Market Overview

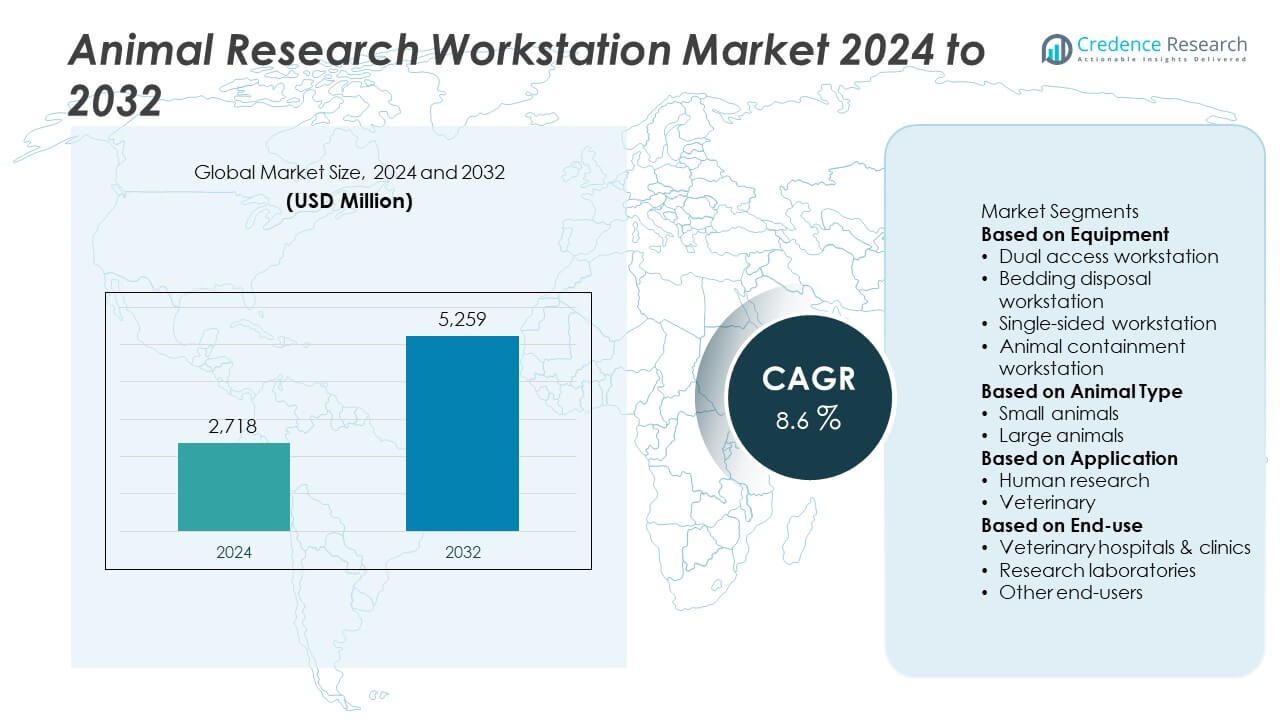

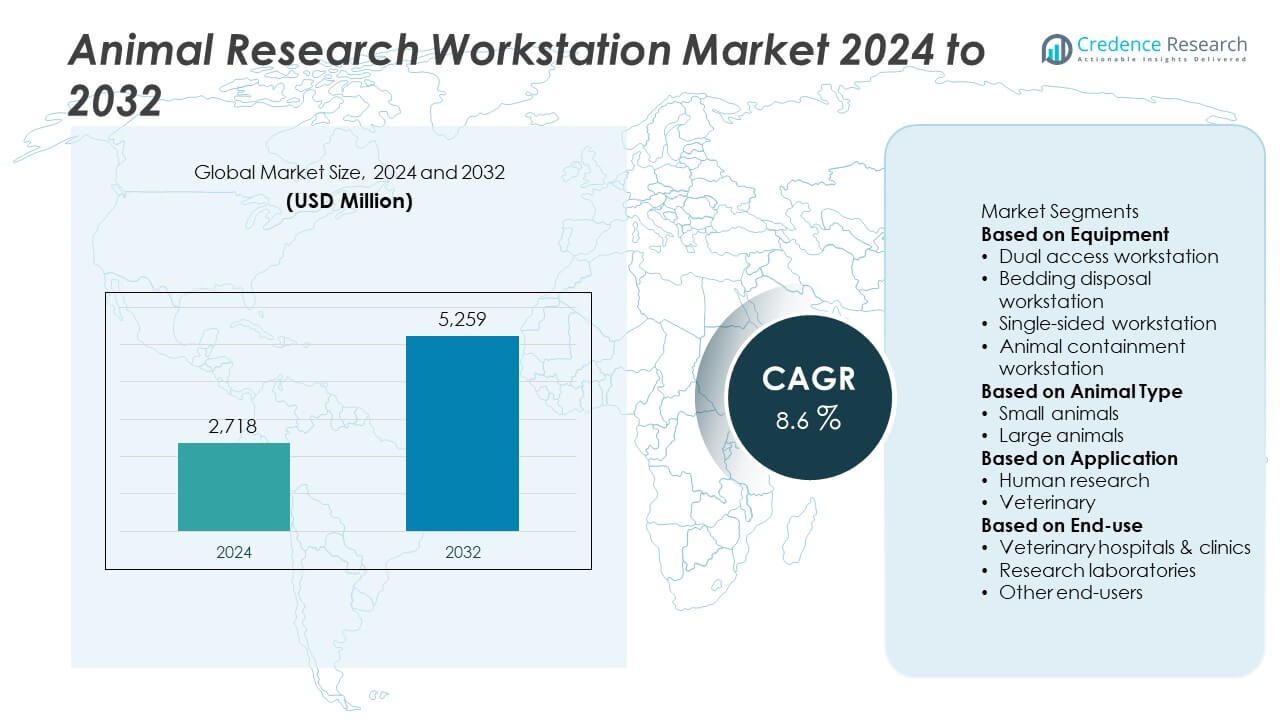

The Animal Research Workstation Market was valued at USD 2,718 million in 2024 and is projected to reach USD 5,259 million by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Research Workstation Market Size 2024 |

USD 2,718 Million |

| Animal Research Workstation Market, CAGR |

8.6% |

| Animal Research Workstation Market Size 2032 |

USD 5,259 Million |

The animal research workstation market is led by prominent companies including Esco Lifesciences Group, Tecniplast S.p.A., Thermo Fisher Scientific Inc., Allentown LLC, and Lab Products, Inc., which collectively dominate due to their strong global presence and advanced product portfolios. These players focus on innovation in ergonomic design, containment efficiency, and automation to support safe and compliant research environments. Emerging participants such as NuAire, Inc., Germfree Laboratories, Inc., Sychem Limited, ALESCO S.r.l., and BIOZONE Global Pvt. Ltd. are expanding through regional collaborations and cost-effective solutions. North America leads the global market with a 41.6% share in 2024, supported by robust biomedical infrastructure and extensive R&D investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The animal research workstation market was valued at USD 2,718 million in 2024 and is projected to reach USD 5,259 million by 2032, growing at a CAGR of 8.6% during the forecast period.

- Growth is driven by rising investments in biomedical and preclinical research, growing demand for ergonomic and safe laboratory setups, and increasing adherence to animal welfare regulations.

- Key trends include the adoption of modular, smart, and digitally integrated workstation systems that enhance safety, workflow efficiency, and compliance in laboratory environments.

- Leading companies such as Esco Lifesciences Group, Tecniplast S.p.A., and Thermo Fisher Scientific Inc. dominate the market through product innovation, advanced ventilation systems, and expansion in emerging economies.

- North America held 41.6% share, followed by Europe with 30.2% and Asia-Pacific with 20.8%. Among equipment types, dual access workstations led with 41.8% share, while small animals accounted for 64.2% share within the animal type segment.

Market Segmentation Analysis:

By Equipment

The dual access workstation segment dominated the animal research workstation market with a 41.8% share in 2024. These systems allow simultaneous operation from both sides, enhancing workflow efficiency and reducing experimental downtime. Their design supports collaborative research in high-throughput laboratories while maintaining containment and ergonomic standards. The growing need for productivity, safety, and optimized space utilization in animal studies drives their adoption. Increasing installations across academic research institutes and pharmaceutical laboratories further reinforce segment growth as dual access systems streamline handling and experimental accuracy.

- For instance, Tecniplast S.p.A. offers dual-configuration biosafety cabinets, such as the ARIA or BS series, which function as a Class II biosafety cabinet and a cage changing station. These systems use H14 HEPA filtration (99.995% efficiency) to ensure operator, product, and environmental protection from allergens and pathogens.

By Animal Type

The small animals segment held the largest share of 64.2% in 2024, driven by the extensive use of mice, rats, and guinea pigs in biomedical and preclinical studies. These animals are preferred for genetic, toxicity, and behavioral research due to their manageable size and reproducibility in controlled environments. The surge in genomics and drug discovery programs fuels demand for specialized containment and ventilated workstations for small species. Expanding R&D investments by pharmaceutical and biotechnology firms continue to strengthen this segment’s dominance globally.

- For instance, Allentown LLC introduced its NextGen Mouse IVC System equipped with a 60 CFM airflow module, ensuring stable micro-environmental conditions for colonies up to 2,000 cages. The system’s SmartSense sensors maintain differential pressure within ±2 Pa to support consistent preclinical results.

By Application

The human research segment accounted for a 57.6% share in 2024, supported by growing demand for translational and disease-model research. These workstations are widely used in preclinical drug testing, vaccine development, and toxicology assessments before human clinical trials. Increasing government funding for biomedical studies and advancements in biosafety and containment technologies drive this segment. The integration of automated and data-driven systems enhances precision, compliance, and safety in research environments, supporting steady growth of human-focused animal research facilities.

Key Growth Drivers

Rising Investment in Biomedical and Preclinical Research

Growing funding for biomedical and pharmaceutical research is a major factor driving the animal research workstation market. Governments, universities, and private institutions are expanding laboratory facilities to support drug discovery and disease modeling. These workstations enable controlled environments for animal testing and enhance research accuracy. The surge in preclinical studies, particularly in oncology, immunology, and neuroscience, continues to strengthen demand for advanced ergonomic and containment-based research systems.

- For instance, Thermo Fisher Scientific opened a 50,000-square-foot viral vector manufacturing facility in Lexington, Massachusetts, in 2019 to support the development, testing, and manufacture of viral vectors used in gene therapies.

Increasing Focus on Animal Welfare and Ethical Standards

Stricter global regulations on animal handling and ethical experimentation are boosting the need for specialized research workstations. Institutions are adopting systems with advanced ventilation, waste management, and ergonomic features to ensure safety for both animals and personnel. Compliance with animal welfare frameworks such as the AAALAC and GLP promotes the use of humane research setups. This focus on welfare and regulatory adherence drives continuous innovation and replacement of outdated laboratory infrastructure.

- For instance, Germfree Laboratories introduced its BSL-3 compliant Animal Transfer Station integrated with HEPA H14 dual-filter units rated at 99.995% efficiency and airflow up to 0.45 m/s. The system minimizes operator exposure during transfers while maintaining animal welfare standards.

Advancements in Ergonomic and Digital Workstation Design

Technological innovation in workstation design is transforming research efficiency. Modern animal research workstations integrate digital monitoring, air filtration, and adjustable height systems that enhance usability and minimize contamination. Automation and real-time data tracking help reduce human error and improve experiment reproducibility. These advancements improve workflow precision, making research environments safer and more efficient, while supporting large-scale laboratory operations across pharmaceutical and academic institutions.

Key Trends & Opportunities

Adoption of Modular and Smart Research Workstations

Modular workstations are gaining popularity for their adaptability and ease of integration into diverse laboratory layouts. Smart systems featuring touchless controls, digital airflow monitoring, and IoT-based data tracking enhance laboratory efficiency. The shift toward automation and customizable workstation designs presents strong growth opportunities. Research centers prefer modular setups for their scalability and compliance with evolving biosafety standards.

- For instance, Esco Lifesciences Group produces the Labculture biological safety cabinet series, which incorporates an integrated airflow sensor capable of real-time airflow monitoring. The workstation uses a DC ECM blower motor with an auto-compensation feature to maintain stable airflow despite filter loading or voltage fluctuations, with a “Night Setback” mode to reduce power consumption.

Expansion of Translational Research and Drug Development Programs

Rising demand for translational studies that bridge preclinical and clinical research is creating new opportunities. Pharmaceutical companies are investing in advanced research facilities equipped with precision-controlled animal workstations. These workstations improve data integrity and experimental consistency across human disease models. The growth of biologics, vaccines, and personalized medicine further fuels demand for efficient and compliant preclinical infrastructure.

- For instance, Sychem Limited provides a wide range of containment solutions and specialist chemicals for pharmaceutical and biomedical facilities, while the University of Manchester has research collaborations with various industry partners on projects ranging from sustainable chemical manufacturing to healthcare ventilation.

Key Challenges

High Cost of Installation and Maintenance

Animal research workstations require significant capital investment due to their advanced engineering and safety compliance features. High installation and maintenance costs often limit adoption, especially in smaller research centers. The need for periodic calibration, airflow testing, and filter replacement adds to operational expenses. These financial constraints may slow adoption in emerging economies despite rising research activity.

Complex Regulatory Compliance Requirements

Strict regulatory standards for animal testing environments pose a major challenge for manufacturers and research institutions. Compliance with multiple international frameworks, including GLP, ISO, and AAALAC, demands extensive documentation and testing. Delays in approvals or audits can affect laboratory operations and procurement cycles. Manufacturers must continuously adapt designs and materials to meet evolving biosafety and ethical requirements.

Regional Analysis

North America

North America held the largest share of 41.6% in 2024, driven by extensive biomedical research infrastructure and strong government funding for life sciences. The region’s advanced pharmaceutical sector and regulatory focus on ethical animal research support continuous workstation upgrades. The United States dominates due to heavy investment in preclinical and translational research, while Canada benefits from expanding academic and contract research organizations. Growing emphasis on ergonomics, automation, and biosafety containment technologies further boosts demand across university and private laboratories.

Europe

Europe accounted for a 30.2% share in 2024, supported by well-established research facilities and stringent regulations on animal welfare. Countries such as Germany, France, and the United Kingdom lead in adopting advanced containment and ventilated workstation systems. The European Union’s funding programs for medical research and emphasis on safe experimental environments drive steady market expansion. Increased collaboration between pharmaceutical companies and research institutes promotes infrastructure modernization. Additionally, ongoing investments in automation and digitalized lab systems enhance productivity and compliance with ethical standards.

Asia-Pacific

Asia-Pacific captured a 20.8% share in 2024, fueled by growing biotechnology industries and rising government funding for research. Countries like China, Japan, and India are expanding preclinical testing capabilities, creating strong demand for animal research workstations. The region’s growing focus on vaccine development, biomedical innovation, and disease modeling supports rapid adoption of modular and ventilated systems. Increasing collaborations with Western research institutions and improvements in laboratory safety standards are further accelerating market penetration. Expanding pharmaceutical manufacturing and R&D investments strengthen Asia-Pacific’s position as a key growth hub.

Latin America

Latin America represented a 4.5% share in 2024, driven by rising academic research and pharmaceutical development in emerging economies such as Brazil and Mexico. The region is witnessing gradual modernization of laboratory infrastructure and growing adoption of ergonomic and biosafe workstation systems. Government support for medical research and international collaborations are fostering industry expansion. However, high equipment costs and limited local manufacturing remain key challenges. Continued efforts toward improving research standards and expanding clinical trial facilities are expected to enhance market opportunities.

Middle East & Africa

The Middle East & Africa region accounted for a 2.9% share in 2024, supported by increasing investment in healthcare and biomedical research infrastructure. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are establishing advanced research centers to meet rising demand for medical innovation. Growth is driven by improved laboratory safety awareness and the adoption of international standards for animal testing. Although the market is still developing, ongoing initiatives to strengthen research capacity and partnerships with global pharmaceutical companies will foster steady expansion.

Market Segmentations:

By Equipment

- Dual access workstation

- Bedding disposal workstation

- Single-sided workstation

- Animal containment workstation

By Animal Type

- Small animals

- Large animals

By Application

- Human research

- Veterinary

By End-use

- Veterinary hospitals & clinics

- Research laboratories

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The animal research workstation market is highly competitive, featuring key players such as Esco Lifesciences Group, Tecniplast S.p.A., Thermo Fisher Scientific Inc., Allentown LLC, Lab Products, Inc., NuAire, Inc., Germfree Laboratories, Inc., ALESCO S.r.l., Sychem Limited, and BIOZONE Global Pvt. Ltd. These companies focus on designing advanced, ergonomic, and containment-based workstations to meet rising research safety and efficiency standards. Strategic initiatives such as product innovation, global partnerships, and facility expansions drive their market leadership. Many players emphasize modular and customizable designs that align with evolving biosafety and animal welfare regulations. Technological integration, including digital airflow monitoring and smart control systems, enhances their competitive edge. The market is also witnessing increased investment in sustainable materials and energy-efficient workstation designs, positioning key manufacturers to cater to expanding biomedical, pharmaceutical, and academic research needs worldwide.

Key Player Analysis

Recent Developments

- In January 2025, Esco Lifesciences Group launched a closed single-use bioreactor system for BSL-3/4 human and animal biosafety applications.

- In September 2024, Esco Lifesciences Group acquired its South Korean distributor, Esco Korea Micro Ltd., to boost its reach in the region and to expand direct sales and service capabilities. This move also supports Esco’s digital transformation initiatives, streamlining operations to meet the growing demands of the biopharma and research sectors.

- In January 2024, Allentown, LLC acquired ClorDiSys Solutions, Inc., enhancing its service offerings in pre-clinical research and life sciences.

- In January 2023, Tecniplast S.p.A. introduced the EMber IVC Heating System designed for its Emerald IVC cages to support post-surgical recovery and thermoregulation studies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment, Animal Type, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing investment in biomedical and pharmaceutical research facilities.

- Adoption of modular and digitally integrated workstation systems will enhance laboratory efficiency and safety.

- Rising focus on ergonomic and operator-friendly designs will improve workflow comfort and reduce fatigue.

- Demand for containment-based and ventilated systems will grow due to stricter biosafety standards.

- Technological advancements in automation and smart monitoring will drive product innovation.

- Expansion of preclinical and translational research will boost workstation utilization across global labs.

- Sustainability initiatives will encourage the use of energy-efficient and eco-friendly workstation materials.

- Growing collaborations between research institutions and manufacturers will accelerate product development.

- Asia-Pacific will emerge as the fastest-growing region with strong R&D infrastructure expansion.

- Leading players will strengthen market presence through product upgrades and strategic partnerships.