Market Overview

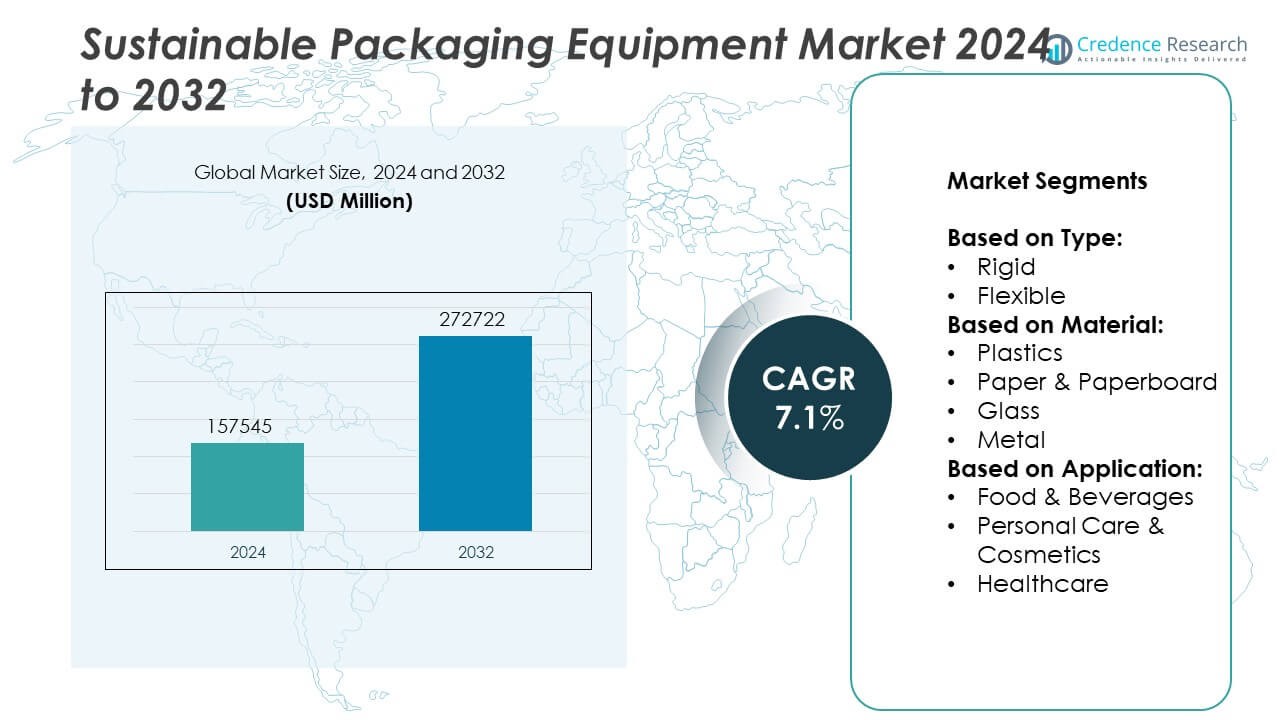

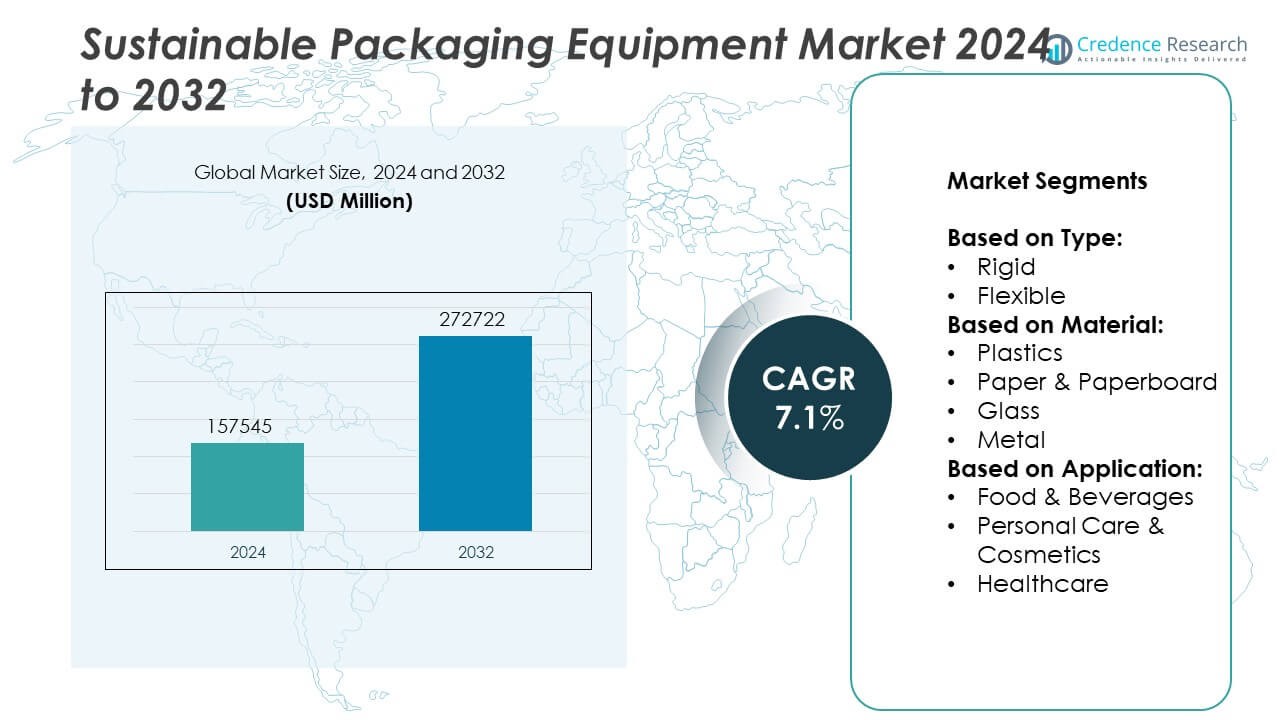

The Sustainable packaging equipment market size was valued at USD 157,545 million in 2024 and is anticipated to reach USD 272,722 million by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable Packaging Equipment Market Size 2024 |

USD 157,545 Million |

| Sustainable Packaging Equipment Market, CAGR |

7.1% |

| Sustainable Packaging Equipment Market Size 2032 |

USD 272,722 Million |

The sustainable packaging equipment market is driven by strict environmental regulations, rising consumer demand for eco-friendly products, and corporate sustainability goals across key industries. Companies are adopting energy-efficient and low-waste machinery to meet compliance standards and improve brand value. Market trends include a shift toward modular and customizable equipment, integration of smart technologies, and growing use of biodegradable and recyclable materials.

The sustainable packaging equipment market shows strong growth across Asia Pacific, North America, and Europe, driven by regulatory initiatives, industrial modernization, and increasing consumer demand for sustainable products. Asia Pacific leads due to its expanding manufacturing base, while Europe emphasizes circular economy practices. Key players in the market include Amcor Plc, Berry Global Inc., and The Mondi Group plc, all focusing on innovative equipment solutions and material compatibility to support eco-friendly packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sustainable packaging equipment market was valued at USD 157,545 million in 2024 and is projected to reach USD 272,722 million by 2032, growing at a CAGR of 7.1% during the forecast period.

- Rising government regulations on plastic use, coupled with corporate sustainability goals, are encouraging industries to adopt eco-friendly packaging machinery that supports recyclable and biodegradable materials.

- Technological advancements such as modular equipment, smart automation, and IoT-enabled systems are shaping new trends, enabling flexible, efficient, and low-waste packaging processes.

- Key players like Amcor Plc, Berry Global Inc., and The Mondi Group plc are focusing on R&D and partnerships to offer innovative machinery compatible with diverse sustainable materials and packaging formats.

- High initial investment costs and limited access to financing remain major challenges for small and mid-sized manufacturers looking to transition to sustainable packaging systems.

- Asia Pacific dominates the global market due to rapid industrialization and regulatory reforms, followed by North America and Europe, where environmental awareness and stringent standards drive equipment upgrades.

- The market is becoming increasingly competitive as both global and regional players invest in product innovation, smart features, and material compatibility to differentiate their offerings and meet industry-specific sustainability requirements.

Market Drivers

Stringent Environmental Regulations and Corporate Sustainability Goals Driving Demand

Governments across the globe are enforcing stricter environmental regulations aimed at reducing plastic waste and carbon emissions. These regulatory frameworks compel manufacturers to adopt eco-friendly packaging solutions, which increases demand for equipment that can handle recyclable, biodegradable, or compostable materials. The sustainable packaging equipment market is benefiting from these mandates, as companies must modernize or replace outdated machinery to remain compliant. Corporations are also under growing pressure to meet internal sustainability targets and respond to investor expectations. This push is leading to increased capital allocation for greener production technologies. Equipment providers that offer energy-efficient and low-waste systems are gaining a competitive edge in this evolving regulatory landscape.

- For instance, Sonoco, a global packaging company, reduced its Scope 1 and 2 greenhouse gas emissions from 1.19 million metric tons of CO₂ equivalent in 2023 to 1.14 million metric tons in 2024 by optimizing logistics and upgrading plant equipment. This included investments in metal packaging processes at its Henderson, Kentucky plant, which achieved an annual reduction of 169 metric tons of CO₂ through enhanced equipment efficiency—a concrete technological achievement aligned with evolving sustainability mandates.

Consumer Preference for Eco-Friendly Products Encouraging Market Growth

Changing consumer behavior is another critical driver for the sustainable packaging equipment market. Buyers are prioritizing products with minimal environmental impact, including those with recyclable or reusable packaging. Brands that adopt sustainable practices attract customer loyalty and improve their public image, leading to stronger sales performance. Equipment capable of producing innovative, eco-friendly packaging formats allows manufacturers to meet consumer expectations more effectively. Retailers and e-commerce platforms are also introducing sustainability guidelines that influence supplier choices. This shift in purchasing decisions across the value chain supports steady market expansion.

- For instance, Mondi plc reported that in 2022, numerical metric packaging and paper products that are reusable, recyclable, or compostable accounted for 82 percent of its revenue.

Technological Advancements Supporting Efficient and Scalable Production

The integration of advanced technologies into packaging machinery is transforming how companies meet sustainability objectives. Innovations in automation, robotics, and digital monitoring enhance the efficiency and precision of packaging processes. The sustainable packaging equipment market is seeing greater investment in smart machinery that reduces material waste and optimizes energy use. Companies adopting these systems report lower operational costs and higher throughput. It becomes easier to switch between packaging types without compromising production speed. These capabilities make the adoption of sustainable practices more feasible across industries.

Rising Demand Across End-Use Industries Fueling Equipment Upgrades

Food and beverage, pharmaceuticals, personal care, and consumer goods sectors are all increasing their use of sustainable packaging. Regulatory compliance, brand differentiation, and export requirements are prompting these industries to upgrade their existing machinery. The sustainable packaging equipment market is responding with modular and customizable solutions tailored to specific sector needs. Flexible equipment that supports multiple packaging types and materials enables companies to reduce capital expenditure. Global supply chains also influence demand by requiring standardized, eco-friendly packaging across markets. This broad-based adoption supports long-term market growth.

Market Trends

Shift Toward Modular and Customizable Machinery to Improve Flexibility

Manufacturers are increasingly adopting modular packaging equipment to enhance production flexibility. These systems allow faster changeovers between different packaging formats and materials, enabling companies to meet evolving consumer and regulatory demands. The sustainable packaging equipment market is seeing growing interest in machines that support multiple packaging types within a single production line. It helps reduce downtime, improve efficiency, and lower operational costs. Customizable equipment designs also allow businesses to scale operations without large capital investments. This shift is particularly valuable for companies introducing new product lines with distinct sustainability requirements.

- For instance, LineXpress from Krones enables customers to change their lines in record time by automating essential processes and taking a holistic approach to organizing them. This cuts change-over times to two third, meaning that what previously took 90 minutes can now be performed in just 30 minutes.

Integration of Smart Technologies to Enhance Operational Efficiency

Smart packaging equipment equipped with sensors, AI, and IoT capabilities is gaining traction in sustainability-driven industries. These technologies allow real-time monitoring of energy use, material consumption, and overall equipment efficiency. The sustainable packaging equipment market is benefiting from this trend by offering systems that reduce waste and optimize resource utilization. It enables predictive maintenance, minimizes machine downtime, and ensures consistent output quality. Enhanced data visibility supports compliance with environmental standards and improves decision-making. Companies adopting these systems often achieve better sustainability metrics and operational performance.

- For instance, Ranpak, a sustainable paper packaging and automation company, deployed over 142,700 packaging systems by the end of 2024, with more than 85,000 units being automated machines that accelerate box filling through AI-enabled computer vision to measure empty space and dispense paper fill optimally.

Increasing Use of Recyclable and Biodegradable Materials Driving Equipment Innovation

The shift from traditional plastic packaging to recyclable and biodegradable alternatives is reshaping machinery design requirements. Equipment manufacturers are developing systems capable of handling new materials without compromising speed or quality. The sustainable packaging equipment market is evolving to accommodate paper-based, compostable, and bio-plastic materials. It requires innovations in sealing, forming, and cutting technologies that preserve product integrity. These materials often have different structural properties, which demand precision handling. Manufacturers investing in such advanced equipment gain access to wider markets and meet rising sustainability expectations.

Collaborative Efforts Between Equipment Makers and Packaging Suppliers Strengthening the Value Chain

Strategic partnerships between machinery manufacturers and sustainable material suppliers are becoming more common. These collaborations aim to develop integrated solutions that improve packaging performance and environmental compliance. The sustainable packaging equipment market is experiencing growth through such partnerships, which accelerate product development and innovation. It allows faster adaptation to market needs and regulatory changes. Joint R&D efforts lead to equipment designs that align with specific material characteristics. This synergy improves the efficiency and market readiness of sustainable packaging solutions.

Market Challenges Analysis

High Initial Capital Investment and Limited Access for Small Manufacturers

Purchasing sustainable packaging equipment often requires significant upfront investment, which can deter small and medium-sized enterprises from adopting it. Many sustainable solutions involve advanced machinery that incorporates automation, precision controls, and compatibility with eco-friendly materials. The sustainable packaging equipment market faces constraints when smaller players struggle to access financing or justify return on investment. It creates a competitive imbalance, where only large corporations can afford state-of-the-art systems. This barrier slows market penetration and limits the broader transition toward sustainable packaging. Supportive policies or leasing models could help bridge this gap and drive adoption.

Technical Challenges in Handling Diverse Sustainable Materials

Eco-friendly packaging materials such as biodegradable plastics, paper-based laminates, and compostable films often require specialized handling. These materials can be more fragile, temperature-sensitive, or less uniform than conventional plastics. The sustainable packaging equipment market is challenged by the need to redesign existing systems to accommodate new material properties. It increases the complexity of machine calibration and maintenance. Operators must invest in training and adapt to stricter quality control standards. These operational difficulties can reduce production efficiency and increase costs, especially during the transition phase.

Market Opportunities

Expansion in Emerging Markets with Growing Sustainability Focus

Emerging economies are actively adopting sustainable practices driven by regulatory developments, urbanization, and shifting consumer behavior. Governments in Asia, Latin America, and Africa are introducing policies to reduce plastic use and encourage sustainable alternatives. The sustainable packaging equipment market holds strong potential in these regions, where industrial expansion and environmental awareness are growing in parallel. It creates a favorable landscape for manufacturers offering cost-effective, scalable solutions. Local producers seek machinery that aligns with global standards without requiring high capital expenditure. This demand opens opportunities for entry-level sustainable equipment tailored to regional production needs.

Innovation in Equipment Design to Support New Packaging Formats

The development of novel packaging formats such as refillable, returnable, or mono-material solutions presents a major opportunity for equipment manufacturers. These formats require machines with advanced adaptability and minimal environmental impact. The sustainable packaging equipment market benefits from the need to integrate automation, digital controls, and energy-efficient systems that suit non-traditional packaging. It enables companies to differentiate their offerings while complying with evolving standards. Equipment that supports lightweight and minimalist designs also appeals to brands seeking to reduce packaging waste. This area remains open for innovation and collaboration between material scientists and machinery developers.

Market Segmentation Analysis:

By Type:

The market is segmented into rigid and flexible packaging equipment types. Flexible packaging equipment holds a significant share due to its adaptability, reduced material usage, and lower environmental footprint. It supports various eco-friendly packaging solutions such as compostable films and recyclable laminates. The rigid segment also remains relevant, particularly in food and beverage applications where product protection and shelf stability are essential. The sustainable packaging equipment market benefits from the growing demand for machines capable of managing both formats to meet diverse production needs. Equipment that can handle hybrid systems is gaining preference across industries seeking greater flexibility.

- For instance, Bosch’s high-speed bar packaging line, integrating the Sigpack HRM flow wrapper and Sigpack TTM topload cartoner, achieved an overall output of more than 1,500 bars per minute, paired with up to 150 cartons per minute in secondary packaging.

By Material:

The market includes plastics, paper and paperboard, glass, and metal. Paper and paperboard dominate due to their recyclability and increasing acceptance among environmentally conscious consumers. Equipment manufacturers are designing systems specifically for paper-based packaging to support the transition from single-use plastics. The plastics segment still holds value, especially with the rise of bio-based and recyclable polymers. It drives the need for advanced machinery that minimizes waste during production. Glass and metal packaging applications continue in niche areas, requiring durable and high-precision equipment for safe handling. The sustainable packaging equipment market is evolving to serve these material categories with tailored technologies.

- For instance, Klockner Pentaplast reported that its SmartCycle® portfolio has recycled more than 11.6 billion plastic beverage bottles into high-quality PCR films designed to run on standard thermoforming and form-fill-seal equipment.

By Application:

Food and beverages represent the largest application segment due to high consumption volume and growing consumer demand for sustainable packaging. Equipment that ensures product safety while reducing packaging waste is in high demand within this sector. The personal care and cosmetics segment is also expanding, with brands shifting toward recyclable and refillable containers. It drives innovation in equipment capable of handling delicate packaging with premium design requirements. Healthcare applications require equipment that meets stringent safety and hygiene standards while supporting eco-friendly material use. The sustainable packaging equipment market caters to these varied needs through specialized machinery and sector-specific solutions.

Segments:

Based on Type:

Based on Material:

- Plastics

- Paper & Paperboard

- Glass

- Metal

Based on Application:

- Food & Beverages

- Personal Care & Cosmetics

- Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the sustainable packaging equipment market, accounting for approximately 28% of the global revenue in 2024. The region’s dominance is driven by strict environmental regulations, strong corporate sustainability mandates, and a mature industrial base. The United States leads with widespread adoption of eco-friendly packaging technologies across sectors such as food and beverage, healthcare, and personal care. Manufacturers in this region prioritize high-performance equipment that reduces material waste and energy usage. Growing awareness among consumers and pressure from regulatory bodies such as the Environmental Protection Agency (EPA) are pushing companies to modernize their packaging lines. Investments in smart, automated, and energy-efficient packaging systems continue to support regional market growth.

Europe

Europe represents the second-largest market, with a market share of around 26% in 2024. The European Union’s Green Deal and Circular Economy Action Plan are central to this growth, as they promote the reduction of single-use plastics and encourage circular packaging models. Countries such as Germany, France, and the Netherlands are at the forefront of this transition, supported by a well-established recycling infrastructure. The sustainable packaging equipment market in Europe is characterized by high demand for flexible machinery compatible with recyclable and biodegradable materials. Manufacturers in this region are developing integrated systems that ensure compliance with evolving regulations. Consumer demand for environmentally responsible products also influences packaging formats, prompting further innovation in equipment design.

Asia Pacific

Asia Pacific holds the largest share of the global market, contributing approximately 31% of the overall revenue in 2024. This region’s dominance stems from its large manufacturing base, rising environmental consciousness, and increasing adoption of automation in packaging operations. China, India, Japan, and South Korea are key contributors, driven by rapid urbanization, population growth, and government-led sustainability initiatives. The sustainable packaging equipment market in Asia Pacific benefits from both domestic demand and exports, with local manufacturers seeking affordable yet advanced machinery. Multinational corporations are also setting up production units in the region to meet localized sustainability goals. Investments in smart and modular packaging solutions are increasing, making Asia Pacific a hub for scalable, eco-friendly packaging technologies.

Latin America

Latin America accounts for roughly 8% of the global market. Brazil, Mexico, and Argentina are the leading contributors, supported by emerging regulatory frameworks and growing consumer demand for sustainable products. Companies in the region are beginning to invest in packaging automation and low-waste machinery to align with global standards. The sustainable packaging equipment market in Latin America is still developing but shows strong potential, especially in the food and beverage sector. Infrastructure limitations and high equipment costs remain challenges, but regional players are exploring strategic partnerships to improve access to advanced technologies.

Middle East & Africa (MEA)

The MEA region holds the smallest share, estimated at 7% of the global market. However, increasing focus on environmental conservation, waste reduction, and sustainable development goals is creating opportunities for growth. The UAE, South Africa, and Saudi Arabia are showing interest in eco-friendly packaging solutions, particularly in the healthcare and food sectors. The sustainable packaging equipment market in this region is gradually expanding, driven by investments in manufacturing and growing awareness of environmental impacts. Limited local production and high import dependence affect market dynamics, but targeted government policies and foreign investments may accelerate adoption in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dart Container Corporation

- Novolex Holdings, Inc.

- Huhtamaki Oyj.

- DS Smith Plc

- Duni AB

- WestRock LLC

- Sealed Air Corporation

- Pactiv LLC

- Detmold Group

- The Mondi Group plc

- Amcor Plc

- RKW Group

- Berry Global Inc.

- Stora Enso Oyj.

- International Paper Company

- Vegware Ltd.

Competitive Analysis

The sustainable packaging equipment market features strong competition among leading players such as Amcor Plc, Berry Global Inc., The Mondi Group plc, DS Smith Plc, Sealed Air Corporation, and WestRock LLC. These companies compete on innovation, technology integration, product quality, and global reach. They focus on developing machinery that supports recyclable, biodegradable, and compostable materials while maintaining high production efficiency. Product differentiation through energy-efficient systems and flexible packaging capabilities remains a key strategic priority. Players are investing in automation, smart controls, and material compatibility to meet the increasing demand for eco-friendly packaging across industries such as food and beverage, healthcare, and personal care. Mergers, acquisitions, and strategic partnerships with packaging suppliers and material scientists are helping expand their market presence and enhance R&D capabilities. Some firms are also strengthening their regional manufacturing bases to address evolving regulatory demands and improve supply chain agility. With rising pressure on sustainability compliance, these companies continue to enhance after-sales services and offer modular, scalable solutions tailored to diverse operational requirements. The competitive landscape is dynamic, marked by technological advancement and a growing focus on sustainability-driven innovation. Players that align machinery performance with environmental regulations are better positioned to lead market growth.

Recent Developments

- In May 2025, Dart received recognition for sustainable packaging products. Their molded fiber products were certified as home compostable by TÜV Austria. Additionally, their new clear microwaveable hinged containers, square plastic bowls, and clear polypropylene cups were awarded the Design® for Recyclability recognition by the Association of Plastic Recyclers (APR) in the US.

- In September 2024, Dart Container announced a strategic partnership with PulPac to install the first Dry Molded Fiber production line in North America using PulPac’s technology. This dry molding process reduces water and energy use, lowers CO2 footprint by up to 80%, and is faster than traditional fiber forming. This aligns with Dart’s commitment to innovation and sustainability in packaging manufacturing.

- In August 2024, Pactiv Evergreen launched Recycleware Reduced-Density Polypropylene (RDPP) meat trays designed as lightweight, recyclable alternatives to traditional foam polystyrene trays. These trays were recognized by the Association of Plastic Recyclers (APR) for recyclability, reinforcing Pactiv’s commitment to sustainable packaging innovation.

Market Concentration & Characteristics

The sustainable packaging equipment market shows a moderately concentrated structure, with a mix of global leaders and regional players competing on innovation, technology, and sustainability. Large companies dominate due to their financial capacity, advanced R&D, and ability to serve multinational clients with scalable solutions. It features high entry barriers driven by capital-intensive machinery, regulatory compliance, and evolving material requirements. The market is characterized by rapid technological advancement, growing demand for automation, and a shift toward eco-friendly materials. Customization, energy efficiency, and flexibility in handling various packaging formats are key competitive factors. It continues to evolve as sustainability regulations tighten and end-user industries seek reliable, low-waste packaging solutions. The presence of established global brands alongside emerging regional manufacturers creates a dynamic landscape where partnerships, acquisitions, and innovation play central roles in gaining market share.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for machinery compatible with recyclable, biodegradable, and compostable materials.

- Equipment manufacturers will focus on automation and smart technology integration to enhance efficiency and reduce waste.

- Small and medium-sized enterprises are expected to adopt sustainable packaging systems through leasing models and financing support.

- Modular and customizable equipment will gain popularity for their adaptability across different packaging formats and industries.

- The food and beverage sector will continue to drive high demand for eco-friendly packaging solutions and advanced equipment.

- Emerging markets in Asia, Latin America, and Africa will create new growth opportunities due to regulatory reforms and industrial expansion.

- Partnerships between equipment manufacturers and material suppliers will strengthen innovation in sustainable packaging technologies.

- Digital tools such as IoT and AI will be increasingly integrated for predictive maintenance and real-time performance monitoring.

- Regulations in developed economies will become stricter, compelling industries to invest in sustainable packaging infrastructure.

- The competitive landscape will intensify as more players enter the market with cost-effective, environmentally focused machinery solutions.