Market Overview:

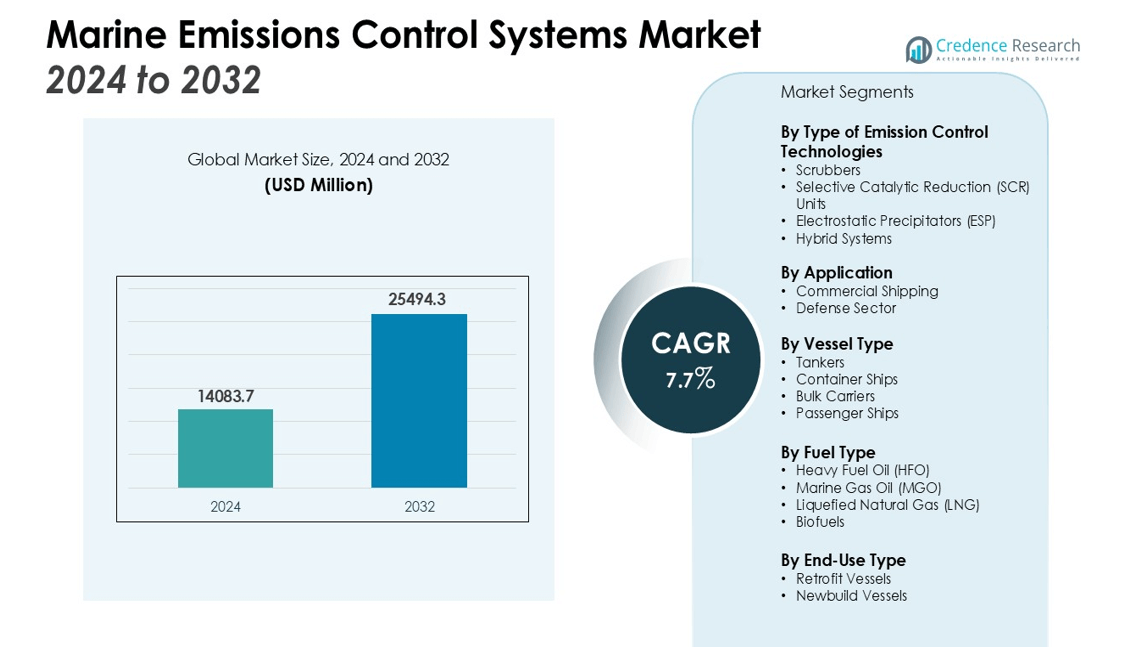

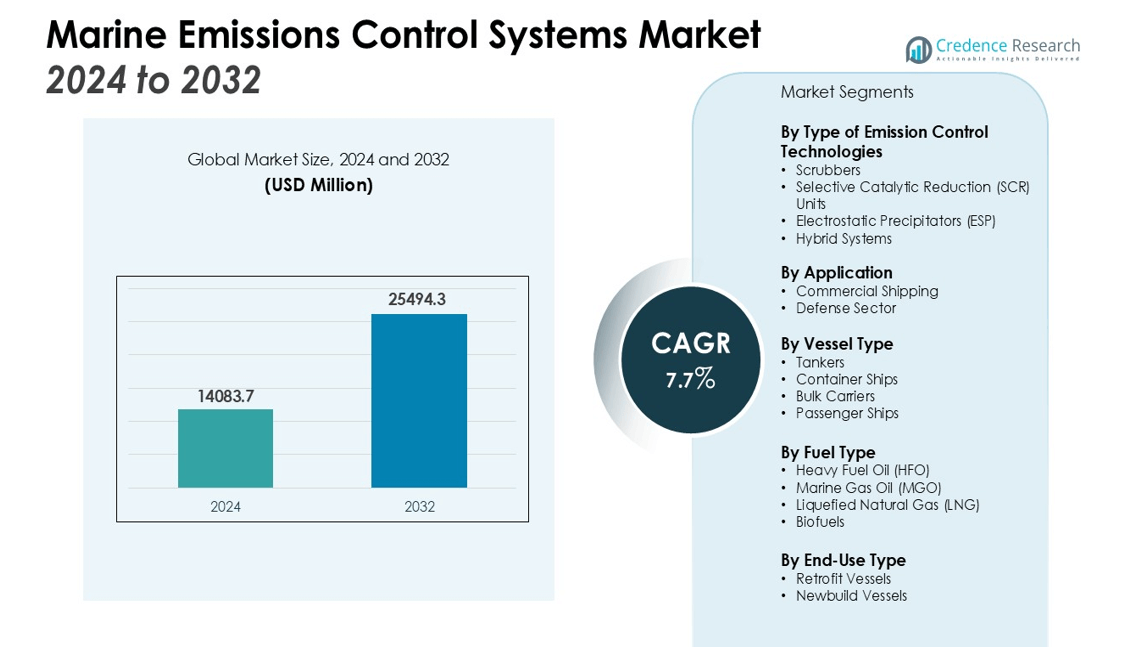

The Marine Emissions Control Systems Market size was valued at USD 14083.7 million in 2024 and is anticipated to reach USD 25494.3 million by 2032, at a CAGR of 7.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Emissions Control Systems Market Size 2024 |

USD 14083.7 million |

| Marine Emissions Control Systems Market, CAGR |

7.7% |

| Marine Emissions Control Systems Market Size 2032 |

USD 25494.3 million |

Stringent international regulations, including MARPOL Annex VI, which limits sulfur and nitrogen oxide emissions, are driving widespread adoption of advanced emission control systems such as scrubbers, selective catalytic reduction (SCR) units, electrostatic precipitators (ESP), and hybrid configurations. Growing environmental awareness, coupled with rising pressure from port authorities and governmental agencies, is accelerating investments in cleaner marine technologies. Advancements in compact, high-efficiency designs and hybrid fuel capabilities are further supporting market penetration across both newbuild and retrofit vessels.

Asia-Pacific dominates the market, supported by strong shipbuilding activity, rapid industrialization, and government-backed emission reduction initiatives. North America holds a notable share, driven by strict regulatory enforcement and demand from commercial and defense sectors. Europe is witnessing steady growth due to expanded Emission Control Areas in the North and Baltic Seas, as well as green-port incentives promoting cleaner vessel operations. The Middle East is emerging as a potential growth hub, supported by expanding port infrastructure and the adoption of low-emission technologies in key maritime trade routes.

Market Insights:

- The Marine Emissions Control Systems Market was valued at USD 14,083.7 million in 2024 and is projected to reach USD 25,494.3 million by 2032, growing at a CAGR of 7.7% during the forecast period. Stringent regulations like MARPOL Annex VI drive the adoption of advanced emission control technologies.

- Advancements in compact, high-efficiency designs and hybrid fuel capabilities are enhancing operational efficiency and reducing costs, supporting the growth of emission control systems.

- Asia-Pacific holds 46% of the market share, driven by strong shipbuilding activity, industrialization, and government-backed emission reduction initiatives.

- North America accounts for 17% of the market share, fueled by stringent regulatory enforcement and early adoption of green shipping policies and technologies.

- Europe holds 23% of the market share, driven by expanded Emission Control Areas and green-port incentives that foster the adoption of emission control systems.

- High installation and operational costs, including retrofitting and maintenance, limit adoption, particularly for smaller shipping companies in competitive markets.

- The technical complexity of emission control systems and evolving regulatory frameworks create challenges, making compliance and integration difficult for shipowners.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent International Maritime Regulations Driving Technology Adoption

The Marine Emissions Control Systems Market is experiencing strong growth due to strict global maritime regulations such as MARPOL Annex VI, which impose limits on sulfur and nitrogen oxide emissions from vessels. These mandates have created significant demand for advanced solutions, including scrubbers, selective catalytic reduction units, and hybrid systems. Compliance requirements are prompting both retrofitting of existing vessels and integration into newbuilds. Shipowners and operators are prioritizing systems that meet evolving emission standards while maintaining operational efficiency. Regulatory enforcement in Emission Control Areas further strengthens the adoption rate.

Rising Environmental Awareness and Sustainability Commitments

Growing recognition of the environmental impact of maritime operations is influencing investment decisions across the Marine Emissions Control Systems Market. It is benefiting from industry-wide sustainability goals that aim to reduce greenhouse gas emissions and improve air quality. Shipping companies are increasingly adopting eco-friendly technologies to align with international climate targets and corporate social responsibility frameworks. Public and governmental pressure to address marine pollution continues to push the industry toward cleaner operational practices. These commitments are fostering steady demand for emission control systems.

- For instance, Alfa Laval PureSOx has been installed on 109 vessels to date, delivering more than 98% SOx removal and trapping up to 80% of particulate matter to ensure compliance with IMO regulations.

Technological Advancements Enhancing Efficiency and Performance

Ongoing innovation is a key driver for the Marine Emissions Control Systems Market, with manufacturers developing compact, high-efficiency systems that optimize space and performance on board. It is witnessing the introduction of hybrid fuel capabilities, improved filtration technologies, and real-time monitoring solutions. These advancements allow operators to achieve compliance while reducing maintenance costs and improving fuel efficiency. Integration with digital control platforms enhances operational transparency and decision-making. Technology-driven improvements are making emission control systems more attractive for global fleet operators.

Expanding Global Shipbuilding and Retrofit Activities

Growth in shipbuilding and retrofit projects is boosting demand in the Marine Emissions Control Systems Market. It is supported by rising global trade volumes, expansion of commercial fleets, and modernization of naval vessels. Increased investment in new port facilities and shipping routes is encouraging the deployment of compliant vessels. Retrofit opportunities are significant, with many operators upgrading older ships to meet environmental standards. This expansion across both newbuild and retrofit sectors reinforces the market’s long-term growth potential.

- For instance, the 19,000 TEU ultra-large container vessel MSC Oscar underwent a windshield energy-saving retrofit by Xinya Shipyard in May 2025, expected to reduce annual fuel consumption by 2%–4%, equivalent to 6,340–12,680 tons of CO2 emissions at a speed of 20 knots.

Market Trends:

Integration of Hybrid and Alternative Fuel-Compatible Emission Control Systems

The Marine Emissions Control Systems Market is witnessing a clear shift toward hybrid configurations and solutions compatible with alternative fuels such as LNG, methanol, and biofuels. This trend is driven by the maritime industry’s transition toward low-carbon operations and the need for versatile systems capable of adapting to multiple fuel types. It is also influenced by shipowners seeking flexibility to meet varying regional regulations and fuel availability across global routes. Manufacturers are investing in systems that can seamlessly switch between operating modes, ensuring compliance without compromising performance. The inclusion of advanced filtration, catalytic conversion, and monitoring technologies within hybrid designs is enhancing both operational efficiency and environmental performance. This capability is positioning hybrid-ready systems as a preferred choice for long-term compliance strategies.

- For instance, MAN Energy Solutions delivered its ammonia-ready Cluster 5 Double Layer SCR converter to Mitsui E&S in March 2024, achieving a 90% reduction in NOₓ emissions.

Adoption of Digital Monitoring and Predictive Maintenance Capabilities

The Marine Emissions Control Systems Market is increasingly shaped by the integration of digital technologies, particularly in real-time emissions monitoring and predictive maintenance solutions. It is enabling operators to track compliance metrics, optimize system performance, and detect potential failures before they impact operations. Data analytics and IoT-enabled sensors are becoming standard features in high-performance systems, providing actionable insights for fuel efficiency and regulatory adherence. Remote diagnostics capabilities are reducing downtime and maintenance costs while improving operational planning. The adoption of these digital features is aligning with broader maritime digitalization trends and strengthening the role of emission control systems as both compliance tools and operational efficiency drivers. This digital shift is expected to continue influencing technology development and purchasing decisions across the industry.

- For instance, Marine Digital’s AI-based Fuel Optimization System enables shipping companies to reduce fleet fuel consumption by 5–12%, saving up to 600tonnes of CO₂ emissions annually per vessel through predictive voyage and environmental performance analytics.

Market Challenges Analysis:

High Installation and Operational Costs Limiting Adoption

The Marine Emissions Control Systems Market faces a significant challenge in the form of high capital investment and ongoing operational expenses. It requires substantial funding for procurement, installation, and integration with existing vessel systems, particularly in retrofit applications. Operating costs, including maintenance, consumables, and energy consumption, add to the financial burden for shipowners. Smaller shipping companies often struggle to justify these expenses, especially in competitive freight markets with tight margins. Limited access to financing in certain regions further restricts widespread adoption. This cost barrier continues to slow market penetration, particularly among older fleets nearing the end of service life.

Technical Complexity and Compliance Uncertainty

The Marine Emissions Control Systems Market is also challenged by the technical complexity of advanced solutions and uncertainties surrounding evolving regulatory frameworks. It demands specialized expertise for installation, calibration, and ongoing operation, which can be scarce in some maritime regions. Variations in regional emission standards complicate system design and selection, increasing the risk of non-compliance. Integration with hybrid fuel systems and digital monitoring platforms often requires substantial modifications to vessel infrastructure. Unplanned downtime due to technical failures or delayed certification can impact operational schedules. These factors contribute to hesitancy among operators, particularly when regulations are expected to tighten further.

Market Opportunities:

Expansion of Green Shipping Initiatives and Global Fleet Modernization

The Marine Emissions Control Systems Market holds significant potential through the expansion of green shipping programs and the modernization of commercial and naval fleets. It is benefiting from international commitments to decarbonize the maritime sector, prompting large-scale investments in clean technology adoption. Government subsidies, tax incentives, and port fee reductions for low-emission vessels are creating favorable conditions for system installations. The growing replacement of older ships with environmentally compliant newbuilds is further driving demand. Collaborations between shipbuilders, technology providers, and regulatory bodies are accelerating the integration of advanced emission control solutions. These developments position the market to capitalize on long-term sustainability trends.

Advancement of Hybrid and Digital-Integrated Solutions

The Marine Emissions Control Systems Market is well-positioned to leverage opportunities from hybrid-compatible and digitally enhanced systems. It is gaining traction from the demand for solutions that can operate efficiently with multiple fuel types, including LNG, methanol, and biofuels. The integration of IoT-enabled monitoring and predictive analytics is creating value by improving operational efficiency and reducing maintenance downtime. Emerging markets with expanding shipping activity present untapped potential for suppliers offering adaptable, cost-efficient systems. The shift toward automation and data-driven compliance verification is expected to open new revenue streams. These advancements align with the industry’s focus on both regulatory compliance and operational optimization.

Market Segmentation Analysis:

By Type of Emission Control Technologies

The market is primarily driven by the adoption of scrubbers, selective catalytic reduction (SCR) units, electrostatic precipitators (ESP), and hybrid technologies. Scrubbers hold a significant market share due to their effectiveness in removing sulfur from exhaust gases, helping vessels meet regulatory requirements. SCR systems are gaining traction for their ability to reduce nitrogen oxide emissions, while ESPs are increasingly used to capture particulate matter. Hybrid systems that combine various technologies are becoming popular as they offer flexibility to meet evolving emission standards across global regions.

- For instance, Damen Shipyards delivered three hybrid Fast Crew Supplier vessels fitted with 190kW battery arrays, enabling emissions-free operation in harbor and supporting IMO Tier 3 compliance for advanced emission control.

By Application

The Marine Emissions Control Systems Market finds applications in both commercial and defense sectors. In commercial shipping, the growing focus on environmental sustainability is driving demand for efficient emission control solutions. The defense sector, particularly naval vessels, is also adopting these systems to comply with regulations and minimize environmental impact. The market is further boosted by the increasing demand for compliance with international maritime regulations, such as MARPOL Annex VI.

- For instance, MAN Energy Solutions delivered a Cluster 5 Double Layer SCR catalytic converter for MITSUI E&S in 2024, the largest ever at 3,900mm diameter and 28 metric tons. This system is ammonia-ready and achieves up to 90% reductions in nitrogen oxide (NOx) emissions for naval and commercial fleets.

By Vessel Type

\

The market is segmented into various vessel types, including tankers, container ships, bulk carriers, and passenger ships. Tankers and container ships dominate the market due to their significant share in global trade. Passenger ships, such as cruise liners, are also adopting emission control technologies to align with environmental goals and enhance public image. Each vessel type has specific needs, which influences the choice of emission control technologies and systems.

Segmentations:

By Type of Emission Control Technologies

- Scrubbers

- Selective Catalytic Reduction (SCR) Units

- Electrostatic Precipitators (ESP)

- Hybrid Systems

By Application

- Commercial Shipping

- Defense Sector

By Vessel Type

- Tankers

- Container Ships

- Bulk Carriers

- Passenger Ships

By Fuel Type

- Heavy Fuel Oil (HFO)

- Marine Gas Oil (MGO)

- Liquefied Natural Gas (LNG)

- Biofuels

By End-Use Type

- Retrofit Vessels

- Newbuild Vessels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leading with Strong Shipbuilding and Regulatory Support

Asia-Pacific holds 46% share of the Marine Emissions Control Systems Market, making it the largest regional contributor. This leadership is driven by its dominant shipbuilding industry and growing regulatory enforcement. It benefits from large-scale vessel production in countries such as China, Japan, and South Korea, where environmental compliance is increasingly prioritized. Government-backed initiatives to reduce maritime pollution are encouraging the adoption of advanced emission control technologies in both domestic and export-bound fleets. Expanding port infrastructure and the rise of regional shipping hubs are supporting consistent market demand. The region’s role as a global trade center further amplifies the need for compliant, high-performance marine systems.

North America Strengthened by Strict Environmental Enforcement

North America accounts for 17% share of the Marine Emissions Control Systems Market, supported by strong adherence to emission control area (ECA) regulations and active implementation of green shipping policies. It is characterized by a high concentration of technologically advanced fleets operating in commercial, passenger, and defense segments. Port authorities in the United States and Canada are enforcing low-sulfur fuel usage and incentivizing retrofits for emission compliance. The region’s adoption rate is boosted by early investment in hybrid and LNG-compatible vessels. Strong collaboration between shipowners, technology providers, and regulatory agencies is enhancing the pace of modernization.

Europe Advancing Through ECA Expansion and Green-Port Initiatives

Europe represents 23% share of the Marine Emissions Control Systems Market, with growth driven by expanded ECAs covering the North Sea and Baltic Sea, along with strict sulfur and nitrogen oxide emission limits. It is supported by the region’s longstanding focus on sustainable shipping practices and high public awareness of environmental issues. Investments in port electrification and shore power facilities are complementing onboard emission control measures. European ship operators are increasingly adopting hybrid systems to meet diverse operating conditions. The presence of major maritime technology providers in the region strengthens innovation and product availability, fostering competitive market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alfa Laval

- Wartsila

- Yara

- Shanghai Bluesoul

- Clean Marine

- DowDuPont

- Niigata Power System

- DEC Maritime

- Mitsubishi

- Johnson Matthey

- Kwangsung

- Damen Shipyards

- Tenneco

Competitive Analysis:

The Marine Emissions Control Systems Market is highly competitive, with several key players dominating the industry. Major companies like Alfa Laval, Wärtsilä Corporation, and Mitsubishi Heavy Industries provide advanced solutions such as scrubbers, selective catalytic reduction (SCR) systems, and hybrid technologies. These companies focus on continuous innovation and product development to meet evolving regulatory standards. The market is characterized by both established players and emerging companies that offer specialized systems, contributing to a dynamic competitive landscape. Suppliers emphasize technological advancements, such as compact and high-efficiency designs, to improve operational performance and reduce installation costs. Partnerships and collaborations between shipbuilders, technology providers, and regulatory bodies further fuel competition. Regional players, particularly in Asia-Pacific, are also gaining a competitive edge by offering cost-effective solutions tailored to local market demands. The market’s growth is influenced by the adoption of low-emission technologies and regulatory enforcement across key shipping hubs.

Recent Developments:

- In July 2025, the Grandis compact SUV was released for the European market.

- In April 2025, Damen signed a MoU with Square Port Shipyard in India to jointly develop a facility for building Damen vessels.

Market Concentration & Characteristics:

The Marine Emissions Control Systems Market is moderately concentrated, with a few key players holding significant market shares. Major companies such as Alfa Laval, Wärtsilä Corporation, and Mitsubishi Heavy Industries dominate, leveraging advanced technologies like scrubbers and selective catalytic reduction (SCR) units to maintain competitive advantages. These players invest heavily in R&D to improve system efficiency and compliance with international regulations. The market also features regional players offering cost-effective solutions tailored to local needs. High barriers to entry, including significant capital investment in technology development and certification processes, limit competition. The demand for emission control systems is primarily driven by regulatory requirements and the need for technological innovation. Smaller companies typically focus on niche segments or offer specialized solutions to cater to specific customer needs.

Report Coverage:

The research report offers an in-depth analysis based on Type of Emission Control Technologies, Application, Vessel Type, Fuel Type, End-Use Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for advanced emission control systems will continue to grow, driven by stricter global maritime regulations.

- Hybrid and LNG-compatible systems will see increasing adoption due to the need for flexibility in fuel usage and emission reduction.

- The expansion of Emission Control Areas (ECAs) worldwide will encourage shipowners to invest in compliant technologies.

- Digital integration, such as real-time monitoring and predictive maintenance, will become more prevalent in emission control systems to optimize performance and reduce downtime.

- The trend toward sustainable shipping practices will push the market toward cleaner and more efficient technologies.

- Retrofit opportunities for older vessels will remain strong as operators seek to meet new regulatory standards without replacing their entire fleet.

- Manufacturers will continue to innovate in compact, high-efficiency designs to meet space and performance requirements on board.

- The increasing use of biofuels and alternative fuels will drive the development of systems compatible with these energy sources.

- Government incentives and subsidies for adopting green technologies will support market growth, especially in regions with stringent environmental policies.

- The market will experience heightened competition, with new players entering and established companies enhancing their portfolios to meet growing demand for emission control technologies.