Market Overview

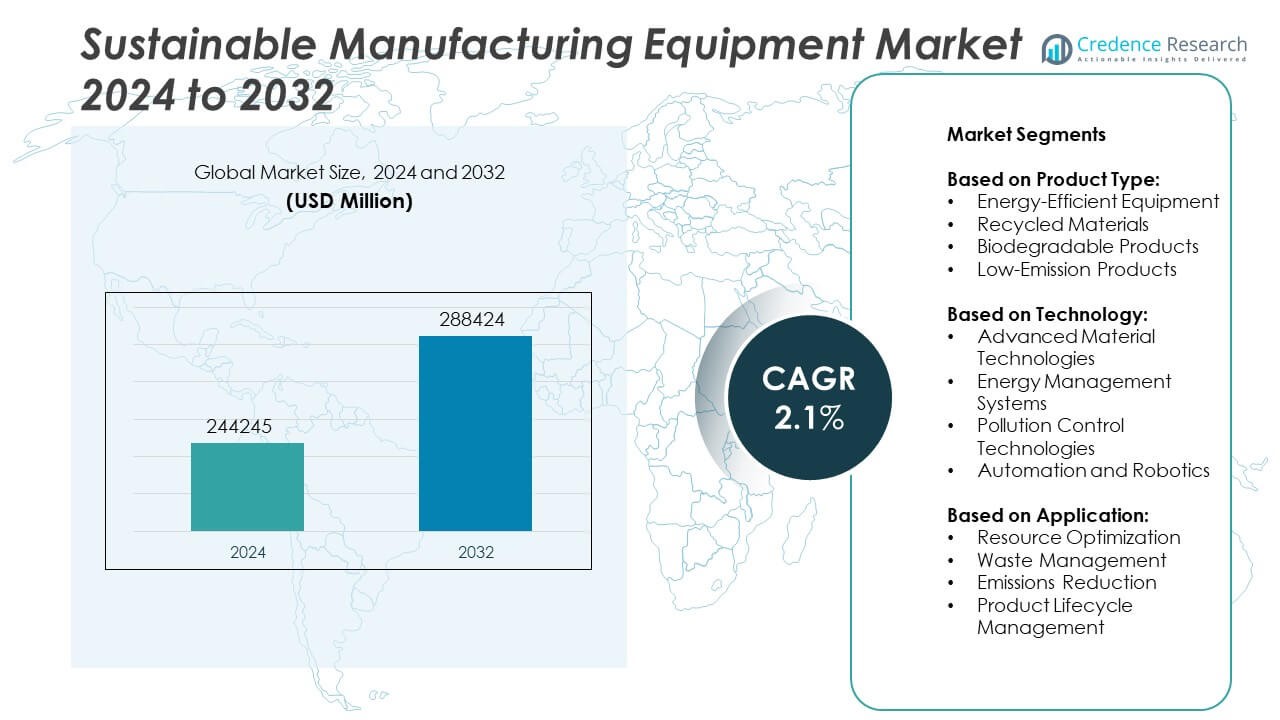

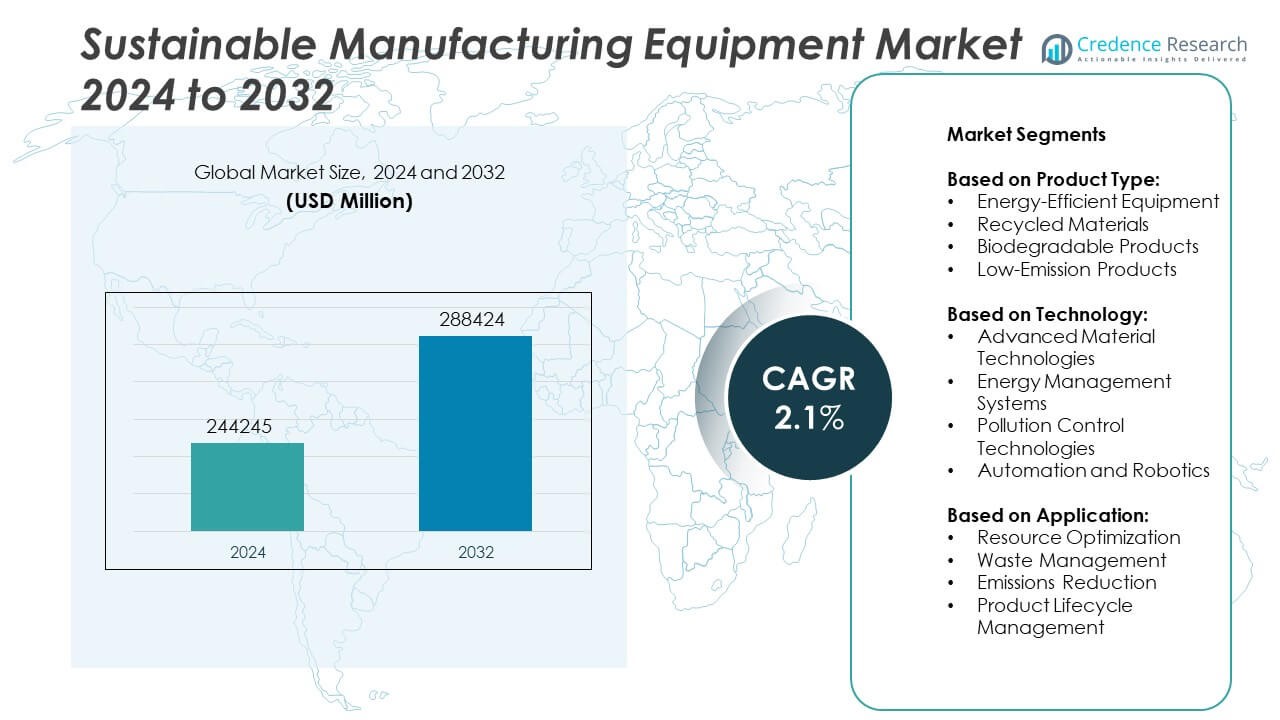

The Sustainable Manufacturing Equipment Market size was valued at USD 244,245 million in 2024 and is anticipated to reach USD 288,424 million by 2032, growing at a CAGR of 2.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable Manufacturing Equipment Market Size 2024 |

USD 244,245 Million |

| Sustainable Manufacturing Equipment Market, CAGR |

2.1% |

| Sustainable Manufacturing Equipment Market Size 2032 |

USD 288,424 Million |

The Sustainable Manufacturing Equipment market is driven by strict environmental regulations, rising demand for resource efficiency, and increased corporate focus on ESG goals. Manufacturers are adopting advanced technologies such as IoT, AI, and automation to improve energy efficiency, reduce emissions, and meet sustainability targets. Trends indicate growing preference for modular designs, recyclable materials, and integration of smart systems that enable real-time monitoring and predictive maintenance.

The Sustainable Manufacturing Equipment market demonstrates strong regional growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each influenced by varying regulatory frameworks, industrial maturity, and technological readiness. North America and Europe show steady adoption due to policy mandates and corporate ESG integration, while Asia Pacific leads in expansion, supported by rapid industrialization and government-backed green initiatives. Latin America and the Middle East & Africa are emerging with growing interest in sustainable practices, though infrastructure and investment gaps remain challenges. Key players in this market include Siemens, known for its advanced automation and energy-efficient solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sustainable Manufacturing Equipment market was valued at USD 244,245 million in 2024 and is projected to reach USD 288,424 million by 2032, growing at a CAGR of 2.1% during the forecast period.

- The market is driven by stringent environmental regulations, global decarbonization goals, and increased demand for energy-efficient machinery across industrial sectors.

- Technological advancements such as AI, IoT, and automation are reshaping equipment capabilities, enabling real-time monitoring, predictive maintenance, and reduced operational waste.

- Leading companies including Siemens, Schneider Electric, Umicore, and Unilever are competing through innovation, sustainable product development, and smart system integration to meet industry demands.

- High initial costs and unclear return on investment remain key challenges for small and medium enterprises, limiting broader adoption of sustainable equipment.

- North America and Europe show strong demand due to regulatory mandates and ESG-focused industries, while Asia Pacific leads in growth due to rapid industrialization and technology investments.

- Emerging markets in Latin America and the Middle East & Africa are showing gradual progress, supported by policy initiatives and growing awareness of environmental sustainability in industrial operations.

Market Drivers

Strict Environmental Regulations and Global Decarbonization Goals Are Driving Industry Transformation

Governments worldwide are enforcing stringent environmental policies to reduce industrial carbon footprints and energy consumption. Regulations targeting emissions, waste reduction, and energy efficiency compel manufacturers to upgrade to sustainable manufacturing equipment. The shift aligns with global climate agreements and national sustainability frameworks. Industries must comply or face penalties, making eco-efficient technologies a necessity rather than an option. The Sustainable Manufacturing Equipment market benefits directly from this regulatory pressure. It motivates companies to invest in greener, more compliant machinery.

- For instance, at Siemens’ Electronics Works Amberg plant, successive automation and digitalization enhancements have yielded a reduction in energy consumption relative to production volume by 47 units of energy per unit output, while maintaining production footprint and increasing product complexity; furthermore, the site produces 17 million products annually—averaging one product per second—and achieves a 6 units of efficiency gain each year since 2016, with full CO₂‑neutral operation scheduled by 2026.

Rising Demand for Resource Efficiency and Circular Economy Practices Is Influencing Adoption

Industries are prioritizing resource optimization to minimize waste and reduce operational costs. Manufacturers are focusing on equipment that supports lean production, energy recovery, and material reuse. These practices support circular economy models that emphasize sustainability throughout the value chain. Equipment with smart monitoring and waste-reduction capabilities is gaining preference. The Sustainable Manufacturing Equipment market reflects this shift in industrial priorities. It plays a critical role in enabling resource-conscious manufacturing systems.

- For instance, at the BMW Group, each vehicle produced today generates approximately 68 kilograms of non‑recyclable waste and consumes around 1.67 cubic meters of potable water, with nearly 99 percent of waste from in‑house production either recycled (93.4 percent) or thermally utilized (5.8 percent).

Technological Advancements and Digital Integration Are Enabling Sustainable Operations

Automation, IoT, AI, and digital twin technologies are making sustainable equipment more efficient and easier to manage. These innovations allow real-time monitoring of emissions, energy use, and performance metrics. Predictive maintenance and adaptive process controls enhance equipment life and reduce energy waste. Companies adopting these technologies benefit from both environmental and operational advantages. The Sustainable Manufacturing Equipment market is experiencing growing interest from sectors modernizing their operations. It acts as a catalyst for smart and sustainable industrial ecosystems.

Corporate ESG Commitments and Consumer Expectations Are Shaping Investment Decisions

Enterprises are under pressure to demonstrate environmental stewardship in line with ESG goals. Sustainability now factors into procurement, investor relations, and supply chain decisions. Businesses are prioritizing equipment that lowers emissions and conserves energy to align with public and stakeholder expectations. Consumer awareness is also influencing how products are sourced and manufactured. The Sustainable Manufacturing Equipment market supports companies striving to meet these evolving demands. It provides the infrastructure for credible and transparent sustainability initiatives.

Market Trends

Integration of Smart Technologies Is Reshaping Sustainable Equipment Design and Functionality

Manufacturers are embedding AI, IoT, and machine learning into sustainable equipment to improve efficiency and control. These technologies enable real-time tracking of emissions, energy use, and machine performance. Equipment can now self-adjust based on process needs, reducing resource consumption and operational downtime. Remote diagnostics and predictive maintenance also lower service costs and extend equipment life. The Sustainable Manufacturing Equipment market reflects this shift toward intelligent systems that support continuous improvement. It is enabling data-driven decision-making across industries.

- For instance, Siemens Energy deployed its “Connected Factory” Industrial IoT platform across 18 global factories, integrating more than 10 industrial data protocols into a unified AWS-powered system. This setup led to a 50% reduction in time spent on manual data collection, a 25% decrease in maintenance costs, and a 15% increase in machine availability.

Customization and Modular Design Are Gaining Traction Among Manufacturers

Companies seek equipment that can adapt to changing production needs and sustainability targets. Modular and scalable machinery allows users to upgrade specific components without replacing entire systems. This approach supports long-term cost savings and reduces industrial waste. Custom solutions tailored to energy profiles, industry requirements, and space constraints are in high demand. The Sustainable Manufacturing Equipment market is evolving to meet this need for flexible and adaptive solutions. It provides options that align with both performance goals and environmental benchmarks.

- For instance, MOD21’s modular timber daycare center project in Reutlingen involved prefabricating 38 modules in four weeks and installing them onsite in five days, achieving a 96 % reduction in CO₂e emissions compared to conventional construction.

Use of Recyclable and Low-Impact Materials Is Influencing Product Development

Manufacturers are selecting materials that reduce the lifecycle impact of production equipment. Equipment frames, enclosures, and components increasingly use recycled metals, bio-based plastics, and low-carbon alloys. This trend supports broader environmental goals and reduces upstream environmental costs. Focus is also shifting to equipment that can be disassembled and repurposed at end of life. The Sustainable Manufacturing Equipment market supports these efforts by promoting materials innovation. It helps reduce embedded emissions in machinery across various sectors.

Growth in Regional Green Manufacturing Initiatives Is Encouraging Market Expansion

Countries are launching domestic programs to boost energy-efficient and low-emission manufacturing. These initiatives include subsidies, tax incentives, and public-private partnerships. Local manufacturers are investing in sustainable equipment to qualify for government support and meet policy benchmarks. Industrial zones and eco-parks are adopting standard guidelines for equipment sustainability. The Sustainable Manufacturing Equipment market benefits from these structured regional initiatives. It is gaining momentum in areas where policy, industry, and innovation intersect.

Market Challenges Analysis

High Initial Investment and Uncertain ROI Are Hindering Adoption Across Small and Medium Enterprises

The upfront cost of sustainable manufacturing equipment often exceeds that of conventional alternatives. Many small and medium enterprises (SMEs) face budget constraints that prevent them from adopting energy-efficient or low-emission machinery. Return on investment remains uncertain due to fluctuating energy prices and evolving regulatory requirements. Some companies hesitate to commit capital without clear short-term benefits. The Sustainable Manufacturing Equipment market faces barriers in expanding to cost-sensitive industrial segments. It must overcome financial apprehension through incentives, leasing options, or government-backed support.

Technical Integration and Skill Gaps Limit Operational Efficiency in Certain Industries

Implementing advanced sustainable equipment requires integration with existing systems and a skilled workforce to operate and maintain it. Many factories lack the digital infrastructure needed to support IoT-enabled or AI-driven machinery. Training workers and aligning legacy systems with new technologies involve both time and cost. Some industries experience disruptions during transitions due to incompatibility or knowledge gaps. The Sustainable Manufacturing Equipment market must address these technical and human challenges to ensure smoother implementation. It needs to support industries with tailored onboarding and scalable solutions.

Market Opportunities

Rising Government Incentives and Green Infrastructure Investments Are Opening New Growth Channels

Governments across developed and emerging economies are launching incentive programs to promote cleaner production systems. Tax benefits, grants, and subsidies are encouraging manufacturers to adopt energy-efficient and low-emission equipment. Large-scale investments in renewable energy, smart cities, and sustainable industrial zones are creating demand for advanced machinery that aligns with environmental targets. These infrastructure developments require sustainable equipment for construction, resource management, and ongoing operations. The Sustainable Manufacturing Equipment market is well-positioned to capitalize on this demand. It can support these initiatives by delivering solutions that meet both regulatory standards and long-term cost efficiency goals.

Expansion of Industry 4.0 in Emerging Markets Creates Strong Potential for Adoption

Emerging economies are accelerating their shift toward digital and automated manufacturing environments. These regions seek to modernize production while reducing energy consumption and environmental impact. Equipment that integrates automation, smart monitoring, and predictive control is in high demand. Manufacturers in Asia, Latin America, and Africa are exploring scalable technologies that offer operational flexibility and sustainability benefits. The Sustainable Manufacturing Equipment market can grow by addressing the digital and environmental goals of these transitioning industries. It plays a central role in helping businesses build competitive, future-ready production systems.

Market Segmentation Analysis:

By Product Type:

Energy-efficient equipment leads the segment due to strong regulatory pressure and rising operational cost awareness. These systems reduce electricity consumption and improve process efficiency across industries. Recycled materials and biodegradable products are gaining traction, particularly in consumer goods and packaging sectors, where companies aim to lower their environmental impact. Low-emission products are also expanding in demand, particularly in regions with strict carbon reduction targets.

- For instance, Coats Bangladesh recovered this waste heat from boiler flue gas by installing an “Economizer” in the flue gas circuit. As a result, the Feed water of the boiler is heated from 55°C to 90°C and the boiler flue gas temperature cools down to 120°C from 210’C.

By Technology:

Automation and robotics dominate the segment, driven by the need for precision, consistency, and reduced human intervention in sustainable processes. These technologies allow real-time monitoring, resource control, and performance optimization. Energy management systems follow closely, offering manufacturers a way to track and reduce energy usage while maintaining productivity. Pollution control technologies are essential for compliance, especially in heavy industries such as chemicals and manufacturing. Advanced material technologies support the use of sustainable and recyclable inputs, improving both product lifecycle and waste reduction.

- For instance, at the Drax Power Station in the UK (4000MW), a flue gas desulphurisation (FGD) plant installed between 1988 and 1996 removes over 250,000 tonnes of sulfur dioxide annually by treating flue gases with limestone slurry. The process produces 15,000 tonnes of gypsum per week as a marketable byproduct.

By Application:

Resource optimization holds the largest share, as industries aim to reduce waste, improve yield, and minimize input costs. Waste management is a critical area, particularly in sectors where by-products or residual materials pose environmental risks. Emissions reduction is central to global climate commitments and is a major application area in automotive, energy, and heavy industries. Product lifecycle management supports long-term sustainability strategies by tracking materials from design through disposal, enabling circular economy models. The Sustainable Manufacturing Equipment market addresses each of these segments through tailored, innovation-driven solutions.

Segments:

Based on Product Type:

- Energy-Efficient Equipment

- Recycled Materials

- Biodegradable Products

- Low-Emission Products

Based on Technology:

- Advanced Material Technologies

- Energy Management Systems

- Pollution Control Technologies

- Automation and Robotics

Based on Application:

- Resource Optimization

- Waste Management

- Emissions Reduction

- Product Lifecycle Management

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America commands around 28% of the global Sustainable Manufacturing Equipment market, driven by aggressive policy measures and corporate ESG mandates. The United States remains the largest contributor, supported by federal incentives promoting clean energy, waste reduction, and energy-efficient industrial practices. Initiatives such as the Inflation Reduction Act have pushed manufacturers to adopt sustainable equipment that reduces emissions and energy costs. Canada also plays a key role, with its Net Zero Emissions goals accelerating investments in advanced manufacturing technologies. Strong R&D capabilities, widespread digital infrastructure, and early adoption of Industry 4.0 further strengthen the region’s leadership. Key end-use sectors—automotive, aerospace, and electronics—are integrating sustainable systems to enhance global competitiveness. With favorable government policies and high awareness, North America continues to drive innovation and demand for sustainable manufacturing solutions.

Europe

Europe holds about 26% of the global market, supported by its robust regulatory framework and long-standing commitment to sustainability. The European Union’s Green Deal, circular economy strategies, and carbon neutrality targets have made energy-efficient equipment mandatory across many sectors. Countries such as Germany, France, and the Netherlands are at the forefront of this transformation, with manufacturers upgrading machinery to comply with emission limits and energy standards. Public-private partnerships and strong funding mechanisms under programs like Horizon Europe further support innovation in sustainable technologies. High energy costs in the region also motivate industries to adopt low-consumption, high-efficiency equipment to reduce operational expenses. Industries such as chemicals, packaging, and heavy machinery are investing in modular, recyclable, and low-emission systems. The region’s mature industrial base and environmental consciousness create a stable and growth-oriented market landscape.

Asia Pacific

Asia Pacific captures the largest share of the Sustainable Manufacturing Equipment market at approximately 31%, driven by rapid industrial development and increasing environmental pressures. China, Japan, South Korea, and India are key contributors, investing in sustainable infrastructure and advanced manufacturing technologies. Governments across the region are offering tax incentives, R&D grants, and policy support to encourage the adoption of green technologies. Growing awareness of environmental risks and global supply chain pressures are pushing industries to modernize and comply with global sustainability standards. The electronics, textiles, and automotive industries in Asia Pacific are major buyers of sustainable equipment as they transition toward low-carbon production models. Urbanization, rising energy costs, and industrial automation trends contribute to sustained demand across the region. With large-scale manufacturing hubs and increasing environmental accountability, Asia Pacific remains the fastest-growing and most dynamic regional market.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa collectively account for approximately 15% of the global market, showing emerging interest in sustainable industrial practices. In Latin America, Brazil and Mexico are leading efforts to integrate sustainable technologies, supported by local policies aimed at environmental protection and renewable energy development. Industrial growth and urban development projects are driving demand for energy-efficient equipment in sectors like construction, mining, and agriculture. In the Middle East & Africa, countries such as the UAE and South Africa are beginning to invest in clean technologies and sustainable manufacturing systems, influenced by diversification goals and global climate commitments. Limited infrastructure and funding challenges persist, but international partnerships and investment programs are helping bridge the gap. While still in the early phase of adoption, both regions are expected to show gradual market expansion over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Sustainable Manufacturing Equipment market features strong competition among leading players such as 3M, Braskem, Cirba Solutions, NatureWorks LLC, Schneider Electric, Siemens, Tesla, Umicore, Unilever, and Veolia. These companies focus on innovation, strategic partnerships, and sustainability-driven product development to maintain and expand their market presence. They invest heavily in research and development to introduce energy-efficient and low-emission equipment that meets evolving regulatory standards and customer expectations. Competitive differentiation often relies on integrating digital technologies like IoT, AI, and predictive analytics into machinery to enhance operational efficiency and reduce environmental impact. Companies also compete through global expansion strategies, targeting high-growth regions and forming alliances with governments and green infrastructure initiatives. Market leaders prioritize circular economy principles by developing recyclable materials, promoting waste reduction, and enabling closed-loop production systems. Pricing strategies, after-sales service, and compliance with regional sustainability policies further shape competitive positioning across industrial sectors.

Recent Developments

- In April 2024, GE Renewable Energy announced the expansion of its offshore wind turbine manufacturing facility in the Asia Pacific region, particularly in China and Taiwan, to meet the growing demand for renewable energy solutions. The expansion is aimed at increasing the company’s production capacity of offshore wind turbines, which are integral to sustainable manufacturing processes, particularly in energy-intensive industries. This move aligns with the region’s efforts to decarbonize its energy production, reduce emissions, and meet environmental targets. The expansion will support industries across the region in transitioning to sustainable manufacturing by providing more access to clean energy solutions.

- In March 2024, Siemens entered a strategic partnership with Airbus to accelerate the transition to sustainable aircraft manufacturing. The collaboration focuses on integrating smart manufacturing technologies, such as energy-efficient automation systems, digital twins, and predictive maintenance, into Airbus’s production facilities. This partnership is expected to reduce the environmental footprint of aircraft production while improving efficiency and sustainability in the aerospace sector. By utilizing Siemens’ advanced technologies, Airbus aims to streamline its operations and move closer to its sustainability targets, positioning both companies as leaders in green manufacturing in the aerospace industry.

- In February 2024, The European Commission launched the Green Deal Industrial Plan, a USD 1 billion initiative aimed at accelerating Europe’s transition to net-zero emissions. The plan includes a significant focus on sustainable manufacturing equipment, with financial incentives for companies adopting clean technologies, including energy-efficient machinery, carbon capture systems, and smart factory automation. The European Union aims to strengthen its competitive edge in green technologies and ensure that manufacturers across Europe have the resources and support needed to adopt sustainable solutions. This initiative is expected to drive widespread adoption of sustainable manufacturing equipment across Europe in the coming years.

- In April 2024, Unilever continues to push its Sustainable Living Plan targeting greenhouse gas reductions, water use limits, and waste reductions. They have local sourcing initiatives in Kenya as per recent supply chain adjustments during the COVID-19 pandemic.

- In July 2023, Braskem increased the production capacity of biopolymers in Brazil by 30% and established a joint venture with SCG Chemicals to develop a green ethylene project in Thailand to increase regional availability of bio-based polyethylene in Asia. They also opened a Tokyo representative office to promote low-carbon solutions aligned with Japan’s net zero goals.

Market Concentration & Characteristics

The Sustainable Manufacturing Equipment market exhibits a moderately consolidated structure, with a mix of global leaders and specialized regional players influencing competitive dynamics. It is characterized by a strong focus on innovation, regulatory compliance, and integration of smart technologies to meet evolving environmental standards. Key players actively invest in R&D to develop equipment that improves energy efficiency, reduces emissions, and aligns with digital transformation goals across industries. The market favors companies capable of offering scalable, adaptable, and compliant solutions tailored to sector-specific requirements. Technological differentiation, supply chain strength, and strategic partnerships are critical for sustaining long-term competitiveness. It serves a wide range of industries, including automotive, electronics, chemicals, food processing, and packaging, each with unique sustainability targets. Demand is highest in regions with strong policy enforcement and corporate ESG integration. The market continues to evolve toward greater digitalization and circular economy practices, with product modularity, lifecycle efficiency, and operational transparency shaping its core attributes.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-emission equipment will increase across all major industrial sectors.

- Governments are expected to introduce stricter regulations to promote sustainable manufacturing practices.

- Integration of AI, IoT, and machine learning will enhance equipment performance and operational transparency.

- Adoption of modular and customizable equipment designs will grow to support flexible production needs.

- Companies will prioritize circular economy models, driving demand for recyclable and biodegradable equipment materials.

- Investments in automation and robotics will rise, improving process efficiency and reducing energy consumption.

- Emerging markets will see accelerated adoption due to growing industrialization and environmental awareness.

- Partnerships between public institutions and private companies will support sustainable technology development.

- Consumer pressure and investor focus on ESG performance will influence purchasing decisions.

- Product lifecycle management tools will become standard, ensuring traceability and sustainable end-of-life strategies.