Table of Content

Chapter No. 1 :….. Introduction.. 27

1.1. Report Description. 27

Purpose of the Report 27

USP & Key Offerings 27

1.2. Key Benefits for Stakeholders 28

1.3. Target Audience. 28

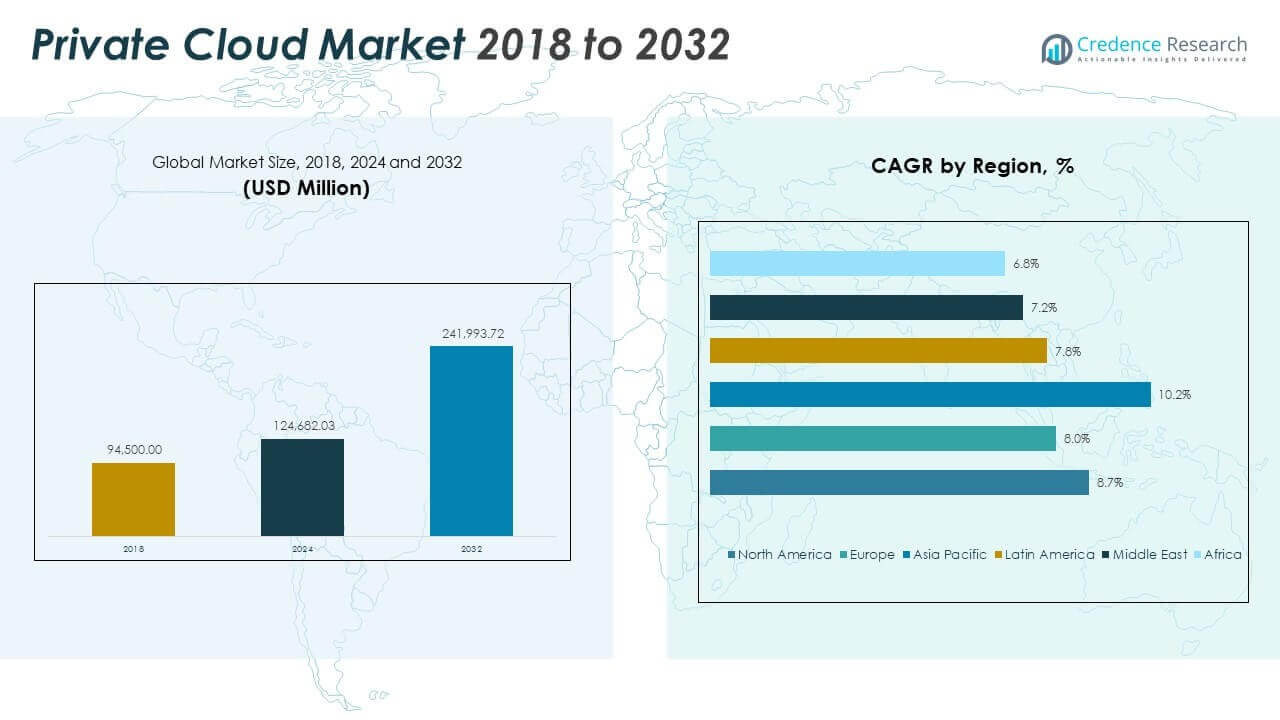

Chapter No. 2 :….. Executive Summary.. 29

Chapter No. 3 :….. MARKET FORCES & INDUSTRY PULSE.. 31

3.1. Foundations of Change – Market Overview.. 31

3.2. Catalysts of Expansion – Key Market Drivers 33

3.2.1. Momentum Boosters – Growth Triggers 34

3.2.2. Innovation Fuel – Disruptive Technologies 34

3.3. Headwinds & Crosswinds – Market Restraints 35

3.3.1. Regulatory Tides – Compliance Challenges 36

3.3.2. Economic Frictions – Inflationary Pressures 36

3.4. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 37

3.5. Market Equilibrium – Porter’s Five Forces 38

3.6. Ecosystem Models Dynamics – Value Chain Analysis 40

3.7. Key Trend Analysis 42

3.8. Macro Forces – PESTEL Breakdown. 43

Chapter No. 4 :….. Europe Data Regulation- Assessment.. 45

4.1. EU Data Act Obligations 45

4.2. General Data Protection Regulation Compliance. 45

4.3. AI Act and Cybersecurity. 45

Chapter No. 5 :….. COMPETITION ANALYSIS. 46

5.1. Company Market Share Analysis 46

5.1.1. Global Private Cloud Market Company Revenue Market Share, by Key Players 46

5.2. Strategic Developments 48

5.2.1. Acquisitions & Mergers 48

5.2.2. New Service Offerings Launch. 49

5.2.3. Agreements & Collaborations 50

5.3. Competitive Dashboard. 51

5.4. Company Assessment Metrics, 2024. 52

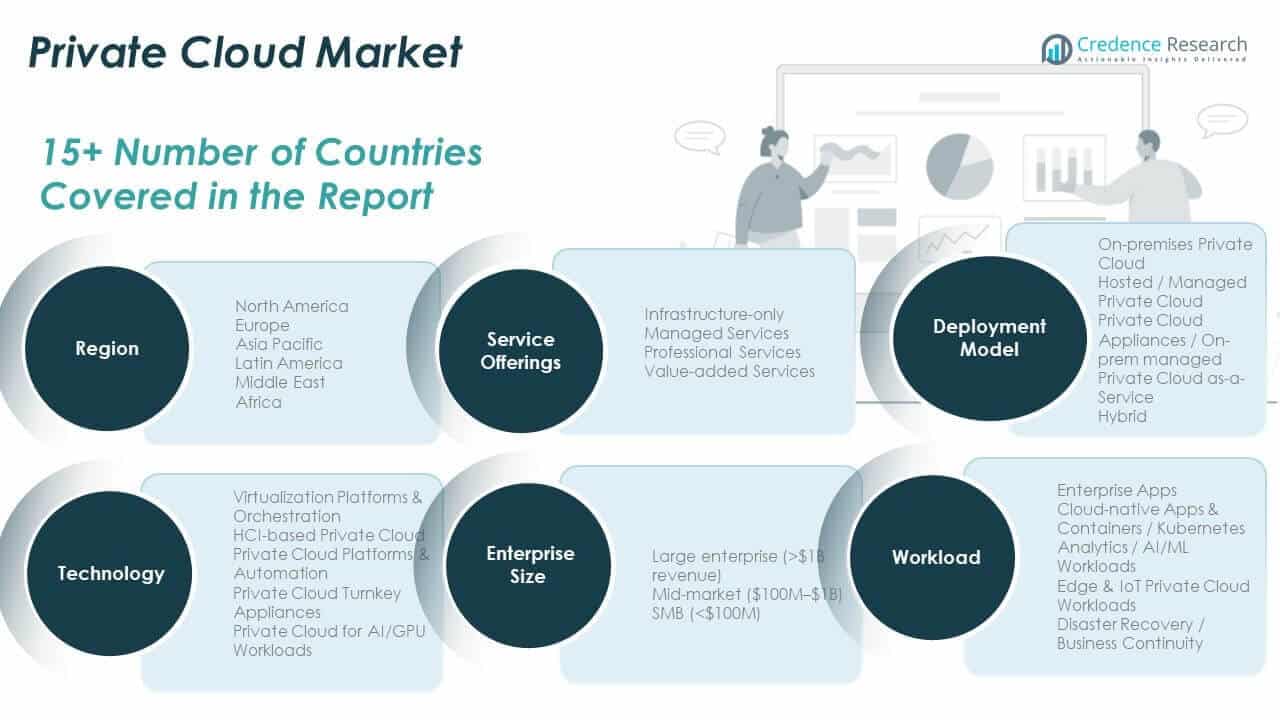

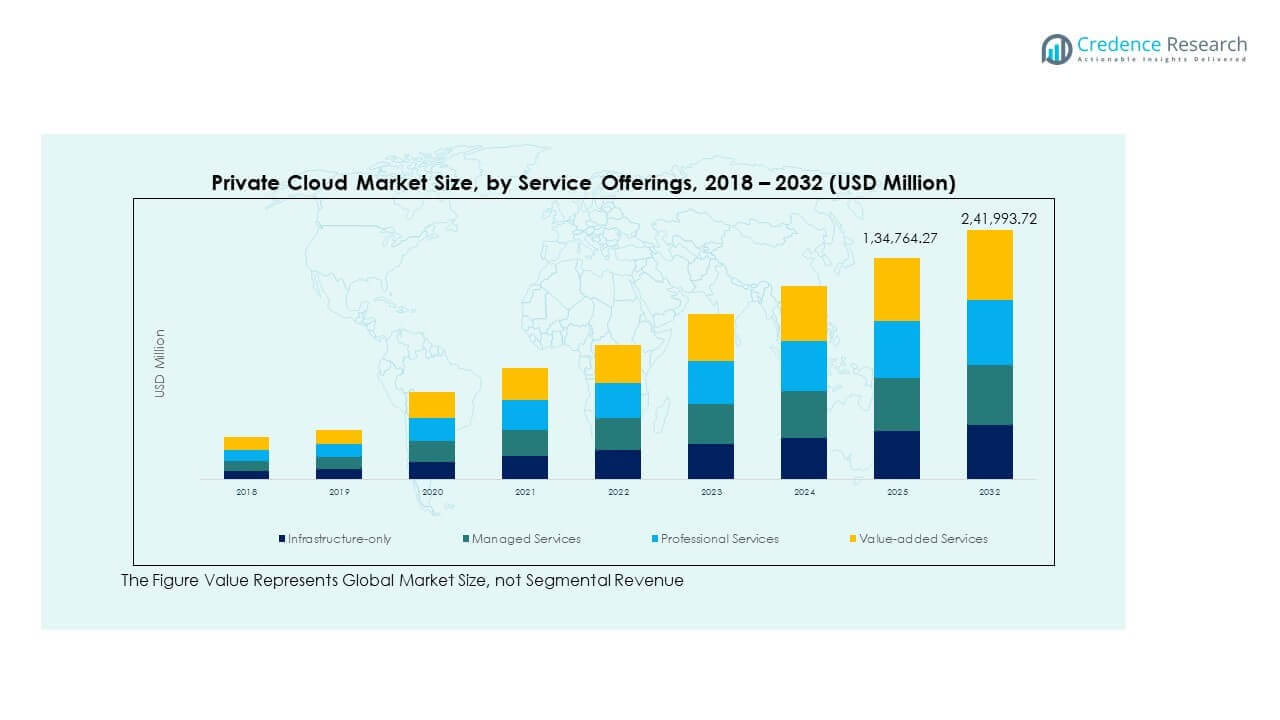

Chapter No. 6 :….. Global Market Analysis, Insights & Forecast, by Service Offerings. 53

Chapter No. 7 :….. Global Market Analysis, Insights & Forecast, by Technology.. 57

Chapter No. 8 :….. Global Market Analysis, Insights & Forecast, by Workload.. 61

Chapter No. 9 :….. Global Market Analysis, Insights & Forecast, by Enterprise Size.. 65

Chapter No. 10 :… Global Market Analysis, Insights & Forecast, by Deployment.. 69

Chapter No. 11 :… Global Market Analysis, Insights & Forecast, by Industry Vertical.. 73

Chapter No. 12 :… Global Market Analysis, Insights & Forecast, by Region.. 77

Chapter No. 13 :… North America Market Analysis, Insights & Forecast, by Country.. 82

13.1. North America Market Analysis, Insights & Forecast, by Service Offerings 84

13.2. North America Market Analysis, Insights & Forecast, by Technology. 85

13.3. North America Market Analysis, Insights & Forecast, by Workload. 86

13.4. North America Market Analysis, Insights & Forecast, by Enterprise Size. 87

13.5. North America Market Analysis, Insights & Forecast, by Deployment 88

13.6. North America Market Analysis, Insights & Forecast, by Industry Vertical 89

13.7. U.S. Market Analysis, Insights & Forecast, by Federal Vs Commercial 90

Chapter No. 14 :… Europe Market Analysis, Insights & Forecast, by Country.. 91

14.1. Europe Market Analysis, Insights & Forecast, by Service Offerings 94

14.2. Europe Market Analysis, Insights & Forecast, by Technology. 95

14.3. Europe Market Analysis, Insights & Forecast, by Workload. 96

14.4. Europe Market Analysis, Insights & Forecast, by Enterprise Size. 97

14.5. Europe Market Analysis, Insights & Forecast, by Deployment 98

14.6. Europe Market Analysis, Insights & Forecast, by Industry Vertical 99

Chapter No. 15 :… Asia Pacific Market Analysis, Insights & Forecast, by Country.. 100

15.1. Asia Pacific Market Analysis, Insights & Forecast, by Service Offerings 103

15.2. Asia Pacific Market Analysis, Insights & Forecast, by Technology. 104

15.3. Asia Pacific Market Analysis, Insights & Forecast, by Workload. 105

15.4. Asia Pacific Market Analysis, Insights & Forecast, by Enterprise Size. 106

15.5. Asia Pacific Market Analysis, Insights & Forecast, by Deployment 107

15.6. Asia Pacific Market Analysis, Insights & Forecast, by Industry Vertical 108

Chapter No. 16 :… Latin America Market Analysis, Insights & Forecast, by Country.. 109

16.1. Latin America Market Analysis, Insights & Forecast, by Service Offerings 112

16.2. Latin America Market Analysis, Insights & Forecast, by Technology. 113

16.3. Latin America Market Analysis, Insights & Forecast, by Workload. 114

16.4. Latin America Market Analysis, Insights & Forecast, by Enterprise Size. 115

16.5. Latin America Market Analysis, Insights & Forecast, by Deployment 116

16.6. Latin America Market Analysis, Insights & Forecast, by Industry Vertical 117

Chapter No. 17 :… Middle East Market Analysis, Insights & Forecast, by Country.. 118

17.1. Middle East Market Analysis, Insights & Forecast, by Service Offerings 121

17.2. Middle East Market Analysis, Insights & Forecast, by Technology. 122

17.3. Middle East Market Analysis, Insights & Forecast, by Workload. 123

17.4. Middle East Market Analysis, Insights & Forecast, by Enterprise Size. 124

17.5. Middle East Market Analysis, Insights & Forecast, by Deployment 125

17.6. Middle East Market Analysis, Insights & Forecast, by Industry Vertical 126

Chapter No. 18 :… Africa Market Analysis, Insights & Forecast, by Country.. 127

18.1. Africa Market Analysis, Insights & Forecast, by Service Offerings 130

18.2. Africa Market Analysis, Insights & Forecast, by Technology. 131

18.3. Africa Market Analysis, Insights & Forecast, by Workload. 132

18.4. Africa Market Analysis, Insights & Forecast, by Enterprise Size. 133

18.5. Africa Market Analysis, Insights & Forecast, by Deployment 134

18.6. Africa Market Analysis, Insights & Forecast, by Industry Vertical 135

Chapter No. 19 :… Company Profile.. 136

19.1. VMware 136

19.2. IBM 139

19.3. Hewlett Packard. 139

19.4. Dell Technologies 139

19.5. Nutanix 139

19.6. Company 6 139

19.7. Company 7 139

19.8. Company 8 139

19.9. Company 9 139

19.10. Company 10 139

19.11. Other Key Players 139

List of Figures

FIG NO. 1……… Private Cloud Market Revenue Share, By Service Offerings, 2024 & 2032. 53

FIG NO. 2……… Market Attractiveness Analysis, By Service Offerings. 54

FIG NO. 3……… Incremental Revenue Growth Opportunity by Service Offerings, 2024 – 2032. 55

FIG NO. 4……… Private Cloud Market Revenue Share, By Technology, 2024 & 2032. 57

FIG NO. 5……… Market Attractiveness Analysis, By Technology. 58

FIG NO. 6……… Incremental Revenue Growth Opportunity by Technology, 2024 – 2032. 59

FIG NO. 7……… Private Cloud Market Revenue Share, By Workload, 2024 & 2032. 61

FIG NO. 8……… Market Attractiveness Analysis by Workload, 2024 – 2032. 62

FIG NO. 9……… Incremental Revenue Growth Opportunity by Workload, 2024 – 2032. 63

FIG NO. 10……. Private Cloud Market Revenue Share, By Enterprise Size, 2024 & 2032. 65

FIG NO. 11……. Market Attractiveness Analysis by Enterprise Size, 2024 – 2032. 66

FIG NO. 12……. Incremental Revenue Growth Opportunity by Enterprise Size, 2024 – 2032. 67

FIG NO. 13……. Private Cloud Market Revenue Share, By Deployment, 2024 & 2032. 69

FIG NO. 14……. Market Attractiveness Analysis, By Deployment 70

FIG NO. 15……. Incremental Revenue Growth Opportunity by Deployment, 2024 – 2032. 71

FIG NO. 16……. Private Cloud Market Revenue Share, By Industry Vertical, 2024 & 2032. 73

FIG NO. 17……. Market Attractiveness Analysis, By Industry Vertical 74

FIG NO. 18……. Incremental Revenue Growth Opportunity by Industry Vertical, 2024 – 2032. 75

FIG NO. 19……. Private Cloud Market Revenue Share, By Region, 2024 & 2032. 77

FIG NO. 20……. Market Attractiveness Analysis, By Region. 78

FIG NO. 21……. Incremental Revenue Growth Opportunity by Region, 2024 – 2032. 79

FIG NO. 22……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 82

FIG NO. 23……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 91

FIG NO. 24……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 100

FIG NO. 25……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 109

FIG NO. 26……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 118

FIG NO. 27……. Private Cloud Market Revenue Share, By Country, 2024 & 2032. 127

List of Tables

TABLE NO. 1. :. Global Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 56

TABLE NO. 2. :. Global Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 56

TABLE NO. 3. :. Global Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 60

TABLE NO. 4. :. Global Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 60

TABLE NO. 5. :. Global Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 64

TABLE NO. 6. :. Global Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 64

TABLE NO. 7. :. Global Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 68

TABLE NO. 8. :. Global Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 68

TABLE NO. 9. :. Global Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 72

TABLE NO. 10. :…… Global Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 72

TABLE NO. 11. : Global Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 76

TABLE NO. 12. : Global Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 76

TABLE NO. 13. :. Global Private Cloud Market Revenue, By Region, 2018 – 2024 (USD Million). 80

TABLE NO. 14. :. Global Private Cloud Market Revenue, By Region, 2025– 2032 (USD Million). 81

TABLE NO. 15. : North America Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 83

TABLE NO. 16. :. North America Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 83

TABLE NO. 17. :…. North America Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 84

TABLE NO. 18. :…. North America Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 84

TABLE NO. 19. :…. North America Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 85

TABLE NO. 20. :…. North America Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 85

TABLE NO. 21. :…… North America Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 86

TABLE NO. 22. :…… North America Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 86

TABLE NO. 23. : North America Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 87

TABLE NO. 24. : North America Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 87

TABLE NO. 25. :… North America Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 88

TABLE NO. 26. :… North America Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 88

TABLE NO. 27. :…. North America Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 89

TABLE NO. 28. :…. North America Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 89

TABLE NO. 29. :…….. U.S. Private Cloud Market Revenue, By User, 2018 – 2024 (USD Million). 90

TABLE NO. 30. :….. North America Private Cloud Market Revenue, By User, 2025 – 2032 (USD Million). 90

TABLE NO. 31. :……….. Europe Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 92

TABLE NO. 32. : Europe Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 93

TABLE NO. 33. :…… Europe Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 94

TABLE NO. 34. :…… Europe Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 94

TABLE NO. 35. :…… Europe Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 95

TABLE NO. 36. :…… Europe Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 95

TABLE NO. 37. :…….. Europe Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 96

TABLE NO. 38. :…….. Europe Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 96

TABLE NO. 39. :. Europe Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 97

TABLE NO. 40. :. Europe Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 97

TABLE NO. 41. :….. Europe Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 98

TABLE NO. 42. :….. Europe Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 98

TABLE NO. 43. :……. Europe Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 99

TABLE NO. 44. :……. Europe Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 99

TABLE NO. 45. :…. Asia Pacific Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 101

TABLE NO. 46. :….. Asia Pacific Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 102

TABLE NO. 47. : Asia Pacific Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 103

TABLE NO. 48. : Asia Pacific Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 103

TABLE NO. 49. : Asia Pacific Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 104

TABLE NO. 50. : Asia Pacific Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 104

TABLE NO. 51. :.. Asia Pacific Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 105

TABLE NO. 52. :.. Asia Pacific Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 105

TABLE NO. 53. :… Asia Pacific Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 106

TABLE NO. 54. :… Asia Pacific Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 106

TABLE NO. 55. :……. Asia Pacific Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 107

TABLE NO. 56. :……. Asia Pacific Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 107

TABLE NO. 57. : Asia Pacific Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 108

TABLE NO. 58. : Asia Pacific Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 108

TABLE NO. 59. :. Latin America Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 110

TABLE NO. 60. :.. Latin America Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 111

TABLE NO. 61. :…. Latin America Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 112

TABLE NO. 62. :…. Latin America Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 112

TABLE NO. 63. :…. Latin America Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 113

TABLE NO. 64. :…. Latin America Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 113

TABLE NO. 65. :……. Latin America Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 114

TABLE NO. 66. :……. Latin America Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 114

TABLE NO. 67. : Latin America Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 115

TABLE NO. 68. : Latin America Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 115

TABLE NO. 69. :…. Latin America Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 116

TABLE NO. 70. :…. Latin America Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 116

TABLE NO. 71. :….. Latin America Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 117

TABLE NO. 72. :….. Latin America Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 117

TABLE NO. 73. :…. Middle East Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 119

TABLE NO. 74. :….. Middle East Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 120

TABLE NO. 75. : Middle East Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 121

TABLE NO. 76. : Middle East Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 121

TABLE NO. 77. : Middle East Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 122

TABLE NO. 78. : Middle East Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 122

TABLE NO. 79. :.. Middle East Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 123

TABLE NO. 80. :.. Middle East Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 123

TABLE NO. 81. :… Middle East Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 124

TABLE NO. 82. :… Middle East Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 124

TABLE NO. 83. :……. Middle East Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 125

TABLE NO. 84. :……. Middle East Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 125

TABLE NO. 85. : Middle East Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 126

TABLE NO. 86. : Middle East Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 126

TABLE NO. 87. : Africa Private Cloud Market Revenue, By Country, 2018 – 2024 (USD Million). 128

TABLE NO. 88. : Africa Private Cloud Market Revenue, By Country, 2025– 2032 (USD Million). 129

TABLE NO. 89. : Africa Private Cloud Market Revenue, By Service Offerings, 2018 – 2024 (USD Million). 130

TABLE NO. 90. : Africa Private Cloud Market Revenue, By Service Offerings, 2025 – 2032 (USD Million). 130

TABLE NO. 91. :……. Africa Private Cloud Market Revenue, By Technology, 2018 – 2024 (USD Million). 131

TABLE NO. 92. :……. Africa Private Cloud Market Revenue, By Technology, 2025 – 2032 (USD Million). 131

TABLE NO. 93. :………. Africa Private Cloud Market Revenue, By Workload, 2018 – 2024 (USD Million). 132

TABLE NO. 94. :………. Africa Private Cloud Market Revenue, By Workload, 2025 – 2032 (USD Million). 132

TABLE NO. 95. :.. Africa Private Cloud Market Revenue, By Enterprise Size, 2018 – 2024 (USD Million). 133

TABLE NO. 96. :.. Africa Private Cloud Market Revenue, By Enterprise Size, 2025 – 2032 (USD Million). 133

TABLE NO. 97. :…… Africa Private Cloud Market Revenue, By Deployment, 2018 – 2024 (USD Million). 134

TABLE NO. 98. :…… Africa Private Cloud Market Revenue, By Deployment, 2025 – 2032 (USD Million). 134

TABLE NO. 99. : Africa Private Cloud Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million). 135

TABLE NO. 100. :……. Africa Private Cloud Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million). 135