Market Overview

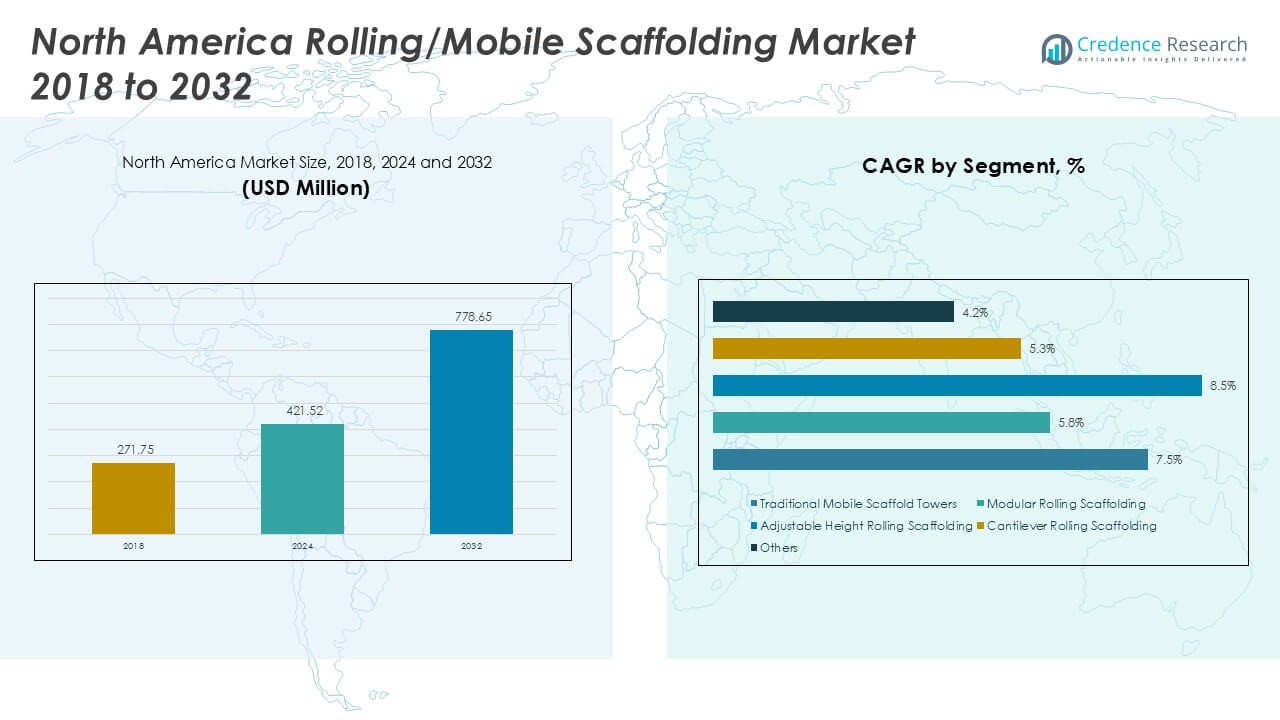

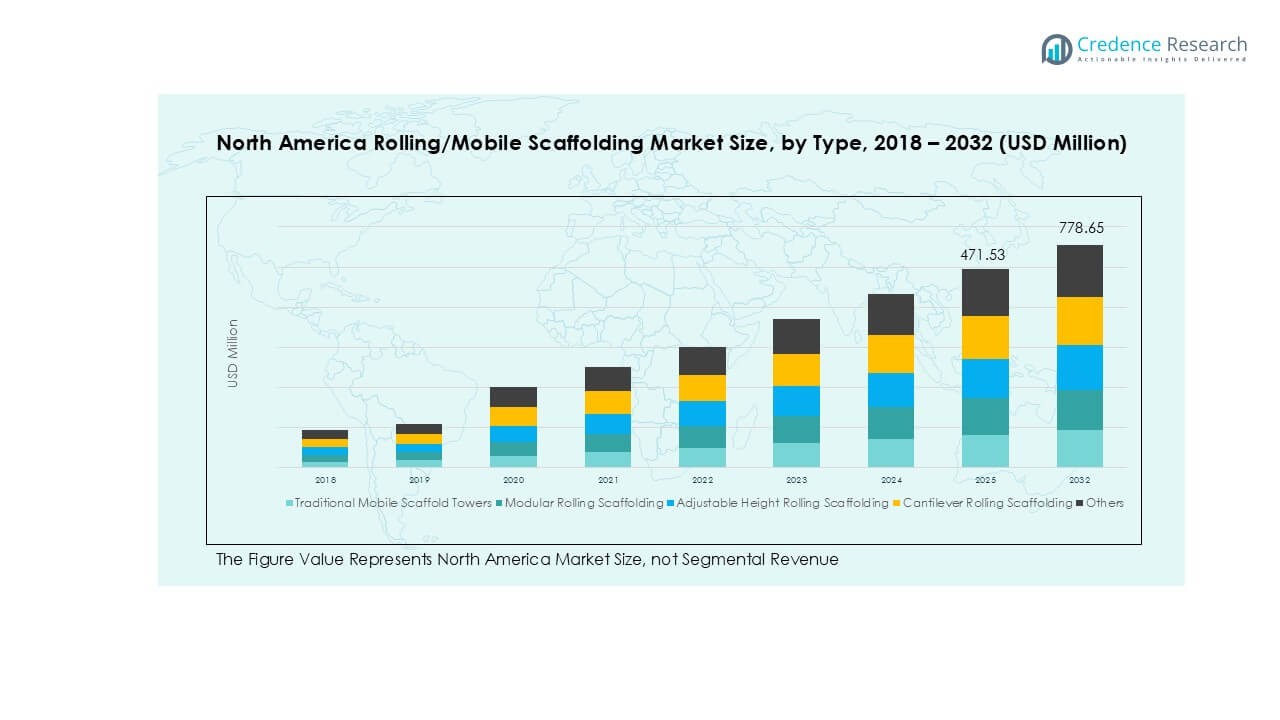

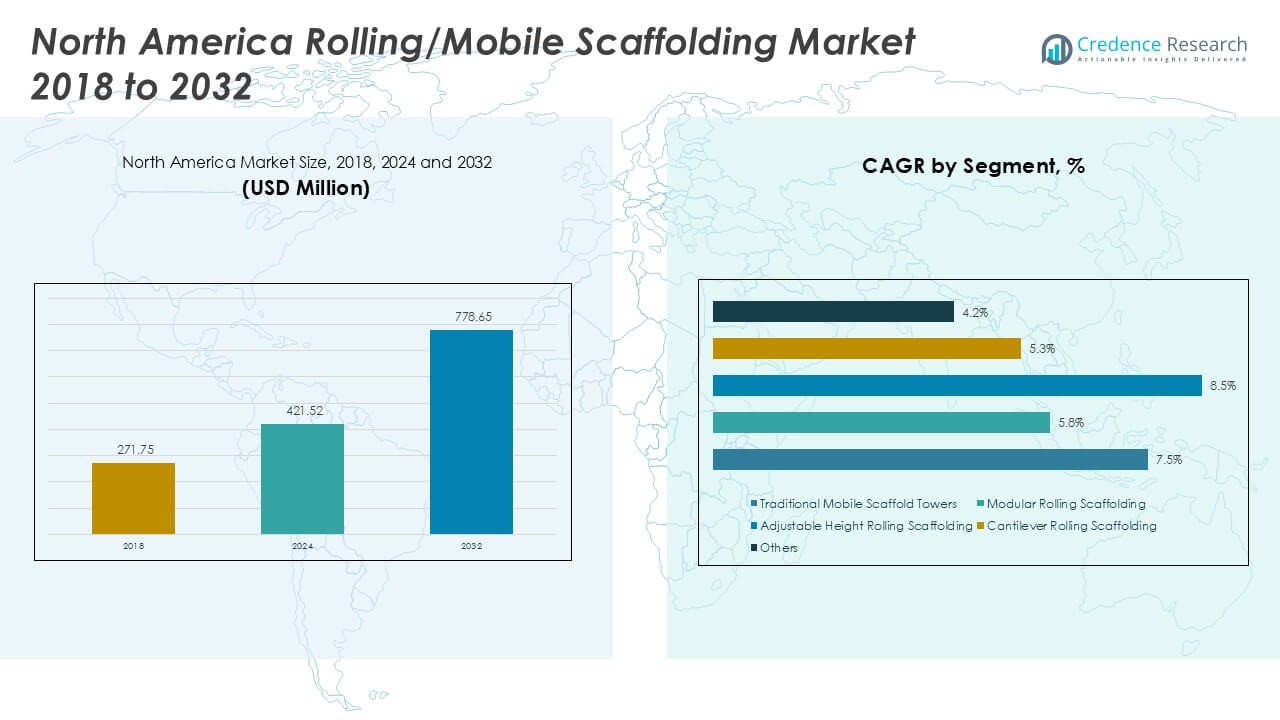

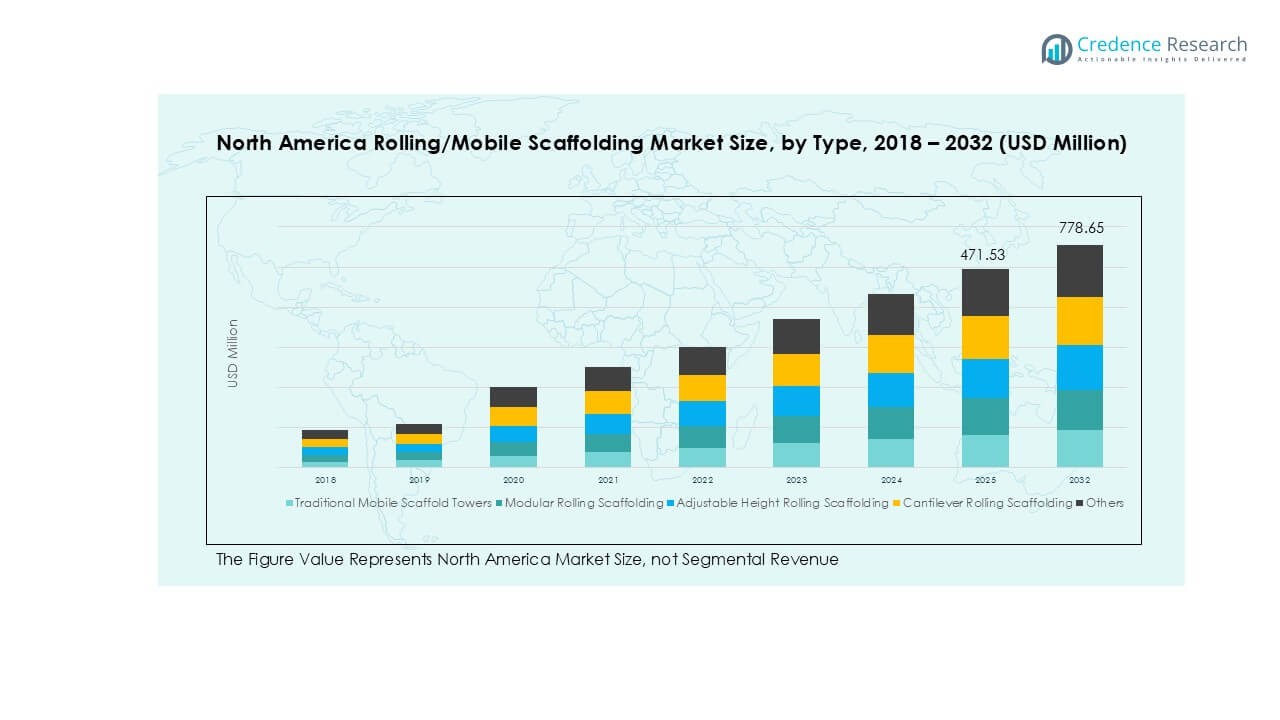

The North America Rolling/Mobile Scaffolding market size was valued at USD 271.75 million in 2018, increased to USD 421.52 million in 2024, and is anticipated to reach USD 778.65 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Rolling/Mobile Scaffolding Market Size 2024 |

USD 421.52 Million |

| North America Rolling/Mobile Scaffolding Market, CAGR |

7.4% |

| North America Rolling/Mobile Scaffolding Market Size 2032 |

USD 778.65 Million |

The North America Rolling/Mobile Scaffolding market is led by prominent players such as ULMA C y E, S. Coop., United Rentals, Brand Industrial Services, Inc., and Sunbelt Rentals, who collectively dominate the competitive landscape through extensive service networks, diversified product offerings, and strong client bases. These companies focus on safety-compliant, lightweight, and modular scaffolding systems tailored to construction, industrial maintenance, and logistics applications. The United States emerges as the leading regional market, capturing approximately 65% of the total market share in 2024, driven by robust construction activity, regulatory enforcement, and widespread adoption across end-use industries. Canada and Mexico follow, contributing 20% and 15% respectively, supported by infrastructure growth and increasing awareness of worker safety standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Rolling/Mobile Scaffolding market was valued at USD 421.52 million in 2024 and is projected to reach USD 778.65 million by 2032, growing at a CAGR of 7.4% during the forecast period.

- The market is primarily driven by increasing construction activities, rising infrastructure development, and strict safety regulations promoting the use of mobile scaffolding across residential, commercial, and industrial sectors.

- A growing trend toward lightweight, modular, and adjustable scaffolding systems—especially aluminium-based designs—is enhancing operational efficiency and driving adoption across maintenance and logistics applications.

- Key players such as ULMA C y E, United Rentals, Brand Industrial Services, and Sunbelt Rentals dominate the market through extensive rental services, innovative products, and strategic partnerships.

- Regionally, the United States holds the largest market share at 65%, followed by Canada at 20% and Mexico at 15%; segment-wise, Traditional Mobile Scaffold Towers and Aluminium-based scaffolding lead due to ease of use and durability.

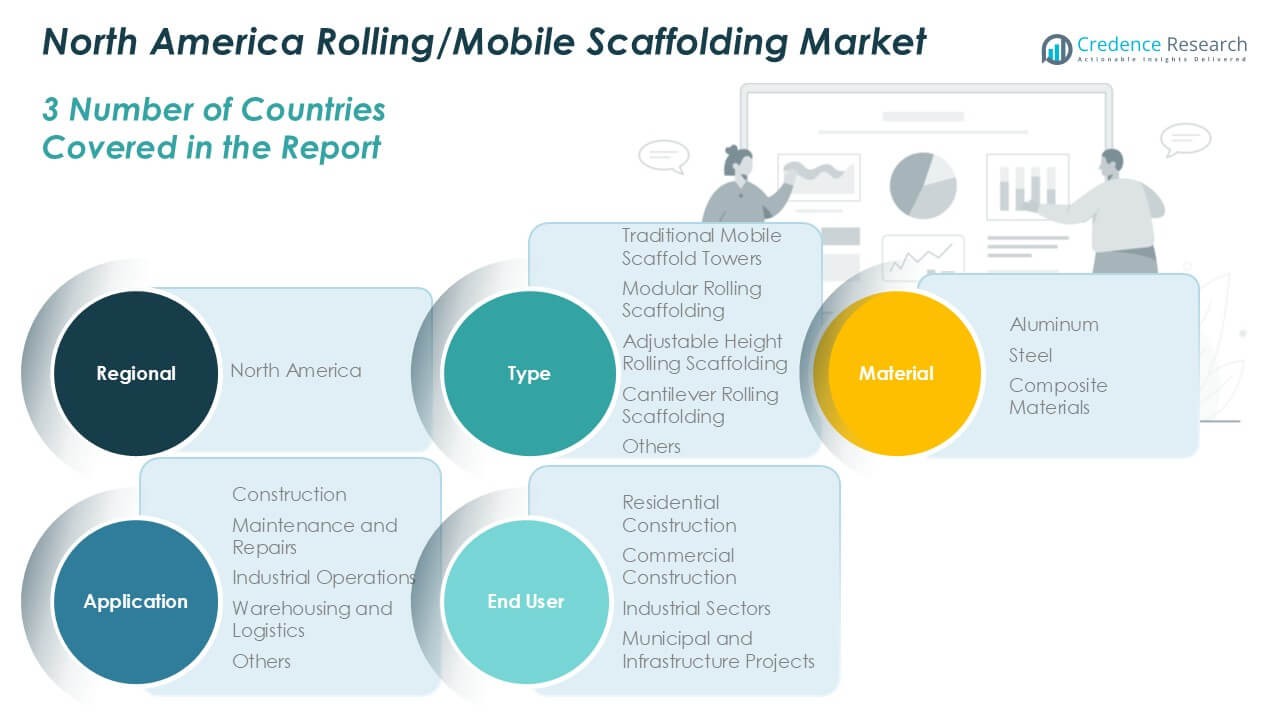

Market Segmentation Analysis:

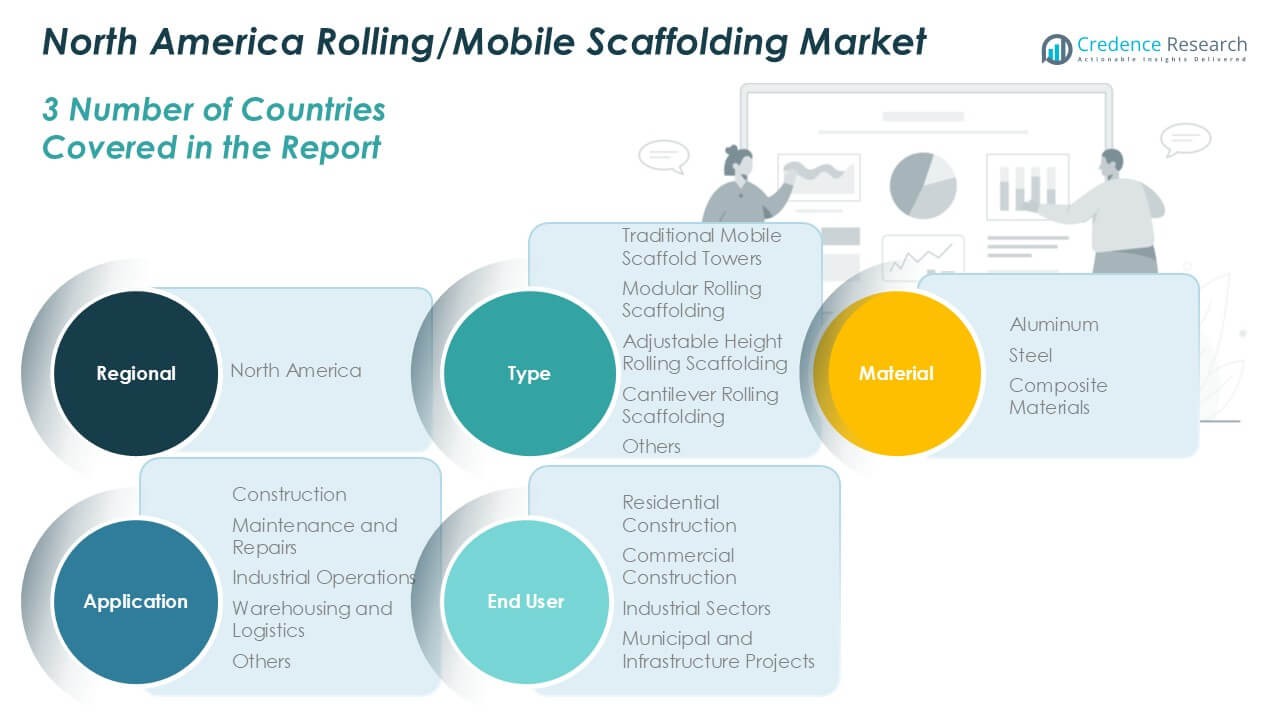

By Type

In the North America Rolling/Mobile Scaffolding market, Traditional Mobile Scaffold Towers hold the dominant market share among type segments. These towers are widely adopted due to their cost-effectiveness, ease of assembly, and compatibility with a broad range of construction and maintenance activities. The increasing demand for reliable and simple mobile platforms in small- to medium-scale construction projects drives this segment’s growth. Additionally, safety standards and regulatory compliance have made traditional scaffold towers a go-to solution for contractors prioritizing stability and worker safety during elevated work.

- For instance, Bil-Jax offers the 4520 Series scaffold tower with a maximum platform height of 20 feet and load capacity of 250 pounds per square foot, providing OSHA-compliant access solutions across diverse job sites.

By Material

Aluminium leads the market in the material segment owing to its lightweight, corrosion-resistant properties, and ease of transportation and assembly. It is particularly favored in fast-paced construction and maintenance operations where mobility and time efficiency are critical. The rising preference for aluminium scaffolding is further supported by its recyclability and reduced structural load on surfaces, making it ideal for both indoor and outdoor use. Compared to steel and composite alternatives, aluminium scaffolding also offers a better cost-to-durability ratio, enhancing its adoption across various industries.

- For instance, Instant Upright manufactures aluminium scaffolding systems that weigh up to 35% less than comparable steel units while maintaining a working height of up to 14 meters, allowing for rapid setup and dismantling.

By Application

The Construction segment dominates the application category, accounting for the largest share of the North America Rolling/Mobile Scaffolding market. Growth in urban infrastructure development, residential and commercial real estate expansion, and renovation activities significantly contribute to the demand for mobile scaffolds. Construction sites benefit from the flexibility and mobility of rolling scaffolds, which allow for faster progress and enhanced worker efficiency at elevated heights. Additionally, strict safety regulations in the construction industry further encourage the use of mobile scaffolding systems, bolstering this segment’s prominence.

Key Growth Drivers

Surging Construction and Infrastructure Developmen

The rapid expansion of construction activities across North America, particularly in urban development, commercial complexes, and infrastructure projects, is a key driver of the rolling/mobile scaffolding market. These scaffolding systems offer enhanced mobility, flexibility, and safety, making them ideal for a variety of elevated tasks. The demand is further supported by government initiatives in infrastructure upgrades and smart city projects. With labor productivity and safety as top priorities, rolling scaffolds are increasingly replacing traditional fixed scaffolds in modern construction workflows.

- For instance, WernerCo deployed over 12,000 mobile scaffolding units across large-scale development projects in the U.S., streamlining contractor workflows and improving time-to-completion benchmarks in residential and mixed-use buildings.

Emphasis on Worker Safety and Regulatory Compliance

Stringent occupational safety regulations enforced by bodies such as OSHA (Occupational Safety and Health Administration) have significantly driven the adoption of mobile scaffolding systems. These structures are designed to enhance fall protection, load-bearing safety, and accessibility, which helps reduce workplace injuries. As safety standards continue to evolve, companies are investing in advanced scaffolding systems to remain compliant and avoid penalties. This trend positions rolling/mobile scaffolding as a preferred solution in sectors requiring high safety performance, including industrial maintenance and infrastructure maintenance.

- For instance, Safway Group introduced the QuikDeck Suspended Access System featuring a fall protection guardrail tested to meet ANSI A10.8 standards and supports live loads up to 75 psf across industrial applications.

Rising Demand for Lightweight and Modular Solutions

The increasing preference for lightweight and easy-to-assemble scaffolding systems, particularly aluminium-based structures, is accelerating market growth. Modular rolling scaffolds enable rapid setup and adjustment, which supports productivity in both small- and large-scale operations. The trend toward more mobile and reusable equipment solutions across industries such as warehousing, logistics, and facilities maintenance also contributes to this demand. As end-users seek efficient and cost-effective systems, the market is responding with innovations in modularity and lightweight design.

Key Trends and Opportunities

Adoption of Advanced Scaffold Designs

Technological advancements are leading to the development of more ergonomic, adjustable, and customizable rolling scaffold systems. Manufacturers are incorporating features such as height-adjustable frames, anti-slip platforms, and enhanced locking mechanisms to improve functionality and safety. These innovations are not only streamlining operations but also expanding the range of applications in industries like aerospace, healthcare, and manufacturing. This shift presents a strong opportunity for companies that prioritize user-friendly and compliant designs.

- For instance, Altrex B.V. developed the RS TOWER 52 module with integrated Safe-Quick GuardRail and self-locking caster wheels, enabling platform height adjustments between 1.2 and 8.2 meters within minutes.

Expansion into Non-Construction Applications

While construction remains the primary application, there is growing demand for rolling scaffolding in sectors such as warehousing, retail, and maintenance services. These sectors require mobile access platforms for regular upkeep, inventory management, and equipment installation. Lightweight and portable scaffolding units are especially useful in indoor environments where space and manoeuvrability are limited. This trend is opening new growth avenues for manufacturers targeting clients outside the traditional construction ecosystem.

- For instance, Metaltech offers the Jobsite Series Mini Scaffold for facility maintenance and retail store refits, with a compact 29-inch frame width and working height of 10 feet, meeting ADA clearance guidelines and space constraints in narrow aisles.

Key Challenges

High Cost of Premium Materials and Components

Despite the benefits of advanced scaffolding systems, the cost associated with high-quality materials—especially aluminium and composite structures—can be a barrier for small and medium enterprises. The initial capital investment required for acquiring modular, adjustable, and compliant units may discourage budget-constrained users, particularly in sectors with tight margins. This cost challenge often leads to continued use of outdated or less safe alternatives, hampering wider adoption.

Logistics and Storage Constraints

Rolling scaffolding systems, while mobile, still require adequate storage and transportation logistics, especially in large quantities. Contractors and service providers often face challenges in managing the space and infrastructure needed to transport and store these units efficiently. In urban settings where job site access and storage are limited, this becomes a major operational hurdle. These logistical constraints can limit the scalability of scaffolding deployment, particularly for fast-paced or remote projects.

Skilled Labor Shortage for Safe Assembly and Use

The effective use of rolling/mobile scaffolding systems requires trained personnel to assemble, operate, and inspect the structures in accordance with safety protocols. A shortage of skilled labor in the construction and maintenance sectors is posing a challenge to safe and efficient deployment. Inadequate training can lead to misuse, accidents, or damage to the equipment, affecting overall productivity and worker safety. This challenge underscores the need for better training and workforce development initiatives.

Regional Analysis

United States

The United States holds the largest market share in the North America Rolling/Mobile Scaffolding market, accounting for over 65% of the regional revenue in 2024. The country’s dominance is driven by the ongoing boom in residential and commercial construction, infrastructure modernization, and maintenance activities across urban and industrial zones. Stringent OSHA regulations promoting worker safety have also accelerated the adoption of mobile scaffolding systems. The presence of leading manufacturers and widespread use in sectors like warehousing, logistics, and industrial maintenance further support market growth. High demand for lightweight and adjustable scaffolding continues to shape innovation and adoption trends in the U.S.

Canada

Canada represents approximately 20% of the North America Rolling/Mobile Scaffolding market and demonstrates steady growth due to increased construction activity, particularly in urban housing and commercial infrastructure. Government investments in public infrastructure projects and sustainable construction practices have encouraged wider use of mobile scaffolding systems. The demand is particularly strong in major cities such as Toronto, Vancouver, and Montreal, where tight space conditions favor rolling and adjustable scaffolding solutions. Rising safety standards and the growing influence of modular construction techniques further enhance market potential in Canada, fostering increased adoption across diverse end-user sectors.

Mexico

Mexico contributes around 15% to the North America Rolling/Mobile Scaffolding market, with growth primarily driven by expanding industrial operations and commercial real estate development. The country’s efforts to improve manufacturing infrastructure and logistics facilities are key contributors to scaffolding demand. While regulatory frameworks are less stringent than in the U.S. and Canada, rising awareness around worker safety is influencing a gradual shift toward standardized mobile scaffolding systems. Additionally, the growth of mid-scale construction and renovation projects, especially in urban centers, supports steady adoption. Mexico’s affordability-driven market also favors durable and cost-effective scaffold types like steel and traditional mobile towers.

Market Segmentations:

By Type

- Traditional Mobile Scaffold Towers

- Modular Rolling Scaffolding

- Adjustable Height Rolling Scaffolding

- Cantilever Rolling Scaffolding

- Others

By Material

- Aluminium

- Steel

- Composite Materials

By Application

- Construction

- Maintenance and Repairs

- Industrial Operations

- Warehousing and Logistics

- Others

By End User

- Residential Construction

- Commercial Construction

- Industrial Sectors

- Municipal and Infrastructure Projects

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America Rolling/Mobile Scaffolding market is characterized by the presence of both established global players and regional specialists, each competing through product innovation, service reliability, and strategic expansion. Key players such as ULMA C y E, S. Coop., United Rentals, and Brand Industrial Services, Inc. hold significant market shares due to their extensive product portfolios, strong distribution networks, and adherence to evolving safety standards. Companies like Sunbelt Rentals and Waco Kwikform Ltd. focus on rental services and customized scaffolding solutions to address varied industry needs. Regional firms such as American Scaffolding, Inc. and Seaway Scaffold & Equipment Co provide cost-effective and localized offerings, maintaining strong client relationships. The market is witnessing increased investments in lightweight and modular scaffold designs, particularly in aluminium-based systems. Strategic partnerships, mergers, and the integration of digital technologies for inventory and safety management are further intensifying competition and shaping the future dynamics of the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ULMA C y E, S. Coop.

- BSL Scaffolding Ltd.

- Brand Industrial Services, Inc.

- Waco Kwikform Ltd.

- Seaway Scaffold & Equipment Co

- American Scaffolding, Inc.

- Rapid Scaffolding (Engineering) Co. Ltd.

- Universal Building Supply Inc.

- Associated Scaffolding Co., Inc.

- QuickAlly Access Solutions

- Sunbelt Rentals

- United Rentals

Recent Developments

- In May 2025, Layher continues its focus on lightweight aluminum scaffolding systems, particularly for the European and North American markets, with a strong emphasis on advanced, modular, and mobile solutions. While no specific new product launches are mentioned in the provided information for 2025, Layher’s ongoing research and development efforts are consistently highlighted for their contributions to quicker and safer assembly, especially concerning rolling and mobile scaffolding systems.

- In April 2025, PERI showcased further development and expansion of the PERI UP Scaffolding Kit, including the introduction of “PERI UP Public” components. These focus on quick installation and safety, specifically for public sector needs, with stairs and access points that meet strict safety standards and require minimal additional components. The modular logic allows more with fewer components, improving efficiency for rolling/mobile scaffolding use. The company also emphasized sustainability and introduced digital solutions (e.g., SYFIT, VEMAVENTURI) for management and safety on construction sites.

- In January 2025, BrandSafway showcased several innovations at the World of Concrete 2025, including enhancements to the QuikDeck® Suspended Access System, new multi-level platform options, and the launch of Flexi Deck, a lightweight, manually movable slab formwork system designed for faster early dismantling and improved site coverage.

Market Concentration & Characteristics

The North America Rolling/Mobile Scaffolding Market exhibits a moderately consolidated structure, with a few dominant players controlling a significant share of the market. Major companies such as ULMA C y E, United Rentals, and Brand Industrial Services maintain competitive advantages through broad product portfolios, extensive service networks, and compliance with evolving safety standards. It shows strong alignment with construction, maintenance, and industrial applications, where mobility, modularity, and safety remain critical purchasing criteria. The market reflects steady demand from both rental and direct purchase channels, with a growing preference for lightweight, height-adjustable, and quick-assembly scaffolding systems. Manufacturers and rental providers actively invest in aluminium-based products and integrated safety features to meet evolving end-user expectations. It remains highly influenced by regulatory standards, particularly in the United States, which holds the largest regional share. Regional demand also reflects varying degrees of price sensitivity and infrastructure development, positioning product versatility and aftersales support as key differentiators in market competition.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising construction and infrastructure development across urban and industrial areas.

- Demand for lightweight and modular scaffolding systems will increase, driven by the need for efficient setup and mobility.

- Aluminium scaffolding will remain the preferred material because of its durability, corrosion resistance, and ease of handling.

- The rental segment will expand as more contractors opt for cost-effective and flexible access solutions.

- Regulatory compliance and worker safety requirements will drive investments in standardized and certified scaffolding systems.

- Innovation in height-adjustable and multi-functional scaffolding will attract end-users seeking versatility on job sites.

- Industrial maintenance and warehousing applications will see rising adoption of rolling scaffolding for operational efficiency.

- Key players will focus on expanding service networks and product offerings to strengthen market presence.

- Technological integration in inventory tracking and scaffold safety will gain traction among service providers.

- The United States will retain its dominance in regional market share, followed by steady growth in Canada and Mexico.