Market Overview:

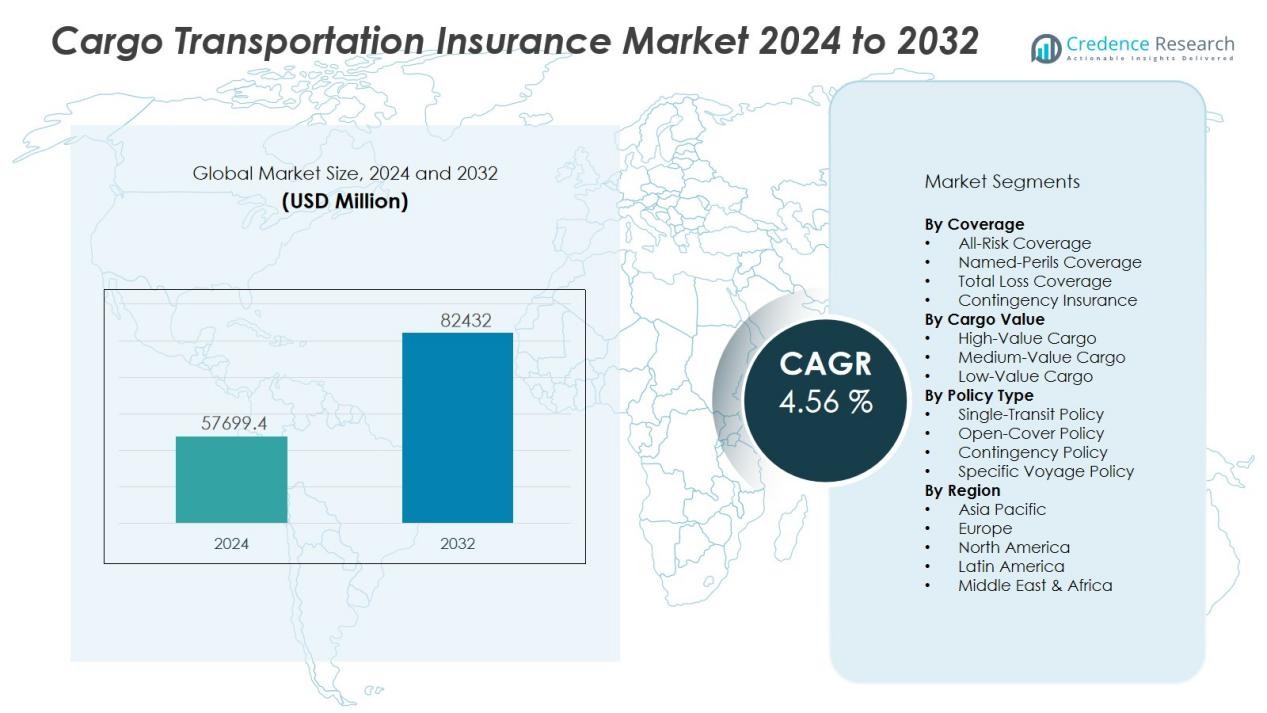

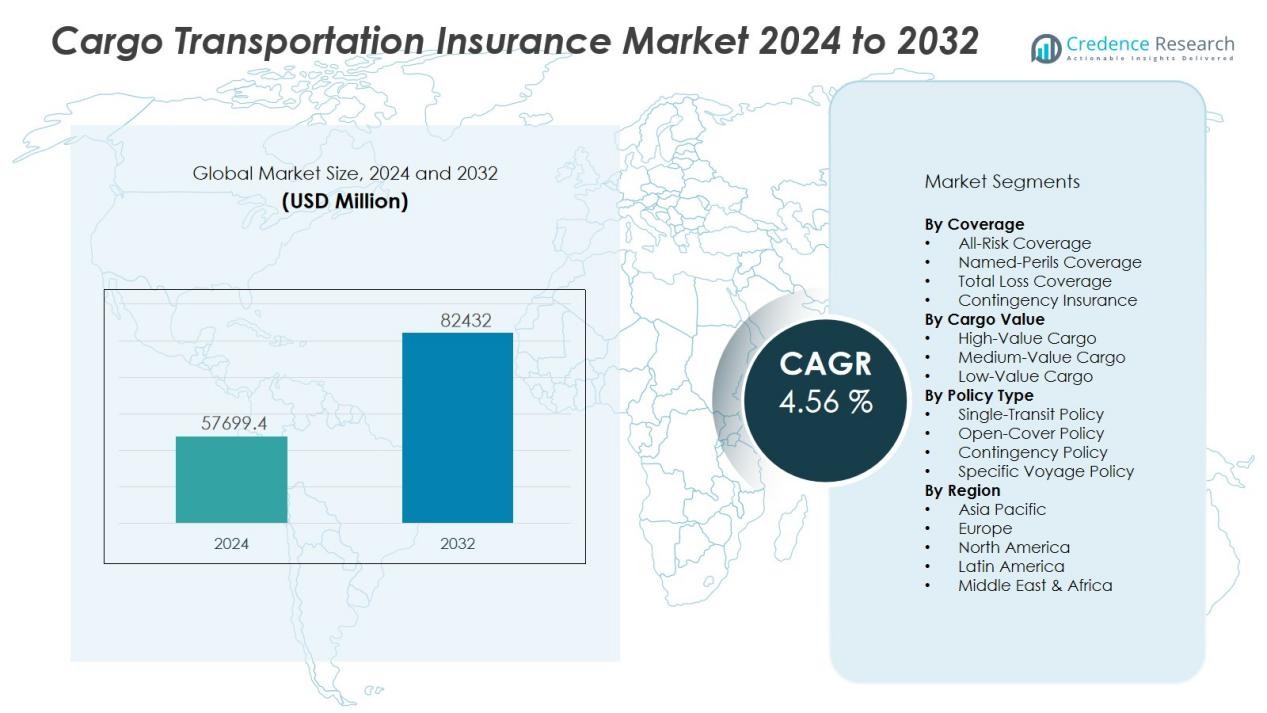

The cargo transportation insurance market size was valued at USD 57699.4 million in 2024 and is anticipated to reach USD 82432 million by 2032, at a CAGR of 4.56 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cargo Transportation Insurance Market Size 2024 |

USD 57699.4 Million |

| Cargo Transportation Insurance Market, CAGR |

4.56 % |

| Cargo Transportation Insurance Market Size 2032 |

USD 82432 Million |

Market growth is driven by heightened risks of cargo damage, theft, and loss during transit, particularly in multimodal transportation networks. Stringent international trade regulations, volatile geopolitical conditions, and climate-related disruptions are also compelling stakeholders to secure coverage against potential liabilities. The integration of advanced tracking technologies, data analytics, and real-time monitoring into insurance offerings is further enhancing risk assessment and claims efficiency. Growing emphasis on customized and flexible policy structures is enabling insurers to meet specific industry needs, from perishable goods to high-value industrial equipment.

Regionally, North America holds a significant share due to robust trade activity, advanced logistics infrastructure, and a mature insurance sector. Europe follows closely, supported by strong regulatory frameworks and high penetration of marine and transport insurance. The Asia-Pacific market is poised for the fastest growth, fueled by expanding manufacturing hubs, rapid e-commerce adoption, and increasing cross-border trade flows, particularly in China, India, and Southeast Asia. Latin America and the Middle East & Africa are also gaining momentum, driven by infrastructure development and rising export activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The cargo transportation insurance market was valued at USD 57,699.4 million in 2024 and is projected to reach USD 82,432 million by 2032, driven by steady growth in global trade and evolving logistics needs.

- Heightened risks of cargo loss, theft, and damage in multimodal transport are pushing demand for comprehensive insurance coverage across industries.

- Geopolitical instability and climate-related disruptions are influencing underwriting strategies and premium structures to address emerging risk factors.

- Advanced technologies, including IoT sensors, GPS tracking, and real-time analytics, are improving cargo visibility, risk assessment, and claims efficiency.

- North America holds 32% market share, supported by mature insurance infrastructure, advanced logistics networks, and high-value shipment volumes.

- Europe accounts for 28% market share, driven by strong regulatory frameworks, major marine insurance hubs, and established intermodal transport systems.

- Asia-Pacific holds 25% market share and is the fastest-growing region, fueled by manufacturing hubs, e-commerce growth, and expanding trade networks.

Market Drivers:

Expansion of Global Trade and Cross-Border Logistics:

The cargo transportation insurance market is benefiting from the sustained expansion of global trade and the increasing complexity of cross-border logistics. Growing import and export activities, coupled with the rise of free trade agreements, are creating higher demand for comprehensive coverage against transit risks. It addresses the financial protection needs of businesses engaged in multimodal transport, where goods are often exposed to varying regulatory and operational environments. The market is aligning with evolving trade patterns, ensuring coverage remains relevant to diverse cargo types and routes.

- For instance, Echo Global Logistics launched EchoInsure+ in February 2023, enabling full coverage for Less-Than-Truckload (LTL) shipments and resolving claims in as little as 10 days, with zero deductibles up to $10,000 through its EchoShip online platform.

Rising Incidence of Cargo Loss, Damage, and Theft:

The cargo transportation insurance market is driven by the growing frequency of cargo-related incidents during storage and transit. Increased congestion at ports, supply chain disruptions, and the use of multiple transport modes heighten the likelihood of loss or damage. It offers shippers, freight forwarders, and logistics providers financial security against these risks. High-value and sensitive goods, such as electronics and pharmaceuticals, require specialized policies to address unique handling and security needs.

- For instance, Parsyl’s ColdCover Parametric product paid a spoilage claim to Niceland Seafood in just 7 hours and 40 minutes, leveraging smart sensor data to achieve industry-leading same-day claims resolution for temperature excursions affecting perishable seafood shipments.

Impact of Geopolitical Instability and Climate Risks;

Geopolitical tensions, regional conflicts, and trade route disruptions are reinforcing the necessity of cargo transportation insurance. It provides coverage against unforeseen events that can halt or delay shipments, impacting contractual obligations and revenue. Climate-related risks, such as storms, floods, and wildfires, are also influencing underwriting practices and premium structures. The market is adapting by integrating predictive analytics to assess risk exposure and enhance policy effectiveness.

Technological Advancements in Risk Assessment and Claims Management:

The cargo transportation insurance market is gaining from the integration of advanced technologies for risk monitoring and claims processing. IoT-enabled sensors, GPS tracking, and real-time data analytics improve visibility across supply chains, enabling proactive risk mitigation. It enhances claims accuracy by providing verifiable evidence of cargo conditions throughout transit. The adoption of digital platforms streamlines policy management, allowing insurers to deliver faster and more transparent services.

Market Trends:

Integration of Digital Technologies and Data-Driven Underwriting:

The cargo transportation insurance market is experiencing a rapid shift toward digital transformation, driven by the need for greater transparency and efficiency in risk management. Insurers are adopting IoT-enabled devices, blockchain-based documentation, and AI-powered analytics to monitor cargo conditions, verify delivery milestones, and detect potential risks in real time. It allows for more accurate underwriting, tailored premium calculations, and faster claims settlement processes. Predictive modeling is becoming a standard tool for assessing risk exposure across complex, multimodal transportation networks. Cloud-based platforms are streamlining policy management, enabling real-time collaboration between shippers, insurers, and logistics providers. The focus on automation and digital tools is strengthening customer trust and improving operational agility across the sector.

- For instance, Maersk’s TradeLens blockchain platform handles 10 million events and more than 100,000 documents every week, cutting document processing time by 30 percent.

Shift Toward Customized and Sustainability-Focused Insurance Solutions:

The cargo transportation insurance market is witnessing a growing emphasis on customized coverage solutions that address the unique needs of different cargo categories and trade routes. High-value goods, temperature-sensitive shipments, and hazardous materials are prompting insurers to design specialized policies with precise risk coverage terms. It is also seeing rising demand for sustainability-focused products that incentivize eco-friendly logistics practices, such as lower premiums for shippers using green-certified transport providers. Regulatory pressures on carbon emissions are pushing insurers to integrate environmental risk assessments into policy frameworks. Collaboration between insurers and logistics technology companies is expanding, enabling the creation of value-added services like supply chain optimization and loss prevention consulting. This shift toward personalization and sustainability is redefining competitive positioning in the market.

- For instance, Maersk’s Value Protect service streamlined its cargo claims workflow to deliver resolutions within 14 days for 100 percent of fully documented claims in 2024.

Market Challenges Analysis:

Complex Risk Assessment in a Dynamic Trade Environment:

The cargo transportation insurance market faces the challenge of accurately assessing risks in an increasingly volatile trade environment. Diverse cargo types, fluctuating geopolitical conditions, and unpredictable weather events complicate underwriting processes. It must account for varying regulations across jurisdictions, creating operational and compliance hurdles for insurers. The rise in high-value and specialized shipments demands more precise coverage structures, yet data gaps in certain regions limit accurate evaluation. Rapid shifts in supply chain patterns also make long-term risk forecasting more difficult. These factors increase the complexity and cost of delivering competitive insurance solutions.

Escalating Claims Costs and Fraud Risks:

The cargo transportation insurance market is under pressure from rising claims costs driven by inflation, higher cargo values, and increased frequency of loss events. It also faces the growing threat of fraudulent claims, which can undermine profitability and erode trust. Detecting and preventing fraud requires advanced verification systems, yet implementation can be resource-intensive. Disputes over liability in multimodal transport often delay settlements, impacting customer satisfaction. Limited access to standardized cargo tracking in certain markets further complicates claim validation. Managing these challenges while maintaining service quality remains a critical priority for insurers.

Market Opportunities:

Expansion into Emerging Trade Corridors and E-Commerce Logistics:

The cargo transportation insurance market holds strong potential in emerging trade corridors, where infrastructure development and cross-border commerce are accelerating. Growing participation of developing economies in global supply chains creates demand for tailored insurance products suited to local regulatory and operational contexts. It can capitalize on the rapid growth of e-commerce, where small and frequent shipments require flexible, short-term coverage options. Insurers that design scalable policies for last-mile delivery, international parcel shipments, and high-volume cross-border trade can capture new customer segments. Partnerships with logistics providers in fast-growing regions will enhance market reach and service responsiveness. This expansion offers a significant avenue for sustained growth.

Leveraging Technology for Value-Added Risk Management Services:

The cargo transportation insurance market can strengthen its competitive position by integrating technology-driven value-added services into policy offerings. Real-time cargo tracking, predictive analytics, and automated claims processing enhance risk mitigation and customer satisfaction. It can offer proactive loss prevention consulting, helping clients reduce claims frequency and improve operational resilience. Growing adoption of IoT and blockchain in logistics enables transparent, verifiable cargo records that build trust and streamline dispute resolution. Tailored digital platforms for policy management and risk assessment will attract tech-savvy clients seeking efficiency. This approach positions insurers as strategic partners in supply chain optimization rather than solely as coverage providers.

Market Segmentation Analysis:

By Coverage:

The cargo transportation insurance market offers a wide range of coverage options, including all-risk policies and named-perils policies. All-risk coverage remains the preferred choice for shippers handling high-value or sensitive goods, offering protection against most unforeseen transit risks. Named-perils coverage is often selected for bulk commodities or shipments with lower vulnerability, focusing on specific risks such as fire, theft, or collision. It enables businesses to tailor protection based on cargo type, route complexity, and transportation mode. The growing demand for multimodal transport solutions is driving interest in flexible, customizable coverage structures.

- For instance, TT Club’s Hazcheck Detect system now screens over 500,000 container booking records daily, ensuring precise risk identification across ocean, rail, and road legs.

By Cargo Value:

The market serves shipments across varying cargo values, from low-value bulk goods to high-value specialized equipment. High-value cargo, such as electronics, pharmaceuticals, and luxury goods, requires comprehensive coverage with higher liability limits. Medium-value shipments often combine cost efficiency with balanced risk protection. Low-value cargo typically relies on limited coverage due to cost sensitivity, yet growing global trade is increasing uptake even in this segment. It is evident that insurers are offering tiered solutions to match specific value categories and risk profiles.

By Policy Type:

Policy types in the cargo transportation insurance market include single-transit policies and open-cover policies. Single-transit policies cater to businesses with infrequent shipments, offering one-time coverage for a specific journey. Open-cover policies appeal to frequent shippers, providing continuous coverage over a defined period for multiple consignments. It allows for operational efficiency, reduced administrative effort, and consistent protection. The choice between these policy types is influenced by shipment frequency, trade routes, and cost considerations.

- For instance, Peters & May Ltd utilizes an annual open cover cargo policy, insuring over 360 international shipments in 2024 under a single contract—eliminating the need for separate policies and streamlining their marine logistics operations.

Segmentations:

By Coverage:

- All-Risk Coverage

- Named-Perils Coverage

- Total Loss Coverage

- Contingency Insurance

By Cargo Value:

- High-Value Cargo

- Medium-Value Cargo

- Low-Value Cargo

By Policy Type:

- Single-Transit Policy

- Open-Cover Policy

- Contingency Policy

- Specific Voyage Policy

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounts for 32% market share in the cargo transportation insurance market, driven by its robust trade activity and advanced logistics networks. The region benefits from a mature insurance infrastructure with established regulatory frameworks and high adoption of marine and transport insurance. It is supported by strong participation from global and regional insurers offering specialized coverage for multimodal transportation. The United States leads the market with significant volumes of high-value shipments in automotive, electronics, and industrial goods. Canada contributes through its extensive cross-border trade with the U.S. and growing export activities to Asia and Europe. The integration of digital risk management tools is further enhancing operational efficiency in the region.

Europe :

Europe holds 28% market share in the cargo transportation insurance market, supported by stringent safety regulations and the presence of major marine insurance hubs. It benefits from a high level of policy penetration among shipping companies, freight forwarders, and exporters. The United Kingdom, Germany, and the Netherlands are leading contributors due to their central role in global trade routes. It is also influenced by the expansion of intermodal transport systems across the EU, driving demand for comprehensive coverage solutions. Increasing adoption of climate risk assessments and sustainability-linked policies is shaping underwriting practices. Strong port infrastructure and well-connected rail and road networks add to the market’s resilience.

Asia-Pacific :

Asia-Pacific captures 25% market share in the cargo transportation insurance market, making it the fastest-growing region. The region’s expansion is driven by high-volume manufacturing hubs in China, India, Japan, and Southeast Asia. It benefits from the surge in e-commerce-driven exports, large-scale industrial shipments, and strategic trade agreements. Rising investments in port modernization and logistics digitization are boosting efficiency and reliability in cargo movement. Insurers are introducing tailored policies for regional supply chain needs, including coverage for perishable goods and high-tech equipment. The region’s dynamic trade growth and infrastructure advancements position it as a key driver of global market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Zurich Insurance Group

- Arch Capital Group Ltd.

- Swiss Reinsurance Company

- Tokio Marine Nichi

- ACE NEWMARK

- MS Amlin

- Everest Reinsurance Company

- AIG

- Allianz SE

- Navigators Group, Inc.

- Chubb

Competitive Analysis:

The cargo transportation insurance market is highly competitive, with global insurers, regional specialists, and niche providers offering a diverse range of products. Key players include Zurich Insurance Group, Arch Capital Group Ltd., Swiss Reinsurance Company, Tokio Marine Nichi, ACE NEWMARK, MS Amlin, Everest Reinsurance Company, AIG, and Allianz SE. It is characterized by strong underwriting capabilities, extensive broker networks, and the integration of advanced risk assessment technologies. Market leaders focus on tailored coverage solutions, competitive pricing, and value-added services such as loss prevention consulting and real-time cargo tracking. Strategic partnerships with logistics providers and investments in digital platforms are enhancing operational efficiency and customer experience. The competitive landscape is further shaped by regulatory compliance, financial strength, and the ability to address emerging risks from geopolitical instability and climate change. Players that innovate in product design and service delivery are well-positioned to strengthen their market share.

Recent Developments:

- In July 2025, MS Amlin simplified its brand name, consolidating its market presence, and launched a partnerships division focused on risk-sharing and participation in London market facilities.

- In June 2025, Everest Reinsurance Company established a unified specialty insurance business within its international division.

Market Concentration & Characteristics:

The cargo transportation insurance market displays a moderately concentrated structure, with a mix of global insurers, regional specialists, and niche providers competing for market share. It is characterized by a broad spectrum of coverage options, from standard marine policies to highly customized solutions for specialized cargo and multimodal transport. Leading players leverage extensive underwriting expertise, strong broker networks, and advanced risk assessment tools to maintain competitive positions. The market demonstrates high entry barriers due to regulatory compliance, capital requirements, and the need for global claims handling capabilities. Technological integration, including IoT-based monitoring and blockchain-enabled documentation, is reshaping service delivery and enhancing transparency. Competitive differentiation increasingly relies on offering value-added services such as loss prevention consulting, real-time tracking, and flexible policy structures tailored to evolving trade patterns.

Report Coverage:

The research report offers an in-depth analysis based on Coverage,Cargo Value, Policy Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growth in cross-border trade and e-commerce will drive increased demand for tailored cargo insurance solutions.

- Insurers will adopt advanced analytics and AI to improve risk assessment accuracy and streamline underwriting processes.

- Climate change and extreme weather events will influence policy structures, with greater emphasis on environmental risk coverage.

- Blockchain and IoT integration will enhance cargo tracking, documentation security, and claims verification efficiency.

- Partnerships between insurers and logistics technology providers will expand, offering value-added risk management services.

- Emerging markets in Asia-Pacific, Latin America, and Africa will provide new revenue streams through trade corridor expansion.

- Demand for specialized coverage for high-value, hazardous, and temperature-sensitive goods will continue to rise.

- Sustainability-linked policies will gain traction, rewarding shippers that adopt eco-friendly transportation practices.

- Real-time monitoring and predictive modeling will become standard tools for proactive loss prevention strategies.

- Regulatory alignment across regions will simplify cross-border policy implementation and strengthen global market integration.