Market Overview

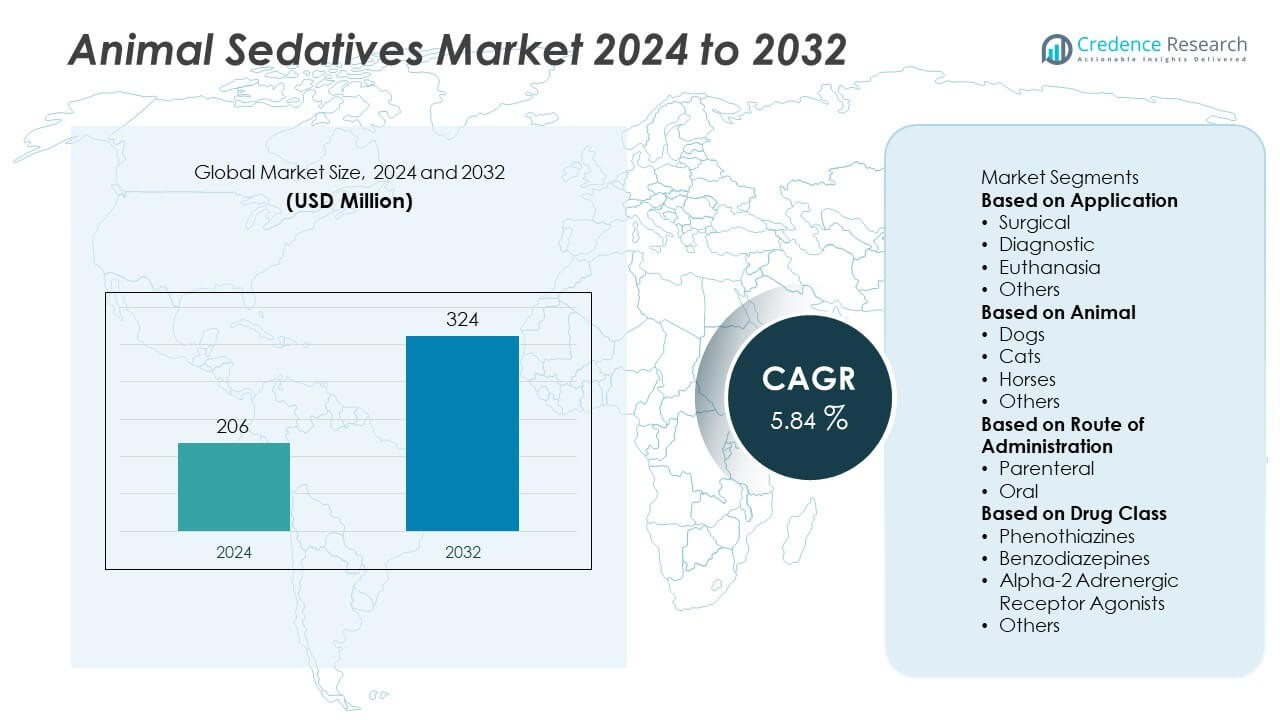

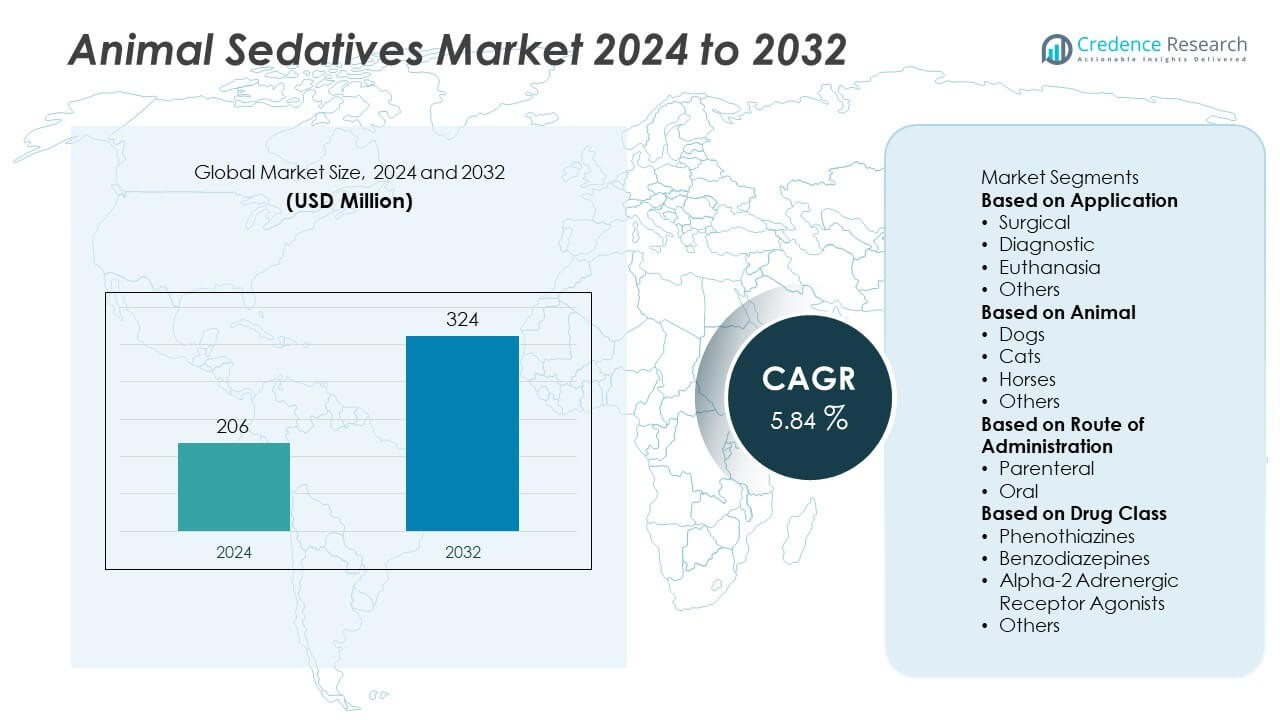

The Animal Sedatives Market was valued at USD 206 million in 2024 and is projected to reach USD 324 million by 2032, growing at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Sedatives Market Size 2024 |

USD 206 Million |

| Animal Sedatives Market, CAGR |

5.84% |

| Animal Sedatives Market Size 2032 |

USD 324 Million |

The animal sedatives market is led by prominent companies including Zoetis Services, LLC, Merck & Co., Inc., Virbac, Dechra, and Bimeda Inc., which collectively hold a major share due to their strong product portfolios and extensive global distribution. These players emphasize advanced veterinary formulations, species-specific sedatives, and expanded clinical applications to enhance safety and precision. Emerging participants such as Ouro Fino Saude Animal Group, Randlab Australia Pty Ltd, and Troy Laboratories Pty Ltd are strengthening regional presence through affordable and efficient solutions. North America leads the global market with a 39.4% share in 2024, driven by high veterinary care expenditure and strong adoption of advanced anesthesia products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The animal sedatives market was valued at USD 206 million in 2024 and is projected to reach USD 324 million by 2032, registering a CAGR of 5.84% during the forecast period.

- Growth is driven by rising pet ownership, increased veterinary care spending, and expanding livestock welfare regulations that promote the ethical use of sedatives in surgical and diagnostic procedures.

- Key trends include the development of safer, species-specific formulations, digital monitoring integration, and growing demand for natural, low-toxicity sedative solutions.

- Leading players such as Zoetis Services, LLC, Merck & Co., Inc., Virbac, and Dechra dominate through product innovation and strategic expansion across companion and livestock segments.

- North America led with 39.4% share, followed by Europe at 29.7%, while Asia-Pacific held 22.1%. The surgical application segment accounted for 42.6% share, and the parenteral route dominated with 67.1% share, highlighting preference for injectable sedative formulations.

Market Segmentation Analysis:

By Application

The surgical segment dominated the animal sedatives market with a 42.6% share in 2024. Sedatives are extensively used in preoperative and postoperative procedures to reduce anxiety, pain, and movement in animals. The growing number of pet surgeries, including orthopedic and dental procedures, is driving this dominance. Diagnostic applications are also expanding as sedatives aid in imaging and examinations requiring immobilization. Increasing adoption of minimally invasive procedures and veterinary infrastructure improvements further strengthen the demand for anesthetic and sedative agents across animal healthcare settings.

- For instance, Dechra Pharmaceuticals launched Zenalpha, a combination of medetomidine and vatinoxan hydrochlorides, providing sedation within 10 minutes and lasting up to 40 minutes. Clinical trials on 223 canine subjects showed 98% procedural success with reduced cardiovascular depression.

By Animal

The dogs segment held the largest share of 48.3% in 2024, supported by rising pet ownership and growing veterinary care expenditure. Sedation in dogs is frequently used for surgeries, diagnostic imaging, and grooming, contributing to higher product use. Cats represent a growing share due to rising feline health awareness and the development of cat-specific sedatives that ensure safety and comfort. The increasing trend of pet humanization and availability of advanced formulations tailored for companion animals are key growth drivers.

- For instance, Zoetis introduced Dexdomitor (dexmedetomidine hydrochloride), offering dose-dependent sedation ranging from 10 to 120 minutes in dogs. In clinical studies, more than 450 veterinary facilities reported stable hemodynamic response and effective restraint for dental and orthopedic surgeries.

By Route of Administration

The parenteral segment accounted for a 67.1% market share in 2024, emerging as the dominant route of administration. Injectable sedatives provide rapid onset and precise dosage control, making them highly preferred in surgical and emergency settings. Veterinarians favor parenteral administration for its effectiveness in handling aggressive or large animals. Oral sedatives, while slower in action, are gaining traction for at-home use and mild sedation needs. Rising adoption of injectable drug delivery systems and the development of long-acting formulations continue to support parenteral dominance.

Key Growth Drivers

Rising Companion Animal Ownership

The increasing adoption of pets, particularly dogs and cats, is fueling demand for animal sedatives. Pet owners are investing more in preventive and surgical care, where sedatives ensure safe and effective treatment. Growing awareness about animal health and wellness has expanded the use of veterinary pharmaceuticals. As urban lifestyles evolve and pet humanization deepens, the need for stress-free veterinary procedures continues to strengthen market growth.

- For instance, Boehringer Ingelheim supplies veterinary sedatives such as Medetomidine Hydrochloride, used in small animal surgeries. The company’s Animal Health division employs more than 10,000 professionals and supports over 150 R&D collaborations worldwide.

Expanding Livestock Healthcare and Welfare Regulations

Governments and animal welfare organizations are enforcing strict regulations on humane livestock handling. These rules promote sedative use during transportation, breeding, and medical care to prevent stress and injury. The livestock industry is also focusing on better animal management practices, driving demand for reliable and fast-acting sedatives. Rising awareness about animal ethics and increased veterinary support in rural areas are further enhancing adoption.

- For instance, Virbac expanded its livestock sedative range with products designed for stress-free cattle restraint during veterinary procedures. The company operates in more than 100 countries and runs dedicated livestock R&D facilities in Carros, France, and Guadalajara, Mexico. Virbac’s veterinary training programs have reached over 25,000 livestock specialists, enhancing compliance with animal welfare protocols.

Advancements in Veterinary Anesthesia and Drug Formulation

Continuous innovation in drug delivery and formulation has transformed the veterinary sedation landscape. Manufacturers are developing safer, species-specific products with faster action and fewer side effects. These advances improve treatment precision and reduce recovery time for animals. Veterinary professionals increasingly prefer modern injectables and oral sedatives that offer enhanced control and reliability, supporting the overall market expansion.

Key Trends & Opportunities

Shift Toward Natural and Low-Toxicity Formulations

Growing demand for safer and eco-friendly veterinary drugs is encouraging the shift toward natural sedatives. Companies are focusing on herbal and biologically derived ingredients that minimize health risks for animals. This trend aligns with sustainable development goals and increasing consumer awareness of product safety. Natural formulations are gaining traction among pet owners seeking chemical-free solutions for anxiety, surgery, and medical care.

- For instance, Vetoquinol operates in around 100 countries (through a combination of subsidiaries in 24 countries and distributors) and employs more than 2,500 people. The company offers a natural calming supplement called Zylkene®, which contains alpha-casozepine (a milk protein derivative) to help pets cope with stress.

Adoption of Digital Monitoring in Veterinary Procedures

Veterinary clinics are integrating digital tools to improve sedation precision and safety. Smart dosing systems and connected monitoring platforms help veterinarians track anesthesia levels and recovery progress in real time. This enhances care quality and minimizes complications during procedures. The fusion of sedatives with technology opens opportunities for innovation in both product development and clinical practice.

- For instance, IDEXX Laboratories introduced the Catalyst One Analyzer, a point-of-care instrument that can run up to 34 parameters, including chemistry, electrolyte, and immunoassay profiles, from a single blood sample, with results typically available in minutes.

Expansion of Online Veterinary Pharmacies

Online platforms are becoming an important distribution channel for veterinary sedatives. Digital pharmacies provide convenient access, wide product choices, and clear information for pet owners and professionals. This accessibility supports higher sales in remote areas and smaller clinics. The growing reliance on e-commerce and tele-veterinary services continues to strengthen market visibility for major brands.

Key Challenges

Stringent Regulatory Requirements

Animal sedatives must undergo extensive testing and approval before entering the market. Regulatory authorities demand strong evidence of safety, efficacy, and ethical manufacturing standards. This process often delays product launches and increases development costs. The complex approval landscape also creates barriers for smaller companies trying to introduce new formulations.

Risks of Overdose and Adverse Reactions

Incorrect dosing or misuse of sedatives can cause serious health issues in animals. These risks make veterinarians cautious about prescribing strong formulations, especially for small or sensitive species. Adverse reactions may lead to decreased confidence among pet owners. Manufacturers are addressing this challenge through better training resources, improved labeling, and precision dosing technologies.

Regional Analysis

North America

North America held the largest share of 39.4% in 2024, driven by advanced veterinary infrastructure and high pet ownership rates. The region’s strong focus on animal welfare, coupled with the widespread adoption of companion animals, supports sustained demand for sedatives. Growth is also fueled by innovations in veterinary anesthesia, the availability of FDA-approved formulations, and a rising number of specialized animal hospitals. The United States remains the key contributor due to increased spending on veterinary care, while Canada benefits from growing livestock management and pet healthcare awareness.

Europe

Europe accounted for a 29.7% share in 2024, supported by stringent animal welfare regulations and widespread adoption of companion pets. The presence of established veterinary pharmaceutical companies and advanced clinical standards drive sedative usage across surgical and diagnostic applications. Nations such as Germany, France, and the United Kingdom are leading markets, backed by favorable government initiatives and expanding veterinary education. The region’s focus on sustainable and low-toxicity formulations also promotes innovation in veterinary drug development.

Asia-Pacific

Asia-Pacific captured a 22.1% market share in 2024, fueled by growing pet ownership, expanding livestock industries, and improving veterinary infrastructure. Rising disposable incomes and increasing awareness of animal healthcare are boosting sedative use in both companion and farm animals. Countries such as China, Japan, and India are witnessing rapid market expansion supported by growing investments in veterinary hospitals and clinics. The region’s large animal population and growing demand for high-quality veterinary pharmaceuticals create strong opportunities for global manufacturers.

Latin America

Latin America represented a 5.4% share in 2024, supported by gradual improvements in animal healthcare and veterinary service accessibility. Brazil and Mexico are major markets where expanding livestock sectors and increasing companion pet adoption drive sedative demand. Government efforts to promote animal welfare and the growth of veterinary clinics in urban areas strengthen market presence. However, limited awareness in rural regions and uneven regulatory frameworks continue to restrain faster adoption.

Middle East & Africa

The Middle East & Africa region accounted for a 3.4% share in 2024, driven by the modernization of livestock management and rising investment in veterinary care. Gulf nations are increasingly emphasizing animal health and welfare, encouraging the adoption of safe sedative formulations. South Africa and the United Arab Emirates are emerging markets, benefitting from expanding veterinary networks and pet ownership growth. Despite infrastructural limitations in certain areas, ongoing development programs and rising awareness are expected to support gradual market advancement.

Market Segmentations:

By Application

- Surgical

- Diagnostic

- Euthanasia

- Others

By Animal

By Route of Administration

By Drug Class

- Phenothiazines

- Benzodiazepines

- Alpha-2 Adrenergic Receptor Agonists

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The animal sedatives market is highly competitive, featuring key players such as Zoetis Services, LLC, Virbac, Ouro Fino Saude Animal Group, Dechra, Merck & Co., Inc., Bimeda Inc., vetcare.fi, Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, and Troy Laboratories Pty Ltd. These companies focus on developing advanced formulations with improved safety, faster onset, and longer duration of action to meet growing veterinary demands. Strategic initiatives include mergers, regional expansions, and R&D investments aimed at diversifying sedative portfolios for both companion and livestock animals. Manufacturers emphasize regulatory compliance and innovation in parenteral and oral delivery systems to strengthen market positioning. Additionally, collaborations with veterinary clinics and distribution networks enhance product accessibility and brand presence. The market is witnessing increased competition in developing bio-based and species-specific sedatives, while leading players continue to leverage digital tools and data-driven insights to support precision dosing and procedural efficiency.

Key Player Analysis

- Merck & Co., Inc.

- Randlab Australia Pty Ltd

- Chanelle Pharma (Exponent)

- Virbac

- Troy Laboratories Pty Ltd

- Zoetis Services, LLC

- Bimeda Inc.

- fi

- Ouro Fino Saude Animal Group

- Dechra

Recent Developments

- In July 2025, Cronus Pharma introduced Butorphic (Butorphanol Tartrate) Injection in the U.S., approved for equine colic and postpartum pain.

- In November 2024, Fidelis Animal Health received FDA indexing for Ethiqa XR in rodents and rabbits, expanding use of its extended-release buprenorphine technology.

- In May 2024, Parnell launched Dexmedetomidine Hydrochloride Injection and CONTRASED, expanding its pet care sedation portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Animal, Route of Administration, Drug Class and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as demand for safe and efficient veterinary sedation grows across surgical, diagnostic, and handling procedures.

- Product innovation focusing on species-specific and low-toxicity sedatives will remain a key development priority.

- Increasing awareness about animal welfare will drive broader adoption across both companion and livestock segments.

- Technological advancements in anesthesia delivery and monitoring systems will improve dosing precision and safety.

- Veterinary service expansion in developing regions will open new market opportunities for global manufacturers.

- Digital and online sales platforms will strengthen product accessibility for clinics and pet owners.

- Regulatory alignment across major markets will streamline product approvals and enhance international trade.

- Research into natural and herbal sedative alternatives will attract investment from sustainability-focused companies.

- Collaboration between veterinary hospitals and pharmaceutical firms will accelerate innovation and field testing.

- North America and Europe will maintain leadership, while Asia-Pacific shows the fastest growth potential.