Market Overview:

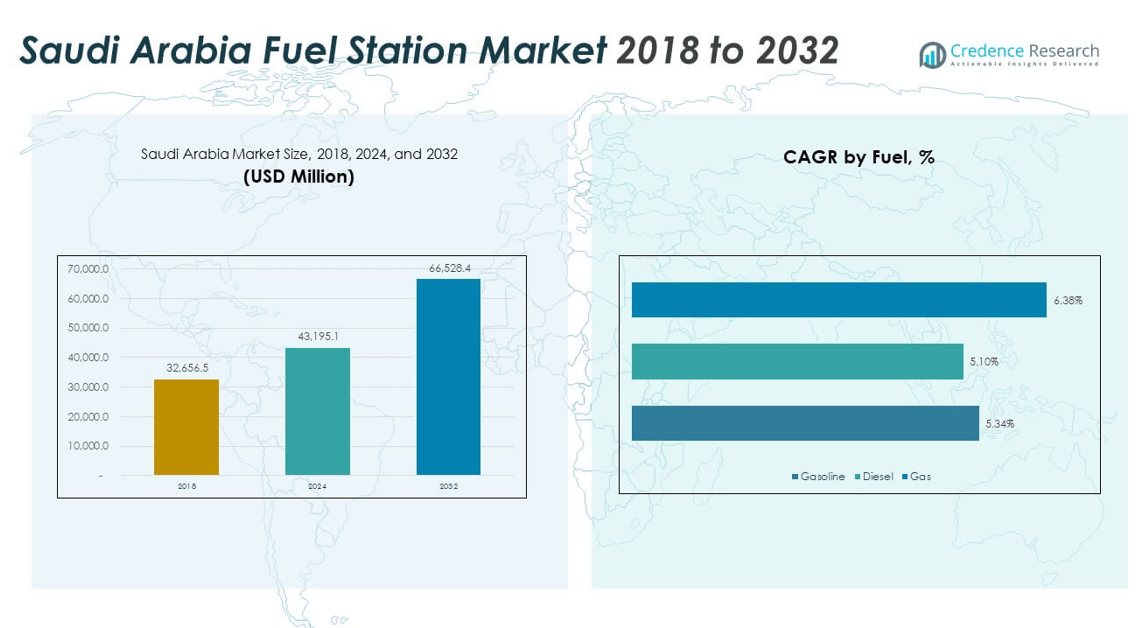

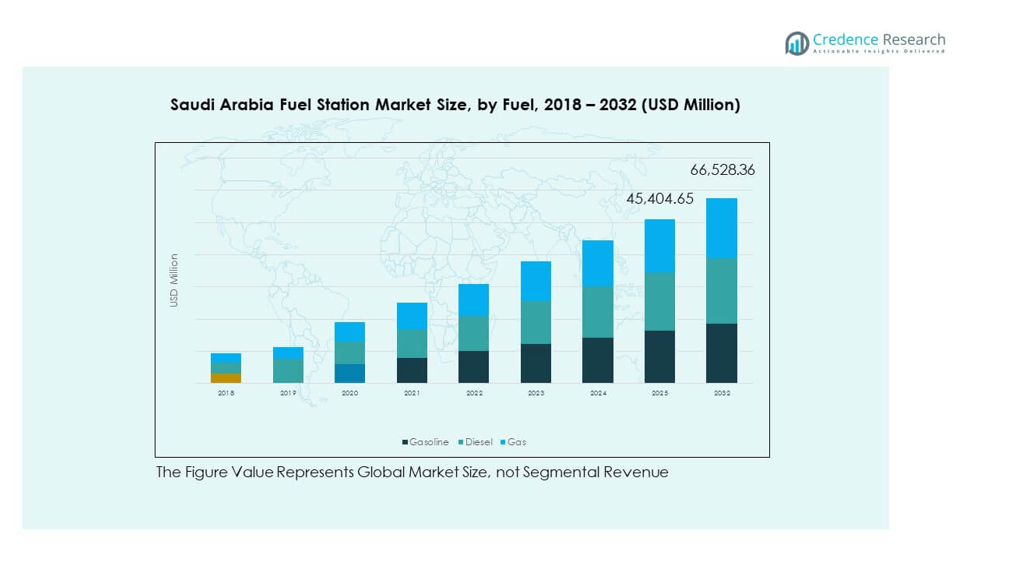

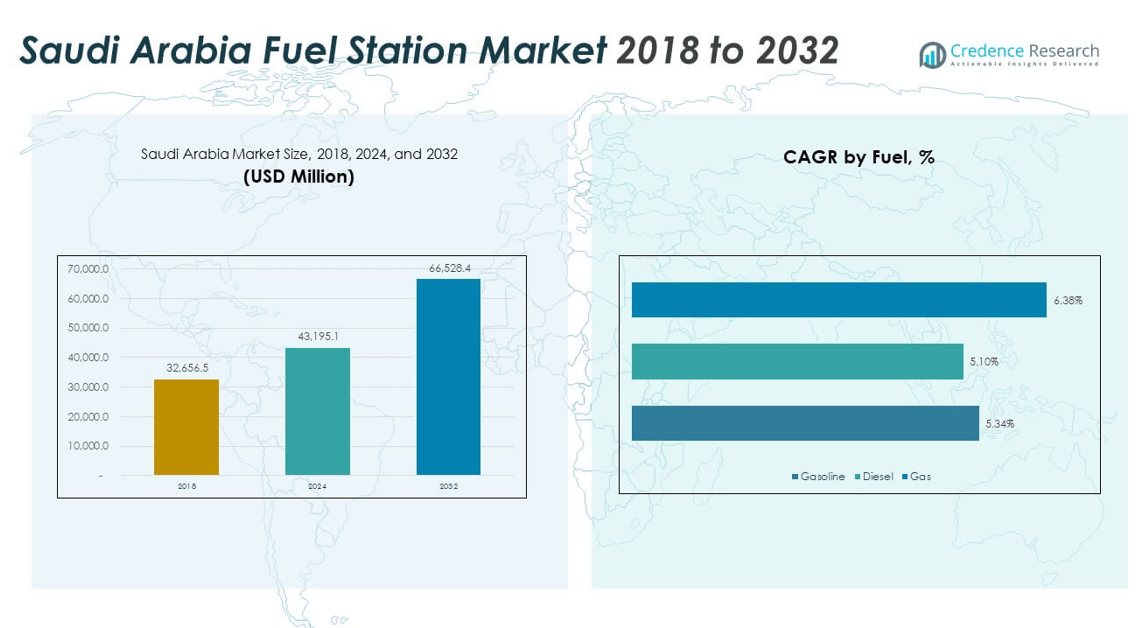

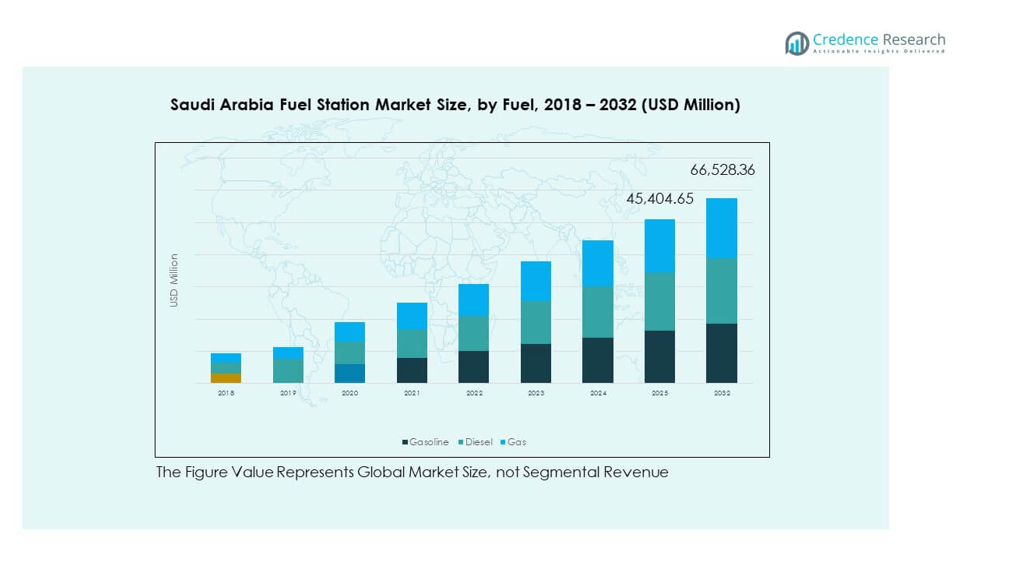

The Saudi Arabia Fuel Station Market size was valued at USD 32,656.50 million in 2018 to USD 43,195.10 million in 2024 and is anticipated to reach USD 66,528.40 million by 2032, at a CAGR of 5.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Fuel Station Market Size 2024 |

USD 43,195.10 million |

| Saudi Arabia Fuel Station Market, CAGR |

5.61% |

| Saudi Arabia Fuel Station Market Size 2032 |

USD 66,528.40 million |

The Saudi Arabia fuel station market is driven by the country’s expanding transportation infrastructure, increasing vehicle ownership, and rising fuel consumption across urban and rural areas. Government investments in road networks, combined with growing tourism and logistics activities, are boosting demand for fuel stations. Additionally, the integration of convenience stores, quick-service restaurants, and value-added services within stations is enhancing customer experience. Efforts to modernize facilities with digital payment systems, automated pumps, and sustainable fuel alternatives are further supporting market growth.

Geographically, the market shows strong development in major urban centers such as Riyadh, Jeddah, and Dammam, where dense population and commercial activities drive higher fuel demand. Emerging opportunities are observed in expanding suburban areas and remote regions, driven by infrastructure development projects. The western and eastern provinces are witnessing steady growth due to their strategic location for trade, tourism, and industrial activities. Coastal cities are benefiting from increasing port operations, while inland regions are experiencing growth from expanding logistics corridors and new transport routes.

Market Insights:

- The Saudi Arabia Fuel Station Market was valued at USD 43,195.10 million in 2024 and is projected to reach USD 66,528.40 million by 2032, growing at a CAGR of 5.61%.

- Rising vehicle ownership, expanding transportation infrastructure, and integration of multi-service station models are driving consistent market growth.

- Government-led modernization initiatives and the adoption of advanced fuel dispensing technology are improving operational efficiency and service quality.

- Environmental compliance requirements and the need for investment in cleaner fuel alternatives present cost and adaptation challenges for operators.

- The central region holds the largest market share at 42%, driven by Riyadh’s high population density, commercial activity, and transport connectivity.

- The western region accounts for 36% of the market, supported by tourism, pilgrimage traffic, and port operations in Jeddah and Makkah.

- The eastern region captures 22% market share, fueled by industrial growth, oil and gas operations, and cross-border trade routes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Vehicle Ownership and Expanding Transportation Networks Fueling Station Demand

The Saudi Arabia Fuel Station Market benefits from a steady rise in vehicle ownership driven by population growth and economic diversification. Expansions in the country’s transportation network, including expressways and highways, support fuel distribution across urban and rural locations. Increased private car usage and the growth of commercial fleets elevate fuel consumption levels. Government infrastructure initiatives stimulate construction of new stations in underserved regions. Tourism development under Vision 2030 increases road traffic, boosting retail fuel demand. Logistics and trade expansion require reliable refueling infrastructure. It experiences stable demand from daily commuters and freight operators. Integration of convenience services enhances customer attraction and retention.

- For instance, Aldrees Petroleum and Transport Services Co. expanded its network to approximately 1,050 fuel stations by the end of 2024, strengthening its presence across Saudi Arabia and supporting growing demand from both commuters and logistics operators.

Government-Led Modernization of Fuel Infrastructure and Service Standards

The market gains momentum from regulatory initiatives to modernize fuel station facilities with enhanced safety and service standards. Licensing reforms encourage investments from both domestic and international operators. Digital transformation in payment systems increases operational efficiency and customer satisfaction. Modern designs with improved traffic flow and service bays improve throughput. Emphasis on environmental compliance drives adoption of cleaner fuels and emission control technologies. Standardized branding and facility upgrades improve competitiveness. It attracts private sector participation through public-private partnerships. Expansion of multi-service models aligns with evolving consumer preferences.

Increased Integration of Ancillary Services for Higher Profitability

Fuel stations in Saudi Arabia increasingly operate as multi-service hubs offering retail, dining, and maintenance facilities. These additions increase revenue streams beyond fuel sales. The market sees strong growth in quick-service restaurants and branded convenience stores within station premises. Value-added services such as car washes, oil change bays, and EV charging points enhance site utility. Consumer preference for combined service points boosts traffic to modern stations. Partnerships with retail chains improve supply efficiency and brand appeal. It supports diversification goals in the energy retail sector. Premium service offerings differentiate operators in competitive areas.

Technological Advancements Improving Fuel Station Operations

The Saudi Arabia Fuel Station Market embraces automation and advanced technology to enhance operational efficiency. Automated fuel dispensers reduce wait times and improve accuracy. Real-time inventory management systems optimize supply logistics. Integration of mobile applications for payments and loyalty programs increases customer engagement. Adoption of predictive maintenance technologies minimizes downtime. Digital monitoring improves compliance with safety and environmental standards. Renewable energy integration, such as solar panels for station power, reduces operating costs. It gains resilience through innovation and adaptation to evolving market needs.

- For example, Go Station partnered with Titan Cloud to deploy a fuel analytics platform across 75 of its stations in Saudi Arabia, with a planned expansion to 325 locations by 2028. The solution delivers centralized, real-time visibility into fuel inventory, variance, and overall supply chain operations, enabling more efficient, data-driven decision-making.

Market Trends

Shift Toward Sustainable and Low-Emission Fuel Alternatives

The market witnesses growing interest in alternative fuels including compressed natural gas (CNG) and biofuels. Operators explore low-emission solutions to align with national sustainability goals. The expansion of electric vehicle infrastructure gradually complements traditional fuel offerings. Partnerships with clean energy providers strengthen brand image. Eco-friendly branding attracts environmentally conscious customers. Government incentives encourage investment in green technologies. It evolves to serve hybrid and EV owners while retaining core petroleum services. The trend supports long-term market adaptability.

- For example, in July 2025, EVIQ, in partnership with Petromin, launched a new EV charging station in Jeddah marking a significant step in Saudi Arabia’s shift toward multi‑energy fuel networks that support both conventional and electric mobility.

Premiumization of Customer Experience at Fuel Stations

Consumers increasingly expect a high-quality service environment during refueling stops. Operators introduce premium lounges, enhanced rest areas, and digital entertainment features. Branded retail spaces offer exclusive products and personalized services. Loyalty programs provide tailored discounts based on purchase history. Smart lighting and climate control improve customer comfort. Contactless payment solutions streamline transactions. It strengthens consumer relationships by aligning service quality with evolving lifestyle expectations. The focus on premium experiences creates brand differentiation in competitive zones.

Expansion of Urban and Suburban Retail Fuel Footprint

The Saudi Arabia Fuel Station Market experiences geographic diversification with a notable increase in suburban and mixed-use location developments. Urban congestion drives operators to invest in strategic suburban corridors. Growth in residential communities increases local refueling demand. Integration with shopping complexes and business districts improves convenience for commuters. Land availability in suburban areas supports larger multi-service layouts. It aligns with urban planning strategies to reduce inner-city congestion. Operators target growth corridors linked to logistics hubs and industrial zones. These investments strengthen long-term coverage.

- For instance, the SASCO Al-Jazeera 1 station on King Fahd Road connecting Riyadh and Al-Qassim stands as one of Saudi Arabia’s largest retail fuel complexes, integrating fuel forecourts with retail amenities and rest zones to serve both urban commuters and long-distance travelers.

Adoption of Data-Driven Operations and Predictive Analytics

The market incorporates advanced analytics to optimize pricing, inventory, and customer engagement. Real-time demand forecasting helps match supply with consumption patterns. Data platforms integrate with payment systems for targeted promotions. Operators monitor fuel quality and dispenser performance remotely. Predictive analytics reduce stockouts and operational inefficiencies. It improves decision-making by combining fuel sales data with regional economic indicators. Customized marketing campaigns increase customer retention. Digital intelligence becomes a competitive asset for leading operators.

Market Challenges Analysis

Regulatory Compliance Pressures and Environmental Responsibility Requirements

The Saudi Arabia Fuel Station Market faces increasing regulatory requirements related to environmental safety, emissions control, and fuel quality standards. Compliance involves costly upgrades to storage tanks, piping systems, and vapor recovery units. Smaller operators struggle to meet stringent specifications, limiting their competitiveness. Regular inspections require sustained investment in maintenance and documentation. Transition toward cleaner fuel alternatives requires technical adaptation and staff training. It must balance modernization with cost control to remain profitable. Tightening environmental laws elevate operational complexity.

Fluctuations in Fuel Prices and Impact on Consumer Demand Patterns

The market operates in a price-sensitive environment where fluctuations in global oil prices influence domestic fuel rates. Price volatility affects purchasing patterns for both consumers and fleet operators. Demand may shift toward alternative transportation modes during price hikes. Operators face revenue uncertainty that complicates long-term investment planning. High dependency on petroleum-based fuels exposes the sector to global market risks. It needs strategies to mitigate financial impacts from sudden price shifts. Price wars among competitors can erode margins further.

Market Opportunities

Growth in Multi-Utility Fuel Station Models and Non-Fuel Revenue Streams

The Saudi Arabia Fuel Station Market has opportunities to expand multi-utility models integrating retail, dining, and maintenance services. Consumer preference for comprehensive service locations boosts traffic and transaction value. Collaborations with quick-service restaurant chains and branded retail outlets enhance profitability. It can leverage non-fuel revenue to offset volatility in fuel sales. Expansion of EV charging infrastructure within these hubs can attract future-ready customers. Strategic partnerships increase customer loyalty and cross-selling opportunities.

Emergence of Technology-Driven and Sustainable Operations

Opportunities exist for operators to adopt renewable energy sources and advanced automation to reduce operational costs. Solar panel installations and energy-efficient lighting systems can improve profitability. It can integrate AI-driven monitoring for predictive maintenance and improved compliance. Expansion into sustainable fuel offerings supports national climate objectives. Mobile app integration with loyalty programs enhances customer engagement. Technology adoption positions operators as leaders in modern fuel retailing.

Market Segmentation Analysis:

By fuel segment, the Saudi Arabia Fuel Station Market is dominated by gasoline due to its extensive use in private vehicles and light-duty transport fleets. Diesel follows as a critical fuel source for heavy-duty trucks, buses, and commercial transport operations, supported by the growth of logistics and industrial activities. Gas is gaining traction in specific sectors, particularly for cost efficiency and lower emissions, aligning with the nation’s sustainability objectives. It continues to see balanced demand across these fuel categories, driven by the country’s expanding vehicle base and infrastructure network.

- For gas, Saudi Aramco’s Jafurah unconventional gas field is expected to begin production in late 2025, and its output is projected to scale up to a sustained 2 billion standard cubic feet per day of sales gas by 2030 aligning with Vision 2030’s goals to support industrial and transport demand while advancing cleaner fuel utilization.

By end user segment, road transport vehicles represent the largest share, supported by high private car ownership, extensive freight movement, and expanding public transportation services. Air transport vehicles contribute a smaller share but hold importance in fueling airport operations and supporting domestic and international air travel. Water transport vehicles, including commercial shipping and coastal transport, form a niche segment with steady demand linked to port activities and maritime trade. It benefits from the steady growth in each end user category, ensuring a diversified demand profile that sustains market stability and growth potential.

- For example, as of February 2025, airlines operating at Red Sea International Airport now have the option to refuel with a blend of 35% Sustainable Aviation Fuel (SAF) and 65% traditional Jet A‑1, marking a regional milestone in reducing aviation-related carbon emissions.

Segmentation:

By Fuel Segment

By End User Segment

- Road Transport Vehicles

- Air Transport Vehicles

- Water Transport Vehicles

Regional Analysis:

The central region commands the largest share of the Saudi Arabia Fuel Station Market, accounting for 42% of total market revenue. Riyadh, as the capital and the most populated city, drives demand through its dense urban traffic, expanding suburbs, and high concentration of commercial activities. The region benefits from strong infrastructure connectivity, making it a key hub for logistics and intercity travel. Fuel stations here focus on high-capacity layouts and integrated services to cater to both private and commercial users. It maintains consistent growth supported by real estate expansion, rising vehicle ownership, and government-backed transport projects. Modernization initiatives and smart station concepts continue to strengthen its competitive position.

The western region holds 36% of the market, driven by cities like Jeddah, Makkah, and Madinah, which experience high seasonal traffic due to tourism and pilgrimage activities. The presence of major ports in Jeddah supports maritime trade, creating consistent demand from both road and water transport segments. Infrastructure projects, including highway expansions and airport upgrades, sustain fuel consumption growth. It sees growing investment in service upgrades, convenience retail integration, and premium fuel offerings. Operators leverage the high influx of domestic and international visitors to introduce differentiated service models. The region’s diverse transport needs ensure stable demand across multiple fuel categories.

The eastern region accounts for 22% of the market, supported by its role as the country’s industrial and energy production hub. Cities like Dammam, Dhahran, and Al Khobar host a large concentration of oil and gas facilities, industrial complexes, and export terminals. Demand is fueled by heavy-duty transport vehicles, industrial fleets, and cross-border trade routes. It benefits from steady infrastructure development, including highway expansions linking it to other Gulf countries. Station operators in this region invest in high-throughput facilities capable of serving large commercial fleets. The combination of industrial growth, port activity, and strategic location reinforces its importance in the overall market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Saudi Arabia Fuel Station Market features a competitive landscape dominated by prominent players such as Saudi Arabian Oil Company, TotalEnergies SE, ADNOC Distribution, and Wafi Energy Co., alongside regional operators like Petromin Corporation and Aldrees Petroleum. Competition is driven by network expansion, modernization of facilities, and integration of non-fuel services such as convenience stores and quick-service restaurants. Operators invest in technology upgrades, automated payment systems, and premium fuel offerings to enhance customer retention. Strategic partnerships with retail brands and infrastructure developers strengthen market positioning. It continues to attract new entrants seeking to leverage growth in suburban and underserved areas, creating an environment where innovation and service differentiation are critical for sustaining market share.

Recent Developments:

- In February 2025, Saudi Arabian Oil Company (Aramco) announced the acquisition of a 25% equity stake in Unioil Petroleum Philippines as part of its broader downstream expansion. While this is international, domestically Aramco’s most recent notable partnership is its ongoing joint venture with TotalEnergies to build and expand a retail service station network across Saudi Arabia.

- In July 2025, Blacklane, a global chauffeur service, and EVIQ, Saudi Arabia’s leading electric vehicle (EV) infrastructure provider, signed a strategic agreement to rapidly accelerate the roll-out of EV infrastructure in Saudi Arabia. Through this partnership, the companies aim to expand the national EV charging network, especially in major cities and mobility hubs, and will set up dedicated fleet-charging hubs including one at Blacklane’s new Gulf regional headquarters in Riyadh.

- In August 2025, ADNOC Distribution announced its intention to launch 160 new service stations in Saudi Arabia by 2026, aiming to expand its network to approximately 300 stations across the kingdom.

Market Concentration & Characteristics:

The Saudi Arabia Fuel Station Market is moderately concentrated, with a few large players controlling significant market share while smaller operators cater to niche and regional demands. It exhibits high entry barriers due to regulatory requirements, capital-intensive infrastructure, and the need for strategic locations. The market is characterized by a blend of state-owned giants, multinational corporations, and local private firms, each focusing on network reach and service diversification. Competitive dynamics are shaped by brand loyalty, operational efficiency, and the integration of value-added services. Technological adoption, including automation and digital payment systems, is becoming a key differentiator. Growing emphasis on sustainable fuel options and eco-friendly infrastructure is influencing long-term competitive strategies.

Report Coverage:

The research report offers an in-depth analysis based on fuel type and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Multi-utility fuel stations will expand, integrating retail outlets, dining options, and vehicle services to diversify revenue streams.

- Digital payment solutions and automated dispensing systems will see broader adoption, improving transaction speed and operational efficiency.

- Electric vehicle charging infrastructure will grow alongside traditional fuel offerings, ensuring readiness for evolving mobility trends.

- Demand for premium fuel grades will rise, supported by consumers seeking improved engine performance and fuel efficiency.

- Investment will target underserved suburban and rural locations, creating new access points for a wider customer base.

- Renewable energy integration, including solar power, will help operators reduce long-term operational costs and improve sustainability.

- Compliance with environmental regulations will drive the adoption of low-emission and alternative fuel options.

- Customer loyalty programs will strengthen, supported by data-driven engagement and personalized rewards.

- Partnerships with convenience store chains and quick-service restaurant brands will expand, enhancing the service experience.

- High-capacity fuel stations near logistics hubs will be developed to meet the refueling needs of commercial fleets and freight operators.