Market Overview

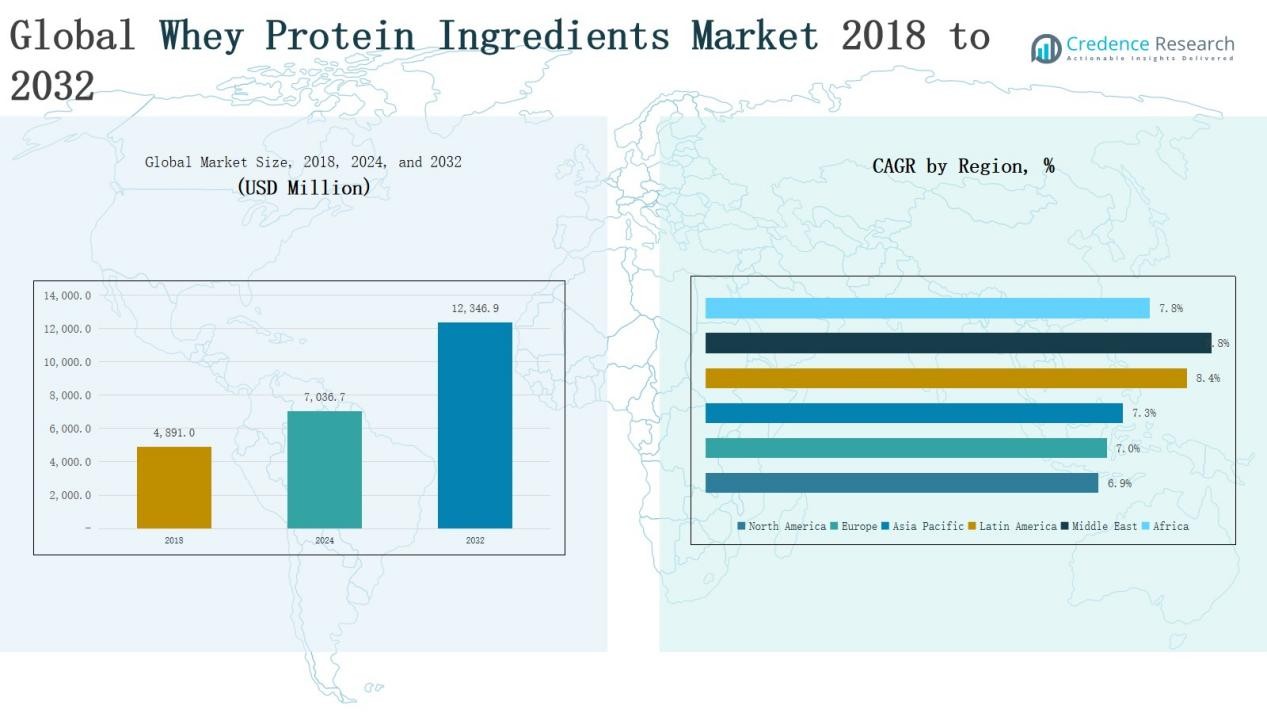

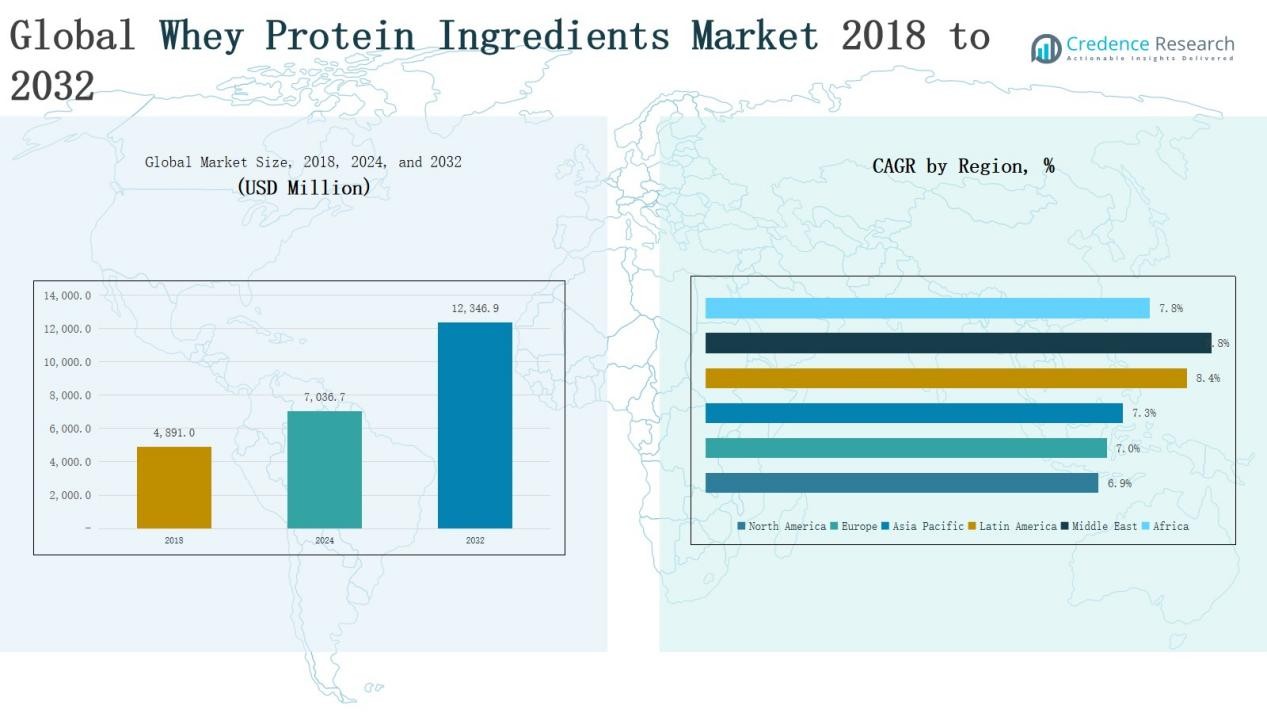

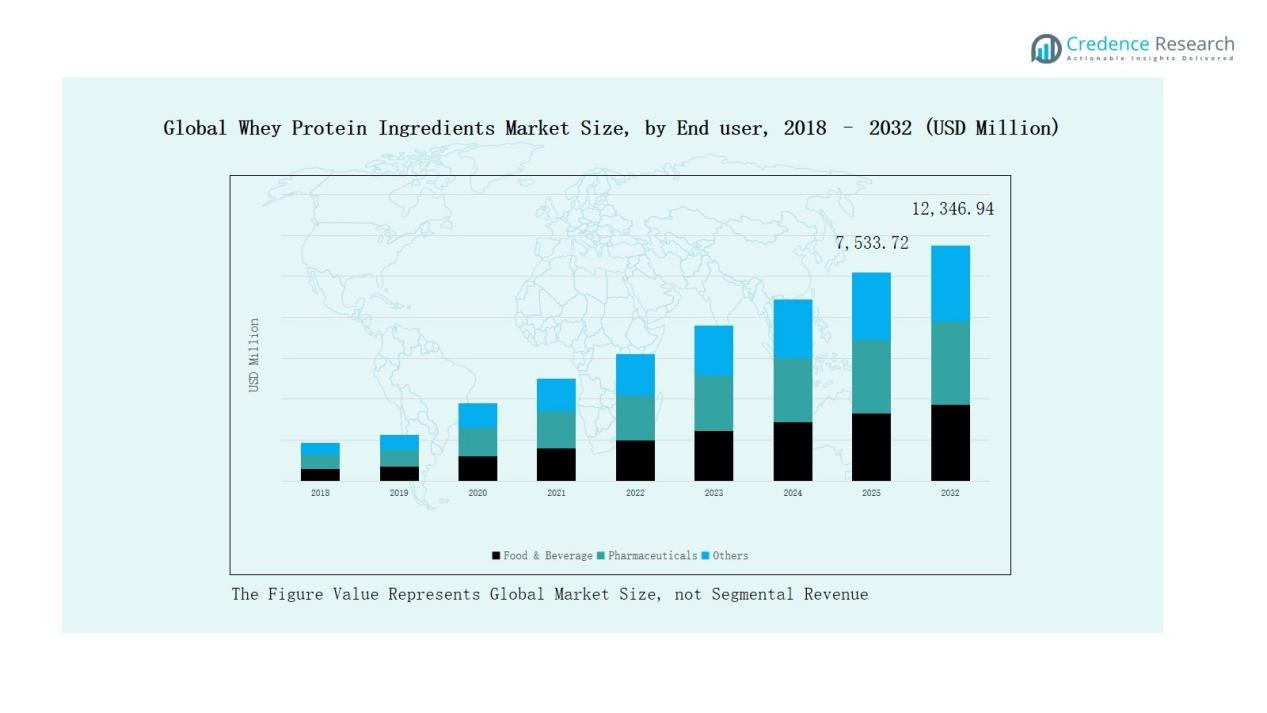

Global Whey Protein Ingredients Market size was valued at USD 4,891.0 million in 2018 to USD 7,036.7 million in 2024 and is anticipated to reach USD 12,346.9 million by 2032, at a CAGR of 7.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Whey Protein Ingredients Market Size 2024 |

USD 7,036.7 Million |

| Whey Protein Ingredients Market, CAGR |

7.31% |

| Whey Protein Ingredients Market Size 2032 |

USD 12,346.9 Million |

The Global Whey Protein Ingredients Market is shaped by leading players including Cargill Incorporated, Arla Foods, Fonterra Co-Operative Group Ltd, Hilmar Cheese Company, Leprino Foods, DMK Group, Carbery Group, Valio, and Glanbia PLC, along with several regional suppliers. These companies maintain strong market positions through vertically integrated operations, extensive product portfolios covering concentrates, isolates, and hydrolysates, and continuous investment in innovation and sustainability. In 2024, Asia Pacific emerged as the leading region, commanding 45.9% of the global market share, driven by rapid urbanization, rising disposable incomes, and increasing demand for infant formula, functional foods, and sports nutrition products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Whey Protein Ingredients Market grew from USD 4,891.0 million in 2018 to USD 7,036.7 million in 2024, and is expected to reach USD 12,346.9 million by 2032, expanding at a CAGR of 31%.

- Whey Protein Concentrates dominate with 57% share, driven by affordability, balanced nutrition, and ease of production, while WPC-80 leads within this category due to higher protein levels.

- Sports Nutrition accounts for 38.9% share, supported by rising gym culture, consumer focus on performance recovery, and growing demand for protein powders, ready-to-drink beverages, and functional snacks.

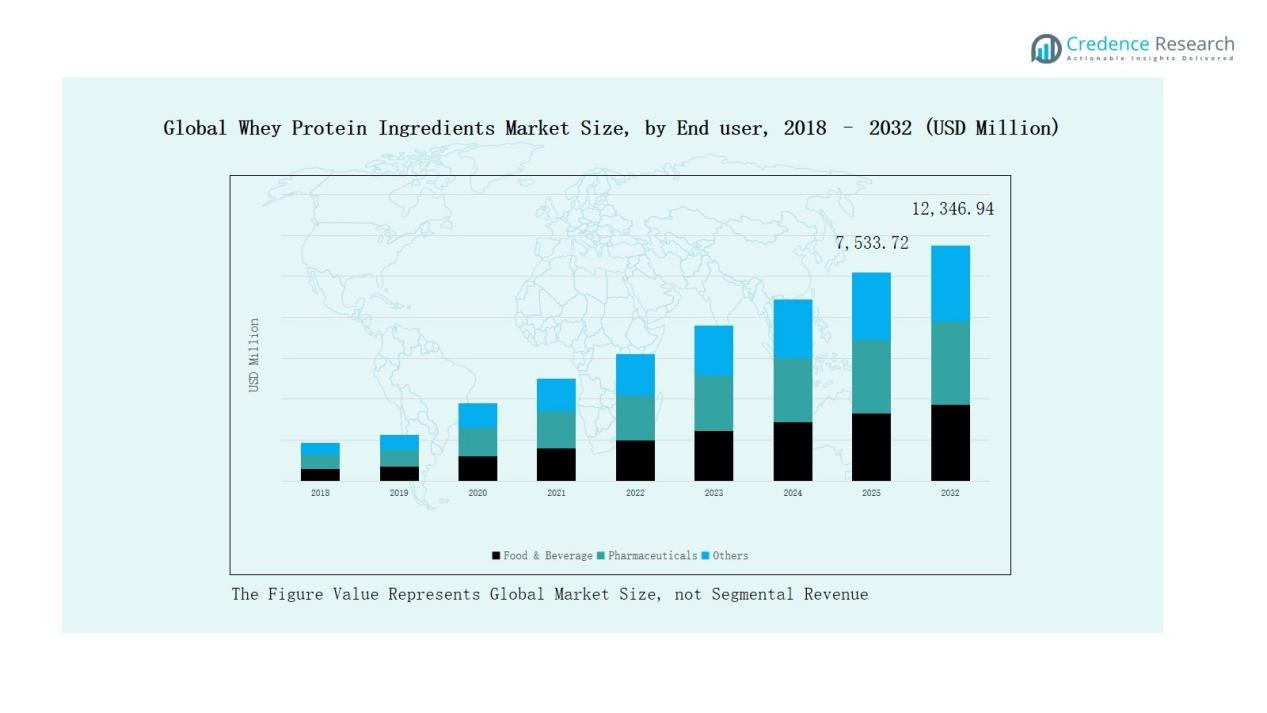

- Food & Beverage is the largest end-user, contributing over half of total demand, with applications across bakery, dairy, and beverages, while pharmaceuticals and infant nutrition segments show high-value growth.

- Asia Pacific leads with 45.9% share in 2024, followed by Europe (37.6%) and North America (24.6%), with Latin America, Middle East, and Africa showing higher growth potential in the forecast period.

Market Segment Insights

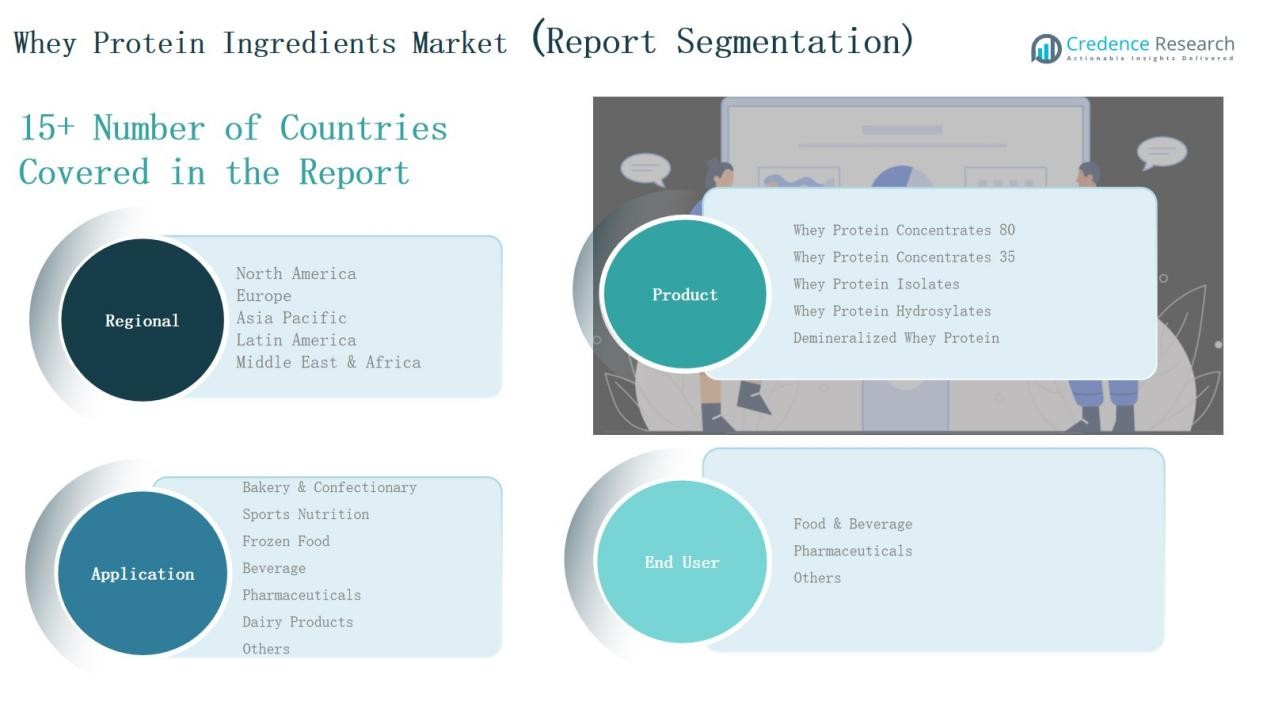

By Product

Whey Protein Concentrates dominate the product mix with about 57% of global market share. Concentrates are favored due to cost-efficiency, balanced nutrition, and ease of production. Among them, WPC-80 outperforms WPC-35 because of its higher protein content (~80%), making it more suitable for sports nutrition and premium formulations. Whey Protein Isolates hold a strong minority share (~36–40%), driven by demand for low-lactose, high-purity proteins in clinical, infant, and elite sports segments. Hydrolysates and demineralized whey remain niche but grow rapidly, especially where digestibility or protein purity is critical.

- For instance, Arla Foods Ingredients launched Lacprodan® BLG-100, a whey protein isolate containing 45% more leucine than standard isolates, targeting sports and medical nutrition.

By Application

Sports Nutrition leads applications with roughly 38.9% share of the whey protein ingredients market. This segment’s growth is fueled by rising gym culture, performance-driven consumers, and increased supplementation for recovery. Beverages, bakery & confectionery, and dairy products also use whey heavily for texture, protein fortification, and flavor stability. Pharmaceuticals and functional foods use hydrolysates or isolates due to purity and bioactivity requirements. “Other” applications grow modestly, often pushed by innovation in snacks and meal replacements.

- For instance, in October 2024, Arla Foods Ingredients introduced a new whey protein hydrolysate ingredient, Lacprodan® HYDRO.365, designed specifically to improve muscle recovery in functional sports foods and beverages.

By End-Use

Food & Beverage is the dominant end-user, accounting for the largest share (well over half in many data reports). Manufacturers in F&B integrate whey protein across bakery, dairy, beverages, and confectionery to meet demand for high-protein, functional foods. The Pharmaceuticals end-user is smaller in terms of volume but commands premium margins, especially for isolates and hydrolysates used in clinical nutrition. The “Others” end-user segment (infant nutrition, animal feed, nutraceuticals) is growing, supported by regulatory approvals and rising awareness of protein’s role in overall health.

Key Growth Drivers

Rising Demand for Sports and Performance Nutrition

Sports nutrition products remain the largest driver of the whey protein ingredients market. Consumers increasingly prioritize muscle development, weight management, and post-exercise recovery, fueling the adoption of whey concentrates and isolates. Fitness culture, particularly among millennials and Gen Z, has led to strong demand for protein powders, RTD beverages, and functional snacks. The global expansion of gyms, wellness centers, and e-commerce platforms further accelerates market penetration. This sustained consumer shift toward active lifestyles strengthens whey protein’s position as a premium functional ingredient.

- For instance, Glanbia debuted its Optimum Nutrition Gold Standard Protein Shake in the U.S. convenience retail channel, offering 24 grams of whey protein per RTD serving to target fitness-focused consumers.

Expansion in Functional and Fortified Foods

The incorporation of whey protein into mainstream food and beverage applications continues to expand. Bakery, confectionery, dairy, and ready-to-drink beverage segments now use whey protein to enhance nutritional value and support product differentiation. Manufacturers develop fortified formulations targeting weight control, satiety, and digestive health, aligning with the rise of preventive healthcare. Convenience-focused protein snacks and meal replacements appeal to busy urban consumers. This diversification beyond traditional sports nutrition significantly broadens the market base and secures long-term growth opportunities across both developed and emerging markets.

- For instance, Arla Foods Ingredients launched Lacprodan® ISO.Water, a ready-to-drink whey protein isolate product designed for clear beverages, offering 100% protein content without added sugar.

Growth in Infant and Clinical Nutrition

Whey protein ingredients hold a critical role in infant formula and medical nutrition due to their digestibility and amino acid profile. Increasing birth rates in Asia and rising healthcare spending globally boost demand for premium infant formulas. Clinical nutrition applications, including hospital-based feeding solutions and dietary supplements for the elderly, also rely on whey isolates and hydrolysates. The growing incidence of malnutrition, chronic illnesses, and age-related conditions drives sustained adoption. Regulatory support for safe, high-quality protein ingredients further supports growth in these sensitive end-user markets.

Key Trends & Opportunities

Shift Toward Clean Label and Natural Formulations

Consumers increasingly prefer clean-label protein products free from artificial additives, GMOs, and allergens. This trend benefits whey protein due to its natural origin and high nutritional profile. Manufacturers focus on transparent sourcing, sustainable dairy supply chains, and environmentally friendly production to capture this demand. Opportunities lie in positioning whey protein as both effective and natural, particularly in premium sports nutrition and wellness segments. Companies that align with consumer expectations for purity and sustainability are well-placed to capture long-term loyalty.

- For instance, Revant Himatsingka launched Only What’s Needed whey protein in India, a clean-label product with community-voted ingredients and packaging, emphasizing zero additives and full transparency on the label.

Expansion in Emerging Economies

Emerging economies present significant opportunities as rising incomes and urbanization reshape dietary preferences. Countries in Asia-Pacific and Latin America witness surging demand for protein-enriched foods and beverages. E-commerce growth, wider product availability, and increasing awareness of the health benefits of whey proteins strengthen adoption. Local players also collaborate with global brands to improve product accessibility. Targeting these high-growth markets allows manufacturers to offset saturation in developed regions and secure a larger consumer base across both mass and premium segments.

- For instance, Nestlé India expanded its whey protein-based Optifast range to target urban consumers seeking weight management and nutritional solutions.

Key Challenges

Price Volatility of Raw Materials

The whey protein ingredients market is highly sensitive to fluctuations in milk prices, which directly affect production costs. Volatility arises from feed supply disruptions, climate variations, and changing global dairy trade policies. Such instability creates uncertainty for manufacturers and often leads to margin pressure. Passing on costs to consumers risks dampening demand in price-sensitive segments, particularly in emerging markets. Long-term contracts, supply chain optimization, and investment in risk management strategies remain crucial to mitigating this challenge.

Intense Market Competition

The market faces strong competition from established dairy cooperatives, multinational food companies, and regional suppliers. Product differentiation often hinges on purity, taste, solubility, and functional performance, driving companies to invest heavily in innovation. However, the rapid expansion of plant-based protein alternatives adds another layer of competitive pressure. Manufacturers must balance cost efficiency with product innovation while defending market share against both traditional rivals and non-dairy substitutes. This competitive intensity limits pricing flexibility and demands continuous investment in research and marketing.

Regulatory and Quality Compliance

Stringent regulatory standards across food, pharmaceutical, and infant nutrition applications pose a key challenge for manufacturers. Compliance with labeling, safety, and nutritional requirements increases operational complexity and cost. Variations in regional standards across North America, Europe, and Asia create additional hurdles for global players. Non-compliance can result in recalls, reputational damage, and financial penalties. Companies must prioritize rigorous quality control and invest in advanced testing capabilities to ensure consistent safety and efficacy of whey protein ingredients worldwide.

Regional Analysis

North America

North America generated USD 967.43 million in 2018, rising to USD 1,358.39 million in 2024, and is projected to reach USD 2,305.17 million by 2032. The region accounted for 24.6% of global share in 2024, growing at a CAGR of 6.9%. Growth is driven by strong demand for sports nutrition, fortified dairy, and functional beverages in the U.S. and Canada. Established retail and e-commerce networks, coupled with consumer preference for premium health products, ensure continued expansion. Regulatory approvals also support applications in infant and clinical nutrition.

Europe

Europe recorded USD 1,463.38 million in 2018, increasing to USD 2,070.41 million in 2024, and is expected to reach USD 3,550.98 million by 2032. With 37.6% of global share in 2024 and a CAGR of 7.0%, Europe remains a leader in whey protein production and consumption. Countries such as Germany, France, and the UK anchor demand, supported by strong dairy industries. Consumer focus on healthy snacking, infant formula, and bakery fortification drives adoption. Strict EU food quality standards strengthen trust in whey-based products, securing long-term market stability.

Asia Pacific

Asia Pacific was valued at USD 1,760.75 million in 2018, reaching USD 2,530.21 million in 2024, and is forecasted at USD 4,432.55 million by 2032. The region held the largest share of 45.9% in 2024 and shows the highest absolute growth at a CAGR of 7.3%. Expansion is fueled by rising disposable incomes, dietary shifts, and strong demand for infant formula in China and India. Ready-to-drink protein beverages and functional foods also gain traction. E-commerce expansion and localized product offerings strengthen whey protein adoption across urban markets.

Latin America

Latin America posted USD 337.48 million in 2018, growing to USD 518.71 million in 2024, and projected at USD 987.76 million by 2032. The region represented 9.4% of global share in 2024 with a CAGR of 8.4%. Brazil leads regional consumption due to rising health and fitness awareness. Expanding middle-class spending power and adoption of sports supplements fuel demand. Penetration into bakery, dairy, and beverages further diversifies usage. The presence of international brands and investment in retail networks support faster market growth compared to mature economies.

Middle East

The Middle East recorded USD 233.79 million in 2018, rising to USD 369.83 million in 2024, and estimated to reach USD 727.24 million by 2032. It accounted for 6.7% of global revenues in 2024, growing at the fastest CAGR among developed regions at 8.8%. Countries such as Saudi Arabia and the UAE drive consumption of whey protein supplements and beverages. Government-led fitness initiatives and urban lifestyle adoption boost demand. Imported premium brands dominate, though regional players are beginning to expand offerings to meet varied consumer preferences.

Africa

Africa generated USD 128.14 million in 2018, increasing to USD 189.19 million in 2024, and forecasted at USD 343.25 million by 2032. The region contributed 3.4% of global revenues in 2024, with growth at a CAGR of 7.8%. Rising health awareness and demand for fortified foods in South Africa, Egypt, and Nigeria are key drivers. Market development is limited by affordability barriers, but urban consumers increasingly adopt whey protein-enriched dairy and supplements. Global players view Africa as an emerging frontier, investing in distribution and affordable formulations.

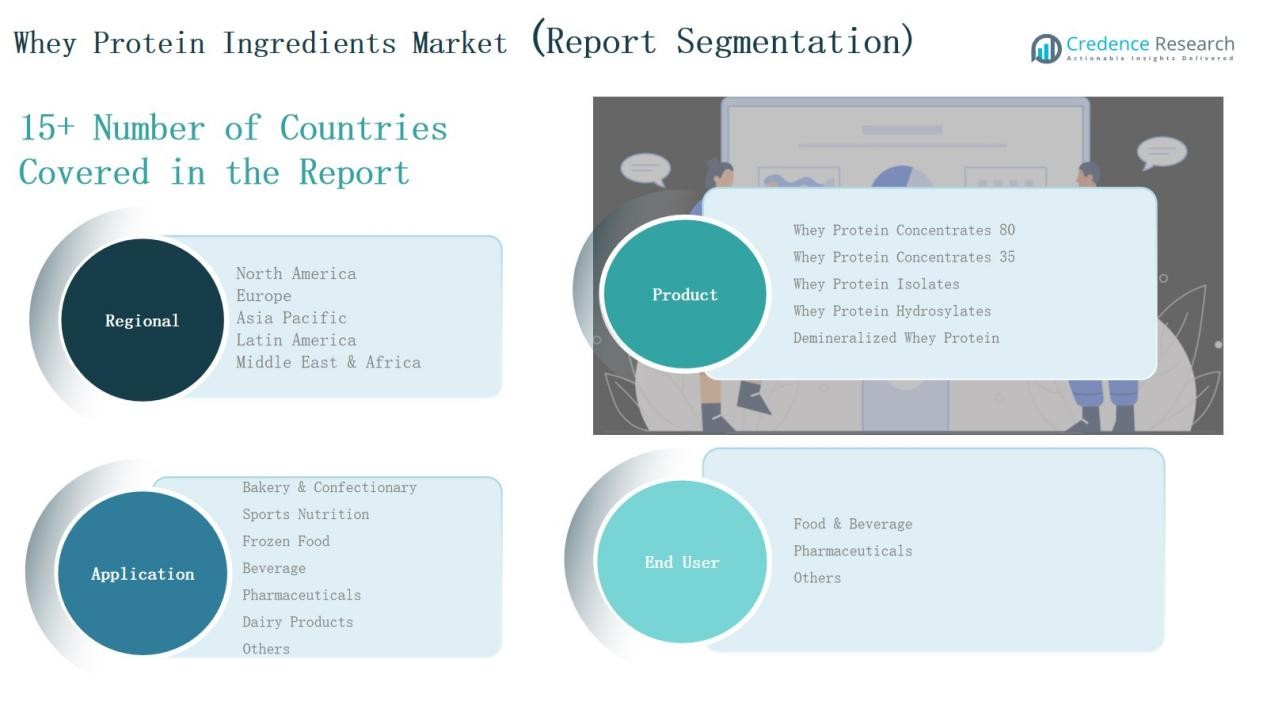

Market Segmentations:

By Product

- Whey Protein Concentrates 80

- Whey Protein Concentrates 35

- Whey Protein Isolates

- Whey Protein Hydrolysates

- Demineralized Whey Protein

By Application

- Bakery & Confectionery

- Sports Nutrition

- Frozen Food

- Beverage

- Pharmaceuticals

- Dairy Products

- Others

By End User

- Food & Beverage

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global Whey Protein Ingredients Market is highly competitive, characterized by the presence of multinational dairy cooperatives, specialized ingredient suppliers, and regional producers. Leading players such as Arla Foods, Fonterra Co-Operative Group, Glanbia PLC, Hilmar Cheese Company, Leprino Foods, and Cargill Incorporated maintain dominance through extensive production capacities, vertically integrated supply chains, and diversified product portfolios covering concentrates, isolates, and hydrolysates. These companies focus on innovation in formulation, solubility, and clean-label positioning to capture demand in sports nutrition, infant formula, and functional foods. Regional players and niche suppliers add competition by offering cost-effective or customized products tailored for local markets. Strategic initiatives such as mergers, joint ventures, and capacity expansions are common, enabling companies to strengthen global reach and secure access to raw materials. The rising demand for high-protein foods and clinical nutrition continues to drive R&D investments, while sustainability commitments and regulatory compliance remain critical factors shaping market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In November 2023, FrieslandCampina Ingredients launched Nutri Whey ProHeat, a heat-stable whey protein for medical nutrition applications, focusing on specialized protein ingredient functionalities.

- In March 2025, Arla Foods entered into a partnership with Valley Queen in South Dakota to produce “Nutrilac ProteinBoost” whey protein ingredients for the U.S. food and beverage market.

- In May 2025, Actus Nutrition acquired a whey protein processing facility in Sparta, Wisconsin from Foremost Farms and signed a long-term exclusive whey protein partnership.

- In November 2024, Arla Foods Ingredients moved forward with its acquisition of Volac’s Whey Nutrition business after approval by the UK’s Competition and Markets Authority. This acquisition strengthens Arla’s position in whey protein isolate production and global supply chain.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for whey protein in sports and performance nutrition will continue to expand globally.

- Growth in functional foods and fortified beverages will drive higher ingredient integration.

- Infant formula and clinical nutrition applications will strengthen adoption in healthcare sectors.

- Clean-label and natural formulations will become a major focus for leading manufacturers.

- Emerging economies will witness rising consumption supported by urbanization and lifestyle shifts.

- Product innovation in taste, solubility, and digestibility will enhance market penetration.

- Sustainability in dairy sourcing and production will influence competitive positioning.

- Plant-based protein competition will push companies to diversify portfolios and improve branding.

- Strategic partnerships and acquisitions will increase to secure supply chains and new markets.

- Digital retail and e-commerce channels will accelerate consumer access to whey protein products.