Market Overview:

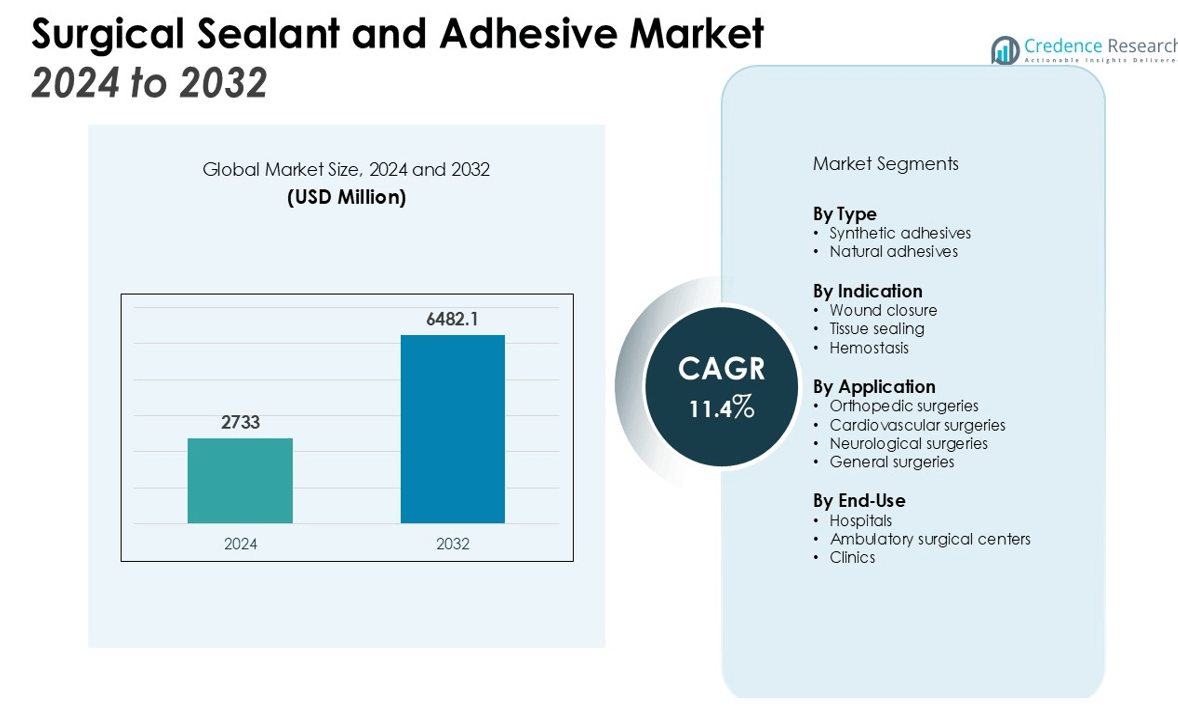

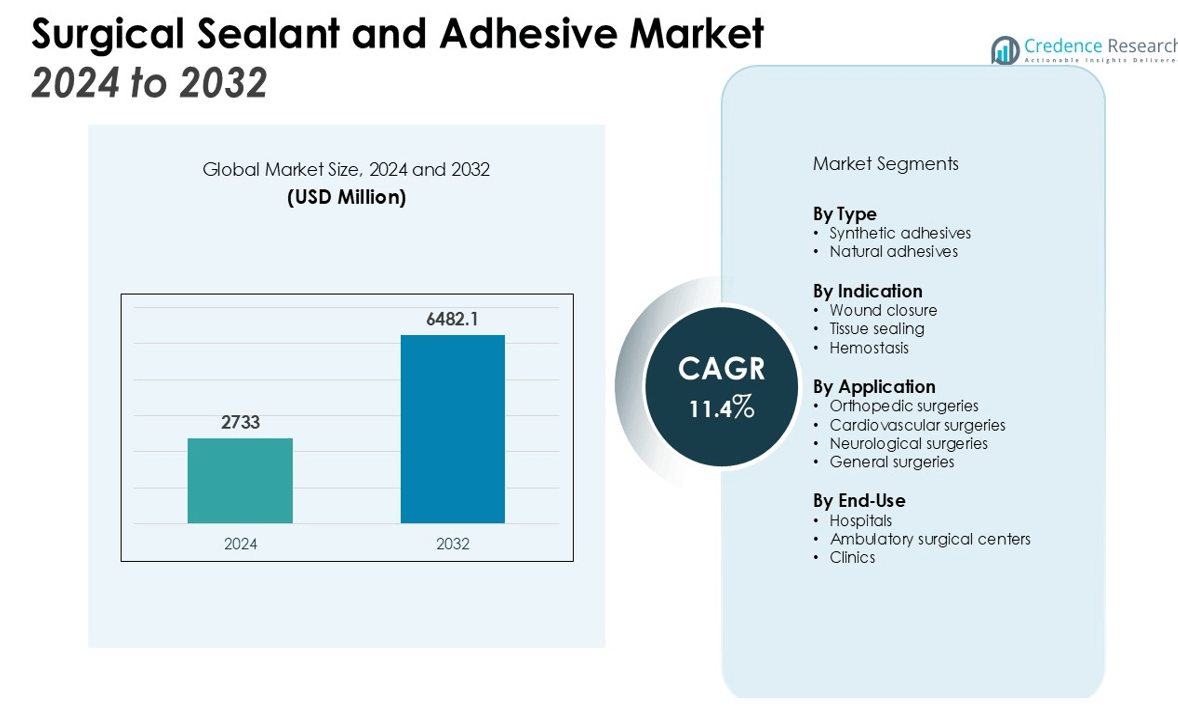

The Surgical Sealant and Adhesive Market size was valued at USD 2733 million in 2024 and is anticipated to reach USD 6482.1 million by 2032, at a CAGR of 11.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Surgical Sealant and Adhesive Market Size 2024 |

USD 2733 million |

| Surgical Sealant and Adhesive Market, CAGR |

11.4% |

| Surgical Sealant and Adhesive Market Size 2032 |

USD 6482.1 million |

Market drivers include the growing preference for minimally invasive surgeries, advancements in biomaterials, and the rising geriatric population prone to surgical interventions. Additionally, technological innovations and the adoption of bio-based sealants contribute significantly to the market’s expansion. Increasing healthcare expenditure, along with improving medical infrastructure, further propels the demand for surgical sealants and adhesives. The growing prevalence of chronic diseases and the need for effective surgical solutions also play a crucial role in driving market growth.

Regionally, North America holds the largest market share due to the high adoption rate of advanced healthcare technologies, a robust healthcare system, and significant investments in research and development. The Asia Pacific region is anticipated to witness the highest growth during the forecast period, driven by expanding healthcare facilities, rising surgical procedures, and improving economic conditions in countries like China and India. Europe also represents a significant market share, with steady demand from countries like Germany and the UK. The increasing number of surgical procedures in emerging economies further boosts regional market dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The surgical sealant and adhesive market was valued at USD 2733 million in 2024 and is projected to reach USD 6482.1 million by 2032, growing at a CAGR of 11.4% during the forecast period (2024-2032).

- The increasing demand for minimally invasive surgeries is driving the market, as these procedures promote quicker recovery and less scarring, with adhesives playing a key role in tissue bonding and wound closure.

- Advancements in biomaterials, including bio-based and synthetic alternatives, are enhancing the safety and effectiveness of surgical adhesives, contributing to their growing adoption.

- The rising geriatric population is a major driver, as older adults often require more frequent surgeries and benefit from the use of effective surgical adhesives for improved outcomes.

- The rapid expansion of healthcare infrastructure in emerging economies like China and India is increasing the number of surgeries, creating a higher demand for surgical sealants and adhesives.

- Regulatory approval challenges and safety concerns, including tissue damage and allergic reactions, continue to hinder the widespread adoption of surgical adhesives.

- North America holds the largest market share at 40%, followed by Europe at 30%, while Asia Pacific, with 25%, is expected to experience the highest growth due to expanding healthcare and rising surgical interventions.

Market Drivers:

Growing Preference for Minimally Invasive Surgeries

The demand for minimally invasive surgeries is a significant driver in the surgical sealant and adhesive market. These procedures, which require smaller incisions, promote faster recovery times and reduce the risk of infection, making them increasingly popular among both patients and healthcare providers. Surgical sealants and adhesives offer excellent benefits in these procedures by providing effective tissue bonding and ensuring wound closure with minimal disruption. The growing adoption of minimally invasive surgeries across various medical disciplines contributes to the increasing demand for advanced sealing and adhesive solutions.

- For instance, Medtronic’s Covidien LigaSure™ vessel sealing technology is utilized in various minimally invasive surgeries, with specific devices capable of sealing vessels up to 7 mm in diameter.

Technological Advancements in Biomaterials

Continuous advancements in biomaterials play a key role in driving the surgical sealant and adhesive market. The development of new and improved materials, including bio-based and synthetic alternatives, enhances the effectiveness and safety of surgical adhesives. These innovations contribute to better tissue compatibility, reduced complications, and faster healing processes. Enhanced materials also enable the creation of stronger and more flexible adhesives, which are critical for maintaining tissue integrity during and after surgery.

- For instance, researchers at the Terasaki Institute for Biomedical Innovation developed a gelatin-based hydrogel that, after chemical modification, increased its adhesive strength up to 4 times.

Rising Geriatric Population and Surgical Interventions

The increasing geriatric population worldwide is another driving factor for the surgical sealant and adhesive market. Older adults often require more frequent surgeries due to age-related conditions such as cardiovascular diseases, cancer, and orthopedic issues. This demographic is more prone to complications such as slower healing, making the use of effective surgical adhesives essential for improved patient outcomes. As the elderly population continues to grow, the demand for surgical sealants and adhesives is expected to rise significantly.

Expanding Healthcare Infrastructure and Surgical Procedures

The expansion of healthcare infrastructure and the increasing number of surgical procedures in emerging economies further fuel the growth of the surgical sealant and adhesive market. Countries in regions such as Asia Pacific are witnessing rapid improvements in healthcare facilities, which, in turn, are supporting the rise in surgeries and medical procedures. These developments, combined with growing healthcare expenditure, are contributing to the heightened demand for advanced surgical products like sealants and adhesives to support various medical interventions.

Market Trends:

Shift Towards Bio-Based Surgical Sealants and Adhesives

One of the prominent trends in the surgical sealant and adhesive market is the increasing shift towards bio-based materials. These materials offer improved biocompatibility and reduce the risks of adverse reactions when used in surgical procedures. The demand for environmentally friendly and sustainable solutions has pushed manufacturers to develop adhesives and sealants derived from natural sources. This trend is not only driven by patient safety concerns but also by regulatory pressures favoring eco-friendly alternatives. Bio-based sealants are particularly beneficial for sensitive surgeries such as organ transplants and cardiovascular procedures, where tissue compatibility is crucial. The continued development of these products aligns with the growing emphasis on sustainability within the medical industry.

- For instance, Ethicon’s ETHIZIA™ Hemostatic Sealing Patch, a bioabsorbable synthetic polymer, was clinically shown to stop disruptive bleeding in 30 seconds.

Technological Advancements in Adhesive Formulations

Technological advancements in adhesive formulations are reshaping the surgical sealant and adhesive market. Innovations focused on improving the strength, flexibility, and ease of use of these products are gaining traction. New adhesive formulations are being developed to address specific clinical challenges such as faster application, enhanced tissue integration, and reduced formation of scars. These developments help surgeons achieve better outcomes with fewer complications, driving the adoption of advanced adhesives in various types of surgeries. The market is also seeing the introduction of adhesives that enable faster healing times and provide more robust and long-lasting bonding for tissues. As these technologies evolve, they promise to expand the range of surgical applications where adhesives can be used effectively.

- For instance, SEAL-G® is a surgical sealant that completely cures within 60 seconds, enabling very rapid and effective application during gastrointestinal surgery.

Market Challenges Analysis:

Regulatory and Approval Challenges

One of the key challenges faced by the surgical sealant and adhesive market is the stringent regulatory approval process. These products must meet high safety and efficacy standards set by regulatory bodies such as the FDA and EMA. The lengthy approval timelines and the complexity of clinical trials can delay the introduction of new products into the market. Manufacturers must navigate multiple regulatory requirements across different regions, adding further complexity to the development and commercialization of surgical sealants and adhesives. These regulatory hurdles can increase costs and slow the pace at which new innovations are made available to healthcare professionals.

Concerns Regarding Product Safety and Efficacy

Safety concerns surrounding the use of surgical sealants and adhesives pose a significant challenge to market growth. The potential for adverse reactions, such as infections, tissue damage, and allergic responses, remains a concern in certain surgical applications. Ensuring the long-term efficacy of these products, particularly in high-stakes surgeries, is critical. While advancements in material science have led to improved formulations, achieving universal compatibility across different types of tissues remains difficult. Addressing these safety and efficacy issues requires continuous research and testing to ensure that the products meet the highest standards in patient care.

Market Opportunities:

Rising Demand for Minimally Invasive Surgical Procedures

The increasing preference for minimally invasive surgeries presents a significant opportunity for the surgical sealant and adhesive market. These procedures often require advanced sealing and bonding solutions to ensure quick recovery, minimal scarring, and reduced complications. Surgical adhesives play a critical role in minimizing tissue damage and improving patient outcomes. As the adoption of minimally invasive techniques continues to grow globally, there will be a greater demand for advanced adhesive products that offer strong bonding with minimal risk. This shift opens up avenues for manufacturers to develop specialized products tailored to specific surgical needs, expanding their market potential.

Expansion in Emerging Markets and Healthcare Infrastructure Development

The rapid growth of healthcare infrastructure in emerging economies offers a substantial opportunity for the surgical sealant and adhesive market. Countries in Asia Pacific, Latin America, and the Middle East are investing heavily in modernizing their healthcare facilities and increasing access to advanced medical treatments. This growth is driving the demand for high-quality surgical products, including adhesives and sealants. As the number of surgeries in these regions rises, the need for effective and efficient surgical solutions will intensify, creating ample market opportunities. Manufacturers can capitalize on this trend by introducing cost-effective, reliable adhesive products tailored to the specific needs of these developing healthcare systems.

Market Segmentation Analysis:

By Type

The surgical sealant and adhesive market is primarily divided into natural and synthetic adhesives. Synthetic adhesives dominate the market due to their strong bonding properties, flexibility, and ease of application. Natural adhesives, which are bio-based, are gaining popularity for their biocompatibility and reduced risk of adverse reactions, especially in sensitive surgeries like organ transplants and cardiovascular procedures.

By Indication

Key indications for surgical sealants and adhesives include wound closure, tissue sealing, and hemostasis. Wound closure and tissue sealing are the leading segments, driven by the growing adoption of minimally invasive surgeries that require adhesives for faster healing and reduced scarring. Hemostasis applications are also expanding, as they assist in controlling bleeding during surgeries, improving patient outcomes and surgical efficiency.

- For instance, in spinal surgery applications, FloSeal Hemostatic Matrix demonstrated a median time to hemostasis of 1.5 minutes.

By Application

The surgical sealant and adhesive market finds applications across various surgical specialties, including orthopedic, cardiovascular, neurological, and general surgeries. Orthopedic surgeries, such as joint replacements and bone repairs, use adhesives for effective tissue bonding and enhanced recovery. Cardiovascular surgeries also drive demand due to the need for reliable adhesives to seal tissues and prevent leaks. General surgeries, including abdominal and laparoscopic procedures, further contribute to market growth as adhesives are used for tissue repair and wound closure.

- For example, CoSeal®, a surgical sealant, is approved for use in vascular reconstructions. It forms a seal in under 3 seconds and is fully absorbed by the body within 5 to 7 days.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Type

- Synthetic adhesives

- Natural adhesives

By Indication

- Wound closure

- Tissue sealing

- Hemostasis

By Application

- Orthopedic surgeries

- Cardiovascular surgeries

- Neurological surgeries

- General surgeries

By End-Use

- Hospitals

- Ambulatory surgical centers

- Clinics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading the Market with Technological Advancements and Healthcare Infrastructure

North America accounts for 40% of the global surgical sealant and adhesive market, maintaining dominance due to advanced healthcare infrastructure and technological innovation. The U.S. leads the region with significant investments in research and development, alongside a well-established healthcare system that adopts the latest surgical technologies. The preference for minimally invasive surgeries and high usage of surgical adhesives for wound closure contribute to the region’s market share. As the healthcare sector continues to evolve, the demand for advanced adhesive products is expected to maintain its growth trajectory in North America.

Europe: Strong Demand Driven by Surgical Innovations and Aging Population

Europe holds 30% of the global surgical sealant and adhesive market, driven by the region’s strong healthcare systems and rising demand for surgical innovations. Key markets like Germany, the UK, and France are at the forefront, with a growing focus on minimally invasive surgical procedures. The increasing geriatric population and the need for efficient wound healing solutions further boost demand for surgical adhesives. Strict regulatory standards and technological advancements continue to support steady market growth across the region, with an emphasis on improving patient outcomes through advanced adhesive technologies.

Asia Pacific: Rapid Growth in Healthcare and Surgical Interventions

Asia Pacific holds 25% of the global market share for surgical sealants and adhesives and is projected to experience the highest growth rate in the coming years. The rapid expansion of healthcare infrastructure, along with an increasing number of surgical procedures, drives the demand for surgical adhesives. Emerging economies like China and India are investing heavily in healthcare, with a rising preference for minimally invasive surgeries where sealants and adhesives are crucial. Economic growth and improving healthcare access in the region present ample opportunities for market players to introduce cost-effective and high-quality products.

Key Player Analysis:

- Johnson & Johnson (Ethicon)

- Artivion, Inc (CryoLife, Inc.)

- C.R. Bard, Inc. (BD)

- Medtronic

- B. Braun SE

- Mallinckrodt

- Cardinal Health

- Baxter

- Integra LifeSciences Corporation

- Stryker

Competitive Analysis:

The surgical sealant and adhesive market is highly competitive, with several key players striving for innovation and market share. Major companies such as Johnson & Johnson, 3M, and Baxter International lead the market, offering a wide range of products with advanced biomaterials and adhesive technologies. These companies focus on enhancing the efficacy, biocompatibility, and safety of their sealants to meet the growing demand for minimally invasive surgeries and efficient wound closure solutions. Smaller, specialized companies are also emerging, offering bio-based adhesives and innovative solutions for niche applications like cardiovascular and orthopedic surgeries. Strategic partnerships, acquisitions, and collaborations with research institutions are common among top players to drive product development and expand market reach. The increasing adoption of bio-based and synthetic adhesives is fostering healthy competition, pushing companies to invest in R&D to improve adhesive performance, minimize side effects, and cater to diverse surgical needs.

Recent Developments:

- In June 2025, Johnson & Johnson MedTech announced the U.S. launch of the ETHICON™ 4000 Stapler, a surgical stapler designed for complex tissue management in both open and laparoscopic procedures.

- In September 2024, Medtronic launched its new VitalFlow™ Extracorporeal Membrane Oxygenation (ECMO) system for bedside and in-hospital patient transport.

- In April 2025, Baxter launched a new room temperature version of its Hemopatch Sealing HemHemostat in Europe for more convenient surgical application.

Market Concentration & Characteristics:

The surgical sealant and adhesive market is moderately concentrated, with a few dominant players holding significant market share. Leading companies, including Johnson & Johnson, 3M, and Baxter International, command a large portion of the market through strong brand recognition, extensive product portfolios, and significant investments in research and development. These players focus on developing high-performance adhesives with improved biocompatibility and functionality to meet the evolving demands of modern surgical procedures. The market also features a growing number of smaller players, especially those offering bio-based or specialized adhesive solutions tailored to niche applications. The market is characterized by continuous innovation, particularly in the development of adhesives for minimally invasive surgeries and high-precision applications. Competitive dynamics are shaped by factors such as product efficacy, regulatory approvals, and technological advancements, driving firms to focus on enhancing adhesive performance and expanding their product offerings.

Report Coverage:

The research report offers an in-depth analysis based on Type, Indication, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The surgical sealant and adhesive market is poised for significant growth, driven by increasing surgical procedures and advancements in adhesive technologies.

- Natural and biological adhesives are gaining traction due to their superior biocompatibility and effectiveness in various surgical applications.

- Synthetic adhesives are evolving with enhanced properties, offering strong bonding and versatility across different surgical specialties.

- The demand for tissue sealing and hemostasis products is rising, reflecting the need for effective solutions in wound closure and bleeding control.

- Orthopedic and cardiovascular surgeries are major contributors to market growth, necessitating reliable adhesives for bone and tissue repair.

- Hospitals continue to be the primary end-users, with ambulatory surgical centers and specialty clinics also adopting these products for outpatient procedures.

- North America maintains a leading position in the market, attributed to advanced healthcare infrastructure and high surgical volumes.

- The Asia Pacific region is experiencing rapid growth, driven by improving healthcare facilities and increasing surgical procedures.

- Regulatory advancements and product approvals are facilitating market expansion, ensuring safety and efficacy in surgical applications.

- Ongoing research and development are focusing on creating next-generation adhesives with enhanced performance and patient outcomes.