Market Overview

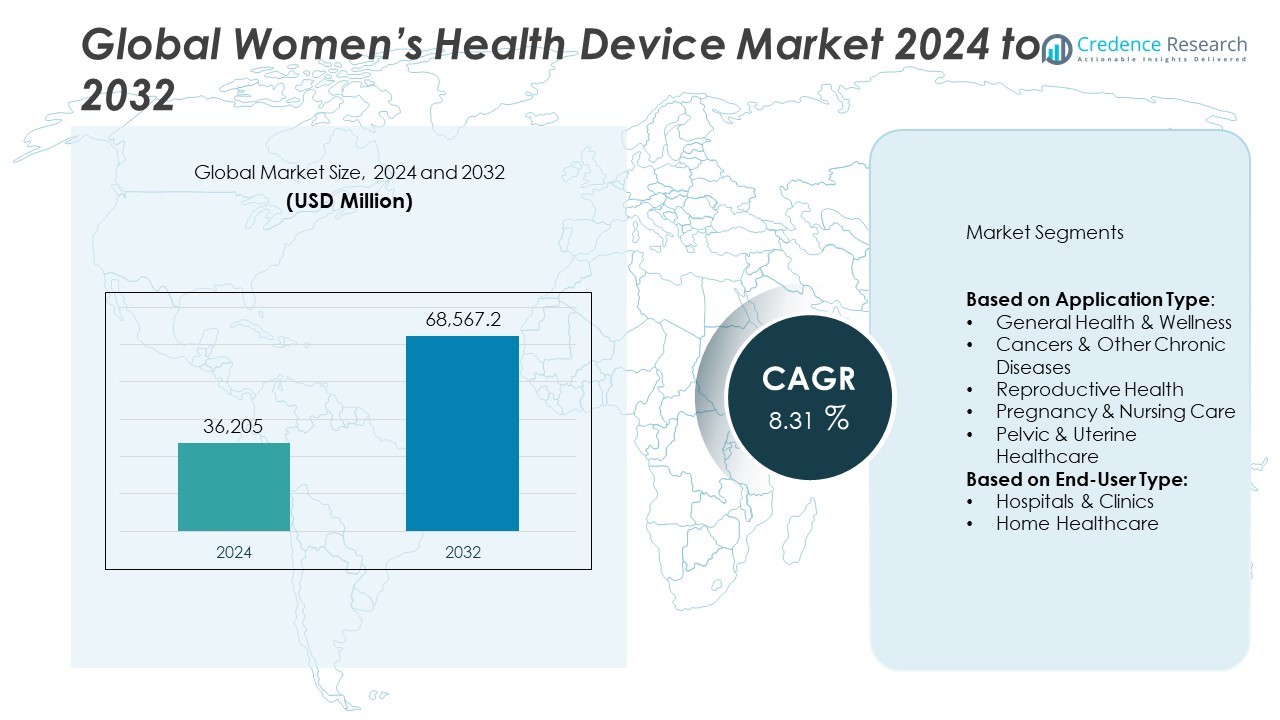

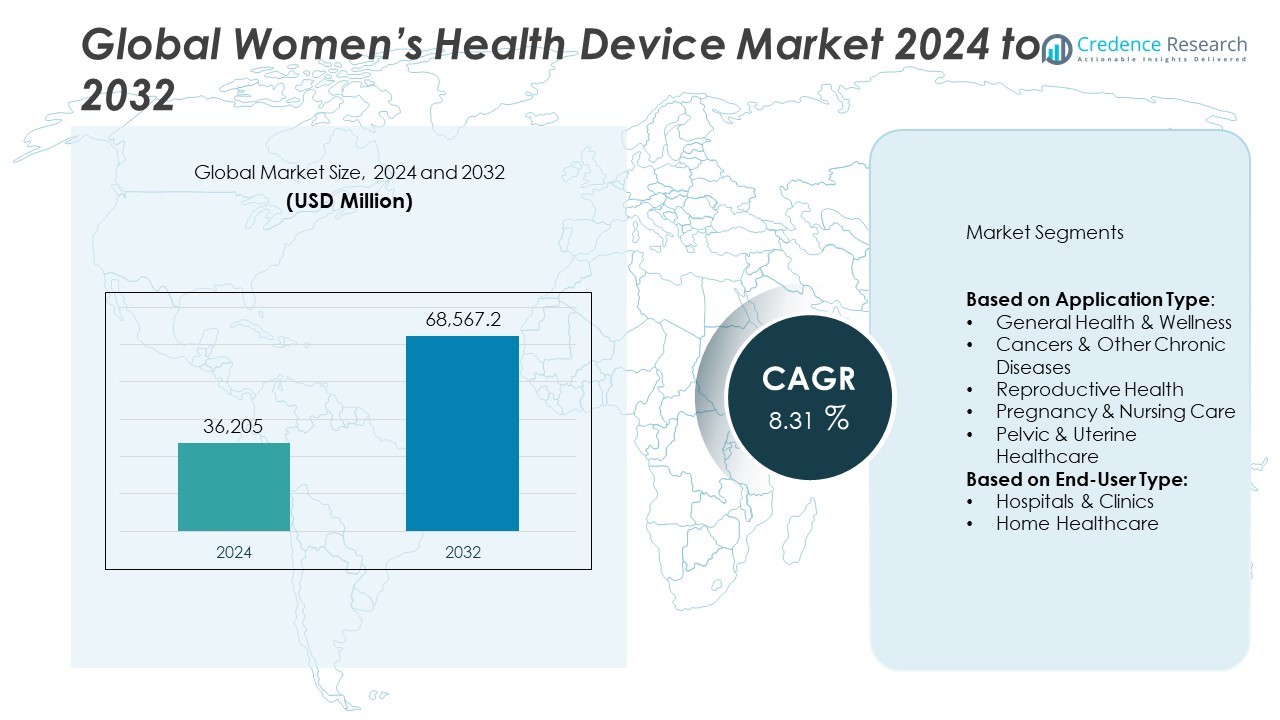

The Women’s Health Devices Market was valued at USD 36,205 million in 2024 and is projected to reach USD 68,567.2 million by 2032, growing at a CAGR of 8.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women’s Health Devices Market Size 2024 |

USD 36,205 Million |

| Women’s Health Devices Market , CAGR |

8.31% |

| Women’s Health Devices Market Size 2032 |

USD 68,567.2 Million |

The women’s health devices market grows steadily, driven by rising awareness of female-specific health issues, increasing demand for fertility monitoring, and advancements in diagnostic technologies. Governments and healthcare providers focus more on preventive care, while the aging female population fuels demand for menopause and osteoporosis management devices.

Geographically, the women’s health devices market demonstrates strong demand across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with advanced healthcare infrastructure, high awareness levels, and widespread adoption of diagnostic and fertility tracking technologies. Europe follows with strong public health initiatives and increasing use of preventive healthcare tools. Asia Pacific presents high growth potential due to expanding healthcare access, rising female population, and growing acceptance of digital health solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The women’s health devices market was valued at USD 36,205 million in 2024 and is projected to reach USD 68,567.2 million by 2032, growing at a CAGR of 8.31% during the forecast period.

- It sees strong growth due to increased focus on female reproductive health, rising awareness, and growing investments in women’s wellness.

- Trends show rising use of wearable devices, AI-driven diagnostic tools, and remote care solutions tailored to female health needs.

- Key players such as CooperSurgical, Hologic Inc., GE Healthcare, and Medtronic continue to expand through product innovations and acquisitions.

- Limited access to healthcare in rural regions and high device costs remain major restraints in many developing markets.

- North America leads the market in terms of demand and innovation, followed by Europe, while Asia-Pacific shows fast-growing adoption.

- The market continues to expand across segments like fertility, pregnancy care, menstrual health, and bone density management.

Market Drivers

Rising Global Awareness and Preventive Healthcare Focus Elevates Demand

Growing awareness about women’s health and increasing emphasis on preventive care significantly drive the Women’s Health Devices Market. Governments and health organizations across regions are launching campaigns to improve access to early diagnosis and personal wellness monitoring. More women are opting for regular screenings and wearable health trackers that support proactive health management. It encourages market players to innovate and introduce smart, user-friendly devices. The demand for non-invasive and at-home diagnostic tools continues to rise. The market responds with accessible solutions for menstrual health, fertility monitoring, and breast care. Increased health literacy strengthens this trend and contributes to higher adoption rates.

- For instance, Ava AG’s wearable fertility tracker contributed to over 10,000 documented pregnancies by 2020, helping women identify their fertile window through analysis of more than 3.5 million recorded cycles.

Technological Innovations Accelerate Product Development and Accessibility

Advances in medical technology enable faster, more precise, and compact health devices tailored for women. Companies invest heavily in R&D to develop devices that deliver real-time insights and remote care capabilities. It enhances usability and supports integration with digital platforms and telehealth services. Wearables now feature AI-powered data tracking and personalized recommendations. Portable ultrasound machines and smart pelvic floor trainers improve clinical outcomes and user experience. The Women’s Health Devices Market benefits from the availability of innovative solutions that align with modern healthcare demands.

- For instance, the Elvie Trainer device—available in over 1,000 clinics—uses patented force and motion sensors to classify pelvic floor contractions with 99% accuracy for correct movements in both supine and standing positions across studies.

Shifting Demographics and Lifestyle Changes Influence Market Expansion

An aging female population and rising lifestyle-related conditions create a growing demand for targeted health solutions. Chronic disorders such as osteoporosis, breast cancer, and urinary incontinence are becoming more prevalent among women. It necessitates regular screening, effective monitoring, and accessible treatment devices. Working women also seek convenient options for reproductive health management and fitness tracking. Urbanization and rising income levels in emerging economies drive consumer spending on personal health devices. The Women’s Health Devices Market adapts to meet these evolving demographic and social trends.

Government Policies and Insurance Coverage Boost Adoption Across Regions

Supportive regulatory policies and improved healthcare reimbursement systems play a crucial role in market development. National health programs increasingly incorporate women-specific health devices to promote early intervention. It improves accessibility, especially in rural and underserved regions. Insurance coverage for diagnostic and monitoring tools encourages more women to adopt advanced health technologies. Government-funded initiatives often include distribution of basic devices for maternal and reproductive health. The Women’s Health Devices Market gains traction as policy environments support wider integration of technology in public health systems.

Market Trends

Adoption of Wearable and Connected Devices Enhances Personalized Health Management

The growing demand for personalized healthcare drives increased adoption of wearable and connected devices among women. These devices track vital parameters such as ovulation cycles, heart rate, and sleep patterns with high precision. It empowers users to take control of their health and share real-time data with healthcare providers. Wearables integrated with mobile apps support fertility planning and pregnancy monitoring. The Women’s Health Devices Market sees strong growth in digital tools that align with modern lifestyles. These technologies promote early detection and encourage preventive healthcare practices.

- For instance, Ava AG’s fertility wearable has facilitated more than 16,000 verified pregnancies by monitoring over 4 million menstrual cycles and cycles per night metrics in user trials.

Telehealth Integration Strengthens Remote Monitoring Capabilities

Integration of women’s health devices with telehealth platforms creates new pathways for remote consultation and continuous monitoring. It reduces the burden on healthcare infrastructure and improves access to specialist care. Devices used for breast exams, prenatal monitoring, and hormonal assessments are increasingly compatible with virtual care systems. Healthcare providers leverage this connectivity to deliver timely interventions and follow-up. The Women’s Health Devices Market evolves to support hybrid care models that blend physical and virtual services. This trend helps address disparities in healthcare delivery across urban and rural populations.

- For instance, the Nurx telehealth platform dispensed over 120,000 at-home hormone test kits across the U.S., integrating device data into virtual consultation workflows for real-time doctor review.

Focus on Menstrual Health and Fertility Solutions Expands Product Portfolios

Rising demand for menstrual hygiene and fertility tracking solutions encourages manufacturers to diversify their offerings. Companies introduce smart menstrual cups, ovulation kits, and hormone testing devices designed for at-home use. It caters to women seeking greater autonomy over reproductive health decisions. Discreet, app-connected products gain traction among younger users and working professionals. The Women’s Health Devices Market aligns product development with changing consumer expectations and lifestyle habits. Brands invest in education and awareness campaigns to support informed usage.

Sustainability and Eco-Friendly Designs Influence Consumer Preferences

Consumers increasingly favor eco-conscious health products that minimize environmental impact. It prompts manufacturers to redesign devices using biodegradable materials and sustainable packaging. Reusable menstrual health devices and energy-efficient monitors see wider adoption. Companies also implement recycling programs to manage electronic waste responsibly. The Women’s Health Devices Market responds to these preferences by aligning product development with environmental goals. Sustainability now plays a critical role in shaping brand loyalty and purchasing decisions.

Market Challenges Analysis

Regulatory Hurdles and Data Privacy Concerns Limit Market Expansion

Stringent regulatory frameworks across regions pose a significant challenge for manufacturers of women’s health devices. It increases the time and cost associated with product approvals, especially for digital and connected solutions. Regulatory variations between countries complicate global market entry and delay innovation cycles. Data privacy concerns further limit adoption, particularly for devices that collect sensitive reproductive or hormonal information. Consumers remain cautious about sharing personal health data with third-party platforms. The Women’s Health Devices Market must address these concerns through transparent practices and strong data security protocols.

Limited Access and Affordability Create Disparities in Usage

High costs associated with advanced diagnostic and monitoring devices restrict access for large sections of the population. It limits adoption in low- and middle-income regions where healthcare budgets remain constrained. Lack of insurance coverage for certain women-focused devices further discourages use. Educational gaps and cultural stigmas also reduce awareness and acceptance, particularly in rural or underserved communities. The Women’s Health Devices Market continues to face barriers in achieving equitable distribution and widespread usage. Addressing affordability and education gaps will remain central to overcoming these challenges.

Market Opportunities

Digital Health Integration and AI Adoption Unlock New Growth Avenues

The increasing integration of digital platforms and AI technologies offers a significant opportunity for innovation in women’s health devices. It enables personalized diagnostics, continuous monitoring, and remote care through smart wearables and mobile health apps. AI-powered tools improve detection accuracy for conditions such as breast cancer, endometriosis, and fertility disorders. Healthcare providers can use predictive analytics to support proactive interventions and treatment plans. The Women’s Health Devices Market can capitalize on this shift by delivering solutions that are both clinically effective and user-friendly. Companies investing in digital ecosystems and cross-platform compatibility will gain a competitive advantage.

Rising Global Focus on Preventive and Reproductive Health Fuels Demand

Government and healthcare organizations are prioritizing preventive care and reproductive health through public initiatives and funding. It creates a favorable environment for introducing screening tools, fertility monitors, and maternal care devices in both developed and emerging markets. Growing awareness about menstrual health, pregnancy wellness, and early disease detection supports demand across all age groups. Telemedicine and e-pharmacy platforms expand access to women’s health solutions in underserved regions. The Women’s Health Devices Market stands to benefit from broader healthcare accessibility and female-centric wellness programs. Strategic partnerships with healthcare providers and NGOs will help expand product outreach and patient engagement.

Market Segmentation Analysis:

By Application Type:

The women’s health devices market shows a strong structure when segmented by application. The diagnostic and monitoring devices segment holds the largest market share due to the high demand for early detection of breast cancer, osteoporosis, and reproductive health disorders. It includes breast imaging, bone densitometry, and ovulation monitors, which continue to see technological advancement and clinical integration. The fertility, pregnancy, and menstrual health segment follows closely, supported by increasing awareness around reproductive health and a rising preference for non-invasive monitoring tools. Wearable fertility trackers and digital pregnancy monitoring devices see growing demand among younger demographics. The contraceptive devices segment is expanding steadily, with increased adoption of long-acting reversible contraceptives (LARCs) such as intrauterine devices (IUDs). It is driven by the rising need for effective, low-maintenance birth control methods across various regions.

- For instance, Hologic’s 3D Mammography system operates in over 6,300 facilities across the U.S. and delivers over 700,000 breast imaging scans monthly through its Genius™ exam technology.

By End-User Type:

Hospitals and clinics represent the largest user base in the women’s health devices market. It benefits from advanced diagnostic infrastructure, trained healthcare professionals, and access to a broader patient population. Public and private hospitals continue to prioritize women’s wellness programs, contributing to higher device procurement rates. The home healthcare segment is growing rapidly, driven by the shift toward personal health management and telemedicine support. It reflects rising demand for portable ovulation kits, menstrual cups, and wearable monitors. Ambulatory surgical centers also contribute a smaller but consistent share, particularly in developed regions where day-care gynecological procedures are common. Each end-user group continues to shape the development and accessibility of women’s health devices across global markets.

- For instance, CooperSurgical distributes over 40,000 fertility monitoring and in-clinic diagnostic systems annually to more than 1,200 reproductive health clinics globally.

Segments:

Based on Application Type:

- General Health & Wellness

- Cancers & Other Chronic Diseases

- Reproductive Health

- Pregnancy & Nursing Care

- Pelvic & Uterine Healthcare

Based on End-User Type:

- Hospitals & Clinics

- Home Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

North America:

North America accounted for the highest market share in the global women’s health devices market in 2024, with approximately 36%. The region benefits from strong healthcare infrastructure, high health awareness, and early adoption of advanced medical technologies. The United States dominates this regional landscape due to significant investment in women-specific medical research and innovation. It supports the rapid integration of digital health platforms, AI-based diagnostics, and at-home health monitoring devices. Increased insurance coverage for maternal and reproductive health further contributes to demand. Major players such as CooperSurgical Inc., Hologic Inc., and Boston Scientific have a strong presence in the region, with continued investments in R&D. Government programs like the Women’s Preventive Services Initiative (WPSI) also reinforce access to diagnostic screenings and essential devices.

Europe:

Europe held a market share of around 29% in the women’s health devices market in 2024. Countries like Germany, the UK, and France are at the forefront of device adoption due to well-established public healthcare systems and strong reimbursement frameworks. It supports growth in diagnostic imaging, fertility monitoring, and breast health equipment. The European region also benefits from active health screening campaigns supported by EU regulations and public health authorities. Technological innovation in wearable gynecological monitors and increasing awareness of menstrual hygiene have helped expand the market scope. Companies including Philips Healthcare and Siemens Healthineers maintain strong European operations, driving localized innovation and distribution. Initiatives such as free cervical screening programs in the UK and digital pregnancy tracking tools are becoming standard.

Asia-Pacific:

Asia-Pacific captured nearly 21% of the market share in 2024 and shows the highest growth momentum. It benefits from expanding healthcare infrastructure, urbanization, and growing health consciousness among women. Countries like China, India, and Japan are witnessing rising demand for fertility tracking apps, pregnancy monitors, and contraceptive devices. It creates a favorable environment for both global and local manufacturers to introduce cost-effective, portable devices. The region faces unique healthcare needs, with maternal and menstrual health driving most product adoption. Rapid digitalization in countries like South Korea and Japan supports telemedicine adoption and at-home diagnostics. Companies such as Nihon Kohden and Nipro Corporation are actively expanding their women’s health product portfolios in this region.

Latin America:

Latin America held around 8% of the global women’s health devices market share in 2024. Brazil and Mexico lead the region, supported by urban healthcare initiatives and rising awareness of women’s reproductive health. It reflects demand for accessible and affordable diagnostic tools and maternal care devices. Meanwhile, the Middle East & Africa accounted for nearly 6% of the market. It is shaped by growing government healthcare investment, especially in Gulf countries, and gradual improvements in women’s health access across Sub-Saharan Africa. Public-private partnerships and mobile health outreach programs continue to support device distribution and awareness. However, limited infrastructure and affordability remain barriers to full-scale adoption in both these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coloplast A/S (Denmark)

- Hologic Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- ALLERGAN (AbbVie, Inc.) (U.S.)

- BD (Becton, Dickinson, and Company) (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- CooperSurgical Inc. (The Cooper Companies, Inc.) (U.S.)

- Caldera Medical (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

Competitive Analysis

The women’s health devices market features a competitive landscape shaped by innovation, product expansion, and strategic collaborations among leading players such as Hologic Inc., CooperSurgical Inc., GE Healthcare, Medtronic, Bayer AG, and Abbott Laboratories. These companies invest heavily in research and development to introduce advanced technologies in diagnostic imaging, fertility tracking, pregnancy care, and gynecological surgical devices. Hologic Inc. maintains a strong foothold through its broad portfolio of breast health and skeletal health products, while CooperSurgical expands its presence with advanced fertility and obstetric devices. GE Healthcare focuses on high-resolution imaging solutions that support early and accurate diagnosis of women’s health conditions. Medtronic contributes with minimally invasive surgical tools tailored to gynecological procedures, and Bayer continues to strengthen its position through innovative contraceptive solutions. Abbott Laboratories emphasizes digital health integration in diagnostic tools for reproductive health monitoring. Together, these players drive competition by prioritizing precision, accessibility, and user-centric designs in their product offerings.

Recent Developments

- In February 2025, Coloplast expanded its Peristeen Light® portfolio with a new product launch. The expansion includes the Peristeen Light 250mL, which features a larger water container and an optional extension tube, providing more options for individuals managing constipation and faecal incontinence.

- In May 2024, Coloplast began launching Luja™, a new intermittent catheter for women featuring Micro-hole Zone Technology, starting in Denmark and Italy. The rollout is planned for other key markets over the following year. Luja™ is designed to help women completely empty their bladders in one continuous flow, potentially reducing the risk of urinary tract infections (UTIs)

- In January 2024, Coloplast introduced Biatain® Silicone Fit, a new silicone foam dressing, to the US market for pressure injury prevention and wound management.

Market Concentration & Characteristics

The women’s health devices market exhibits moderate to high market concentration, with a few key players holding a significant share due to strong brand portfolios, advanced technology, and global distribution networks. It reflects characteristics of a technology-driven industry, where innovation, clinical efficacy, and regulatory compliance guide product development. Companies in this space focus on specialization, offering targeted devices for diagnostics, monitoring, surgical intervention, and reproductive health. The market favors firms with integrated R&D capabilities and established partnerships with healthcare providers. It demands consistent regulatory approvals, pushing firms to maintain high standards in quality and clinical validation. Strong demand for personalized and preventive healthcare solutions shapes the competitive dynamics. The women’s health devices market remains responsive to demographic trends, awareness campaigns, and rising healthcare investments, especially in fertility, maternal health, and early diagnosis. It also reflects increasing patient preference for non-invasive and digital-enabled solutions, influencing product design and market entry strategies.

Report Coverage

The research report offers an in-depth analysis based on Application Type, End-User Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising emphasis on women’s preventive healthcare will increase demand for diagnostic and monitoring devices.

- Growth in telemedicine will drive adoption of women’s health devices compatible with remote health platforms.

- Integration of AI and machine learning will improve accuracy of fertility and breast health diagnostics.

- Expansion in wearable health technology will lead to broader use of continuous monitoring tools among women.

- Portable and at‑home diagnostic kits will become more popular for menstrual tracking and early disease detection.

- Manufacturers will focus on user‑friendly devices with mobile app connectivity and personalized feedback.

- Collaboration between device makers and healthcare providers will improve access in underserved regions.

- Advanced surgical solutions for conditions like pelvic floor dysfunction will gain traction in clinical settings.

- Product designs will increasingly incorporate sustainable materials and energy‑efficient components.

- Mergers and strategic alliances will support geographic expansion and access to complementary technological capabilities.