Market Overview

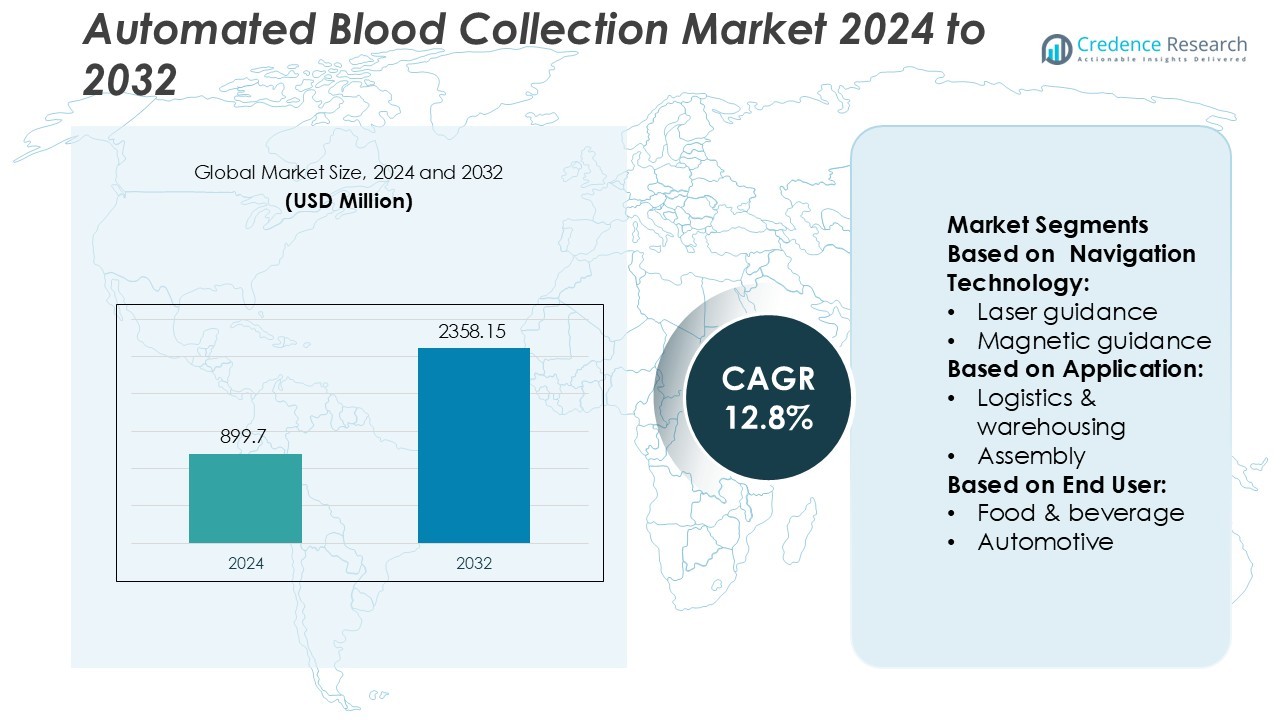

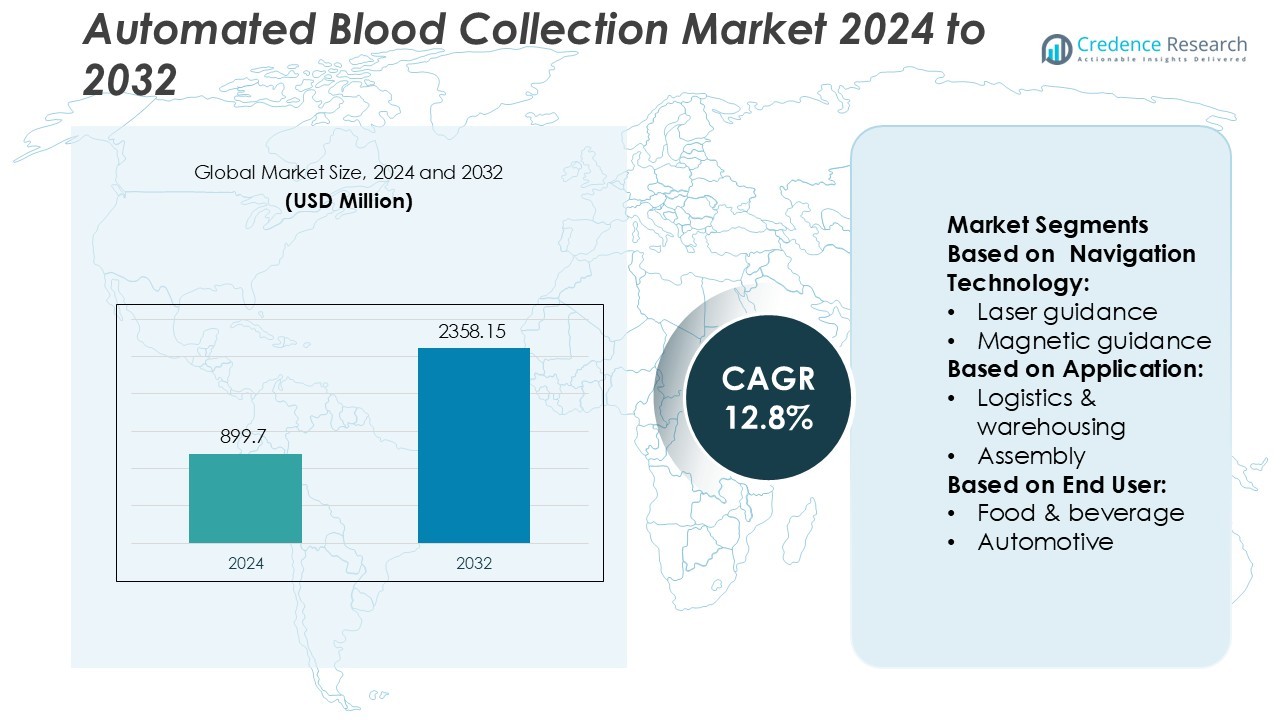

Automated Blood Collection Market size was valued USD 899.7 million in 2024 and is anticipated to reach USD 2358.15 million by 2032, at a CAGR of 12.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automated Blood Collection Market Size 2024 |

USD 899.7 Million |

| Automated Blood Collection Market, CAGR |

12.8% |

| Automated Blood Collection Market Size 2032 |

USD 2358.15 Million |

The automated blood collection market features strong competition among leading players such as Toyota Industries Corporation, Schaefer Systems International, Inc., E&K Automation GmbH, JBT, Seegrid Corporation, Bastian Solutions, Inc., Hyster-Yale Materials Handling, Inc., Dematic, Fetch Robotics, Inc., and Daifuku Co., Ltd. These companies focus on continuous innovation, incorporating AI, robotics, and precision imaging to improve collection accuracy and patient safety. North America leads the global market with a 37% share, supported by advanced healthcare infrastructure, strong R&D investment, and rapid adoption of automation technologies in hospitals and diagnostic centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automated Blood Collection Market was valued at USD 899.7 million in 2024 and is expected to reach USD 2,358.15 million by 2032, growing at a CAGR of 12.8% during the forecast period.

- Rising demand for automation in healthcare and increasing diagnostic testing volumes are key drivers boosting market growth across hospitals and laboratories.

- Integration of AI, robotics, and image-guided systems represents a major trend, improving vein detection accuracy and enhancing patient safety.

- High initial setup and maintenance costs remain a key restraint, limiting adoption among smaller clinics and facilities in developing regions.

- North America dominates the market with a 37% regional share, while the laser-guided navigation segment leads among technologies, supported by strong investments in R&D and digital healthcare infrastructure.

Market Segmentation Analysis:

By Navigation Technology

Laser guidance dominates the automated blood collection market, holding the largest share due to its precision and consistency in locating veins. This technology uses advanced sensors and optical systems to enhance accuracy and reduce errors during collection. Magnetic and vision guidance systems are also gaining traction for their ability to adapt to various patient conditions and environments. The rising adoption of AI-integrated laser systems enables automated vein mapping and reduces the need for manual intervention, improving procedural efficiency and patient comfort across hospitals and diagnostic centers.

- For instance, E&K Automation’s “MEDI MOVE” transport platform (launched in 2023) supports 24/7 indoor clean-room operation with a baseplate height of just 110 mm and integrates 3D object-recognition sensors to manage unstable loads without human guidance.

By Application

The logistics and warehousing segment leads the application category, driven by increasing demand for efficient sample handling and storage automation in large-scale healthcare facilities. Automated systems enhance sample traceability, minimize contamination risks, and ensure timely delivery to laboratories. Packaging and assembly applications are expanding as hospitals and diagnostic labs integrate robotics for sterilized container handling. The growing emphasis on automation in healthcare logistics for accuracy, speed, and safety continues to strengthen this segment’s dominance in the overall market landscape.

- For instance, JBT’s Automated Guided Vehicle (AGV) line designed for hospital and healthcare applications, branded as the C.A.R.E. fleet. Official product specifications list the maximum capacity as 330.7 lbs, which equates to approximately 150 kg.

By End-User

The pharmaceutical segment holds the highest market share in the automated blood collection market, supported by its need for high-throughput and sterile collection systems in drug trials and R&D activities. Automation helps ensure consistent sample integrity and supports large-scale clinical testing. The healthcare and diagnostic manufacturing sectors are rapidly adopting these systems to reduce human error and improve compliance with regulatory standards. Increased investments in laboratory automation and precision medicine research further drive the dominance of pharmaceutical end-users in this market.

Key Growth Drivers

Rising Adoption of Automation in Healthcare

Healthcare facilities increasingly use automated systems to improve efficiency and reduce human error in blood collection. Automation enhances sample accuracy, shortens turnaround time, and minimizes the risk of contamination. Hospitals and diagnostic centers are adopting smart robotic systems for repetitive collection tasks to ensure consistency. The growing focus on patient comfort and safety, along with the need to handle higher testing volumes efficiently, continues to drive strong adoption of automated blood collection technologies worldwide.

- For instance, Seegrid’s autonomous mobile robots have logged over 17 000 000 miles of operation in customer facilities as of mid-2025, demonstrating broad deployment and operational maturity.

Increasing Demand for Diagnostic Testing

The expanding demand for diagnostic testing in chronic disease management significantly boosts the automated blood collection market. Advanced automated systems support faster and more accurate results, aiding physicians in early disease detection and treatment planning. Rising prevalence of conditions such as diabetes, cardiovascular diseases, and infections fuels the need for high-volume blood testing. Laboratories increasingly deploy automated collection systems to manage large patient inflows and ensure operational efficiency while maintaining compliance with healthcare standards.

- For instance, Bastian Solutions completed its 100th installation of the AutoStore system at a facility that features 28 of the R5 robots and more than 90,000 storage bins.

Technological Advancements in Robotic Collection Systems

Continuous innovation in robotic and AI-based blood collection systems drives market growth. Modern devices now integrate infrared sensors, 3D vein mapping, and image-guided navigation for improved vein localization. These systems reduce needle-stick errors and enhance patient experience. Manufacturers are investing heavily in R&D to develop compact, portable units suitable for clinics and home healthcare. The integration of machine learning algorithms further refines blood draw accuracy, enabling real-time monitoring and predictive maintenance for medical laboratories.

Key Trends & Opportunities

Integration of Artificial Intelligence and Vision Technology

AI and vision-guided technologies are transforming automated blood collection by enhancing vein detection and optimizing puncture accuracy. AI-driven software analyzes patient skin tone, vein depth, and temperature for real-time decision-making. These advancements improve success rates and reduce discomfort during procedures. Growing collaboration between medical device companies and AI firms presents opportunities for developing next-generation automated phlebotomy systems with predictive analytics and adaptive algorithms.

- For instance, Hyster-Yale’s Yale® Reliant™ operator-assist system is currently deployed on more than 7,800 lift-truck units, following over 40,000 hours of R&D investment.

Rising Focus on Point-of-Care and Home-Based Diagnostics

The demand for portable and self-operating blood collection systems is rising with the growth of home diagnostics and telemedicine. Automated systems enable safe and hygienic sample collection outside traditional healthcare settings. This trend supports preventive care and remote patient monitoring initiatives. Companies developing compact, user-friendly, and connected devices are positioned to capitalize on this shift, particularly in aging populations and regions with limited healthcare infrastructure.

- For instance, Dematic’s autonomous mobile robot (AMR) platform features a vertical reach of up to 12 meters and uses LiDAR scanners for obstacle detection in real-time environments.

Expansion in Emerging Healthcare Markets

Emerging economies are witnessing increased investments in healthcare automation. Hospitals and diagnostic centers in Asia-Pacific, Latin America, and the Middle East are modernizing their facilities to improve diagnostic efficiency. Supportive government initiatives, digital health programs, and growing healthcare expenditure create strong opportunities for automated blood collection manufacturers. Local production partnerships and technology transfer agreements further enhance regional market penetration.

Key Challenges

High Initial Setup and Maintenance Costs

Automated blood collection systems require significant upfront investment, limiting adoption in small clinics and low-income regions. High costs of robotic units, software integration, and maintenance deter healthcare facilities with limited budgets. Additionally, frequent calibration and servicing increase operational expenses. Overcoming cost barriers through modular pricing and leasing options remains a key challenge for manufacturers aiming to expand market reach.

Regulatory and Standardization Constraints

Stringent regulatory requirements for medical device approval slow the commercialization of new automated systems. Variations in safety and performance standards across regions create complexities for manufacturers. Compliance with ISO and FDA guidelines demands extensive clinical validation, prolonging product launch timelines. The absence of global standardization also impacts interoperability between devices from different suppliers, hindering smooth adoption across diverse healthcare environments.

Regional Analysis

North America

North America holds the largest share of 37% in the automated blood collection market, driven by advanced healthcare infrastructure and strong adoption of automation technologies. The U.S. leads regional growth due to widespread integration of robotic and AI-based systems in hospitals and diagnostic laboratories. High demand for efficient blood testing in chronic disease management and strong R&D investments by major players such as Becton Dickinson and Terumo support market expansion. Favorable reimbursement policies and increasing focus on precision medicine further strengthen the region’s dominance in global automated blood collection adoption.

Europe

Europe accounts for 29% of the global market, supported by growing automation in medical laboratories and rising investments in smart healthcare systems. Germany, France, and the U.K. represent key contributors with strong clinical research networks and government initiatives promoting digital healthcare. The region’s emphasis on patient safety and laboratory efficiency has accelerated the shift toward automated phlebotomy systems. Additionally, the implementation of strict EU medical device regulations ensures product quality and standardization, driving demand for reliable and certified blood collection technologies across both hospital and outpatient settings.

Asia-Pacific

Asia-Pacific captures a 24% share of the automated blood collection market, emerging as the fastest-growing region. Rapid urbanization, expanding healthcare infrastructure, and increasing diagnostic testing volumes drive regional growth. Countries such as China, Japan, and India are investing heavily in healthcare digitization and automation. Rising incidences of chronic diseases and growing awareness of preventive healthcare encourage adoption of advanced blood collection devices. Furthermore, favorable government initiatives and partnerships with global manufacturers promote technology transfer, making Asia-Pacific a key hub for affordable and scalable automated blood collection solutions.

Latin America

Latin America accounts for 6% of the global market, with Brazil and Mexico leading adoption due to modernization of healthcare systems and expansion of private diagnostic laboratories. Growing investment in hospital automation and public health programs supports market development. Regional laboratories increasingly deploy automated systems to improve sample handling and minimize procedural errors. Although budget constraints limit widespread adoption, the demand for efficient, low-contact blood collection solutions continues to rise. Strategic partnerships between local healthcare providers and international technology companies are expected to enhance accessibility and affordability.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the global automated blood collection market, showing gradual progress driven by healthcare infrastructure upgrades. The United Arab Emirates and Saudi Arabia lead adoption with investments in smart hospitals and advanced diagnostic centers. Efforts to modernize laboratory operations and reduce dependence on manual collection methods are gaining momentum. In Africa, countries such as South Africa and Kenya are adopting cost-effective automation solutions supported by international aid programs. Growing awareness of patient safety and infection control is further fostering regional market development.

Market Segmentations:

By Navigation Technology:

- Laser guidance

- Magnetic guidance

By Application:

- Logistics & warehousing

- Assembly

By End User:

- Food & beverage

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The automated blood collection market is highly competitive, with key players including Toyota Industries Corporation, Schaefer Systems International, Inc., E&K Automation GmbH, JBT, Seegrid Corporation, Bastian Solutions, Inc., Hyster-Yale Materials Handling, Inc., Dematic, Fetch Robotics, Inc., and Daifuku Co., Ltd. The automated blood collection market is defined by rapid technological innovation and strategic collaboration among manufacturers. Companies are focusing on developing intelligent, AI-integrated systems that enhance precision, minimize procedural errors, and improve patient comfort. The shift toward automated and contactless blood collection is driving research in robotic arms, image-guided navigation, and machine learning–based vein detection. Partnerships with hospitals, diagnostic laboratories, and healthcare technology firms are expanding product reach and accelerating adoption. Additionally, increased investment in R&D and regulatory compliance ensures reliability, safety, and consistency, strengthening competitiveness across global healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toyota Industries Corporation

- Schaefer Systems International, Inc.

- E&K Automation GmbH

- JBT

- Seegrid Corporation

- Bastian Solutions, Inc.

- Hyster-Yale Materials Handling, Inc.

- Dematic

- Fetch Robotics, Inc.

- Daifuku Co., Ltd.

Recent Developments

- In July 2024, Bastian Solutions, LLC, opened its new manufacturing and corporate campus in Noblesville, Indiana. The newly established campus, chosen for its strategic location, would become the central hub for Bastian Solutions, LLC’s manufacturing processes and corporate activities, consolidating various existing sites into one centralized location.

- In March 2024, Locus Robotics introduced the LocusHub business intelligence engine. LocusHub, a key element of the LocusOne platform, leverages advanced analytics, AI, and ML to provide predictive and prescriptive insights. These insights aim to enhance productivity, reduce expenses, and reveal new dimensions of intelligence within the warehouse.

- In February 2024, Swisslog Holding AG expanded its presence in Lyon, France. This expansion broadened its customer base in France and strengthened its market position as an intralogistics automation solutions provider. The Lyon office is set to function as a pivotal center for business growth, client interaction, and fostering partnerships with regional enterprises.

- In December 2023, BD (Becton, Dickinson & Company) announced it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for an innovative blood collection device designed to obtain samples via a fingerstick.

Report Coverage

The research report offers an in-depth analysis based on Navigation Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for automated blood collection systems will increase with the expansion of diagnostic laboratories.

- Integration of AI and robotic systems will enhance accuracy and minimize manual intervention.

- Hospitals will continue adopting automation to improve patient safety and collection efficiency.

- Miniaturized and portable blood collection devices will gain traction in home healthcare settings.

- Partnerships between med-tech firms and hospitals will accelerate technology deployment worldwide.

- Emerging economies will witness strong growth due to improving healthcare infrastructure and investments.

- Data integration with electronic health records will enhance traceability and regulatory compliance.

- Manufacturers will focus on developing eco-friendly and cost-efficient automated systems.

- Continuous innovation in vision and infrared-based vein detection will improve patient comfort.

- Expanding use of telemedicine and remote diagnostics will boost demand for connected blood collection solutions.