Market Overview

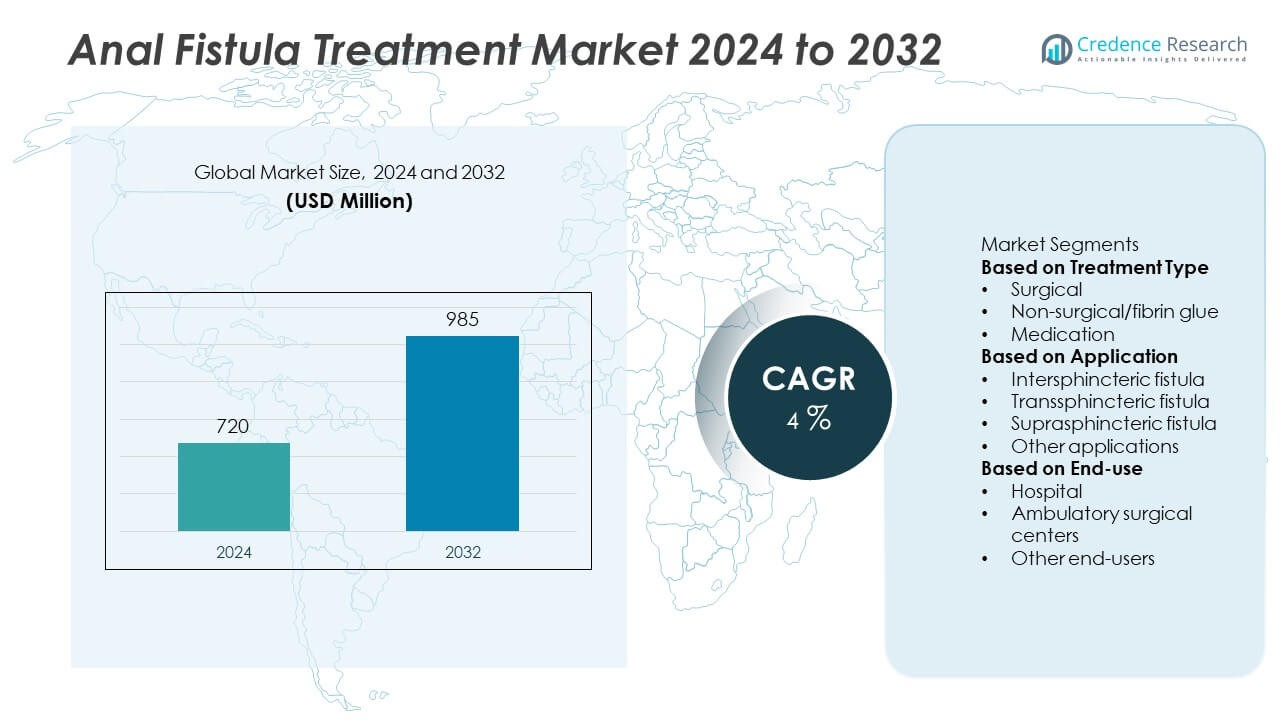

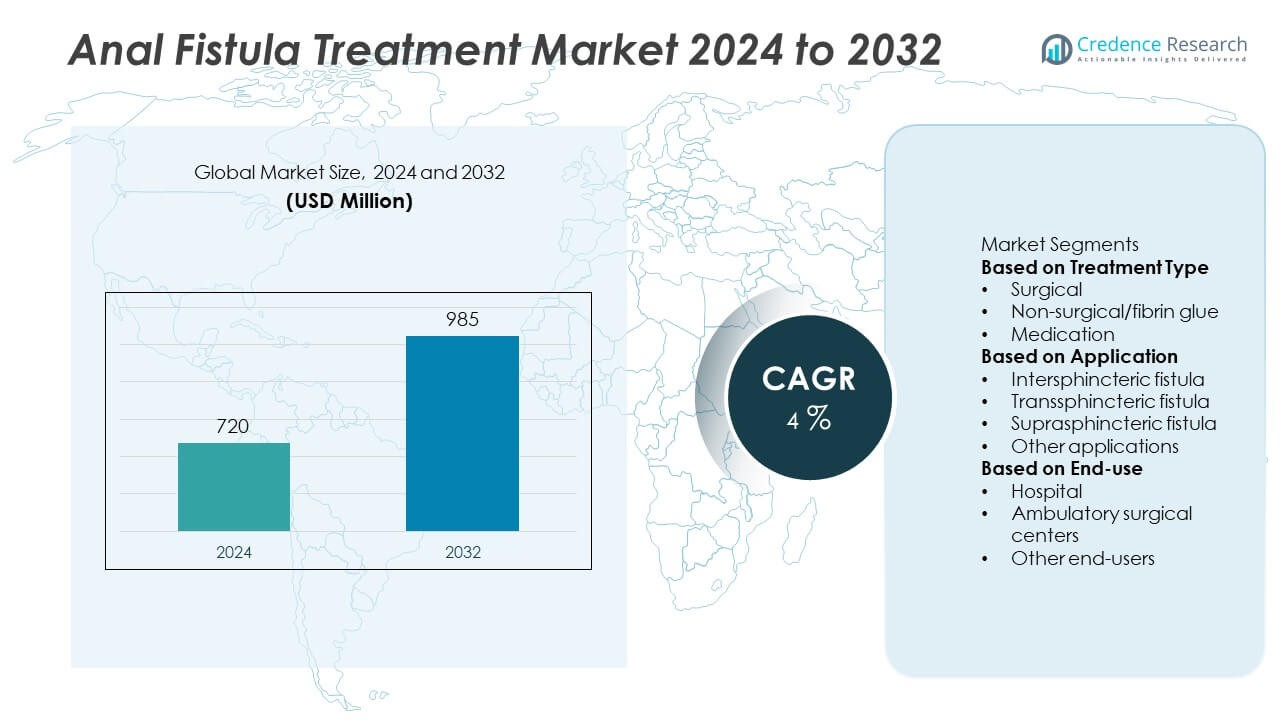

The Anal Fistula Treatment Market was valued at USD 720 million in 2024 and is projected to reach USD 985 million by 2032, expanding at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anal Fistula Treatment Market Size 2024 |

USD 720 Million |

| Anal Fistula Treatment Market, CAGR |

4% |

| Anal Fistula Treatment Market Size 2032 |

USD 985 Million |

The anal fistula treatment market is led by prominent companies such as Cook Medical, Biolitec AG, Medtronic plc, KARL STORZ SE & Co. KG, and Boston Scientific Corporation, which collectively maintain strong market positions through advanced surgical systems and laser-assisted technologies. These players emphasize minimally invasive procedures that improve healing outcomes and reduce recurrence rates. Emerging participants, including AbbVie, Coloplast Group, Integra LifeSciences Holdings Corporation, Becton, Dickinson and Company, and Gem srl, are expanding their presence with innovative biologic and device-based solutions. North America dominated the global market with a 38.9% share in 2024, supported by robust healthcare infrastructure, skilled professionals, and high adoption of laser-based fistula treatment systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The anal fistula treatment market was valued at USD 720 million in 2024 and is projected to reach USD 985 million by 2032, growing at a CAGR of 4% during the forecast period.

- Growth is driven by the rising incidence of anal fistula cases, advancements in minimally invasive surgical procedures, and increasing patient preference for faster recovery options.

- Key trends include the adoption of laser-based and fibrin glue treatments that reduce recurrence and promote rapid healing, enhancing clinical outcomes and patient comfort.

- Leading players such as Medtronic plc, Boston Scientific Corporation, Cook Medical, KARL STORZ SE & Co. KG, and Biolitec AG dominate through innovation, global reach, and product differentiation in laser and surgical systems.

- North America led with 38.9% share, followed by Europe at 30.1% and Asia-Pacific at 22.8%; by treatment, surgical procedures accounted for 61.3% share, reflecting their reliability and long-term effectiveness in complex fistula management.

Market Segmentation Analysis:

By Treatment Type

The surgical segment dominated the anal fistula treatment market with a 68.2% share in 2024, driven by its high success rate and long-term effectiveness. Surgical procedures such as fistulotomy, advancement flap, and seton placement remain the most preferred approaches for complex and recurring cases. Advancements in minimally invasive techniques, including video-assisted and laser-based procedures, have improved recovery time and reduced postoperative complications. The increasing availability of skilled surgeons and advanced surgical tools continues to strengthen the segment’s leadership in both developed and emerging healthcare markets.

- For instance, Biolitec AG introduced its FiLaC® laser therapy system that delivers a 1470 nm wavelength through a radial fiber. Studies report varied primary healing rates for FiLaC, generally ranging from 60% to 80%, with some studies finding rates of approximately 74.7% in cases that included many patients with prior surgeries or a 76.9% rate at 5-year follow-up.

By Application

The intersphincteric fistula segment held the largest market share of 45.7% in 2024, owing to its higher prevalence compared to other fistula types. This condition, often caused by chronic infection or inflammation, requires effective drainage and surgical repair for complete healing. The rising adoption of minimally invasive and sphincter-sparing techniques has enhanced treatment outcomes and patient satisfaction. Growing awareness among patients and advancements in diagnostic imaging contribute to early detection and management, further reinforcing the segment’s dominance in the overall market.

- For instance, Cook Medical’s Biodesign® Anal Fistula Plug is a bioprosthetic device whose acellular collagen matrix promotes natural tissue regeneration without compromising continence.

By End-use

The hospital segment accounted for a 70.3% share in 2024, supported by the availability of specialized colorectal surgeons, advanced diagnostic facilities, and post-operative care infrastructure. Hospitals remain the primary centers for both open and minimally invasive procedures, offering comprehensive treatment for complex anal fistula cases. Increasing patient preference for hospital-based care due to safety, precision, and faster recovery strengthens this segment’s growth. Meanwhile, ambulatory surgical centers are gaining momentum due to shorter treatment times, cost-effectiveness, and growing adoption of outpatient minimally invasive procedures.

Key Growth Drivers

Rising Prevalence of Anal Fistula and Related Anorectal Disorders

The growing number of patients suffering from anal fistula, often associated with Crohn’s disease, obesity, and infections, is fueling market demand. Increasing sedentary lifestyles and delayed diagnosis contribute to a higher incidence of chronic anal fistulas. Healthcare providers are focusing on early intervention and advanced surgical techniques to reduce recurrence. This rising disease burden is encouraging hospitals and clinics to adopt modern diagnostic tools and treatment systems, supporting the steady expansion of the anal fistula treatment market globally.

- For instance, the device division of Medtronic plc reported that more than 250 000 patients have been treated with its InterStim™ sacral-neuromodulation system for bowel control, and in a five-year follow-up 89 % of chronic fecal-incontinence patients achieved clinical success.

Advancements in Minimally Invasive and Laser-Based Techniques

The introduction of minimally invasive and laser-assisted procedures has transformed anal fistula management. These techniques minimize postoperative pain, hospital stay, and recurrence risk while enhancing patient comfort. Laser-based closure and video-assisted treatments are gaining popularity due to their precision and faster healing times. Increasing investments by manufacturers in advanced surgical equipment and greater surgeon training in minimally invasive approaches are driving the market’s technological evolution and improving clinical outcomes.

- For instance, a study published in 2023 reported that a novel treatment cohort achieved clinical improvement in 80.4 % of patients and clinical closure in 64.4 % of cases of complex anal fistulas using a minimally invasive approach.

Increasing Healthcare Awareness and Access to Specialized Care

Rising awareness of anorectal health and the growing availability of specialized colorectal care centers are boosting early diagnosis and treatment rates. Governments and healthcare organizations are conducting awareness programs to promote early consultation and reduce disease complications. Improved access to medical facilities and reimbursement support for advanced procedures are also increasing patient preference for professional treatment. Expanding healthcare infrastructure in emerging economies further strengthens market growth by improving access to skilled practitioners and modern therapeutic options.

Key Trends & Opportunities

Growing Adoption of Outpatient and Day-Care Procedures

The shift toward outpatient and same-day surgical care is accelerating due to advancements in anesthesia and minimally invasive techniques. Ambulatory surgical centers are gaining traction by offering cost-effective, quick, and efficient treatment options. Patients prefer these facilities for reduced hospital stays and lower infection risks. This trend creates opportunities for expanding outpatient care infrastructure and adopting advanced devices suited for minimally invasive anal fistula procedures, especially in urban and high-income regions.

- For instance, Medtronic plc’s InterStim™ sacral neuromodulation system has been used in more than 400,000 patients worldwide, with the permanent device implanted during a short, minimally invasive outpatient procedure.

Integration of Imaging and Diagnostic Technologies

Technological progress in imaging, including MRI and endoanal ultrasound, has improved preoperative planning and treatment precision. These tools help surgeons assess fistula tract complexity and choose the most suitable procedure, reducing recurrence risks. The integration of imaging with surgical systems enhances accuracy in identifying internal openings and assessing healing progress. This growing reliance on advanced diagnostics is driving demand for comprehensive treatment solutions that combine imaging, therapy, and post-surgical monitoring.

- For instance, Biolitec AG reported in a study of 117 patients treated with its FiLaC® laser fibre that a 1470 nm diode laser achieved a primary healing rate of 75 out of 117 cases (64.1) and a secondary healing rate of 103 out of 117 cases (88 healed) at a median follow-up of 25.4 months, demonstrating the value of combining imaging diagnostics with precise laser delivery.

Expansion in Emerging Healthcare Markets

Developing economies in Asia-Pacific and Latin America are witnessing increasing adoption of modern anal fistula treatments. Rising healthcare expenditure, improving hospital infrastructure, and greater availability of colorectal specialists are fueling market expansion. Governments are encouraging medical tourism and upgrading surgical facilities with advanced technologies. Growing awareness of minimally invasive treatment benefits and international collaborations among device manufacturers present significant growth opportunities in these regions over the forecast period.

Key Challenges

High Cost of Advanced Surgical and Laser Treatments

Despite their clinical advantages, laser-assisted and video-guided procedures remain expensive for many patients, particularly in developing regions. The high cost of equipment, maintenance, and specialized training increases overall treatment expenses. Limited reimbursement coverage for advanced procedures also restricts patient access. As a result, cost remains a major barrier to widespread adoption, encouraging healthcare providers to seek affordable, efficient alternatives without compromising treatment quality.

Risk of Postoperative Complications and Recurrence

Even with advanced technologies, recurrence and postoperative complications such as infection, pain, or incontinence continue to pose challenges. Complex or recurrent fistulas often require multiple procedures, affecting patient confidence and increasing healthcare costs. Limited availability of standardized treatment guidelines and inconsistent outcomes across techniques further hinder market growth. Continuous clinical evaluation, improved surgeon training, and the development of next-generation closure systems are crucial to overcoming these limitations and ensuring sustainable progress in anal fistula management.

Regional Analysis

North America

North America held the largest share of 38.9% in 2024, driven by high awareness of anorectal diseases, advanced healthcare infrastructure, and the growing adoption of minimally invasive treatments. The United States leads the region due to strong availability of skilled colorectal surgeons, favorable reimbursement policies, and increasing use of laser and fibrin glue procedures. Canada contributes significantly through rising investments in surgical advancements and hospital upgrades. Continuous technological innovation and increasing prevalence of anal fistula cases strengthen regional growth, making North America a dominant market for advanced treatment solutions.

Europe

Europe accounted for a 30.6% share in 2024, supported by well-established healthcare systems, rising geriatric population, and an increasing number of patients with Crohn’s disease and inflammatory bowel disorders. Countries such as Germany, France, and the United Kingdom lead in adopting laser-based and minimally invasive techniques. The region benefits from strong regulatory standards, government-backed healthcare access, and the presence of key medical device manufacturers. Growing awareness of post-surgical recovery outcomes and the shift toward outpatient procedures further enhance Europe’s position in the anal fistula treatment market.

Asia-Pacific

Asia-Pacific captured a 21.4% market share in 2024, fueled by a rising patient population, growing healthcare spending, and improving access to specialized colorectal care. Countries including China, India, and Japan are expanding hospital infrastructure and adopting minimally invasive procedures at a fast pace. Increasing public awareness of anorectal health and favorable government initiatives promoting early diagnosis are strengthening regional adoption. Rapid urbanization and expanding medical tourism markets further attract international manufacturers to invest in localized production and training programs, establishing Asia-Pacific as the fastest-growing market for anal fistula treatment.

Latin America

Latin America represented a 5.6% share in 2024, driven by improving healthcare access and a rising number of hospitals offering advanced colorectal surgeries. Brazil and Mexico dominate the regional market due to growing awareness of anorectal diseases and expanding adoption of laser-assisted treatments. Government initiatives to improve surgical infrastructure and the entry of global medical device companies are fostering regional growth. However, limited reimbursement support and uneven access to specialized care in rural areas remain challenges. Continued investments in healthcare modernization are expected to enhance treatment availability across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3.5% share in 2024, supported by increasing healthcare expenditure, modernization of surgical facilities, and growing prevalence of anorectal disorders. Gulf nations such as Saudi Arabia and the United Arab Emirates are leading regional growth through strong government healthcare investments and collaborations with international medical device providers. In Africa, expanding awareness campaigns and NGO-backed medical outreach programs are improving access to treatment. Despite challenges related to limited specialist availability, ongoing infrastructure upgrades are expected to drive gradual growth across this region.

Market Segmentations:

By Treatment Type

- Surgical

- Non-surgical/fibrin glue

- Medication

By Application

- Intersphincteric fistula

- Transsphincteric fistula

- Suprasphincteric fistula

- Other applications

By End-use

- Hospital

- Ambulatory surgical centers

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The anal fistula treatment market is highly competitive, featuring key players such as Cook Medical, Biolitec AG, Medtronic plc, KARL STORZ SE & Co. KG, AbbVie, Boston Scientific Corporation, Integra LifeSciences Holdings Corporation, Coloplast Group, Becton, Dickinson and Company, and Gem srl. These companies focus on developing advanced surgical tools, laser-based systems, and biologic therapies to improve treatment precision and healing outcomes. Strategic initiatives such as product innovation, mergers, and collaborations with hospitals and research centers are strengthening their market positions. Manufacturers are emphasizing minimally invasive, sphincter-sparing techniques to reduce recurrence and enhance patient recovery. Continuous investment in R&D, coupled with the integration of imaging technologies, supports market differentiation and procedural efficiency. The competitive environment is shaped by innovation in laser fiber systems, expanding access to outpatient procedures, and growing focus on cost-effective yet high-performance treatment solutions across global healthcare settings.

Key Player Analysis

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In July 2025 Biolitec AG published a consensus document defining that its FiLaC® – Fistula tract Laser Closure procedure is a first-line, sphincter-saving treatment option for complex anal fistulas.

- In March 2024, AbbVie Inc.’s investigational drug Upadacitinib (ABT-494) showed higher rates of drainage resolution and external opening closure in patients with perianal fistulizing disease (mainly perianal fistulas).

- In January 2024, Boston Scientific corporation initiated the acquisition of certain endoscopic vacuum therapy assets from B. The acquisition includes the Endo-SPONGE, the Eso-SPONGE, and the Endo-SPONGE Fistula and their respective replacements, upgrades, and accessories.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption of minimally invasive treatment options.

- Laser and fibrin glue procedures will gain traction due to faster healing and reduced recurrence.

- Hospitals will continue to dominate as the primary treatment centers for complex fistula cases.

- Growing patient awareness and early diagnosis will drive higher treatment adoption rates.

- Technological advancements will improve precision and outcomes in anal fistula surgeries.

- Asia-Pacific will emerge as the fastest-growing region due to improving healthcare infrastructure.

- Manufacturers will focus on developing cost-effective and patient-friendly treatment devices.

- Collaborations between hospitals and device makers will enhance clinical efficiency and training.

- Increasing investment in research will lead to new biologically compatible materials for repair.

- Expanding outpatient surgical centers will improve accessibility and affordability of treatments.