Market Overview:

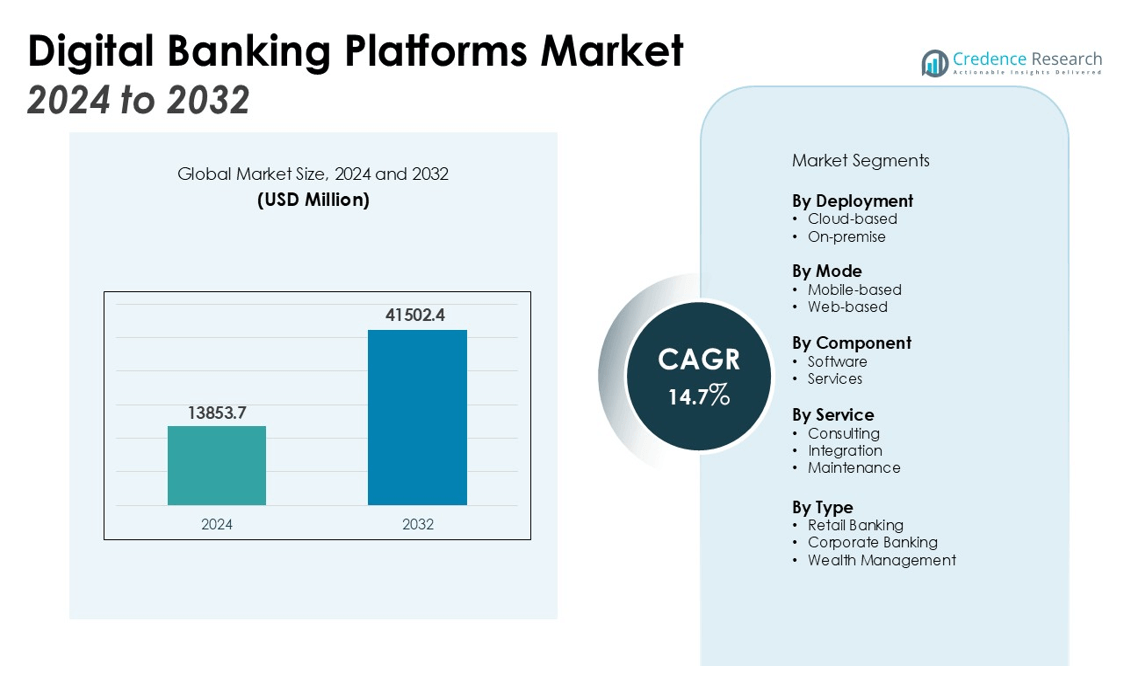

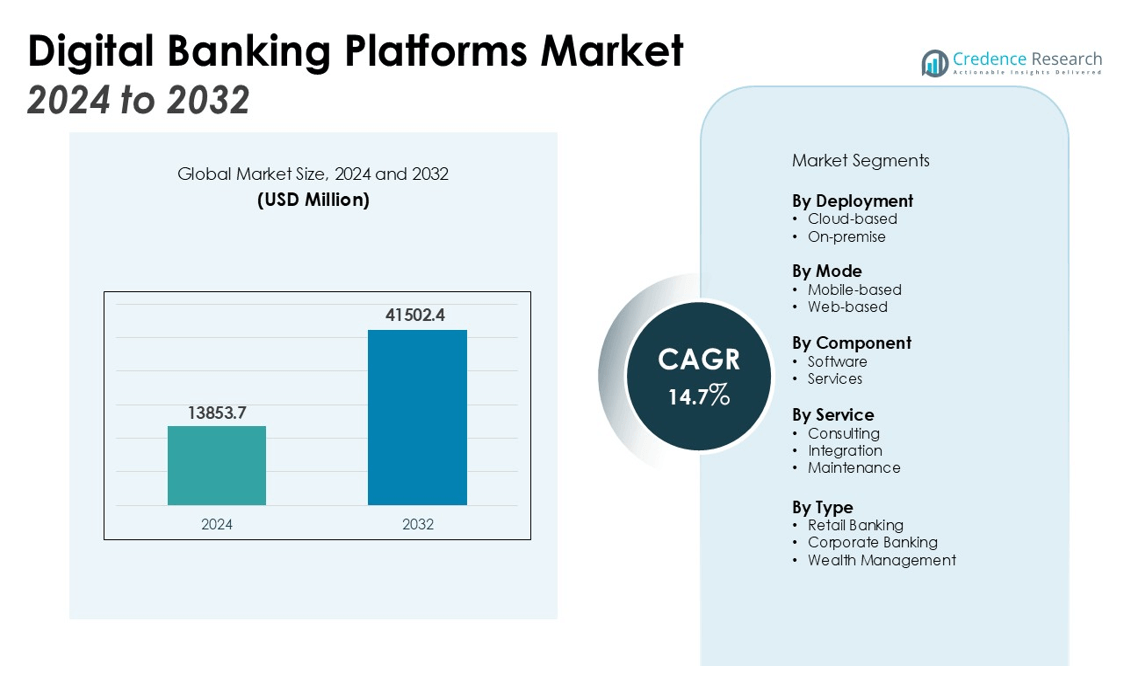

The Digital Banking Platforms Market size was valued at USD 13853.7 million in 2024 and is anticipated to reach USD 41502.4 million by 2032, at a CAGR of 14.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Banking Platforms Market Size 2024 |

USD 13853.7 million |

| Digital Banking Platforms Market, CAGR |

14.7% |

| Digital Banking Platforms Market Size 2032 |

USD 41502.4 million |

Key drivers of market growth include the rapid digitization of financial services, the shift towards cashless economies, and the rising demand for secure, user-friendly banking platforms. The integration of artificial intelligence, blockchain, and data analytics within digital banking platforms is further advancing service offerings, allowing institutions to offer personalized services, fraud detection, and improved customer support. Additionally, the growing adoption of mobile banking is significantly contributing to the market’s growth, as consumers demand more accessible and efficient financial services. The increasing focus on regulatory compliance and data privacy is also pushing financial institutions to invest in advanced digital banking platforms.

Regionally, North America holds the largest market share, primarily due to the presence of key market players and the high rate of digital banking adoption. Europe follows closely, supported by advanced technological infrastructure and regulatory frameworks. The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid urbanization, increasing smartphone penetration, and the rising adoption of mobile payments in emerging economies. This trend is further fueled by government initiatives to support financial inclusion and digitization in the region.

Market Insights:

- The Digital Banking Platforms Market was valued at USD 13,853.7 million in 2024 and is expected to reach USD 41,502.4 million by 2032, growing at a CAGR of 14.7% during the forecast period (2024-2032).

- Key drivers of market growth include the rapid digitization of financial services, the shift towards cashless economies, and the rising demand for secure, user-friendly platforms.

- The integration of advanced technologies such as AI, blockchain, and data analytics is improving service offerings, enabling institutions to provide personalized services, fraud detection, and better customer support.

- Mobile banking adoption is increasing globally, with more consumers opting for mobile-first banking solutions for greater convenience and accessibility.

- The need for secure digital banking solutions is also pushing growth, as financial institutions prioritize data privacy and regulatory compliance to meet evolving standards.

- North America holds the largest market share at 40%, benefiting from high digital banking adoption, strong infrastructure, and a well-established financial ecosystem.

- The Asia-Pacific region is poised for the highest growth, driven by rapid urbanization, increasing smartphone penetration, and rising adoption of mobile payments in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Digital Transformation in the Financial Sector

The Digital Banking Platforms Market is expanding due to the rapid digital transformation of financial services. Financial institutions are adopting digital platforms to enhance operational efficiency, streamline processes, and improve customer experiences. This shift is driven by the demand for faster, more accessible banking services that align with modern consumer expectations. The push for automation and digitization has led to the development of advanced banking systems, allowing financial institutions to operate more effectively and efficiently across various channels.

The Growing Demand for Secure and User-Friendly Solutions

Security and ease of use have become critical factors driving the Digital Banking Platforms Market. As financial services migrate to digital platforms, there is an increasing demand for secure systems that protect sensitive customer data and ensure compliance with regulations. Consumers expect seamless and intuitive banking experiences, leading to an uptick in user-friendly solutions that deliver both convenience and robust security. This focus on security, coupled with enhanced usability, ensures that institutions can meet consumer expectations while minimizing risks associated with fraud and data breaches.

- For instance, DBS Bank in Singapore enhances its fraud detection with AI models trained on over 300 features and 10 data sources.

The Rise of Mobile Banking and Cashless Transactions

The growing adoption of mobile banking is another key driver of the Digital Banking Platforms Market. With increasing smartphone penetration globally, more consumers are opting for mobile banking solutions to manage their finances. This demand for mobile-first solutions is pushing financial institutions to enhance their digital platforms to cater to this growing consumer base. The rise of cashless transactions further complements this trend, with consumers increasingly relying on digital payment methods for daily transactions, further accelerating the demand for efficient digital banking systems.

- For instance, the magnitude of this trend is evidenced by the approximately 2 billion mobile wallet debit transactions processed in the U.S. in a single year, a market where Apple Pay holds the dominant position.

Integration of Advanced Technologies Like AI and Blockchain

Technologies such as artificial intelligence (AI) and blockchain are transforming the landscape of the Digital Banking Platforms Market. AI is used to enhance customer service through chatbots, improve fraud detection, and offer personalized financial advice. Blockchain provides a secure, decentralized framework for transactions, which further strengthens the security and transparency of digital banking services. The integration of these technologies helps institutions deliver innovative services, stay ahead of competitors, and meet evolving customer demands.

Market Trends:

Increased Focus on Personalization and Customer-Centric Solutions

The Digital Banking Platforms Market is witnessing a strong trend towards personalization, as financial institutions strive to deliver tailored experiences to customers. By leveraging data analytics and machine learning, banks are able to offer customized services, such as personalized financial advice, predictive analytics for budgeting, and individualized product recommendations. This trend is being driven by the growing expectation among consumers for banking services that cater to their unique needs and preferences. Financial institutions are increasingly focusing on developing intuitive, user-friendly platforms that allow customers to easily access personalized features, enhancing customer satisfaction and loyalty. Personalized offerings not only improve customer experience but also help financial institutions differentiate themselves in a highly competitive market.

- For instance, JPMorgan Chase’s machine learning program, COIN (Contract Intelligence), automates the interpretation of commercial-loan agreements, completing work in seconds that previously required 360,000 hours from lawyers and loan officers annually.

Integration of Open Banking and Collaboration with FinTech Startups

Open banking is emerging as a key trend within the Digital Banking Platforms Market, driven by the growing demand for transparency and better access to financial data. This shift allows customers to share their banking data securely with third-party providers, enabling them to access a wider range of services and solutions. Open banking fosters collaboration between traditional financial institutions and FinTech startups, encouraging innovation and creating opportunities for more diverse financial products and services. Banks are integrating APIs and adopting a more open, modular approach to banking to facilitate these collaborations. The adoption of open banking not only enhances consumer choice but also increases the overall agility and adaptability of financial services, aligning with the evolving expectations of modern consumers.

- For instance, Citi’s CitiConnect API platform processed over 1 billion API calls since its launch, a milestone reached in 2021.

Market Challenges Analysis:

Regulatory Compliance and Data Privacy Concerns

One of the primary challenges in the Digital Banking Platforms Market is maintaining compliance with increasingly stringent regulatory requirements. Financial institutions must navigate complex local and international regulations, including data protection laws such as GDPR and PSD2. These regulations impose significant demands on banks to ensure the security and privacy of customer data, particularly as they adopt new technologies like AI and blockchain. Failure to comply with these regulations can result in heavy penalties and reputational damage. As the digital banking sector evolves, staying ahead of changing regulatory landscapes and ensuring the platform meets these compliance standards remains a critical challenge for financial institutions.

Cybersecurity Threats and Fraud Risks

Cybersecurity risks pose a significant challenge for the Digital Banking Platforms Market. As more customers turn to digital banking, the frequency and sophistication of cyberattacks continue to increase. Hackers target sensitive financial data, and phishing, malware, and ransomware attacks have become more prevalent. Financial institutions must invest heavily in advanced security measures to safeguard their platforms against these evolving threats. While digital banking offers convenience, the risk of fraud and data breaches can undermine trust in these services, creating a barrier to market growth. Balancing convenience with robust cybersecurity is a challenge that banks must address to retain customer confidence and ensure business continuity.

Market Opportunities:

Expansion of Financial Inclusion in Emerging Markets

The Digital Banking Platforms Market offers significant opportunities in emerging markets, where financial inclusion remains a major challenge. Many consumers in developing regions are underserved by traditional banking institutions, presenting a unique opportunity for digital banking platforms to bridge this gap. By leveraging mobile banking and internet-based solutions, financial institutions can reach a larger population, offering services like digital payments, savings accounts, and microloans. The rising smartphone penetration and increasing internet access in these regions enable more people to participate in the formal financial system, driving growth for digital banking solutions. Institutions that tailor their platforms to these markets can tap into a largely untapped customer base, expanding their reach and enhancing profitability.

Integration of Advanced Technologies for Enhanced Services

The integration of advanced technologies, such as AI, machine learning, and blockchain, presents substantial opportunities in the Digital Banking Platforms Market. These technologies enable financial institutions to offer more personalized services, improve operational efficiency, and enhance security measures. AI-driven chatbots, for instance, can automate customer service, while machine learning can assist in fraud detection and risk management. Blockchain allows for secure, transparent transactions, making it an attractive solution for digital banking. By embracing these technologies, financial institutions can differentiate their offerings, increase customer satisfaction, and optimize back-end processes, thus gaining a competitive edge in the digital banking landscape.

Market Segmentation Analysis:

By Deployment

The Digital Banking Platforms Market is segmented by deployment, including cloud-based and on-premise solutions. Cloud-based platforms dominate the market due to their scalability, flexibility, and cost-efficiency. These solutions allow financial institutions to easily scale their operations, reduce infrastructure costs, and provide seamless services to customers. On-premise deployments, while less prevalent, offer greater control over data security and compliance, making them a preferred option for larger institutions with stringent data protection requirements. As banks increasingly adopt digital solutions, the cloud-based segment is expected to see continued growth, driven by the ongoing shift to remote services and mobile banking.

- For instance, by utilizing a cloud-based banking platform, Goldman Sachs’ transaction banking service successfully achieved zero-downtime for its critical operations.

By Mode

The market is also segmented by mode, which includes mobile and web-based platforms. Mobile banking solutions have gained significant traction due to the widespread use of smartphones and the growing demand for on-the-go banking services. Mobile platforms enable customers to perform transactions, check balances, and access other banking services anytime, anywhere. Web-based platforms remain important for providing comprehensive banking services, especially for business and corporate banking needs. These solutions support more extensive features and are preferred by users who require detailed financial management tools. The increasing reliance on mobile banking will likely drive the expansion of mobile-based solutions.

- For instance, Revolut’s systems, powered by AI and advanced machine learning, demonstrate the robust security of its platform by having averted potential fraud worth over £600 million in 2024.

By Component

The Digital Banking Platforms Market is segmented by component into software and services. Software solutions encompass core banking systems, payment gateways, and mobile banking applications, providing the foundation for digital banking services. Services include consulting, integration, and maintenance, which are crucial for ensuring the smooth operation and continuous improvement of digital banking systems. As digital banking evolves, there is growing demand for integrated solutions that combine software and services, ensuring financial institutions remain competitive and can offer seamless experiences to their customers.

Segmentations:

By Deployment

By Mode

By Component

By Service

- Consulting

- Integration

- Maintenance

By Type

- Retail Banking

- Corporate Banking

- Wealth Management

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: The Dominant Market Leader

North America accounts for 40% of the global Digital Banking Platforms Market share, driven by a well-established financial ecosystem and the presence of key market players. The region benefits from high rates of digital banking adoption, driven by a tech-savvy population and robust infrastructure. Major financial institutions are investing heavily in digital banking technologies, aiming to enhance user experience, security, and efficiency. The regulatory environment in North America, particularly in the United States and Canada, also fosters innovation while ensuring compliance with stringent standards. These factors contribute to North America’s leadership in the global market, with continued growth expected due to the ongoing shift toward mobile and online banking solutions.

Europe: Steady Growth with Strong Regulatory Support

Europe holds 30% of the global Digital Banking Platforms Market share, supported by a well-developed banking sector and advanced technological infrastructure. The region has seen an increasing demand for digital banking platforms, driven by consumer preferences for mobile and online banking services. Europe’s stringent regulatory frameworks, such as GDPR and PSD2, have accelerated the adoption of secure and compliant digital banking solutions. Additionally, many European banks are collaborating with fintech startups to enhance their digital offerings, making the market more dynamic and competitive. The rise of open banking is another significant trend in the region, further boosting the growth of digital banking platforms.

Asia-Pacific: Rapid Growth and Untapped Potential

Asia-Pacific holds 25% of the global Digital Banking Platforms Market share and is expected to experience the highest growth rate due to rapid urbanization, increasing smartphone penetration, and the growing adoption of mobile payments. Countries like China, India, and Southeast Asia are witnessing a surge in digital banking services as more consumers shift towards mobile-first banking solutions. The region’s large unbanked population presents significant opportunities for financial inclusion, with digital platforms offering easier access to banking services. Government initiatives to promote financial inclusion and technological innovation further drive market growth in this region. As infrastructure improves and consumer demand for digital services increases, Asia-Pacific is poised for substantial expansion in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alkami Technology Inc.

- Appway AG

- Temenos

- Urban FT Group, Inc.

- Finastra

- Fiserv, Inc.

- Crealogix AG

- Q2 Software, Inc.

- Tata Consultancy Service

- Sopra Banking Software

Competitive Analysis:

The Digital Banking Platforms Market is highly competitive, with key players such as Temenos AG, Finastra, and Infosys offering comprehensive solutions across various banking sectors. These companies provide cloud-based and on-premise platforms, enabling financial institutions to deliver secure, scalable, and user-friendly services. Temenos AG leads with its extensive suite of digital banking solutions, catering to retail, corporate, and private banking needs. Finastra focuses on open banking and collaborative solutions, fostering innovation and enhanced customer experiences. Infosys, through its Finacle platform, offers a robust digital banking solution that supports a range of banking services, including payments, core banking, and wealth management. New entrants in the market, particularly FinTech startups, are pushing for disruptive innovation, challenging traditional banking models by offering more agile, cost-effective platforms. To stay competitive, leading players continue to invest in AI, machine learning, and blockchain technologies, enhancing functionality and security across digital banking platforms.

Recent Developments:

- In May 2025, Finastra announced its agreement to sell its Treasury and Capital Markets (TCM) division to an affiliate of Apax Funds.

- In April 2025, Fiserv, Inc. acquired Pinch Payments, a payment facilitator based in Australia. This acquisition enhances Fiserv’s payment service offerings and expands its presence in the Asia-Pacific region.

- In May 2025, Temenos launched its Product Manager Copilot, a new Generative AI tool designed to help banks create and manage financial products more quickly.

- In August 2025, Tata Consultancy Services renewed and expanded its partnership with Weatherford International for five years, focusing on AI-driven business transformations.

Market Concentration & Characteristics:

The Digital Banking Platforms Market exhibits moderate concentration, with several key players dominating the space. Established companies such as Temenos AG, Finastra, and Infosys hold significant market shares, providing comprehensive, integrated banking solutions to a wide range of financial institutions. These players leverage strong brand recognition, advanced technology, and extensive customer bases to maintain their leadership positions. However, the market also sees increasing participation from FinTech startups, which offer innovative and agile solutions that challenge traditional models. This dynamic competitive environment fosters continuous innovation, with industry leaders investing in AI, machine learning, and blockchain technologies to enhance their offerings. While the market remains competitive, the demand for secure, scalable, and efficient digital banking platforms supports ongoing growth opportunities for both established players and new entrants. The increasing focus on customer experience and personalized services is also driving the evolution of platform offerings.

Report Coverage:

The research report offers an in-depth analysis based on Deployment, Mode, Component, Service, Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Digital Banking Platforms Market will continue to expand as more financial institutions adopt digital solutions to meet the evolving demands of consumers.

- Increased adoption of AI and machine learning will enhance personalization and automation in digital banking, improving customer service and operational efficiency.

- The integration of blockchain technology will improve security, transparency, and efficiency in digital transactions, driving growth in both retail and corporate banking sectors.

- Open banking initiatives will become more widespread, fostering collaboration between traditional banks and FinTech companies, leading to a more innovative and competitive environment.

- The demand for mobile banking solutions will increase, with more consumers opting for on-the-go financial services, driving the growth of mobile-based platforms.

- Governments and regulatory bodies will implement more frameworks to ensure data privacy and security, creating a secure environment for digital banking expansion.

- Financial inclusion efforts will grow in emerging markets, where digital platforms can offer banking services to underserved populations.

- Increased competition from FinTech startups will push traditional banks to further innovate and enhance their digital offerings to stay competitive.

- The shift to cloud-based banking platforms will accelerate, driven by their scalability, cost-effectiveness, and ability to support modern banking needs.

- Enhanced data analytics will allow banks to offer more customized financial products, improving customer retention and acquisition strategies.