Market Overview

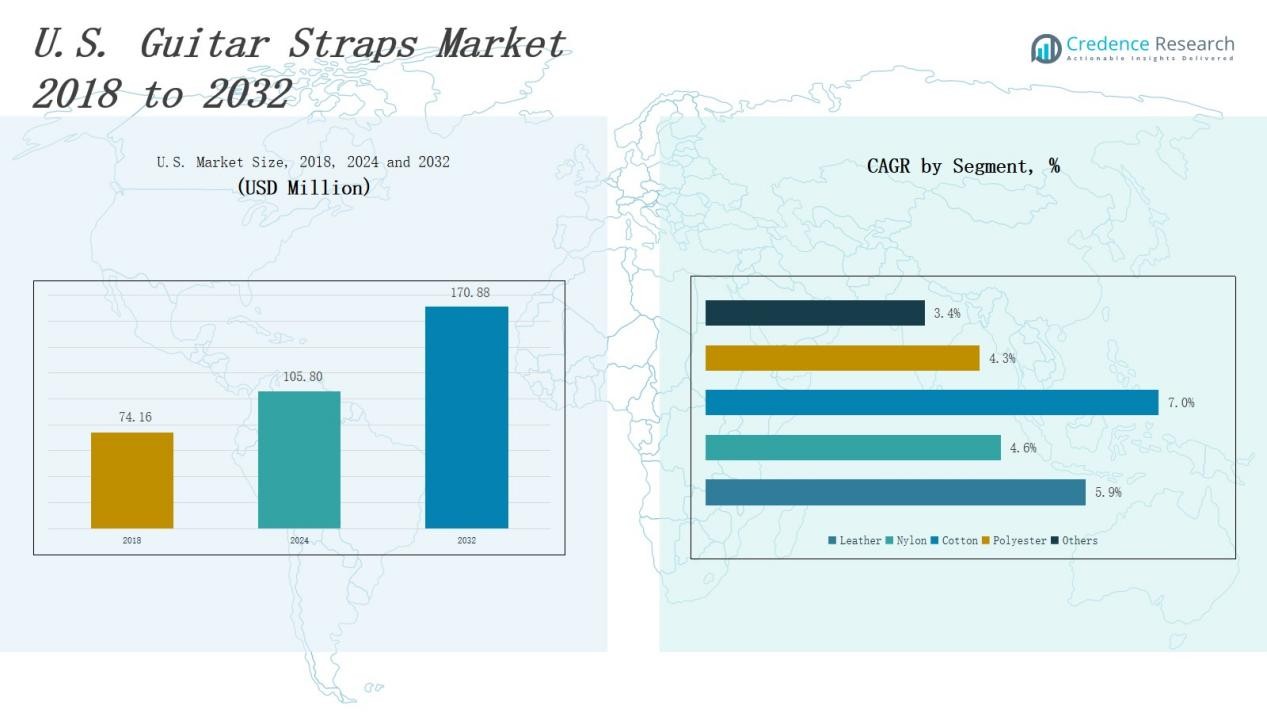

U.S. Guitar Straps Market size was valued at USD 74.16 million in 2018 to USD 105.80 million in 2024 and is anticipated to reach USD 170.88 million by 2032, at a CAGR of 6.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Guitar Straps Market Size 2024 |

USD 105.80 Million |

| U.S. Guitar Straps Market, CAGR |

6.18% |

| U.S. Guitar Straps Market Size 2032 |

USD 170.88 Million |

The U.S. Guitar Straps Market is driven by prominent players such as Dunlop Manufacturing, Kyser Musical Products, Shubb Capos, Paige, Fender, SpiderCapo, Alice, D’Andrea, Creative Tunings, and Jim Dunlop (USA Branch), who maintain strong competitive positions through product innovation, quality craftsmanship, and diversified distribution networks. These companies cater to a wide spectrum of guitarists, from professionals to hobbyists, leveraging both traditional materials like leather and modern synthetics such as nylon and polyester to meet varying consumer preferences. The market is geographically concentrated, with the United States leading as the dominant region, capturing 68.4% of the total share, supported by its robust music industry, high consumer spending on musical accessories, and well-established retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Market valued at USD 105.80 million in 2024, projected to reach USD 170.88 million by 2032 at 6.18% CAGR, driven by major brands and diverse materials.

- Growing music interest and live events boost demand for premium, comfortable, and stylish straps.

- Innovation and customization, including eco-friendly materials and artist-endorsed designs, attract wide consumer base.

- E-commerce growth and omni-channel retail expand accessibility, exclusive launches, and virtual try-ons.

- South leads with 36% share, followed by West (25%), Northeast (21%), and Midwest (18%), each with distinct preferences.

Market Segment Insights

By Type

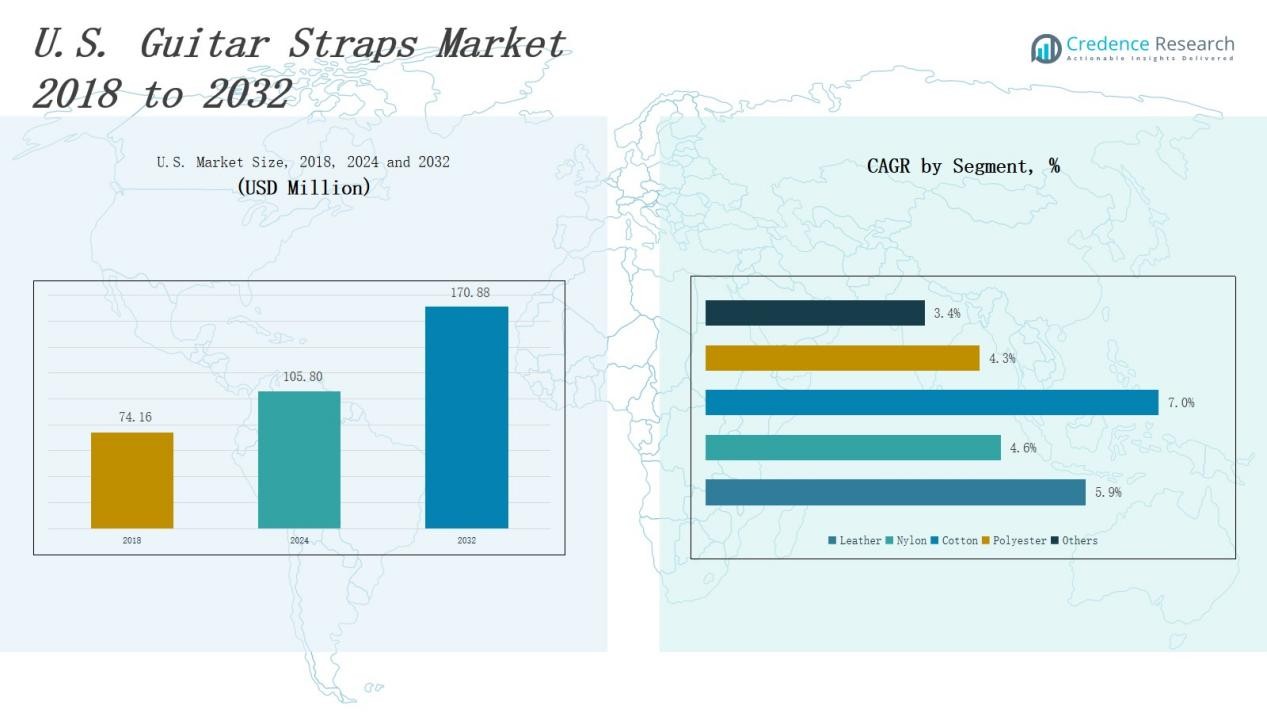

The U.S. Guitar Straps Market is segmented into Leather, Nylon, Cotton, Polyester, and Others. Leather straps emerge as the dominant sub-segment, driven by their premium quality, long-lasting durability, and strong appeal among professional musicians who value comfort and visual aesthetics. Their popularity is further boosted by brand-led customization options, artisanal craftsmanship, and the rising trend of vintage-inspired accessories across both retail and online channels. Nylon and polyester straps also hold notable positions due to their affordability, lightweight nature, and suitability for beginners and casual players.

For instance, Levy’s Leathers, a brand dating back to 1973, produces high-quality leather guitar straps combining comfort with distinctive fashion, sold worldwide to musicians who appreciate both legacy and craftsmanship.

By Application

The market is categorized into Acoustic, Electric, Classical, Bass, and Others. The electric guitar segment stands out as the leading sub-segment, supported by its widespread use in popular music genres and consistent adoption by professional performers. Growth in this segment is driven by high replacement demand, the introduction of ergonomic designs, and a broad range of materials catering to diverse playing preferences. Acoustic and bass guitar applications also contribute significantly, fueled by expanding live performance opportunities, increased participation in music education, and sustained interest from hobbyists.

For instance, Yamaha’s acoustic and bass guitar lines have seen growth from rising music education enrollment and more live performances worldwide.

Key Growth Drivers

Rising Popularity of Music and Live Performances

The growing interest in music as both a profession and hobby is driving consistent demand for guitar straps in the U.S. Musicians across genres increasingly invest in high-quality, comfortable, and aesthetically appealing straps for stage performances and studio sessions. The revival of live concerts, music festivals, and local gigs further supports replacement and upgrade purchases. This trend is strengthened by the influence of social media platforms, where artists showcase their gear, inspiring enthusiasts and beginners to emulate their style and invest in premium strap options.

For instance, Gibson reported growing demand for premium leather guitar straps alongside its guitars in 2024, driven by the revival of concerts and festivals.

Product Innovation and Customization Demand

Manufacturers are increasingly focusing on product innovation, introducing straps with ergonomic designs, eco-friendly materials, and enhanced adjustability to meet diverse consumer needs. Customization, including personalized prints, artist-endorsed designs, and vintage-inspired themes, has become a key differentiator in the market. These innovations cater to both functional requirements and style preferences, enabling brands to appeal to a broad consumer base. The rising trend of gifting customized straps also contributes to sales growth, particularly during seasonal promotions and music-related events.

For instance, VELCRO® Brand offers customized straps with a variety of shapes, colors, and fastening options to meet specific industry needs, including military-grade color customization and medical-grade softness levels.

Expansion of E-commerce and Omni-channel Retail

The growth of e-commerce platforms and omni-channel retail strategies has expanded accessibility to a wide variety of guitar straps in the U.S. Consumers now benefit from an extensive product range, competitive pricing, and customer reviews that aid purchasing decisions. Leading brands are leveraging online channels for exclusive launches, limited editions, and artist collaborations, boosting brand visibility. Additionally, the integration of augmented reality for virtual try-ons and targeted advertising enhances online engagement, converting browsing into purchases and driving overall market expansion.

Key Trends & Opportunities

Sustainability and Eco-friendly Materials

There is a notable shift toward sustainable production practices in the U.S. Guitar Straps Market, with brands introducing eco-friendly materials such as recycled fabrics, plant-based leather alternatives, and organic cotton. This trend is driven by growing consumer awareness of environmental impacts and a preference for ethically sourced products. Companies adopting sustainable manufacturing not only meet regulatory and consumer expectations but also gain a competitive advantage by aligning with the values of environmentally conscious musicians, thereby opening opportunities in premium and niche market segments.

For instance, D’Addario offers Eco Guitar Straps crafted from 90% recycled Repreve® fiber combined with eco-leather ends, colored using a waterless dye system to reduce environmental impact.

Collaborations and Artist-Endorsed Collections

Partnerships between strap manufacturers and popular musicians are creating strong brand visibility and driving consumer interest. Artist-endorsed collections combine functionality with unique aesthetics that appeal to fans and professional players alike. These collaborations often feature limited-edition designs, premium materials, and special packaging, enhancing perceived value. The trend also offers marketing leverage through promotional events, social media campaigns, and music videos, helping brands connect with target audiences more effectively and stimulating demand across multiple retail channels.

For instance, Moody Straps has partnered with renowned artists like Richie Kotzen and Mike Dirnt from Green Day, offering guitar straps made of high-quality genuine leather and suede that are praised for durability and comfort.

Key Challenges

Price Sensitivity in Entry-level Segments

While premium guitar straps attract professional players, a significant portion of the market consists of beginners and hobbyists who remain highly price-sensitive. This limits the adoption of high-end designs and materials in the entry-level segment. Manufacturers face the challenge of balancing cost efficiency with product quality to remain competitive. Aggressive pricing from low-cost imports further intensifies competition, often forcing established brands to adjust pricing strategies or introduce budget-friendly product lines without compromising brand image.

Intense Market Competition and Brand Differentiation

The U.S. Guitar Straps Market is highly fragmented, with numerous domestic and international players competing on price, design, and distribution reach. Differentiating products in such a crowded space requires continuous innovation, marketing investment, and strategic partnerships. Smaller brands often struggle to gain visibility against established names with strong artist endorsements and global reach. Maintaining market share demands consistent product updates, unique value propositions, and effective positioning to avoid being overshadowed by aggressive competitors.

Supply Chain Disruptions and Material Availability

Fluctuations in the availability and cost of raw materials such as leather, cotton, and synthetic fabrics can disrupt production and increase operational expenses. Global supply chain disruptions, including shipping delays and geopolitical uncertainties, further impact timely product availability in the U.S. market. Manufacturers must navigate these challenges by diversifying suppliers, adopting local sourcing strategies, or maintaining higher inventory levels, which can increase costs but ensure consistent supply to meet consumer demand.

Regional Analysis

Northeast

The Northeast holds 21% of the U.S. Guitar Straps Market, supported by a vibrant music culture and a strong concentration of professional musicians. It benefits from a dense network of specialty music stores and active participation in live music events across cities such as New York, Boston, and Philadelphia. The region’s consumer base shows high interest in premium leather and custom-designed straps, driven by fashion-conscious buyers and brand loyalty. Growth is reinforced by music education programs and a thriving independent artist community. E-commerce adoption is strong, allowing consumers to access a broad range of domestic and imported products. It remains a competitive space for both established and emerging strap manufacturers.

Midwest

The Midwest accounts for 18% of the U.S. Guitar Straps Market, anchored by a mix of urban music hubs and rural areas with strong community-based music scenes. It is characterized by demand for durable, affordable straps catering to both amateur and professional musicians. Local festivals and regional tours contribute to steady product turnover, especially for acoustic and electric guitar users. Large retail chains and online platforms dominate distribution, making competitive pricing a key success factor. Leather and nylon remain popular due to their versatility and availability. It continues to attract manufacturers seeking to tap into a cost-conscious yet loyal customer base.

South

The South commands 36% of the U.S. Guitar Straps Market, making it the largest regional segment. Its dominance is driven by a rich heritage of country, blues, and rock music, which sustains high demand for stylish and functional straps. The presence of major music cities such as Nashville and Austin fuels sales through both professional and amateur channels. Customization and artist-endorsed products see strong acceptance, reflecting a deep connection between musicians and regional culture. The retail landscape is a mix of independent stores and large chain outlets, complemented by active online sales. It remains the focal point for product launches and brand promotions targeting passionate guitar players.

West

The West holds 25% of the U.S. Guitar Straps Market, supported by a dynamic mix of entertainment industries and tech-driven retail channels. It benefits from a strong concentration of music production hubs in California and an active gig culture in states like Washington and Oregon. Consumers here show a preference for innovative designs, sustainable materials, and high-performance strap features. The region’s high disposable incomes contribute to demand for premium and limited-edition products. Distribution is dominated by both large online marketplaces and specialty music retailers with strong brand partnerships. It continues to set trends that influence strap designs nationwide.

Market Segmentations:

By Type

- Leather

- Nylon

- Cotton

- Polyester

- Others

By Application

- Acoustic

- Electric

- Classical

- Bass

- Others

By Region

- NorthEast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Guitar Straps Market is characterized by the presence of established domestic brands and emerging niche players competing on product quality, design innovation, and distribution reach. Leading companies such as Dunlop Manufacturing, Kyser Musical Products, Shubb Capos, Paige, Fender, SpiderCapo, Alice, D’Andrea, Creative Tunings, and Jim Dunlop (USA Branch) maintain strong market positions through diverse product portfolios that cater to both professional musicians and hobbyists. Competition is intensified by the availability of a wide range of materials, from premium leather to cost-effective synthetics, enabling brands to target multiple price segments. Strategic initiatives, including artist endorsements, limited-edition releases, and collaborations, are common approaches to enhance brand visibility and loyalty. E-commerce platforms play a pivotal role in broadening reach and enabling direct consumer engagement. The market’s fragmentation encourages continuous innovation and differentiation, making brand identity, quality craftsmanship, and customer experience critical success factors for sustaining growth.

Key Players

- Dunlop Manufacturing

- Kyser Musical Products

- Shubb Capos

- Paige

- Fender

- SpiderCapo

- Alice

- D’Andrea

- Creative Tunings

- Jim Dunlop (USA Branch)

Recent Developments

- In July 2025, Fender launched its seventh annual Fender Next artist development program, showcasing emerging guitar talent worldwide and reinforcing its role in the broader guitar accessories market, including straps.

- In January 2025, Rainbow Musical Instruments Limited introduced a new embroidered guitar strap in the U.S. market, featuring adjustable buckles, handcrafted embroidery, and a blend of soft fabrics with leather ends for enhanced comfort and style.

- In April 2025, Fairfield Guitar Co. introduced the Angela Petrilli Signature Strap in the U.S. market a deluxe, hand-cut 4-inch wide leather strap with a cracked-leather front, turquoise triple stitching, suede backing for slip resistance, and silver-foil imprints of the Fairfield logo and Angela’s name, fully made in the USA and adjustable from 45” to 54”.

Market Concentration & Characteristics

The U.S. Guitar Straps Market exhibits a moderately fragmented structure, with a mix of well-established brands and smaller niche manufacturers competing across diverse price and quality segments. It features a broad product range, from premium leather and custom designs aimed at professional musicians to affordable nylon and polyester options for entry-level users. Market players leverage both traditional retail and rapidly expanding e-commerce channels to reach a wide audience. It is characterized by frequent product innovation, artist collaborations, and an emphasis on design aesthetics alongside functionality. Demand is influenced by cultural music trends, live performance activity, and growing interest in personalized accessories. Competition is shaped by brand reputation, material quality, pricing strategies, and distribution networks, requiring consistent investment in marketing and product differentiation to maintain relevance in a dynamic marketplace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and custom-designed guitar straps will continue to grow, driven by professional musicians and collectors.

- Sustainable and eco-friendly materials will gain wider adoption as consumer awareness of environmental impact increases.

- E-commerce will strengthen its position as the primary sales channel, supported by virtual try-on features and targeted marketing.

- Artist collaborations and limited-edition releases will remain a key strategy for brand differentiation.

- Technological innovations, including ergonomic designs and enhanced adjustability, will improve user comfort and functionality.

- Music education programs and rising participation in amateur music will boost entry-level strap sales.

- Regional music festivals and live events will stimulate higher replacement demand and brand exposure.

- Direct-to-consumer strategies will expand, enabling brands to build stronger customer relationships.

- Import competition will push domestic players to focus on quality, branding, and innovation.

- Personalization options will become a major selling point, appealing to diverse style preferences.