Market Overview

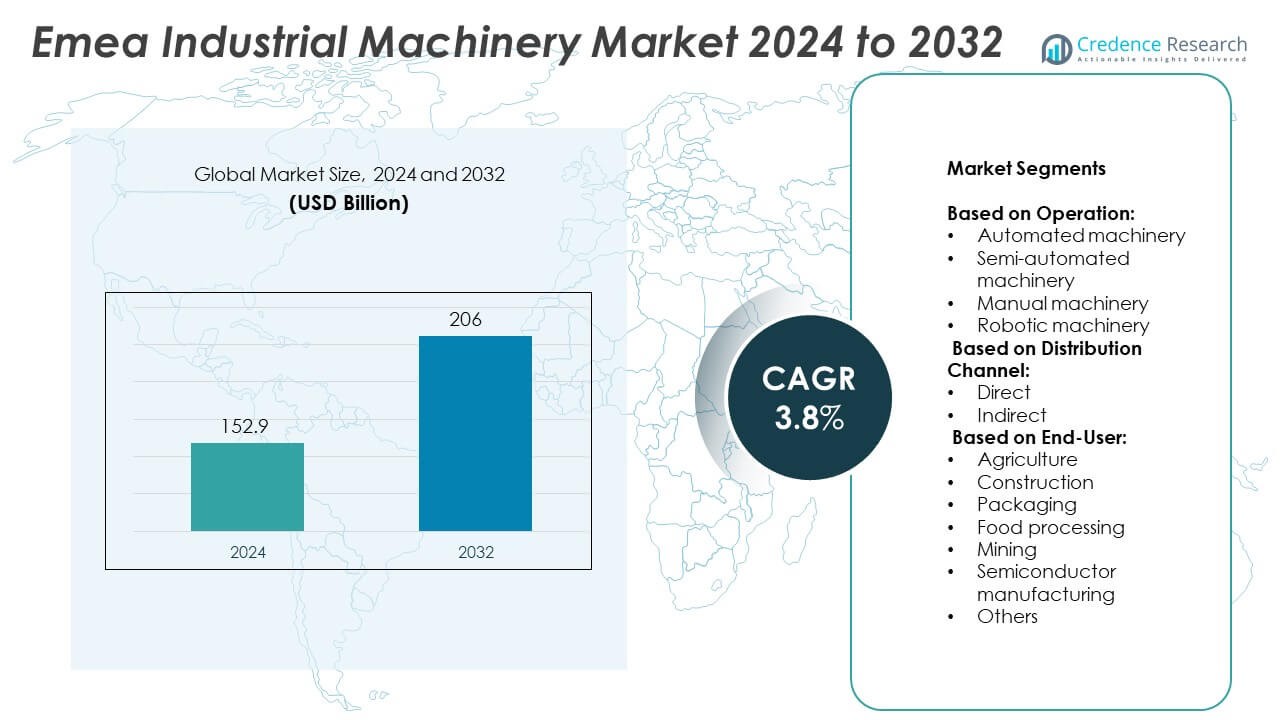

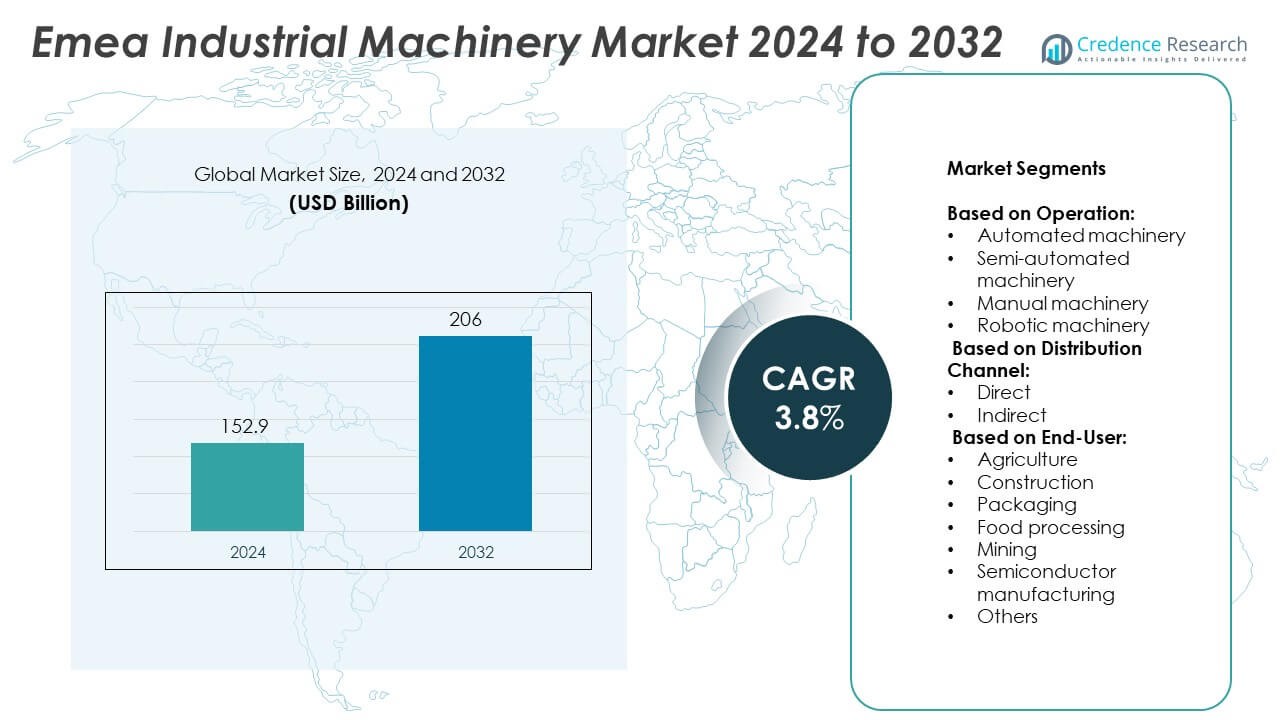

The EMEA Industrial Machinery Market size was valued at USD 152.9 billion in 2024 and is expected to reach USD 206 billion by 2032, registering a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EMEA Industrial Machinery Market Size 2024 |

USD 152.9 Billion |

| EMEA Industrial Machinery Market, CAGR |

3.8% |

| EMEA Industrial Machinery Market Size 2032 |

USD 206 Billion |

The Emea Industrial Machinery market grows through strong drivers such as rising automation, expanding infrastructure projects, and technological advancements in smart manufacturing. Companies adopt robotics and energy-efficient systems to improve productivity and comply with sustainability regulations. Digital integration with IoT and AI enables predictive maintenance and real-time monitoring. Trends highlight a shift toward modular machinery, customized industry-specific solutions, and eco-friendly designs. Diverse end-use sectors including construction, agriculture, and food processing continue to strengthen demand across the region.

The Emea Industrial Machinery market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with growth driven by infrastructure expansion, automation, and industrial modernization. Europe leads in sustainability initiatives, while Asia-Pacific benefits from rapid industrialization. North America emphasizes advanced manufacturing and digital adoption, and emerging regions witness steady demand from construction and mining. Key players shaping the market include Caterpillar Inc., Komatsu Ltd., Deere & Company, and Atlas Copco AB.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Emea Industrial Machinery market was valued at USD 152.9 billion in 2024 and is expected to reach USD 206 billion by 2032, growing at a CAGR of 3.8%.

- Rising automation and adoption of robotics across manufacturing, construction, and agriculture sectors drive steady market growth.

- Sustainability-focused designs and energy-efficient machinery create opportunities, supported by stricter environmental compliance requirements across developed economies.

- Leading players strengthen their position through innovation, digital integration, and partnerships, with strong portfolios across multiple industries.

- High initial costs and skilled labor shortages act as restraints, limiting adoption for small and mid-sized enterprises.

- Europe leads demand with strong sustainability initiatives, Asia-Pacific grows through rapid industrialization, while North America focuses on advanced manufacturing.

- Latin America and the Middle East & Africa record steady expansion through mining, agriculture, and infrastructure development projects.

Market Drivers

Rising Automation and Robotics Adoption

Automation plays a central role in driving demand across the Emea Industrial Machinery market. Companies integrate robotics to achieve faster production cycles and reduce operational errors. Automated solutions enhance efficiency in manufacturing, packaging, and construction sectors. It supports businesses in addressing labor shortages while maintaining high precision standards. Investments in robotic machinery reduce downtime and improve cost-efficiency in large-scale operations. The increasing adoption of collaborative robots also opens opportunities for mid-sized firms.

- For instance, ABB’s IRB 5710 and IRB 5720 robots offer payloads from 70 kg to 180 kg, reach up to 3 m, and boast positional repeatability of 0.04 mm. They also integrate internal cable routing to extend service life by several years.

Expansion of Infrastructure and Construction Projects

Infrastructure growth remains a critical factor shaping the Emea Industrial Machinery market. Governments allocate large budgets for road, rail, and energy projects. Construction firms deploy heavy equipment to meet project deadlines efficiently. It supports higher demand for semi-automated and manual machinery in building activities. Large-scale urban development projects across Eastern Europe and the Middle East boost equipment utilization. Companies supplying advanced machinery benefit from long-term infrastructure pipelines.

- For instance, Caterpillar supported Malaysia’s East Coast Rail Link by deploying over 50 excavators on a 665 km line. On the Pan-Borneo Highway, more than 70 machines built roughly 800 km of road in the first phase.

Technological Advancements in Smart Manufacturing

The integration of digital technologies supports the steady expansion of the Emea Industrial Machinery market. Smart factories adopt connected machinery with IoT, AI, and predictive maintenance systems. These innovations improve equipment life cycles and lower repair costs. It enhances production quality by offering real-time monitoring and performance optimization. Manufacturers increasingly focus on energy-efficient designs to meet sustainability goals. Technological upgrades also create new opportunities for aftermarket services and spare parts.

Rising Demand from Diverse End-Use Sectors

Demand from industries such as agriculture, mining, and food processing strengthens the Emea Industrial Machinery market. Agriculture equipment manufacturers invest in automated harvesters to improve productivity. Mining companies adopt heavy-duty machinery to ensure higher extraction volumes. It supports strong equipment demand in regions with natural resource projects. Food processors rely on automated systems for packaging and quality control. Growing industrialization across emerging economies further increases adoption rates across diverse applications.

Market Trends

Shift Toward Sustainable and Energy-Efficient Machinery

Sustainability drives a major trend in the Emea Industrial Machinery market. Companies focus on reducing carbon footprints by introducing low-emission and energy-efficient machines. It supports industries in complying with strict environmental regulations across Europe and the Middle East. Manufacturers develop equipment with recyclable materials and advanced energy-saving features. Customers prefer machinery that lowers long-term operating costs and aligns with green policies. This trend encourages innovation in both heavy and light industrial equipment.

- For instance, Komatsu’s PC200-8 Hybrid excavator achieves up to a 41% reduction in fuel consumption compared to conventional models during high-frequency swing operations. The hybrid system utilizes an electric swing motor-generator to capture kinetic energy during braking, storing it in an ultra-capacitor to assist the engine when accelerating. This technology results in an average fuel savings of approximately 25% across different applications

Integration of Digitalization and Smart Technologies

Digital transformation reshapes operations across the Emea Industrial Machinery market. IoT-enabled machinery and predictive analytics improve uptime and reduce unexpected breakdowns. It allows companies to track performance in real time and optimize output. Smart technologies also facilitate remote monitoring and automated control in manufacturing plants. Artificial intelligence enhances production planning and quality assurance. This trend pushes traditional machinery manufacturers to invest in software-driven upgrades.

- For instance, Siemens’ Senseye platform, acquired in 2022, helps clients reduce unplanned downtime and improve maintenance efficiency by significant percentages. Specifically, marketing materials from Siemens cite potential reductions in unplanned downtime of up to 50% and improvements in maintenance efficiency (maintenance staff productivity) of up to 55%

Growing Popularity of Modular and Flexible Equipment

Flexibility in machinery design gains momentum in the Emea Industrial Machinery market. Modular systems allow businesses to scale production capacity efficiently. It reduces installation time and lowers capital expenditure for industrial users. Companies invest in multipurpose equipment that adapts to different production needs. This approach benefits sectors like packaging, food processing, and construction where demand fluctuates. The trend ensures equipment longevity and broader usability across industries.

Expansion of Customized and Industry-Specific Solutions

End users increasingly demand machinery tailored to unique operational requirements within the Emea Industrial Machinery market. Customization supports higher productivity and minimizes resource waste. It enables manufacturers to offer solutions for agriculture, mining, and semiconductor sectors. Clients seek specialized features such as automation add-ons, safety systems, and durability enhancements. The trend highlights the growing preference for industry-focused engineering. It also strengthens collaboration between machinery suppliers and end users for long-term value creation.

Market Challenges Analysis

High Initial Costs and Maintenance Burden

High capital investment remains a significant challenge for the Emea Industrial Machinery market. Advanced machinery requires substantial upfront costs that limit adoption among small and mid-sized enterprises. It also demands consistent maintenance, spare parts, and skilled technicians, adding long-term expenses. Many industries hesitate to upgrade due to budget constraints and unpredictable returns. Frequent downtime during maintenance disrupts production schedules and lowers profitability. This financial burden restricts growth opportunities in price-sensitive markets.

Regulatory Compliance and Skilled Labor Shortages

Strict environmental and safety regulations create barriers in the Emea Industrial Machinery market. Companies face rising costs to meet compliance standards across multiple regions. It requires machinery upgrades and certification processes that delay adoption. At the same time, skilled labor shortages affect operation and servicing of advanced equipment. Many firms struggle to recruit professionals with expertise in robotics, automation, and digital systems. This workforce gap slows productivity gains and limits the benefits of modern technologies.

Market Opportunities

Rising Adoption of Advanced Manufacturing Technologies

The growing use of advanced technologies creates strong opportunities for the Emea Industrial Machinery market. Companies integrate automation, artificial intelligence, and predictive maintenance tools to improve efficiency. It enables industries to reduce downtime and enhance product quality in competitive sectors. Smart factories across Europe and the Middle East demand connected machinery with real-time monitoring. Investments in Industry 4.0 initiatives encourage widespread adoption of digital solutions. This shift opens avenues for suppliers offering innovative, software-driven equipment.

Expanding Demand Across Emerging Sectors and Regions

Diverse industries present new growth opportunities for the Emea Industrial Machinery market. Agriculture, renewable energy, and semiconductor manufacturing require specialized machinery to support expansion. It allows manufacturers to provide customized solutions tailored to sector-specific needs. Urban development projects in Eastern Europe and Africa create demand for construction equipment. Food processing and packaging industries also seek automated systems to meet rising consumption. These opportunities strengthen long-term growth prospects for machinery suppliers across the region.

Market Segmentation Analysis:

By Operation:

Automated machinery holds a dominant role in the Emea Industrial Machinery market due to its efficiency in reducing errors and improving output consistency. Companies prefer automation to enhance productivity in large-scale production facilities. Semi-automated machinery maintains relevance in small and mid-sized enterprises where budget flexibility is limited. It offers a balance between manual supervision and machine efficiency. Manual machinery continues to serve traditional industries with lower capital resources. Robotic machinery grows rapidly as firms adopt advanced robotics for high-precision applications and labor shortage challenges. It strengthens long-term demand in industrial sectors seeking greater flexibility and safety.

- For instance, Yaskawa’s GP series includes a wide range of versatile industrial robots, with some models designed for payloads up to 165 kg and reaches up to 3 meters or more. Certain models, like the GP165R, achieve high positional repeatability of 0.05 mm.

By Distribution Channel:

Direct sales account for a significant portion of equipment supply in the Emea Industrial Machinery market. Manufacturers rely on direct relationships with clients to offer customization and aftersales services. It ensures customer loyalty and smooth technical integration during installation. Indirect distribution through dealers and suppliers remains vital for reaching smaller enterprises and rural markets. This channel supports widespread access to spare parts and localized services. It also creates opportunities for regional distributors to expand their role in equipment availability.

- For instance, Liebherr operates its own network, Liebherr has companies in more than 50 countries across all continents

By End-User:

The Emea Industrial Machinery market shows strong adoption across diverse industries. Agriculture increasingly uses automated tractors and harvesting machines to boost efficiency. Construction generates substantial demand for heavy-duty equipment to support infrastructure and urban development projects. Packaging machinery benefits from rising e-commerce and demand for efficient logistics solutions. Food processing industries adopt modern machinery to improve quality standards and production capacity. Mining companies require robust machinery for resource extraction and material handling. Semiconductor manufacturing invests heavily in advanced systems to meet high-precision needs. Other end users such as textiles and chemicals also contribute to steady growth by requiring specialized machinery for industry-specific applications.

Segments:

Based on Operation:

- Automated machinery

- Semi-automated machinery

- Manual machinery

- Robotic machinery

Based on Distribution Channel:

Based on End-User:

- Agriculture

- Construction

- Packaging

- Food processing

- Mining

- Semiconductor manufacturing

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 27% share of the Emea Industrial Machinery market, supported by strong industrial automation and advanced manufacturing activities. The region benefits from significant investments in robotics and smart factories, particularly in the United States. It records consistent demand for machinery in automotive, aerospace, and food processing sectors. Government incentives for modernizing industrial infrastructure further enhance equipment adoption. It also witnesses rising adoption of energy-efficient and environmentally compliant machinery to meet regulatory standards. The presence of leading manufacturers and technology providers strengthens the supply chain, ensuring competitive advancements.

Europe

Europe holds a 32% share of the Emea Industrial Machinery market, making it the largest regional contributor. The region leads in sustainability initiatives, pushing demand for low-emission and energy-efficient machinery. Germany, Italy, and France represent key hubs due to their well-established industrial bases. It benefits from strong demand in construction, packaging, and food processing industries. European firms also invest heavily in Industry 4.0 and digital manufacturing systems. Regional policies encouraging carbon-neutral practices create opportunities for advanced machinery suppliers. This share reflects the maturity of industrial innovation and strong integration of smart technologies.

Asia-Pacific

Asia-Pacific captures 28% share of the Emea Industrial Machinery market, driven by large-scale industrialization in China, Japan, and India. The region witnesses rising adoption of robotic and automated machinery to meet export-oriented production. It records high demand across construction, mining, and semiconductor manufacturing sectors. Governments support industrial growth through infrastructure investments and manufacturing incentives. It also shows increasing preference for flexible, modular machinery that aligns with evolving industry needs. Growing e-commerce and packaging industries fuel additional demand for equipment. The rapid pace of industrial expansion ensures continuous growth prospects for machinery manufacturers.

Latin America

Latin America accounts for 7% share of the Emea Industrial Machinery market, supported by construction, agriculture, and mining industries. Brazil and Mexico lead the adoption due to expanding infrastructure and resource extraction projects. It demonstrates steady growth in agricultural machinery, particularly automated harvesters and irrigation systems. Regional governments encourage industrial development through policies that support local manufacturing and modernization. The food processing industry also drives adoption of packaging and handling equipment. Limited capital investments remain a challenge, yet demand for cost-effective solutions continues to expand. This smaller but consistent market share reflects a developing machinery landscape.

Middle East & Africa

Middle East & Africa represents 6% share of the Emea Industrial Machinery market, influenced by strong activity in construction and energy sectors. Large infrastructure projects in the Gulf countries generate demand for advanced heavy-duty equipment. It also benefits from mining projects across Africa requiring durable machinery for resource extraction. Governments invest in diversifying economies, increasing demand for industrial and food processing machinery. Regional adoption of semi-automated machinery remains common due to cost considerations. The presence of ongoing smart city initiatives and urban development creates growth opportunities. This share highlights gradual but expanding market presence across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEA Group

- Komatsu Ltd.

- Illinois Tool Works Inc.

- Sandvik AB

- Brandt Industries Ltd.

- AGCO Corporation

- Terex Corporation

- Mitsubishi Electric Corporation

- ALFA LAVAL

- Caterpillar Inc.

- Volvo Construction Equipment

- CNH Industrial N

- ShawCor Ltd.

- Atlas Copco AB

- ESCO Corp.

- Ingersoll Rand

- Hitachi Construction Machinery Co., Ltd.

- Deere & Company

- Gerdau S.A.

- Honeywell International Inc.

Competitive Analysis

Leading players in the Emea Industrial Machinery market include AGCO Corporation, ALFA LAVAL, Atlas Copco AB, Brandt Industries Ltd., Caterpillar Inc., CNH Industrial N, Deere & Company, ESCO Corp., Gerdau S.A., GEA Group, Hitachi Construction Machinery Co., Ltd., Honeywell International Inc., Illinois Tool Works Inc., Ingersoll Rand, Komatsu Ltd., Mitsubishi Electric Corporation, Sandvik AB, ShawCor Ltd., Terex Corporation, and Volvo Construction Equipment. These companies focus on strengthening their presence through advanced product offerings and continuous innovation. They invest in automation, robotics, and energy-efficient technologies to address rising demand from diverse industries. Expansion of distribution networks and strategic partnerships enhances their market competitiveness across Emea. Many firms prioritize sustainability by developing machinery with reduced emissions and improved energy performance. They also emphasize digital integration, offering IoT-enabled equipment for predictive maintenance and real-time monitoring. Regional growth strategies include targeting infrastructure development, agriculture modernization, and mining projects. Companies diversify portfolios to serve multiple end-use sectors, ensuring steady revenue streams. Aftermarket services, technical support, and training programs further secure long-term client relationships. With strong R&D investments and focus on customer-specific solutions, these players maintain leadership in a competitive and evolving landscape.

Recent Developments

- In May 2025, Caterpillar company rolled out its 2025 hydraulic excavator updates, featuring enhanced Cat Grade 2D/3D systems, a redesigned user interface, and advanced payload capabilities

- In February 2025, AGCO and SDF entered a supply agreement to refresh the Massey Ferguson utility tractor range

- In December 2024, Harbin Electric developed a 660 MW CFB unit in Binchang, China, successfully completed a trial operation.

Report Coverage

The research report offers an in-depth analysis based on Operation, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for automation and robotics.

- Companies will invest more in energy-efficient and low-emission machinery.

- Digital transformation will drive adoption of IoT-enabled and smart factory equipment.

- Robotics will see higher usage across construction, mining, and agriculture sectors.

- Aftermarket services and predictive maintenance will grow in importance for suppliers.

- Emerging economies will increase machinery adoption through infrastructure development.

- Sustainability regulations will accelerate the shift toward eco-friendly machinery designs.

- Flexible and modular equipment will gain traction across packaging and food processing.

- Customization of machinery for industry-specific applications will create new opportunities.

- Strategic partnerships and technology integration will shape future competitive advantages.