Market Overview

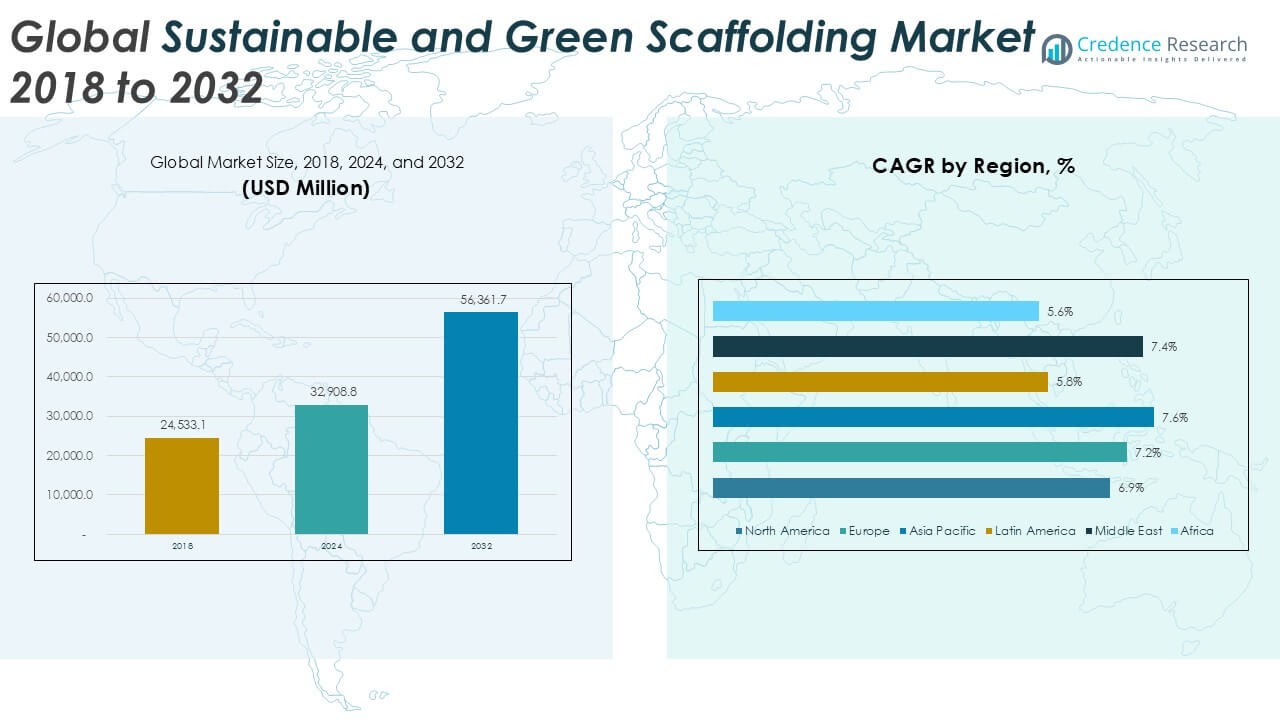

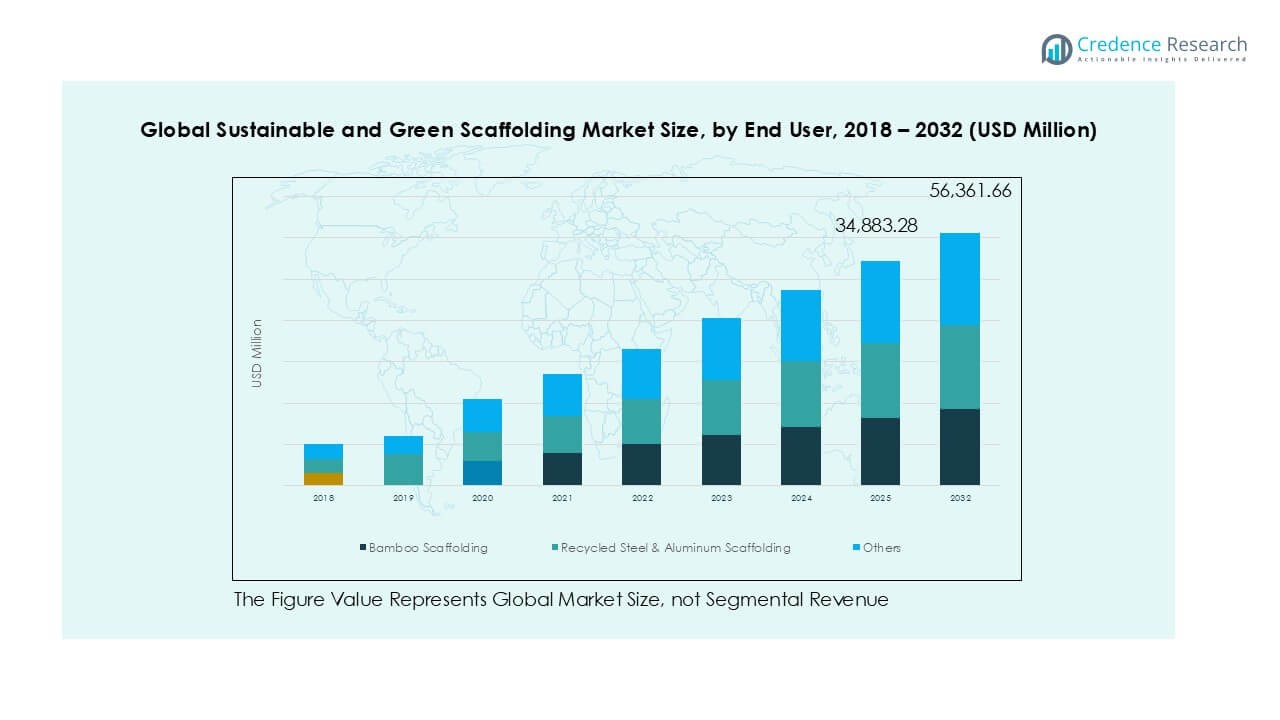

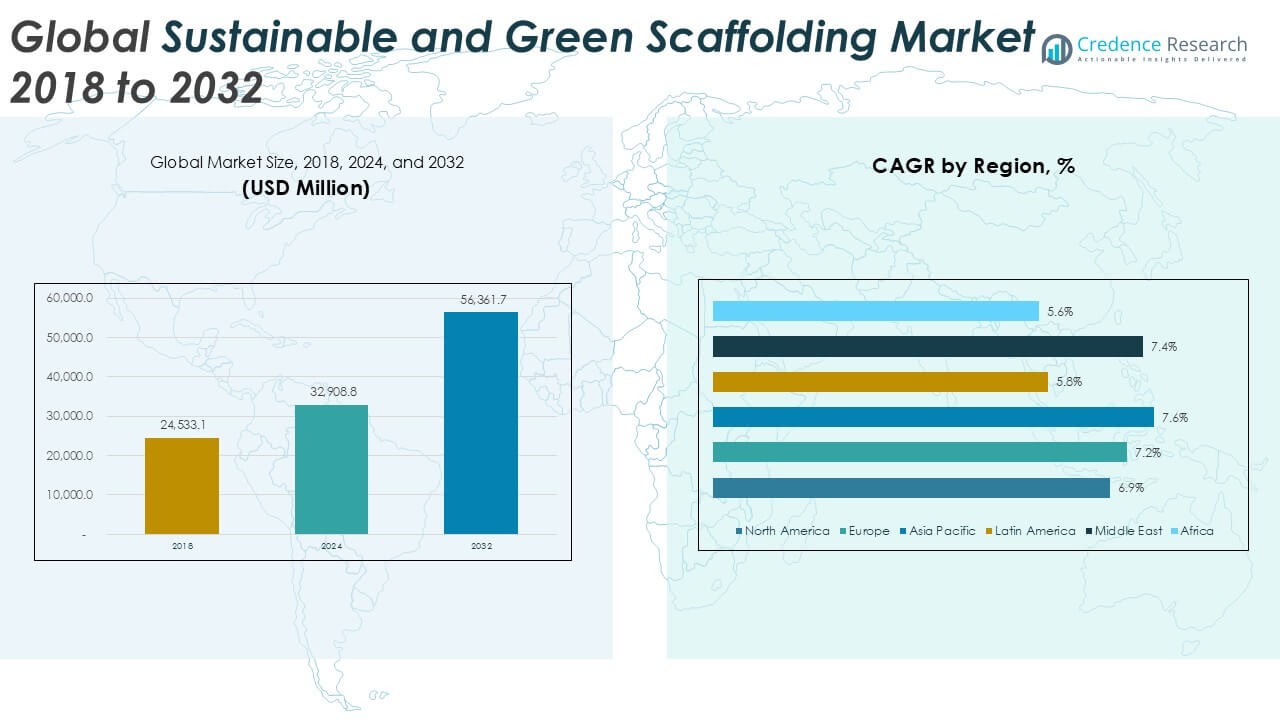

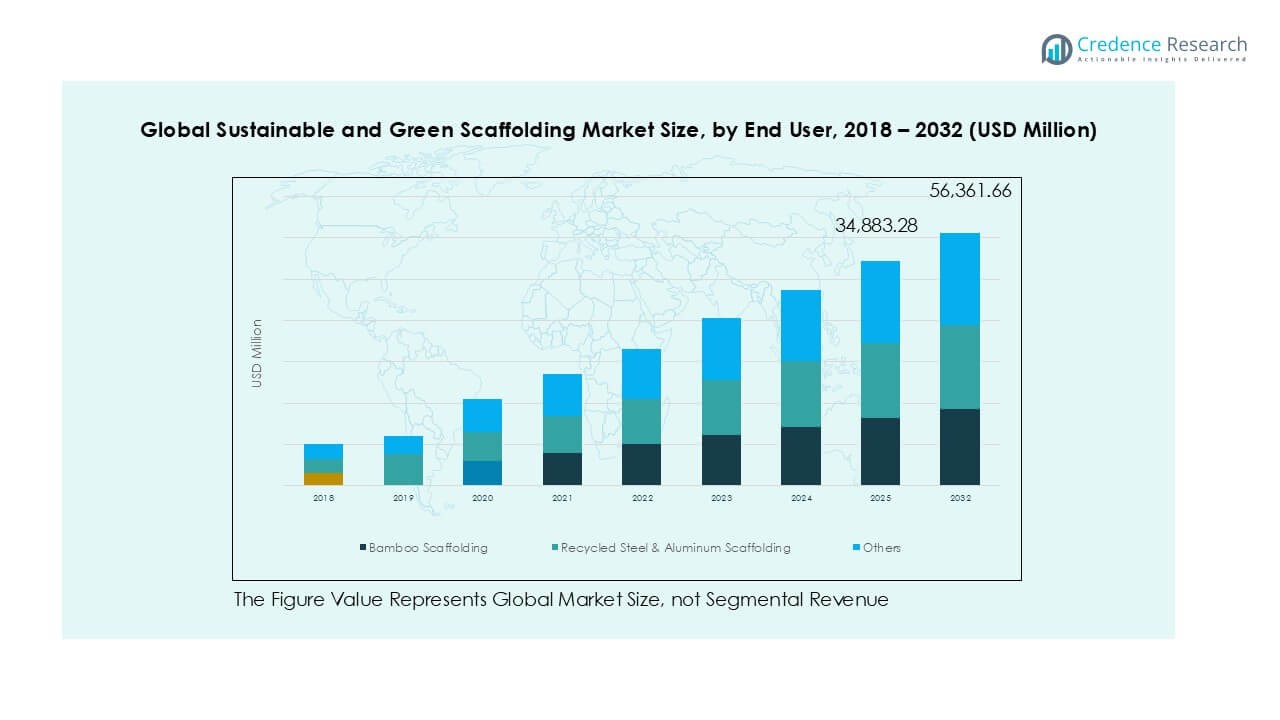

The Sustainable and Green Scaffolding market size was valued at USD 24,533.1 million in 2018, increased to USD 32,908.8 million in 2024, and is anticipated to reach USD 56,361.7 million by 2032, at a CAGR of 7.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable and Green Scaffolding Market Size 2024 |

USD 32,908.8 Million |

| Sustainable and Green Scaffolding Market, CAGR |

7.09% |

| Sustainable and Green Scaffolding Market Size 2032 |

USD 56,361.7 Million |

The Sustainable and Green Scaffolding market is driven by key players such as Green’s Scaffolding Services Ltd, Tianjin Easy Scaffolding Co., Ltd, SafetyRise, Kensal Green Scaffolding, and MG Scaffolding, each focusing on recyclable materials, modular systems, and circular service models. These companies are actively enhancing their service portfolios and geographic reach to meet the rising demand for eco-friendly construction solutions. Asia Pacific leads the global market with a 32.4% share in 2024, fueled by rapid infrastructure growth and sustainable building initiatives across China and India. North America follows with a 27.2% market share, supported by strict environmental regulations and early technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sustainable and Green Scaffolding market was valued at USD 32,908.8 million in 2024 and is projected to reach USD 56,361.7 million by 2032, growing at a CAGR of 7.09% during the forecast period.

- Growth is primarily driven by rising adoption of eco-friendly construction practices, increasing demand for recyclable materials like aluminium and steel, and supportive government regulations promoting green infrastructure.

- A key trend includes the growing use of bamboo scaffolding in emerging markets and the integration of circular economy models such as rental and reuse-based scaffolding services.

- Competitive players such as Green’s Scaffolding Services Ltd, Tianjin Easy Scaffolding, and SafetyRise are focusing on innovation and modular designs, though high initial costs and lack of standardization remain key market restraints.

- Asia Pacific leads with 32.4% market share in 2024, followed by North America (27.2%) and Europe (23.8%); by material, Recycled Steel & Aluminium Scaffolding holds the largest segment share.

Market Segmentation Analysis:

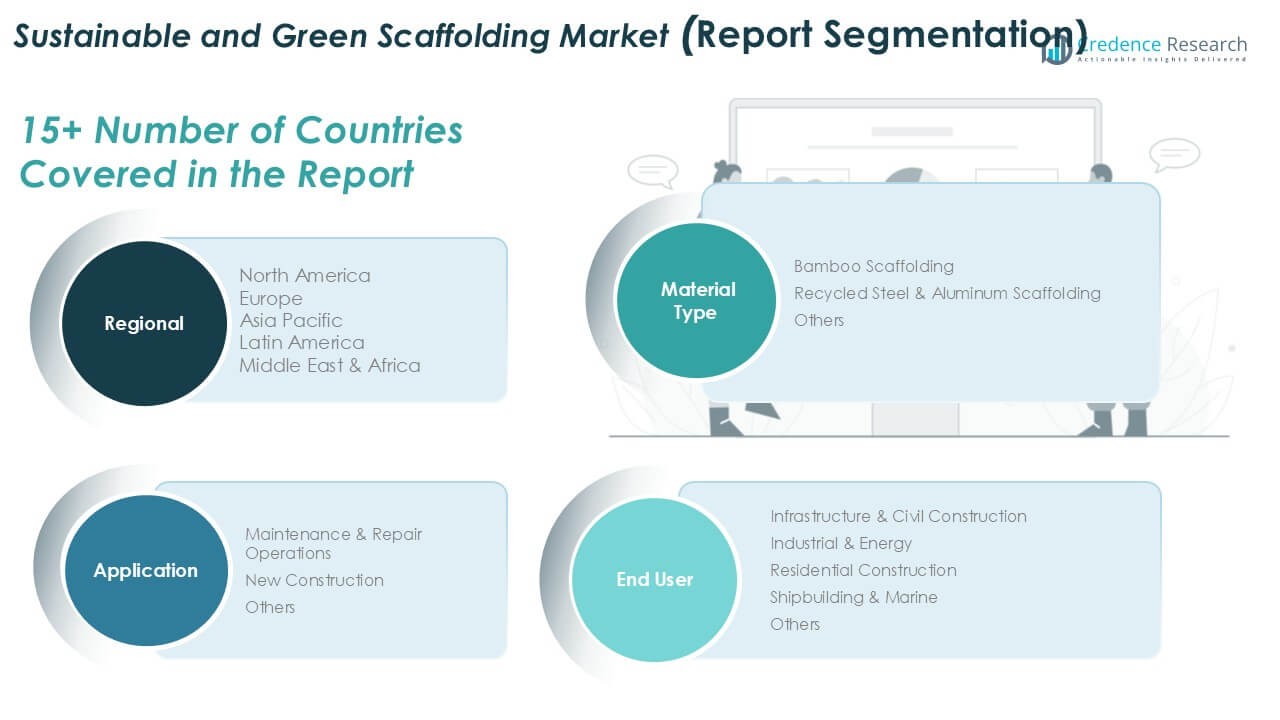

By Material Type

In the Sustainable and Green Scaffolding market, Recycled Steel & Aluminium Scaffolding emerged as the dominant material segment, accounting for the largest market share in 2024. This dominance is driven by increasing global emphasis on recycling, material durability, and reduced carbon footprints associated with metal reuse. Recycled metals offer superior strength, corrosion resistance, and reusability, making them ideal for long-term and large-scale projects. Bamboo scaffolding, though traditionally used in Asia-Pacific regions, is gaining traction due to its biodegradability and lower environmental impact. However, limited structural strength and regional usage constraints hinder its global adoption.

- For instance, Tianjin Easy Scaffolding Co., Ltd processes over 6,000 tons of recycled steel annually to manufacture modular scaffolding systems, significantly reducing raw material extraction and promoting sustainable reuse cycles.

By Application

New Construction held the largest market share in the application segment of the sustainable scaffolding market in 2024. The growth is primarily fueled by rising green building initiatives and eco-friendly infrastructure projects worldwide. Governments and developers are increasingly prioritizing sustainability in new developments, pushing demand for environmentally responsible scaffolding solutions. Maintenance & Repair Operations also show steady growth, supported by ongoing retrofitting and restoration activities in aging structures. The “Others” segment, encompassing temporary installations and event setups, remains niche but is gaining relevance with the growing focus on sustainable practices in non-construction sectors.

- For instance, MG Scaffolding supported the construction of 48 new LEED-certified buildings in the UK between 2021 and 2024, exclusively using their proprietary modular eco-scaffolding systems in alignment with sustainable application protocols.

By End User

The Infrastructure & Civil Construction segment led the market in terms of end-user share, benefiting from large-scale government investments in sustainable urban infrastructure and public utilities. The segment’s dominance is reinforced by the demand for robust, environmentally conscious scaffolding in transportation, bridges, and energy-efficient public buildings. Industrial & Energy follows closely, propelled by green energy projects and environmentally compliant industrial facilities. Residential Construction is steadily adopting green scaffolding amid rising consumer awareness and regulatory mandates. Shipbuilding & Marine and Other sectors contribute moderately, with growth driven by niche applications and stricter environmental standards in specialized industries.

Key Growth Drivers

Rising Demand for Eco-Friendly Construction Materials

The increasing emphasis on sustainable development is driving the adoption of eco-friendly scaffolding solutions. Governments and industry stakeholders are promoting green construction practices to reduce environmental impact, carbon emissions, and resource consumption. This push for sustainability has led to greater demand for recyclable materials such as aluminium and steel, and renewable materials like bamboo. Builders are shifting from conventional scaffolding systems to greener alternatives to comply with environmental regulations and earn sustainability certifications such as LEED, which significantly boosts the market for sustainable and green scaffolding solutions.

- For instance, Green’s Scaffolding Services Ltd has deployed over 12,000 meters of recycled aluminium scaffolding across 200+ green building projects since 2022, contributing to LEED certification achievements in multiple developments.

Government Regulations and Green Building Policies

Stringent environmental regulations and supportive policy frameworks are accelerating market growth. Many countries are implementing green building codes and offering tax incentives or subsidies to encourage the use of sustainable construction practices. These regulatory shifts compel construction firms to adopt eco-friendly scaffolding materials and systems that meet energy efficiency and emissions standards. Additionally, public infrastructure projects are increasingly mandated to follow green construction norms, thereby boosting demand for sustainable scaffolding. This regulatory environment not only fosters compliance but also positions green scaffolding as a competitive necessity.

- For instance, Southwest Scaffolding & Supply provided equipment for 35 public infrastructure projects in California between 2020 and 2023, adhering to CALGreen codes that required use of recyclable scaffolding components.

Technological Advancements and Modular Designs

Advancements in scaffolding technology, such as modular and pre-engineered systems using recyclable materials, are enhancing efficiency and environmental performance. These innovations reduce material waste, improve safety, and speed up installation processes. Modular green scaffolding systems are especially attractive for high-rise buildings and complex infrastructure projects. Integration of smart tracking systems for monitoring environmental compliance and material usage further drives demand. The construction industry’s increasing focus on productivity, safety, and sustainability makes such innovations critical growth enablers in the sustainable and green scaffolding market.

Key Trends & Opportunities

Growing Adoption of Bamboo Scaffolding in Emerging Markets

Bamboo scaffolding is gaining traction in emerging economies due to its renewability, low cost, and environmental friendliness. While traditionally used in Asia, especially in regions like Hong Kong and India, this material is now being reconsidered globally for light-duty construction tasks. As sustainable construction awareness grows, opportunities are emerging to standardize and regulate bamboo scaffolding for broader use. Research into improving its structural integrity and safety could allow this material to compete more directly with metals in low-rise and temporary structures, presenting a cost-effective green alternative.

- For instance, Green Forest Company Limited has supplied over 90,000 linear meters of treated bamboo scaffolding to low-rise construction projects across southern India and Southeast Asia since 2021, aligning with local green building codes.

Integration of Circular Economy Practices

The market is increasingly aligning with circular economy principles, where scaffolding materials are reused, recycled, and repurposed across multiple projects. Companies are adopting leasing and return models for scaffolding equipment, minimizing waste and maximizing lifecycle value. This approach not only reduces material costs but also contributes to environmental sustainability. Circular business models offer significant opportunities for players to differentiate themselves by offering eco-efficient services and building long-term client relationships. As awareness of environmental responsibility grows, circularity will continue to shape the scaffolding industry’s evolution.

- For instance, JBM Scaffolding operates a closed-loop system where over 85% of its scaffold components are recovered, refurbished, and reused, enabling service to more than 120 construction projects per year without new material inputs.

Key Challenges

High Initial Investment and Material Costs

One of the major challenges in the sustainable and green scaffolding market is the high upfront cost associated with eco-friendly materials. Recycled steel and aluminium, while sustainable, often involve additional processing that increases their price compared to traditional alternatives. Similarly, advanced modular systems and smart scaffolding technologies require significant capital investment. For small and medium-sized contractors, these costs can be prohibitive, limiting widespread adoption despite long-term cost savings. Balancing economic viability with environmental compliance remains a key obstacle in scaling market growth.

Lack of Standardization and Global Regulations

The absence of universally accepted standards and regulations for sustainable scaffolding materials poses a significant challenge. Different regions have varying safety and environmental norms, which complicates product development, certification, and deployment for global manufacturers. This lack of harmonization can lead to confusion in compliance requirements, delay in product approvals, and restricted cross-border market expansion. Without cohesive guidelines and industry benchmarks, it is difficult to ensure consistency in quality, safety, and sustainability, which undermines market confidence and limits growth potential.

Limited Awareness and Training

Despite growing interest in green construction, there remains a significant gap in awareness and expertise regarding sustainable scaffolding among contractors and construction workers. Many firms continue to rely on conventional scaffolding systems due to familiarity and lack of training in handling eco-friendly alternatives. Additionally, safety concerns around using new materials like bamboo or recycled metals deter adoption. Bridging this gap requires robust training programs, industry-wide education, and collaboration between manufacturers and regulatory bodies to build trust and enhance workforce capabilities in sustainable scaffolding use.

Regional Analysis

North America

North America held a significant share of the Sustainable and Green Scaffolding market, valued at USD 6,761.33 million in 2018, reaching USD 8,952.59 million in 2024, and is projected to grow to USD 15,065.47 million by 2032, at a CAGR of 6.9%. In 2024, the region accounted for approximately 27.2% of the global market. Growth is driven by stringent environmental regulations, increased adoption of green building standards, and strong investment in infrastructure modernization. The United States leads the market due to early adoption of recyclable materials and advanced modular scaffolding systems across commercial and industrial sectors.

Europe

Europe’s Sustainable and Green Scaffolding market was valued at USD 5,806.99 million in 2018, rose to USD 7,821.94 million in 2024, and is expected to reach USD 13,470.44 million by 2032, growing at a 7.2% CAGR. The region captured about 23.8% of the global market in 2024. Growth is supported by strong regulatory frameworks, a mature construction sector, and widespread integration of sustainable construction materials. Countries such as Germany, France, and the UK are advancing adoption through green building certifications and government-backed energy efficiency initiatives, making Europe a key contributor to market expansion.

Asia Pacific

Asia Pacific leads the Sustainable and Green Scaffolding market, with a valuation of USD 7,715.67 million in 2018, rising to USD 10,675.60 million in 2024, and forecasted to reach USD 19,027.70 million by 2032, at a robust CAGR of 7.6%. The region held the largest market share of approximately 32.4% in 2024. Rapid urbanization, increasing construction activity, and growing awareness of eco-friendly practices are major growth drivers. China, India, and Southeast Asian countries are investing heavily in infrastructure, prompting demand for recyclable scaffolding solutions. Local preferences for bamboo scaffolding also support segment diversity within the region.

Latin America

The Latin American Sustainable and Green Scaffolding market stood at USD 2,504.83 million in 2018, reached USD 3,142.79 million in 2024, and is projected to rise to USD 4,886.56 million by 2032, at a CAGR of 5.8%. The region accounted for roughly 9.6% of the global market in 2024. Brazil and Mexico are key contributors, driven by public housing initiatives and urban renewal projects. While regulatory support is still evolving, increased awareness of environmental impact and the gradual shift towards sustainable construction practices offer growth opportunities for green scaffolding products.

Middle East

The Middle Eastern market was valued at USD 1,172.68 million in 2018, grew to USD 1,604.07 million in 2024, and is anticipated to reach USD 2,818.08 million by 2032, at a CAGR of 7.4%. In 2024, the region represented about 4.9% of the global market. The growth is driven by ambitious infrastructure developments and smart city projects, particularly in the UAE and Saudi Arabia. Adoption of green building codes under national sustainability agendas, like Vision 2030, supports the integration of sustainable scaffolding systems in commercial and public infrastructure developments.

Africa

Africa’s Sustainable and Green Scaffolding market was valued at USD 571.62 million in 2018, increased to USD 711.77 million in 2024, and is forecasted to reach USD 1,093.42 million by 2032, growing at a CAGR of 5.6%. The region held the smallest share, about 2.2% of the global market in 2024. Growth is moderate due to infrastructure constraints and lower awareness of green construction practices. However, increasing foreign investment in sustainable development and urban housing projects, especially in South Africa and Nigeria, is expected to gradually stimulate demand for eco-friendly scaffolding solutions in the coming years.

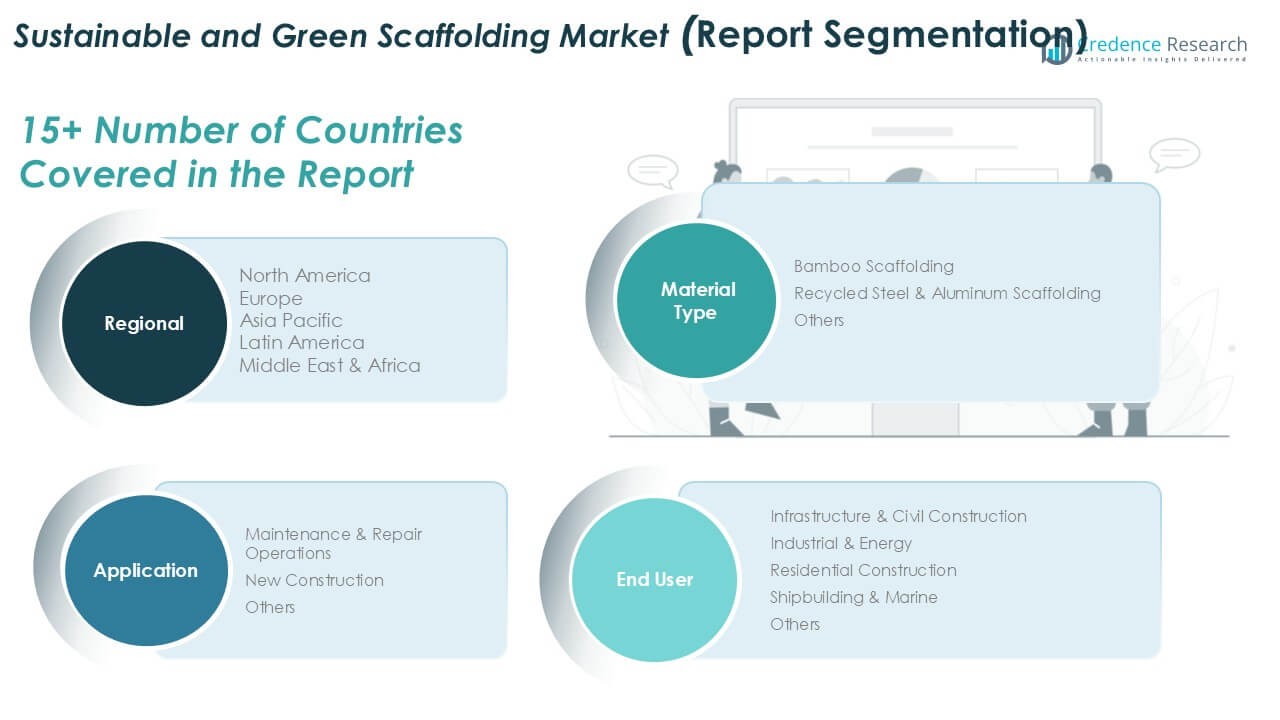

Market Segmentations:

By Material Type

- Bamboo Scaffolding

- Recycled Steel & Aluminium Scaffolding

- Others

By Application

- Maintenance & Repair Operations

- New Construction

- Others

By End User

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sustainable and Green Scaffolding market is characterized by a mix of established players and emerging companies focusing on innovation, sustainability, and geographic expansion. Key players such as Green’s Scaffolding Services Ltd, Tianjin Easy Scaffolding Co., Ltd, and SafetyRise are investing in eco-friendly materials, modular system designs, and recyclable scaffolding solutions to meet growing demand for sustainable construction practices. Companies are increasingly adopting circular economy principles, offering rental and reuse-based scaffolding services to reduce waste and improve cost-efficiency. Regional players like Kensal Green Scaffolding and MG Scaffolding cater to local projects with tailored green solutions, while firms like Greenlands Energy and Southwest Scaffolding & Supply are expanding their presence through partnerships and service diversification. Innovation, regulatory compliance, and strategic collaborations remain central to competitive positioning. As market awareness increases, companies emphasizing environmental stewardship and cost-effective sustainability solutions are expected to gain a competitive edge and expand their market share globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Green’s Scaffolding Services Ltd

- Tianjin Easy Scaffolding Co., Ltd

- SafetyRise

- Kensal Green Scaffolding

- MG Scaffolding

- Greenlands Energy

- Southwest Scaffolding & Supply

- JBM Scaffolding

- Green Forest Company Limited

Recent Developments

- In 2025, Green’s Scaffolding Services Ltd, like many manufacturers, is prioritizing sustainability by using recycled metals, eco-friendly coatings, and energy-efficient practices. They are also innovating with modular designs to reduce waste and improve assembly efficiency.

- In July 2024, MG Scaffolding upgraded its vehicle fleet to meet Euro 6D AR environmental standards for NOx emissions, directly reducing carbon output related to logistics and transportation.

Market Concentration & Characteristics

The Sustainable and Green Scaffolding Market displays a moderately fragmented structure with a mix of global and regional players competing for market share. It features both well-established companies with broad service portfolios and smaller firms catering to local demands. The market exhibits strong innovation potential, with emphasis on modular, reusable, and recyclable materials that align with green construction mandates. It benefits from clear regulatory direction in developed regions and rising awareness in emerging economies. Companies are forming strategic partnerships and expanding their rental-based service models to improve sustainability and cost efficiency. It remains highly competitive in urban centers where infrastructure investment and green building codes are more aggressive. Entry barriers include high initial costs, limited industry standardization, and the technical know-how required to adopt advanced eco-friendly scaffolding systems. Pricing pressure exists, but demand for compliant, durable, and reusable solutions supports stable growth. The market continues to evolve toward sustainability-driven product offerings and performance-based differentiation.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising global adoption of sustainable construction practices.

- Demand for recyclable materials like aluminium and steel will remain strong across major construction projects.

- Emerging economies will increasingly adopt bamboo scaffolding, supported by cost-efficiency and local availability.

- Government regulations and green building certifications will drive wider adoption of eco-friendly scaffolding systems.

- Technological advancements in modular and reusable scaffolding designs will improve installation speed and reduce waste.

- Circular economy models such as rental and reuse services will gain traction among contractors and developers.

- Asia Pacific will retain its dominant position due to rapid infrastructure expansion and urbanization.

- North America and Europe will see continued growth driven by regulatory mandates and environmental awareness.

- Small and mid-sized enterprises may face challenges due to high initial costs and lack of standardization.

- Strategic collaborations and innovation will be key for companies seeking competitive advantage and long-term growth.