Market Overview

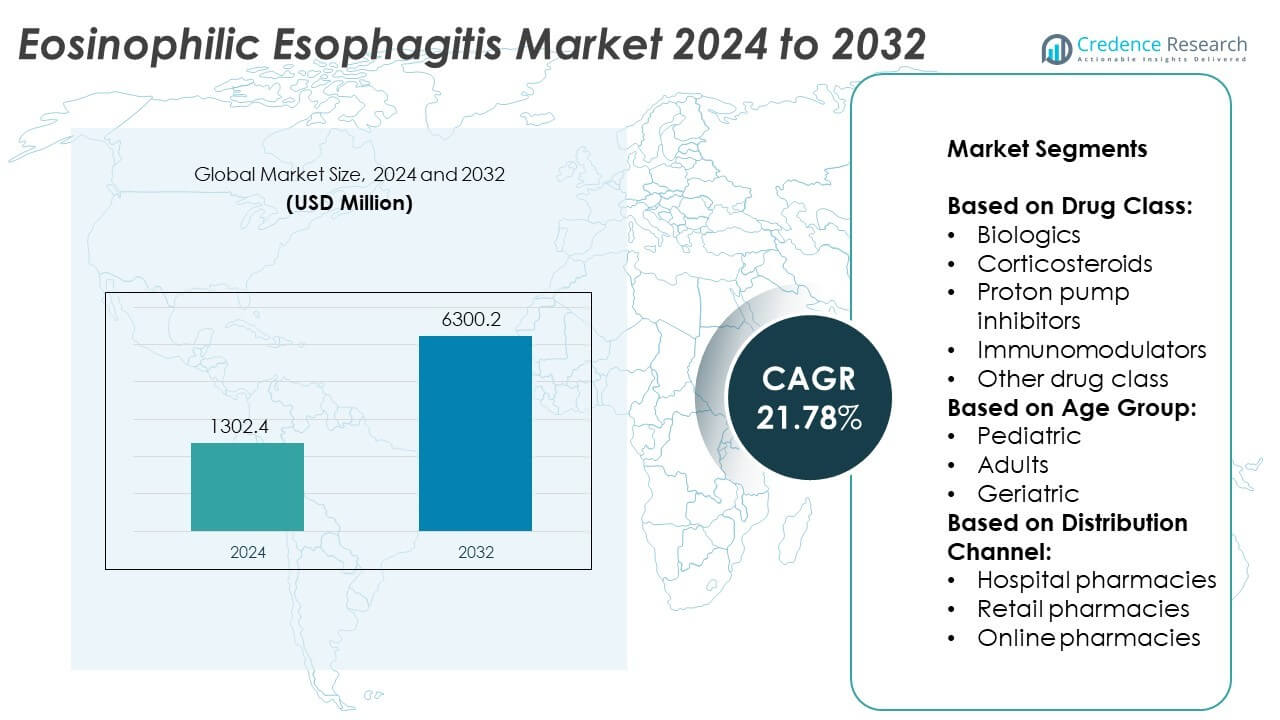

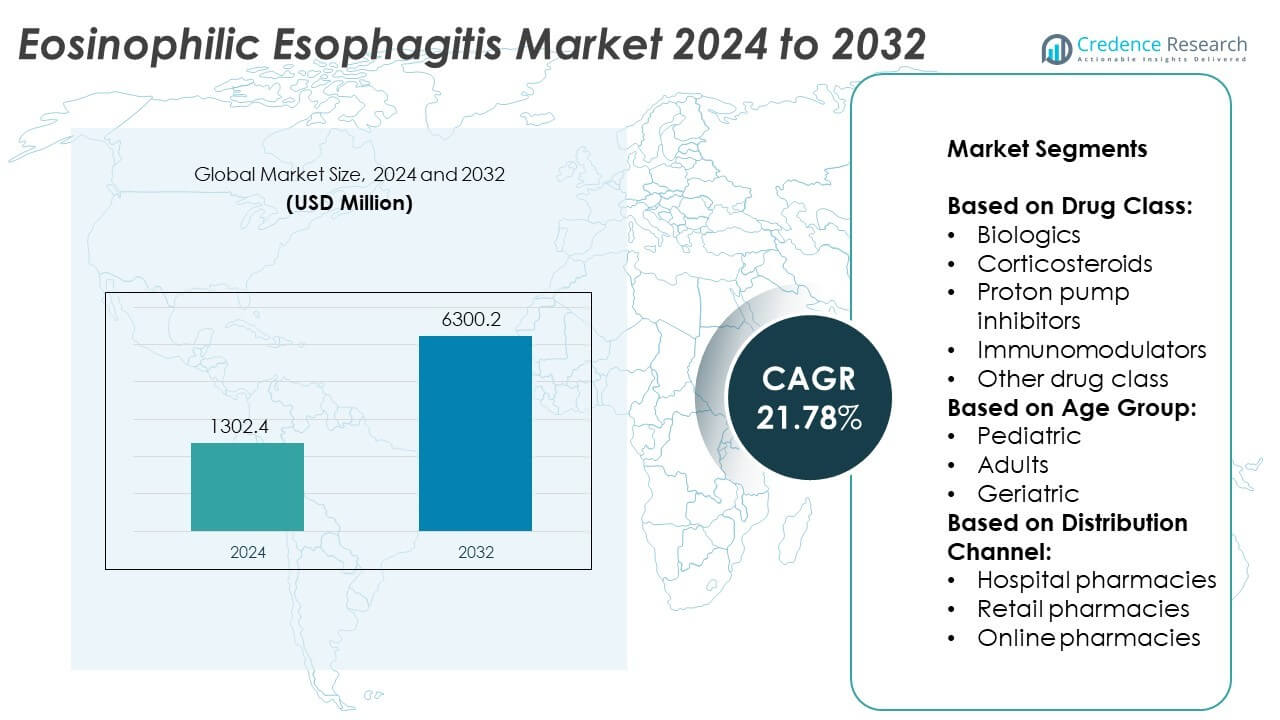

The Eosinophilic Esophagitis (EoE) market size was valued at USD 1302.4 million in 2024 and is anticipated to reach USD 6300.2 million by 2032, growing at a compound annual growth rate (CAGR) of 21.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eosinophilic Esophagitis Market Size 2024 |

USD 1302.4 million |

| Eosinophilic Esophagitis Market, CAGR |

21.78% |

| Eosinophilic Esophagitis Market Size 2032 |

USD 6300.2 million |

The Eosinophilic Esophagitis market is driven by rising food allergy prevalence, increased clinical recognition, and growing demand for targeted biologics offering long-term inflammation control. Regulatory support for orphan drugs and advancements in endoscopic diagnostics further expand treatment adoption. Key trends include the shift toward biologic therapies, personalized elimination diets, and integration of digital health tools for symptom monitoring and patient engagement. Pediatric diagnosis rates continue to climb, prompting age-specific therapies and nutritional management strategies.

North America leads the Eosinophilic Esophagitis market due to strong clinical infrastructure, early biologic adoption, and high disease awareness. Europe follows with growing diagnostic capabilities and structured treatment guidelines across major economies. Asia-Pacific shows emerging potential, supported by expanding endoscopic access and rising immunological research activity. Latin America and the Middle East & Africa remain nascent but gradually improve in clinical reach and awareness. Key players shaping the market include Sanofi, which leads with approved biologic therapies, Takeda Pharmaceutical Company with a strong gastrointestinal portfolio, and Ellodi Pharmaceuticals.

Market Insights

- The Eosinophilic Esophagitis market was valued at USD 1302.4 million in 2024 and is projected to reach USD 6300.2 million by 2032, registering a CAGR of 21.78% during the forecast period.

- Rising prevalence of food allergies and atopic disorders, particularly among children and young adults, is driving earlier diagnosis and long-term treatment demand.

- A key trend is the growing adoption of biologic therapies such as monoclonal antibodies targeting interleukin pathways, offering improved disease control and fewer systemic effects.

- Market players such as Sanofi, Takeda Pharmaceutical, and Allakos are focusing on expanding indications, enhancing pipeline assets, and investing in pediatric-specific therapies.

- High treatment costs, limited insurance coverage for biologics, and dependence on invasive diagnostics continue to restrain market accessibility, especially in developing regions.

- North America leads the market due to advanced healthcare systems and early regulatory approvals, followed by Europe with structured clinical protocols and increasing research support.

- Asia-Pacific shows growing potential with expanding diagnostic capacity in countries like Japan and China, while Latin America and the Middle East & Africa reflect emerging markets with gradual adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Food Allergies and Atopic Disorders Amplifies Disease Incidence

The Eosinophilic Esophagitis market experiences strong growth due to the rising global burden of food allergies and associated atopic disorders. An increasing number of patients suffer from immune-mediated conditions, including asthma, eczema, and allergic rhinitis, which elevate the risk of developing EoE. This correlation drives earlier diagnosis and sustained medical engagement. Healthcare systems have intensified allergy screenings and immunological evaluations, further identifying EoE cases. The market benefits from heightened awareness among both physicians and patients about chronic esophageal symptoms tied to food triggers. It leverages this shift in diagnostic vigilance to expand the patient pool and support therapeutic demand.

- For instance, Takeda Pharmaceutical reported over 2,000 patients screened across 90 trial sites globally during its EOHILIA development program, reflecting increased diagnostic activity tied to atopic disorder monitoring.

Growing Demand for Targeted Biologic Therapies Accelerates Treatment Innovation

The demand for biologic therapies targeting the IL-4 and IL-13 pathways fuels innovation across the Eosinophilic Esophagitis market. Conventional steroid-based approaches show limitations in long-term efficacy and relapse prevention. Biologics demonstrate superior control of eosinophilic inflammation without extensive systemic side effects. Companies prioritize clinical trials for monoclonal antibodies to obtain regulatory approvals for pediatric and adult use. This focus on precision medicine reshapes the treatment landscape, allowing for more sustainable disease management. It encourages investment in research pipelines and fosters competitive momentum among pharmaceutical developers.

- For instance, Sanofi’s dupilumab demonstrated a 64% reduction in peak eosinophil count and achieved FDA approval in May 2022 for patients aged 12 and older with EoE.

Expanded Regulatory Recognition and Orphan Drug Incentives Support Drug Development

The Eosinophilic Esophagitis market gains momentum from improved regulatory clarity and incentives supporting orphan disease therapies. Agencies such as the FDA and EMA have officially recognized EoE as a distinct clinical entity, granting orphan designation to several investigational drugs. These designations offer market exclusivity, fee reductions, and accelerated review timelines, encouraging investment in novel treatments. Pharmaceutical firms align with these frameworks to streamline development and mitigate financial risks. Regulatory alignment enhances trial enrollment efficiency and speeds time to market. It reinforces confidence among stakeholders and drives strategic portfolio expansion.

Advances in Endoscopic Techniques and Biomarker Tools Drive Diagnostic Precision

Refinements in endoscopic imaging and esophageal biopsy protocols improve diagnostic reliability across the Eosinophilic Esophagitis market. Physicians now deploy minimally invasive tools with enhanced visualization to detect subtle mucosal abnormalities. Biopsy-based scoring systems help quantify eosinophil density and disease severity with greater accuracy. Researchers also develop non-invasive biomarkers to reduce dependence on repeated endoscopies. These advances shorten diagnostic timelines and reduce misclassification. It supports earlier intervention and tailors therapy to disease progression. The market responds by integrating these tools into clinical workflows to optimize patient outcomes.

Market Trends

Increased Adoption of Biologics Reshapes Standard of Care Protocols

The Eosinophilic Esophagitis market is witnessing a major shift toward biologic therapies that target underlying immunological mechanisms. Emerging treatments focus on interleukin signaling pathways, aiming to reduce eosinophil accumulation in esophageal tissues. FDA approval of dupilumab for EoE patients marks a significant turning point for disease management strategies. It strengthens physician confidence in prescribing targeted immunomodulators over traditional corticosteroids. Biologics offer improved long-term control, lower relapse rates, and fewer systemic side effects. This trend drives pharmaceutical companies to expand clinical trials for new biologics with broader patient eligibility.

- For instance, Ellodi Pharmaceuticals received FDA Fast Track designation for budesonide oral suspension, facilitating faster clinical development timelines and expanded trial enrollment across over 50 U.S. centers.

Integration of Digital Health Tools Enhances Monitoring and Compliance

Telemedicine platforms, digital symptom trackers, and remote monitoring systems are gaining traction across the Eosinophilic Esophagitis market. These tools improve communication between patients and providers, enabling timely adjustments in diet, medication, or therapy plans. It helps reduce emergency visits caused by uncontrolled flare-ups and supports adherence to long-term care protocols. Mobile applications allow for daily symptom tracking, facilitating early identification of treatment failure. Healthcare providers increasingly adopt digital solutions to manage chronic gastrointestinal diseases in outpatient settings. This trend aligns with the broader shift toward patient-centered care and continuous disease management.

- For instance, Revolo Biotherapeutics initiated a Phase IIa trial evaluating biomarker responses in patients treated with immune-resetting agent 1104, measuring eosinophil levels in real-time via peripheral blood assays.

Clinical Focus on Pediatric and Adolescent Population Strengthens Pipeline

Rising diagnosis rates in children have prompted greater focus on pediatric formulations and age-specific treatment protocols in the Eosinophilic Esophagitis market. Clinical trials now emphasize dosing safety, nutritional support, and symptom control tailored to young patients. It influences the development of milder corticosteroids, chewable formulations, and biologics approved for pediatric use. Research centers collaborate with schools and pediatric clinics to streamline early detection. Nutritional therapy plays a critical role in disease management for children with dietary restrictions. This trend underscores the need for therapeutic diversity and long-term compliance strategies across age groups.

Shift Toward Personalized Diet Therapy Increases Patient Engagement

The market shows rising interest in personalized elimination diets guided by allergy testing and esophageal biopsies. This method targets symptom control without over-restricting food intake, improving patient quality of life. It uses elemental diets, six-food elimination protocols, or guided reintroduction based on biomarker feedback. Healthcare professionals combine diet therapy with pharmacological intervention to reduce esophageal inflammation more effectively. It supports shared decision-making between patients and clinicians, enhancing long-term engagement. The Eosinophilic Esophagitis market reflects this shift by incorporating nutritional services into multidisciplinary care models.

Market Challenges Analysis

High Treatment Costs and Limited Access Restrict Widespread Adoption

The Eosinophilic Esophagitis market faces cost-related challenges that limit access to advanced therapies. Biologic drugs such as dupilumab come with high price tags, creating affordability issues for patients without comprehensive insurance coverage. Repeated endoscopies and allergy testing further raise the overall burden of care. It creates disparities between patients who can access specialty clinics and those in underserved regions. Payers often delay reimbursement approvals due to the chronic nature of the disease and limited long-term outcomes data. This challenge slows treatment initiation and places pressure on healthcare systems to justify resource allocation.

Delayed Diagnosis and Misclassification Undermine Early Intervention

Symptoms of EoE often mimic gastroesophageal reflux disease (GERD), leading to diagnostic delays and inappropriate treatment. Primary care providers may overlook eosinophilic inflammation or misattribute dysphagia and chest discomfort to common gastrointestinal issues. The Eosinophilic Esophagitis market contends with this diagnostic gap, which results in untreated inflammation and progressive esophageal narrowing. It affects long-term outcomes and increases the risk of complications such as food impaction and fibrosis. Variability in diagnostic protocols across regions adds to this complexity, especially where access to pediatric gastroenterologists and biopsy-based confirmation remains limited. Early identification and standardized evaluation remain key to improving disease management.

Market Opportunities

Expansion of Biologic Drug Indications Creates Long-Term Commercial Potential

Pharmaceutical companies can capitalize on the opportunity to broaden indications of approved biologics for EoE treatment across different age groups and disease severities. Recent regulatory approvals for monoclonal antibodies in adults pave the way for pediatric extensions and maintenance-phase applications. It allows firms to pursue lifecycle management strategies and expand market reach through post-approval studies. Companies with strong immunology portfolios can leverage existing manufacturing and distribution infrastructure to enter this niche segment. The Eosinophilic Esophagitis market rewards early movers who secure exclusivity through orphan drug pathways and demonstrate clinical differentiation. Strong demand for targeted therapies continues to drive investment in biologic innovation.

Development of Non-Invasive Diagnostic Tools Enhances Early Detection Scope

The need for less invasive, more cost-effective diagnostic tools presents an untapped opportunity in the EoE space. Current reliance on multiple endoscopies limits patient compliance and delays timely evaluation. It opens the door for blood-based biomarkers, saliva testing, or imaging-based modalities that reduce procedural burden. Diagnostic companies investing in these platforms can partner with specialty clinics and academic centers to validate clinical utility. The Eosinophilic Esophagitis market will benefit from earlier intervention and wider screening if such tools gain regulatory clearance. Adoption of these diagnostics could reshape standard care models and improve long-term patient outcomes.

Market Segmentation Analysis:

By Drug Class:

Biologics represent the fastest-growing drug class in the Eosinophilic Esophagitis market due to their targeted mechanism of action and long-term efficacy in reducing eosinophilic inflammation. Corticosteroids, particularly swallowed topical formulations, remain widely used for symptom control and mucosal healing. Proton pump inhibitors continue to hold a significant share, especially for patients showing PPI-responsive esophageal eosinophilia. Immunomodulators are prescribed in select cases where steroid resistance or comorbid autoimmune disorders complicate treatment. Other drug classes contribute marginally, often serving niche or experimental roles. The market continues to shift toward precision therapies that offer sustainable disease control with minimal adverse effects.

- For instance, Sanofi’s Phase III LIBERTY-EoE-TREET trial showed that 60.9% of patients receiving dupilumab achieved histological remission (≤6 eosinophils/high power field) at 24 weeks compared to 5.0% in placebo, confirming biologics’ long-term efficacy in eosinophilic control.

By Age Group:

The pediatric segment dominates the Eosinophilic Esophagitis market due to high diagnosis rates in children and early onset of symptoms. Growth in this group is supported by increased awareness among pediatricians and parents, along with tailored therapeutic and dietary protocols. The adult segment shows rising incidence, particularly in males, driven by improved diagnostic capabilities and chronic symptom recognition. It often includes patients with a history of undiagnosed atopic disorders or persistent dysphagia. The geriatric segment remains limited due to lower prevalence, though late-onset cases do occur and require careful management given polypharmacy risks. Each age group requires distinct clinical strategies and care coordination to manage disease progression.

- For instance, Takeda Pharmaceutical’s EOHILIA (budesonide oral suspension) demonstrated significant improvement in dysphagia symptom scores by 13.2 points on the DSQ (Dysphagia Symptom Questionnaire) among adolescents aged 11 to 17, based on its pivotal Phase III data submitted to the FDA in 2023.

By Distribution Channel:

Hospital pharmacies hold a major share in the distribution channel due to their role in dispensing biologics and specialty medications under physician supervision. They support treatment initiation, especially for newly diagnosed or severe cases. Retail pharmacies serve patients with stable prescriptions for corticosteroids and proton pump inhibitors, ensuring accessibility and convenience. Online pharmacies are gaining momentum, particularly for recurring medication needs, offering cost efficiency and home delivery services. It expands reach in underserved areas and supports adherence among chronic patients. The Eosinophilic Esophagitis market continues to diversify access points to meet evolving patient expectations and distribution logistics.

Segments:

Based on Drug Class:

- Biologics

- Corticosteroids

- Proton pump inhibitors

- Immunomodulators

- Other drug class

Based on Age Group:

- Pediatric

- Adults

- Geriatric

Based on Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the dominant position in the Eosinophilic Esophagitis market with a market share of 48.7% in 2024. The region benefits from high disease awareness, well-established diagnostic protocols, and early adoption of biologic therapies. The United States accounts for the largest portion of the regional revenue due to widespread access to endoscopic procedures and strong reimbursement frameworks for specialty treatments. Academic medical centers and children’s hospitals play a critical role in pediatric diagnosis, research trials, and treatment innovation. The FDA’s approval of biologics such as dupilumab has accelerated clinical adoption and created momentum for pipeline expansion. It strengthens regional leadership through robust pharmaceutical activity, advanced healthcare infrastructure, and patient advocacy programs.

Europe

Europe represents the second-largest regional market with a share of 26.4% in 2024. Countries such as Germany, the United Kingdom, and France lead the market through structured clinical guidelines, centralized healthcare systems, and increased recognition of EoE as a distinct allergic condition. The European Medicines Agency’s orphan drug incentives and research funding support the development of novel therapies. Hospitals across Western Europe have expanded biopsy-based diagnostics and food allergy screening in both children and adults. Central and Eastern European countries contribute to moderate growth but face challenges in specialized care access. It reflects steady expansion driven by clinical harmonization, rising diagnosis rates, and integration of biologics into national formularies.

Asia-Pacific

Asia-Pacific accounts for a growing share of 13.2% in 2024, with rapid expansion in urban healthcare centers across Japan, South Korea, China, and Australia. The region sees rising awareness of food-related immune disorders and increasing use of endoscopy in pediatric gastroenterology. Japan and Australia contribute significantly to the regional value due to higher screening rates and clinical research participation. China demonstrates strong potential with improving healthcare access and expanding pharmaceutical pipelines, though diagnosis often remains delayed. The region’s diverse dietary patterns and genetic predispositions offer unique research insights into disease triggers. It shows strong growth momentum supported by evolving clinical capacity and increased investment in immunology-driven care.

Latin America

Latin America holds a modest market share of 6.3% in 2024. Brazil and Mexico represent the key markets, driven by gradual improvements in diagnostic practices and gastroenterology infrastructure. Awareness among clinicians is rising, especially in pediatric specialties, though endoscopy access remains limited in rural areas. The adoption of corticosteroids and PPIs continues to dominate treatment protocols due to lower cost and broader availability. Biologics remain accessible only in select tertiary centers due to pricing and reimbursement limitations. It reflects emerging opportunities tied to improved training, regional partnerships, and expanded clinical outreach in underserved populations.

Middle East & Africa

The Middle East & Africa region contributes the smallest share at 5.4% in 2024. Access to advanced diagnostics and biologic therapies is concentrated in high-income Gulf countries such as Saudi Arabia and the United Arab Emirates. Public and private sector collaboration supports niche-level awareness, but broader regional disparities in healthcare infrastructure persist. Sub-Saharan Africa shows limited penetration due to scarce gastroenterology services and underdiagnosis. It presents long-term growth potential with rising healthcare investments, medical tourism, and inclusion of immunological disorders in national health strategies. The Eosinophilic Esophagitis market remains at a nascent stage but gains traction with targeted health initiatives and specialist-led advocacy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sun Pharmaceutical

- GlaxoSmithKline

- Allakos

- Arena Pharmaceuticals

- Teva Pharmaceutical

- Cipla

- Takeda Pharmaceutical Company

- Ellodi Pharmaceuticals

- AstraZeneca

- Sanofi

- EsoCap

- Revolo Biotherapeutics

Competitive Analysis

The leading players in the Eosinophilic Esophagitis market include Sanofi, Takeda Pharmaceutical Company, Allakos, Ellodi Pharmaceuticals, Arena Pharmaceuticals, AstraZeneca, GlaxoSmithKline, Cipla, Teva Pharmaceutical, EsoCap, Sun Pharmaceutical, and Revolo Biotherapeutics.These companies actively compete on therapeutic innovation, clinical trial success, regulatory approvals, and commercial reach. Biologics remain the primary focus of competitive development, with multiple candidates targeting interleukin pathways to offer durable inflammation control. Sanofi’s approval of dupilumab for EoE has established a benchmark in targeted therapy. Competitors are working to differentiate through dosing convenience, pediatric compatibility, and safety profiles. Firms with gastrointestinal portfolios leverage established prescriber networks to accelerate market penetration. Smaller biotech players emphasize steroid-based formulations with optimized delivery methods, aiming for localized action and fewer side effects. Companies also invest in biomarker-driven diagnostics to support early intervention and enhance therapeutic precision. Strategic partnerships, licensing deals, and acquisitions enable faster pipeline expansion and access to emerging markets. Competitive activity remains intense, driven by rising diagnosis rates and high unmet clinical need across pediatric and adult populations. Regulatory incentives for orphan diseases further stimulate market entry, encouraging both large pharmaceutical firms and niche innovators to develop next-generation therapies. The competitive landscape favors firms that combine clinical efficacy with accessibility and long-term disease management solutions.

Recent Developments

- In 2025, Sun Pharmaceutical launched Fexuprazan (brand name Fexuclue®) tablets in India for erosive esophagitis.

- In February 2024, Takeda announced that the U.S. Food and Drug Administration (FDA) has approved EOHILIA (budesonide oral suspension), for people 11 years and older with eosinophilic esophagitis. This helped the company expand its product range.

- In January 2024, FDA approved Dupixent (dupilumab) for the treatment of pediatric patients aged 1 to 11 years, weighing at least 15 kg, with eosinophilic esophagitis. This approval aimed to broaden the treatment availability, complementing existing therapies for eosinophilic esophagitis.

Market Concentration & Characteristics

The Eosinophilic Esophagitis market displays a moderately concentrated structure, with a few multinational pharmaceutical companies and specialized biotechs driving innovation and market share. Key players focus on developing biologics and optimized corticosteroid therapies supported by regulatory designations such as orphan drug status. The market exhibits high clinical complexity due to its reliance on endoscopy-based diagnosis, specialized care pathways, and chronic disease management protocols. It demands continuous innovation in both treatment and diagnostics to improve long-term outcomes and reduce patient burden. Product differentiation centers around delivery mechanisms, dosing frequency, age-specific safety, and efficacy in maintaining histological remission. Market entry requires significant R&D investment, robust clinical evidence, and regulatory expertise, which favor established players. The Eosinophilic Esophagitis market remains characterized by strong unmet need, rising awareness, and increasing interest in patient-tailored therapies that align with immunological precision and gastrointestinal safety.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly due to increasing diagnosis rates across pediatric and adult populations.

- Biologic therapies will gain broader approval for diverse age groups and disease severities.

- Companies will invest in non-invasive diagnostics to reduce reliance on repeated endoscopies.

- Personalized elimination diets will become more common with support from biomarker-driven tools.

- Telehealth platforms will enhance treatment monitoring and improve long-term adherence.

- Regulatory bodies will continue to offer incentives for rare disease treatments, encouraging pipeline growth.

- Strategic partnerships between pharmaceutical firms and research institutes will accelerate clinical development.

- Asia-Pacific will emerge as a high-growth region with improved diagnostic access and healthcare investment.

- Smaller biotech firms will play a critical role in delivering niche formulations and innovative therapies.

- The market will shift toward integrated care models combining pharmacologic, nutritional, and digital solutions.