Market Overview:

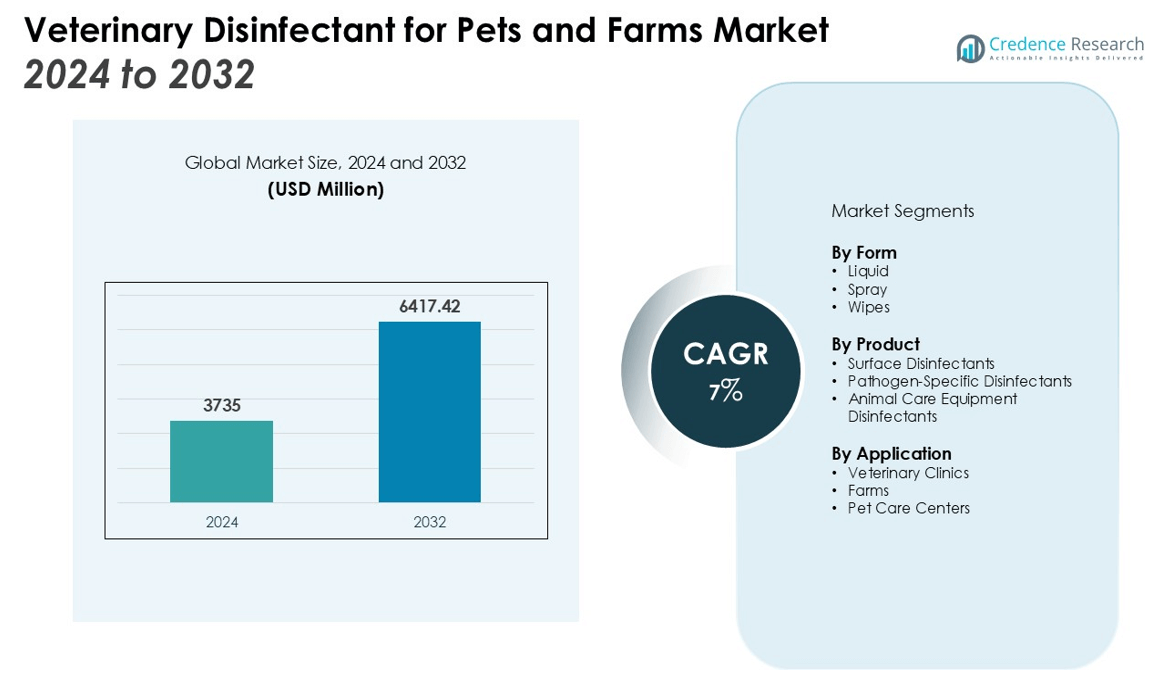

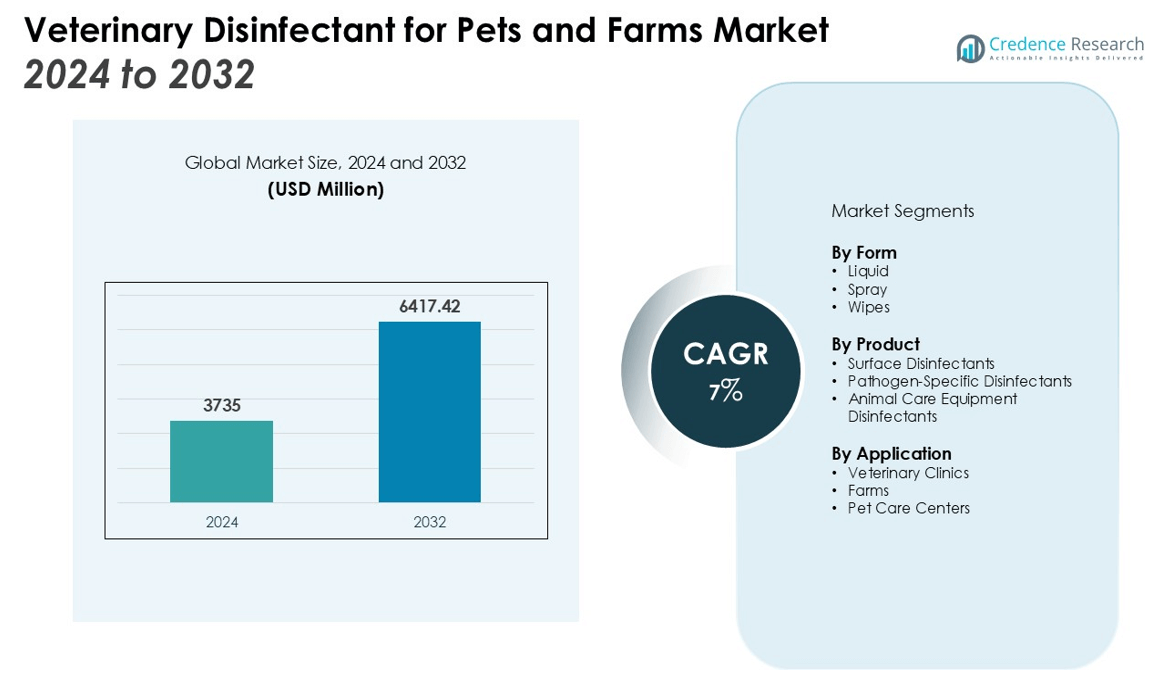

The Veterinary Disinfectant for Pets and Farms Market size was valued at USD 3735 million in 2024 and is anticipated to reach USD 6417.42 million by 2032, at a CAGR of 7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Veterinary Disinfectant for Pets and Farms Market Size 2024 |

USD 3735 million |

| Veterinary Disinfectant for Pets and Farms Market, CAGR |

7% |

| Veterinary Disinfectant for Pets and Farms Market Size 2032 |

USD 6417.42 million |

Key drivers of market growth include the heightened focus on animal health and welfare, along with the expanding pet care industry. The rise in pet ownership, especially in urban areas, and the growing awareness of preventive healthcare measures are contributing to the demand for veterinary disinfectants. Moreover, the increasing prevalence of infectious diseases in livestock and pets further emphasizes the need for effective sanitation solutions to prevent disease outbreaks. The shift toward environmentally friendly and non-toxic disinfectants is also gaining traction, as consumers and businesses alike prioritize sustainability in their purchasing decisions.

Regionally, North America holds the largest market share, driven by well-established veterinary care infrastructure and high pet ownership rates. Europe follows closely, with significant demand for veterinary disinfectants across both companion animal and livestock sectors. The Asia Pacific region is expected to experience the highest growth due to expanding veterinary services and growing pet adoption rates, alongside a growing emphasis on biosecurity in farms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Veterinary Disinfectant for Pets and Farms Market is projected to grow from USD 3.735 billion in 2024 to USD 6.417 billion by 2032, with a CAGR of 7%.

- The demand for veterinary disinfectants is fueled by the growing awareness of animal health and hygiene, especially in urban areas where pet ownership is rising.

- Eco-friendly and non-toxic disinfectants are gaining traction as consumers prioritize sustainability alongside animal health, leading to a shift toward biodegradable products.

- The increasing prevalence of zoonotic diseases and infections in pets and livestock is driving the need for effective sanitation solutions to prevent outbreaks.

- Expanding veterinary services and stricter farm biosecurity protocols globally are further propelling demand for disinfectant products to maintain health and hygiene standards.

- High costs associated with premium eco-friendly disinfectants present a challenge, limiting adoption in smaller veterinary clinics and farms with budget constraints.

- North America leads the market, accounting for 40% of the share, followed by Europe with 30%, while the Asia Pacific region shows the highest growth potential, driven by rising pet adoption and biosecurity concerns.

Market Drivers:

Growing Awareness of Animal Health and Hygiene

The increasing focus on animal health and hygiene is a key driver in the Veterinary Disinfectant for Pets and Farms Market. As pet ownership rises, particularly in urban areas, there is a growing awareness among pet owners about the importance of maintaining a clean and safe environment for animals. This heightened focus on preventive health measures, such as routine disinfection, is driving the demand for veterinary disinfectants. It plays a vital role in protecting pets from infectious diseases, which boosts the market for effective sanitization solutions.

- For instance, Boehringer Ingelheim awards five separate grants of $15,000 each annually to veterinarians for research into equine infectious respiratory diseases, supporting advancements in preventive health measures and hygiene for horses.

Rising Demand for Eco-Friendly and Non-Toxic Products

A significant driver for the Veterinary Disinfectant for Pets and Farms Market is the rising consumer preference for eco-friendly and non-toxic disinfectant products. There is a growing trend among pet owners and farm operators toward using safer, sustainable solutions that do not harm animals or the environment. The adoption of biodegradable and non-toxic disinfectants is gaining momentum as consumers increasingly prioritize environmental sustainability alongside animal health, prompting manufacturers to innovate and offer safer alternatives.

- For instance, Ecolab’s Daily Disinfectant Cleaner achieves disinfection against 38 organisms in five minutes and SARS-CoV-2 in one minute, while requiring no personal protective equipment at use dilution, highlighting its safety and environmental consideration.

Prevalence of Zoonotic and Infectious Diseases

The rising incidence of zoonotic diseases and infections in both pets and livestock is a major factor propelling the Veterinary Disinfectant for Pets and Farms Market. The need for effective sanitization to control the spread of diseases such as parvovirus, avian flu, and other pathogens is creating strong demand for veterinary disinfectants. It is critical to prevent disease outbreaks that can affect both animal health and human safety, thereby driving the demand for comprehensive disinfection solutions in veterinary clinics, farms, and pet care facilities.

Expanding Veterinary Care and Farm Biosecurity Standards

As veterinary care services expand globally, especially in emerging markets, the demand for disinfectants is rising. In addition, growing concerns over farm biosecurity are pushing agricultural sectors to adopt stricter hygiene protocols. These include the regular use of disinfectants to prevent the spread of disease among livestock and to ensure the health of both farm animals and workers. The Veterinary Disinfectant for Pets and Farms Market benefits from these developments, as both sectors require effective disinfectant products for optimal health management and biosecurity.

Market Trends:

Increased Adoption of Organic and Natural Disinfectants

One of the prominent trends in the Veterinary Disinfectant for Pets and Farms Market is the growing adoption of organic and natural disinfectants. With increasing concerns about the harmful effects of synthetic chemicals on pets, livestock, and the environment, consumers are seeking alternatives that offer both safety and effectiveness. Organic disinfectants, often derived from plant-based ingredients, are gaining traction due to their non-toxic and eco-friendly properties. This trend aligns with the broader shift toward sustainable and ethical products, especially as pet owners and farm operators become more conscious of the impact of their purchasing decisions. The demand for these green disinfectants is expected to continue rising as both regulatory standards and consumer preferences evolve.

- For instance, a dairy farm in Norfolk replaced chemical disinfectants with an ozone-based system from Oxi-Tech Solutions, achieving energy and carbon dioxide savings totaling 5 tonnes annually, while improving animal health and creating safer working conditions.

Technological Advancements in Disinfection Solutions

Technological advancements are also shaping the Veterinary Disinfectant for Pets and Farms Market. Innovations in disinfectant formulations, such as the development of long-lasting and multi-surface disinfectants, are enhancing the effectiveness of cleaning protocols. Additionally, the integration of automation and smart technologies into disinfection processes, such as the use of UV light and electrostatic sprayers, is improving efficiency and reducing labor costs. These technologies ensure more consistent and thorough disinfection, which is particularly beneficial in large-scale farm operations and veterinary clinics. As these technological solutions become more accessible and affordable, they are expected to drive further growth in the market, particularly in regions with rapidly expanding veterinary care infrastructure.

- For instance, Protectus Ultimate™ by RBT Global is a water-based disinfectant that provides sustained efficacy for up to 24 hours on surfaces using residual barrier technology, effectively killing 99.999% of bacteria and viruses including MRSA and coronaviruses within 5 minutes.

Market Challenges Analysis:

High Costs of Premium Disinfectants

One significant challenge in the Veterinary Disinfectant for Pets and Farms Market is the high cost associated with premium disinfectant products. While eco-friendly and organic disinfectants are gaining popularity, they often come at a higher price point compared to conventional chemical alternatives. This pricing disparity can limit their adoption, particularly in smaller veterinary clinics and farms with tighter budgets. The cost factor becomes more critical as demand for advanced disinfectants increases, posing a challenge for manufacturers to balance affordability with quality and innovation.

Regulatory Compliance and Safety Standards

Another challenge facing the Veterinary Disinfectant for Pets and Farms Market is the complex regulatory landscape. Disinfectants must meet stringent safety and efficacy standards set by various regulatory bodies, including the Environmental Protection Agency (EPA) and other regional authorities. Navigating these regulations can be time-consuming and costly for manufacturers, particularly those introducing new products. The need to comply with these standards while maintaining product performance can slow down the development of new solutions and increase operational costs, hindering market growth in certain regions.

Market Opportunities:

Expansion of Veterinary Services in Emerging Markets

One significant opportunity in the Veterinary Disinfectant for Pets and Farms Market lies in the expansion of veterinary services in emerging markets. As economies in regions such as Asia Pacific, Latin America, and Africa continue to grow, there is an increasing demand for veterinary care, including the use of disinfectants for pet and farm animal health. The rising disposable income and changing attitudes toward animal welfare in these regions create a favorable environment for the adoption of advanced disinfectant solutions. This presents a vast opportunity for manufacturers to tap into new markets and meet the growing demand for effective and safe sanitation products.

Innovation in Disinfection Technologies

There is also a strong opportunity for innovation in disinfection technologies to drive growth in the Veterinary Disinfectant for Pets and Farms Market. The development of more efficient, longer-lasting, and faster-acting disinfectants can enhance their appeal to pet owners and farm operators. Emerging technologies such as electrostatic sprayers, UV light disinfection, and smart disinfectant systems can provide significant advantages in large-scale operations. These innovations present manufacturers with the chance to differentiate their products and cater to the evolving needs of the market, creating a competitive edge while supporting cleaner and safer environments for animals.

Market Segmentation Analysis:

By Form:

The Veterinary Disinfectant for Pets and Farms Market is divided into liquid, spray, and wipes forms. Liquid disinfectants dominate the market due to their versatility and effectiveness in large-scale applications, particularly in veterinary clinics and farm settings. Sprays and wipes are increasingly popular in smaller, high-traffic areas like pet care centers and homes due to their ease of use and convenience.

- For instance, Contec, Inc.’s PeridoxRTU Burst Pouch Disinfectant Wipes kill bacterial spores in 3 minutes and viruses in 2 minutes, with an EPA-registered formula that is gentle on stainless steel and effective in controlled environments.

By Product:

This market includes a variety of disinfectants tailored for pets and livestock, such as surface cleaners and pathogen-specific formulations. Surface disinfectants hold the largest market share, while products targeting specific diseases like parvovirus and avian flu are gaining traction. The rise in zoonotic diseases has fueled the demand for more specialized disinfectant products aimed at preventing outbreaks in both companion animal and agricultural settings.

- For example, Rescue Disinfectants with accelerated hydrogen peroxide are effective against parvovirus when used at a 1:32 dilution with a 10-minute contact time, proving critical for outbreak control in animal shelters.

By Application:

The application of veterinary disinfectants spans across veterinary clinics, farms, and pet care centers. Veterinary clinics account for the largest share of the market, where disinfectants are essential for maintaining sterile environments. The farm sector follows closely, with disinfectants crucial for biosecurity to prevent disease spread among livestock. The growing pet care market also contributes significantly, driven by increased pet adoption and the need for regular sanitization in homes and pet care facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Form:

By Product:

- Surface Disinfectants

- Pathogen-Specific Disinfectants

- Animal Care Equipment Disinfectants

By Application:

- Veterinary Clinics

- Farms

- Pet Care Centers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Dominance in Veterinary Infrastructure and Pet Ownership

North America holds the largest market share in the Veterinary Disinfectant for Pets and Farms Market, accounting for 40% of the total market value. The region’s well-established veterinary care infrastructure, coupled with high pet ownership rates, drives significant demand for disinfectant products. With a strong focus on animal welfare and hygiene, North American pet owners and farm operators are increasingly adopting disinfectants to maintain clean and safe environments. The region’s regulatory frameworks also push for high standards in sanitation, further boosting market growth. The U.S. and Canada are key players, with a growing emphasis on eco-friendly and advanced disinfection solutions.

Europe: Strong Veterinary Care and Adoption of Sustainable Solutions

Europe holds a 30% market share in the Veterinary Disinfectant for Pets and Farms Market, driven by its robust veterinary care sector and increasing pet ownership. The demand for high-quality disinfectants is rising across both companion animal and livestock markets. European consumers are particularly inclined toward environmentally sustainable and non-toxic disinfectant products, which is reshaping the market landscape. Countries such as Germany, France, and the UK have stringent animal health regulations, further promoting the adoption of advanced disinfectant solutions. The shift towards organic and eco-friendly products presents manufacturers with growth opportunities in this region.

Asia Pacific: High Growth Potential Due to Expanding Veterinary Services

The Asia Pacific region holds 20% of the Veterinary Disinfectant for Pets and Farms Market, with significant growth potential due to expanding veterinary services. Rapidly increasing pet adoption, growing awareness of animal health, and a rising demand for disinfectants are key drivers in this market. Emerging economies, particularly in countries like China, India, and Southeast Asia, are witnessing a rise in disposable income, contributing to the growing demand for pet care products, including disinfectants. Furthermore, the agricultural sector’s focus on improving biosecurity standards for livestock is increasing the demand for disinfectant solutions in farms. The region presents substantial growth potential for manufacturers seeking to expand their footprint in emerging markets.

Key Player Analysis:

- Zoetis Inc.

- Merck & Co.

- Clorox Company

- Oxydez

- Charles River Laboratories International, Inc.

- Lysol (Reckitt Benckiser)

- Diversey Holdings, Ltd.

- Ecolab Inc.

- C. Johnson Professional

- Hygiena LLC

- Virox Technologies Inc.

- Animal Health International

Competitive Analysis:

The Veterinary Disinfectant for Pets and Farms Market is highly competitive, with several global and regional players dominating the landscape. Key players like Clorox Company, Ecolab Inc., and Zoetis Inc. lead the market due to their established product portfolios and strong distribution networks. These companies offer a wide range of disinfectants tailored for veterinary clinics, farms, and pet care centers, focusing on safety, efficacy, and ease of use. The market also sees increasing participation from smaller players who focus on eco-friendly, non-toxic solutions to cater to the growing demand for sustainable products. Competition is driven by innovation in product formulations, with many companies developing pathogen-specific and long-lasting disinfectants. The rise of environmentally conscious consumers further intensifies competition, prompting companies to enhance their offerings with biodegradable and safe disinfectants. Players are also expanding their market reach by establishing partnerships and regional collaborations to tap into emerging markets.

Recent Developments:

- In July 2025, Merck & Co. announced its plan to acquire Verona Pharma for approximately $10 billion.

- In May 2025, Ecolab launched the 3D TRASAR™ Technology for Direct-to-Chip Liquid Cooling, a new advanced solution designed to enhance performance and efficiency in data center cooling, addressing the rising energy demands due to AI growth.

Market Concentration & Characteristics:

The Veterinary Disinfectant for Pets and Farms Market is moderately concentrated, with a few large players holding significant market share, while numerous smaller companies cater to niche segments. Leading players like Clorox Company, Ecolab Inc., and Zoetis Inc. dominate the market, benefiting from strong brand recognition, extensive product portfolios, and established distribution channels. The market is characterized by ongoing product innovation, with a focus on eco-friendly, non-toxic, and pathogen-specific disinfectants to meet growing consumer demand for sustainable and effective solutions. Competitive dynamics are influenced by factors such as regulatory compliance, product efficacy, and the ability to offer cost-effective solutions for both large-scale farm operations and smaller pet care businesses. The market also sees increasing fragmentation as smaller players focus on eco-friendly formulations and specialized products, contributing to a diverse competitive landscape.

Report Coverage:

The research report offers an in-depth analysis based on Form, Product, Application, Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly and non-toxic disinfectants will continue to rise as consumers prioritize sustainability alongside animal health.

- Increased adoption of advanced disinfection technologies, such as electrostatic sprayers and UV light, will drive market innovation and efficiency.

- Growing concerns over zoonotic diseases will result in higher demand for disinfectants in both veterinary clinics and farm operations.

- Expansion in emerging markets, particularly in Asia Pacific and Latin America, will fuel growth as pet ownership and veterinary services increase.

- Regulatory frameworks will become more stringent, encouraging companies to enhance product formulations to meet safety and efficacy standards.

- Veterinary disinfectants will evolve to target specific pathogens, with products increasingly tailored to address diseases like avian flu and parvovirus.

- The rise in organic and natural product demand will push manufacturers to innovate and introduce biodegradable and safer alternatives.

- The market will see further segmentation, with products catering to both small-scale pet care facilities and large-scale agricultural operations.

- Strategic partnerships and acquisitions among key players will help expand their reach and diversify product portfolios to meet growing consumer demands.

Increased awareness of preventive healthcare and hygiene among pet owners and livestock farmers will continue to drive demand for veterinary disinfectants.