Market Overview

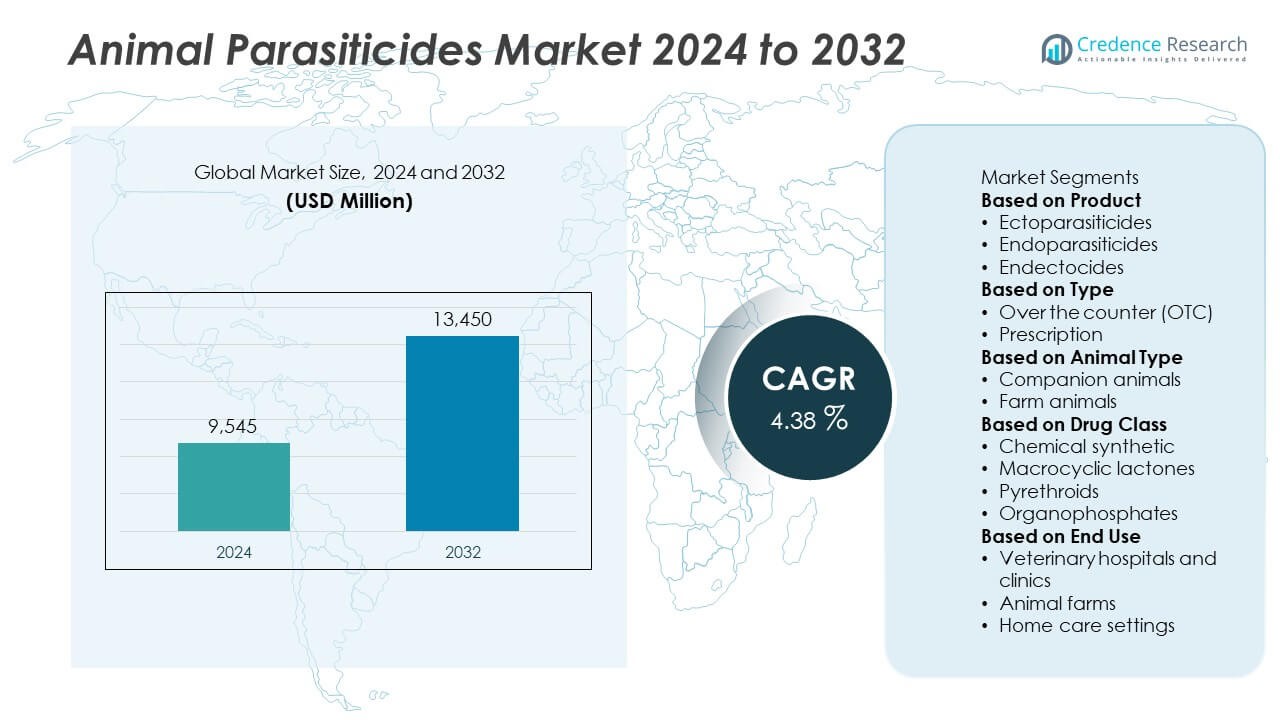

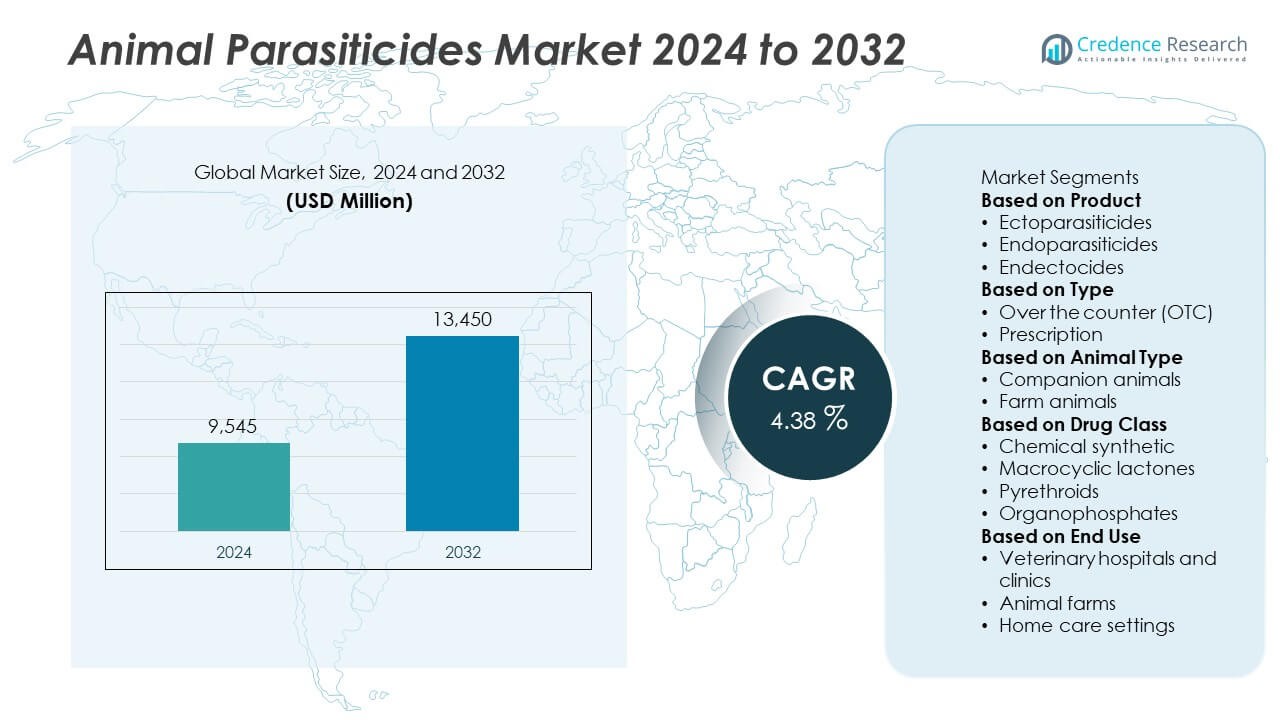

The Animal Parasiticides Market was valued at USD 9,545 million in 2024 and is projected to reach USD 13,450 million by 2032, growing at a CAGR of 4.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Parasiticides Market Size 2024 |

USD 9,545 Million |

| Animal Parasiticides Market, CAGR |

4.38% |

| Animal Parasiticides Market Size 2032 |

USD 13,450 Million |

The animal parasiticides market is led by major companies including Boehringer Ingelheim International, Merck, Elanco Animal Health, Ceva Sante Animal, and Dechra Pharmaceuticals, which hold strong market positions through innovative product portfolios and global distribution networks. These players focus on developing long-acting and combination parasiticides to combat resistance and improve treatment outcomes across livestock and companion animals. Emerging participants such as Bimeda, Norbrook Laboratories, Ourofino Saúde Animal, Neogen Corporation, and Biogénesis Bagó are expanding their presence through cost-effective formulations and regional collaborations. North America dominated the global market with a 38.7% share in 2024, supported by advanced veterinary care and high awareness of parasite prevention.

Market Insights

- The animal parasiticides market was valued at USD 9,545 million in 2024 and is projected to reach USD 13,450 million by 2032, growing at a CAGR of 4.38% during the forecast period.

- Growth is driven by rising parasite infestation rates in livestock and pets, increasing focus on preventive veterinary care, and expanding global livestock production.

- Key trends include the development of long-acting, combination, and eco-friendly parasiticides, along with wider adoption of digital monitoring tools for dosage accuracy.

- Leading companies such as Boehringer Ingelheim International, Merck, Elanco Animal Health, Ceva Sante Animal, and Dechra Pharmaceuticals dominate the market through strong product portfolios and global expansion strategies.

- North America led with 38.7% share, followed by Europe at 29.8% and Asia-Pacific at 21.6%; among products, ectoparasiticides accounted for 48.5% share, while farm animals represented 63.1% share, driven by growing demand for efficient parasite control in livestock.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The ectoparasiticides segment dominated the animal parasiticides market with a 48.5% share in 2024, driven by the high prevalence of external parasites such as ticks, fleas, and mites in both livestock and companion animals. These products are widely used in sprays, spot-on treatments, and pour-on formulations for easy application. Rising pet ownership and awareness regarding flea and tick prevention have boosted demand across veterinary clinics and home-care settings. Continuous product innovation, including long-acting and combination formulations, further strengthens ectoparasiticides’ leadership in the global market.

- For instance, Merck Animal Health’s BRAVECTO® TriUNO received European approval in November 2024 for immediate and persistent treatment of fleas, ticks and mites in dogs, with more than 300 million doses of the broader BRAVECTO line already distributed worldwide.

By Type

The over-the-counter (OTC) segment accounted for a 56.7% market share in 2024, supported by growing consumer preference for easily accessible and self-administered parasitic treatments. Increasing availability of OTC formulations through retail pharmacies, supermarkets, and e-commerce platforms enhances market penetration. Pet owners increasingly favor these products due to affordability and convenience, especially for routine parasite prevention. The rising use of topical and oral OTC treatments in developed markets further contributes to this segment’s dominance in the animal parasiticides industry.

- For instance, Bimeda launched its Doracide™ (doramectin topical solution at concentration 5 mg/mL) in the US market in May 2025 for livestock parasite control, thereby reinforcing its generics-portfolio strategy in OTC and para-prescription channels.

By Animal Type

The farm animals segment held the largest share of 63.1% in 2024, driven by the need to prevent parasitic infestations that directly impact livestock productivity and food safety. Parasiticides are extensively used in cattle, sheep, swine, and poultry to reduce disease burden and economic losses. Government-led livestock health programs and strict hygiene regulations strengthen adoption across commercial farms. Moreover, growing global demand for meat, milk, and eggs encourages farmers to maintain effective parasite control practices, solidifying the dominance of farm animals in the overall market.

Key Growth Drivers

Rising Prevalence of Parasitic Infections in Animals

The growing incidence of internal and external parasitic infections in livestock and companion animals is a major market driver. Parasites such as ticks, fleas, worms, and mites cause significant health and productivity losses, increasing demand for effective parasiticides. Veterinary professionals and farmers are adopting preventive treatments to control disease spread and improve animal welfare. The expanding awareness of zoonotic risks further supports the regular use of antiparasitic products across both urban and rural animal healthcare practices.

- For instance, Boehringer Ingelheim International GmbH’s NexGard® (afoxolaner) chewable demonstrated 100 % effectiveness against adult fleas 24 hours post-infestation for 35 days and over 90 % effectiveness against ticks 48 hours post-infestation for 30 days in laboratory studies.

Expanding Livestock Production and Food Security Initiatives

The rising global demand for animal-derived products like meat, milk, and eggs has intensified the need for parasite control in livestock. Governments and international bodies are promoting large-scale livestock health programs to ensure food safety and agricultural productivity. The use of endo- and ectoparasiticides helps prevent economic losses from infestations. Growing investment in livestock farming, especially in developing regions, continues to drive adoption of advanced parasitic management solutions.

- For instance, Elanco Animal Health Incorporated reported that its global portfolio includes more than 6,500 patents and applications across 90 + countries; this IP supports innovations targeting both pet and farm animals, including parasiticides tailored for livestock.

Technological Advancements in Formulation and Delivery Systems

Innovations in parasiticide formulations are enhancing product efficacy, safety, and convenience. Manufacturers are introducing long-acting, combination, and broad-spectrum products that minimize treatment frequency and improve compliance. Advanced drug delivery systems such as oral chewables, injectables, and spot-on applications are gaining popularity among veterinarians and pet owners. These innovations address resistance issues and enhance animal comfort, strengthening the market’s technological edge and supporting consistent product demand globally.

Key Trends & Opportunities

Growth in Companion Animal Healthcare

Increasing pet ownership and rising expenditure on pet health are expanding the companion animal parasiticides segment. Owners are prioritizing preventive care for dogs and cats to avoid flea, tick, and worm infestations. The availability of palatable, easy-to-administer formulations and the influence of veterinary recommendations boost product sales. Growing awareness of pet hygiene and zoonotic disease prevention also supports continuous product innovation, particularly in developed markets.

- For instance, Ceva Santé Animale’s Vectra 3D™ spot-on formulation achieved knock-down of 96 fleas per 100 treated dogs within six hours and repelled four tick species and three mosquito genera in field studies across dogs of all weight ranges.

Adoption of Combination and Long-Acting Parasiticides

The market is witnessing growing demand for combination parasiticides that target multiple parasites simultaneously. Long-acting formulations offering sustained protection are increasingly preferred for both farm and companion animals. These products improve compliance and reduce treatment frequency. Veterinary pharmaceutical companies are focusing on research and development of multi-spectrum formulations that combine endo- and ectoparasitic properties, creating opportunities for new product launches and stronger brand differentiation.

- For instance, Virbac introduced Effitix, a combination of fipronil and permethrin that provides external parasite control in dogs for up to four weeks. This innovation highlights the trend toward combination formulations that enhance convenience and broaden parasite protection coverage.

Expansion of E-Commerce and Veterinary Distribution Channels

Digital sales channels are reshaping the parasiticides market, allowing easier access to products for pet owners and livestock farmers. Online veterinary pharmacies and e-commerce platforms offer convenience, price transparency, and wider product availability. This trend enhances product reach in remote and emerging markets. Manufacturers are strengthening digital marketing strategies and partnerships with veterinary suppliers to expand their global footprint and capture the growing online customer base.

Key Challenges

Growing Parasiticide Resistance

Long-term use and misuse of parasiticides have led to increased resistance among parasites, reducing treatment efficacy. Resistance to active compounds in both endo- and ectoparasiticides poses a major challenge to veterinarians and producers. This issue requires ongoing research, product reformulation, and awareness campaigns promoting responsible use. Managing resistance while maintaining effectiveness is a key priority for manufacturers striving to sustain market growth and customer confidence.

Stringent Regulatory Requirements and High Development Costs

Developing and approving new parasiticides involve extensive safety testing and regulatory compliance, increasing production costs. Variations in regional regulations and delays in product approvals often slow market entry. Smaller players face financial and operational hurdles in meeting global standards. Additionally, maintaining stable cold-chain logistics for product distribution adds to operational expenses. These challenges can limit innovation and restrict market accessibility, particularly in developing economies.

Regional Analysis

North America

North America held the largest share of 38.7% in 2024, driven by the widespread use of parasiticides in both livestock and companion animals. The region benefits from strong veterinary healthcare infrastructure, high awareness of parasite prevention, and advanced formulations. The United States leads with robust product availability and extensive distribution networks, while Canada’s livestock management practices support consistent demand. Ongoing R&D by leading pharmaceutical companies and government-led parasite control programs continue to strengthen the regional market, ensuring sustainable growth across animal health sectors.

Europe

Europe accounted for a 29.8% market share in 2024, supported by stringent regulations on animal welfare and preventive health measures. Countries such as Germany, France, and the United Kingdom dominate due to their advanced livestock production systems and strong emphasis on parasite management. The European Union’s policies promoting food safety and disease control have increased the use of veterinary parasiticides. Rising pet ownership and awareness of zoonotic diseases further enhance market growth. Continuous innovation in eco-friendly and resistance-targeted products reinforces Europe’s leadership in sustainable animal health solutions.

Asia-Pacific

Asia-Pacific captured a 21.6% market share in 2024, fueled by the rapid expansion of the livestock sector and growing companion animal population. Countries like China, India, and Japan are key markets driven by increasing government support for veterinary care and parasite control programs. The region’s improving animal healthcare infrastructure and rising income levels encourage greater adoption of preventive products. Multinational companies are investing in local manufacturing and distribution networks to meet rising demand. Asia-Pacific’s strong agricultural base and expanding awareness of animal health continue to position it as a fast-growing market.

Latin America

Latin America represented a 6.2% share in 2024, driven by high livestock density and growing emphasis on disease prevention in countries such as Brazil, Argentina, and Mexico. Expanding export-oriented meat production encourages adoption of effective parasite control measures. Regional governments are strengthening veterinary programs to reduce production losses caused by parasitic infections. However, uneven access to veterinary services and limited awareness in remote areas remain challenges. Increasing collaboration between international manufacturers and local distributors is improving product reach and supporting the region’s long-term market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 3.7% market share in 2024, supported by the modernization of livestock farming and increasing focus on animal health management. Gulf countries such as Saudi Arabia and the United Arab Emirates are investing in veterinary research and parasite control initiatives. In Africa, rising cattle and poultry farming, coupled with donor-funded vaccination and treatment programs, drives steady product demand. Despite challenges related to infrastructure and affordability, growing awareness of animal welfare and expanding veterinary networks are fostering gradual market development across the region.

Market Segmentations:

By Product

- Ectoparasiticides

- Endoparasiticides

- Endectocides

By Type

- Over the counter (OTC)

- Prescription

By Animal Type

- Companion animals

- Farm animals

By Drug Class

- Chemical synthetic

- Macrocyclic lactones

- Pyrethroids

- Organophosphates

By End Use

- Veterinary hospitals and clinics

- Animal farms

- Home care settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The animal parasiticides market is highly competitive, featuring key players such as Boehringer Ingelheim International, Neogen Corporation, Bimeda, Ourofino Saúde Animal, Ceva Sante Animal, Merck, Biogénesis Bagó, Dechra Pharmaceuticals, Elanco Animal Health, and Norbrook Laboratories. These companies focus on developing advanced formulations targeting both internal and external parasites in livestock and companion animals. Strategic initiatives such as product innovations, mergers, and partnerships with veterinary institutions strengthen their global presence. Major players emphasize long-acting, combination, and resistance-management products to enhance treatment efficiency. Continuous investment in research and development supports the introduction of safer, more effective parasiticides. Moreover, expanding e-commerce channels and regional distribution networks are improving product accessibility. The competition is intensifying as manufacturers prioritize sustainable formulations, precision dosing systems, and digital veterinary tools to ensure compliance, efficacy, and environmental safety across the growing global animal health market.

Key Player Analysis

- Boehringer Ingelheim International

- Neogen Corporation

- Bimeda

- Ourofino Saúde Animal

- Ceva Sante Animal

- Merck

- Biogénesis Bagó

- Dechra Pharmaceuticals

- Elanco Animal Health

- Norbrook Laboratories

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In July 2025, Merck Animal Health (a division of Merck & Co., Inc.) received U.S. regulatory approval for BRAVECTO® QUANTUM (fluralaner for extended-release injectable suspension), which is designed to protect dogs against fleas and ticks with one annual dose.

- In January 2024, Neogen Corporation launched its Provecta® Pro Flea & Tick Collar for Dogs in the U.S., offering long-duration protection for six months per collar application.

- In July 2023, Bimeda, Inc. launched SpectoGard (spectinomycin sulfate) sterile solution in the U.S. This is the first bioequivalent, generic spectinomycin sulfate injectable solution approved for use in cattle.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Animal Type, Drug Class, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing demand for effective parasite control in animals.

- Advancements in long-acting and combination formulations will enhance treatment efficiency.

- Rising awareness of zoonotic diseases will boost preventive parasite management programs.

- Companion animal healthcare expansion will drive higher use of topical and oral parasiticides.

- Technological innovation in precision dosing and digital monitoring will improve treatment accuracy.

- Manufacturers will invest more in sustainable and environmentally safe product development.

- Strengthened government programs for livestock health will support widespread adoption.

- Asia-Pacific will witness the fastest growth due to expanding livestock and pet populations.

- Strategic mergers and partnerships will enhance market penetration and product reach.

- Focus on managing parasiticide resistance will encourage continuous R&D investment globally.