Market Overview:

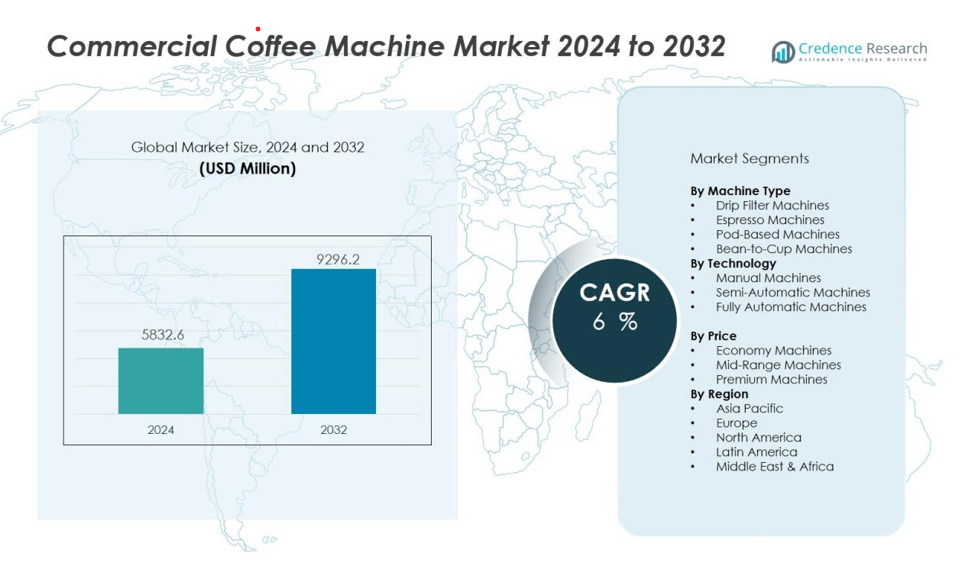

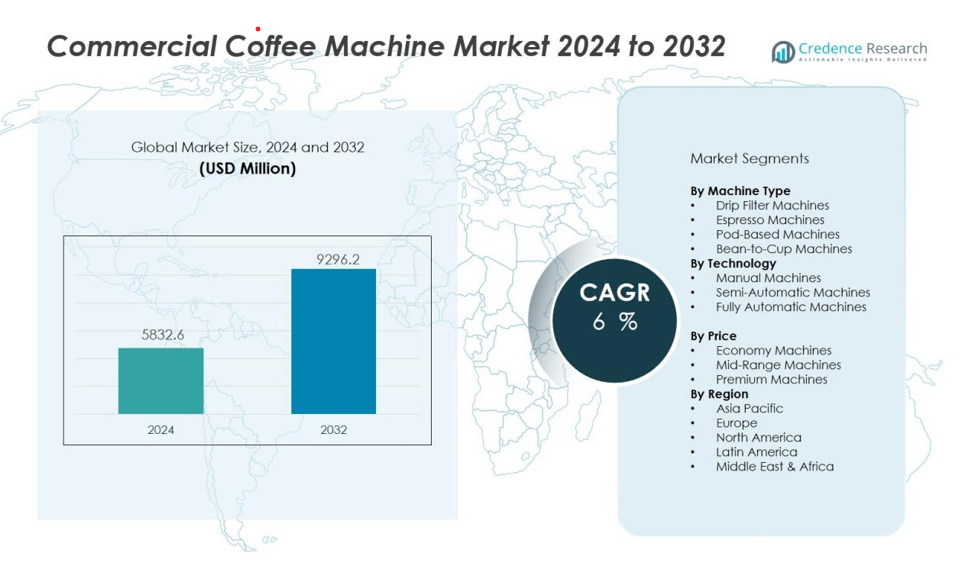

The Commercial coffee machine market size was valued at USD 5832.6 million in 2024 and is anticipated to reach USD 9296.2 million by 2032, at a CAGR of 6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Coffee Machine Market Size 2024 |

USD 5832.6 million |

| Commercial Coffee Machine Market, CAGR |

6% |

| Commercial Coffee Machine Market Size 2032 |

USD 9296.2 million |

Market growth is driven by shifting consumer preferences toward high-quality, barista-style coffee experiences and the need for consistent brewing performance in high-volume environments. The expansion of café chains, workplace coffee culture, and the integration of smart coffee machines with IoT-enabled features for remote monitoring and customization are fueling adoption. Sustainability trends, such as energy-efficient models and machines designed for minimal waste, are also influencing purchasing decisions.

Regionally, Europe holds a significant share of the commercial coffee machine market due to its established café culture and strong presence of premium coffee chains. North America follows closely, driven by high specialty coffee demand and advanced foodservice infrastructure. The Asia-Pacific region is expected to register the fastest growth, supported by urbanization, rising disposable incomes, and the rapid expansion of coffee outlets in emerging economies like China, India, and Southeast Asian countries.

Market Insights:

- The commercial coffee machine market was valued at USD 5,832.6 million in 2024 and is projected to reach USD 9,296.2 million by 2032, growing at a CAGR of 6% during 2024–2032.

- Rising demand for specialty coffee and premium beverages is driving investments in advanced machines capable of delivering consistent quality across multiple coffee styles.

- Expansion of international and regional coffee chains, along with quick-service restaurants, is increasing the need for high-capacity, durable, and easy-to-operate machines.

- Integration of IoT, automated cleaning, and programmable brewing features is enhancing operational efficiency and beverage customization for cafés, hotels, and workplaces.

- Sustainability trends, including eco-modes, recyclable components, and water-saving technologies, are influencing equipment choices among eco-conscious businesses.

- High initial investment costs, technical complexity, and maintenance requirements remain key challenges for small and emerging operators.

- Europe leads with 38% market share due to its strong café culture, followed by North America at 31%, while Asia-Pacific holds 24% and is expected to grow fastest due to urbanization and rising disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Specialty Coffee and Premium Beverages:

The growing global preference for specialty coffee and premium beverages is a major driver for the commercial coffee machine market. Consumers increasingly seek high-quality, barista-style coffee experiences in cafés, restaurants, and workplaces. This shift encourages businesses to invest in advanced brewing equipment capable of delivering consistent flavor and quality. It has also prompted manufacturers to develop machines that cater to diverse coffee styles, from espresso to cold brew, to meet evolving customer expectations.

- For instance, La Marzocco Linea PB’s dual PID technology allows electronic control over both coffee and steam boiler temperatures, with industry-leading temperature stability that keeps water temperature variance within ±2°F, ensuring every shot is consistent in flavor and quality in high-volume service.

Expansion of Coffee Chains and Foodservice Outlets:

The rapid expansion of international and regional coffee chains is significantly boosting demand for commercial coffee machines. Franchises and independent outlets require reliable, high-capacity machines to serve large customer volumes efficiently. It supports the need for durable, easy-to-operate equipment that maintains consistent output during peak hours. The growth of quick-service restaurants and specialty cafés worldwide continues to strengthen market opportunities for equipment suppliers.

Technological Advancements and Automation Features:

Integration of advanced technologies is reshaping the commercial coffee machine market. Smart features such as IoT connectivity, automated cleaning systems, and programmable brewing profiles improve operational efficiency and beverage consistency. It enables operators to monitor performance remotely, reduce downtime, and tailor offerings to customer preferences. Energy-efficient designs and user-friendly interfaces are also driving adoption among hospitality and corporate sectors.

Sustainability and Energy Efficiency Trends:

The industry is witnessing rising demand for environmentally friendly coffee machines that reduce energy consumption and waste. Businesses are increasingly adopting models with eco-modes, recyclable components, and water-saving technologies. It aligns with corporate sustainability initiatives and regulatory pressures for greener operations. Manufacturers focusing on sustainable design gain a competitive advantage in attracting eco-conscious customers and large enterprises seeking to enhance their environmental credentials.

- For instance, Animo coffee machines utilize stainless steel as a base material, which is 100% recyclable, and their machines consist on average of 300 different parts, with recyclability data tracked for each material type per device.

Market Trends:

Integration of Smart Technologies and Customization Features:

The commercial coffee machine market is experiencing a strong shift toward smart technologies that enhance efficiency and personalization. IoT-enabled machines allow operators to monitor usage, track maintenance needs, and adjust brewing parameters remotely. Touchscreen interfaces and programmable recipes are enabling cafés, hotels, and corporate offices to offer a wider variety of coffee beverages without extensive barista training. It is also driving consistency in flavor and quality across multiple locations. Demand for machines capable of adjusting grind size, water temperature, and brewing time to customer preferences is increasing. This trend reflects a broader move toward premiumization in the foodservice industry, where customization plays a key role in customer satisfaction.

- For example, the Café Affetto Automatic Espresso Machine integrates built-in WiFi for full app control, offers five precise grind settings, and extracts beans at the industry gold standard of 20 bars pressure, delivering a cup in 90 seconds.

Focus on Sustainability and Energy-Efficient Designs:

Sustainability is becoming a defining trend in the commercial coffee machine market, influencing product design and purchasing decisions. Manufacturers are introducing machines with reduced water consumption, lower energy usage, and recyclable components to meet both regulatory requirements and consumer expectations. It is encouraging foodservice operators to replace older models with eco-friendly alternatives that align with their environmental commitments. The market is also witnessing innovations such as low-carbon manufacturing processes and components designed for longer lifespans to minimize waste. Growing awareness among businesses about lifecycle costs, including energy bills and maintenance, is further promoting adoption of sustainable models. This focus on eco-efficiency is likely to remain a long-term competitive differentiator for brands.

- For instance, Nuova Simonelli’s Appia Life commercial espresso machine employs an insulated boiler that reduces energy consumption by 13% compared to its predecessor, the Appia II.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs:

The commercial coffee machine market faces a challenge from the high upfront cost of advanced brewing equipment. Businesses, particularly small cafés and independent operators, often find it difficult to allocate significant capital for premium machines. It requires ongoing maintenance, periodic servicing, and replacement of parts to ensure consistent performance, which adds to operational expenses. Complex machines also demand skilled operators or training, increasing labor costs. This financial barrier can slow adoption rates in emerging markets and among smaller foodservice establishments.

Operational Downtime and Technical Complexity:

Frequent use in high-demand environments can lead to operational downtime, impacting service efficiency and customer satisfaction. The technical complexity of modern commercial coffee machines makes repairs time-consuming and dependent on specialized technicians. It can result in longer service interruptions, especially in regions with limited after-sales support. Integration of advanced features also increases the risk of software or system malfunctions. Limited availability of spare parts in certain markets further compounds the challenge, pushing businesses to seek more durable and easily serviceable solutions.

Market Opportunities:

Growing Demand in Emerging Markets and Non-Traditional Sectors:

The commercial coffee machine market has significant growth potential in emerging economies where café culture and premium coffee consumption are expanding rapidly. Rising disposable incomes and urbanization are creating new opportunities in countries across Asia-Pacific, Latin America, and the Middle East. It is also finding applications in non-traditional sectors such as healthcare facilities, educational institutions, and co-working spaces, where coffee service enhances customer and employee experiences. Expanding distribution networks and localized product offerings can help manufacturers penetrate these markets more effectively.

Product Innovation and Expansion of Sustainable Solutions:

Continuous product innovation offers opportunities to capture market share by addressing evolving customer preferences. Manufacturers introducing compact, energy-efficient, and multifunctional machines can appeal to both established and new operators. It can leverage the rising demand for eco-friendly models with features that minimize waste and optimize resource use. Customization options, integration with mobile ordering systems, and subscription-based equipment leasing models present additional revenue streams. Brands that align technological advancements with sustainability commitments are likely to gain a competitive edge in the global market.

Market Segmentation Analysis:

By Machine Type:

The commercial coffee machine market is segmented into drip filter, espresso, pod-based, and bean-to-cup machines. Espresso machines hold the largest share, driven by their ability to produce high-quality beverages quickly, catering to cafés, restaurants, and specialty outlets. Bean-to-cup machines are gaining traction in offices and hotels due to their convenience and consistent output. Pod-based machines appeal to small businesses seeking minimal maintenance and quick service, while drip filter models maintain relevance in high-volume, cost-sensitive environments.

- For instance, Philips 5500 Series Fully Automatic Espresso Machine can brew up to 20 different hot and iced coffee recipes with a single touch, perfectly aligning with the demand for variety and efficiency in office settings.

By Technology:

The market includes manual, semi-automatic, and fully automatic machines. Fully automatic machines lead demand due to their efficiency, ease of operation, and consistent brewing quality. Semi-automatic models remain popular among baristas and specialty coffee shops that prioritize craftsmanship and beverage control. Manual machines serve niche applications, particularly in premium hospitality venues where customization and traditional brewing techniques are valued.

- For instance, the Flair Pro 2 delivers up to 30 bar of manually generated pressure using a spring-loaded piston design, allowing baristas to tailor shot duration and pressure profiles in as little as 30 seconds.

By Price:

The market is divided into economy, mid-range, and premium segments. Mid-range machines dominate due to their balance of affordability, durability, and performance, making them suitable for most foodservice establishments. Premium machines, equipped with advanced features and customization options, attract high-end cafés, hotels, and corporate offices. Economy models find demand in small-scale operations and emerging markets where budget constraints shape purchasing decisions.

Segmentations:

By Machine Type:

- Drip Filter Machines

- Espresso Machines

- Pod-Based Machines

- Bean-to-Cup Machines

By Technology:

- Manual Machines

- Semi-Automatic Machines

- Fully Automatic Machines

By Price:

- Economy Machines

- Mid-Range Machines

- Premium Machines

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe :

Europe holds 38% market share in the commercial coffee machine market, supported by its deep-rooted café culture and high consumption of specialty coffee. Countries such as Italy, France, Germany, and the UK drive demand through a dense network of coffee shops, hotels, and restaurants. The presence of leading manufacturers and advanced foodservice infrastructure strengthens product availability and innovation. It benefits from strict quality standards and a mature consumer base that values consistent brewing performance. Growth is further supported by sustainability-focused procurement policies and the adoption of energy-efficient models in hospitality chains.

North America :

North America accounts for 31% market share, fueled by the growing preference for specialty beverages and a strong network of premium coffee chains. The United States dominates regional demand, supported by rapid adoption in quick-service restaurants, offices, and convenience stores. It is witnessing rising investment in smart coffee machines with IoT connectivity for performance monitoring and beverage customization. Canada contributes with a stable market driven by high per capita coffee consumption and emphasis on sustainable operations. The shift toward workplace coffee solutions and subscription-based machine leasing is boosting penetration in corporate sectors.

Asia-Pacific :

Asia-Pacific holds 24% market share and is expected to record the fastest growth during the forecast period. Rapid urbanization in China, India, and Southeast Asian countries is driving café expansion and premium coffee demand. It is benefiting from rising disposable incomes, lifestyle changes, and the influence of Western coffee culture. Local and international chains are aggressively expanding their presence, creating demand for high-capacity, versatile machines. Government initiatives promoting hospitality and tourism are further enhancing equipment adoption across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Breville

- Keurig

- Philips

- De’Longhi

- Electrolux

- Nestlé

- Melitta

- Morphy Richards

- Newell

- Bosch

- Panasonic

Competitive Analysis:

The commercial coffee machine market is highly competitive, with global and regional players focusing on product innovation, technological integration, and brand differentiation. Key companies include Breville, Keurig, Philips, De’Longhi, Electrolux, Nestlé, and Melitta, each leveraging strong distribution networks and diverse product portfolios to strengthen market presence. It is characterized by continuous investment in R&D to introduce machines with advanced automation, energy efficiency, and customization features. Leading brands target both premium and mid-range segments, catering to cafés, restaurants, hotels, and corporate offices. Strategic partnerships with coffee chains, equipment leasing models, and after-sales service excellence are critical to retaining customer loyalty. Sustainability, compact designs, and smart technology integration remain central to competitive positioning, while expansion into emerging markets offers long-term growth opportunities.

Recent Developments:

- In May 2023, Philips acquired DiA Imaging Analysis, an AI-based ultrasound imaging company, for nearly $100 million to expand its AI capabilities in healthcare imaging.

- In February 2024, Keurig expanded its partnership with Lavazza to boost sales and distribution of Lavazza K-Cup pods and introduced Kicking Horse Coffee pods.

- In September 2024 Breville launched the Oracle Jet, its most advanced espresso machine with enhanced grinding and frothing technology.

Market Concentration & Characteristics:

The commercial coffee machine market exhibits a moderately concentrated structure, with a mix of global leaders and regional players competing through product innovation, technology integration, and brand reputation. It is characterized by high entry barriers due to the need for advanced manufacturing capabilities, quality certifications, and strong distribution networks. Leading companies focus on expanding product portfolios with energy-efficient, smart, and customizable models to meet evolving customer demands. Competition is influenced by service quality, after-sales support, and the ability to deliver consistent performance in high-volume environments. Sustainability, automation, and compact designs are shaping product development strategies, while partnerships with coffee chains and hospitality groups strengthen market positioning.

Report Coverage:

The research report offers an in-depth analysis based on Machine Type, Technology, Price and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for specialty coffee equipment will continue to rise as consumer preferences shift toward premium, café-style beverages.

- Manufacturers will expand their product lines to include compact, multifunctional machines catering to small businesses and non-traditional sectors.

- Integration of IoT, AI, and automation will enhance operational efficiency, predictive maintenance, and beverage customization.

- Sustainability will remain a central focus, with growth in machines featuring energy-saving technologies and recyclable components.

- Corporate adoption will increase as workplaces invest in high-quality coffee solutions to improve employee satisfaction.

- The hospitality sector will drive substantial demand, particularly from hotels, restaurants, and quick-service outlets seeking consistent brewing quality.

- Subscription-based equipment leasing and coffee-as-a-service models will gain traction among cost-conscious operators.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will witness accelerated adoption due to urbanization and expanding coffee culture.

- Strategic partnerships between machine manufacturers and coffee brands will strengthen market penetration and brand loyalty.

- Continued investment in R&D will lead to innovative designs and features that improve user convenience, serviceability, and product lifespan