Market Overview:

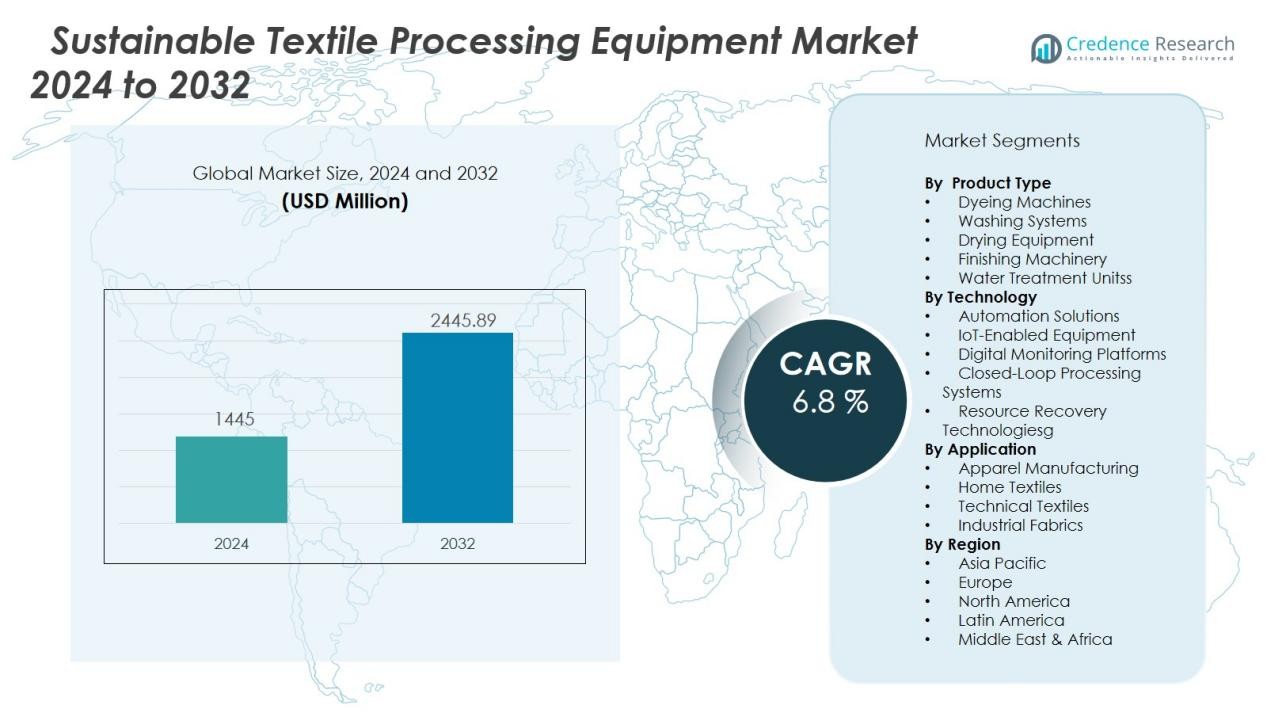

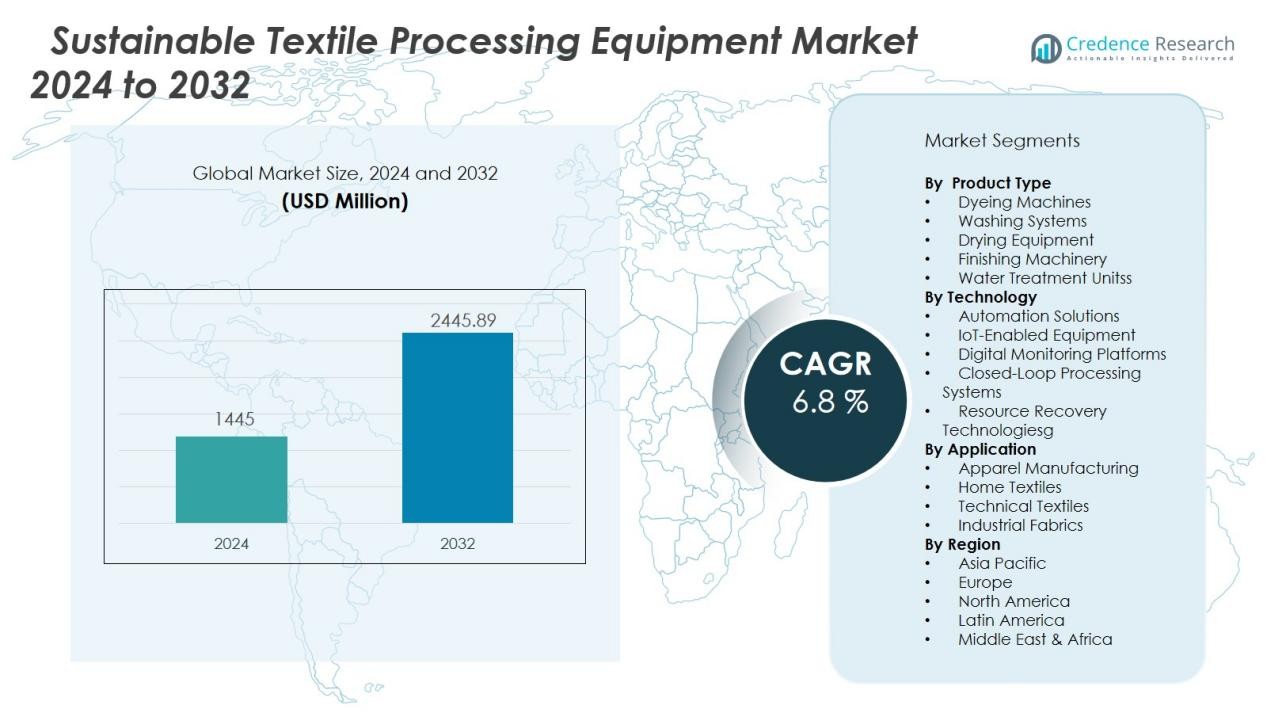

The Sustainable textile processing equipment market size was valued at USD 1445 million in 2024 and is anticipated to reach USD 2445.89 million by 2032, at a CAGR of 6.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable textile processing equipment market Size 2024 |

USD 1445 Million |

| Sustainable textile processing equipment market, CAGR |

6.8 % |

| Sustainable textile processing equipment market Size 2032 |

USD 2445.89 Million |

Key market drivers include growing environmental awareness across the textile value chain, regulatory mandates on wastewater treatment and chemical usage, and consumer preference for sustainably produced textiles. Manufacturers are prioritizing resource efficiency and circularity by integrating automation, digital monitoring, and closed-loop systems that minimize waste and reduce operational costs. The adoption of sustainable equipment not only addresses compliance requirements but also enhances brand value and market competitiveness for textile producers.

Regionally, Europe leads the sustainable textile processing equipment market, benefiting from strict environmental standards and proactive government initiatives promoting sustainability in manufacturing. Asia-Pacific is emerging as a high-growth region due to expanding textile industries, rising investments in green technologies, and increasing regulatory focus on pollution control, especially in countries like China, India, and Bangladesh. North America maintains steady demand, driven by sustainability goals and advanced technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The sustainable textile processing equipment market reached USD 1,445 million in 2024 and is forecast to grow to USD 2,445.89 million by 2032, driven by a CAGR of 6.8%.

- Strong environmental regulations and compliance pressures push manufacturers to upgrade equipment for pollution control and resource efficiency.

- Rising consumer demand for sustainable textiles and apparel accelerates adoption of advanced machinery, supporting responsible sourcing and brand differentiation.

- Automation, digital monitoring, and closed-loop systems reduce water, energy, and chemical use, helping producers manage costs and meet regulatory targets.

- High upfront investment and technical complexity present adoption challenges, especially for small and medium-sized textile firms.

- Europe holds 34% of the global market, setting benchmarks with strict regulations, traceability, and proactive sustainability initiatives.

- Asia-Pacific leads with 41% market share, supported by rapid industry growth, policy reforms, and strong investments in green technology, while North America maintains steady demand with a 17% share and advanced technology integration.

Market Drivers:

Environmental Regulations and Compliance Pressures Accelerate Sustainable Investments:

Stricter global regulations on pollution, chemical use, and wastewater discharge are compelling textile manufacturers to upgrade their processing equipment. Governments and regulatory agencies enforce stringent standards to minimize environmental impact throughout the textile value chain. The sustainable textile processing equipment market gains momentum as producers seek solutions that ensure compliance while maintaining efficiency and profitability. It is expected to benefit further from ongoing updates to international sustainability protocols.

- For instance, Levi Strauss & Co. has saved more than 3 billion liters of water since 2011 using its Water<Less® manufacturing techniques, and set a goal to reduce freshwater use in manufacturing by 50% in areas of high water stress by 2025.

Rising Consumer Awareness and Shift Toward Sustainable Fashion Drive Equipment Demand:

Consumers increasingly prefer textiles and apparel produced through environmentally responsible processes. The demand for sustainable fashion encourages brands and manufacturers to invest in advanced machinery that reduces resource consumption and emissions. The sustainable textile processing equipment market responds to this trend by offering technologies that support transparency and responsible sourcing. It creates opportunities for differentiation and brand loyalty across the industry.

- For instance, Oerlikon Neumag’s EvoSteam staple fiber plant eliminates the need for water baths. It cuts water usage by 3.5 million liters annually.

Operational Efficiency and Cost Reduction Through Technology Adoption:

Manufacturers focus on operational efficiency and cost control by adopting innovative processing equipment with lower water, energy, and chemical requirements. Automated systems, digital monitoring, and closed-loop technologies help reduce waste and optimize production. The sustainable textile processing equipment market benefits from growing investments in such solutions that align with both environmental and economic objectives. It helps manufacturers remain competitive while meeting regulatory and sustainability goals.

Corporate Social Responsibility and Strategic Industry Partnerships Encourage Market Growth:

Textile companies recognize the importance of corporate social responsibility and sustainable business practices in today’s market. Collaborations with technology providers and industry stakeholders accelerate the adoption of sustainable processing solutions. The sustainable textile processing equipment market grows stronger as companies align operations with global sustainability standards and engage in partnerships for continuous improvement. It positions itself as a critical enabler of responsible manufacturing within the textile sector.

Market Trends:

Integration of Digitalization and Smart Technologies Reshapes Equipment Capabilities:

The sustainable textile processing equipment market continues to evolve with rapid integration of digitalization and smart technologies. Advanced sensors, IoT connectivity, and data analytics enable real-time monitoring and process optimization, helping manufacturers reduce resource consumption and improve product quality. Automation in dyeing, finishing, and washing operations drives consistent results while minimizing human error and operational costs. Equipment manufacturers focus on offering user-friendly interfaces and remote control capabilities, aligning with broader trends in Industry 4.0 adoption. These innovations create competitive advantages by enabling predictive maintenance and reducing machine downtime. The market is witnessing steady adoption of cloud-based platforms for performance tracking and sustainability reporting, supporting greater transparency across the supply chain.

- For instance, Mahlo’s Qualiscan QMS-12 system—equipped with the Aqualot DS-115 microwave-resonance moisture sensor—achieves an online moisture measurement resolution of ±0.01 g/m² across a 1–25 g/m² range.

Focus on Circular Economy and Closed-Loop Processing Solutions Gains Traction:

Growing emphasis on circular economy principles is influencing equipment design and investment in the sustainable textile processing equipment market. Manufacturers prioritize machinery that facilitates recycling, water reuse, and closed-loop chemical management to reduce waste and environmental footprint. New equipment designs support efficient use of raw materials and enable integration with renewable energy sources, further strengthening sustainability outcomes. Companies seek processing solutions that help achieve ambitious climate targets and meet eco-labeling standards demanded by global retailers and consumers. The market responds to these needs by accelerating the development and commercialization of modular, upgradeable equipment that extends product life cycles. Strategic collaborations and R&D investments in closed-loop solutions continue to shape the direction of market growth.

- For instance, DyeCoo’s PurestJet CO₂ dyeing system eliminates water usage entirely by using pressurized carbon dioxide, processing 100% of fabrics without a drop of water.

Market Challenges Analysis:

High Capital Investment and Cost Barriers Limit Widespread Adoption:

The sustainable textile processing equipment market faces significant challenges from high upfront costs and capital investment requirements. Many small and medium-sized textile manufacturers hesitate to adopt new technologies due to budget constraints and uncertainty about long-term returns. It must address concerns related to payback periods and maintenance costs, which can impact purchasing decisions. While financial incentives and government support can reduce initial expenses, the transition to advanced sustainable equipment often disrupts established production workflows. Manufacturers need to balance sustainability goals with operational realities, creating resistance to immediate adoption across some segments.

Technical Complexity and Skill Gaps Create Implementation Hurdles:

Rapid technological advancements in sustainable equipment introduce a steep learning curve for operators and technicians. The sustainable textile processing equipment market requires ongoing training and technical support to ensure efficient use and maintenance of new systems. Limited technical expertise in emerging markets can slow down installation and integration, delaying benefits for manufacturers. Equipment downtime during transition phases and integration with legacy systems can disrupt production schedules. It must support industry-wide education and workforce development to overcome skill shortages and technical complexity, enabling broader market growth.

Market Opportunities:

Rising Demand for Eco-Friendly Textiles Unlocks New Growth Avenues:

The sustainable textile processing equipment market benefits from a surge in demand for environmentally friendly textiles among both consumers and global brands. Companies invest in machinery that supports reduced water and energy consumption, creating new business opportunities for equipment manufacturers. It enables textile producers to meet the strict sustainability criteria set by international retailers and certification bodies. Brands with clear sustainability goals drive suppliers to upgrade to advanced equipment, fostering a competitive landscape for innovation. This trend opens access to premium market segments and enhances brand reputation for early adopters. Growing government incentives and green financing also support capital investment, accelerating market expansion.

Expansion into Emerging Markets and Development of Modular Equipment Designs:

Manufacturers in the sustainable textile processing equipment market are poised to capitalize on opportunities in emerging economies with rapidly expanding textile industries. Rising regulatory focus on environmental protection in countries such as China, India, and Vietnam fuels adoption of sustainable processing technologies. Equipment providers can gain market share by offering modular and scalable solutions that align with varied production capacities and investment levels. It enables smaller manufacturers to transition toward sustainable operations without significant disruptions. Collaboration with local industry stakeholders and tailored after-sales support further strengthens market penetration and customer loyalty.

Market Segmentation Analysis:

By Product Type:

The sustainable textile processing equipment market covers a wide range of product types, including dyeing machines, washing systems, drying equipment, finishing machinery, and water treatment units. Dyeing and finishing machines lead the segment due to high demand for processes that reduce water, energy, and chemical use. Manufacturers focus on developing equipment that meets strict sustainability criteria while supporting high production volumes.

- For instance, Jeanologia’s G2 Dynamic and Anubis finishing machines cut water usage from 100 L to just 1 L per garment.

By Technology:

Advanced technologies play a central role in shaping the sustainable textile processing equipment market. Automation, IoT-enabled systems, and digital monitoring platforms enhance operational efficiency and process control. The segment emphasizes closed-loop solutions and resource recovery technologies that minimize waste and environmental impact. Equipment providers invest in R&D to integrate smart controls and predictive analytics for maintenance and optimization.

- For example, Recover™ has developed a proprietary closed-loop process that can transform 1kg of textile waste into 0.7kg of high-quality recycled cotton fiber, integrating it back into the fashion supply chain.

By Application:

The sustainable textile processing equipment market serves diverse applications across apparel, home textiles, technical textiles, and industrial fabrics. Apparel manufacturing dominates demand, driven by global fashion brands adopting sustainable production practices. Home textiles and technical textiles represent growing segments, supported by increasing awareness of sustainability in non-apparel categories. It responds to varied application requirements with tailored equipment solutions that support resource efficiency and compliance with global environmental standards.

Segmentations:

By Product Type:

- Dyeing Machines

- Washing Systems

- Drying Equipment

- Finishing Machinery

- Water Treatment Units

By Technology:

- Automation Solutions

- IoT-Enabled Equipment

- Digital Monitoring Platforms

- Closed-Loop Processing Systems

- Resource Recovery Technologies

By Application:

- Apparel Manufacturing

- Home Textiles

- Technical Textiles

- Industrial Fabrics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe :

Europe commands a significant share of the sustainable textile processing equipment market, holding 34% of the global value. Strict environmental regulations and ambitious sustainability targets drive rapid adoption of eco-friendly processing solutions across the region. Government incentives and funding support the transition to advanced machinery, particularly in countries such as Germany, Italy, and France. Textile manufacturers leverage technological partnerships and R&D initiatives to enhance operational efficiency and environmental performance. The region’s strong focus on traceability and circular economy principles fuels investments in closed-loop processing systems. European brands and retailers actively collaborate with equipment providers to ensure compliance and maintain global competitiveness. It continues to set industry benchmarks for sustainable textile manufacturing practices.

Asia-Pacific :

Asia-Pacific captures 41% of the sustainable textile processing equipment market, making it the largest regional segment. China, India, and Bangladesh lead the regional expansion, driven by rapid industrialization, growing export demand, and stricter local environmental regulations. Governments promote sustainable manufacturing through policy reforms and infrastructure investments. Equipment suppliers find significant growth opportunities by offering solutions tailored to the needs of diverse textile producers, ranging from large export-oriented factories to small and medium enterprises. Investments in automation, digital monitoring, and waste management solutions enable producers to align with global sustainability standards. It is expected to maintain high growth momentum as sustainability priorities continue to rise across the region.

North America :

North America holds 17% of the global sustainable textile processing equipment market, supported by advanced manufacturing capabilities and strong sustainability commitments from leading brands. The region prioritizes innovation in water-saving and energy-efficient equipment to meet both regulatory and corporate goals. U.S. and Canadian manufacturers invest in research partnerships and pilot projects to advance sustainable textile technologies. The market benefits from growing consumer awareness and transparent supply chain requirements. Textile producers adopt closed-loop and modular processing solutions to improve flexibility and reduce environmental impact. It positions North America as a key region for technology-driven progress within the sustainable textile sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The sustainable textile processing equipment market features a competitive landscape shaped by established global players and innovative regional firms. Key companies such as A.T.E. Enterprises, Biancalani, Brückner Textile Technologies, Loris Bellini, Andritz Küsters, Benninger, and DiloGroup actively pursue technological advancement and sustainability certifications to gain market share. Leading firms invest in research and development to introduce energy-efficient and resource-saving equipment tailored to diverse customer needs. Strategic partnerships, global distribution networks, and robust after-sales support strengthen their positions and expand their reach. The market rewards companies that demonstrate expertise in automation, digital integration, and compliance with evolving environmental regulations. It creates opportunities for continuous innovation, allowing agile players to differentiate their offerings and address both established and emerging demands.

Recent Developments:

- In July 2025, A.T.E. Enterprises signed a binding memorandum to acquire full ownership of Petro-Victory, marking a major strategic expansion.

- In August 2024 Brückner Textile Technologies launched advanced stenter machines specifically designed for knitted fabrics, emphasizing increased energy efficiency, greater production speeds, and enhanced sustainability features.

- In February 2025, ANDRITZ acquired LDX Solutions, a North American leader in emission reduction technologies, to strengthen its Environment & Energy division.

Market Concentration & Characteristics:

The sustainable textile processing equipment market exhibits moderate concentration, with a mix of established global players and emerging regional manufacturers competing for market share. Leading companies focus on technological innovation, sustainability certifications, and strategic partnerships to strengthen their positions. The market features a broad product portfolio, including energy-efficient dyeing, washing, and finishing machines tailored for diverse textile applications. It is characterized by ongoing advancements in automation, digital monitoring, and closed-loop systems, driving both compliance and operational efficiency. Companies prioritize R&D and customization to address evolving regulatory requirements and customer demands, reinforcing a dynamic and competitive landscape.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers will prioritize investment in eco-efficient equipment to comply with evolving environmental regulations and consumer expectations.

- Digitalization and smart technologies will drive process automation, enabling real-time monitoring and predictive maintenance across production lines.

- Demand for closed-loop and modular systems will increase, supporting circular economy initiatives and resource optimization.

- Partnerships between equipment providers, textile brands, and regulatory bodies will accelerate adoption of sustainable solutions industry-wide.

- Expansion into emerging economies will create significant growth opportunities, driven by new sustainability policies and rapid textile industry development.

- Customization and flexible equipment designs will address the diverse needs of both large-scale manufacturers and small to medium enterprises.

- Integration of renewable energy sources and water recycling technologies will become standard features in new processing equipment.

- Training programs and technical support will be critical as manufacturers adapt to new systems and bridge skill gaps.

- Equipment upgrades and retrofitting of existing plants will gain traction, allowing companies to enhance sustainability without major disruptions.

- Focus on supply chain transparency and traceability will encourage continued innovation, ensuring that sustainable practices extend from equipment manufacturing to finished textile products.