Market Overview

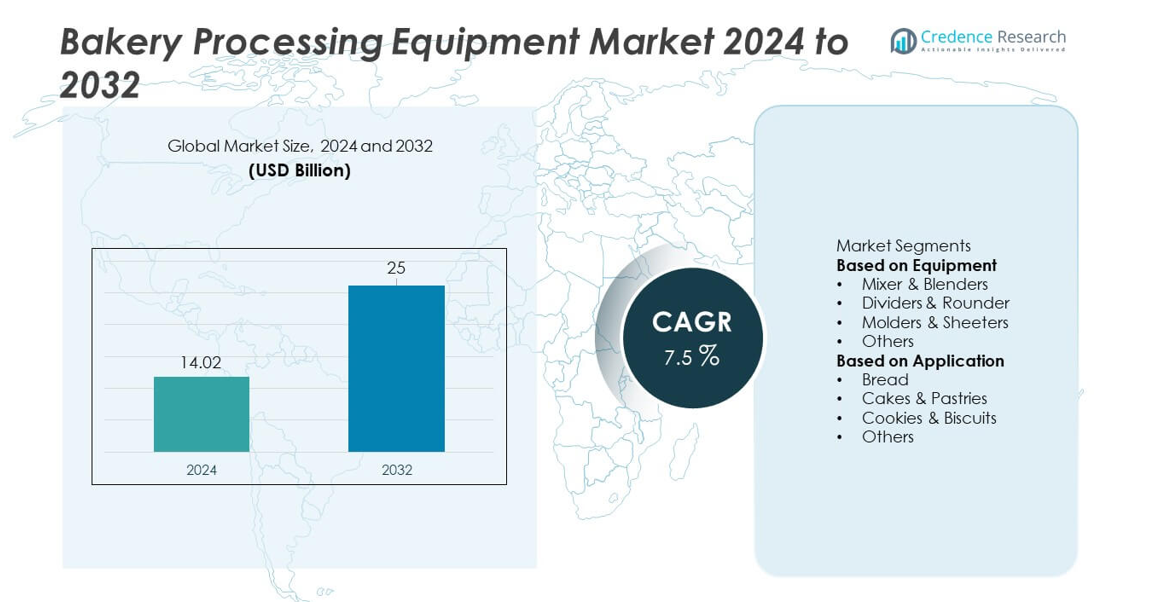

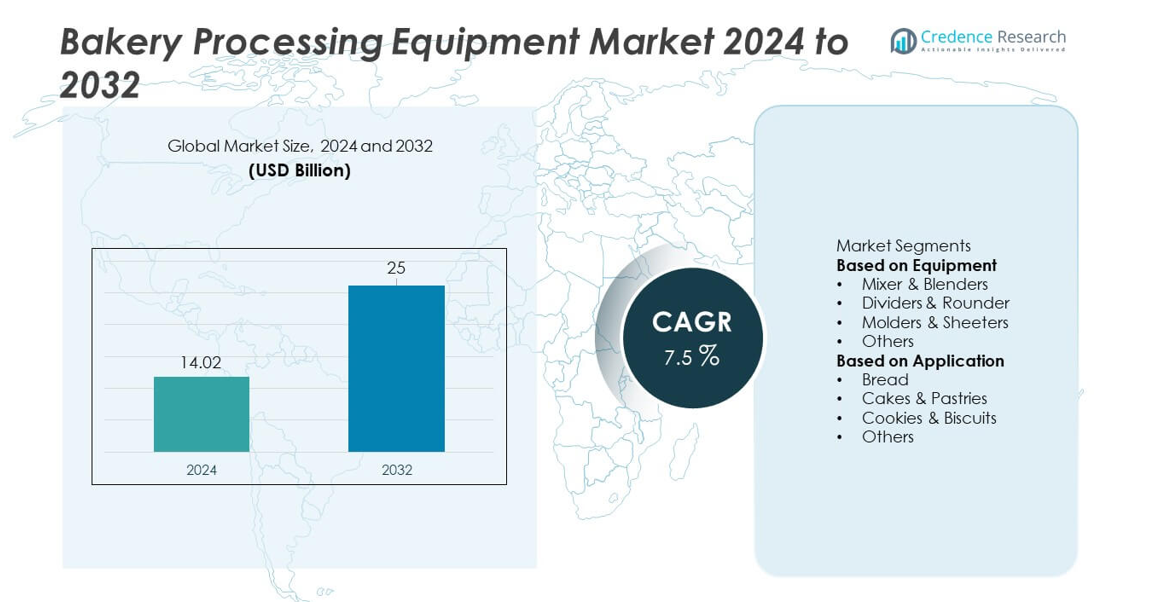

The Bakery Processing Equipment market reached USD 14.02 billion in 2024. The market is expected to grow to USD 25 billion by 2032, supported by a CAGR of 7.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bakery Processing Equipment Market Size 2024 |

USD 14.02 billion |

| Bakery Processing Equipment Market, CAGR |

7.5% |

| Bakery Processing Equipment Market Size 2032 |

USD 25 billion |

The top players in the Bakery Processing Equipment market include Ali Group S.r.l., Baker Perkins Limited, Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, Markel Food Group, JBT Corporation, Heat & Control, Inc., RHEON Automatic Machinery Co., Ltd., and Anko Food Machine Co., Ltd. These companies expand their presence through advanced automation, high-capacity processing lines, and energy-efficient equipment designed for large commercial and industrial bakeries. North America leads the market with a 37% share, driven by strong adoption of automated baking solutions and strict food safety standards. Europe follows with a 30% share, while Asia Pacific accounts for 24%, supported by rising bakery consumption and rapid industrial expansion.

Market Insights

- The Bakery Processing Equipment market reached USD 14.02 billion in 2024 and will grow at a CAGR of 7.5 percent through 2032 due to rising automation needs.

- Growing demand for packaged bread and convenience bakery products drives equipment adoption, with mixers and blenders leading the segment at a 36 percent share.

- Smart processing lines, digital monitoring, and energy-efficient designs shape key market trends as bakeries modernize production to improve consistency and reduce labor use.

- Strong competition among Ali Group, Bühler, GEA, Middleby, Baker Perkins, Markel, JBT, Heat & Control, RHEON, and Anko influences innovation, while high installation costs and skill shortages act as major restraints.

- North America leads regional growth with a 37 percent share, followed by Europe at 30 percent and Asia Pacific at 24 percent, while bread applications dominate with a 41 percent market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis:

By Equipment

Mixers and blenders lead the market with a 36% share, driven by strong demand for uniform dough preparation and high-capacity batch production in commercial bakeries. Their ability to improve dough consistency, reduce processing time, and support automated workflows strengthens adoption across large-scale facilities. Dividers and rounders follow as bakeries prioritize precision in dough portioning and shape accuracy. Molders and sheeters gain steady traction due to rising production of flatbreads and laminated products. Other equipment categories, including ovens and proofers, expand with increasing investments in energy-efficient and automated baking systems.

- For instance, MIWE’s roll-in e+ rack oven reduces energy consumption by up to 25% due to its advanced heat circulation and insulation technology.

By Application

Bread processing dominates the market with a 41% share, supported by continuous demand for packaged bread, artisanal loaves, and specialty bakery products. Large bakeries invest in automated dough handling, proofing, and baking lines to achieve consistent quality and higher throughput. Cakes and pastries follow as consumers shift toward premium, flavored, and customized baked goods. Cookies and biscuits gain momentum due to growing snack consumption and longer shelf-life preferences. Other applications expand with rising demand for frozen bakery items and diversified product portfolios in commercial and industrial bakeries.

- For instance, JBT’s Frigoscandia GyroCompact spiral freezer delivers freezing capacities up to 3,600 kg per hour, supporting large-scale frozen bakery production with compact floor usage.

Key Growth Drivers

Rising Demand for Automated and High-Capacity Bakery Systems

Automation drives strong growth as bakeries move toward high-capacity production to meet rising demand for packaged and specialty baked goods. Automated mixers, dividers, sheeters, and ovens improve consistency, reduce labor dependence, and enhance overall efficiency. Manufacturers introduce advanced control panels, precision sensors, and servo-driven mechanisms to support continuous processing. Commercial bakeries adopt integrated lines to handle large batches with minimal downtime. This shift accelerates operational scalability and supports the expansion of industrial bakery facilities worldwide.

- For instance, Middleby’s Auto-Bake Serpentine system delivers high throughput and utilizes advanced automation and control systems, enabling synchronized baking, cooling, and handling within a compact footprint.

Growing Consumption of Packaged and Convenience Bakery Products

Demand for packaged bread, cookies, pastries, and ready-to-eat baked goods increases as consumers seek convenient, longer-lasting, and premium bakery options. This trend encourages bakeries to upgrade equipment for improved throughput and uniform product quality. High-speed processing systems help meet surging supermarket and quick-service restaurant supply needs. Manufacturers also enhance equipment hygiene standards to align with food safety regulations. The expanding retail footprint of bakery products further strengthens equipment adoption across medium and large production units.

- For instance, the Bühler Meincke V60 production system is a versatile wire cutter and depositor designed for high output and high hygienic standards, allowing for quick changeovers even between allergenic masses.

Rising Adoption of Energy-Efficient and Hygienic Equipment Designs

Energy-efficient bakery machinery gains attention as bakeries aim to reduce operational costs and comply with global sustainability targets. Equipment with optimized heating systems, insulated chambers, and low-energy motors lowers power consumption while maintaining product quality. Hygienic designs with stainless steel bodies, easy-clean structures, and CIP systems support stricter food safety compliance. Manufacturers invest in eco-friendly technologies that minimize waste and extend equipment lifespan. These advancements create strong incentives for bakeries to replace older systems with modern, compliant alternatives.

Key Trends & Opportunities

Expansion of Smart and Digitally Integrated Bakery Equipment

Digital adoption rises as bakeries integrate smart sensors, data analytics, and automated controls into processing equipment. Smart monitoring helps track temperature, pressure, and dough characteristics in real time, enhancing product consistency and reducing errors. Remote diagnostics and predictive maintenance reduce downtime and optimize equipment life cycles. IoT-enabled systems provide better traceability and support food safety requirements. These features create strong opportunities for equipment manufacturers offering advanced digital capabilities tailored to industrial bakery needs.

- For instance, GEA’s SmartControl system supports remote diagnostics that can help identify potential issues, minimize downtime, and improve overall equipment performance.

Growing Demand for Specialty and Customized Bakery Product Lines

Rising interest in artisanal, gluten-free, organic, and premium bakery items increases the need for flexible and multi-functional equipment. Bakeries seek machinery capable of handling varied dough types, shapes, and textures without compromising output. Small and medium enterprises adopt modular production lines to support rapid product diversification. Manufacturers respond with adaptable molders, sheeters, and depositors designed for specialty recipes. This trend opens strong opportunities for equipment suppliers catering to innovative and niche bakery product categories.

- For instance, RHEON’s V4 Stress-Free Divider processes dough hydration levels up to 85% and handles 18,000 pieces per hour.

Key Challenges

High Initial Investment Costs and Maintenance Requirements

Advanced bakery equipment requires significant capital investment, making adoption difficult for small and medium-sized bakeries. High installation expenses, ongoing maintenance needs, and skilled labor requirements further increase operational burdens. Complex automated systems demand regular servicing to maintain precision and hygiene, raising ownership costs. These financial constraints slow equipment upgrades in emerging markets. Addressing affordability and offering flexible financing solutions remain critical for broader adoption.

Operational Skill Gaps and Limited Workforce Training

The shift toward automated and digitally integrated equipment increases the need for trained operators and technicians. Many bakeries face skill shortages in handling advanced control systems, diagnostics, and maintenance routines. Insufficient workforce training leads to inefficiencies, higher error rates, and machine downtime. Smaller bakeries struggle to attract skilled personnel, limiting their ability to adopt modern systems. Strengthening industry training programs and automated support tools is essential to overcome this challenge and ensure efficient equipment utilization.

Regional Analysis

North America

North America holds a 37% market share, driven by strong demand for automated bakery equipment across large commercial and industrial bakeries. Rising consumption of packaged bread, cakes, and specialty baked goods supports continuous investment in high-capacity mixers, sheeters, and ovens. Manufacturers expand smart and energy-efficient equipment portfolios to meet strict food safety and sustainability standards. The region benefits from advanced manufacturing capabilities, strong retail bakery networks, and rapid adoption of digital processing systems. Growing demand for consistent quality and reduced labor dependency strengthens market growth across the United States and Canada.

Europe

Europe accounts for a 30% share, supported by well-established bakery traditions and strong demand for artisanal, organic, and premium bakery products. Commercial bakeries invest heavily in automated dough handling, lamination, and proofing systems to meet rising production needs. Strict food safety regulations encourage adoption of hygienic and stainless-steel equipment designs. The region also embraces energy-efficient technologies to reduce operating costs and support sustainability goals. High bakery product consumption in Germany, France, Italy, and the U.K. drives continuous equipment upgrades across industrial and mid-sized baking facilities.

Asia Pacific

Asia Pacific represents a 24% market share, driven by rising urbanization, growing bakery product consumption, and rapid expansion of quick-service restaurants and supermarkets. Commercial bakeries invest in automated dough processing lines and high-speed ovens to meet strong demand for bread, biscuits, and pastries. China, India, Japan, and Southeast Asia show significant growth in packaged bakery products, supporting equipment adoption across new manufacturing plants. Increasing preference for Western-style bakery goods and premium pastries further boosts demand for flexible and multi-functional machinery. Rising food safety focus strengthens modernization efforts across emerging markets.

Latin America

Latin America holds an 6% share, supported by expanding bakery chains, rising bread consumption, and growing interest in packaged bakery snacks. Brazil, Mexico, and Argentina lead equipment adoption as manufacturers upgrade to automated systems to enhance product consistency and reduce labor dependency. Demand increases for mixers, dividers, and ovens suited for both traditional and industrial bakery items. Economic improvements and supermarket growth also support wider use of commercial baking equipment. Despite challenges in smaller markets, rising modernization efforts drive steady growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share, driven by rising demand for packaged bread, premium pastries, and frozen bakery products. Urban centers in the UAE, Saudi Arabia, and South Africa invest in automated bakery solutions to support growing retail and hospitality sectors. Bakeries adopt energy-efficient ovens, sheeters, and mixers to improve productivity and meet quality standards. Increasing tourism and expansion of bakery cafés also contribute to equipment upgrades. While adoption remains limited in low-income markets, improving food infrastructure supports gradual growth across the region.

Market Segmentations:

By Equipment

- Mixer & Blenders

- Dividers & Rounder

- Molders & Sheeters

- Others

By Application

- Bread

- Cakes & Pastries

- Cookies & Biscuits

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Ali Group S.r.l., Baker Perkins Limited, Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, Markel Food Group, JBT Corporation, Heat & Control, Inc., RHEON Automatic Machinery Co., Ltd., and Anko Food Machine Co., Ltd. These companies strengthen their market position through advanced dough processing technologies, high-capacity production lines, and energy-efficient baking systems. Manufacturers invest in automation, smart controls, and hygienic equipment designs to meet rising demand for consistent product quality and regulatory compliance. Strategic partnerships with commercial bakeries and food manufacturers enhance equipment integration and global reach. Players also expand their portfolios with flexible and modular systems that support diverse bakery products such as bread, pastries, and biscuits. Continuous innovation, strong service networks, and growing adoption of digital monitoring tools contribute to an increasingly competitive environment across global bakery equipment markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Baker Perkins Limited and other leading players (including GEA Group) were cited as major contributors to a surge in demand for bakery processing equipment.

- In October 2023, Rademaker, a prominent player in the baking equipment sector, entered into an exclusive collaboration with Form & Frys Maskinteknik, a Danish company known for its expertise in machinery designed for folding, forming, and filling pastries and other baked products

Report Coverage

The research report offers an in-depth analysis based on Equipment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation adoption will rise as bakeries upgrade to high-capacity production lines.

- Smart sensors and digital monitoring systems will gain stronger integration across equipment.

- Energy-efficient designs will become a priority as bakeries target lower operating costs.

- Demand for flexible and modular machinery will grow with expanding specialty bakery products.

- Hygiene-focused equipment designs will strengthen due to stricter food safety regulations.

- Emerging markets will increase investment in commercial bakery facilities and modern machinery.

- IoT-enabled predictive maintenance will support higher uptime and longer equipment life cycles.

- Partnerships between equipment makers and industrial bakeries will expand integrated processing lines.

- Customization capabilities will grow as bakeries diversify product shapes, sizes, and textures.

- Advanced dough handling technologies will evolve to improve consistency and support premium products.