Market overview

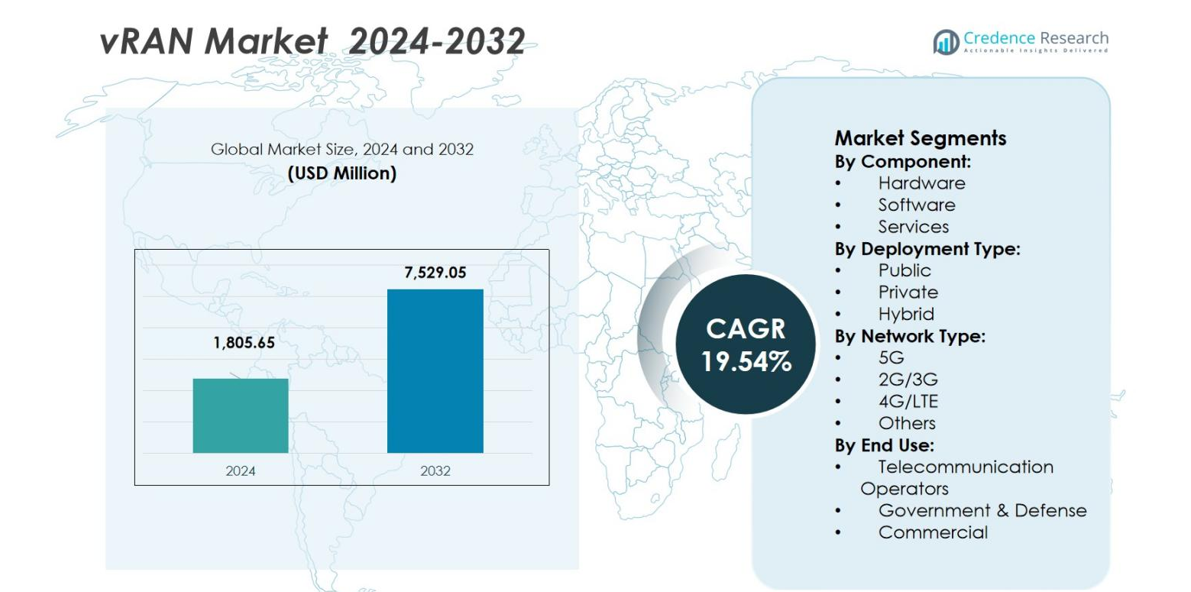

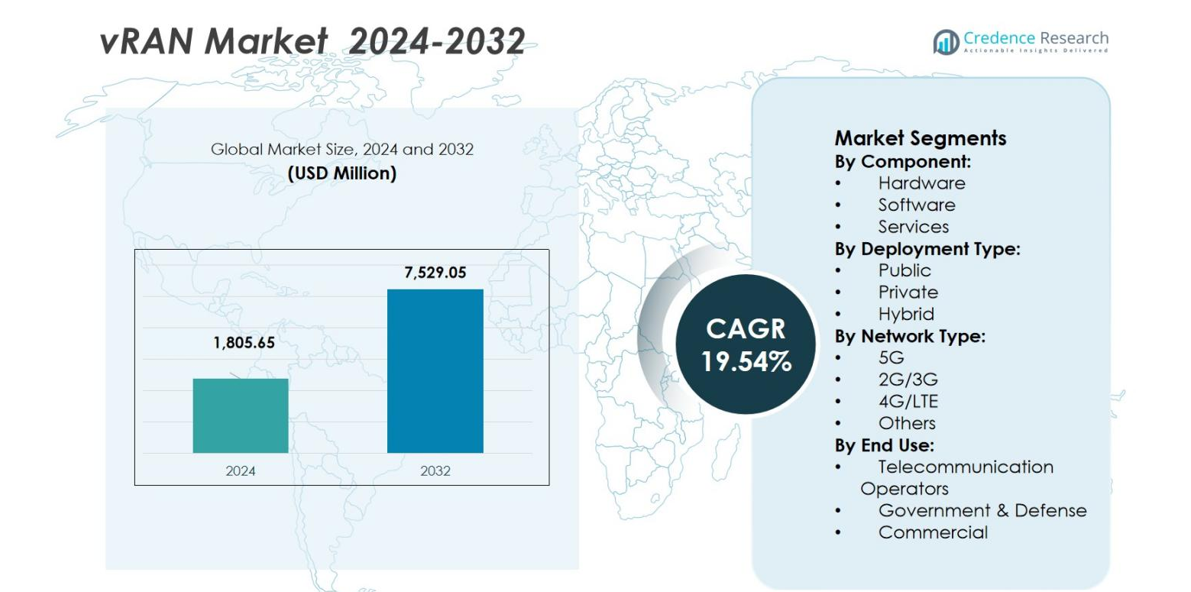

The vRAN Market size was valued at USD 1,805.65 Million in 2024 and is anticipated to reach USD 7,529.05 Million by 2032, at a CAGR of 19.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| vRAN Market Size 2024 |

USD 1,805.65 Million |

| vRAN Market, CAGR |

19.54% |

| vRAN Market Size 2032 |

USD 7,529.05 Million |

The vRAN Market is led by key players such as Cisco Systems, Fujitsu Limited, Huawei Technologies Co. Ltd., NEC Corporation, Samsung Electronics Co., Ltd., Verizon Communications, Ericsson Inc., Nokia Corporation, Red Hat, Inc., and Hewlett Packard Enterprise Development LP, which leverage extensive telecom networks and cloud‑native architectures. In terms of geography, North America commanded a market share of 38.0% in 2024, benefitting from early 5G roll‑outs and substantial investments from major operators. Asia Pacific followed closely with a 36.0% share in 2024, driven by rapid 5G deployments and strong government support for network modernisation.

Market Insights

- The vRAN Market was valued at USD 1,805.65 Million in 2024 and is projected to reach USD 7,529.05 Million by 2032 at a CAGR of 19.54%.

- The hardware segment held a share of 1% in 2024, driven by demand for high‑performance servers and networking equipment.

- 5G network type commanded a dominant share of 2% in 2024 as operators upgrade infrastructure for ultra‑low latency and high‑speed services.

- North America accounted for a regional market share of 0% in 2024, followed by Asia Pacific at 36.0%, supported by strong 5G roll‑outs and telecom investments.

- Adoption of a cloud‑native, disaggregated RAN architecture and multi‑vendor Open RAN deployment offers growth opportunities, while integration complexity with legacy systems and data‑security concerns act as market restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

The vRAN market is segmented into Hardware, Software, and Services. The hardware segment dominates the market, holding a share of 42.1% in 2024. This dominance is driven by the increasing demand for high-performance servers, storage, and networking equipment required for virtualized radio access networks. The software segment is growing rapidly, expected to reach USD 2,390.21 Million by 2032, driven by advancements in network management software and automation tools. Services, including installation and maintenance, contribute significantly to the market as telecom operators transition to vRAN solutions, supporting the overall ecosystem’s growth.

- For instance, Intel’s Xeon 6 SoC server integrates up to 72 cores with Intel vRAN Boost acceleration, enabling a single server to replace multiple traditional units, significantly enhancing capacity and reducing footprint at cell sites.

By Deployment Type:

The deployment type segment of the vRAN market is divided into Public, Private, and Hybrid categories. The public deployment type is expected to hold the largest market share of 47.5% in 2024. This is driven by telecom operators and service providers opting for public cloud-based vRAN solutions to reduce infrastructure costs, enhance scalability, and improve network performance. Hybrid deployment is also gaining momentum, as it offers the benefits of both public and private clouds, offering flexibility and security for large enterprises and telecom operators looking for optimized solutions across multiple environments.

- For instance, Japanese NEC, which plans to deploy 50,000 vRAN base stations by 2026 with a virtualized distributed unit integrated with Qualcomm’s acceleration technology, demonstrating high performance on cloud environments.

By Network Type:

The vRAN market is segmented by network type into 5G, 2G/3G, 4G/LTE, and Others. The 5G network type holds the dominant share of 51.2% in 2024, driven by the global rollout of 5G networks and the growing demand for high-speed, low-latency connections for applications such as IoT, autonomous vehicles, and smart cities. As telecom operators upgrade their infrastructure to support 5G, the market for vRAN solutions is expected to expand significantly. The 4G/LTE and 2G/3G segments are also contributing to the market, but at a slower pace, as operators focus more on 5G.

Key Growth Drivers

5G Rollout and Demand for High-Speed Networks

The global rollout of 5G networks is a major growth driver for the vRAN market. As telecom operators and service providers upgrade their infrastructure to support 5G, vRAN solutions are essential for providing the flexibility, scalability, and high-performance needed for these next-generation networks. The adoption of 5G is expected to drive substantial demand for virtualized solutions, enabling operators to deliver ultra-low latency and high-speed services, especially for applications such as autonomous vehicles, IoT, and smart cities.

- For instance, Samsung’s fully virtualized 5G RAN has been deployed at scale by a leading U.S. operator, serving millions of users and enabling wide-scale 5G commercialization with ultra-low latency and high throughput.

Cost Efficiency and Scalability

Cost efficiency is a significant growth driver for the vRAN market, as telecom operators look to minimize CapEx and OpEx while scaling their networks. Virtualized RAN solutions allow for the consolidation of hardware and software into virtualized environments, reducing the need for expensive physical infrastructure. Additionally, these solutions offer greater scalability, enabling operators to easily expand network capacity to meet growing demand. This flexibility supports faster deployment and network upgrades, making vRAN an attractive option for service providers globally.

- For instance, the collaboration between HPE and Intel, which delivered a verified reference configuration for vRAN using HPE ProLiant servers with Intel Xeon processors, providing significant scalability and high-performance benefits in real network environments.

Shift Toward Cloud-Based Solutions

The shift toward cloud-based network infrastructure is a key driver for the vRAN market. Telecom operators are increasingly adopting cloud technologies to enhance network agility, automate operations, and improve performance. Cloud-based vRAN solutions enable centralized management, flexible resource allocation, and efficient scaling, allowing operators to respond quickly to changing demands. This shift aligns with the broader trend of digital transformation, where service providers are looking to move away from traditional hardware-centric solutions to more cost-effective, agile, and automated cloud-native environments.

Key Trends & Opportunities

Adoption of Open RAN Architecture

The growing trend of adopting Open RAN architecture presents significant opportunities for the vRAN market. Open RAN enables operators to mix and match components from different vendors, leading to reduced vendor lock-in and greater flexibility in network design. As telecom operators look to diversify their vendor base and reduce costs, Open RAN is becoming an attractive option. This trend is expected to drive innovation, competition, and collaboration across the industry, creating opportunities for new players and solutions in the vRAN ecosystem.

- For instance, Vodafone selected Samsung as a primary partner for deploying Open RAN across Germany and other European countries, with thousands of sites planned under a five-year program, marking one of the largest Open RAN deployments in Europe.

Deployment of vRAN in Rural and Remote Areas

The expansion of vRAN technology into rural and remote areas offers new growth opportunities. Traditional RAN infrastructure is often costly and difficult to deploy in less populated regions. However, vRAN solutions, with their flexibility and lower infrastructure costs, allow operators to extend network coverage to underserved areas. This opportunity is especially significant in emerging markets, where telecom providers are looking to expand 4G and 5G networks into remote locations. The ability to deploy cost-effective and scalable solutions in these areas can improve connectivity and bridge the digital divide.

- For instance, Altiostar’s Open vRAN solution has been used by rural mobile network operators (MNOs) to upgrade to 5G broadband with cloud-native software, significantly lowering CAPEX by using open architecture suitable for low population density regions.

Key Challenges

Integration Complexity and Legacy Systems

One of the primary challenges faced by telecom operators in the vRAN market is the integration of virtualized solutions with legacy systems. Many telecom operators are still reliant on traditional RAN infrastructure, which can be difficult and costly to integrate with newer, virtualized solutions. Transitioning from legacy networks to a fully virtualized architecture requires significant investment in both technology and skilled personnel. Operators must also address interoperability issues between various vendors and technologies, which can slow down the adoption of vRAN solutions.

Security and Data Privacy Concerns

Security and data privacy concerns pose significant challenges in the vRAN market. As virtualized solutions rely on cloud-based infrastructure, operators must ensure that sensitive data is protected and that their networks are secure from cyber threats. The distributed nature of vRAN systems, with multiple components operating across various locations, can make it more challenging to monitor and secure. Ensuring compliance with regional data privacy regulations, such as GDPR, adds complexity for telecom operators, requiring robust security protocols and regular system updates to protect against potential vulnerabilities.

Regional Analysis

North America

The North America region accounted for a market share of 38.0% in the global vRAN market in 2024. The region’s dominance stems from early commercial roll‑outs of 5G standalone networks, strong cloud and edge infrastructure adoption, and investments from large telcos in disaggregated, virtualised radio access solutions. The presence of hyperscale cloud providers and steady operator CAPEX in the U.S. amplify deployment of vRAN frameworks. Regulatory support for Open RAN initiatives and multi‑vendor ecosystems underpin the region’s leadership, while growing enterprise private‑5G and industrial campus use‑cases further bolster market traction.

Asia Pacific

Asia Pacific held a market share of 36.0% in 2024, making it the largest individual regional segment for vRAN globally. The region benefits from accelerated 5G roll‑out in China, India, South Korea and Japan, government subsidies for telecom modernisation, and high mobile data consumption. Operators in the region are aggressively migrating toward virtualised RAN architectures to reduce CapEx/OpEx and enhance flexibility. The concentration of telecom equipment manufacturers and network operators drives localisation of vRAN solutions, while rural and semi‑urban expansion programmes provide a strong growth engine.

Europe

Europe’s vRAN market share stood at 17%, with the region registering moderate growth relative to Asia Pacific and North America. Drivers include EU regulatory frameworks promoting network virtualization and energy-efficient infrastructure, as well as rising demand for Open RAN interoperability. Telecom operators are prioritizing software-defined and cloud-native RAN deployments to meet industrial automation, fixed-wireless access, and smart city requirements. Challenges such as multi-vendor integration and slower legacy replacement pace temper growth, but long-term infrastructure refresh cycles sustain forward momentum.

Latin America

In Latin America, vRAN adoption is emerging with a smaller share relative to mature markets, estimated under 10%, though exact figures are modest in published data. The region’s growth is driven by telecom operators seeking cost‑efficient network upgrades, extension of 4G/5G coverage into underserved areas and government digital‑inclusion programmes. While infrastructure investment budgets are constrained, virtualised RAN offers appeal for lowering total cost of ownership. However, slower regulatory alignment, limited fibre/backhaul roll‑out and operator consolidation restrict rapid uptake in the short term.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for a modest portion of the global vRAN market, with a market share of 8.5% in 2024. Growth prospects are supported by government-led digital infrastructure initiatives and telecom-operator network modernization drives. The region is adopting vRAN to meet demands for mobile broadband expansion, enterprise private networks (oil & gas, industrial zones), and cost-efficient rollouts in remote geographies. Growth is constrained by fragmented markets, budgetary limitations, and varying regulatory environments, but long-term investment in 5G and Open RAN ecosystems offers meaningful potential.

Market Segmentations:

By Component:

- Hardware

- Software

- Services

By Deployment Type:

By Network Type:

By End Use:

- Telecommunication Operators

- Government & Defense

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Analysis of the global vRAN market reveals that Cisco Systems, Fujitsu Limited, Huawei Technologies Co. Ltd, NEC Corporation, Samsung Electronics Co., Ltd., Verizon Communications, Ericsson Inc., Nokia Corporation, Red Hat, Inc., and Hewlett Packard Enterprise Development LP are among the leading participants. These key players leverage their strong R&D capabilities, expansive partner ecosystems and deep telecom‑market experience to drive innovation in virtualised RAN solutions. They are actively forming strategic alliances, acquiring niche software vendors and driving open architecture (e.g., Open‑RAN) deployments, which enhance their competitive positioning across hardware, software and services. The competitive dynamic is intensifying as new entrants and specialised software firms push operators to move beyond proprietary stacks toward disaggregated, cloud‑native infrastructure. Established incumbents are responding by expanding their portfolio to include edge compute, AI‑powered orchestration and multi‑vendor interoperability, thereby defending market share while preparing for the next wave of 5G‑ and 6G‑centric vRAN adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ericsson Inc.

- Fujitsu Limited

- Huawei Technologies Co. Ltd

- Red Hat, Inc.

- Verizon Communications

- Cisco Systems, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Hewlett Packard Enterprise Development LP

- NEC Corporation

Recent Developments

- In October 2025, Samsung was selected by Vodafone Group to provide virtualized RAN and Open RAN solutions across multiple European countries, signalling a large‑scale rollout across thousands of sites.

- In May 2024, O₂ Telefónica and Samsung Electronics Co., Ltd. launched a commercial vRAN and Open RAN site in Germany, marking the first deployment of Samsung’s 5G‑vRAN solution in a live network.

- In February 2023, Fujitsu Limited launched its new 5G vRAN solution that combines its virtualised CU/vDU with NVIDIA Corporation’s GPU technology, enabling both base‑station functions and edge‑applications to run on a single server

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Type, Network Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is set to expand rapidly as network operators intensify migration to virtualised architectures to support accelerating 5G and later-generation deployments.

- Cloud-native and disaggregated RAN frameworks will gain prominence, enabling operators to decouple hardware from software and optimise infrastructure utilisation.

- The shift towards Open RAN standards and multi-vendor interoperability will unlock competitive dynamics and increase vendor diversity across the ecosystem.

- Private networks for enterprise, industrial and campus use cases will emerge as a meaningful incremental segment, offering new growth pathways beyond traditional telco deployments.

- Emerging markets will contribute disproportionately to growth as network modernisation accelerates, rural connectivity expands and cost-efficient vRAN solutions are deployed.

- Artificial intelligence and machine learning will become embedded in vRAN orchestration, enabling dynamic optimisation, predictive maintenance and energy-efficient operations.

- Edge computing convergence with vRAN will increase, supporting ultra-low latency services, distributed processing and real-time analytics at the network edge.

- Hardware innovation especially in commercial off-the-shelf (COTS) servers, accelerators and open-platforms will remain critical as carriers seek to lower cost of ownership and scale capacity.

- Energy-efficiency and sustainability goals will drive operators to adopt virtualised solutions that reduce site power consumption, footprint and cooling costs.

- Integration of legacy systems and management of vendor complexity will remain key operational priorities as deployments at scale move forward, requiring strong orchestration and lifecycle management frameworks.