Market Overview

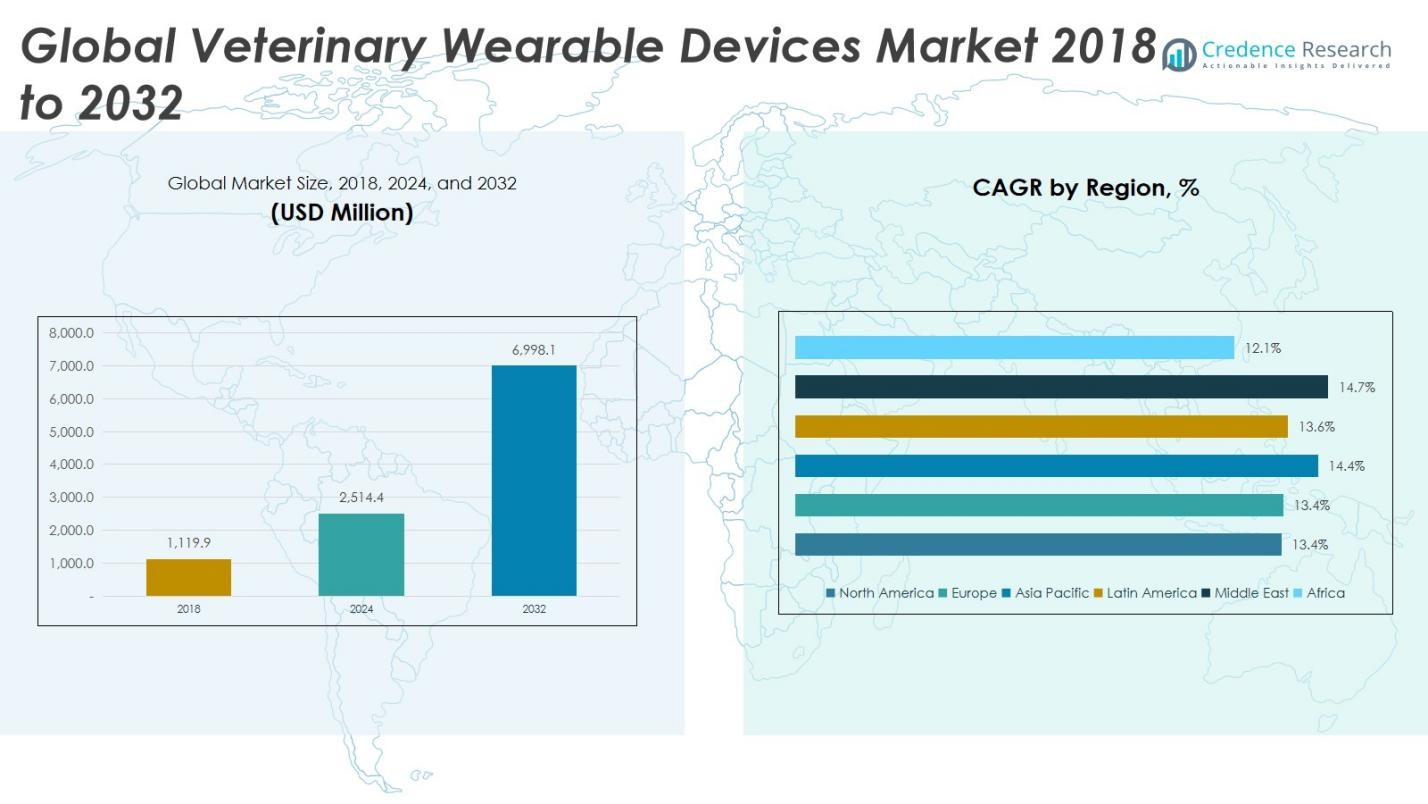

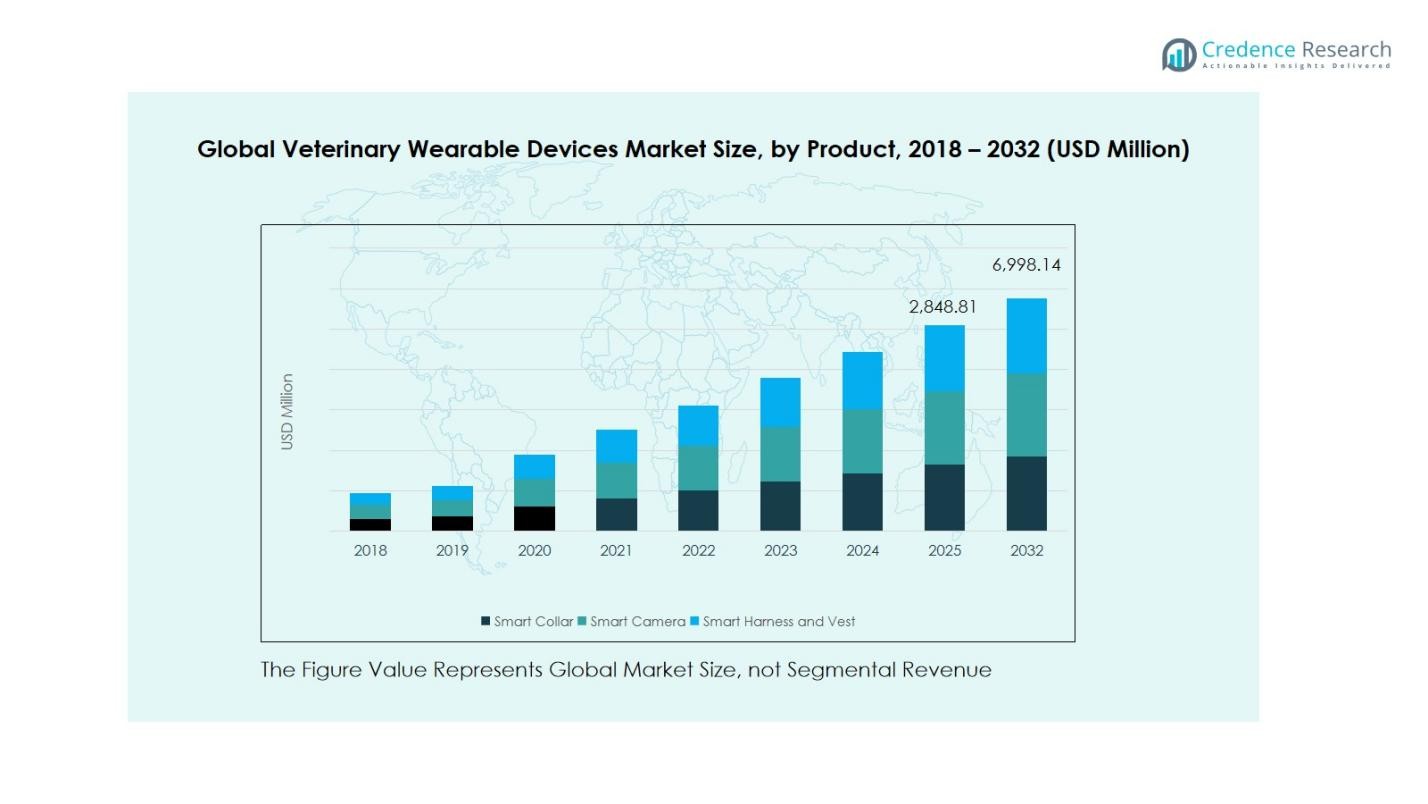

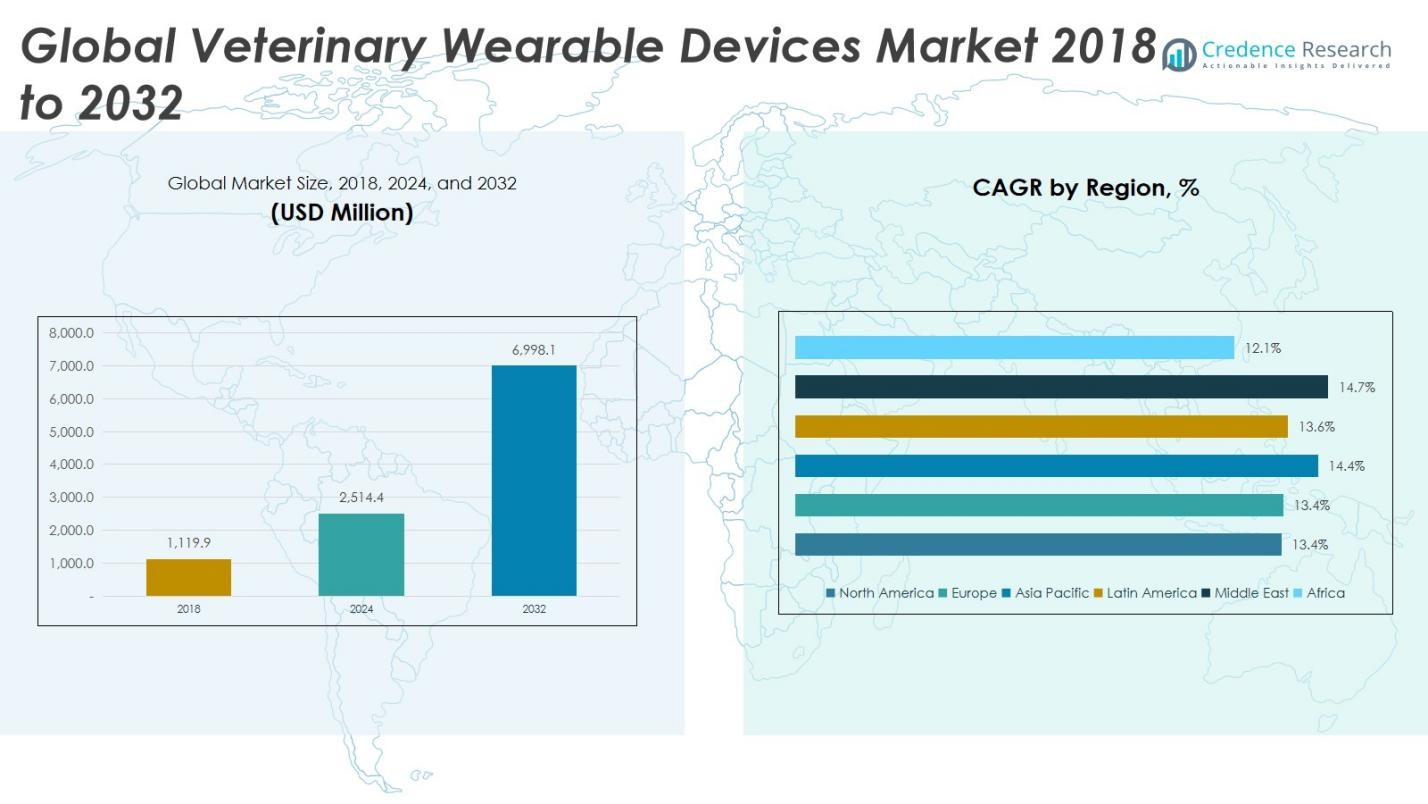

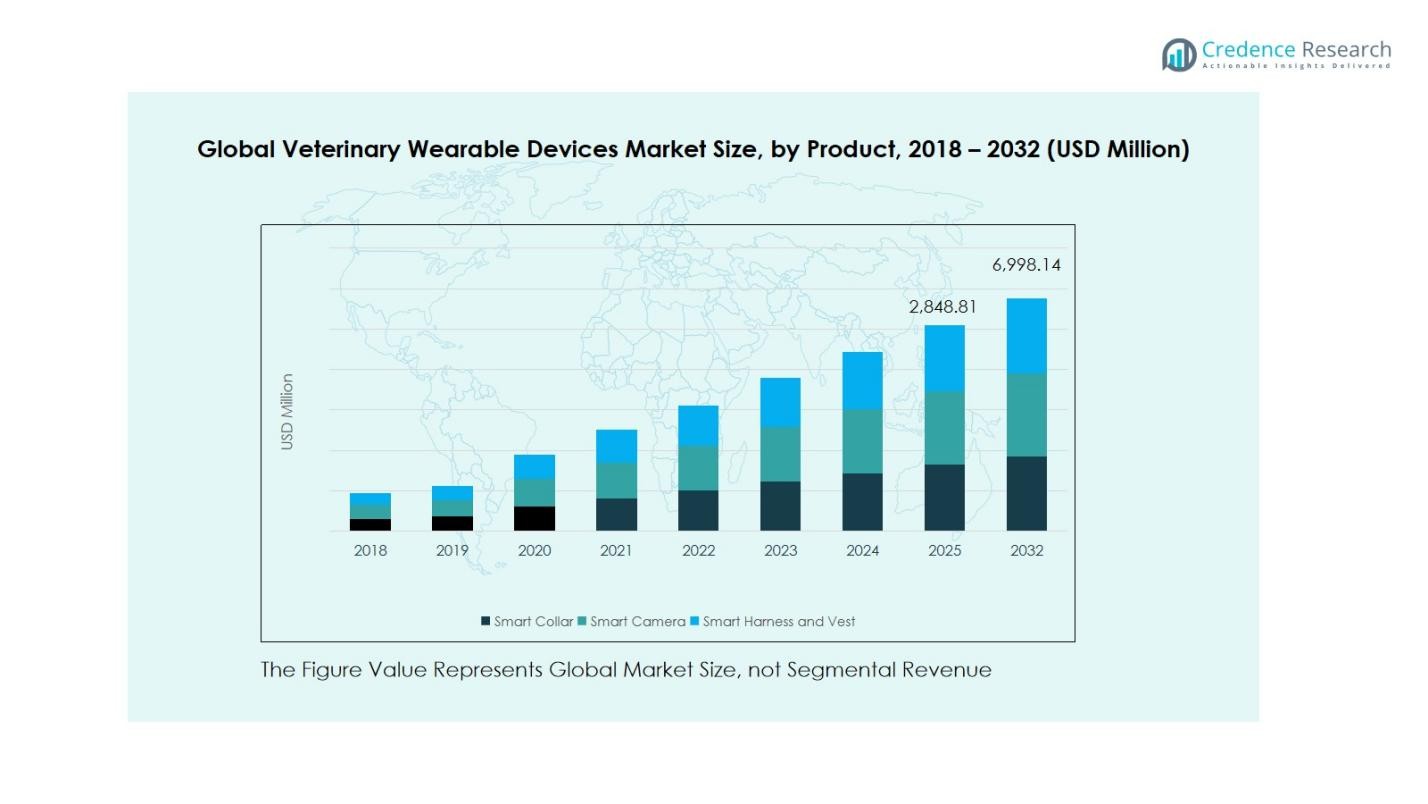

The Global Veterinary Wearable Devices Market size was valued at USD 1,119.9 million in 2018 and increased to USD 2,514.4 million in 2024. It is anticipated to reach USD 6,998.1 million by 2032, growing at a CAGR of 13.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Wearable Devices Market Size 2024 |

USD 2,514.4 Million |

| Veterinary Wearable Devices Market, CAGR |

13.70% |

| Veterinary Wearable Devices Market Size 2032 |

USD 6,998.1 Million |

The Global Veterinary Wearable Devices Market is highly competitive, with major players such as Avid Identification Systems, Barking Labs, Datamars, Felcana, FitBark Service, Garmin Ltd., Mars Incorporated, Inovotec Animal Care, and Lamdagen Corporation leading innovation and market expansion. These companies focus on developing advanced monitoring devices integrated with GPS, RFID, and sensor technologies to enhance animal health tracking and diagnostics. North America dominates the market with a 35.8% share in 2024, driven by high pet ownership rates, technological adoption, and strong veterinary infrastructure. Europe follows with a 28.2% share, supported by growing awareness of animal welfare and preventive healthcare. Both regions continue to invest heavily in connected animal health solutions, strengthening their global leadership positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Veterinary Wearable Devices Market reached USD 2.5 billion in 2024 and is projected to grow at a CAGR of 13.9% from 2024 to 2032, driven by increasing pet healthcare awareness and technological integration across veterinary applications.

- Rising demand for real-time animal monitoring, preventive healthcare, and early disease detection continues to fuel market expansion, especially in the companion animal segment, which holds over 55% of the market share.

- Market trends highlight rapid adoption of smart collars and sensor-based systems for behavior monitoring and medical diagnostics, supported by AI and IoT advancements.

- The competitive landscape features key players such as Avid Identification Systems, Garmin Ltd., Datamars, and Mars Incorporated, focusing on R&D and product innovation to enhance animal health management solutions.

- Regionally, North America leads with 35.8%, followed by Europe at 28.2% and Asia Pacific at 23.6%, driven by rising pet ownership and advanced veterinary infrastructure.

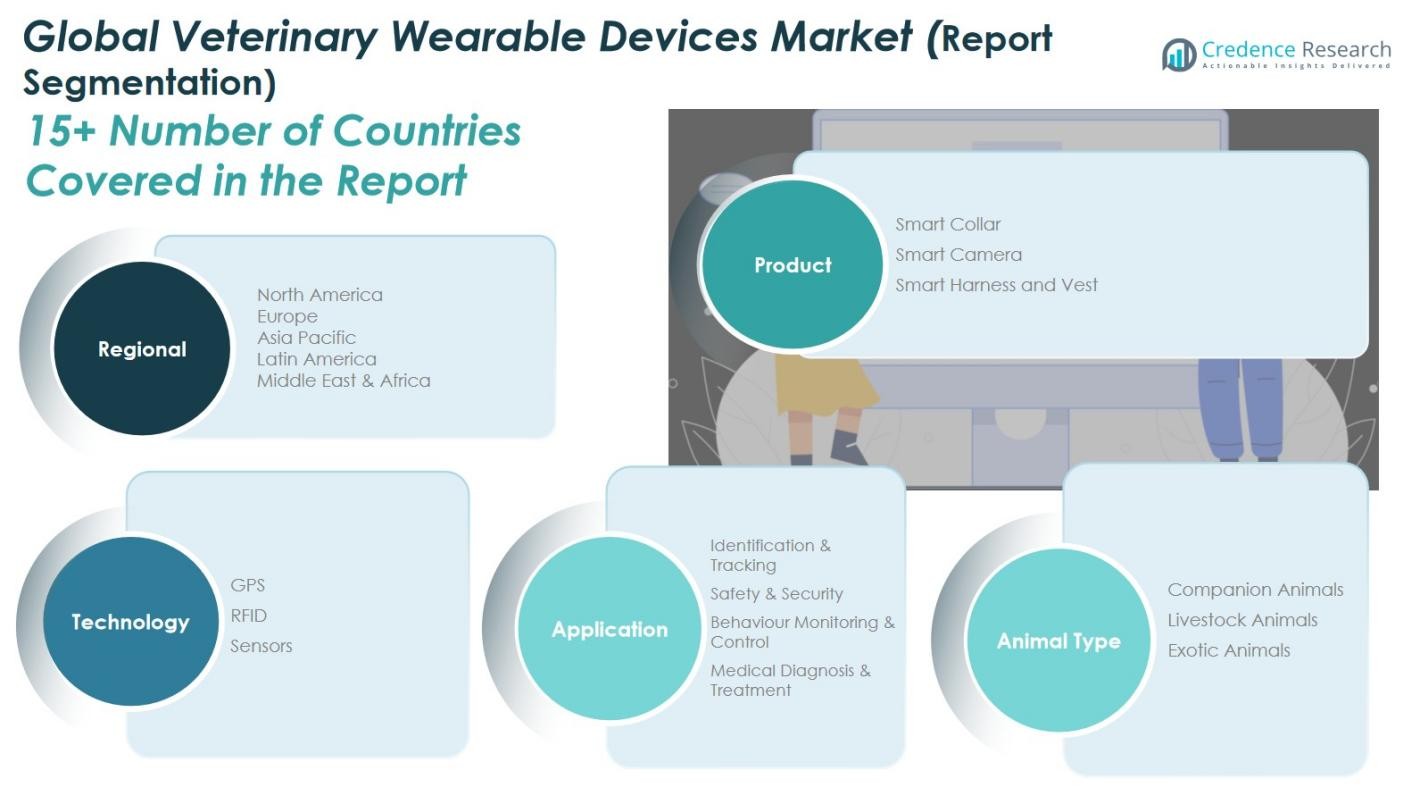

Market Segmentation Analysis:

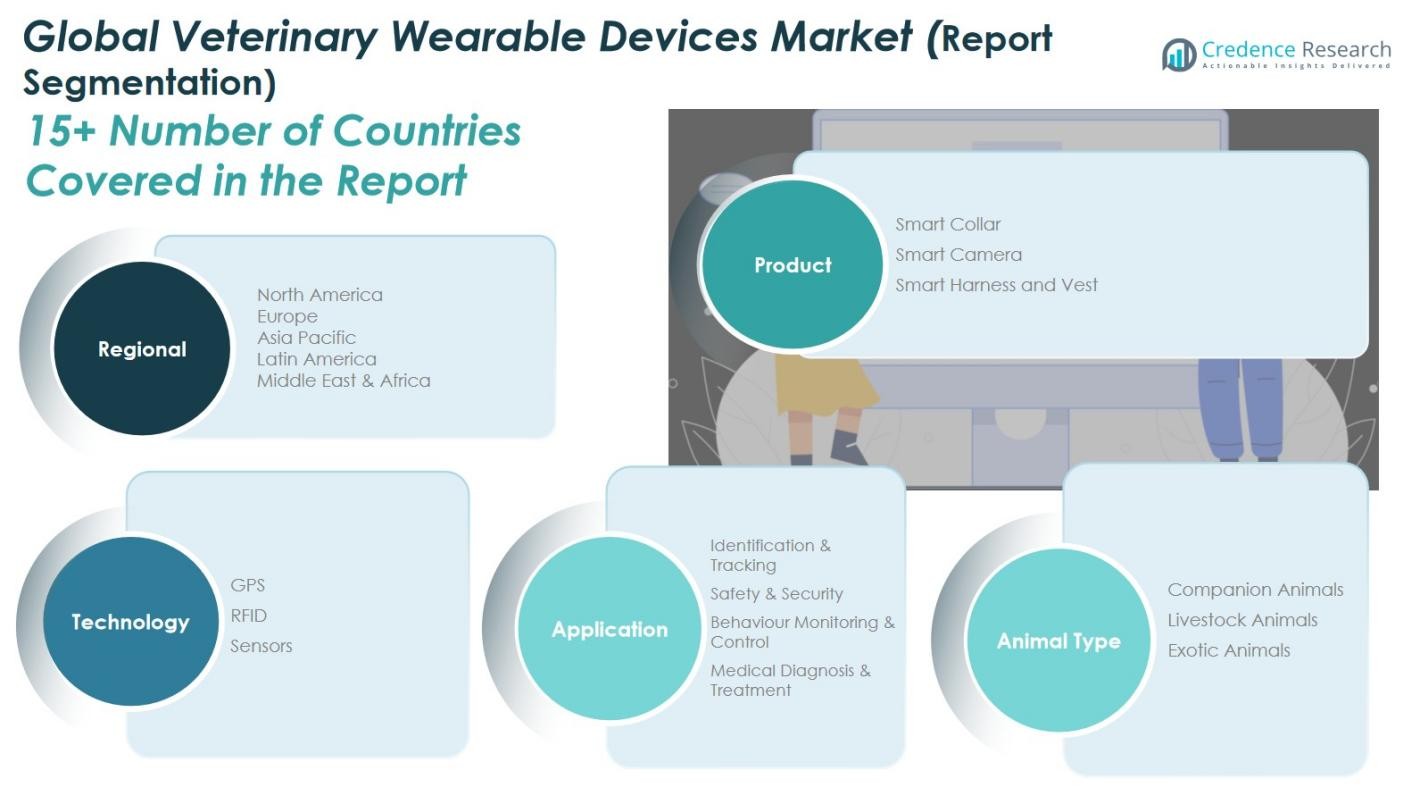

By Product:

The global veterinary wearable devices market by product is dominated by the smart collar segment, which accounted for over 48% of the total market share in 2024. Smart collars are widely adopted due to their multifunctional use in tracking, health monitoring, and behavioral analysis of pets and livestock. Their integration with GPS and sensor technologies enhances real-time monitoring capabilities, driving their demand among pet owners and veterinarians. The smart harness and vest segment is growing steadily, supported by applications in medical diagnostics and livestock health management, while smart cameras show rising adoption for remote pet surveillance.

For instance, PetPace’s smart collar collects continuous data on temperature, pulse, and respiration rates in dogs and cats, generating automated wellness alerts for veterinarians.

By Technology:

Within the technology segment, the GPS-based veterinary wearable devices hold the largest market share of around 44% in 2024, owing to their accuracy in animal tracking and movement analytics. The technology is highly favored for livestock and companion animal management, enabling owners to monitor location, activity, and safety in real time. RFID systems follow closely, driven by use in identification and bio-data tagging for large herds, while sensors continue to expand at a robust pace due to their growing role in monitoring physiological parameters such as temperature, pulse, and stress indicators.

For instance, Tractive GmbH produces lightweight GPS collars with virtual fencing and activity tracking, helping pet owners monitor health and location simultaneously.

By Application:

The identification and tracking segment leads the global veterinary wearable devices market, representing approximately 40% of total market share in 2024. This dominance is driven by the increasing demand for livestock management systems, pet safety solutions, and anti-theft technologies. Growing awareness about animal welfare and disease prevention supports further integration of GPS and RFID tools for continuous tracking. Behaviour monitoring and control and medical diagnosis and treatment applications are gaining momentum, reflecting the rise in pet healthcare investments and the adoption of advanced monitoring systems for early disease detection and preventive care.

Key Growth Drivers

Rising Pet Ownership and Humanization of Animals

The increasing global pet population and the growing trend of pet humanization are major drivers of the veterinary wearable devices market. Pet owners are investing more in animal health and wellness, leading to the adoption of smart monitoring devices that track activity, location, and vital signs. The emotional connection between owners and their pets has fueled demand for preventive healthcare technologies, thereby accelerating the integration of wearable devices in both home and clinical settings. This shift is strongly influencing product innovation and market expansion worldwide.

Advancements in Sensor and IoT Technology

Continuous technological progress in sensors, wireless connectivity, and IoT integration is transforming veterinary care. Modern wearable devices equipped with advanced biosensors can monitor physiological and behavioral data in real time, enabling early diagnosis and preventive treatment. These devices also support data sharing with veterinarians for better clinical decisions. The convergence of AI-driven analytics and cloud platforms further enhances accuracy and functionality, driving the development of smarter and more efficient veterinary wearables for both companion and livestock animals.

For instance, large industry players like Tata Consultancy Services (TCS) are leveraging cloud and AI/ML technologies to enhance healthcare innovations, including veterinary applications.

Growing Focus on Livestock Health and Productivity

The livestock industry increasingly relies on wearable technology to optimize animal health, breeding, and productivity. Farmers and agritech companies are adopting GPS and RFID-based systems to monitor herd movement, feeding patterns, and disease outbreaks. This data-driven approach supports sustainable farming practices and reduces economic losses due to animal illness. As global demand for meat and dairy products rises, wearable solutions that improve herd management and biosecurity are gaining traction, positioning livestock monitoring as a vital growth driver in the market.

For instance, smart ear tags equipped with temperature and activity sensors are used to monitor cattle health indicators such as body temperature and movement patterns, enabling early disease detection and improved welfare.

Key Trends and Opportunities

Integration of AI and Predictive Analytics

The adoption of artificial intelligence and predictive analytics is emerging as a key trend in the veterinary wearable devices market. AI algorithms analyze large volumes of animal health data collected from wearable sensors, providing early warnings for diseases and behavioral abnormalities. This predictive capability enhances veterinary diagnostics, reduces treatment costs, and supports personalized care plans. The integration of AI also enables automation in data interpretation, creating new opportunities for companies to develop intelligent, connected, and data-driven veterinary health management systems.

For instance, SignalPET, used in over 2,300 veterinary clinics worldwide, utilizes AI to analyze companion-animal X-rays instantly and generate reports on more than 50 radiographic findings, aiding rapid diagnostics.

Rising Demand for Preventive Healthcare Solutions

Preventive healthcare is gaining prominence as pet owners and livestock managers seek to minimize medical emergencies and costs. Veterinary wearables that continuously track heart rate, temperature, and activity enable proactive health management and early intervention. The growing awareness of zoonotic diseases and animal welfare regulations has increased adoption in both developed and emerging markets. This trend presents an opportunity for manufacturers to expand product portfolios with multifunctional and user-friendly devices that cater to preventive and real-time animal health monitoring.

For instance, FitBark’s smart collars integrate with health platforms to monitor sleep, calorie expenditure, and overall wellbeing for pets.

Key Challenges

High Cost and Limited Accessibility

The high cost of advanced veterinary wearable devices remains a significant barrier, particularly in price-sensitive markets. The integration of sophisticated sensors, GPS modules, and connectivity features increases production costs, making devices less affordable for small-scale farmers and average pet owners. Limited access to these technologies in developing regions also constrains market penetration. Addressing affordability through scalable manufacturing, low-cost components, and subscription-based models will be crucial to expanding global adoption and ensuring market inclusivity.

Data Accuracy and Connectivity Limitations

Ensuring reliable data accuracy and uninterrupted connectivity continues to challenge the veterinary wearable devices market. Environmental conditions, signal disruptions, and device calibration issues can affect performance, especially in rural or agricultural settings. Inaccurate readings may lead to misdiagnosis or ineffective health monitoring, undermining user confidence. Overcoming these limitations requires investment in robust sensor technologies, improved network infrastructure, and secure data management systems to enhance reliability and build trust among veterinarians and end-users.

Regional Analysis

North America

North America dominated the global veterinary wearable devices market with a share of 35.8% in 2024, valued at USD 899.29 million, and is projected to reach USD 2,449.35 million by 2032, growing at a CAGR of 13.4%. The market was valued at USD 406.96 million in 2018. Growth is driven by the strong presence of leading industry players, high pet ownership rates, and rapid adoption of advanced pet health monitoring solutions. Technological innovation, coupled with increased spending on animal welfare and healthcare infrastructure, continues to strengthen the region’s leadership position in the global market.

Europe

Europe held a significant 28.2% market share in 2024, reaching USD 708.52 million, and is expected to attain USD 1,936.39 million by 2032, expanding at a CAGR of 13.0% from USD 319.83 million in 2018. The region benefits from well-established veterinary services, growing awareness of animal health, and supportive government initiatives promoting pet care technology. Countries such as Germany, the UK, and France are key contributors due to their advanced veterinary networks and strong demand for preventive healthcare and wearable monitoring solutions across both companion and livestock animals.

Asia Pacific

The Asia Pacific market is emerging as the fastest-growing region, expanding at a CAGR of 14.4% from USD 243.91 million in 2018 to USD 569.19 million in 2024, and projected to reach USD 1,664.16 million by 2032. The region accounted for 22.6% of the global market share in 2024. Rapid urbanization, rising disposable incomes, and increasing pet adoption in China, Japan, and India are fueling demand for smart pet monitoring devices. The expansion of veterinary healthcare infrastructure and growing awareness of livestock productivity enhancement further accelerate market growth across emerging economies.

Latin America

Latin America represented 7.3% of the global market share in 2024, valued at USD 182.87 million, and is forecasted to reach USD 504.57 million by 2032, registering a CAGR of 13.6% from USD 81.97 million in 2018. The region’s market growth is driven by improving veterinary services, increasing livestock farming modernization, and the gradual adoption of pet health monitoring devices. Brazil and Argentina lead in regional adoption due to expanding agricultural technology investments and rising awareness regarding animal welfare. Growing urbanization and digital connectivity also contribute to the market’s long-term expansion potential.

Middle East

The Middle East veterinary wearable devices market was valued at USD 50.39 million in 2018 and reached USD 119.61 million in 2024, with expectations to achieve USD 356.91 million by 2032 at a CAGR of 14.7%. The region accounted for 4.7% of the global market share in 2024. Market expansion is supported by rising adoption of smart livestock management tools in GCC countries and increasing investments in precision farming. The growing demand for pet monitoring devices in urban households and advancements in animal tracking technologies are strengthening the regional market outlook.

Africa

Africa held a 1.4% market share in 2024, with the market valued at USD 34.91 million, expected to reach USD 86.78 million by 2032, growing at a CAGR of 12.1% from USD 16.80 million in 2018. Growth in this region is primarily driven by expanding livestock sectors, improving veterinary awareness, and gradual technological adoption in animal health management. Countries such as South Africa and Egypt are showing early adoption trends, supported by government-led initiatives for livestock monitoring and disease control. However, limited infrastructure and affordability challenges still constrain rapid market penetration across the continent.

Market Segmentations:

By Product:

- Smart Collar

- Smart Camera

- Smart Harness and Vest

By Technology:

By Application

- Identification & Tracking

- Safety & Security

- Behaviour Monitoring & Control

- Medical Diagnosis & Treatment

By Animal Type:

- Companion Animals

- Livestock Animals

- Exotic Animals

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Veterinary Wearable Devices Market is characterized by the presence of leading players such as Avid Identification Systems, Barking Labs, Datamars, Felcana, FitBark Service, Garmin Ltd., Mars Incorporated, Inovotec Animal Care, and Lamdagen Corporation. These companies focus on continuous innovation, strategic collaborations, and new product launches to strengthen their market positions. The competition is driven by advancements in sensor technologies, AI integration, and data analytics for real-time animal monitoring. Established players are emphasizing user-friendly designs and multifunctional devices to cater to both companion and livestock animal segments. Emerging start-ups are introducing cost-effective, cloud-connected solutions to capture niche markets, while global players are expanding through acquisitions and partnerships with veterinary institutions. The industry also witnesses increasing investment in R&D to enhance device accuracy and connectivity, positioning innovation and technological integration as the core strategies shaping the market’s competitive dynamics.

Key Player Analysis

- Avid Identification Systems, Inc.

- Barking Labs

- Datamars

- Felcana

- FitBark Service

- Garmin Ltd.

- Inovotec Animal Care

- Lamdagen Corporation

- Milkline

- Mars, Incorporated

- co.uk Ltd.

- Other Key Players

Recent Developments

- In July 2025, Tractive announced the acquisition of Whistle from Mars Petcare, integrating Whistle’s customer base and technology assets to strengthen its position in the U.S. market and expand its global leadership in the pet-tech sector.

- In January 2025, PetPace introduced its “Health 2.0” smart collar, an AI-powered wearable for continuous pet health monitoring, which was recognized as the “IoT Wearables Device of the Year” at the IoT Breakthrough Awards.

- In March 2025, SATELLAI launched its first-ever satellite-powered pet tracker at MWC 2025, featuring global satellite connectivity (in 180+ countries) and AI health-monitoring for pets.

- In August 2025, PetPace launched its “V 3.0” smart collar, featuring integrated AI-based epilepsy monitoring and advanced vital sign tracking for dogs and cats, marking a major step forward in intelligent pet health monitoring.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global veterinary wearable devices market will continue to expand steadily, driven by rising pet ownership and animal health awareness.

- Increasing integration of IoT and AI technologies will enhance device accuracy and real-time monitoring capabilities.

- Demand for multifunctional smart collars and harnesses will grow across both companion and livestock animal segments.

- Preventive healthcare solutions will gain momentum as owners prioritize continuous health tracking and early disease detection.

- Expansion of cloud-based data analytics platforms will improve veterinary diagnostics and remote monitoring efficiency.

- Emerging economies in Asia Pacific and Latin America will witness faster adoption due to growing pet care expenditure.

- Strategic collaborations between tech firms and veterinary service providers will foster product innovation and accessibility.

- The livestock management sector will increasingly rely on wearable devices to improve productivity and animal welfare.

- Advancements in battery efficiency and wireless connectivity will enhance user experience and product reliability.

- Regulatory support and rising investment in animal healthcare technology will sustain long-term market growth globally.