Market Overview:

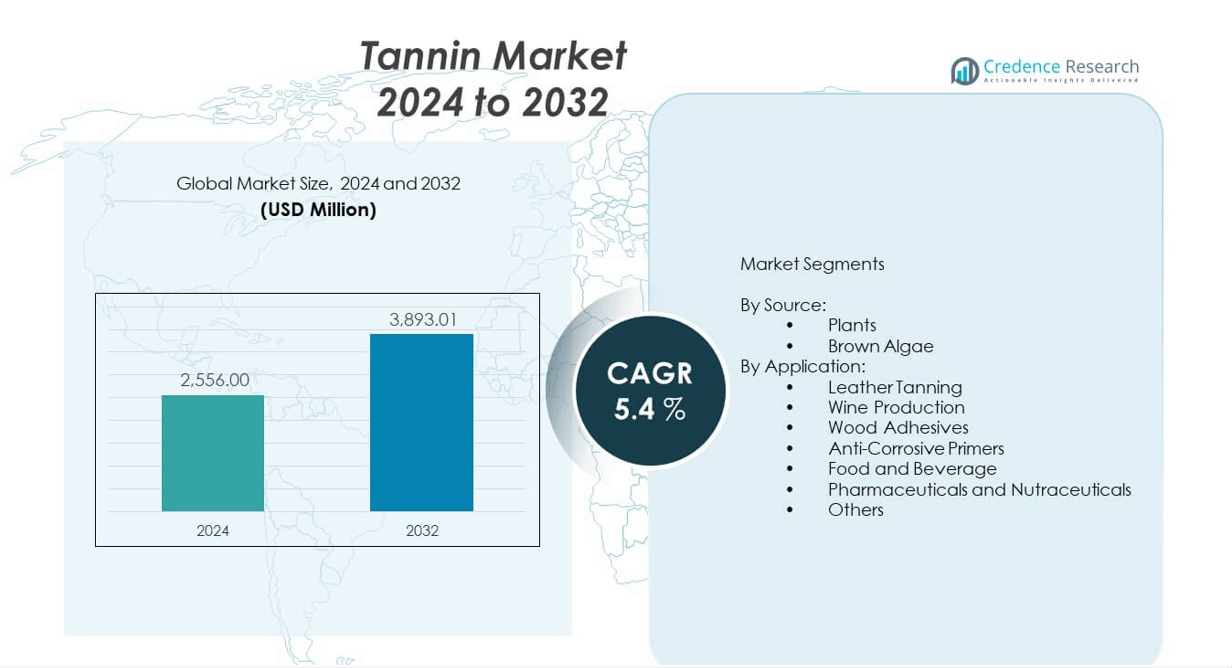

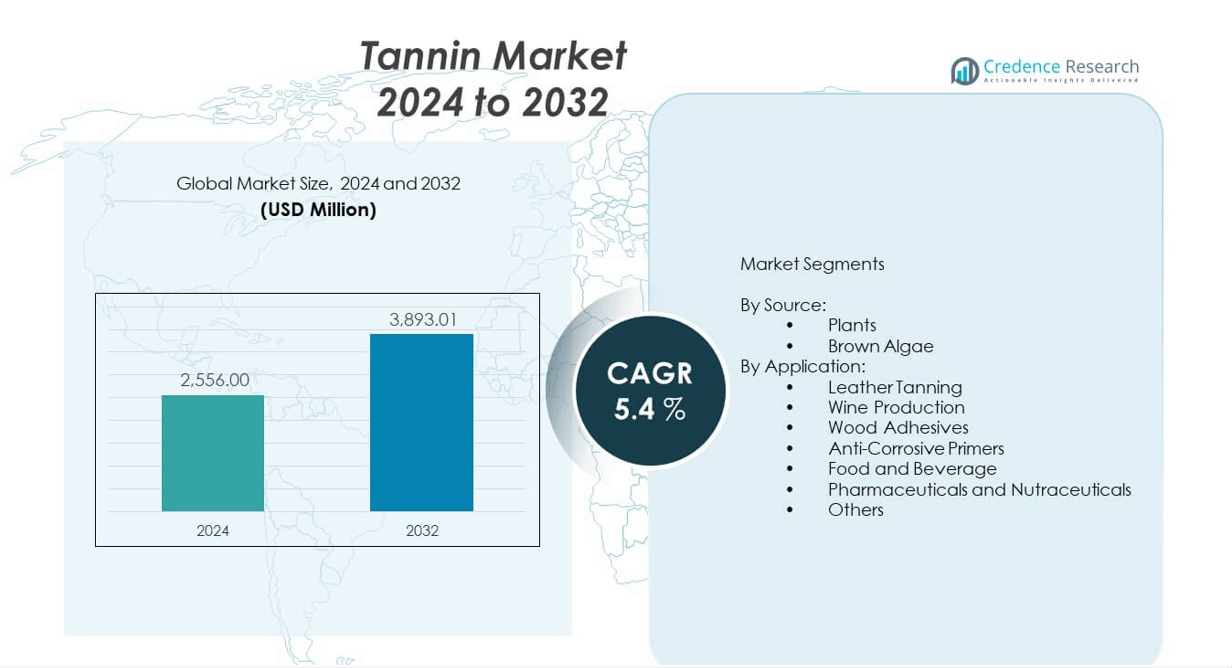

The tannin market is projected to grow from USD 2,556 million in 2024 to an estimated USD 3,893.01 million by 2032, with a compound annual growth rate (CAGR) of 5.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tannin Market Size 2024 |

USD 2,556 million |

| Tannin Market, CAGR |

5.4% |

| Tannin Market Size 2032 |

USD 3,893.01 million |

The market growth is fueled by rising consumption in wine production, where tannins play a key role in flavor, color stabilization, and aging properties. Additionally, the leather tanning industry continues to be a major consumer due to tannins’ ability to enhance durability and appearance. The pharmaceutical sector is also contributing significantly, leveraging tannins’ antimicrobial and antioxidant properties. Increasing consumer preference for natural and plant-based additives further propels market expansion across diverse industries.

Europe dominates the tannin market, driven by its robust wine industry, advanced leather production facilities, and strong demand for natural additives. North America follows, supported by steady growth in specialty food, beverages, and pharmaceuticals. The Asia-Pacific region is emerging as a high-potential market, fueled by expanding leather manufacturing, rising wine production in countries like China and Australia, and growing awareness of plant-based bioactive compounds. Latin America shows promise, supported by a strong agricultural base and increasing investments in value-added natural products.

Market Insights:

- The tannin market was valued at USD 2,556 million in 2024 and is projected to reach USD 3,893.01 million by 2032, registering a CAGR of 5.4% during the forecast period.

- Growing demand from the wine industry for flavor enhancement, stability, and aging potential remains a primary driver of market growth.

- Expanding applications in pharmaceuticals, nutraceuticals, and animal feed are boosting adoption across diverse industries.

- Fluctuations in raw material supply and price volatility pose challenges for manufacturers in maintaining consistent output.

- Stringent regulatory compliance and varying regional standards create barriers to market entry and product expansion.

- Europe leads the market with 42% share, followed by Asia-Pacific at 26% and North America at 24%, driven by strong wine and leather sectors.

- Emerging markets in Latin America and the Middle East & Africa are witnessing growth through increased use in water treatment, feed additives, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand in the Wine Industry for Enhanced Quality and Preservation:

The tannin market benefits significantly from the global wine industry’s steady growth. Tannins contribute to the flavor profile, stability, and aging potential of wine, making them indispensable in premium wine production. Wineries across Europe, North America, and parts of Asia-Pacific are increasing their reliance on high-quality tannins for both red and white wines. It meets consumer expectations for better taste, aroma, and shelf life in finished products. The growing popularity of premium wines in emerging economies strengthens demand further. Producers are also investing in improved extraction techniques to enhance tannin efficiency. Demand from artisanal and craft wine producers is rising in niche segments. The market continues to gain from sustained consumer interest in natural, plant-based wine additives.

- For instance, Enartis, a leading supplier in wine additives, developed their patented Tanninálisis™ technology which allows wineries to extract and quantify specific tannin fractions, improving extraction accuracy by an average of 15% per batch, thereby enhancing wine structure and aging potential as demonstrated in French premium wineries.

Expanding Role of Tannins in Leather Tanning Processes:

The tannin market experiences steady growth through its crucial application in the leather industry. Tannins are valued for their ability to stabilize proteins in hides, resulting in durable, flexible, and aesthetically appealing leather products. It caters to both traditional and modern leather tanning processes, offering sustainable alternatives to synthetic chemicals. Leather producers in Europe, Asia, and Latin America are increasing their reliance on vegetable tannins due to environmental regulations and consumer preference for eco-friendly products. The luxury goods industry’s growth drives higher demand for premium leather materials, further stimulating tannin use. Advanced processing technologies improve tannin absorption efficiency, enhancing finished leather quality. Industrial demand aligns with sustainability certifications, giving vegetable tannins a competitive edge. This consistent application sustains a robust market base globally.

- For instance, Silvateam has developed patented vegetable tannins (under the Ecotan® brand) implemented by multiple tanneries in Latin America and Asia, increasing leather tensile strength by measured increments of 0.5 MPa over conventional methods and delivering eco-certified leather complying with manufacturing emissions regulations.

Expanding Pharmaceutical Applications Leveraging Bioactive Properties:

The tannin market gains momentum from its increasing role in pharmaceuticals due to its bioactive and therapeutic properties. Tannins exhibit antimicrobial, antioxidant, and anti-inflammatory effects, making them valuable in wound healing products, dietary supplements, and herbal medicines. It aligns with the growing global shift toward plant-derived and naturally sourced health products. Research initiatives explore tannin-based compounds for cancer prevention, cardiovascular health, and gastrointestinal treatments. Rising consumer awareness of herbal remedies further supports market penetration. Regulatory bodies encourage safe and standardized herbal formulations, promoting tannin integration in product lines. Pharmaceutical companies in Asia-Pacific and Europe are leading innovation in this segment. Demand from nutraceutical manufacturers strengthens the long-term growth outlook.

Growing Use in Animal Feed to Enhance Livestock Health:

The tannin market benefits from the rising incorporation of tannins into animal feed formulations. Tannins help improve digestion, reduce methane emissions, and prevent parasitic infections in livestock. It provides a natural alternative to antibiotics, aligning with global efforts to reduce antibiotic use in animal farming. The livestock sector in Latin America, North America, and Asia-Pacific is adopting tannin-based feed additives to improve productivity and animal welfare. Growing awareness of sustainable livestock management practices strengthens adoption. Feed manufacturers are investing in research to optimize tannin dosage and efficacy. The demand is particularly strong in ruminant farming, where tannins contribute to improved feed efficiency. This segment continues to be a strong revenue contributor to the market.

Market Trends:

Increasing Use of Sustainable and Plant-Based Extraction Methods:

The tannin market is witnessing a shift toward eco-friendly extraction processes using renewable plant sources. Producers are adopting advanced water-based and solvent-free technologies to minimize environmental impact. It supports the demand for organic and sustainably sourced tannins in industries such as wine, leather, and cosmetics. Regulatory pressure in developed markets accelerates the transition to greener manufacturing. Partnerships between extraction technology firms and tannin producers drive efficiency gains. Sustainable sourcing from forestry and agricultural waste also contributes to circular economy goals. Consumer-facing industries increasingly highlight eco-certified tannins as part of their product marketing. This trend aligns with broader global sustainability commitment.

- For instance, Silvateam, a leader in natural extracts, implemented a proprietary water-extraction process for chestnut tannins that reduces solvent use by 95% and energy consumption by 20%, supplying both the cosmetics and leather industries with USDA Organic certified products.

Diversification of Applications in High-Value Industries:

The tannin market is broadening its application scope beyond traditional wine and leather segments. Cosmetic manufacturers are incorporating tannins for their antioxidant and astringent properties in skincare products. It also finds use in water treatment processes due to its ability to bind heavy metals and organic matter. Industrial adhesives and wood protection coatings represent additional growth areas. Research is uncovering potential uses in bio-based packaging solutions. The versatility of tannins attracts attention from specialty chemical producers. This diversification reduces dependency on seasonal industries like wine production. Companies are actively developing tannin-based innovations to target high-margin markets.

- For instance, Tanac S.p.A., an Italian tannin producer, launched a bio-based adhesive formulation incorporating mimosa tannins that demonstrated improvement in bonding strength in wood panels compared to synthetic adhesives, validated through standardized ISO tests in collaboration with European research institutions.

Integration of Tannins in Functional Food and Beverage Products:

The tannin market is gaining from the growing demand for functional foods and beverages with added health benefits. Tannins contribute antioxidant capacity, digestive support, and antimicrobial effects, making them attractive in wellness-oriented product lines. It is increasingly used in tea, herbal infusions, and fortified beverages targeting health-conscious consumers. Beverage manufacturers highlight tannin content as part of their product differentiation strategy. The rising popularity of polyphenol-rich diets supports consistent demand. Health claims backed by scientific research help improve market acceptance. This trend is prominent in developed markets and spreading to urban populations in emerging economies. Regulatory approvals for functional claims further boost adoption.

Technological Advancements in Tannin Formulation and Blending:

The tannin market benefits from innovation in formulation technologies that improve solubility, stability, and bioavailability. Advanced blending techniques allow customization for specific applications such as feed, pharmaceuticals, and beverages. It enables producers to offer consistent quality across large-scale production. Microencapsulation and nano-formulation methods are gaining traction for controlled release in high-performance applications. These advancements also improve compatibility with other active ingredients. Research institutions are partnering with manufacturers to refine production efficiency. High-precision blending ensures tannins meet application-specific standards. Technology-driven improvements are expected to strengthen product competitiveness in the global market.

Market Challenges Analysis:

Raw Material Supply Fluctuations and Price Volatility:

The tannin market faces challenges related to inconsistent raw material availability and fluctuating costs. Tannins are primarily extracted from plant sources such as chestnut, quebracho, and tara, which are subject to seasonal variations and climatic conditions. It creates supply instability, particularly for manufacturers relying on single-source suppliers. Market participants often face increased costs due to global transportation delays and currency fluctuations. Price volatility affects competitiveness in export markets. Long-term supply contracts are becoming more common to reduce procurement risks. Producers are exploring diversification of sourcing to mitigate disruptions. Fluctuating input prices can limit profit margins, especially in price-sensitive applications. Addressing these challenges requires robust supply chain strategies.

Regulatory Compliance and Quality Standardization Barriers:

The tannin market is influenced by strict regulations governing food additives, pharmaceuticals, and animal feed ingredients. Compliance with varying regional standards requires significant investment in testing and certification. It can delay product launches and limit market entry in highly regulated countries. Differences in permissible levels and labeling requirements complicate international trade. Quality standardization is essential to maintain brand credibility and customer trust. Smaller producers often face higher compliance costs, affecting their competitive position. Delays in regulatory approvals can slow innovation adoption. Companies are prioritizing transparent documentation and adherence to global certifications to maintain market presence.

Market Opportunities:

Emerging Applications in High-Growth Industrial Segments:

The tannin market has substantial opportunities in expanding its footprint across high-growth sectors such as bio-based adhesives, water treatment, and cosmetics. Tannins’ natural binding properties make them a viable alternative to synthetic chemicals in eco-conscious industrial applications. It aligns with the increasing preference for biodegradable and renewable raw materials. Water treatment facilities are exploring tannins for heavy metal removal and wastewater purification. Cosmetics brands are leveraging tannins for anti-aging and skin-firming formulations. Emerging uses diversify revenue streams and reduce reliance on traditional markets. Manufacturers are actively investing in research to enhance application efficiency.

Rising Demand in Emerging Economies with Expanding Middle-Class Consumers:

The tannin market is poised to benefit from rising disposable incomes and shifting consumer preferences in emerging economies. Growing middle-class populations in Asia-Pacific, Latin America, and parts of Africa are driving demand for premium wines, leather goods, and functional foods. It creates new opportunities for tannin suppliers to expand geographically. Urbanization and lifestyle changes increase the appeal of quality-driven products containing natural additives. Strategic partnerships with local distributors improve market penetration. Awareness campaigns highlighting the benefits of tannins can further accelerate adoption.

Market Segmentation Analysis:

By Source

The tannin market is segmented into plants and brown algae. Plant-derived tannins dominate due to their wide availability and established use in industries such as wine production, leather tanning, and pharmaceuticals. Chestnut, quebracho, and tara are key plant sources, valued for their high tannin concentration and consistent quality. Brown algae, rich in phlorotannins, is gaining attention for its antioxidant properties and potential in nutraceuticals, cosmetics, and specialty industrial applications. It offers a sustainable marine-based alternative, appealing to manufacturers targeting eco-conscious consumers.

- For instance, Algaia leads in brown algae phlorotannins with products highly standardized to contain upwards of 90% purified phlorotannins, offering a marine-sourced antioxidant option increasingly adopted in specialty nutraceutical applications.

By Application

The tannin market serves diverse industries with leather tanning and wine production remaining the largest segments, driven by demand for high-quality leather goods and premium wines. Wood adhesives and anti-corrosive primers utilize tannins for their binding and protective properties, particularly in sustainable and bio-based product lines. The food and beverage sector, including wine, RTD drinks, tea, coffee, and juices, benefits from tannins’ flavor-enhancing and preservative functions. Pharmaceuticals and nutraceuticals leverage tannins’ antimicrobial, antioxidant, and anti-inflammatory benefits for herbal medicines and dietary supplements. Other applications such as animal feed, water treatment, and chemical industries contribute to market growth through specialized uses that improve livestock health, reduce environmental impact, and enhance industrial efficiency.

- For instance, Pharmaceutical and nutraceutical markets use tannins from companies like Polyphenolics, producing standardized extracts with specific antimicrobial and antioxidant activity levels quantified in mg per dosage unit for consistent health benefits.

Segmentation:

By Source:

By Application:

- Leather Tanning

- Wine Production

- Wood Adhesives

- Anti-Corrosive Primers

- Food and Beverage

- Pharmaceuticals and Nutraceuticals

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a significant share of the tannin market, accounting for approximately 24% of the global total. The region benefits from a mature wine industry in the United States and Canada, coupled with a robust demand for high-quality leather products. It also experiences growing adoption of tannins in pharmaceuticals and nutraceuticals, driven by consumer preference for plant-based and natural health solutions. The construction and marine sectors utilize tannin-based anti-corrosive coatings and wood adhesives, further supporting demand. Regulatory support for eco-friendly products encourages greater use of sustainable tannin sources. Ongoing investments in R&D by regional manufacturers aim to enhance product quality and broaden application scope.

Europe

Europe leads the tannin market with an estimated 42% share, supported by its strong wine production industry in countries like France, Italy, and Spain. Leather manufacturing in Italy and Portugal also drives significant consumption of vegetable tannins. The region’s preference for sustainable and natural additives aligns with the growing use of plant-based tannins in food, beverages, and pharmaceuticals. It benefits from advanced extraction technologies and well-established distribution networks across the European Union. The shift toward eco-certified products further strengthens demand across multiple sectors. Strategic collaborations between European tannin producers and end-use industries enhance market stability and competitiveness.

Asia-Pacific and Other Regions

Asia-Pacific holds around 26% of the tannin market, driven by expanding wine production in China and Australia, rapid growth in leather manufacturing in India, and increasing applications in animal feed. It benefits from abundant raw material availability and a growing middle-class population demanding premium wine and leather products. Latin America, with a share of about 5%, leverages its strong forestry base in Brazil and Argentina to supply plant-derived tannins globally. The Middle East & Africa account for roughly 3% of the market, with emerging applications in water treatment, food processing, and niche leather production. Regional diversification in sourcing and application development continues to create growth opportunities across these markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tanin Sevnica d.d.

- Laffort

- Silvateam

- TANAC S.A.

- Forestal Mimosa Ltda.

- Ever s.r.l.

- Zhushan County Tianxin Medical & Chemical Co., Ltd.

- Vinicas

- Polyphenolics

- Tannin Corporation

Competitive Analysis:

The tannin market is characterized by the presence of well-established global and regional players competing through product innovation, vertical integration, and expansion into emerging markets. Leading companies such as Silvateam, TANAC S.A., Laffort, and Tanin Sevnica d.d. maintain strong market positions through diversified product portfolios, advanced extraction technologies, and extensive distribution networks. It sees ongoing investment in R&D to improve tannin quality, enhance application versatility, and address sustainability concerns. Competitors focus on strategic collaborations with wine producers, leather manufacturers, and pharmaceutical companies to strengthen demand channels. The market’s competitive landscape is shaped by the ability to meet regulatory standards, secure reliable raw material sources, and offer cost-efficient solutions tailored to end-use industries.

Recent Developments:

- In February 2024, Silvateam S.p.A. achieved a strategic milestone by acquiring a majority stake in wet-Green GmbH, the creator of patented wet-green® technology for producing biodegradable, non-toxic leather from olive leaf byproducts. This partnership supports Silvateam’s Ecotan® brand and sets a new standard in sustainable plant-based tanning solutions.

- In August 2023, TANAC S.A. launched its Green-Line premium vegetable tannin extracts designed specifically for sustainable leather tanning. This line reflects TANAC’s commitment to combining high performance with eco-friendly processes, meeting growing industry sustainability requirements.

Market Concentration & Characteristics:

The tannin market is moderately consolidated, with a few large multinational players holding significant shares alongside numerous regional producers. It is driven by long-term relationships between suppliers and end-use industries, particularly wine, leather, and pharmaceuticals. High entry barriers arise from specialized extraction processes, regulatory compliance, and the need for reliable raw material supply chains. Competitive differentiation depends on product quality, sustainability certifications, and application-specific innovation. Companies with integrated production capabilities and global distribution networks hold a competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on By Source and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of tannin applications in pharmaceuticals and nutraceuticals driven by growing demand for plant-based bioactives.

- Increased adoption of sustainable extraction technologies to meet environmental compliance and consumer expectations.

- Rising integration of tannins in functional foods and beverages for health-focused product lines.

- Strong growth potential in Asia-Pacific markets fueled by expanding wine and leather industries.

- Emergence of marine-derived tannins from brown algae as a niche but growing source.

- Greater use in eco-friendly wood adhesives and anti-corrosive coatings for industrial applications.

- Development of customized tannin blends tailored for premium wine production.

- Continued partnerships between tannin suppliers and end-use industries to ensure long-term supply stability.

- Increased focus on R&D to improve tannin efficacy, solubility, and application versatility.

- Regulatory support for natural and biodegradable additives enhancing market credibility.