurgence of residential housing projects and commercial complexes has amplified scaffolding demand. Construction companies seek modular systems for high-rise buildings and complex structures due to ease of configuration and stability. Developers invest in efficient and compliant scaffolding systems to meet safety standards and project deadlines. London’s vertical construction boom underscores the market’s momentum in metro areas. Commercial hubs like Manchester and Birmingham are also experiencing rapid growth. The UK Modular & System Scaffolding Market thrives in this environment of sustained construction activity. It aligns with broader urbanization and redevelopment trends.

Emphasis on Worker Safety and Compliance with Stringent Building Regulations

The UK construction sector faces rigorous health and safety mandates that impact scaffolding choices. Organizations prioritize systems with high load capacity, stability, and fall protection features. The modular scaffolding format allows firms to minimize risk while maximizing efficiency. Government authorities impose penalties for non-compliance, encouraging widespread adoption of modern scaffolding. It enables companies to remain competitive without compromising safety. Building codes and safety inspection regimes are growing stricter, particularly for high-risk projects. The UK Modular & System Scaffolding Market responds with innovative, regulation-aligned designs.

- For instance, HAKI’s Universal Gallows scaffolding system (available in steel and aluminum) incorporates integral guardrails and anti‑slip deck boards for enhanced safety and site versatility.

Shift Toward Sustainable Construction Practices and Material Efficiency

Sustainability is influencing material and design choices across construction disciplines. Modular scaffolding supports eco-friendly goals due to its reusability and long lifecycle. Contractors reduce waste and environmental footprint by investing in system scaffolding solutions. Aluminum and galvanized steel are preferred materials for their durability and recyclability. The UK Modular & System Scaffolding Market benefits from alignment with green building certifications. It also appeals to public and private sector clients with environmental compliance goals. The market reflects broader trends in circular construction practices. It positions modular scaffolding as a responsible long-term investment.

- For instance, Altrad Generation offers the Futuro Ring System Scaffold a multidirectional modular system engineered for rapid assembly (over 60% faster) and reduced component weight (≈28% lighter than traditional systems), fully compliant with EN 12810/12811 standards.

Market Trends:

Integration of Digital Planning Tools and BIM Compatibility in Scaffolding Design

The industry is embracing digital transformation by incorporating Building Information Modeling (BIM) in scaffolding planning. Contractors use 3D simulations to model scaffold systems with precision before site execution. This enhances safety planning and reduces rework costs. The UK Modular & System Scaffolding Market is aligning with the digital-first approach in construction. BIM-compatible scaffolding designs are gaining preference across public tenders. It helps clients ensure spatial coordination with other trades. Digitization improves project predictability and minimizes downtime. Technology is becoming integral to scaffolding procurement decisions.

Growing Use of Lightweight, High-Strength Alloys to Improve Installation Efficiency

Weight reduction without compromising load capacity is a rising trend in the scaffolding market. Manufacturers are introducing modular systems made from advanced alloys and treated metals. These materials speed up transport and setup, reducing overall project timelines. Contractors benefit from reduced labor intensity and faster dismantling post-completion. The UK Modular & System Scaffolding Market is seeing a shift toward aluminum-dominated systems. It supports safer handling in confined urban environments. Lighter materials also facilitate compliance with new labor safety standards. Material innovation is reshaping system design strategies.

Rising Popularity of Rental Models and On-Demand Scaffolding Services

Construction companies are shifting from outright purchase to renting scaffolding solutions. Rental models offer cost savings, particularly for short-duration or seasonal projects. Equipment leasing firms provide modular units tailored to project scale and timeline. The UK Modular & System Scaffolding Market is adapting to this service-oriented trend. On-demand availability ensures flexibility in response to project delays or scope changes. Companies reduce capital expenditure and avoid long-term storage costs. The rental ecosystem is expanding with value-added services like on-site consultation and assembly.

- For instance, TWICE Commerce offers a unified rental management platform including serialized tracking, detailed maintenance logs, and product condition monitoring well-suited for scaffolding inventory. It enables real-time tracking of individual rental items and availability, helping rental businesses maximize utilization and minimize downtime.

Customization and Project-Specific Engineering for Complex Architectures

Architectural innovation in the UK has led to more complex building geometries. Modular scaffolding providers now offer customizable systems that accommodate curves, angles, and non-linear elevations. The UK Modular & System Scaffolding Market supports bespoke design-to-installation services for these projects. Clients expect scalable solutions that adapt to changing site conditions. Customized scaffolding accelerates workflows for specialized restoration and retrofit jobs. Engineering teams use modular components with adaptable locking mechanisms. This trend reflects growing client expectations around precision and adaptability.

- For instance, Scafom‑rux supplies the RINGSCAFF modular scaffolding system featuring ringlock (RINGSCAFF) connectors, minimal hardware design, and rapid setup to support highly customized installations such as industrial or bridge projects. The system offers exceptional strength, high load-bearing performance

Market Challenges Analysis:

High Initial Investment and Limited Access to Advanced Systems for Small Contractors

While modular scaffolding offers long-term benefits, the upfront investment remains a barrier for smaller construction firms. High costs of advanced systems, accessories, and transportation limit market penetration among SMEs. Many contractors rely on older equipment or temporary solutions due to budget constraints. The UK Modular & System Scaffolding Market experiences an adoption gap between large-scale developers and small firms. Limited financial flexibility delays the shift toward modern systems. Rental alternatives are not always feasible for complex or long-duration projects. The cost of maintenance and storage adds to total ownership burden.

Shortage of Skilled Labor and Rising Training Requirements in System Assembly

Proper assembly of modular scaffolding requires trained personnel familiar with system specifications. A shortage of skilled workers has impacted project timelines and increased operational risk. Employers must invest in ongoing training to meet safety and technical standards. The UK Modular & System Scaffolding Market faces delays and inefficiencies when labor shortages intersect with complex installations. Newer system variants often require specialized know-how, which limits flexibility in staffing. Labor constraints are more severe in rural regions with fewer training centers. Retaining trained workers also presents challenges amid a competitive labor market.

Market Opportunities:

Expansion of Industrial Facilities and Energy Sector Infrastructure Projects

The UK’s industrial and energy sectors are undergoing modernization, creating new scaffolding opportunities. Projects in renewable energy, oil and gas decommissioning, and utility maintenance require safe access structures. The UK Modular & System Scaffolding Market can leverage demand for robust, high-capacity systems tailored to industrial use cases. These projects typically involve long durations, encouraging use of durable and modular designs. Industrial clients prioritize efficiency and compliance, making system scaffolding a preferred choice.

Government Support for Housing and Urban Redevelopment Schemes

National programs aimed at increasing housing stock and upgrading public spaces provide a foundation for scaffolding demand. Urban renewal projects in older neighborhoods require adaptable scaffolding for restoration work. The UK Modular & System Scaffolding Market benefits from policy momentum around affordable housing. Government-backed funding improves project viability, boosting demand across public and private partnerships. Scaffold providers can align offerings with regional urban development plans.

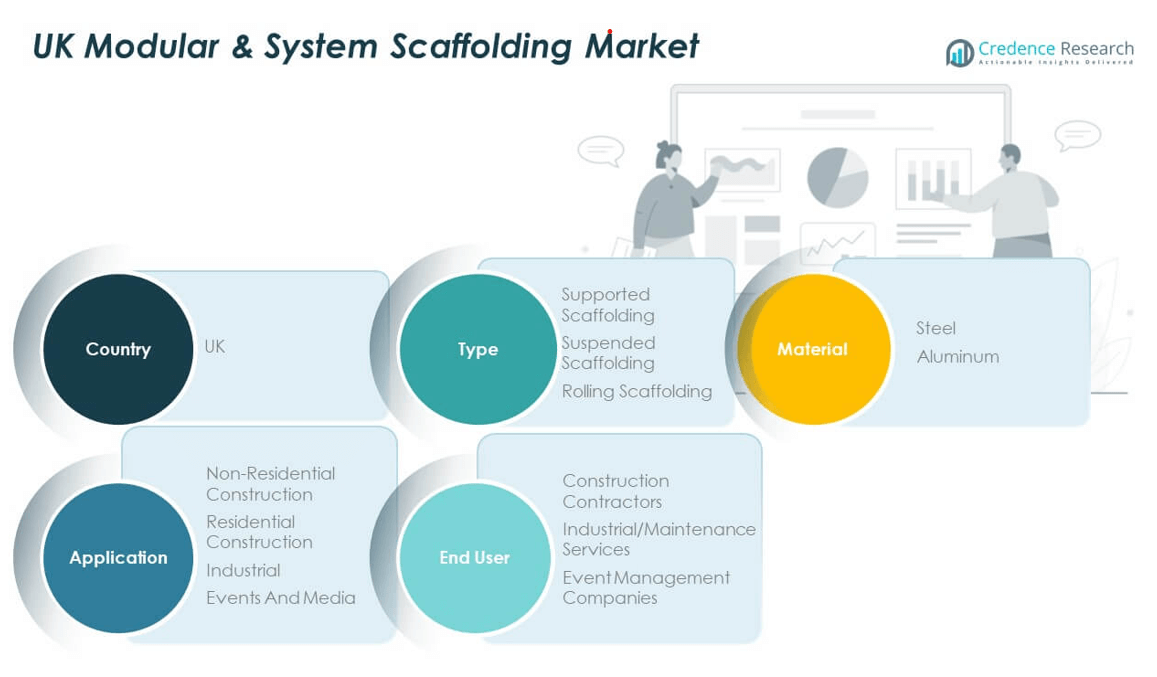

Market Segmentation Analysis:

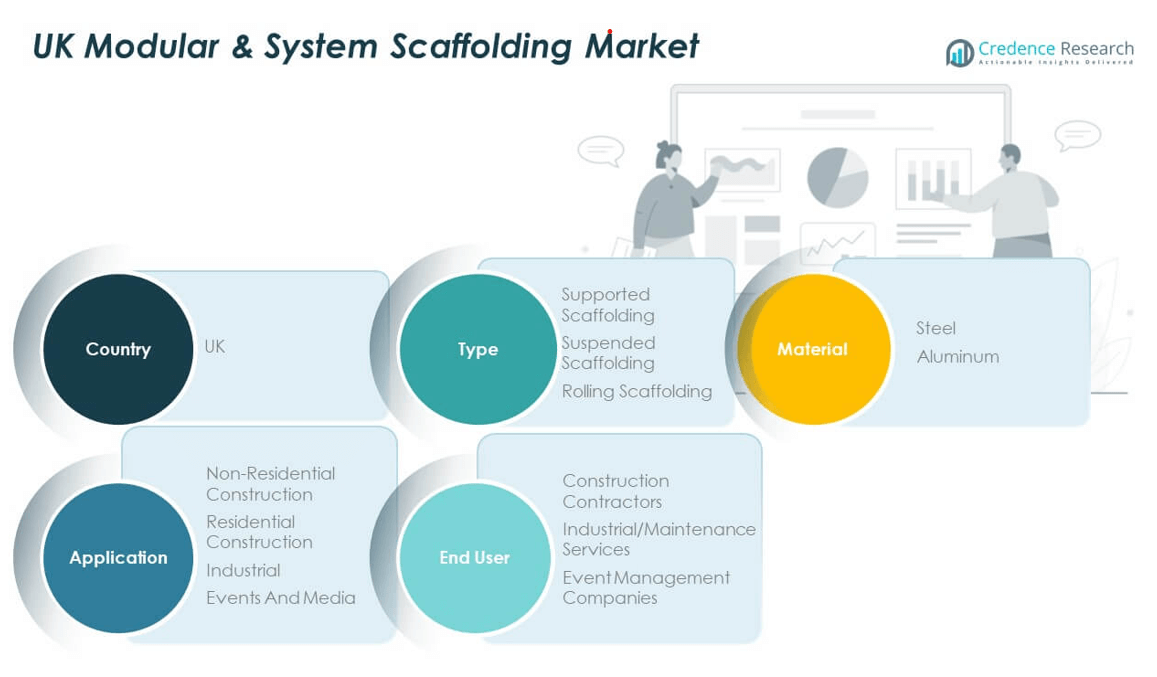

The UK Modular & System Scaffolding Market demonstrates strong segmentation across type, material, application, and end-user categories, each contributing to targeted industry demand.

By type, supported scaffolding dominates due to its widespread use in building construction and refurbishment. Suspended scaffolding finds relevance in high-rise and façade work, while rolling scaffolding appeals to indoor and event-related applications requiring mobility.

By material, steel remains the preferred choice for structural strength, durability, and heavy-duty usage, whereas aluminum scaffolding is gaining traction for projects demanding lightweight and corrosion-resistant solutions.

- For example, BrandSafway’s CupLok® system is a heavy-duty, galvanized steel supported scaffold engineered for large-scale infrastructure applications and offered through the company’s Infrastructure Services Group.

By application, non-residential construction leads the market with consistent demand from commercial and public infrastructure projects. Residential construction is expanding steadily, supported by government-backed housing schemes. Industrial applications rely on modular scaffolding for maintenance in sectors such as energy and manufacturing. Events and media segments utilize these systems for temporary installations and stage setups, contributing niche but consistent growth. The UK Modular & System Scaffolding Market effectively caters to all segments through adaptable solutions designed to meet safety and operational standards.

- For instance, Cape plc has provided scaffolding and access services as part of integrated shutdown and turnaround operations at the Grangemouth refinery, including contracts awarded via AMEC and Ineos.

By end user, construction contractors represent the largest share, driven by ongoing building and renovation projects. Industrial and maintenance service providers use modular systems for access in complex facilities. Event management companies require flexible scaffolding for short-term setups and customized stage configurations. This segmentation highlights the market’s ability to serve a diverse range of needs through versatile and regulation-compliant scaffolding systems.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region:

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis:

England holds the dominant position in the UK Modular & System Scaffolding Market, accounting for over 63% of the total market share in 2024. Its leadership stems from the concentration of infrastructure, commercial real estate, and urban redevelopment projects in cities like London, Manchester, and Birmingham. Major transport upgrades, high-rise developments, and heritage building renovations drive continuous demand. Contractors in these regions adopt modular scaffolding systems for efficiency, regulatory compliance, and tight project timelines. High urban density and skilled labor availability further support system deployment. England’s leadership reflects its role as the core hub for construction activity.

Scotland contributes approximately 19% to the UK Modular & System Scaffolding Market. It is gaining momentum through industrial and energy sector developments, particularly in the Central Belt region including Glasgow and Edinburgh. Ongoing wind energy projects and retrofit works on aging infrastructure are key demand drivers. Scotland’s adoption of modular systems is rising due to harsh weather conditions requiring robust and quick-to-assemble scaffolds. The government’s infrastructure investment plans across public services and housing also support market growth. Contractors prefer system scaffolding for safer and more adaptive execution in diverse terrains.

Wales and Northern Ireland collectively account for around 18% of the market, with Wales leading slightly ahead. Both regions benefit from government-funded construction schemes, social housing expansion, and urban regeneration initiatives. In Wales, Cardiff and Swansea represent key demand centers where modular systems are used in public infrastructure and mixed-use developments. Northern Ireland is witnessing gradual adoption of modular scaffolding driven by modern building regulations and regional redevelopment programs. While these regions lag behind England and Scotland in scale, their growing infrastructure budgets and policy support are laying a foundation for sustained growth in system-based scaffolding solutions. The UK Modular & System Scaffolding Market remains geographically diverse with opportunities across all constituent regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Altrad UK

- Kaefer

- Lyndon SGB

- TRAD Group

- Enigma Industrial

- Alltask

- Brogan Group

- GKR Scaffolding

- Palmers Scaffolding

- PHD Modular Access

Competitive Analysis:

The UK Modular & System Scaffolding Market features a competitive landscape with a mix of multinational players and regional providers. Key companies include PERI Ltd., Layher Ltd., Harsco Infrastructure, Altrad Group, and Generation UK. These firms compete on technological innovation, safety standards, material quality, and rental service models. Leading players invest in modular engineering, digital planning tools, and eco-efficient materials to differentiate their offerings. Mid-sized firms focus on regional project partnerships and customer service. The market rewards operational reliability and compliance with evolving building regulations. It remains moderately consolidated, with top companies capturing significant market share across infrastructure and commercial segments.

Recent Developments:

- In February 2025, Altrad UK made strategic strides by acquiring Stork TS Holdings Limited, which included the Stork UK group of companies. This move significantly expands Altrad’s scale in the UK market, particularly within both offshore and onshore operations, and brings Stork UK’s 1,900 employees into the Altrad business. The same month, Altrad Generation acquired the UK assets and branch operations of Heras Mobile Fencing & Security, broadening its portfolio and market reach in temporary fencing products for construction.

- In February 2025, Lyndon SGB, one of the UK’s largest scaffolding and access companies, changed its trading name to Brand Access Solutions. This rebranding underlines the company’s integration into the BrandSafway group, enhancing its service offerings while maintaining its long-standing legacy and customer base across the UK.

Market Concentration & Characteristics:

The UK Modular & System Scaffolding Market demonstrates moderate concentration, with the top five players accounting for a substantial share of national demand. It is characterized by high safety compliance, modular customization, and strong rental penetration. Manufacturers prioritize rapid deployment systems that cater to varied project scales. Demand peaks in urban and industrial zones, where quick assembly and regulatory adherence are essential. Rental services dominate due to cost efficiency and flexibility. The market favors long-term partnerships and tender-based contracts with public and private developers. Digital integration and tailored engineering solutions continue to reshape product development strategies. Companies also emphasize sustainability and reusability to meet evolving procurement standards.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Urban redevelopment and smart city initiatives will accelerate demand for modular scaffolding across major UK cities.

- Increased focus on worker safety will drive adoption of compliant and standardized system scaffolding.

- Growth in prefabricated and modular construction methods will complement the rise of system scaffolding usage.

- Public infrastructure investments will sustain market expansion in transportation and utilities sectors.

- Demand for digital scaffolding solutions integrated with BIM will increase across commercial projects.

- Energy-efficient scaffolding materials will gain preference amid rising sustainability targets.

- Rental and leasing models will become dominant due to project-specific deployment needs.

- Emerging projects in Scotland and Wales will diversify regional revenue contributions.

- Skilled labor development programs will support efficient assembly and reduce safety risks.

- Industry consolidation is likely, with leading players enhancing service offerings and regional coverage.