Market Overview:

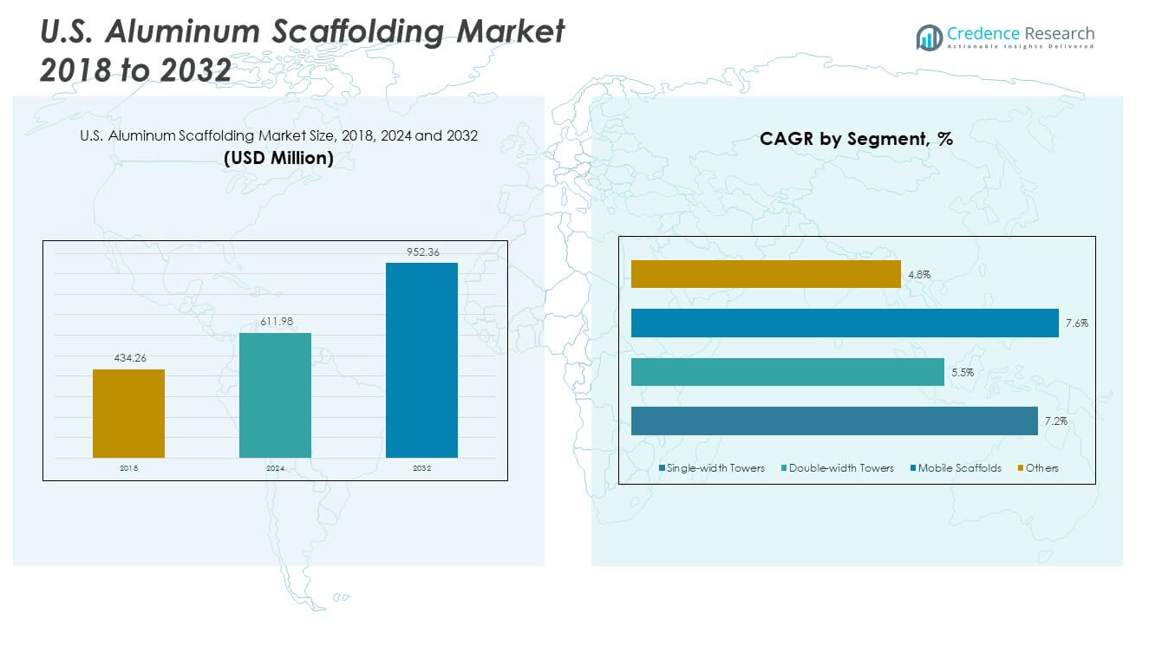

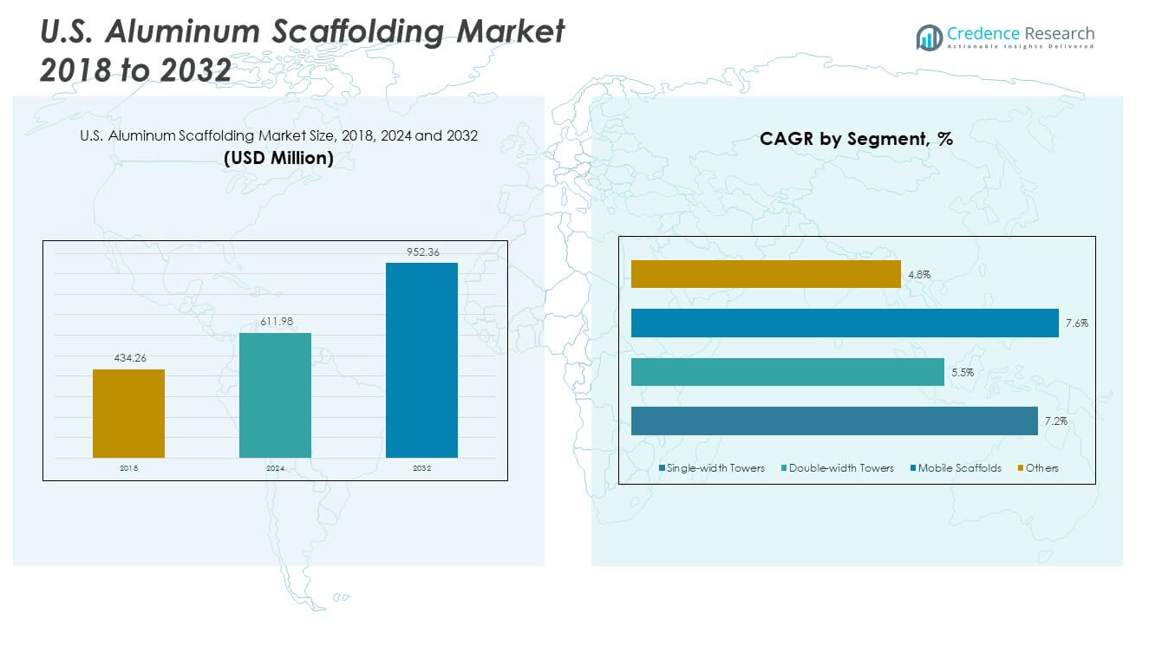

The U.S. Aluminum Scaffolding Market size was valued at USD 434.26 million in 2018 to USD 611.98 million in 2024 and is anticipated to reach USD 952.36 million by 2032, at a CAGR of 5.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| U.S. Aluminum Scaffolding Market Size 2024 |

USD 611.98 million |

| U.S. Aluminum Scaffolding Market, CAGR |

5.77% |

| U.S. Aluminum Scaffolding Market Size 2032 |

USD 952.36 million |

Growth in the U.S. Aluminum Scaffolding Market is driven by the ongoing demand for safe, lightweight, and durable access systems in construction, maintenance, and industrial applications. The aluminum scaffold’s corrosion resistance, ease of assembly, and transportability make it ideal for high-frequency use in both urban and industrial environments. Infrastructure upgrades, commercial construction activities, and stricter safety regulations have boosted adoption across end-use sectors. Additionally, increased rental demand and rising labor safety awareness continue to push manufacturers toward innovation in ergonomic and compliant scaffold systems.

Regionally, states with high construction activity such as California, Texas, and Florida lead the U.S. market, owing to their booming real estate, infrastructure, and industrial development. Urban centers along the East and West Coasts are witnessing strong demand due to ongoing commercial renovations and new high-rise projects. Emerging regions in the Midwest and Southeast are also expanding their scaffold usage, driven by increasing public infrastructure investments and growth in manufacturing and energy sectors requiring lightweight, adaptable access solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Aluminum Scaffolding Market was valued at USD 611.98 million in 2024 and is projected to reach USD 952.36 million by 2032, growing at a CAGR of 5.77%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Increasing construction activity and infrastructure upgrades are driving the demand for lightweight and compliant scaffolding systems across the U.S.

- Safety regulations by OSHA and ANSI are prompting contractors to shift from traditional materials to modular aluminum scaffolds.

- Volatility in raw material prices and supply chain disruptions continue to challenge manufacturers in maintaining consistent pricing.

- Southern U.S. dominates the market share due to high infrastructure spending and rapid urban development in states like Texas and Florida.

- Mobile scaffolds lead the product segment owing to their versatility and preference in both commercial and maintenance applications.

- Maintenance and renovation sectors contribute steady demand, particularly in public facilities and industrial environments.

Market Drivers:

Surge in Urban Infrastructure Projects Stimulates Demand for Lightweight Access Solutions

Urbanization continues to drive the need for efficient vertical access systems in the U.S., with aluminum scaffolding emerging as a key choice due to its mobility and ease of installation. Rapid growth in commercial and residential building projects demands frequent scaffold assembly and disassembly, which aluminum structures accommodate efficiently. The U.S. Aluminum Scaffolding Market benefits from construction firms prioritizing lightweight systems that reduce labor fatigue and improve safety. City-based high-rise developments create repeat demand for compact, height-adjustable platforms. The expanding use of prefabricated construction technologies requires adaptable scaffolding support systems. Contractors seek solutions that comply with OSHA standards while minimizing setup time. The market responds by offering ergonomic aluminum systems that streamline workflows and reduce operational costs.

- For instance, Safway, now operating under BrandSafway, has been involved in multiple high-profile infrastructure projects across the U.S., providing aluminum scaffolding systems designed for rapid assembly and disassembly in complex environments.

Expansion of Maintenance and Renovation Work Across Public and Private Facilities

Aging public infrastructure and the need for periodic maintenance across bridges, airports, and government buildings contribute significantly to scaffold demand. The U.S. Aluminum Scaffolding Market finds opportunities in retrofitting and ongoing upgrades across educational institutions, transit hubs, and healthcare facilities. These projects require flexible, corrosion-resistant systems that can be deployed quickly without structural damage. Aluminum scaffolds support operations in environments where heavy steel alternatives are impractical. Renovation of industrial plants and warehouse facilities increases the call for scaffolding that is both durable and easily relocatable. Facility managers prefer modular aluminum units to meet short project timelines. Safety considerations further encourage the switch from traditional wooden or steel setups to aluminum-based platforms.

Growth in Demand from the Industrial and Manufacturing Sectors

Industrial sectors such as oil and gas, power generation, and manufacturing facilities require scaffolding for routine inspection, repair, and maintenance work. The U.S. Aluminum Scaffolding Market serves this demand by offering corrosion-resistant solutions compatible with chemical-rich environments. These sectors prioritize platforms that ensure minimal downtime and quick access in confined spaces. Maintenance contracts now often include requirements for modular aluminum scaffolds that fit varied plant layouts. Industries appreciate aluminum’s non-magnetic and non-sparking properties, which suit volatile operational areas. Customizable scaffold towers enable teams to perform overhead work safely and efficiently. The market sees growth through rentals to EPC firms managing refinery upgrades and energy plant installations.

Increasing Focus on Worker Safety and Regulatory Compliance in Construction Practices

Strict enforcement of OSHA safety standards and rising concern over construction site injuries push contractors to adopt certified, high-performance access systems. The U.S. Aluminum Scaffolding Market aligns with this shift by offering tested systems equipped with guardrails, anti-slip surfaces, and stabilizers. Contractors favor aluminum scaffolds due to their weight advantage and reduced risk of fatigue-induced accidents. Safety training programs now recommend aluminum structures for small and medium-sized operations. Insurance providers also consider scaffold compliance when evaluating risk coverage, indirectly influencing buyer preference. Manufacturers enhance product lines to meet ANSI and CSA safety benchmarks. Investments in R&D ensure the delivery of scaffolding that supports not only productivity but also stringent safety protocols.

- For instance, Layher’s Allround Lightweight (LW) aluminum scaffolding system complies with OSHA standard 1926.451, including requirements for integrated guardrails, toeboards, and fully decked platforms. Layher confirms that Erection, use, and maintenance of its Allround system must conform to Layher instructions and OSHA scaffolding safety regulations

Market Trends:

Growing Popularity of Mobile Tower Scaffolds in Urban Work Environments

Construction firms in metropolitan areas are adopting mobile aluminum tower scaffolds for their flexibility and space-saving configurations. These systems allow teams to perform indoor and outdoor tasks efficiently within restricted zones such as city streets and narrow hallways. The U.S. Aluminum Scaffolding Market experiences a shift toward compact towers that reduce setup time and maximize floor access. Mobile scaffolds support quick job transitions between ceiling maintenance, painting, HVAC installations, and electrical repairs. Facility service providers increasingly specify wheeled aluminum platforms for recurring maintenance. The rise in short-duration repair projects boosts market preference for movable scaffold units. Lightweight frames with locking wheels enhance user control and ensure quick repositioning during operation.

Technological Integration in Scaffold Design Enhances Safety and Productivity

Digital innovation influences scaffold engineering with the introduction of smart components and safety enhancements. The U.S. Aluminum Scaffolding Market incorporates solutions like RFID tags for inventory tracking and sensor-activated alarms for stability warnings. Manufacturers now provide digital load monitoring systems to alert users about weight thresholds in real-time. Platforms feature adjustable legs and built-in level indicators to ensure even placement on uneven ground. These tech upgrades address contractor needs for safer, smarter scaffolding systems. Digital blueprint compatibility also enables scaffold preconfiguration based on project layout. The integration of software-controlled erection guides helps reduce setup errors and improves compliance. Clients view these features as value additions that support safe deployment in regulated job sites.

Rental Market Growth Driven by Cost Optimization and Project Flexibility

Construction firms, facility managers, and event organizers prefer renting scaffolds over outright purchase to manage costs and project-specific needs. The U.S. Aluminum Scaffolding Market sees a rising share of its business from rental fleets maintained by national and regional equipment providers. Contractors use short-term scaffold rentals to meet peak project demands without overinvesting in storage and maintenance. Rental companies offer value-added services like on-site setup, dismantling, and transportation, improving customer convenience. Smaller contractors especially benefit from access to advanced scaffolding without capital investment. Aluminum’s lightweight property also reduces transport and handling costs for rental suppliers. The trend toward lean construction practices aligns well with rental-based scaffold access models.

- For instance, Waco Scaffolding, with over 70 years of experience, offers certified rental aluminum scaffolding solutions that include delivery, professional installation, and OSHA/SAIA-compliant safety training, helping SMEs and specialized contractors reduce equipment ownership costs.

Increased Adoption of Foldable and Telescopic Scaffold Systems

Space-saving aluminum scaffolding solutions gain traction among interior renovators and maintenance contractors. The U.S. Aluminum Scaffolding Market supports this demand by offering foldable systems that are easy to carry and store in tight spaces. Telescopic designs allow quick vertical adjustments without dismantling, suiting electrical and ceiling-based repair work. These compact systems are preferred in apartment buildings, hospitals, and educational institutions where traditional large-scale scaffolds are impractical. Contractors look for scaffolds that fit through standard doors and elevators while providing height flexibility. Foldable designs reduce transport costs and eliminate storage concerns for freelance professionals. The shift reflects evolving job site requirements focused on accessibility and mobility within built environments.

- For instance, OrangeLocation’s Baker Scaffold offers a fully foldable, tool-free aluminum design that weighs just 63lbs (28.6kg), enabling technicians to quickly deploy it in tight indoor spaces, including elevators and narrow shafts.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions Impact Manufacturing and Pricing

Volatility in aluminum prices significantly affects production costs for scaffold manufacturers, leading to margin pressures and pricing instability. The U.S. Aluminum Scaffolding Market faces challenges due to global supply chain disruptions, particularly in sourcing high-grade aluminum and alloy components. Tariffs on imported materials also contribute to fluctuating cost structures. Manufacturers must navigate delays and pricing issues while meeting delivery timelines for construction and industrial clients. These dynamics strain procurement strategies and lead to inconsistent availability of scaffold components in some regions. Companies struggle to maintain competitive pricing without compromising quality or safety features. The market remains sensitive to changes in raw material availability and global trade regulations. Inventory planning and local sourcing become critical for sustaining operations under such volatility.

Limited Awareness Among Smaller Contractors Slows Adoption in Rural and Low-Income Areas

Despite its advantages, aluminum scaffolding adoption remains low in some regions due to limited awareness or budget constraints among smaller construction firms. The U.S. Aluminum Scaffolding Market encounters slower penetration in rural zones where traditional wooden or steel scaffold systems dominate. Contractors in these areas may lack access to rental services or face challenges in training labor to use aluminum systems safely. Initial investment appears high to budget-conscious operators, despite long-term cost benefits. Local regulations may not always enforce scaffold safety compliance, reducing urgency to upgrade. Distributors struggle to expand reach in less urbanized markets without localized marketing and support. Bridging this adoption gap requires targeted education and scalable financing models.

Market Opportunities:

Opportunities in Customized Solutions for Niche and Specialized Applications

The U.S. Aluminum Scaffolding Market presents strong growth potential in developing scaffolding systems tailored for niche uses, such as aircraft maintenance, shipbuilding, or cleanroom environments. These applications demand corrosion-resistant, lightweight, and modular platforms that support specific operational protocols. Custom designs allow scaffold configurations to fit around irregular structures and tight spaces. Clients seek systems with quick assembly, minimal damage risk, and compatibility with sensitive surroundings. Manufacturers can differentiate by offering application-specific solutions backed by training and support. It positions them to serve industries seeking precision access equipment.

Strong Growth Potential Through Expansion of E-commerce and Direct Distribution Channels

Online sales channels and direct-to-contractor distribution models create new opportunities for scaffold suppliers to reach end-users efficiently. The U.S. Aluminum Scaffolding Market benefits from increased visibility of scaffold products on digital platforms. E-commerce simplifies purchasing, allows easy comparison, and supports scalable order fulfillment for small-to-medium enterprises. Suppliers offering virtual consultations, real-time stock availability, and configuration tools gain a competitive edge. Direct access also helps educate buyers on compliance features and product suitability. This sales approach reduces dependency on third-party distributors and opens up previously underserved regional markets.

Market Segmentation Analysis:

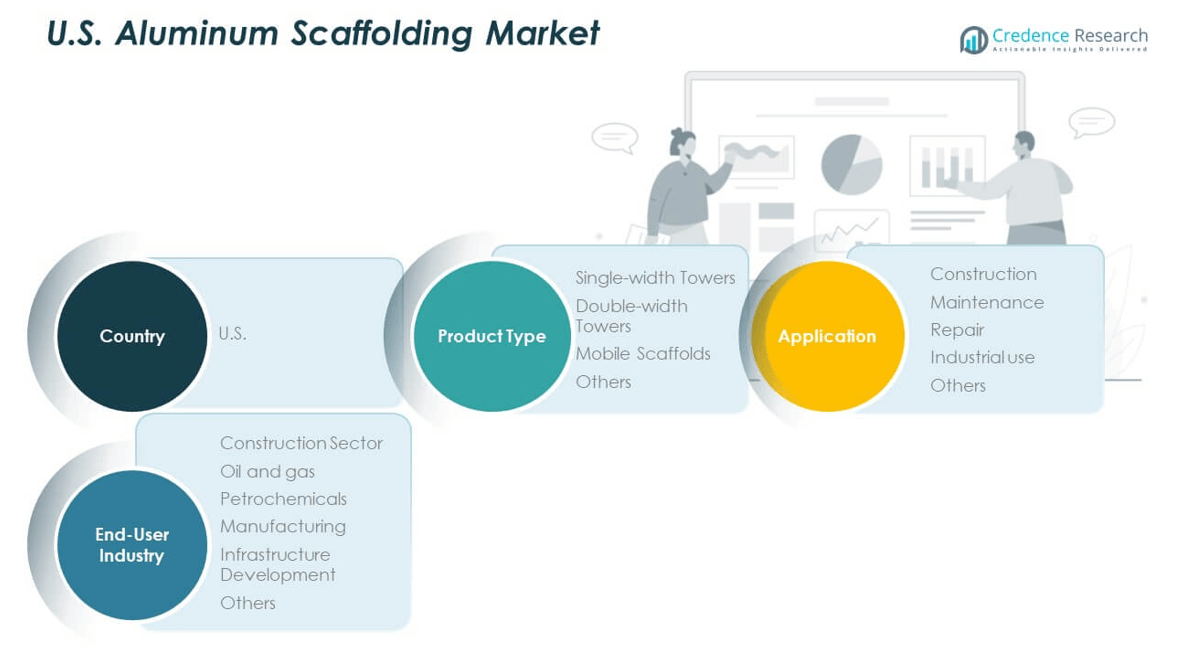

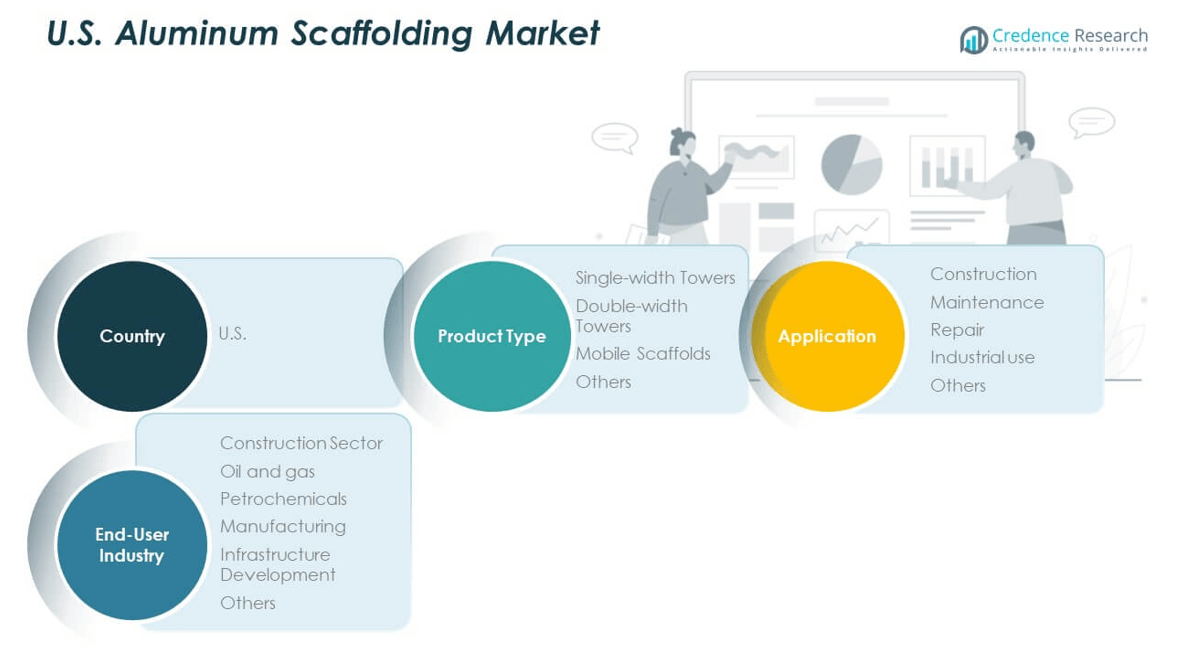

By product type, the U.S. Aluminum Scaffolding Market demonstrates strong performance across diverse product types, led by mobile scaffolds due to their adaptability, ease of movement, and suitability for dynamic construction and maintenance environments. Double-width towers follow closely, offering greater platform space for high-rise and industrial applications. Single-width towers serve confined indoor spaces efficiently, while the “others” category, which includes modular and custom configurations, is gaining traction in specialized use cases.

- For instance, Instant UpRight’s “Span 500” mobile aluminum scaffold tower features a fast-track design with 500 mm rung spacing and integral ladder frames, enabling platform heights up to 12 m indoors for double‑width configurations and 8 m for single‑width versions.

By application, construction remains the dominant segment, driven by new builds and urban infrastructure development. Maintenance follows, reflecting the demand for lightweight and portable systems in facility management and renovation work. The repair segment supports consistent usage across public and private infrastructure, while industrial use is expanding steadily in sectors that require compliance-driven and corrosion-resistant access systems.

By end-user industries, the construction sector leads scaffold deployment, supported by infrastructure development projects. The oil and gas and petrochemical industries contribute to rising demand due to ongoing inspection and maintenance activities. Manufacturing and utility sectors also rely on aluminum scaffolds for safe access in operational environments. The U.S. Aluminum Scaffolding Market supports these segments through scalable, compliant, and ergonomic product offerings.

- For example, Altrex’s modular aluminum scaffolding systems feature Quickpin connections and high load-bearing capacity, designed to meet OSHA and ANSI safety standards. Their lightweight construction and modular versatility make them suitable for use in a variety of construction and maintenance applications across the U.S., particularly where safety and efficiency are priorities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

Regional Analysis:

The Southern United States holds the largest share of the U.S. Aluminum Scaffolding Market, accounting for 38% of the total revenue. States like Texas and Florida lead the region due to robust commercial construction, highway expansion, and residential housing developments. The area’s high frequency of hurricane-related rebuilding also contributes to consistent scaffold demand. Contractors in the South prefer aluminum scaffolding for its portability and resistance to corrosion in humid climates. Strong infrastructure investments and a growing number of industrial projects keep the region ahead. The presence of major rental and distribution hubs also ensures rapid availability of scaffold systems.

The Western region contributes 27% of the U.S. Aluminum Scaffolding Market, driven by high-rise commercial and mixed-use construction in cities like Los Angeles, San Francisco, and Seattle. Stricter building codes and seismic design requirements lead builders to adopt lightweight and code-compliant scaffolding. The market sees sustained demand from tech campuses, transit-oriented developments, and renewable energy projects. California’s sustainability regulations further support aluminum scaffold use due to its recyclability. Contractors value the efficiency gains in assembling aluminum towers for large-scale developments. The market thrives on innovation and the presence of top-tier scaffolding manufacturers and service providers in the region.

The Midwest and Northeast regions hold market shares of 19% and 16% respectively, with growth driven by public infrastructure upgrades and institutional renovation projects. In the Midwest, states like Illinois and Ohio deploy aluminum scaffolding for bridge work, plant maintenance, and warehouse installations. The Northeast supports demand through school, healthcare, and transit renovations, especially in urban centers like New York and Boston. Cold-weather states favor aluminum scaffolds due to their rust resistance and ease of handling during winter. The U.S. Aluminum Scaffolding Market benefits from regional partnerships between contractors and equipment rental firms. Continued federal and state funding for infrastructure rejuvenation sustains demand across these areas.

Key Player Analysis:

- BrandSafway

- United Rentals

- Sunbelt Rentals

- The Brock Group

- Mattison Scaffolding Ltd

- Brand Industrial Services, Inc.

- WernerCo

- ULMA Form Works, Inc.

- Penn Tool Co.

- Ver Sales, Inc.

Competitive Analysis:

The U.S. Aluminum Scaffolding Market features a moderately fragmented competitive landscape with the presence of both global manufacturers and regional suppliers. Key players include WernerCo, Alufase USA, Bil-Jax, Instant Upright, and BrandSafway, each offering a diverse portfolio of mobile towers, folding units, and modular systems. Companies compete on product durability, compliance with OSHA standards, customization options, and distribution efficiency. Rental service providers also play a critical role, catering to short-term project needs across construction, maintenance, and industrial sectors. Innovation in ergonomic design and lightweight configurations gives firms a competitive edge. Market participants invest in expanding product lines and enhancing aftersales support to retain customer loyalty. Partnerships with contractors and digital distribution strategies further strengthen their market positioning. The U.S. Aluminum Scaffolding Market remains competitive through continuous product improvement and adaptability to evolving safety standards and construction practices.

Recent Developments:

- In January 2025, BrandSafway introduced innovative solutions at the World of Concrete 2025 event. Highlights included Flexi Deck, a lightweight slab formwork system designed for quick assembly and dismantling, the Hydro Mobile M2 Summit motorized access system for rapid work platform access, and the Spider SC1000 Voyager battery-powered hoist, providing enhanced site flexibility and safety without the need for external power.

- In May 2025, PERI USA’s parent company, Perion, completed the acquisition of Greenbids, a cutting-edge AI technology firm, to accelerate its digital transformation strategy in the U.S. modular and system scaffolding market.

- In June 2025, United Rentals launched Workspace Ready Solutions, a customizable set of packages for mobile and container jobsite offices.

- In Sep 2024, BrandSafway expanded its capabilities by acquiring Covan’s Insulation Company, strengthening its portfolio in insulation and specialty construction services.

Market Concentration & Characteristics:

The U.S. Aluminum Scaffolding Market exhibits moderate concentration, with several well-established players maintaining significant brand recognition and distribution networks. It caters to both purchase and rental segments, serving a wide range of end users including construction firms, facility maintenance providers, and industrial contractors. The market values compliance, safety, and ease of deployment, making lightweight and modular solutions highly attractive. It responds to regional construction dynamics, with customization and mobility emerging as key purchasing factors. Demand fluctuates with infrastructure investments and seasonal building activity. The presence of strong rental ecosystems supports widespread access, especially among small and mid-sized firms. It shows a steady shift toward digital sales channels and integrated service offerings.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for aluminum scaffolding is expected to grow steadily, supported by rising infrastructure modernization across urban and semi-urban areas.

- Technological innovations such as integrated safety features and smart load indicators will drive adoption among safety-conscious contractors.

- The rental segment will expand further, with small and mid-sized enterprises opting for flexible, short-term access solutions.

- Increased government spending on public infrastructure projects will boost scaffold requirements for bridge, road, and transit development.

- Growth in the maintenance and renovation sector will sustain recurring demand for mobile and foldable scaffolding systems.

- Manufacturers will prioritize lightweight, modular designs that meet evolving OSHA and ANSI compliance standards.

- Expansion of e-commerce platforms and digital catalogs will streamline procurement and broaden market reach in underserved regions.

- Industrial sectors including energy, aviation, and manufacturing will generate demand for custom aluminum scaffold systems.

- Eco-conscious construction practices will support aluminum scaffolding due to its recyclability and reduced environmental impact.

- Ongoing workforce training and safety awareness campaigns will encourage the replacement of outdated scaffold systems.